Last Updated on March 11, 2025 by Sam Gupta

Blackstone and Vista Equity Partners have completed their Smartsheet acquisition, a work management and collaboration platform, in an $8.4 billion all-cash transaction. Smartsheet shareholders received $56.50 per share, a price reflecting an 8.5% premium over the company’s last closing price before the announcement and a 41% premium over its 90-day volume-weighted average stock price as of July 17, 2024. Following the completion of the deal, Smartsheet has officially transitioned into private ownership and has been delisted from the New York Stock Exchange.

The Smartsheet acquisition is part of a broader trend of private equity firms investing in high-growth SaaS companies, particularly those that integrate AI and automation into enterprise workflows. With Blackstone and Vista Equity Partners taking control, the focus will likely shift toward enhancing Smartsheet’s AI capabilities, expanding its market reach, and improving operational efficiency. This transition raises key questions about its impact on customers, employees, and the competitive landscape of the work management software industry.

Breakdown of the Smartsheet Acquisition

The Smartsheet acquisition agreement includes several key elements:

- Transaction Value and Premium: The deal was completed at $56.50 per share, representing an 8.5% increase from Smartsheet’s last closing price before the announcement and a 41% premium over its 90-day volume-weighted average stock price as of July 17, 2024.

- Go-Shop Period: The agreement allowed Smartsheet a 45-day “go-shop” period to explore alternative acquisition offers. However, no competing proposals emerged.

- Delisting from NYSE: With the Smartsheet acquisition finalized, the company’s shares have been removed from public trading, making it a privately held firm.

This deal highlights the growing interest of private equity firms in the SaaS market, where recurring revenue models and AI-driven automation make companies like Smartsheet attractive investment opportunities.

Strategic Rationale for the Smartsheet Acquisition

Blackstone and Vista Equity Partners have been actively investing in enterprise SaaS platforms. Their investment in Smartsheet signals confidence in its potential for long-term growth and scalability. The Smartsheet acquisition is expected to enable the company to:

- Enhance AI and Automation Capabilities: AI-driven automation is a key focus area in work management software. With additional investment, Smartsheet is likely to integrate more AI-powered features, such as predictive analytics and workflow automation.

- Improve Operational Efficiencies: Private equity firms often streamline operations in acquired companies, which could lead to restructuring efforts aimed at enhancing profitability and cost management.

- Expand Market Reach: Smartsheet may prioritize global expansion and deeper penetration into the enterprise sector.

These strategic priorities align with broader trends in SaaS, where automation and AI-driven solutions are becoming critical competitive differentiators.

Impact of the Smartsheet Acquisition on Stakeholders

The acquisition of Smartsheet by Blackstone and Vista Equity Partners is expected to bring changes across multiple stakeholder groups, including customers, employees, and competitors. Here’s how each group may be impacted by this acquisition.

For Smartsheet Customers

Existing users of Smartsheet may see continued investment in AI-driven features, though potential adjustments to service structures could occur.

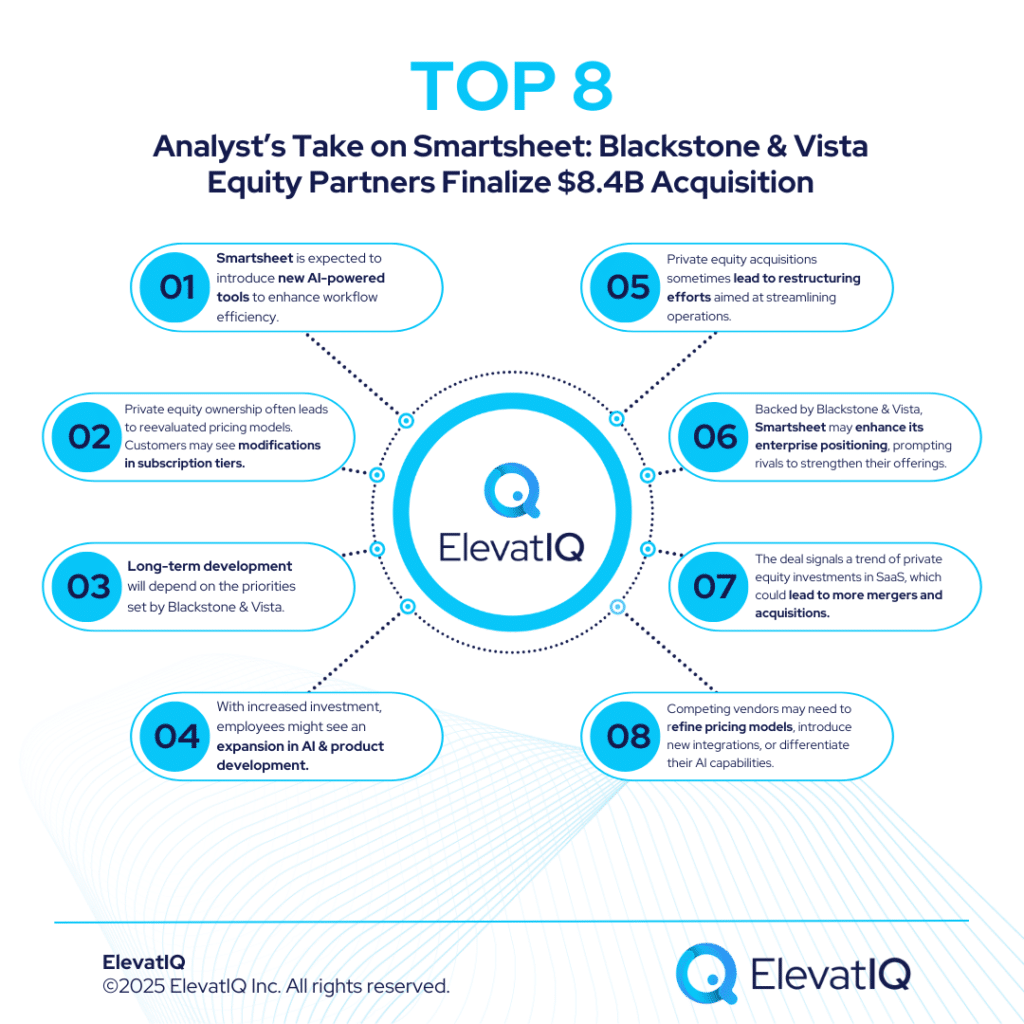

- AI and Automation Advancements: Smartsheet is expected to introduce new AI-powered tools to enhance workflow efficiency.

- Potential Pricing Adjustments: Private equity ownership often leads to reevaluated pricing models. While no immediate changes have been announced, customers may see modifications in subscription tiers.

- Long-Term Product Development: The Smartsheet acquisition provides the company with financial backing to innovate further, but its long-term direction will depend on the priorities set by Blackstone and Vista.

For Smartsheet Employees

Employees at Smartsheet may experience changes as the company transitions to private ownership.

- Expanded AI and Product Development: With increased investment, teams focused on AI and automation could see greater opportunities.

- Potential Organizational Adjustments: Private equity acquisitions sometimes lead to restructuring efforts aimed at streamlining operations.

While private equity ownership brings financial discipline, it may also introduce shifts in corporate culture and management strategies.

For Competitors in the Work Management Market

The Smartsheet acquisition could have implications for competitors such as Asana, Monday.com, and Atlassian.

- Increased Market Competition: Backed by Blackstone and Vista, Smartsheet may enhance its enterprise positioning, prompting rivals to strengthen their offerings.

- Potential Industry Consolidation: The deal signals a trend of private equity investments in SaaS, which could lead to more mergers and acquisitions.

- Shifts in Market Strategy: Competing vendors may need to refine pricing models, introduce new integrations, or differentiate their AI capabilities.

With AI and automation becoming key drivers of innovation, competitors will likely accelerate their technological advancements to remain competitive.

Analyst’s Take on the Smartsheet Acquisition

The Smartsheet acquisition by Blackstone and Vista Equity Partners presents both opportunities and challenges as the company transitions to private ownership. While increased financial flexibility could support long-term innovation, a shift in strategic priorities—such as profitability and operational efficiency, may influence its future direction.

Smartsheet’s Future Under Private Ownership

The Smartsheet acquisition presents both opportunities and challenges. While private ownership offers financial flexibility to pursue long-term innovation, new priorities, such as profitability and operational efficiency could shape Smartsheet’s future direction.

Key factors influencing its trajectory include:

- Operational Adjustments: Changes in pricing, service structures, or internal processes could affect users and employees.

- AI and Automation Integration: Continued advancements in AI-driven tools could reinforce Smartsheet’s market position.

- Expansion Strategy: The company may focus on international markets and enterprise growth.

Broader SaaS and Private Equity Trends

The Smartsheet acquisition reflects a larger movement in which private equity firms are actively investing in SaaS.

- Potential for Market Consolidation: More acquisitions in the SaaS industry could reshape competitive dynamics.

- Recurring Revenue Models: SaaS companies offer predictable revenue, making them attractive investment opportunities.

- AI and Automation Focus: Increasing AI adoption in enterprise software is shaping investment strategies.

Challenges and Risks of the Smartsheet Acquisition

While the acquisition presents several growth opportunities, potential risks include:

- Operational Execution Risks: Ensuring a smooth transition while maintaining innovation will be critical for Smartsheet’s success.

- Regulatory Scrutiny: Large technology deals sometimes face regulatory reviews, particularly regarding competition.

- Customer Adaptation: If service models change significantly, user retention could be impacted.