Last Updated on March 17, 2025 by Sam Gupta

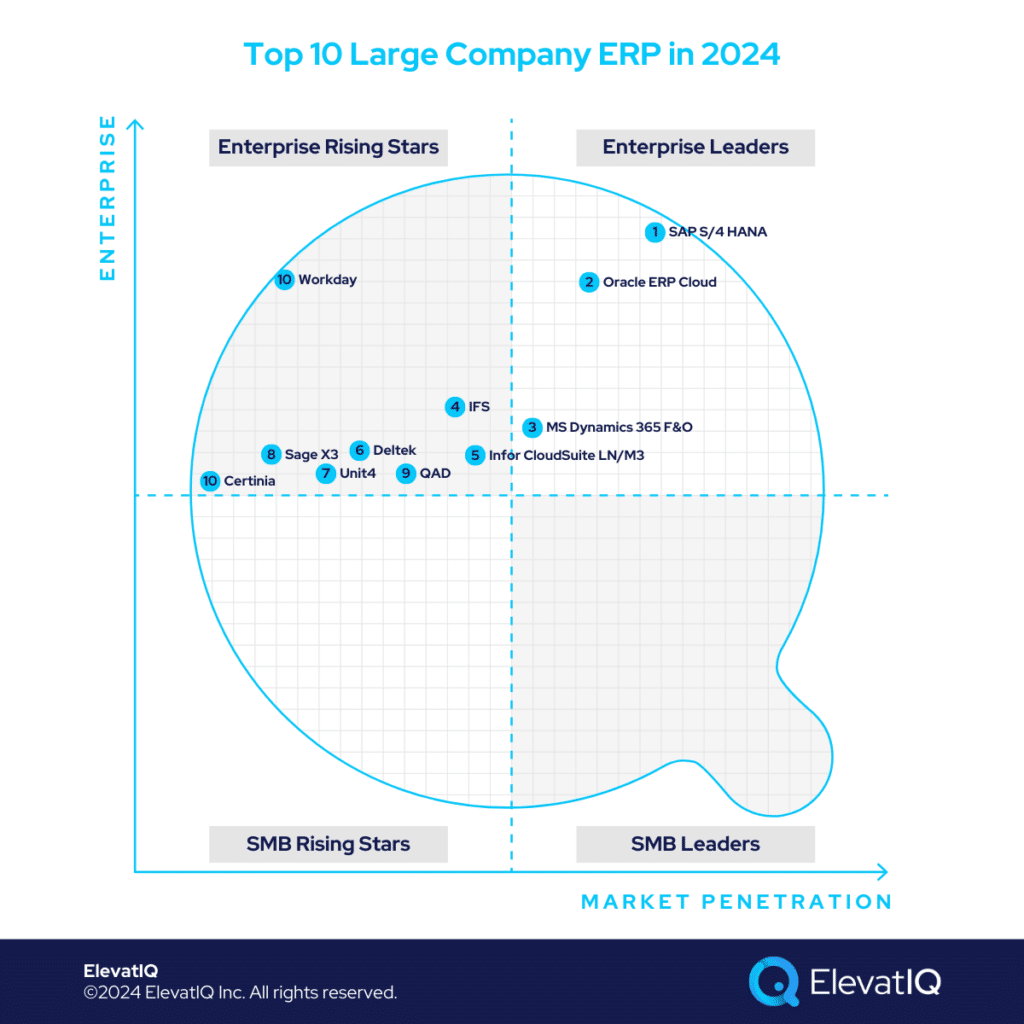

For large companies, selecting an ERP system is no longer about meeting functional specifications. Instead, it’s about their ability to handle the transactional capacity and cross-functional process throughput. Evaluating software-enabled processes’ throughput mirrors physical or human resources planning, commencing with the desired state and identifying necessary resources. Contrary to the misconception of infinite capacity in software systems, meticulous capacity planning is indispensable.

The critical determinant in cross-functional process throughput boils down to the choice between isolated and tightly integrated processes. Amidst variables like human resources interactions, reconciliation overhead, and the switchover effect, pinpointing the most financially efficient approach proves challenging. Consequently, companies adopt varied ERP implementation strategies—some favoring tightly integrated methods, others leaning towards slightly more best-of-breed approaches. Additional factors include the generation of journal entries per user interaction, driving system overhead, and the cycle time for cross-functional processes. Advocates for real-time to batch conversion exist, yet even in batch mode, time considerations take precedence. For example, an MRP run exceeding 5 hours could fracture SQL connections and disrupt planning schedules, underscoring the need for meticulous analysis and ERP selection aligned with these considerations.

While throughput assessment may seem scientific, persuading every department to use the same ERP system can cause political resistance and power struggles. Evolving desired states and extended implementation horizons are other challenges large organizations face, forcing them to treat ERP as the corporate financial ledger while allowing their subsidiaries to choose their systems. So, which systems prove optimal at this stage regardless of their choice of architecture? Let’s delve in.

Criteria

- Definition of a large company. More than $1B in revenue or more than 1000 employees. Might be publicly listed. Financial controls are a must for SOX compliance and public reporting. Finance takes over operational needs. Might be present in more than ten countries.

- Overall market share/# of customers. Higher market share among the large companies ranks higher.

- Ownership/funding. The more committed the management to the product roadmap for large companies, the higher it ranks on our list.

- Quality of development. The more cloud-native capabilities, the higher it ranks on our list.

- Community/Ecosystem. The larger the community with large companies, the higher it ranks on our list.

- Depth of native functionality for specific industries. The deeper the publisher-owned out-of-the-box functionality, the higher it ranks on our list.

- Quality of publicly available product documentation. The poorer the product documentation, the lower it ranks on our list.

- Larger company market share. The higher the focus on large companies, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with large companies. The more aligned the acquisitions are with the large companies, the higher it ranks on our list.

- User Reviews. The deeper the reviews from large companies, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product such as QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. Workday/Certinia

Workday, initially tailored as an HCM solution for Fortune 1,000 accounts, finds its niche in industries with sizable white-collar workforces. While Workday serves well as a comprehensive ERP for large enterprises in sectors like tech, media, telecom, banks, retail, and financial services, its suitability diminishes for product-centric industries requiring deeper transactional depth in inventory, costing, and MRP processes. However, it can excel in product-centric scenarios in a best-of-breed architecture sitting atop a corporate financial ledger.

Historically, Certinia served as an alternative for finance before Workday developed its financial module. Depending on architectural preferences, both Workday and Certinia would be fit for best-of-breed architecture in some industries or function as complete ERPs in others. Despite a lower market share as ERP, their unique presence secures the #10 position on this list.

Strengths

- Enterprise-grade best-of-breed capabilities. Workday and FinancialForce excel in HCM and PSA, respectively, in their target industries, sitting atop the corporate financial ledger such as SAP or Oracle.

- Proven for enterprise workloads. Both solutions have been proven for enterprise workloads where the Fortune 100 may process millions of journal entries per hour, only possible with the disconnected architecture.

- Cloud-native. Both solutions are cloud-native, a huge plus for large enterprises aiming for superior cross-functional throughput.

Weaknesses

- Requires internal IT maturity. The executives with limited experience in building complex architecture might struggle to hire skilled experts.

- Requires discipline with master data governance. The inability to build cross-functional with master data governance and cross-functional integration workflows might be counterproductive.

- Expensive. While operationally efficient, best-of-breed architecture is likely to be the most expensive of all, with substantial integration and maintenance costs in the long term.

9. QAD

QAD, a supply chain-focused manufacturing solution, caters to large automotive, F&B, and high-tech companies. Ideal as a subsidiary-level solution or as a corporate ERP for lower enterprise markets, it suits firms seeking robust functionality in supplier collaboration and international trade. Although a legacy solution, QAD has announced its plans to rearchitect the solution on a modern tech stack. However, its smaller size may pose challenges with transactional processing for larger accounts, and its niche nature could be limiting for enterprises with diverse operational models. Considering these factors, QAD secures the #6 rank among large company ERP systems.

Strengths

- Pre-integrated best-of-breed suite tailored for specific micro-verticals. QAD shines in specific micro-verticals where the generalized BOMs and recipes of vanilla solutions might struggle, especially beneficial as a subsidiary solution of large enterprises.

- ERP + Supply Chain Suite. QAD is perhaps the only suite that combines the capabilities of both suites, especially beneficial in architecture with disconnected supply chain planning at the plant level.

- Multi-entity Support. QAD would be a great fit for enterprises that want to consolidate some entities relevant to supply chain planning while keeping the remaining integrated through the corporate financial ledger.

Weaknesses

- Limited focus. The limited focus might be a challenge for enterprises planning to host all of their entities in one solution, requiring an upgrade to a more diverse solution.

- Limited ecosystem. QAD’s ecosystem is substantially limited, causing issues with global rollout in countries with limited local talent.

- Technology. While QAD plans to redesign its entire platform, moving away from legacy technologies such as RPG, it might take a few years before it fully stabilizes.

8. Sage X3

Sage X3 is suitable for enterprises in the agriculture, F&B, and process manufacturing industries as a subsidiary-level best-of-breed solution, sitting atop SAP or Oracle– or, as a corporate solution for lower enterprises. With one of the strongest security and financial traceability, it could be a great fit for publicly traded or audit-ready companies in the lower enterprise market. However, it’s not proven with the upper enterprise market, particularly those necessitating millions of journal entries per hour. Despite these considerations, it secures the #8 spot among large company ERP systems.

Strengths

- Great for enterprise pharma and agriculture companies. Last mile capabilities for pharma, agriculture, and process-centric companies as a subsidiary solution atop a corporate financial ledger such as SAP or Oracle.

- Deep ERP layers for audit-ready and public companies. Ideal as a complete ERP solution, especially in the process-centric companies in the lower enterprise market.

- Great ecosystem of consultants for pharma validation. The ecosystem includes consulting companies with deep expertise in the Sage X3 product and validation procedures.

Weaknesses

- Limited focus. The limited focus of the solution might be a challenge for enterprises active with the M&A cycle and using it as a corporate solution with the desire to host all of their entities in one solution.

- Not proven for the larger enterprise market. While great for the lower enterprise market and as a subsidiary solution, it’s not a great fit as a corporate solution for the upper enterprise market.

- Limited best-of-breed capabilities. Enterprise companies looking for pre-integrated best-of-breed options may struggle to find those options with Sage X3.

7. Unit4

Unit4, a robust ERP system, specifically targets large educational institutions and public-sector entities. Its forte lies in people-centric functionality augmented by enterprise-grade ERP capabilities. Noteworthy is Unit4’s unique standing, offering enterprise-grade functionalities for student information and teacher workflow management, setting it apart in the market. Proven in handling substantial workloads, Unit4 boasts successful implementations in some of the largest universities and public sector organizations, traditionally domains of Oracle Cloud ERP, Workday, or Microsoft Dynamics 365 F&O. Despite being rearchitected for a cloud-native experience, Unit4 remains a legacy product.

While primarily a European solution, Unit4 ensures localization and globalization for numerous countries. However, its challenge lies in accommodating diverse business models, making it less suitable for companies acquiring entities with varied business models, securing the #7 position on our list of large company ERP systems.

Strengths

- Enterprise-grade capabilities for universities and non-profits. Perhaps the only solution in this space that has depth in the public sector space, requiring substantial consulting efforts atop vanilla solutions.

- Cloud capabilities. While the solution is legacy, they have made substantial progress with their cloud capabilities.

- Pre-integrated HCM and procurement processes tailored for service-centric industries. Solutions such as Workday that offer best-of-breed HCM and indirect procurement capabilities might be technically and financially risky.

Weaknesses

- Limited focus. The limited focus of the solution might be a challenge for enterprise companies active with M&A cycles, especially for business models outside of Unit4’s expertise.

- Limited ecosystem and consulting base. As of today, their North American presence and consulting base is significantly limited.

- Limited best-of-breed capabilities. Enterprise companies opting to build best-of-breed architecture might not find as many pre-baked integration options, requiring substantial consulting efforts.

6. Deltek

Deltek caters to major government contractors, AE, and construction companies, serving as an ideal subsidiary solution for large enterprises or as a corporate solution for lower enterprise segment planning to host all of their global entities in one database. Tailored for these industries, Deltek offers unique capabilities, leveraging industry-specific databases and integrations, which is particularly crucial for processes like CPQ. While excelling in deep capabilities for certain industries, Deltek is not as complete as an ERP as other solutions on this list, necessitating additional integrations. Despite its focused scope, recent developments have influenced its ranking, securing the #6 position among large company ERP systems.

Strengths

- Last-mile capabilities for GovCon and construction-centric verticals. Deltek has last-mile capabilities in the construction and GovCon space, making it an ideal subsidiary solution for large enterprises.

- Access to the databases and networks relevant to these industries. Deltek has several products in its portfolio with industry databases and networks that would be much harder to build atop vanilla solutions because of the subject matter expertise required in these industries.

- Multi-entity capabilities. Their multi-entity capabilities are rich, making them suitable for lower enterprise companies seeking a corporate solution to host all of their entities in one database.

Weaknesses

- Limited focus. The limited focus of the solution might be a challenge for enterprise companies active with M&A cycles, especially for business models outside of Deltek’s expertise.

- Limited ecosystem and consulting base. As of today, their ecosystem and consulting base is significantly limited.

- Not proven for the larger enterprise market. While great for the lower enterprise market and as a subsidiary solution, it’s not a great fit as a corporate solution for the upper enterprise market.

5. Infor CloudSuite M3/LN

Infor LN and M3, distinct products bundled into CloudSuite offerings, share our list’s ranking due to their non-overlapping target markets. While Infor CloudSuite LN focuses on discrete-centric verticals like aerospace and automotive, Infor M3 caters to industries such as apparel and food and beverage. Both offer comprehensive manufacturing solutions for global organizations with diversified manufacturing business models, including essential components like PLM and industry-specific quality features. Positioned as subsidiary solutions for the upper enterprise market or corporate solutions for the lower enterprise market, they secure the #5 spot among large ERP systems.

Strengths

- Great for lower enterprise companies as pureplay manufacturing business models. Ideal for lower enterprise companies as a corporate solution or as a subsidiary solution for upper enterprise, publicly traded, private equity-owned, or holding companies.

- Most comprehensive manufacturing capabilities. Both can support the most complex manufacturing business models for global companies exploring operational synergies across global entities.

- Enterprise-grade capabilities for lower enterprise companies. While most smaller solutions might require ad-hoc arrangements for global financial operations, both have them natively built.

Weaknesses

- Not the best fit as a corporate ledger. Large enterprises, private equity, or holding companies requiring global solutions while using a tier-2 solution at the subsidiary level might not find the most value with both.

- Limited focus. The limited focus on certain business models poses the risk of requiring other ERP systems to support complex and diverse business operations.

- Limited ecosystem and consulting base. The consulting base is highly limited, primarily relying on very few Infor resellers for consulting and support.

4. IFS

IFS focuses on large enterprises in the airline, MRO, construction, oil and gas, and heavy equipment field service sectors, offering strong ERP, EAM, field service, and enterprise project management capabilities. Suited for large enterprises seeking best-of-breed solutions, IFS can sit atop financial ledgers like SAP or Oracle or serve as a subsidiary solution. Despite notable progress in North America, its install base is comparatively limited. With recent growth in enterprise adoption, IFS secures the #4 position on our list.

Strengths

- Enterprise-grade field service and asset management capabilities. This is especially suitable for upper enterprise companies seeking best-of-breed capabilities with field service and asset management.

- The data model is aligned with companies with large programs. Industries such as MRO, Oil, and Gas follow very different project structures and BOMs. And IFS’s data model allows them to manage complex programs without any ad-hoc arrangements.This is especially beneficial for lower enterprise companies looking for last-mile capabilities pre-baked with the solution.

- Technology – While a legacy solution, IFS technology has been rearchitected and modernized using cloud-native SaaS technologies.

Weaknesses

- Limited focus. The limited focus might be a challenge for enterprise companies active with M&A cycles.

- Limited ecosystem. Its presence and install base are still limited in North America compared to other solutions on this list.

- Not proven for the larger enterprise market. While great as a best-of-breed solution for field service or EAM, it’s not proven for the workload of Fortune 1000 companies.

3. Microsoft Dynamics 365 Finance & Operations

Microsoft Dynamics 365 F&O is perhaps the most diverse solution accommodating several global business models in one database, making it an ideal solution for lower enterprise companies seeking a corporate solution to host all of their entities in one database. While a great fit as a corporate ledger for large enterprises, it’s not as proven as other leading solutions in the enterprise market with workloads as high as millions of journal entries per hour that Fortune 1000 companies might demand. Given these considerations, it secures the #3 spot on our large company ERP systems list.

Strengths

- Diverse capabilities.Supports global operations and business models and pre-baked integration for the best-of-breed CRM and field service solutions.

- Ecosystem. This is especially beneficial for private equity and holding companies trying to streamline all of their entities on one solution. They can find add-ons if the core solution doesn’t meet their needs for last-mile industry capabilities.

- Global capabilities. Global capabilities would help enterprise companies in countries with its limited presence or support, making it a truly global solution compared to other platforms on this list.

Weaknesses

- The channel is not as regulated. Microsoft channel is very complex, without any direct support for its resellers and partners, making navigating the Microsoft channel extremely hard.

- Limited best-of-breed capabilities directly through OEM. While Microsoft Dynamics 365 F&O has a vibrant marketplace to augment its core capabilities, crucial capabilities such as PLM, etc, might not be owned and pre-integrated by Microsoft.

- Limited last-mile capabilities. The last-mile capabilities required in specific micro-verticals such as dairy, plastic, building supplies, or metal might require add-ons or expensive development on top of the core platform.

2. Oracle Cloud ERP

Ideal for large enterprises in service industries, Oracle Cloud ERP stands out as a top choice as a corporate financial ledger within best-of-breed architectures, whether for publicly traded or privately owned entities. While excelling as a financial ledger, its suitability as a subsidiary solution in best-of-breed setups is limited due to over-bloated global capabilities and leaner last-mile functionalities compared to other solutions on the list. Given these considerations, Oracle Cloud ERP claims the #2 spot among large company ERP systems.

Strengths

- Robust finance capabilities for large, global enterprises. Capabilities include having five layers of GL restrictions, multiple layers of sub-ledgers, and book closing requirements across divisions, making an ideal corporate ledger for complex global enterprises.

- Proven solution as a corporate ledger with Fortune 1000 workloads. It can handle the workload of large enterprises processing millions of GL entries per hour.

- Ecosystem. Oracle Cloud ERP has an ecosystem of experienced consultants capable of handling the architecture of such complex enterprises.

Weaknesses

- Global transactional and financial traceability are not as intuitive. While functionally capable, transactional and financial traceability might not be as intuitive for large, complex enterprises.

- It may not be the best fit for large enterprises with complex transactions or Fortune 1000 global MRP workloads. While great as a financial ledger, complex products with serialized structures or large enterprises with very complex BOMs with operational and financial synergies among entities might struggle with the solution because of the workload requirements at this scale.

- Not the best fit as a subsidiary solution. There are better solutions on this list that can offer much deeper operational capabilities at the subsidiary level without the overloaded complex financial layers of Oracle Cloud ERP.

1. SAP S/4 HANA

SAP S/4 HANA is among the few solutions with capabilities to handle the workload expectations of most complex products with global MRP runs, making it ideal as a corporate ledger for most enterprise companies, publicly or privately owned, or as a corporate ERP for globally integrated product-centric industries, regardless of their design including shared services. Despite its enterprise-grade capabilities, it is not as suitable for enterprises seeking deeper operational capabilities at the subsidiary level. Given these considerations, it secures the #1 rank among large ERP systems.

Strengths

- Robust finance capabilities for large, global enterprises. Capabilities include several financial hierarchies to support complex, global organizations without requiring ad-hoc arrangements for global traceability or consolidations.

- Proven solution with the most detailed enterprise-grade MRP strategy for global planning. Globally connected enterprises with shared product models and dependencies among entities, SAP S/4 HANA, can handle most complex planning configurations without the requirement of decoupling the transactions.

- Intuitive global transactional and financial traceability. It is one of the most intuitive ERP products for such complex operations with its transactional maps capabilities built with the products, making debugging complex financial enterprises easier.

Weaknesses

- Behind in cloud ERP capabilities. Despite advanced financial traceability and technical capabilities, the functional capabilities are not as rich as with its on-prem version.

- Not the best fit as a subsidiary solution. There are better solutions on this list that can offer much deeper operational capabilities at the subsidiary level without the over-bloated complex financial and enterprise layers.

- Limited last-mile capabilities. In industries where it might not be the most frequently installed as an operational solution, the other solutions are likely to have deeper last-mile capabilities.

Conclusion

Transitioning into the $1B club brings unique challenges like navigating multiple country regulations, cash flow intricacies, currency hedging, and international supply chain complexities—issues less prevalent in mid-market companies.

Deploying systems designed for smaller enterprises may lead to financial control shortcomings. Large companies should avoid squeezing into ill-fitting solutions and explore options tailored to their specific needs. Let this list guide you in narrowing down suitable ERP choices for your enterprise with the help of independent ERP consultants.