Last Updated on March 17, 2025 by Sam Gupta

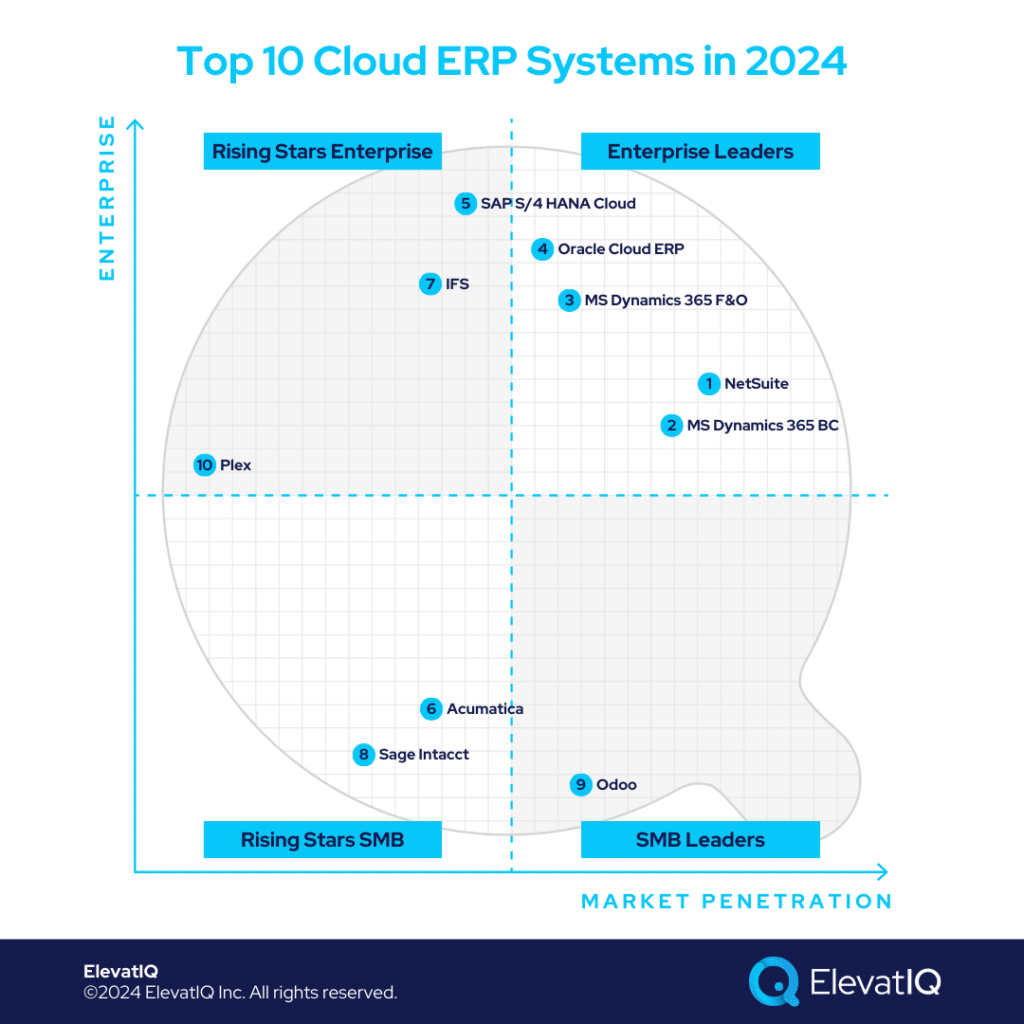

Cloud ERP systems exhibit a broad spectrum, ranging from those disguising outdated backends as cloud-based to extreme cases deploying on-prem code bases in data centers, asserting a ‘web link’ qualifies as the cloud. Untangling this complexity requires an understanding of diverse layers and factors that define the cloud, encompassing both technical and financial aspects. In easier terms, think of it as renting (cloud) versus buying (on-premises). However, similar to renting, diverse cloud business models exist, varying in roles and responsibilities of each party involved.

Particularly in a standard cloud solution, the provider handles infrastructure upkeep, and your responsibility is to consume services for a periodic rent, facilitating the conversion of CapEx spending into OpEx. However, this analogy has a significant limitation. Vendors can hire specialized firms for financial translation and infrastructure management, also allowing them to claim their offerings as cloud overnight. This mirrors the practice of legacy ERP vendors selling repainted cars as new—potentially fraud in the automotive sector but perfectly legal in the ERP industry.

Thus to discern between repainted cars and new ones from the lenses of cloud-native technologies, a profound understanding of their nuances is imperative. Unlike on-prem technologies, which target a singular interface, cloud technologies must adeptly serve numerous interfaces, introducing exponential complexity with a greater number of variables. Seemingly minor issues like enterprise search or font rendering can dramatically impede operations, contrary to ERP vendors’ claims of the cloud as a “universal answer” to all business performance issues. While these drawbacks may not be immediately apparent during the selection phase, users frequently encounter frustration upon implementation. Seeking truly groundbreaking cloud ERP systems? Explore our curated list for reliable recommendations.

Criteria

- Definition of a Cloud ERP System. The richness of functionality in the cloud. How cloudy is the experience? Financial? Operational? Technical? All? Replaced only the front end? Or the whole stack? User experience modernized for the cloud interfaces?

- Overall market share/# of customers. A higher market share in the cloud ranks higher on our list.

- Ownership/funding. The more committed management to the product roadmap in the cloud ranks higher on our list.

- Quality of development. More cloud-native capabilities rank higher on our list.

- Community/Ecosystem. Communities with a heavy presence from cloud users rank higher on our list.

- Depth of native functionality for specific industries. The deeper the publisher-owned out-of-the-box cloud-native functionality, the higher it ranks on our list.

- Quality of publicly available product documentation. The poorer the product documentation, the lower it ranks on our list.

- Cloud market share (and documented commitment of the publisher through financial statements). The higher the focus on the cloud, the higher the cloud ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with the cloud-native strategy. Acquiring legacy products to wrap in a fancy marketing package? The lower it ranks on our list.

- User Reviews. The deeper the reviews from cloud-native users, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product such as QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. Plex

Plex, born in the cloud, specializes in automotive, F&B, and industrial manufacturing. Ideal if MES expertise is paramount but less suitable for those emphasizing deep ERP layers and mixed-mode manufacturing. A top choice for pure-play companies within the Toyota and Ford ecosystems, generating up to $1B in revenue from $50M. This is particularly fitting for businesses with traceability and supply chain integrations, like F&B enterprises. However, not the optimal choice for companies with diverse business models. Therefore, Plex secured the #10 spot on our list, a slight downgrade from previous rankings.

Strengths:

- Born in the Cloud. Built from the ground up for the cloud-native experience. Consistent design and architecture across screens and modules.

- Manufacturing and MES. Designed from the perspective of automotive OEMs. Also contains supply chain and quality processes tailored for specific micro-verticals.

- Automotive Capabilities. Built out of the box are the Toyota and Ford compliance and quality capabilities. Expect substantial efforts to enable similar capabilities with other similar products not tailored for automotive.

Weaknesses:

- Ecosystem. Plex approaches its ERP implementations in the hand-off mode. And the consulting options might not be as prevalent due to the limited install base.

- Limited Focus on the Solution. Great for pure-play automotive companies. However, it might not work for diverse business models, even within manufacturing.

- Not the best fit for Companies Growing Through M&A. Not the best fit for companies in the M&A cycle, whether planning for carve-outs, mergers, or acquisitions. Primarily due to the uncertainty of the to-be business model.

9. Odoo

Odoo stands out as a cloud-native system particularly tailored for small to medium-sized businesses. As a born-in-the-cloud product, it maintains a cohesive design across screens and modules. If a cloud-native experience is your top priority, then Odoo deserves a spot on your list. However, success with Odoo hinges on engaging a seasoned business consultant experienced in ERP implementations and integrations. Caution is advised against excessive customization, generally resulting in derailed ERP implementations. We have upgraded Odoo a little bit this year due to the lack of momentum in Plex’s portfolio, jumping to the rank of #9 on this list.

Strengths:

- Designed for Global Companies. Fit for smaller companies that might have entities in many different countries. Regions such as Europe and South America are likely to benefit from Odoo, generally consisting of multiple entities in many countries.

- User Experience and Consistent Design. Expect one of the best UX and consistent design patterns across screens and modules.

- Open Source. Despite the perception of savings with licensing, don’t forget to consider the overall costs, sometimes exceeding more than commercial options.

Weaknesses:

- Out-of-the-box Capabilities to Support Larger Organizations. The open-source nature leads to a tendency to over-customize, resulting in an inferior product experience despite its cutting-edge UX.

- Limited Business Consulting Expertise. Consisting primarily of developers, the ecosystem particularly doesn’t have a seasoned program, change management, and business consultants to keep the large programs on track.

- Limited Last Mile Capabilities. The last-mile capabilities for specific micro-verticals are limited, requiring significant customization for their work with specific industries.

8. Sage Intacct

Sage Intacct focuses on service-centric sectors like non-profit, healthcare, financial services, software, and technology. Perfect for those particularly prioritizing contract compliance, ASC606, and subscription-based features. However, less suitable for inventory-centric businesses. If you operate in service-centric fields like non-profit, SaaS, healthcare, or financial services, then Sage Intacct could be a solid choice. It received a notable downgrade in this year’s ranking due to lacking core operational cloud functionality found in other ERP solutions, securing the #8 position on our list.

Strengths:

- Deep Subscription-centric Capabilities. Sage Intacct has one of the strongest subscription-centric capabilities, particularly including ASC606, revenue recognition, payment terms at the contract line item level, intercompany accounting, and multi-element allocation.

- Globalized and Localized in over 120 countries. Sage Intacct can natively support multi-entity collaboration features of over 120 countries.

- Brightpearl, Procore, and Salesforce Integrations are built and Owned by Sage. Also Brightpearl, Procore, and Salesforce integrations are owned and maintained by Sage, ensuring the quality of development.

Weaknesses:

- Manufacturing and Industrial Distribution Capabilities. Companies with diverse business models, such as tech companies with manufacturing or distribution needs, might struggle with the solution.

- Limited Supply Chain and CRM Capabilities. Primarily an accounting solution. So the solution doesn’t have any CRM capabilities at all. As well as limited supply chain capabilities, even for indirect procurement. But non-profit and healthcare organizations needing inventory and warehouse capabilities might struggle with the solution.

- Too Many Moving Pieces During Implementation. While the integration required for Brightpearl, Procore, and Salesforce is supported by Sage, there will be multiple parties involved during the implementation, increasing the implementation failure risk.

7. IFS

Positioned uniquely, IFS targets mid-to-large project and field-service-centric organizations with substantial assets. It excels when best-of-breed field service and asset management capabilities are needed, even as standalone offerings atop SAP or Oracle. However, it may not be the best fit for mixed-mode manufacturing or companies with diverse business models or those undergoing M&A cycles. Particularly suitable for companies in the MRO and airline ecosystem seeking a cloud ERP system. Thus, IFS secures the 7th position on our list as a robust cloud ERP solution for specific industries.

Strengths:

- User Experience and Interface. One of the most consistent user experiences that have been rearchitected and modernized, similar to born-in-the-cloud products.

- Best of Breed Field Service Capabilities. Abilities to manage the field service scheduling of over 50K field service technicians particularly with substantial R&D investments in resource optimization capabilities.

- Best of Breed Asset Management Capabilities. One of the strongest asset-management capabilities for organizations with very thick asset and predictive maintenance needs, such as MRO organizations.

Weaknesses:

- Ecosystem. Expect a limited presence in North America and also a lean partner ecosystem.

- Limited Focus. Companies with a diverse business model, such as manufacturing or expecting changes with the model, might outgrow or struggle with the solution.

- May not be the best fit for Companies Growing Through M&A. Companies involved with the M&A or the ones part of the PE portfolio might not be the best fit for IFS.

6. Acumatica

Established in the cloud, Acumatica caters to distribution, construction, field services, and manufacturing-centric organizations, primarily suitable for companies with operations in select countries like the US and UK, with deeper operational capabilities and less emphasis on global financial requirements. It is an ideal choice for companies with revenue ranging from $10 million to $100 million but may not be as suitable for large global enterprises. Therefore, Acumatica is recommended if prioritizing a cloud-native experience is crucial over extensive operational and global capabilities. Thus, positioned as a robust cloud ERP solution, Acumatica secures the 6th position on our list.

Strengths:

- One Product, Multiple Business Model. Supports several complex business models as part of the same package, ranging from construction, manufacturing, and distribution.

- Consumption-based Pricing. The consumption-based pricing model might be friendlier particularly for companies with low transaction volume or seasonal labor requirements.

- Marketplace and Ecosystem. Vibrant marketplaces and ecosystems with controlled procedures enforced by Acumatica for quality development.

Weaknesses:

- Globalization Capabilities. Acumatica would require hosting multiple countries in different instances with an external consolidation add-on, also limiting collaboration capabilities between those entities. Not the best fit for global companies with significant collaboration needs.

- Ability to Handle Larger Workloads. Primarily an SMB product and not designed to handle the workload of larger organizations.

- Not a Fit for Companies Growing Through M&A. Such companies require global collaboration among entities such as those with private equity structure or part of holding companies.

5. SAP S/4 HANA Cloud

SAP S/4 HANA is tailored for large, public-centric product organizations particularly with intricate product models and demanding MRP runs. It excels as an ideal choice for large global companies seeking consolidated management for all entities within a single system. However, it may not be the optimal solution for companies outgrowing smaller ERP systems or QuickBooks, requiring a certain level of IT maturity for successful implementation. Thus as a robust cloud ERP solution, SAP S/4 HANA secures the 5th position on our list.

Strengths:

- HANA. Because of the power of HANA, SAP S/4 HANA can process very complex MRP runs with product models containing millions of serial numbers and SKUs and the ability to process millions of costing and scheduling entries much faster than most ERP systems.

- Best of Breed Capabilities Pre-integrated. The best-of-breed software, such as SAP Commerce Cloud, Hybris, Concur, SuccessFactors, and EWM, is pre-integrated with the SAP S/4 HANA, potentially saving millions of dollars with integration.

- Financial Traceability for Large, Global Organizations. Large complex financial organizations require end-to-end traceability of SOX compliance workflows, also built with each document and transaction with SAP S/4 HANA.

Weaknesses:

- Limited Last-mile Capabilities. The pre-baked last-mile capabilities specific to micro-industries might be limited, requiring either development or add-ons on top of the core solution.

- Limited Capabilities of the Cloud Version and Marketplace Options. The cloud version is behind with development in comparison to the on-prem variant. Equally limited are the marketplace options compared to other competing solutions.

- Overwhelming for Smaller Organizations. The data model is designed for large, complex organizations, and also overwhelming for smaller organizations outgrowing QuickBooks or smaller ERP systems.

4. Oracle Cloud ERP

Oracle Cloud ERP is designed for large publicly traded organizations seeking comprehensive global financial capabilities. However, it may not be the most suitable option for smaller product-centric companies that are outgrowing their ERP or accounting systems. Thus positioned as a robust cloud ERP solution, Oracle Cloud ERP secures the 4th spot on our list.

Strengths:

- Designed for Large Service Organizations. The embedded HCM, CRM, and CPQ processes are suitable for large service-centric organizations with leaner inventory and operational needs. Also the P2P workflows are friendlier for indirect procurement organizations.

- Embedded WMS and TMS Processes. The embedded WMS and TMS processes are particularly suitable for logistics and healthcare-centric organizations. As well as any other services-centric organizations leaner on their inventory management needs.

- Designed to Support Financial Processes of Large, Regulated Industries. The product architecture supports the needs of large complex financial organizations with deep sub-ledger hierarchies, the ability to close books at the subsidiary level, and also keeping user-defined books for complex branch, fund, partnership accounting, etc.

Weaknesses:

- Limited Capabilities for Product-centric Companies. The P2P processes, CPQ, and manufacturing capabilities may not be the friendliest for product-centric organizations particularly with the needs for MES, PLM, and S&OP-centric processes.

- Ability to Handle MRP Runs of Fortune 500. Might struggle with the complex MRP runs hitting millions and millions of costing, scheduling, and also WIP industries.

- Overwhelming for Smaller Organizations. The data model and translations required to be successful with the product may be too overwhelming for companies outgrowing QuickBooks or other smaller ERP systems.

3. Microsoft Dynamics 365 Finance & Operations

Microsoft Dynamics 365 Finance & Operations stands out as one of the most comprehensive cloud solutions, also capable of accommodating various business models within a single software platform. It is particularly well-suited for large global companies seeking integrated WMS and TMS capabilities without the need for additional add-ons. Particularly tailored for global operations spanning multiple countries, it may not be the optimal choice for smaller companies with revenue under $250 million that are outgrowing platforms like QuickBooks or other compact ERP systems. Thus, boasting substantial upgrade this year, it secures the 3rd position on our list.

Strengths:

- Designed for Large Organizations. Ideal for large, global companies with complex business models operating in multiple countries, requiring one system for the entire operations.

- Embedded WMS and TMS Processes. Embedded WMS and TMS processes help companies requiring end-to-end traceability including external supply chain.

- Mixed-mode Manufacturing Capabilities, including Process, Discrete, and PSA. Microsoft Dynamics 365 F&O can accommodate several business models as part of the same solution, such as PSA, process, and discrete manufacturing.

Weaknesses:

- May not be the Best Fit for Publically-traded Companies. The traceability requirements for publicly traded companies might not be as intuitive as the other ERP solutions designed from the perspective of the CFO.

- Ability to Handle MRP Runs of Fortune 500. Might not be the most suitable for the transactional workload and the MRP run of the fortune 500 due to the heavy lifting required.

- Overwhelming for Smaller Organizations. Companies under $250M in revenue or outgrowing smaller ERP or accounting systems such as QuickBooks might struggle, with limited data modeling and translation expertise.

2. Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central, fully re-engineered for the cloud, is designed for SMBs with extensive financial requirements, PSA, and FMCG distribution needs. Also advantageous for global SMBs with a presence in multiple countries. However, it may not be the optimal choice for companies in the industrial distribution and manufacturing sectors seeking intricate operational capabilities, necessitating add-ons atop MS Dynamics 365 BC. In summary, Microsoft Dynamics 365 Business Central is recommended for those seeking global financial capabilities coupled with a dynamic marketplace of developers. With noteworthy enhancements this year, it secures the 2nd position on our list.

Strengths:

- Designed for Global Companies. Natively supports global regions and localizations where Acumatica, Epicor, or Infor might have limited support.

- Deep Supply Chain Capabilities for Complex Distribution and Retail Organizations. The data model is friendlier for FMCG and distribution companies requiring native support for complex features such as bin tracking or license plate support.

- Ideal for Diverse Companies Growing Through M&A. The global nature and the available options through the marketplace make it ideal for companies growing through M&A, regardless of whether they might be vertically integrated or globally expanding.

Weaknesses:

- Limited Last Mile Capabilities. The native last-mile capabilities might be limited for industries such as industrial manufacturing or distribution.

- Technical Focus and Limited Business Consulting Expertise of the Microsoft Ecosystem. The ecosystem has technical companies with limited business consulting experience, generally resulting in over-customization and overengineering of Microsoft products.

- Limited Microsoft Support for Smaller Partners. Unlike other ERP companies, Microsoft doesn’t offer any support or control to its smaller products, leading to ERP implementation issues because of the lack of control over the channel.

1. NetSuite

NetSuite is tailored for SMBs with a global footprint, particularly those in service or commerce sectors. It excels for organizations with varied business models seeking a global financial ledger and robust CRM workflows. However, it may not be the optimal choice for industrial distribution or manufacturing needs. Overall, NetSuite is recommended for service-centric or commerce-oriented SMBs, especially those undergoing growth via acquisitions or under private equity ownership. With slight enhancements this year, it claims the top spot on our list.

Strengths:

- Supports both Product and Service-centric Companies. Along with the robust financial ledger, CRM, and PSA, NetSuite can support the inventory needs of commerce-centric organizations.

- Marketplace and Ecosystem. NetSuite has one of the most vibrant marketplaces and ecosystems, with tons of pre-baked integrations and add-ons available.

- Ideal for Global Companies Growing Through M&A. NetSuite can support several diverse and global business models out of the box, making it ideal for companies part of the private equity portfolio and growing through M&A.

Weaknesses:

- Patchy User Experience. Although NetSuite was born in the cloud, the user experience is not as modern as Acumatica or Sage Intacct, making it slightly inferior for companies looking for a solution known for its user experience and cloud-nativeness.

- Not friendly for B2C, Unified Commerce, and Omnichannel Experience. You might run into performance issues in storing millions of B2C customer records and transactions that should be part of the commerce or OMS layer.

- Limited Manufacturing Capabilities. The BOMs and MRP capabilities are extremely limited and not really designed for the complex workflows of industrial manufacturing with busy shop floors.

Final Words

Whether or not the cloud is a priority, discerning the authenticity of cloud systems is crucial. When evaluating the cloud as a factor, carefully assess each variable based on your specific requirements. If prioritizing the cloud experience, this list can serve as a valuable starting point. However, recognizing genuine cloud solutions from fake ones demands expertise. Consider seeking advice from independent ERP consultants to ensure informed decisions.