Last Updated on August 17, 2025 by Shrestha Dash

The enterprise software landscape witnessed another significant consolidation move in August 2025. SYSPRO announced its acquisition of warehouse management systems provider DATASCOPE. This marks SYSPRO’s second acquisition in 2025, following the July 2025 riteSOFT deal and the late 2024 NexSys acquisition, signaling an aggressive ERP acquisition strategy that manufacturing companies should understand when evaluating their manufacturing ERP selection options. For organizations seeking guidance through this evolving landscape, this article provides crucial insights into how these strategic moves impact WMS ERP integration decisions.

Understanding the SYSPRO DATASCOPE Acquisition Impact

SYSPRO’s ERP acquisition strategy with DATASCOPE represents more than a typical software company buyout. The 20-year partnership between these companies suggests this move was designed to create seamless WMS ERP integration rather than forcing together incompatible systems. For manufacturing companies currently navigating manufacturing ERP selection processes, this acquisition demonstrates the growing importance of integrated supply chain capabilities that independent ERP consultants frequently emphasize in their recommendations.

According to SYSPRO CEO Jaco Maritz, “DATASCOPE has been a long-standing strategic partner, with a solution built to complement and enhance the SYSPRO ERP experience.” This statement indicates that the WMS ERP integration challenges typically associated with acquisitions may be minimized, though manufacturing companies should still conduct thorough due diligence during their manufacturing ERP selection process.

ERP Industry Acquisition Trends – What’s Driving Consolidation

The current wave of ERP vendor acquisition trends reflects several market pressures that manufacturing companies should understand when working with independent ERP consultants:

- Industry Specialization Demand: Cloud ERP vendors like Acumatica and NetSuite have increasingly included basic WMS capabilities within their ERP packages, creating competitive pressure on traditional ERP providers. SYSPRO’s acquisition strategy with DATASCOPE appears to fill this portfolio gap. Thus, bringing their solution closer to parity with other cloud ERP solutions that offer integrated warehouse management functionality alongside manufacturing digital transformation solutions.

- Integration Complexity Reduction: Rather than forcing customers to manage multiple vendor relationships, companies are acquiring complementary technologies to offer unified supply chain ERP solutions with improved WMS ERP integration.

- Competitive Differentiation: As ERP markets mature, vendors are seeking unique capabilities to differentiate themselves in manufacturing ERP selection processes, making the role of independent ERP consultants even more critical for objective evaluation.

However, manufacturing companies should approach these ERP vendor acquisition trends cautiously. While consolidation can offer benefits, it also reduces vendor choice and may impact ERP pricing negotiations during manufacturing ERP selection initiatives.

How ERP Acquisitions Affect Manufacturing Companies

Manufacturing companies evaluating ERP systems during periods of vendor consolidation face both opportunities and challenges that experienced independent ERP consultants help navigate:

Potential Benefits

- Faster Innovation: Combined development resources may accelerate feature development, benefiting future manufacturing ERP selection evaluations

- Reduced Integration Risk: Pre-integrated solutions may minimize warehouse management system integration complexities that often challenge manufacturing ERP selection projects

- Single Vendor Accountability: One point of contact for ERP and WMS support, simplifying the WMS ERP integration management process

Potential Concerns

- Pricing Power: Reduced competition may affect future pricing negotiations in manufacturing ERP selection processes

- Feature Evolution: ERP acquisition strategy priorities may not align with your specific WMS ERP integration needs

- Support Continuity: Changes in support structure during integration periods can impact existing implementations

Manufacturing companies should work with independent ERP consultants for manufacturing to evaluate how vendor consolidation affects their specific requirements and risk tolerance during manufacturing ERP selection initiatives.

Benefits of Integrated ERP and WMS Systems

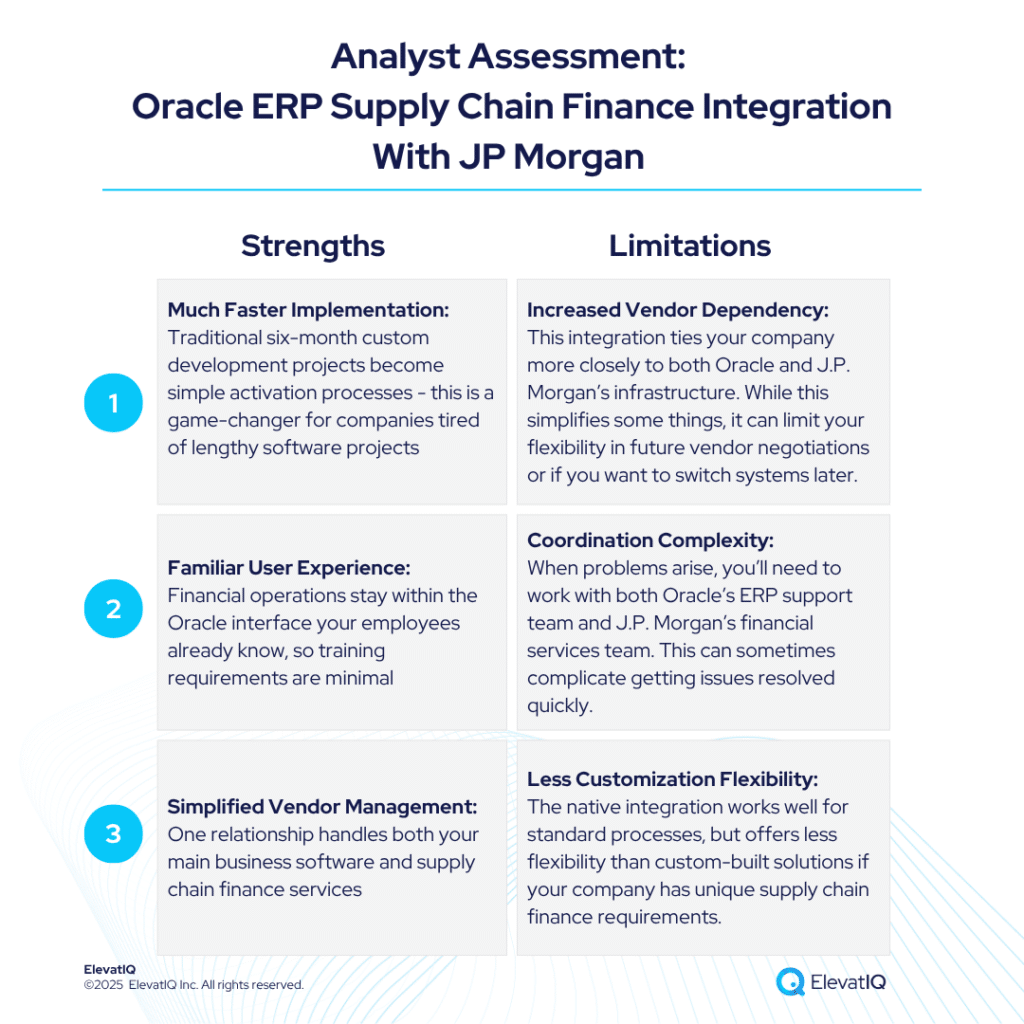

While SYSPRO’s messaging emphasizes the benefits of integrated ERP and WMS systems, manufacturing companies should examine these claims objectively:

- Inventory Visibility: Integrated systems can provide real-time inventory tracking across production and warehouse operations, though companies should verify this capability meets their specific visibility requirements.

- Operational Efficiency: Eliminating data synchronization between separate ERP and WMS systems may reduce errors and improve workflow efficiency, but organizations should assess whether their current integration challenges justify this approach.

- Supply Chain Control: A unified platform may offer better supply chain oversight, though companies should evaluate whether this integration provides meaningful advantages over their current systems.

The key question for manufacturing companies isn’t whether integration is theoretically beneficial, but whether the specific integration offered by SYSPRO-DATASCOPE addresses their operational challenges better than alternatives.

What to Consider When Choosing ERP with WMS Capabilities

Manufacturing companies evaluating ERP systems with integrated warehouse management should consider several factors:

| Functional Requirements Assessment | Integration Architecture | Vendor Stability and Strategy |

| Does the WMS functionality match your warehouse complexity? | How deep is the actual integration between ERP and WMS modules? | How will ongoing acquisitions affect product development priorities? |

| Can the system handle your specific inventory management requirements? | Can you implement ERP without WMS initially if needed? | What is the vendor’s long-term commitment to your industry segment? |

| Are industry-specific features adequately addressed? | What customization options exist for unique requirements? | How does pricing compare to best-of-breed alternatives? |

The Independent Consultant Perspective

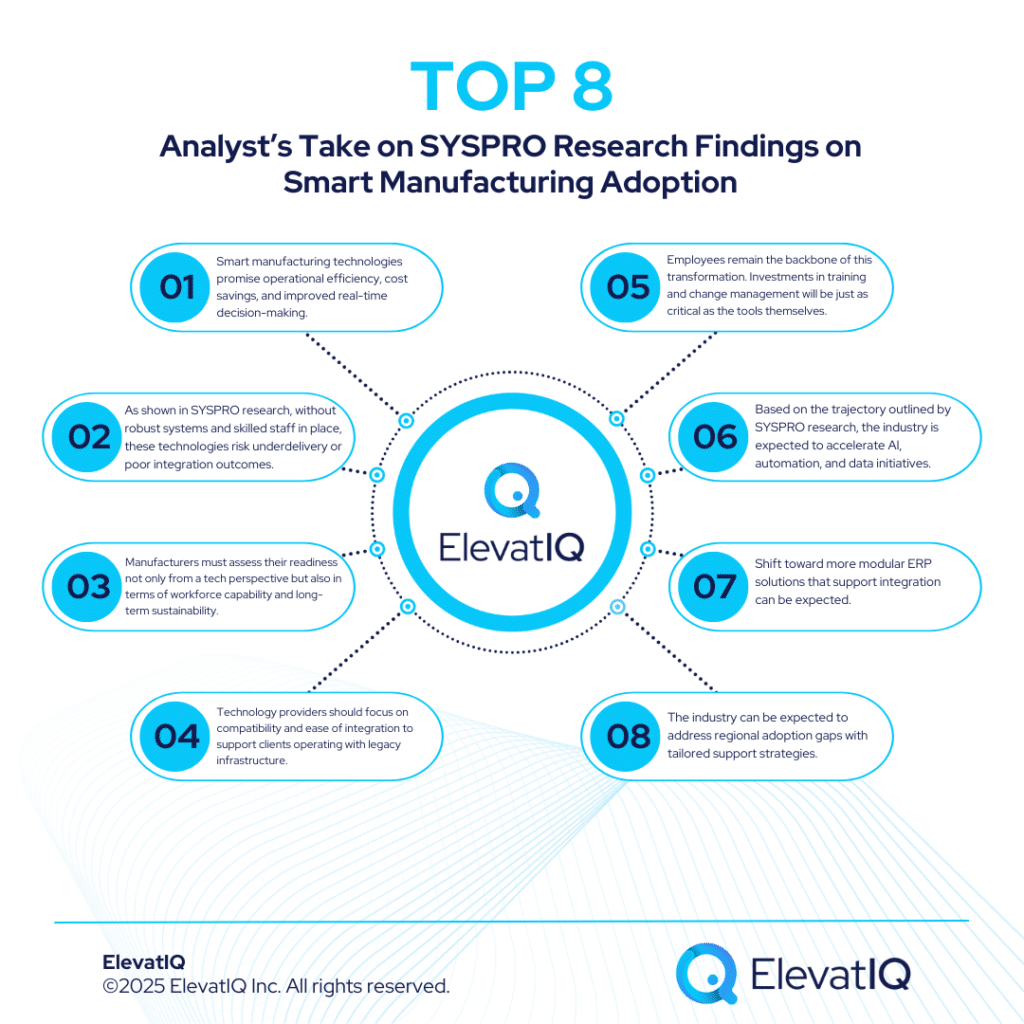

From an independent ERP consultant’s viewpoint, SYSPRO’s ERP acquisition strategy presents both advantages and considerations for manufacturing companies pursuing manufacturing ERP selection.

Advantages: The company’s focus on manufacturing and distribution creates deep industry expertise that benefits WMS ERP integration projects. The acquisition of longtime partners like DATASCOPE suggests lower integration risk compared to acquisitions of unrelated technologies, which independent ERP consultants recognize as a positive factor in manufacturing ERP selection decisions.

Considerations: Manufacturing companies should evaluate whether SYSPRO’s specific ERP acquisition strategy aligns with their operational requirements and growth plans. The company’s acquisition activity, while potentially strengthening WMS ERP integration capabilities, also creates uncertainty about future product direction.

Manufacturing companies can benefit from working with vendor-neutral independent ERP consultants who can objectively assess how these ERP acquisition strategy developments affect their specific situation. Independent evaluation becomes particularly important during periods of vendor consolidation when marketing messages may not fully address WMS ERP integration realities.

Implications for Manufacturing ERP Selection Processes

The SYSPRO-DATASCOPE acquisition highlights several considerations for manufacturing ERP selection that independent ERP consultants emphasize when guiding clients through ERP acquisition strategy evaluations.

Vendor Evaluation Criteria

- Product Roadmap Stability: How will the ERP acquisition strategy affect future development priorities and WMS ERP integration capabilities?

- Integration Maturity: Are acquired capabilities truly integrated or simply bundled in the manufacturing ERP selection offering?

- Industry Focus: Does the vendor’s specialization align with your manufacturing segment’s WMS ERP integration requirements?

Due Diligence Requirements

- Reference Customer Analysis: Speak with customers using both ERP and WMS components to understand real WMS ERP integration experiences

- Implementation Complexity: Understand real-world deployment experiences that independent ERP consultants can help evaluate

- Support Structure: Evaluate how the ERP acquisition strategy affects customer support quality during manufacturing ERP selection implementation

Negotiation Considerations

- Pricing Transparency: Understand how bundled solutions affect cost structures in manufacturing ERP selection projects

- Implementation Flexibility: Ensure you can implement WMS ERP integration components independently if needed

- Contract Protection: Include provisions addressing future vendor changes resulting from ongoing ERP acquisition strategy activities

Making Informed Decisions in a Consolidating Market

Manufacturing companies navigating today’s evolving ERP landscape need objective guidance to make informed manufacturing ERP selection decisions. The SYSPRO-DATASCOPE acquisition illustrates why independent ERP consultants provide valuable perspective during vendor evaluation processes, especially when evaluating complex WMS ERP integration requirements and ERP acquisition strategy implications.

At ElevatIQ, our experience with manufacturing ERP selection projects provides insight into how vendor consolidation affects implementation outcomes. We help manufacturing companies evaluate acquisitions like SYSPRO-DATASCOPE objectively, focusing on how these ERP acquisition strategy changes impact specific WMS ERP integration requirements rather than vendor marketing claims.

Our vendor-neutral approach ensures manufacturing companies understand both the opportunities and risks associated with consolidated platforms during their manufacturing ERP selection process. Whether evaluating SYSPRO’s enhanced WMS ERP integration capabilities or comparing alternatives, independent ERP consultants help clients make decisions based on thorough analysis of functional requirements, implementation complexity, and long-term strategic fit.

Key Takeaways for Manufacturing Companies

The SYSPRO-DATASCOPE acquisition represents a significant development in manufacturing ERP selection, but its impact depends on individual company requirements:

- Evaluate Integration Claims: Verify that integrated ERP and WMS capabilities address your specific operational challenges

- Consider Alternatives: Compare consolidated solutions against best-of-breed approaches

- Assess Vendor Strategy: Understand how acquisition activity aligns with your long-term technology strategy

- Seek Independent Advice: Work with experienced consultants who can provide objective evaluation of vendor claims

The evolving ERP landscape requires manufacturing companies to approach vendor selection with both opportunity awareness and appropriate caution. While acquisitions like SYSPRO-DATASCOPE may offer genuine benefits, thorough evaluation remains essential for making decisions that support long-term operational success.

Understanding how ERP acquisitions affect manufacturing companies requires expertise in both technology evaluation and industry requirements. As the consolidation trend continues, independent guidance becomes increasingly valuable for navigating complex vendor landscapes and making informed technology investments.