J.P. Morgan Payments and Oracle recently announced a significant collaboration, introducing a native Oracle ERP supply chain finance integration. This integration could reshape how enterprises approach embedded financial services. This comprehensive analysis explores this integration and its implications for organizations evaluating such solutions within their ERP systems.

The Oracle ERP supply chain finance integration operates through Oracle B2B via API connectivity, embedding J.P. Morgan’s financial services directly within Oracle Fusion Cloud ERP workflows. Companies can now offer suppliers immediate payment options without leaving their primary business system, representing a shift from traditional standalone financial platforms to integrated enterprise software selection.

Understanding the Oracle ERP Supply Chain Finance Integration

The partnership between Oracle and J.P. Morgan marks more than just a technical upgrade. By embedding supply chain finance directly into Oracle Fusion Cloud ERP, companies gain the ability to streamline supplier payments, reduce reliance on separate financial portals, and accelerate cash‑flow decisions without leaving their familiar workflows.

This integration is designed for organizations looking to simplify complex payment ecosystems while maintaining compliance and security. In order to understand the integration, this section first explores how the system works in this integration, why this approach is different, and what’s the big picture for strategy.

How the System Actually Works

The Oracle ERP supply chain finance integration works like having a built-in financial advisor inside your existing business software. Instead of using separate systems that don’t talk to each other, everything happens in one place – your Oracle Fusion Cloud ERP system.

Here’s what happens in simple terms: When a supplier sends you a bill, your system automatically gives you two options. You can either pay according to your normal payment schedule, or you can offer the supplier immediate payment through J.P. Morgan’s financing program. J.P. Morgan uses your company’s good credit to get better rates for everyone involved.

Why This Approach Is Different

Traditional supply chain finance solutions require companies to juggle multiple systems – your main business software, a separate payment portal, and various connection tools to make them work together. Independent ERP selection consultants often see companies struggle with these complex setups that require months of custom programming and extensive employee training.

This Oracle ERP supply chain finance integration eliminates those headaches. Everything happens within your familiar Oracle interface, so employees don’t need to learn new systems or remember different passwords. The financial payment options appear right where your team already processes invoices and approvals.

Built-in Security and Compliance

The system maintains the same security standards you already have in Oracle Fusion Cloud ERP. All financial transactions follow the same approval processes and create the same audit records as your other business processes. This means your compliance and governance procedures don’t need to change. The new financial capabilities simply work within your existing framework.

Real-World Success Story: How FedEx Made It Work

A practical example of this integration can be seen in FedEx’s recent rollout. Their treasury and finance teams reported that adopting the Oracle ERP–J.P. Morgan supply chain finance solution strengthened FedEx’s overall financial position and improved operational resilience. Most notably, what would have traditionally required months of custom development was reduced to a straightforward activation within their existing Oracle ERP environment.

But here’s the most interesting part: Gunter explained that “This collaboration transformed what would typically be a six-month custom development project into a simple activation process.” So, you can say instead of spending half a year building complex connections between different systems, FedEx turned on a feature that was already built into their Oracle system.

This experience shows why the Oracle Fusion Cloud ERP integration approach works well. Traditional supply chain finance projects often get stuck in development hell. Teams spend months trying to make different software systems talk to each other, costs spiral out of control, and many projects never actually finish. Independent ERP implementation consultants see this happen regularly when companies try to force separate systems to work together.

A Bigger Picture Strategy

This Oracle ERP supply chain finance integration isn’t just a one-off feature. It’s part of a much larger plan between Oracle and J.P. Morgan. The two companies are working together on multiple projects, including AI-powered expense reporting and new blockchain-based tools for managing company cash flow through J.P. Morgan’s Kinexys platform.

According to J.P. Morgan Payments’ leadership, the broader goal of this collaboration is to optimize financial performance for enterprises while supporting sustainable business growth. Thus, positioning Oracle’s ERP ecosystem as not just operational software, but also a platform for embedded financial services.

This shift represents a major change in how enterprise software works. Instead of buying different programs for different jobs, companies increasingly want everything integrated into one system. Independent ERP advisory services are seeing this trend accelerate as companies get tired of managing multiple vendor relationships and complex integrations.

What This Means for Companies Choosing Enterprise Software

The Oracle ERP supply chain finance integration signals a major shift in how companies should think about business software. The lines between traditional business management tools and financial services are disappearing. Companies now expect their main business system to handle financial services too, not just basic record-keeping.

This change will likely affect how companies choose their next enterprise software system. Instead of just asking “Can this software manage our inventory and customers?”, buyers now need to ask “What financial services come built-in, and how well do they work?” The Oracle ERP supply chain finance integration sets a new standard for what integrated financial tools should look like.

For companies already using Oracle systems, this integration offers better functionality without needing to manage relationships with multiple vendors or build complex connections between different systems. However, it also means becoming more dependent on Oracle’s ecosystem. Which has both benefits and risks that independent ERP selection consultants help companies evaluate.

How This Compares to Competitors

This Oracle ERP supply chain finance integration puts Oracle ahead of most competitors in embedded financial services. While companies like SAP and Microsoft offer various financial connections, Oracle’s partnership with J.P. Morgan provides supply chain finance solutions that work natively within the main business system. Something that could pressure other software companies to catch up.

If this approach becomes popular, we might see more partnerships between enterprise software companies and major banks. Embedded solutions like this Oracle ERP J.P. Morgan integration solution could challenge traditional supply chain finance providers, especially for mid-sized and large companies who prefer dealing with fewer vendors rather than managing multiple specialized relationships.

What Companies Need to Know Before Implementing

At this point, companies need to take a step back and assess the bigger picture. Implementing supply chain finance within Oracle ERP isn’t just a plug-and-play solution. It touches every layer of your operations, from vendor risk to compliance standards. This next section breaks down the criteria that might help you know if your company is ready for this Oracle ERP supply chain finance integration or not.

Technical Requirements Made Simple

Companies considering the Oracle ERP supply chain finance integration need to think beyond just technical features. Since this integration depends on J.P. Morgan’s financial infrastructure, you need to understand what happens if their services go down, how quickly problems get resolved, and what your backup plans should be. Independent ERP advisory services typically recommend having clear agreements about these service levels before moving forward.

Data security becomes especially important when financial services are built into your main business system. Companies in regulated industries like healthcare or finance need to verify that this setup meets their specific compliance requirements. The good news is that the embedded approach keeps data within your existing Oracle environment while connecting to J.P. Morgan’s services, but you should verify this works with your company’s security policies.

Understanding the Real Costs

The cost analysis goes beyond just the fees for using supply chain finance services. You also need to consider the money saved from not having to build custom connections between different systems, plus faster implementation times compared to traditional approaches. The FedEx case study suggests significant time savings, but also suggests that you should always consider your company’s specific situation and business requirements.

While implementation costs appear lower than traditional custom integration projects, companies should plan for some training requirements and change management. The embedded nature of the solution reduces some typical implementation risks but creates new dependencies on J.P. Morgan’s service infrastructure.

Is Your Company Ready?

Before moving forward with Oracle ERP embedded financial services evaluation, companies should first assess whether they have the right foundation:

| Requirements | |

| Technical Readiness | Clean, accurate data in your supplier and invoice management systems |

| Employees who are comfortable using Oracle Fusion Cloud ERP and have adopted existing workflows | |

| IT support team capable of ongoing maintenance and user assistance | |

| Organizational Readiness | Clear, consistent processes for paying suppliers that can work with automated approval workflows |

| Ability to manage organizational change when introducing new financial service workflows | |

| Executive support for adopting embedded financial services within your main business system |

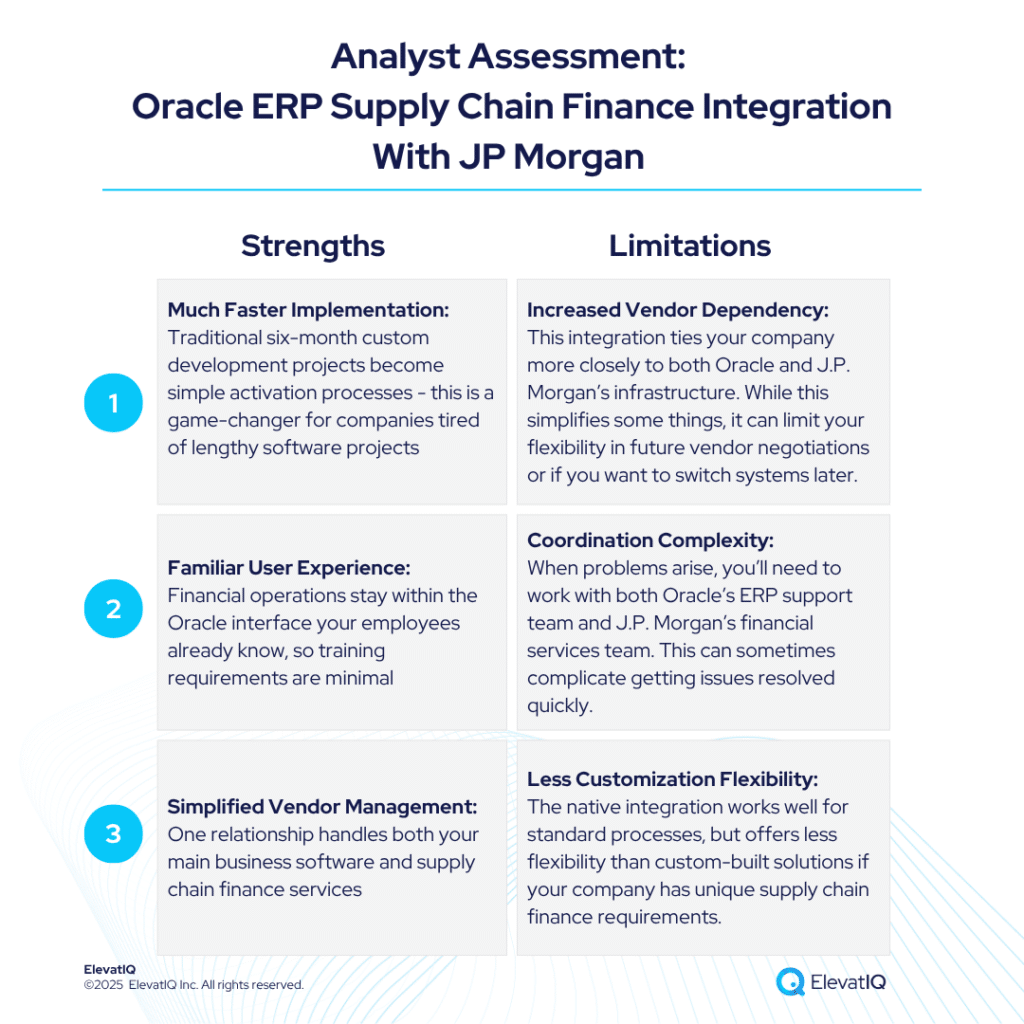

Analyst Assessment: What Works and What Doesn’t

Strengths

The Oracle ERP supply chain finance integration offers several proven benefits based on FedEx’s real-world experience and the announced capabilities:

- Much Faster Implementation:Traditional six-month custom development projects become simple activation processes – this is a game-changer for companies tired of lengthy software projects

- Familiar User Experience: Financial operations stay within the Oracle interface your employees already know, so training requirements are minimal

- Streamlined Operations: Automated invoice processing and approval workflows with payment options appear right where your team already works

- Simplified Vendor Management: One relationship handles both your main business software and supply chain finance services

Limitations

You should be aware of several real considerations before going for this ERP implementation:

- Increased Vendor Dependency: This integration ties your company more closely to both Oracle and J.P. Morgan’s infrastructure. While this simplifies some things, it can limit your flexibility in future vendor negotiations or if you want to switch systems later.

- Coordination Complexity: When problems arise, you’ll need to work with both Oracle’s ERP support team and J.P. Morgan’s financial services team. This can sometimes complicate getting issues resolved quickly.

- Less Customization Flexibility: The native integration works well for standard processes, but offers less flexibility than custom-built solutions if your company has unique supply chain finance requirements.

Why Independent Advice Matters

As embedded financial services become tightly woven into core business systems like Oracle ERP, the stakes for making the right implementation choices grow higher. It’s no longer just about selecting software, it’s about choosing the right ecosystem. This is where independent ERP analysis plays a critical role. The following sections explore how unbiased insights and expert guidance can help companies cut through vendor messaging and make more informed, future-proof decisions.

Getting Unbiased Analysis

The complexity of evaluating embedded financial services within business software highlights why many companies benefit from working with an independent ERP selection consultant during their decision process. These consultants can provide unbiased analysis of how integrated financial services fit with your specific business needs and existing technology setup, without any vendor bias.

An independent consultant can help you understand the real total cost of ownership for embedded solutions versus traditional separate-system approaches. This ensures your decisions are based on your unique company situation rather than vendor sales presentations.

Professional ERP Integration Services and Planning

For companies evaluating this Oracle ERP supply chain finance integration or similar embedded solutions, comprehensive independent ERP advisory services become increasingly important. The evaluation process now requires expertise in both enterprise software selection and financial services integration to ensure you get the best outcome.

Independent ERP selection or ERP integration services should include detailed analysis of integration requirements, security implications, and long-term vendor relationship management. As embedded financial services within business software systems become more complex, companies need expanded due diligence beyond traditional software evaluation.

Companies can access independent ERP expertise through platforms like ElevatIQ’s enterprise technology selection services, which provide guidance on enterprise software selection and implementation strategies. These services are particularly valuable when evaluating innovative solutions that combine different types of business capabilities.

What This Means for the Future

This Oracle ERP supply chain finance integration shows an early example of how business software is evolving. More companies want their main business system to handle financial services too, not just basic record-keeping. The success of this partnership will likely encourage more collaborations between business software companies and financial service providers, potentially changing how companies approach vendor selection and system design decisions.

The shift toward embedded financial services within business software systems creates opportunities for better efficiency, but also introduces new considerations around vendor dependency and service integration complexity. Companies will need to carefully balance these benefits and risks during their evaluation and implementation phases.

Changes in How Companies Choose Software

Future business software evaluations will likely need to consider integrated service capabilities alongside traditional software functionality. Independent ERP implementation consultants may play increasingly important roles in helping companies navigate complex vendor ecosystems where software and financial services come together.

The Oracle ERP J.P. Morgan integration analysis suggests that vendor partnerships will become more important in enterprise software selection decisions. This requires evaluation frameworks that consider not just individual vendor capabilities but also partnership stability and service integration quality.