Last Updated on March 16, 2025 by Sam Gupta

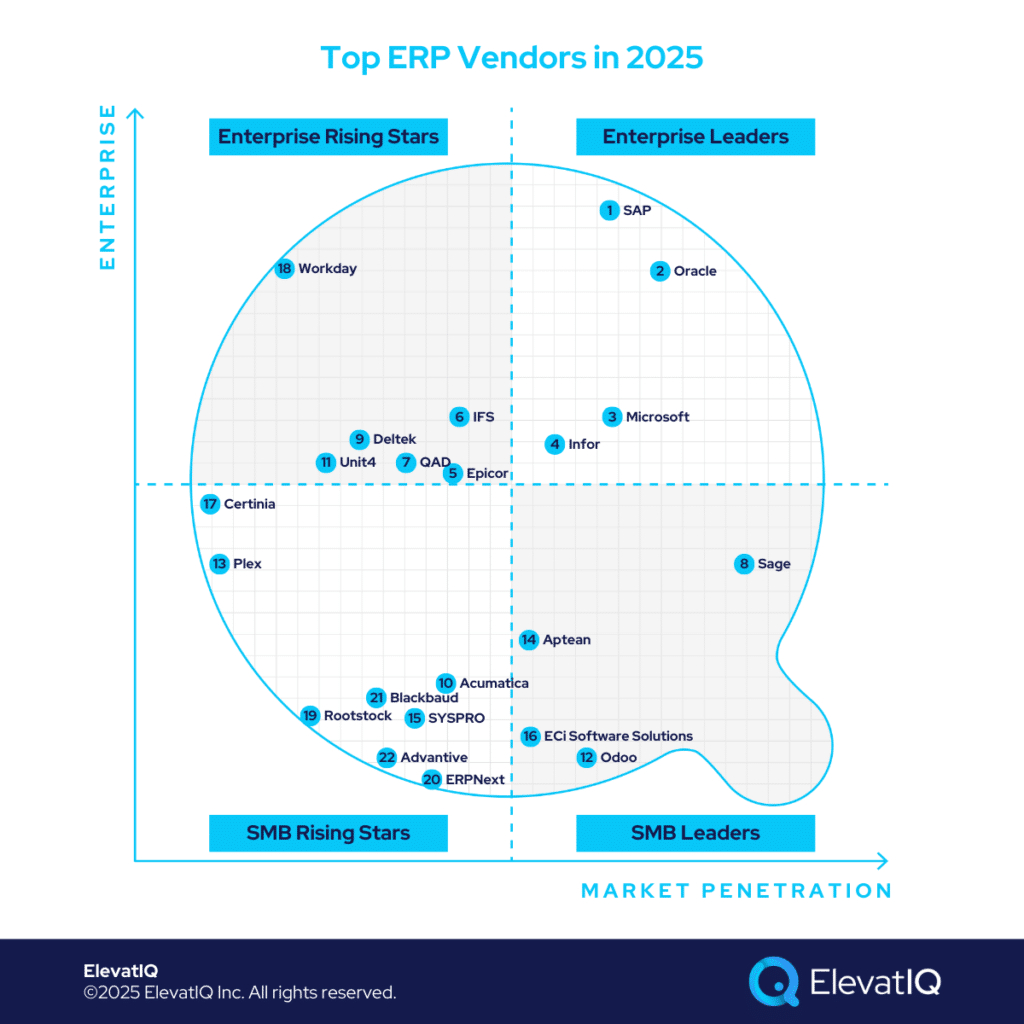

With uncertainty surrounding how AI agents will influence transactional applications, many ERP vendors are still in the experimentation phase until clearer expectations emerge across the industry. This phase could lead to intriguing developments, such as new interaction models, architectural changes, or even the potential obsolescence of certain categories. It could also significantly alter the positions of ERP vendors.

In recent years, cloud-nativeness and upgrades to cloud technologies have been a dominant focus for both vendors and customers. Newer cloud-native vendors held an unfair advantage over legacy vendors, mainly because they faced fewer challenges related to backward compatibility. However, this advantage may no longer hold in the new world. In fact, legacy vendors could now have the upper hand over cloud-native vendors, thanks to their more robust backend layers and the ease of integrating AI agents, which, in terms of efforts required, might be simpler than completely rewriting an application with cloud-native technologies.

Ease of implementation is just one advantage; it also offers superior interfaces, potentially revolutionizing the ERP industry and significantly shifting vendors’ positions. As with any technological advancement, new vendors could emerge if building AI-first systems becomes easier than upgrading legacy systems, further disrupting the market. Another key innovation that could have a major impact on the ERP market is the adoption of no-schema databases, once (if ever) proven to provide the same transactional integrity required by ERP applications. While there are significant developments on the horizon, it’s still too early to predict the future direction of the ERP industry. Therefore, for this year, the positions of ERP vendors will remain relatively stable, with some changes.

10. Acumatica

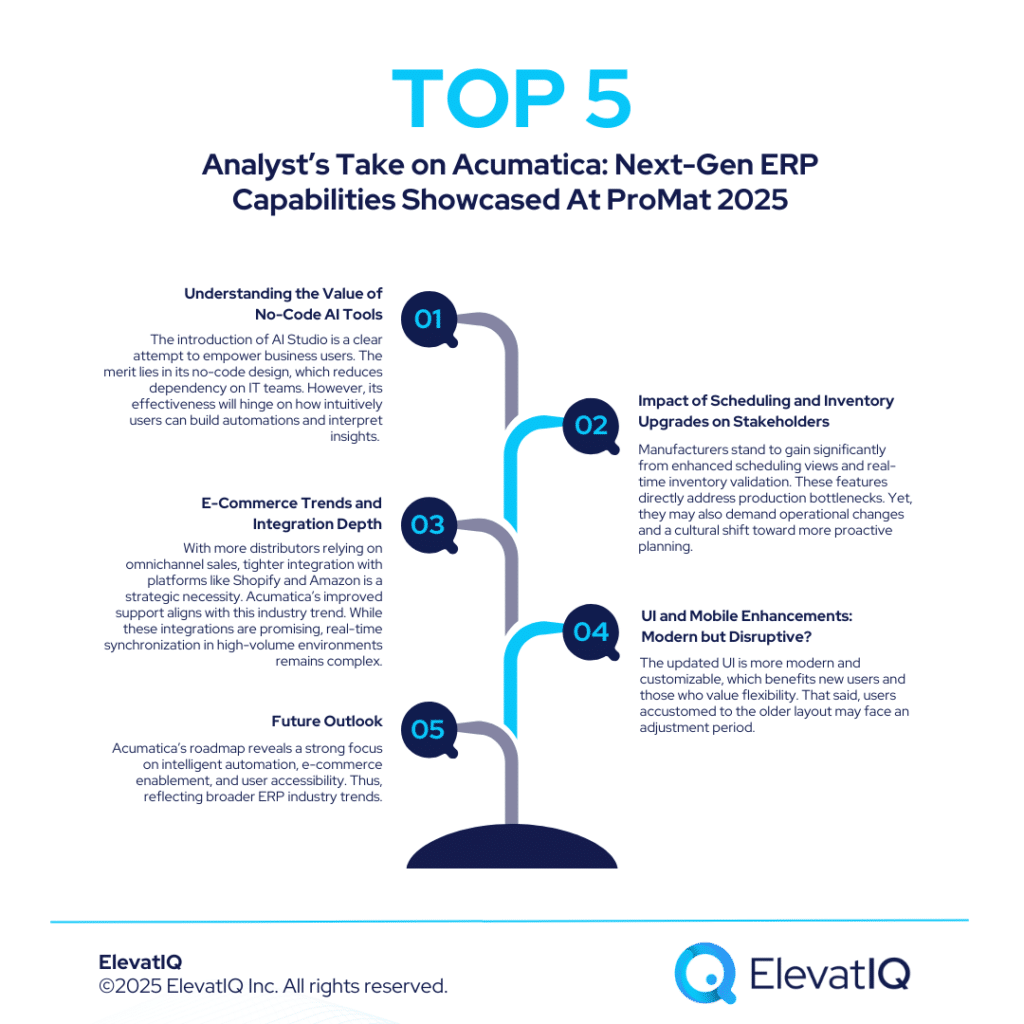

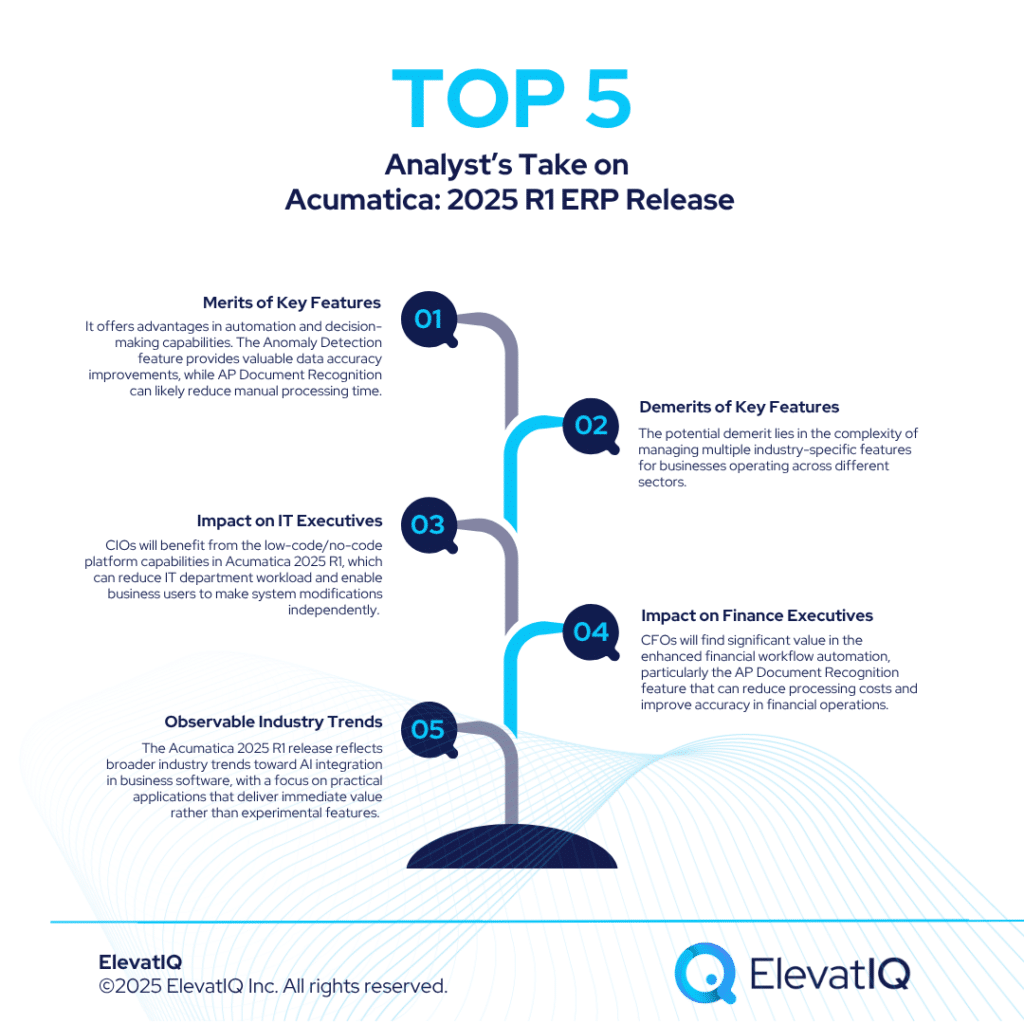

Breaking into the top 10 ERP vendors is no small feat for companies with revenue under $100 million, yet Acumatica has successfully earned its place. However, its presence in segments exceeding $100 million in revenue remains limited, with stronger traction among businesses generating $50–100 million. Geographically, Acumatica’s footprint is also narrower, concentrated in developed markets like the US, UK, and Australia. While Acumatica delivers solid operational capabilities as a true ERP solution, its micro-capabilities are relatively lean for complex industries such as manufacturing. Competitors like Infor, Epicor, and IFS offer deeper functionality for businesses advancing their ERP maturity. That said, Acumatica’s simplicity, affordability, and ease of implementation make it a strong choice for companies moving beyond entry-level solutions like Odoo or QuickBooks.

Is Acumatica’s focus on cloud-native features like enterprise search and mobility enough to meet your business needs, or could its limited operational depth pose challenges? How does its vibrant marketplace help fill solution gaps, and what risks come with its limited native global localization compared to competitors like NetSuite and Sage Intacct? While Acumatica’s pricing is often viewed as a strength, how might its complexity affect your budgeting? With recent updates introducing a PSA module for professional services, how does this change its suitability for your industry? And with lingering questions about its AI roadmap and presence among larger enterprises, is Acumatica still a top contender for your ERP strategy in 2025? For deeper insights, download the full Top ERP Vendors in 2025 report now!

9. Deltek

Deltek is a specialized ERP vendor with a strong focus on government contracting, construction, and architecture sectors. It has a proven track record of success in small to upper-mid-market accounts within these verticals, offering tailored capabilities and data platforms designed to meet their unique needs. However, its suitability may be limited for companies with diversified business models or those pursuing M&A strategies to expand beyond their core industries.

How does Deltek’s ownership by Roper Technologies impact its growth potential compared to ERP vendors backed by larger private equity firms? What role do strategic acquisitions, such as IntelliTrans, play in strengthening Deltek’s capabilities for regulated manufacturing industries? With its proprietary data and research providing a unique edge, how can businesses leverage these resources for benchmarking and compliance? While Deltek’s subject matter expertise continues to secure major clients, will its slower AI innovation hinder its long-term competitiveness? And as Deltek’s dominance in its niche industries remains strong, is it still the right choice for your ERP strategy in 2025? For deeper insights into Deltek and other leading ERP vendors, download the full Top ERP Vendors in 2025 report now!

8. Sage

Sage, traditionally known as an accounting software vendor with strong distribution channels through accounting firms, maintains a presence in the ERP market. Their legacy products—Sage 100, 200, 300, and 500—continue to serve existing customers, while Sage 50 competes directly with QuickBooks in the small business segment. Sage’s growth strategy emphasizes newer solutions like Sage Intacct, which targets smaller service-sector accounts, and Sage X3, positioned for larger enterprises and process manufacturing industries such as Food & Beverage and Life Sciences.

How does Sage’s reliance on partner add-ons impact its ability to compete with cloud-native ERP vendors offering richer operational capabilities? With Sage’s legacy solutions still maintaining market presence, what challenges might your business face when transitioning to its newer offerings? While Sage’s strong focus on security and regulatory compliance aligns well with AICPA standards, could these features feel excessive for smaller businesses without stringent audit needs? And with Sage’s AI strategy remaining unclear, how might this uncertainty affect its long-term competitiveness? To explore Sage’s positioning and insights into other leading ERP vendors, download the full Top ERP Vendors in 2025 report now!

7. QAD

QAD stands out as a specialized ERP solution designed for supply chain-intensive industries such as Automotive, Food & Beverage, and Life Sciences. With integrated supply chain and PLM capabilities, QAD effectively addresses complex challenges within highly specific micro-verticals—challenges that many broader industry solutions may struggle to meet.

How will QAD’s transition to its new O3 cloud-native platform impact its competitiveness in the ERP market? With its move to AWS, Java, MariaDB, and TypeScript aligning with modern architectures like NetSuite, could this shift improve scalability and flexibility for your business? How does QAD’s acquisition of Redzone—integrating HCM and shop floor processes—enhance its value for manufacturers and industrial businesses? As QAD aligns its cloud transformation with emerging AI trends, could this timing position it for greater long-term success? And with Thoma Bravo’s typical investment timeline nearing its midpoint, how might future ownership changes influence QAD’s strategy? For deeper insights into QAD and other leading ERP vendors, download the full Top ERP Vendors in 2025 report now!

6. IFS

IFS follows a strategy similar to QAD, Deltek, and Unit4 but distinguishes itself with higher revenue. Like Epicor, IFS has experienced notable growth, recently surpassing the $1 billion revenue milestone. Positioned as a strong alternative for enterprise companies seeking deep operational functionality, IFS offers capabilities that go beyond traditional horizontal ERP solutions like SAP and Oracle. Its enterprise-grade EAM and field service capabilities have helped IFS secure contracts with major airlines and MROs—markets historically dominated by SAP and Oracle—where managing large fleets of service technicians is critical.

How will IFS’s strategic acquisitions and focus on predictive maintenance reshape its role in manufacturing-centric ERP solutions? With its expanding presence in North America, can IFS effectively challenge established players like Infor, SAP, and Microsoft in larger enterprise accounts? While IFS’s AI investments have focused on data-related innovations, how might its approach to generative AI influence its future capabilities? And given IFS’s significant install base of best-of-breed solutions, how should buyers assess its ERP-specific value? To explore IFS’s positioning and insights into other leading ERP vendors, download the full Top ERP Vendors in 2025 report now!

5. Epicor

Like IFS, Epicor belongs to the exclusive $1 billion revenue club, offering a diverse portfolio of industry-leading solutions across multiple micro-verticals. Notable products include Epicor Kinetic, Epicor Prophet 21, Epicor Eclipse, BisTrack, and LumberTrack. While Epicor was slower to adopt cloud technologies than some legacy vendors, it has made significant progress. Its Kinetic UI and UX now deliver mature cloud capabilities, including enterprise search. Epicor has also been developing enterprise traceability transactional maps similar to those found in SAP, marking a key advancement for the platform.

How does Epicor’s deep focus on micro-verticals give it an edge in industries like metal, automotive, and aerospace? With its fully integrated MES available as a standalone solution, could Epicor be the right fit for businesses seeking advanced Industry 4.0 capabilities? How will Epicor’s recent acquisitions, such as S&OP planning and PIM, enhance its integrated suite—and what challenges might arise for customers needing to replace existing solutions? As Epicor’s leadership shifts focus toward AI readiness, how soon can businesses expect meaningful innovations? To learn more about Epicor’s position and other top ERP vendors in 2025, download the full top ERP vendors in 2025 report now!

4. Infor

Infor’s revenue surpasses that of Sage and Epicor but remains significantly lower than the largest ERP vendors. With its comprehensive product suite, Infor competes with Epicor, SAP, Oracle, and Microsoft, offering enterprise-grade solutions tailored to specific industries. While Infor’s global reach may not match SAP or Oracle, its strength lies in deep vertical specialization. It is also among the few vendors outside the industry’s largest players capable of delivering a best-of-breed architecture similar to SAP, Oracle, and Microsoft. In certain areas, such as workforce management (Infor WFM) and supply chain connectivity (Infor Nexus), its capabilities may even outperform Microsoft’s, which relies on third-party add-ons for these capabilities.

How does Infor’s ability to deliver robust industry-specific functionality give it an edge over smaller vendors like Epicor and Aptean in demanding sectors such as Aerospace, Healthcare, and Utilities? With its recent shift toward a platform-centric approach, how might Infor’s strategy mirror successful models from Salesforce and Microsoft? As Infor announces AI initiatives, what gaps remain in its roadmap for integrating AI-driven innovations? And with new partnerships positioning Infor to target larger accounts, can it successfully expand its presence in enterprise markets? For deeper insights into Infor’s strategy and other leading ERP vendors, download the full Top ERP Vendors in 2025 report now!

3. Microsoft

Microsoft has significantly strengthened its cloud-native capabilities across its two flagship ERP solutions: suites of applications targeting larger companies such as Project Operations or Supply Chain Management — and Business Central. Similar to SAP and Oracle, Microsoft offers a comprehensive suite of best-of-breed applications to support enterprise architecture, with Azure standing out as a leading cloud infrastructure platform for custom application development. Its seamless integration with the Microsoft 365 Suite further enhances its overall value proposition.

How does Microsoft’s dominance in both ERP and CRM categories enhance its competitive edge, particularly against SAP and Salesforce? With its cloud-native ERP capabilities outperforming SAP in some areas, could Microsoft’s solutions better support your business model needs? While Business Central’s reliance on third-party add-ons may limit its core operational depth, does Microsoft’s extensive developer ecosystem help mitigate these gaps? And as Microsoft positions itself as an AI leader, how might its still-unclear roadmap impact future innovation? For a deeper look at Microsoft’s strategy and insights into other top ERP vendors, download the full Top ERP Vendors in 2025 report now!

2. Oracle

Oracle offers two prominent cloud ERP solutions: Oracle Cloud ERP and NetSuite. Both are highly advanced in cloud capabilities, though they cater to different segments. NetSuite, with its extensive localization and deep operational functionality, is particularly well-suited for small to upper-mid-market companies.

How does Oracle’s deep integration with Java and Oracle databases give it an advantage in industries like media, telecom, and energy? With its strong presence in both enterprise and mid-market segments, can Oracle maintain its ERP leadership despite its growing focus on database and cloud infrastructure? Will NetSuite’s vibrant ecosystem offset Oracle’s slowing ERP momentum? And how will Oracle’s Cerner acquisition shape its influence in the healthcare sector? For a comprehensive analysis of Oracle’s position and insights into other top ERP vendors, download the full Top ERP Vendors in 2025 report now!

1. SAP

SAP holds the largest market share in the ERP space, driven largely by its dominance in enterprise deals, which are significantly larger than mid-market transactions. Its extensive portfolio features best-of-breed solutions, particularly within the SAP S/4HANA Suite, which is favored by enterprise-grade organizations. Key offerings such as SAP SuccessFactors (HCM), SAP Hybris (Commerce), SAP EWM (WMS), Ariba (P2P), and Concur (T&E) further expand its comprehensive capabilities.

How does SAP S/4HANA’s in-memory architecture give it an edge in managing high transaction volumes and complex traceability? With its ability to streamline multi-country operations in a single database, could SAP be the right fit for your global business needs? As SAP continues to refine its mid-market strategy with Rise and Grow, will it successfully capture SMB traction despite lingering uncertainties around SAP Business One and ByDesign? And how might SAP’s Databricks partnership enhance its cloud capabilities in a competitive landscape increasingly shaped by AI innovation? For deeper insights into SAP’s positioning and other leading ERP vendors, download the full Top ERP Vendors in 2025 report now!

Conclusion

The ERP market is set for significant transformation in 2025, with AI-first strategies likely taking center stage. The traditional advantage held by cloud-native vendors may no longer be as relevant, paving the way for new categories and potentially new vendors offering AI-driven solutions. While AI is expected to be the dominant theme of 2025, other developments, such as no-schema databases, could also have a profound impact on the ERP landscape.

Though it’s too early to predict how these trends will reshape the industry and affect vendor positioning, one thing is certain: ERP as we know it today will look very different in the near future. Who’s ready for an exciting (and possibly uncertain) journey ahead?