Last Updated on November 21, 2025 by Shrestha Dash

Manufacturing organizations face unique challenges when negotiating ERP contracts that differ significantly from service-based or distribution companies. The need to integrate shop floor operations with enterprise systems, connect IoT-enabled machinery, deploy Manufacturing Execution Systems (MES), and manage complex supply chain networks creates contract considerations absent from generic enterprise software agreements.

With manufacturing ERP implementations typically ranging from $300,000 to over $2 million depending on organizational size and complexity, the contract terms governing these investments determine not just immediate costs but long-term operational flexibility, integration capabilities, and the ability to achieve Industry 4.0 digital transformation objectives that define competitive advantage in modern manufacturing.

Understanding the industry-specific contract terms that matter most for manufacturers—and negotiating comprehensive protections before implementation begins—separates organizations that achieve efficient, connected operations from those who discover their contracts constrain the shop floor connectivity, IoT integration, and supply chain visibility essential for manufacturing excellence.

The Manufacturing ERP Contract Challenge

Generic ERP contract frameworks developed for service organizations or simple distribution operations prove inadequate for manufacturers whose systems must bridge the gap between enterprise-level planning and real-time shop floor execution. Manufacturing ERP contract negotiations require addressing technical integration complexities, operational technology (OT) licensing, and industry-specific modules that standard agreements overlook.

Why Manufacturing ERP Contracts differ

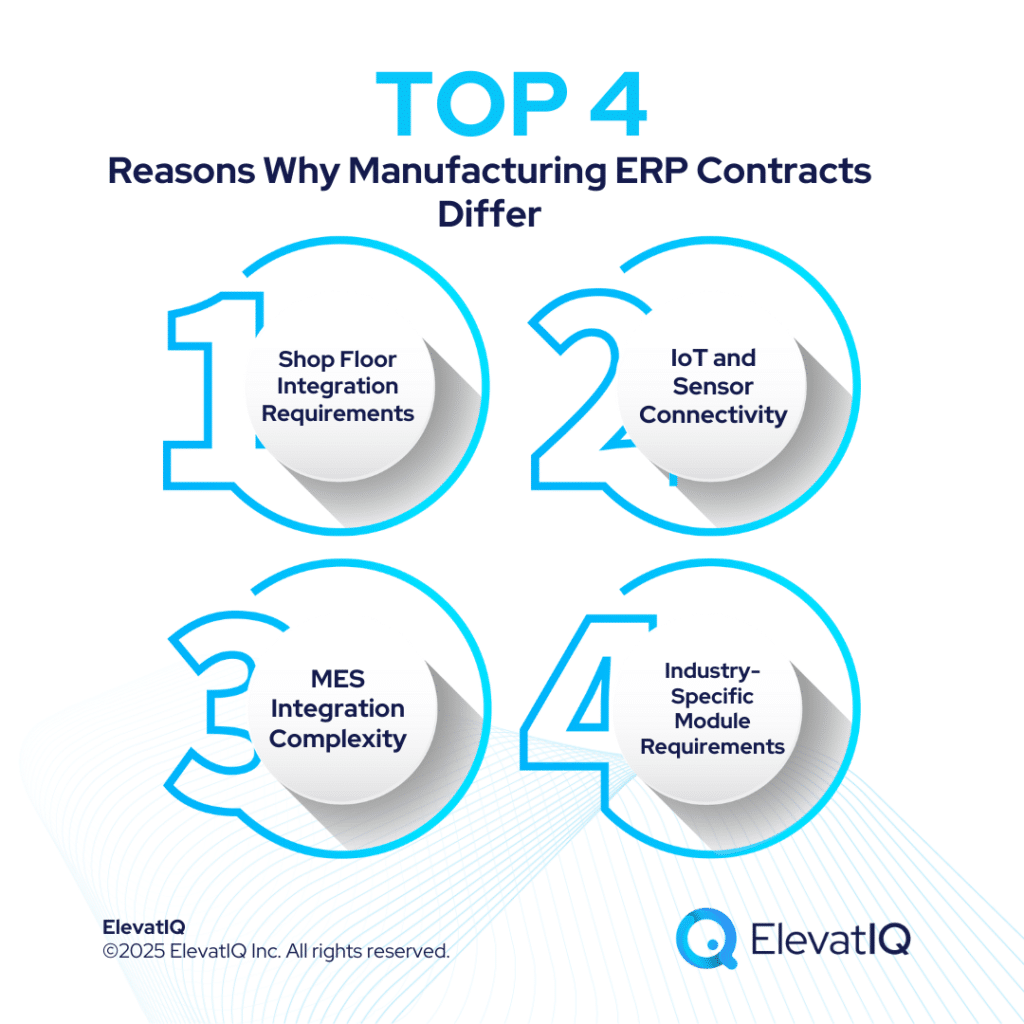

Manufacturing organizations operate with unique requirements that create specific contract negotiation imperatives:

- Shop Floor Integration Requirements: Unlike office-based ERP users, manufacturers need systems that connect directly to production equipment, capture machine data, track work-in-progress, and provide real-time visibility into manufacturing operations. Manufacturing ERP contract negotiations must address how shop floor connectivity is licensed, priced, and supported.

- IoT and Sensor Connectivity: Modern manufacturing relies heavily on IoT sensors that monitor machine performance, track asset utilization, enable predictive maintenance, and drive data-driven decision-making. Contracts must clarify how IoT device connections are counted, whether they consume user licenses, and what connectivity infrastructure vendors support.

- MES Integration Complexity: The disconnect between ERP planning systems and shop floor execution represents one of manufacturing’s persistent challenges. Manufacturing ERP contract negotiations must address whether MES capabilities are included, separately licensed, or require third-party integration—each approach creating different cost and complexity implications.

- Industry-Specific Module Requirements: Manufacturing verticals—automotive, aerospace, medical device, food and beverage, electronics—require specialized functionality for quality management, traceability, compliance, and industry regulations. Contracts must clearly define which vertical-specific capabilities are included versus separately priced add-ons.

IoT Integration Costs and Licensing

The proliferation of IoT in manufacturing creates new contract negotiation complexity as vendors introduce licensing models for connected devices, data transmission, and analytics capabilities that weren’t contemplated in traditional user-based licensing structures.

Understanding IoT Licensing Models

Vendors approach IoT connectivity pricing through various models that significantly impact costs as manufacturers scale their connected operations:

- Device-Based Licensing: Some vendors charge per connected device—each sensor, machine controller, or IoT gateway consuming a license similar to human users. For manufacturers with hundreds or thousands of connected devices, this model can dramatically inflate costs beyond traditional user licensing.

- Data Volume Pricing: Alternatives include charging based on data volumes transmitted from IoT devices to ERP systems. As manufacturers expand sensor deployments and increase data collection frequency, these consumption-based models create variable costs that strain budget predictability.

- Tiered Connectivity Packages: Many manufacturing ERP vendors offer tiered packages—basic connectivity for limited devices, standard for moderate IoT deployments, enterprise for extensive sensor networks. Understanding tier thresholds and transition pricing becomes critical for manufacturing ERP contract negotiations.

- Bundled IoT Capabilities: Some vendors position IoT connectivity as included within manufacturing-specific license tiers rather than charging separately. NetSuite, for example, includes certain IoT capabilities in base subscriptions, while SAP and Microsoft often charge separately for IoT integration features.

Negotiating IoT Integration Protections

Smart manufacturing ERP contract negotiations establish clear frameworks for IoT costs that prevent future surprises:

- Define IoT Device Classification: Negotiate precise definitions of what constitutes a “device” requiring licensing. Clarify whether sensors, PLCs, machine controllers, edge gateways, and other industrial automation equipment each consume licenses or whether certain device categories are excluded from counts.

- Establish Device Count Limits: For device-based licensing, negotiate included device allocations within base pricing rather than paying per device from unit one. Secure substantial included devices (e.g., 500-1,000 devices) that accommodate current needs plus growth runway.

- Lock in Growth Pricing: Pre-negotiate per-device pricing for expansion beyond included allocations. As manufacturers scale IoT deployments, these pre-agreed rates prevent vendors from charging premium prices when they recognize platform dependency.

- Data Transmission Caps: For consumption-based IoT models, establish maximum monthly or annual data transmission charges. Manufacturing generates enormous data volumes, and uncapped consumption pricing creates significant cost risk as sensor deployments expand.

- Integration Infrastructure Clarity: Clarify what IoT integration infrastructure vendors provide versus requiring third-party solutions. Some vendors include IoT platforms, gateways, and connectivity tools while others expect manufacturers to provide these components at additional cost.

Shop Floor Licensing and User Models

Traditional “named user” licensing models developed for office workers break down when applied to manufacturing environments where shop floor workers share terminals, use mobile devices intermittently, and don’t require continuous system access comparable to desk-based employees.

Manufacturing-Specific User Types

Manufacturing ERP contract negotiations should address multiple user categories with different licensing requirements:

- Shop Floor Operators: Production workers who clock in/out, acknowledge work orders, enter production counts, and report quality issues represent high user counts but limited functional needs. Negotiate specific “shop floor operator” license types at reduced rates compared to full ERP users.

- Machine Operators: Equipment operators who interact with systems through shop floor terminals or tablets for job tracking, material consumption, and downtime reporting. Manufacturing ERP contracts should price these users appropriately for their limited transaction patterns.

- Quality Inspectors: Specialized workers conducting inspections, recording measurements, and managing non-conformances need quality module access but not full ERP functionality. Secure advantageous licensing for quality-specific users.

- Maintenance Technicians: Personnel managing preventive maintenance, recording work orders, and tracking equipment history represent another user category requiring limited access. Negotiate maintenance-specific license types that reflect actual system usage patterns.

- Engineering Users: Product engineers, process engineers, and manufacturing engineers accessing systems for bill of materials, routing management, and engineering change orders require different functionality than shop floor personnel. Manufacturing ERP contract negotiations should recognize these distinct needs.

Concurrent vs. Named Licensing for Manufacturing

The choice between named user and concurrent user licensing creates dramatically different cost outcomes in manufacturing environments:

- Named User Limitations: Assigning individual licenses to each shop floor worker who might occasionally access systems creates license proliferation where organizations pay for dozens or hundreds of users who collectively represent much lower simultaneous usage.

- Concurrent User Benefits: Manufacturing environments with many occasional users achieve better economics through concurrent licensing where 50 concurrent licenses might support 200-300 shop floor workers who access systems intermittently throughout shifts.

- Hybrid Licensing Strategies: Optimal manufacturing ERP contract negotiations often employ hybrid approaches—named licenses for office personnel with consistent needs, concurrent licenses for shop floor populations with intermittent access patterns.

- Terminal-Based Licensing: Some vendors offer terminal or device-based licensing for shop floor environments where multiple workers share fixed workstations. This model can prove more economical than either named or concurrent approaches for certain manufacturing configurations.

MES Integration: Build, Buy, or Bundle

The relationship between ERP and MES systems—how they integrate, who provides them, and how they’re licensed—represents one of the most critical considerations in manufacturing ERP contract negotiations.

Understanding MES-ERP Integration Options

Manufacturers face several architectural approaches to MES-ERP connectivity, each creating different contract implications:

- Integrated MES Within ERP: Some ERP vendors include MES capabilities as native modules within their platforms. DELMIAWorks (formerly IQMS), Epicor Kinetic, and Plex Systems provide integrated approaches where MES and ERP operate as unified solutions. Manufacturing ERP contract negotiations for integrated solutions should clarify exactly which MES capabilities are included versus separately licensed advanced features.

- Separate Best-of-Breed MES: Large manufacturers with complex shop floor requirements often deploy specialized MES solutions from vendors like Siemens, Rockwell Automation, or Dassault Systèmes that integrate with ERP systems. This approach requires negotiating both ERP and MES contracts plus integration services.

- Hybrid Approaches: Many manufacturers use ERP for high-level production planning while deploying specialized MES for detailed shop floor control and data collection. Manufacturing ERP contracts should address how systems exchange data, what integration tools vendors provide, and who bears responsibility for successful connectivity.

MES Integration Cost Considerations

The expense of MES-ERP integration extends beyond software licensing to include substantial implementation and ongoing maintenance costs:

- Integration Development Costs: Connecting separate ERP and MES systems requires custom integration development, typically ranging from $50,000 to $500,000 depending on complexity. Manufacturing ERP contract negotiations should clarify whether vendors include integration services or charge separately for connectivity development.

- Data Mapping and Transformation: ERP systems and MES solutions often use different data structures, requiring mapping and transformation logic. Contracts should specify who provides data mapping services and at what cost.

- Real-Time vs. Batch Integration: Manufacturers needing real-time data exchange between shop floor and enterprise systems require more sophisticated (and expensive) integration architecture than those accepting periodic batch updates. Manufacturing ERP contracts should clearly define integration performance standards and associated costs.

- Ongoing Integration Maintenance: As both ERP and MES systems receive updates, integration connections require ongoing maintenance. Negotiate clear responsibility allocation for maintaining integrations when vendor updates potentially disrupt connectivity.

- API Licensing and Limits: Some vendors limit API calls or charge separately for API access required for MES integration. Manufacturing ERP contract negotiations must address API availability, call volume limits, and overage pricing to prevent integration throttling.

Supply Chain Module Pricing and Functionality

Manufacturing supply chains introduce complexity exceeding simple procurement and inventory management, requiring specialized modules that vendors often price as premium add-ons rather than base ERP inclusions.

Manufacturing Supply Chain Capabilities

Manufacturers need robust supply chain functionality that generic ERP may not provide:

- Advanced Planning and Scheduling (APS): Sophisticated production scheduling considering constraints, bottlenecks, and optimization represents critical manufacturing capability often licensed separately from base ERP. Manufacturing ERP contract negotiations should secure favorable APS pricing or inclusion in manufacturing-specific license tiers.

- Demand Planning and Forecasting: AI-powered demand forecasting, consumption-based planning, and statistical forecasting capabilities frequently require separate licenses or premium add-ons. Negotiate inclusion or pre-agreed pricing for demand planning modules manufacturers will inevitably need.

- Supplier Collaboration Portals: Connecting suppliers into planning, forecasting, and replenishment processes through web portals represents another common add-on. Contracts should clarify whether supplier portal access consumes additional licenses and at what cost.

- Quality Management Systems (QMS): Comprehensive quality management including supplier quality, incoming inspection, in-process quality control, and non-conformance management often requires separately licensed QMS modules. Manufacturing ERP contracts should address QMS licensing comprehensively.

- Product Lifecycle Management (PLM) Integration: Connecting ERP with PLM systems for engineering change management, BOM synchronization, and product data exchange creates integration costs similar to MES connectivity. Negotiate PLM integration tools and services upfront.

Multi-Tier Supply Chain Visibility

Global manufacturers require visibility beyond direct suppliers into second-tier, third-tier, and contract manufacturers throughout their supply networks:

- Supply Chain Control Tower: Real-time visibility into multi-tier supplier networks, logistics tracking, and supply chain event management represents advanced functionality vendors typically position as premium modules. Manufacturing ERP contract negotiations should address control tower capabilities and pricing.

- Contract Manufacturer Integration: Organizations leveraging contract manufacturing need to exchange production data, forecasts, inventory positions, and quality information with external manufacturers. Contracts must clarify how contract manufacturer connectivity is licensed and supported.

- Logistics and Transportation Management: Integration with 3PLs, freight forwarders, and transportation management systems creates additional licensing and integration costs. Ensure manufacturing ERP contracts address logistics connectivity comprehensively.

Production-Specific Contract Terms

Beyond licensing and integration, manufacturing ERP contracts require specific operational provisions reflecting production environment realities.

Shop Floor Uptime Requirements

Manufacturing operations depend on ERP availability differently than office environments, creating unique SLA requirements:

- Production Hours Coverage: Office-hours support proves inadequate for manufacturers operating multiple shifts. Manufacturing ERP contract negotiations must secure 24/7 support coverage aligning with production schedules.

- Critical Transaction Response Times: Unlike back-office processes tolerating occasional slowdowns, shop floor transactions—job acknowledgments, material issues, quality holds—require immediate response. Negotiate specific response time commitments for production-critical transactions.

- Planned Downtime Windows: Manufacturers can’t simply shut down systems for maintenance during business hours. Contracts must address planned maintenance windows that don’t disrupt production and specify advance notice requirements.

- Disaster Recovery and Failover: Production downtime costs manufacturers thousands per hour. Manufacturing ERP contracts should include robust disaster recovery commitments, failover capabilities, and maximum recovery time objectives matching operational criticality.

Data Collection and Accuracy

Shop floor data collection introduces unique challenges requiring specific contractual protections:

- Bar Code and RFID Support: Automatic data collection through bar codes, RFID, or other technologies reduces errors and improves efficiency. Contracts should clarify whether scanning infrastructure, label printing, and mobile data collection tools are included or separately priced.

- Machine Data Collection Interfaces: Direct machine-to-system interfaces for automatic data capture represent specialized functionality often requiring additional licensing. Manufacturing ERP contract negotiations must address machine connectivity comprehensively.

- Data Validation and Error Handling: Shop floor workers entering data under production pressure create error risk. Contracts should address system validation capabilities, error correction workflows, and data quality tools included in manufacturing modules.

Quality and Compliance Provisions

Regulated manufacturing industries face unique contract requirements ensuring ERP systems support quality and compliance obligations:

Industry-Specific Compliance

Different manufacturing verticals require specialized compliance capabilities:

- FDA Regulated Industries: Medical device and pharmaceutical manufacturers need 21 CFR Part 11 compliance, electronic signatures, audit trails, and validation documentation. Manufacturing ERP contracts for regulated industries must include specific compliance warranties and validation support commitments.

- Automotive IATF 16949: Automotive suppliers require APQP, PPAP, control plans, and traceability supporting IATF 16949 certification. Negotiate explicit automotive compliance capabilities within contracts.

- Aerospace AS9100: Aerospace manufacturers need AS9100-compliant systems with comprehensive traceability, serialization, and certificate of conformance generation. Contracts should warrant aerospace-specific functionality.

- ISO Certification Support: Manufacturers maintaining ISO 9001, ISO 13485, or other quality certifications need systems supporting certification requirements. Manufacturing ERP contracts should commit to providing documentation, audit trails, and configuration supporting ISO compliance.

Traceability and Serialization

Product traceability represents critical manufacturing capability requiring specific contract attention:

- Lot Tracking: Forward and backward lot traceability enabling recall management represents basic manufacturing requirement. Contracts must confirm comprehensive lot tracking is included in base licensing.

- Serial Number Management: Products requiring unique serial numbers throughout manufacturing, testing, and service lifecycle need sophisticated serialization. Manufacturing ERP contract negotiations should address serialization capabilities and any associated pricing.

- Genealogy Tracking: Complex products requiring component-level traceability showing exactly which parts went into which finished units represent advanced capability sometimes requiring additional licensing. Negotiate genealogy tracking inclusion or favorable add-on pricing.

Strategic Manufacturing ERP Contract Negotiation

Manufacturing organizations face unique contract negotiation challenges reflecting the technical complexity of connecting shop floor operations with enterprise systems, integrating IoT-enabled equipment, deploying MES capabilities, and managing sophisticated supply chains that define modern manufacturing.

Successfully negotiating manufacturing ERP contracts requires addressing industry-specific considerations around shop floor licensing, IoT integration costs, MES connectivity, supply chain modules, production-specific SLAs, and compliance requirements that generic enterprise software agreements overlook. Organizations that invest effort in comprehensive manufacturing ERP contract negotiations—securing appropriate shop floor licensing models, establishing clear IoT pricing frameworks, addressing MES integration costs, negotiating supply chain module inclusion, and ensuring quality/compliance support—position themselves for successful ERP implementations that deliver the operational visibility and connectivity essential for manufacturing excellence.

For manufacturers navigating ERP procurement, independent advisory expertise provides essential guidance through the complex dynamics of manufacturing-specific contract terms, integration architecture decisions, and vendor-specific licensing models. The specialized knowledge advisors bring to manufacturing ERP contract negotiations typically delivers value far exceeding advisory costs through improved terms, avoided pitfalls, and contractual protections that serve manufacturers throughout their system lifecycle.