Acumatica announced that it has entered into a definitive agreement to be acquired by Vista Equity Partners. Vista is a global investment firm specializing in enterprise software, data, and technology-enabled businesses. This Acumatica Vista Equity Partners acquisition 2025 represents a significant strategic move in the cloud-native ERP market. Also, validating the company’s AI-first product strategy and sustained growth trajectory in serving small and mid-sized businesses.

Structured Breakdown of the News

The Acquisition Agreement

The Acumatica Vista Equity Partners acquisition 2025 involves a definitive agreement signed between the cloud-native ERP provider and Vista Equity Partners. Vista is recognized as a global investment firm that focuses exclusively on enterprise software, data, and technology-enabled businesses. The transaction is expected to close in Q3 2025, marking a pivotal moment in Acumatica’s corporate development. The deal is reportedly valued at approximately $2 billion, including debt.

Strategic Validation and Market Position

According to the announcement, this acquisition validates Acumatica’s success across multiple dimensions. Specifically, sustained growth performance, innovative AI-first product strategy, and customer-centric culture. CEO John Case emphasized that “Our partnership with Vista not only marks a significant milestone in Acumatica’s history but also is a strong endorsement of the real-world value we deliver to the market and our customers.”

Investment Rationale from Vista’s Perspective

Vista Equity Partners views the Acumatica acquisition 2025 as a strategic investment in a rapidly growing market segment. Monti Saroya, Co-Head of Vista’s Flagship Fund and Senior Managing Director, described Acumatica as “an ascendant, cloud-native ERP platform that has become a leading provider of mission-critical tools that enable small and mid-sized businesses to run more efficiently and effectively.” The investment firm particularly noted Acumatica’s “industry-leading, strong partner ecosystem and growing presence in markets embracing cloud-based business technology.”

Growth Strategy and Future Development Plans

The acquisition is expected to accelerate Acumatica’s product development and market expansion. John Case stated that “Vista’s investment can help power our AI-first product strategy and further strengthen our thriving Community of partners, developers and customers, working together to find better ways to work and redefine business management software for everyone.” The partnership aims to enhance product innovations, AI-enabled capabilities, and deliver increased value to customers.

Partner Ecosystem Strengthening

A key focus of the Acumatica Vista Equity Partners acquisition 2025 is strengthening the existing partner ecosystem. John Stalder, managing director at Vista, highlighted that “Acumatica has established a strong market position with differentiated, flexible, and industry-specific ERP solutions as well as a uniquely dedicated channel of value-added resellers.” Vista expressed commitment to partnering with Acumatica’s community to drive continued growth and product innovation.

Common Questions That We Are Hearing

Will existing Acumatica customers experience changes in service or support?

The acquisition is expected to enhance rather than disrupt customer service. Given Vista’s track record of growing software companies and Acumatica’s emphasis on customer-centric culture, existing customers are likely to benefit from accelerated product development and enhanced AI capabilities. However, customers may expect to see changes in product roadmaps and feature prioritization as the integration progresses.

How will the AI-first strategy be implemented under Vista’s ownership?

This acquisition is specifically positioned to power the AI-first product strategy. Customers can expect to see enhanced AI-enabled capabilities integrated into the platform, though the announcement did not detail specific implementation timelines and features. The investment is likely to accelerate AI development resources and expertise.

What changes can partners expect in the channel program?

Partners are expected to benefit from deepened engagement and strengthened ecosystem support. Vista’s investment is likely to result in enhanced partner enablement programs, expanded market reach, and potentially new partnership opportunities. However, partners may also face increased competition as the platform scales and attracts more channel participants.

Will pricing models change following the acquisition?

While specific pricing details were not disclosed in the announcement, enterprise software acquisitions by Vista typically focus on growth and market expansion rather than immediate pricing changes. Customers are likely to see continued investment in product value before any significant pricing adjustments, though long-term pricing strategies may evolve as the platform scales.

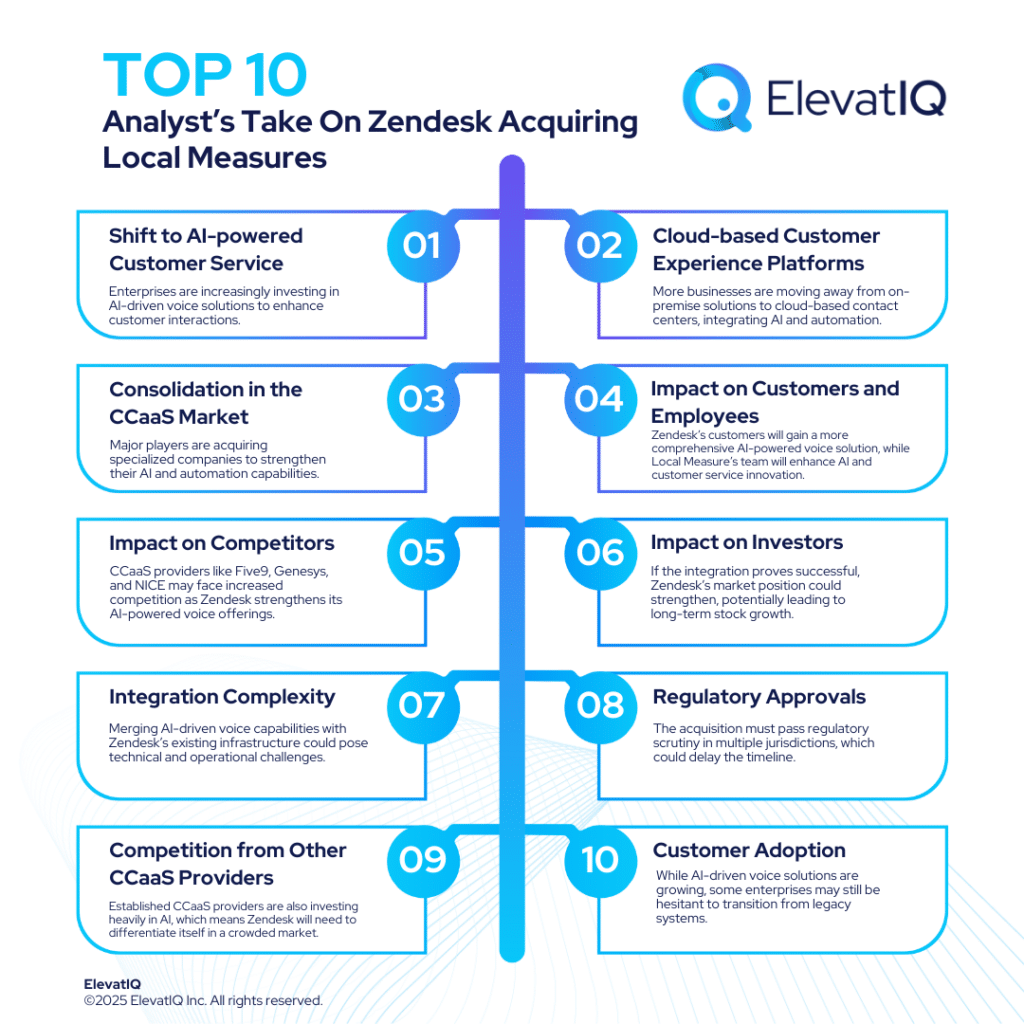

Analyst’s Take on This

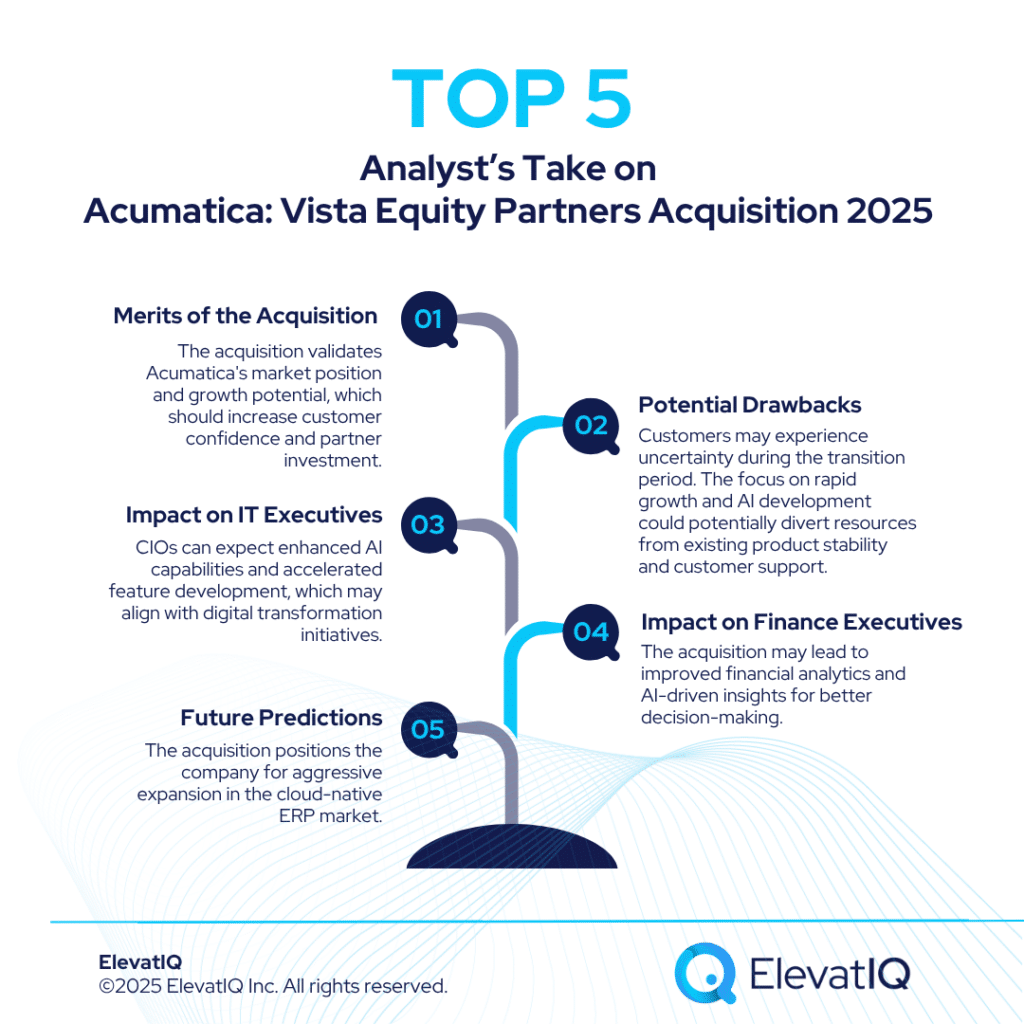

Merit and Demerit Analysis

Merits of the Acquisition: The Acumatica Vista Equity Partners acquisition 2025 provides significant financial backing for accelerated product development and AI integration. Vista’s proven track record in growing software companies offers valuable expertise and resources. The acquisition validates Acumatica’s market position and growth potential, which should increase customer confidence and partner investment. Additionally, the acquisition represents an exit for EQT, Acumatica’s previous majority owner, which helped drive sevenfold revenue growth and global expansion since 2019.

Potential Demerits: Integration challenges may arise as Vista implements its growth strategies and operational changes. Customers may experience uncertainty during the transition period. The focus on rapid growth and AI development could potentially divert resources from existing product stability and customer support. Additionally, as a private equity-backed company, there may be increased pressure for aggressive growth targets.

Impact on IT Executives

CIOs evaluating cloud-native ERP solutions are likely to view this acquisition positively. This is because it signals platform stability and continued innovation investment. CIOs can expect enhanced AI capabilities and accelerated feature development, which may align with digital transformation initiatives. However, they should prepare for potential changes in product roadmaps and integration strategies as Vista influences development priorities.

Impact on Financial Executives

CFOs can expect to benefit from Vista’s investment in financial management capabilities and reporting enhancements. The acquisition may lead to improved financial analytics and AI-driven insights for better decision-making. However, CFOs should monitor potential pricing changes and contract modifications as the platform evolves under new ownership.

Future Predictions

The Acumatica Vista Equity Partners acquisition 2025 positions the company for aggressive expansion in the cloud-native ERP market. Vista’s investment approach typically focuses on scaling successful platforms, suggesting potential geographic expansion and vertical market penetration. The AI-first strategy is likely to accelerate, potentially leading to advanced automation and predictive analytics capabilities. The acquisition may also trigger increased competition in the small and mid-sized business ERP market. This could benefit customers through improved innovation and competitive pricing across the sector.

Industry Trend Analysis

Private Equity Investment in Cloud ERP: The Acumatica Vista Equity Partners acquisition 2025 reflects broader private equity interest in cloud-native ERP platforms. This trend indicates market confidence in the digital transformation of business management software and the growth potential of cloud-based solutions.

AI Integration in Enterprise Software: The emphasis on AI-first strategy aligns with industry-wide trends toward intelligent automation and predictive analytics in enterprise software. This acquisition positions Acumatica to compete with larger ERP providers who are also investing heavily in AI capabilities.

Focus on SMB Market Segment: Vista’s investment in Acumatica demonstrates continued market opportunity in serving small and mid-sized businesses with sophisticated ERP solutions. This segment will drive significant growth as businesses increasingly adopt cloud-native platforms for digital transformation.

Partner Ecosystem Evolution: The acquisition highlights the importance of strong partner ecosystems in ERP success. Vista’s commitment to strengthening Acumatica’s partner community reflects industry recognition that channel partnerships are critical for market penetration and customer success. As Monti Saroya noted, “With its industry-leading, strong partner ecosystem and growing presence in markets embracing cloud-based business technology, we believe Acumatica is well-positioned to lead the shift toward modern, integrated ERP solutions.” The transaction represents Vista’s confidence in cloud-native ERP platforms and their potential to transform business management software for the evolving needs of modern enterprises.