Zoho Corporation announced the launch of Zoho Payments, marking the company’s entry into the U.S. payments processing market. The unified payment solution enables businesses to collect card and ACH payments while integrating directly with Zoho’s existing business software ecosystem. The Zoho Payments launch addresses the growing demand for connected financial workflows as 87% of transactions are likely to be cashless, and 81% of U.S. consumers prefer card payments.

Structured Breakdown of the News

Core Product Features

The Zoho Payments launch introduces a comprehensive payment processing solution that handles both card and ACH transactions. The platform supports card payments in over 135 currencies globally, while ACH payments remain limited to U.S. domestic transactions. Major card networks including Visa, Mastercard, American Express, Discover, JCB, UnionPay, and Diners Club are supported through the unified system.

The solution operates natively within Zoho’s existing application suite, connecting with finance, operations, sales, marketing, low-code, and collaboration platforms. Third-party systems can also integrate through available APIs, extending the platform’s reach beyond Zoho’s ecosystem.

Payment Collection Methods

Businesses can collect payments through multiple channels following the Zoho Payments launch. The platform supports invoice-based payments sent directly to customers, payment links for quick transactions, and hosted payment pages for both one-time and recurring billing scenarios. Also, E-commerce integration capabilities can allow online retailers to process transactions through their existing stores.

Security and Compliance

The Zoho Payments launch includes PCI DSS Level 1 compliance, representing the highest security standard for payment processing. The platform incorporates fraud protection mechanisms designed to reduce chargebacks and minimize losses from fraudulent transactions. Additionally, risk management tools are built into the core system to help businesses maintain secure payment operations.

Operational Capabilities

Automated reconciliation features can reduce manual work for finance teams while improving accuracy in financial record-keeping. The platform provides faster settlements compared to traditional payment processors and offers customized payout scheduling options. Thus, transaction volumes can now scale with business growth through the platform’s designed architecture.

Analytics and Reporting

The system provides visibility into payment transactions, payouts, refunds, and payment failures through integrated dashboards. It also offers account summaries which gives insights into cash flow patterns, payment trends, and operational bottlenecks. These reporting capabilities aim to support business decision-making through data-driven insights.

Pricing Structure

Domestic card transactions are priced at 2.9% plus 30 cents per transaction, covering all supported card networks. International card transactions carry an additional 1.5% fee on top of the domestic rate, resulting in a total fee of 4.4% plus 30 cents for cross-border payments.

Common Questions We Are Hearing

How does Zoho Payments compare to existing payment processors like Stripe or Square?

The Zoho Payments launch differentiates through native integration with Zoho’s business software suite. Thus eliminating the need for separate logins and complex integrations. Pricing at 2.9% + 30¢ for domestic cards aligns with industry standards, while the 4.4% + 30¢ rate for international cards falls within typical ranges for cross-border transactions.

What ACH capabilities are included in the launch?

A: The Zoho Payments launch includes ACH processing for U.S. domestic transactions only. Specific ACH pricing was not disclosed in the announcement, though businesses can process bank-to-bank transfers through the unified platform.

Can existing Zoho customers migrate their current payment processing?

A: The Zoho Payments launch targets existing Zoho users through seamless integration with applications like Zoho Books. The platform works out-of-the-box with current Zoho installations, though migration timelines and processes might vary.

What countries can accept payments through the 135+ currency support?

A: While the Zoho Payments launch supports 135+ currencies for card transactions, the announcement focuses on U.S. market entry. International availability and specific country support details are not clear yet.

How does the automated reconciliation feature work?

A: The automated reconciliation capability reduces manual finance team work by automatically matching payment transactions with corresponding invoices and records. Specific technical details about the reconciliation process might vary and would need further investigation.

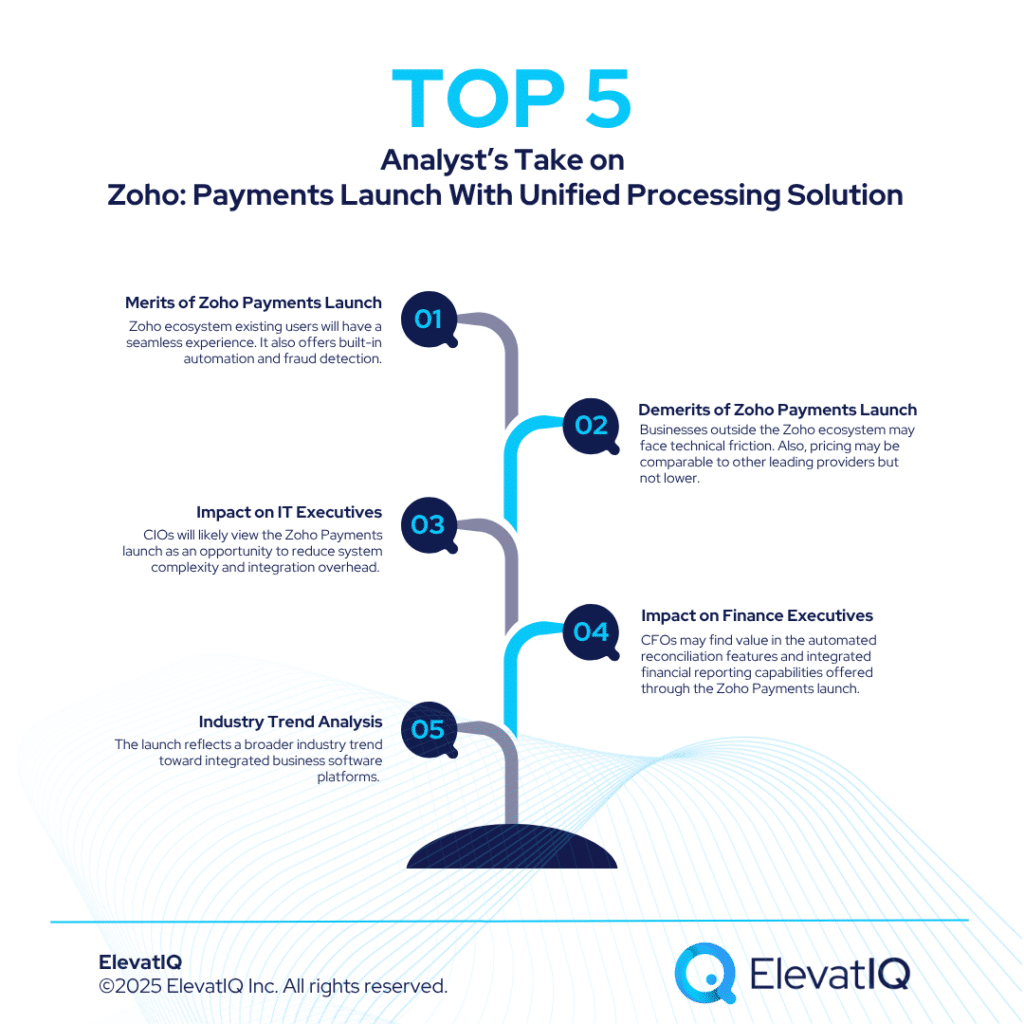

Analyst’s Take

Customer Impact Analysis

The Zoho Payments launch addresses legitimate business pain points identified in the announcement. James Martin, Founder and CEO of Keystone Transport Services, stated: “Our transportation company has used third-party payment portals before, but they came with extra logins and separate integrations that didn’t fit smoothly into our workflow.” This feedback highlights the integration challenges that the new solution aims to resolve.

However, businesses must weigh the benefits of integrated payments against potential vendor lock-in concerns. While seamless workflow integration offers operational advantages, companies may find themselves more dependent on Zoho’s ecosystem for critical payment functions.

Merit:

- Seamless experience for Zoho ecosystem users

- Built-in automation and fraud detection

- High scalability for growing transaction volumes

Demerit:

- Businesses outside the Zoho ecosystem may face technical friction

- Pricing may be comparable to other leading providers but not lower

Impact on IT Executives

CIOs will likely view the Zoho Payments launch as an opportunity to reduce system complexity and integration overhead. The native connection to existing Zoho applications eliminates the need for custom API development and ongoing maintenance of third-party payment integrations.

The security benefits include PCI DSS Level 1 compliance handling, which reduces compliance burden on internal IT teams. However, CIOs must consider the implications of centralizing payment processing within a single vendor ecosystem, particularly regarding backup payment processing capabilities and disaster recovery planning.

Impact on Finance Executives

CFOs may find value in the automated reconciliation features and integrated financial reporting capabilities offered through the Zoho Payments launch. The promise of better authorization rates could improve revenue capture, while fraud protection mechanisms may reduce chargeback-related losses.

The pricing structure at 2.9% + 30¢ for domestic transactions aligns with market rates, though CFOs should evaluate total cost of ownership including potential savings from reduced manual reconciliation work. The 4.4% + 30¢ rate for international transactions may impact businesses with significant cross-border payment volumes.

Industry Trend Analysis

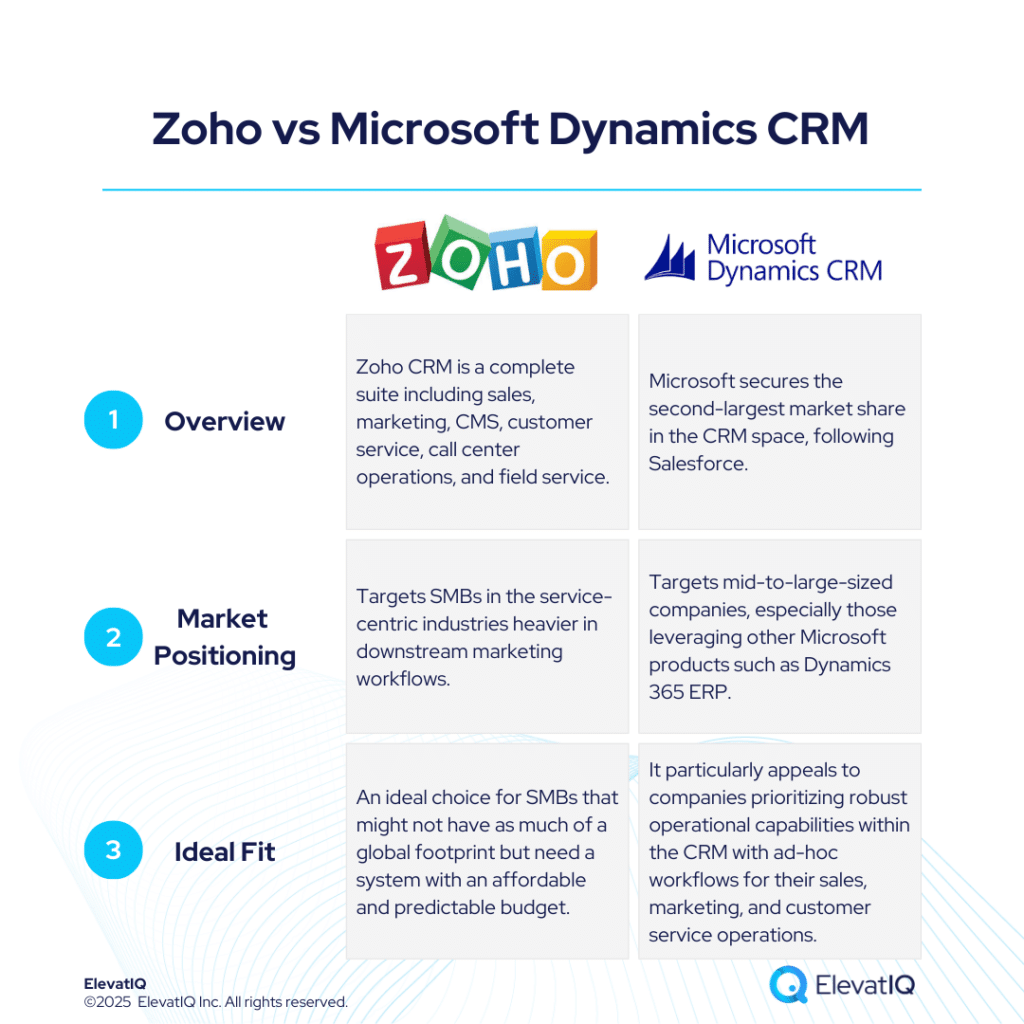

The Zoho Payments launch reflects a broader industry trend toward integrated business software platforms. Companies increasingly seek unified solutions that eliminate data silos and workflow disruptions between different business functions.

Raju Vegesna, Chief Evangelist at Zoho, emphasized this trend: “As digital payments become the default preference for everything from online purchases to subscription services, businesses need a payment solution that not only offers flexibility, but is also tightly connected to their financial operations.”

This approach contrasts with the historical model of best-of-breed point solutions, suggesting that integration capabilities may become more important than specialized features for certain market segments.

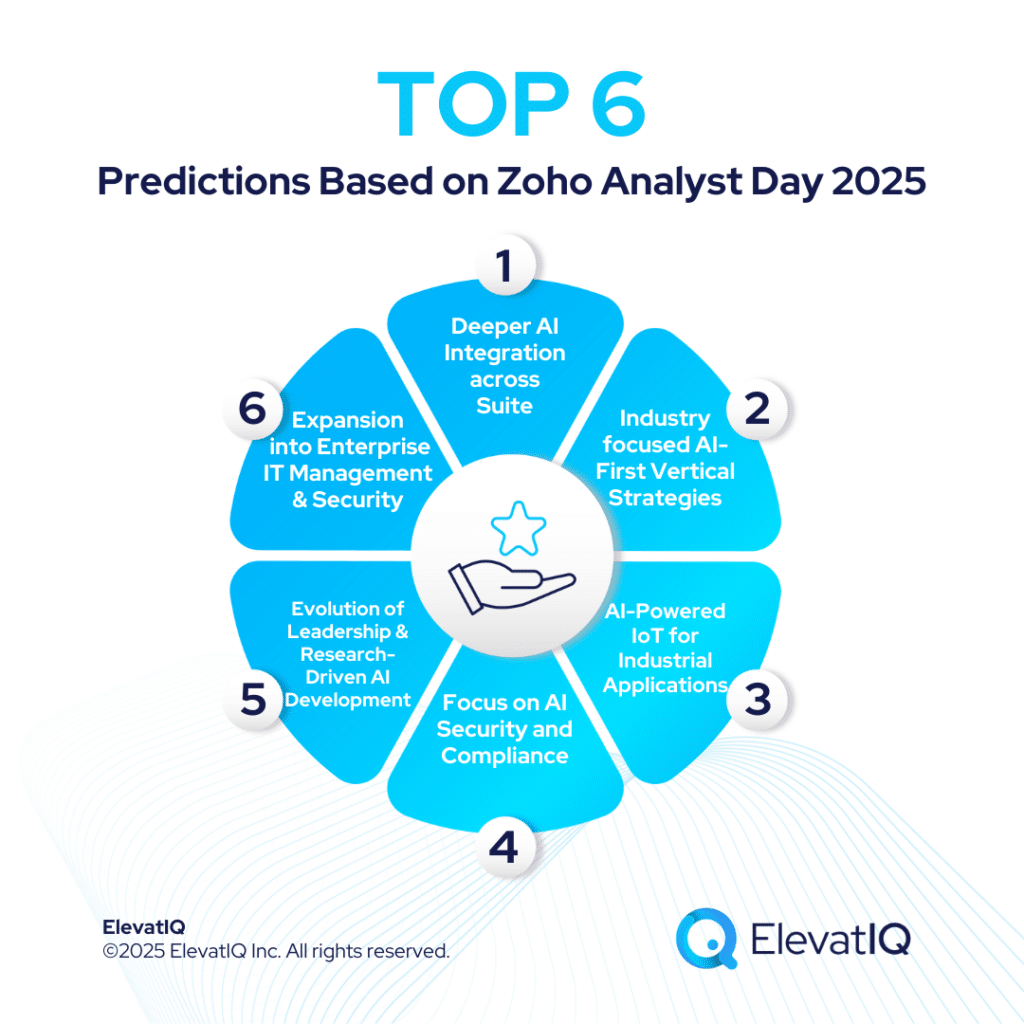

Future Predictions

The Zoho Payments launch likely represents the first phase of Zoho’s broader financial services strategy. The company may expand into additional payment methods, international markets, and complementary financial products to compete with established players like Stripe and Square. The success of this integrated approach could influence other business software providers to develop native payment capabilities rather than relying on third-party partnerships.

This trend may lead to increased competition in the small and medium business payment processing market. The emphasis on automated reconciliation and financial workflow integration suggests that future payment processing solutions will need to demonstrate clear operational efficiency benefits beyond basic transaction processing capabilities to remain competitive in the evolving market landscape.