Suite roles in architecture hinge on cross-functional embeddedness. Supply chain suites restrict ERP suites to financial reporting, while retail-focused suites demand collaboration with WMS, TMS, and OMS for mature capabilities like inventory management and allocation. These were traditionally considered to naturally reside particularly inside the ERP, sparking debates if hosted elsewhere. In retail, procurement aligns closely with merchandising and planning engines. Conversely, in manufacturing and industrial settings, procurement collaborates more directly with production and accounting, illustrating the diverse nature of suite roles.

In the past, distinctions were blurred, and organizations either didn’t prioritize external supply chain tracking or built custom ERP-based systems for traceability. The evolving landscape of supply chain suites, particularly driven by private equity, has changed this dynamic. Today, previously unattainable possibilities are realized through marketplaces and networks, fostering global insights and collaboration. Technologies like blockchain facilitate seamless global data exchange, transcending international interests. While ESG and e-invoicing are in their infancy, their impact on future architecture remains uncertain. However, it’s likely that a portion of these models will be embedded within the supply chain suite, leveraging networks for collaborative documentation exchange.

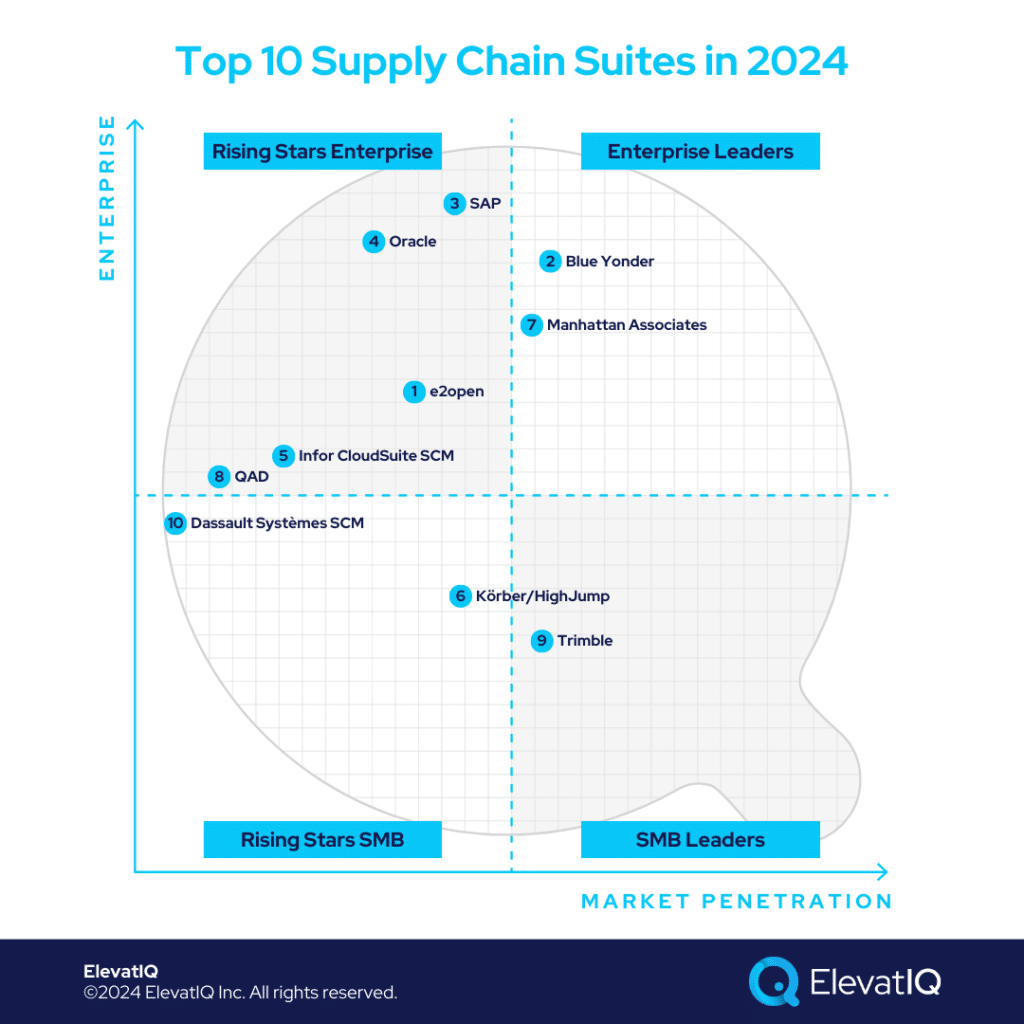

As supply chain suites continue to broaden their scope, determining the optimal placement particularly for specific processes within an architecture becomes increasingly complex. While straightforward for pure-play retail or manufacturing models, challenges intensify for businesses with overlapping models, like aftermarket operations blending aspects of both retail and manufacturing. This scenario is particularly applicable to softline and hardline retailers with significant manufacturing exposure. If you’re navigating supply chain suite choices, this list can assist in streamlining your options.

10. Dassault Systèmes SCM

Dassault Systèmes employs a distinctive approach in its suite, positioned at the crossroads of ERP, CAD, and S&OP. Although tailored for supply chain industries overlapping with process manufacturing and retail, it caters to automotive- and aerospace-centric sectors, necessitating robust supplier collaboration. The suite’s roots lie in plastics, offering integrated tools for plastic-like operations across diverse industries. In contrast, other suites like Blue Yonder may face challenges in these specialized sectors, making Dassault stand out and securing its spot at #10 on our list.

Pros

- Integrated with the ERP solution. The biggest plus with Dassault systems is its close alignment with ERP and CAD-centric systems,thus making it ideal for industries heavier on cost tracking, requiring ERP-centric processes, and limiting the role of S&OP to just planning.

- Comprehensive suite with PLM/PDM, SCM, and ERP. Integration with PLM and PDM would be friendlier for companies particularly heavier with S&OP processes in their NPD and R&D phases, a critical requirement for process-centric manufacturers.

- Compliance pre-baked for automotive and plastic verticals. Compliance processes heavily embedded with supply chain workflows, such as supplier collaboration, would require tight embeddedness of Dassault SCM.

Cons

- Technology is not modern. The technology might not be as modern as some of the newer options on this list, such as e2open.

- Limited ecosystem. The consulting ecosystem is highly limited, with their reseller channel being heavily crowded with CAD resellers without deeper supply chain expertise.

- The network is not part of the suite. They don’t have access to the proprietary network, a critical limitation for demand forecasting, primarily relying on customers’ internal and industry data sources, which are generally substantially off because of inadequacies of their source channels.

9. Trimble

Navigating supply chain planning, particularly in sectors like transportation, construction, and agriculture brings unique hurdles. Transportation prioritizes dispatch and preventive maintenance, influenced by distinctive driver-side compliance processes. Also, agriculture adds seasonal and crop quality factors to the planning mix. In construction, quoting processes wield substantial influence over supply chain planning. Thus, securing the 9th spot on our list, its suite’s specialized approach caters to the demands of these industries.

Pros

- A most comprehensive suite containing telematics and fleet management. Most other manufacturing-focused suites might struggle with business models particularly with internal fleets and transportation operations, positioning Trimble uniquely.

- Strong in transportation visibility. Their traceability and supply chain equation would be limited to transportation visibility, a strength for transportation-centric industries but a huge limitation for other industries.

- 3PL-specific planning and data. 3PL-specific planning and data are unique, a limitation with other solutions on this list.

Cons

- Not ideal for manufacturing or retail-centric industries. It is not an ideal fit for manufacturing and retail-centric industries, even if they might be using it for the transportation side of the processes.

- Limited network. The limited nature of the network would not complete the supply chain equation, thus limiting companies seeking end-to-end supply chain planning.

- Primarily focused on transportation execution and compliance. The other execution processes, such as retail, manufacturing, and production, would be highly limiting.

8. QAD

QAD adopts a strategy similar to Dassault’s by integrating CAD/PLM, S&OP, WMS, TMS, and ERP capabilities. Tailored for retail and supply chain-centric industries, it leans towards particularly discrete manufacturing and is less focused on process manufacturing for several industries like automotive and life sciences. QAD’s suite is structured around unique product categories, thus influencing supply chain and production processes across diverse industries. It mirrors the strategies of many supply chain suites, which exclusively focus on the supply chain function, omitting the ERP aspect, therefore making the QAD suite unique. Thus with its distinct attributes, QAD secures the 8th spot on our list.

Pros

- Integrated with the ERP solution. The biggest advantage of QAD’s suite is its alignment with ERP-centric processes for cost-focused industries where processes such as cost accounting and production scheduling are critical.

- Comprehensive suite with SCM and ERP. It combines the best of both worlds, including most components from the SCM suite, such as WMS and TMS, embedded with ERP processes, as well as CAD and PLM.

- Compliance pre-baked for automotive and F&B industries. Compliance processes that require tighter embeddedness with the S&OP processes would find QAD’s suite extremely compelling.

Cons

- Backend technology is not modern. The backend technology is not as modern as some of the newer platforms on this list.

- Limited ecosystem. QAD ecosystem is highly limited, with very few consulting companies maintaining expertise on the product set, making finding talent challenging.

- Network not part of the suite. QAD would rely on internal and customer-provided external data for its analysis, a substantial limitation compared to other systems owning and maintaining their networks as part of the suite.

7. Manhattan Associates

Manhattan specializes in retail and warehouse execution, tailored for industries tightly integrating physical store planning with warehousing and merchandising processes. These industries, less cost-focused with stable pricing models, don’t demand meticulous cost tracking, as seen in complex industrial sectors. The industries that Manhattan targets adopt a distinctive approach to intricate functions like inventory management, allocation, and omnichannel fulfillment. Its specific applicability to certain industries positions it at the 7th spot on our list.

Pros

- Tailored flow for retail merchandisers and planners. Retail merchandising and planning are foundational processes for retailers, collaborating tightly with procurement, new product development, and design teams, requiring unique suites like Manhattan.

- Warehouse and store visualization and planning. The critical success factors for industries that Manhattan targets are warehouse and store visualization, influencing planning and allocation cycles substantially, requiring a unique architecture.

- Integrated suite, including POS and distributed order management. The POS and DSD-centric business processes require unique architecture, only possible through suites like Manhattan.

Cons

- External supply chain planning is limited. The limited focus of Manhattan on retail execution leaves the external supply chain planning outside of the scope of Manhattan.

- Network not included. Without a network, the planning components would be dependent upon internal and customer-provided external data, a huge limitation for companies seeking decision-grade data for the entire supply chain.

- Not SMB friendly. The enterprise data and process layers would be overwhelming and unnecessarily expensive for SMBs.

6. Körber/HighJump

Körber, akin to Manhattan, adopts a distinct approach with a focus on warehouse and execution components. It caters to 3PL-centric business models, crucial for distribution-focused companies often incorporating 3PL elements. Unlike Manhattan, Körber targets the mid and upper-mid markets, integrating processes like WMS, TMS, and freight claims management. While comprehensive, it lacks certain critical components found in other suites. Its unique approach and more limited applicability position it at the 6th spot on this list.

Pros

- Strong warehouse management capabilities. It is one of the strongest cloud-native WMS systems for mid-market companies, covering most aspects of warehouse management relevant to mid-market companies.

- TMS capabilities integrated. Industries where the embeddedness of TMS and WMS processes matter, especially for supply chain companies, would find Korber highly attractive.

- Strong last mile and parcel capabilities. The last-mile capabilities are uniquely complex because of the scheduling and compliance processes of various industries, making Korber unique for DSD-centric operations.

Cons

- External supply chain limited. While great for the internal supply chain, external supply chain capabilities are highly limited.

- Network not included. The missing network would not provide the decision-grade data included with other supply chain suites.

- No supply chain planning or collaboration. The missing planning or collaboration component might not be the best fit for companies requiring tighter embeddedness of WMS and TMS processes with S&OP.

5. Infor CloudSuite SCM

Similar to Dassault and QAD, Infor CloudSuite SCM adopts a distinctive approach, integrating diverse processes like CAD/PLM, WMS, ERM, and HCM with S&OP processes. It proves ideal for companies with manufacturing-heavy business models where supply chain processes tightly intertwine with new product development and ERP. Pure-play retailers might find other suites more suitable, as S&OP processes may not align with their needs. Given its unique market position, Infor CloudSuite SCM secures the 5th spot on this list.

Pros

- A comprehensive suite for supply chain management. Infor CloudSuite is uniquely comprehensive, most components pre-integrated, needed for manufacturers.

- Great visibility platform with planning. Includes a visibility platform for supplier collaboration and procurement without carrier-focused visibility, generally included in 3PL and retail-centric suites.

- Global trade workflows and compliance capabilities. Global trade compliance requires country and geopolitical restrictions that need to be integrated with business processes.

Cons

- Weak transportation execution component. Due to the nature of industries Infor CloudSuite SCM targets, the transportation execution component is not as critical for the suite but might be a limitation for diverse operations.

- Not proven with enterprise workloads. The enterprises requiring millions of transactions per hour for planning cycles might struggle with it.

- Not fit for smaller businesses. The overbloated data and process layers might be overwhelming for smaller businesses.

4. Oracle

Oracle Supply Chain Suite proves ideal for global enterprises with diverse operations and various business models, effectively accommodating the planning cycles of multiple industries. In comparison, industry-specific suites like Infor, QAD, or Trimble may face challenges in handling such diverse operations. Mid-market-focused suites may struggle with the high workload of enterprise-level planning cycles, especially those involving millions of transactions per hour. While limited by its proprietary network, Oracle Supply Chain Suite excels in providing operational capabilities for global enterprises that demand seamless integration across systems such as HCM, ERP, WMS, and TMS with S&OP. Its unique position for large enterprises secures its rank at #4 on our list.

Pros

- Comprehensive supply management suite, including global trade management capabilities. The supply chain suite would cover the need for the most diverse operations for global enterprises.

- Strong planning platform integrated with execution suite. The planning platform is not industry- or function-specific, providing end-to-end traceability of all planning datasets, including S&OP, human resources, and FP&A.

- Pre-integrated with ERP. Embedded processes with ERP, along with a disconnected supply chain suite, can cover both architectures equally well, covering the needs of diverse operations.

Cons

- Network not part of the suite. Missing a network would require additional components, and the processes that need to be tightly embedded with the network might struggle.

- Not SMB friendly. The enterprise data and process model might be overwhelming for SMBs leaner on their process overhead.

- Expensive. Ultra expensive for SMBs looking for cheaper options with learner process and data models.

3. SAP

Like Oracle, SAP Supply Chain Suite is tailored for global enterprises with diverse operations, accommodating planning cycles across various business models. Unlike Oracle, SAP offers friendliness for product-centric industries deeply involved in cost accounting and MRP-driven processes. Mid-market-focused suites may struggle with the high workload of enterprise-level planning cycles, dealing with millions of transactions per hour. Despite its proprietary network limitations, SAP Supply Chain Suite excels in providing operational capabilities for global enterprises, seamlessly integrating systems such as ERP, WMS, HCM, and TMS with S&OP. This unique position earns it the #3 rank on our list.

Pros

- Comprehensive supply management suite, including global trade management capabilities. The supply chain suite is comprehensive for highly regulated organizations requiring process tightness and control across systems such as ERP, WMS, TMS, and S&OP.

- Strong planning platform integrated with execution suite. The tight integration of the planning suite with execution components allows cross-pollination of business rules, which is highly critical for publicly traded organizations.

- Pre-integrated with ERP. The pre-integration with ERP allows exploring diverse warehouse architectures – decoupled or embedded, catering to different business models, being especially friendly for 3PL-centric operations.

Cons

- Network not part of the suite. The missing network would struggle with the cross-pollination of business rules, requiring a network.

- Not SMB friendly. The overbloated enterprise data and process layers would be overwhelming for SMB companies.

- Expensive. SMBs might find the SAP’s price tag cost-prohibitive and overly expensive.

2. Blue Yonder

Blue Yonder stands out as a unique suite, akin to Manhattan, offering retail-centric capabilities enriched with robust external supply chain processes and control tower capabilities. In contrast to industry-specific suites like QAD, Infor Nexus, and Dassault, Blue Yonder may not excel in industries requiring seamless integration of business rules from WMS, TMS, and OMS with ERP, particularly those emphasizing cost accounting and MRP-centric processes. Unlike SAP and Oracle, which may lack depth in external supply chain capabilities, Blue Yonder proves more suitable for industries necessitating the decoupling of cost-centric overhead. Differing from e2open, Blue Yonder lacks its proprietary network. Its versatile application across various industries earns it the #2 spot on our list.

Pros

- Strongest supply chain suite with planning and execution components. One of the strongest pure-play supply chain suites for retail-centric industries.

- Ability to handle a large number of SKUs for enterprise retailers. Enterprise retail workloads require processing millions of transactions per hour for planning loads containing millions of SKUs and location planning.

- External supply chain capabilities. One of the strongest supply chain suites for end-to-end supply chain traceability, internal or external.

Cons

- ERP is not included as part of the suite. In the processes and business models where cross-pollinations of business rules with ERP is critical, Blue Yonder might not be the best fit.

- Network is not part of the suite. With Blue Yonder not owning its own network, it might not have as much control over the third parties providing them network.

- Not SMB friendly. The enterprise process and data layers might be overwhelming for SMBs.

1. e2open

e2open takes a unique approach to its suite, straddling the realms of retail and manufacturing and integrating transactional CRM processes. Diverging from Blue Yonder, e2open prides itself on its proprietary network, ensuring precise decision-grade data, a valuable asset for companies contending with demand forecasting challenges and data dependencies on external factors. While exhibiting similarities with QAD or Infor Nexus in various capacities, e2open encounters constraints in architectures necessitating ERP cross-pollination for specific industries. In such contexts, e2open may not be the optimal choice. Nonetheless, its robust enterprise-grade capabilities and deep supply chain processes catapult it to the forefront, securing the coveted #1 rank on our list.

Pros

- Most comprehensive supply chain suite with planning, network, and execution. One of the most comprehensive options with all aspects of the supply chain suite that other solutions on this list might not have.

- Channel marketing planning and collaboration. One of the unique aspects of e2open is that it has a process for channel-driven organizations with trade rebate planning and several other processes that are relevant for collaborative channels.

- Global compliance and e-invoicing support. Along with the capabilities that most suites offer, it also has capabilities for global compliance and e-invoicing support, requiring only one platform for all collaboration and joint planning needs.

Cons

- ERP is not included as part of the suite. For industries where planning processes might require cross-pollination with ERP processes, e2open might not be the best fit.

- Not SMB friendly. The enterprise data and process layers might be overwhelming for SMB companies.

- Limited ecosystem. The consulting ecosystem is not as prevalent as some of the other solutions on this list, so finding talent might be harder with e2open.

Conclusion

Supply chain suites have diverse origins, evolving from various perspectives—some rooted in execution systems, others in planning. Over time, they’ve developed significant overlaps with each other and other enterprise software categories, intensifying architectural challenges. In your quest for a supply chain suite, delineate your business process boundaries and determine their natural placement based on required process embeddedness. This list aims to streamline your options, yet identifying the right suite demands expertise, often provided by independent ERP consultants.