Last Updated on February 10, 2026 by Shrestha Dash

The decision of when to launch an ERP system ranks among the most consequential choices in implementation projects. Get the timing right, and organizations transition smoothly with minimal disruption. Get it wrong, and the ERP go-live failure can result in operational paralysis, supply chain collapse, revenue losses, and financial impacts that dwarf the original implementation investment.

Two recent cases illustrate the devastating consequences of ERP go-live failure driven by poor timing decisions. Zimmer Biomet, a global medical device manufacturer, launched SAP S/4HANA on July 4, 2024, only to experience such severe operational disruption that the company filed a $172 million lawsuit against implementation partner Deloitte. Metcash, Australia’s leading wholesale distributor, saw its Microsoft Dynamics 365 implementation reportedly exceed $200 million with years of delays as repeated attempts to reach go-live readiness exposed unresolved issues.

Understanding why ERP go-live failure occurred, how faulty timing decisions created operational disasters, and what organizations can learn from these experiences is essential for anyone planning ERP implementations. The pattern is clear: organizations that prioritize meeting deadlines over ensuring genuine readiness consistently experience catastrophic outcomes that cost far more to remediate than delaying launch would have required.

Case Study 1: Zimmer Biomet’s July 4 Disaster

Zimmer Biomet Holdings, Inc., a global leader in musculoskeletal healthcare with approximately $8 billion in annual revenue, engaged Deloitte Consulting to implement SAP S/4HANA across its North American and Latin American operations. The project aimed to consolidate nine legacy ERP systems into a unified platform, with projected benefits of $197-316 million over 10 years through inventory reduction and operational efficiency.

The Timeline That Kept Slipping

The implementation timeline reveals a pattern of optimistic projections followed by reality-based delays:

- Original target: February 2023 go-live

- First delay: Pushed to May 2023

- Second delay: Moved to February 2024

- Third delay: Rescheduled to May 2024

- Final launch: July 4, 2024 (Independence Day weekend)

Each delay indicated unresolved readiness issues, yet the company ultimately proceeded with go-live during a holiday weekend when support resources were limited and business operations were already disrupted by the holiday schedule.

The Operational Catastrophe

According to court filings and public disclosures, the July 4 go-live created immediate and severe operational problems:

- Order Fulfillment Collapse: The company experienced significant difficulties processing orders. Basic order-to-cash workflows that should have been straightforward became bottlenecks that prevented timely customer fulfillment.

- Shipment Processing Failures: Zimmer Biomet’s ability to ship products to customers deteriorated dramatically. The company reported shipment delays contributing to an estimated 1–1.5% revenue impact (approximately $75 million annually).

- Invoicing Breakdown: The system struggled with basic invoicing functions. Customers who received products experienced delays in receiving accurate invoices, creating accounts receivable problems and customer service issues.

- Reporting Paralysis: Management lost visibility into basic business metrics. Sales reporting that executives relied on for decision-making became unreliable or unavailable, creating blind spots during a critical period.

The Financial Impact

The financial consequences extended far beyond direct implementation costs:

| Impact Category | Amount | Description |

| Original Contract | $69 million | Base implementation services from Deloitte |

| Change Orders | $23 million | 51 change orders increasing costs 36% above baseline |

| Alleged Damages | $172 million | Lawsuit claim against Deloitte for implementation failures |

| Post-Go-Live Remediation | ~$72 million | Estimated costs to stabilize and fix system post-launch |

| Revenue Impact | ~$75 million/year | 1-1.5% revenue decline attributed to shipment delays |

| Market Cap Loss | ~$2 billion | Stock price decline following disclosure of ERP problems |

| Workforce Reduction | 3% of workforce | Layoffs partially attributed to ERP-related operational challenges |

The total financial impact approaches $400-500 million when all direct costs, revenue losses, and market confidence impacts are included—nearly 6-7 times the original $69 million ERP implementation contract.

What Went Wrong: The Timing Decision

Court filings suggest that readiness concerns existed before the July 4 go-live, yet the company proceeded. Zimmer Biomet alleges that Deloitte pushed for go-live despite system unreadiness. Deloitte contends that contractual obligations were met and that the client benefited from a functioning system.

Regardless of which narrative is accurate, the outcome is undeniable: the system was not ready for production use in July 2024. Several timing-related factors contributed:

- Holiday Weekend Launch: Going live during Independence Day weekend meant limited support availability, disrupted business operations even beyond ERP issues, and skeleton staffing when problems required all hands on deck.

- External Pressure: After three previous delays, organizational pressure to “just launch” likely overrode objective readiness assessments. The cost of another delay may have seemed unacceptable despite clear warning signs.

Inadequate Stabilization Planning: The company appears to have underestimated the post-go-live stabilization period required for a transformation of this magnitude. The expectation may have been that the system would function smoothly immediately, rather than planning for intensive hypercare support.

Case Study 2: Metcash’s Extended Implementation Saga

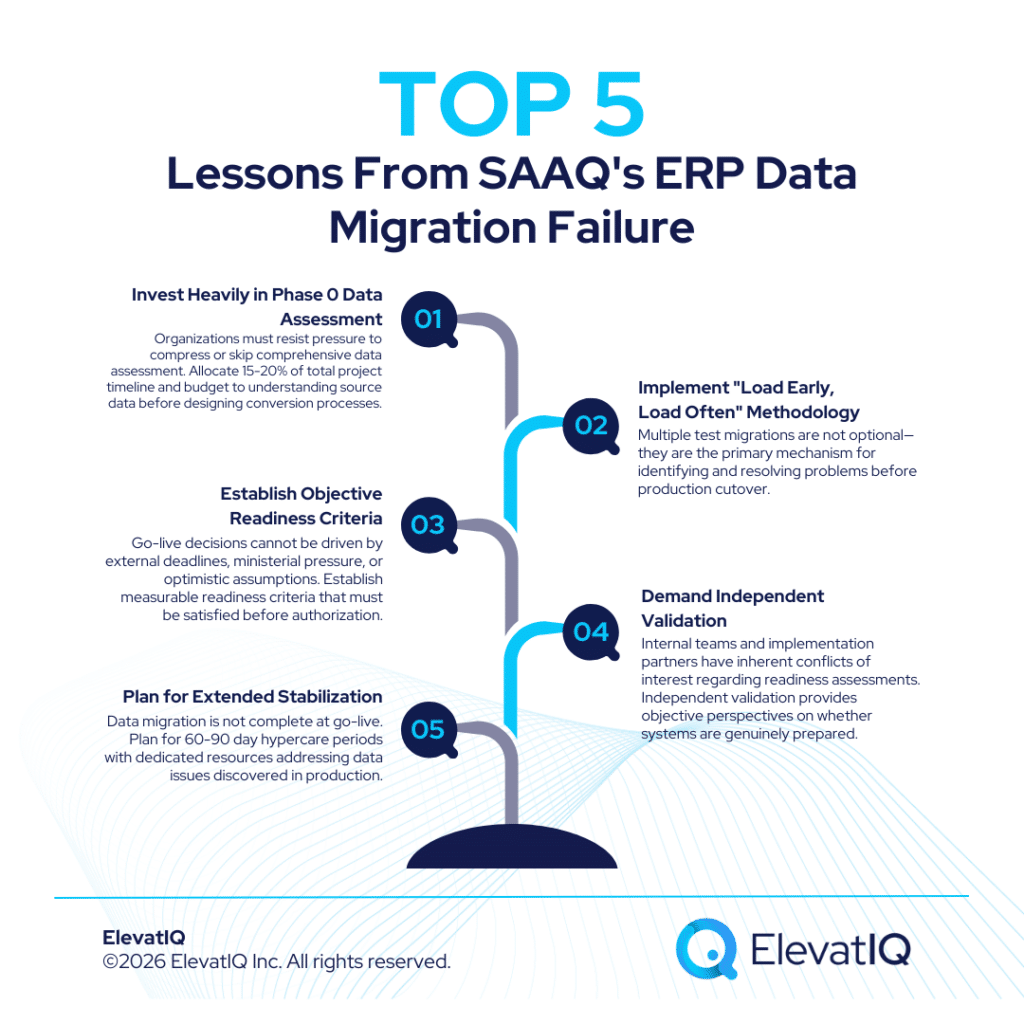

Metcash Limited, Australia’s leading wholesale distribution company with over $14 billion in annual sales, embarked on a Microsoft Dynamics 365 implementation to modernize its technology infrastructure. What was planned as a manageable transformation became a multi-year ordeal marked by cost overruns exceeding $200 million. Also, repeated delays as premature ERP go-live attempts revealed fundamental readiness problems.

The Implementation Timeline

Metcash’s journey illustrates how poor timing decisions compound:

- Initial announcement: Project launched with optimistic timelines and budget

- First delay: Initial go-live date missed as readiness concerns emerged

- Second delay: Additional time required for testing and stabilization

- Final costs: Over $200 million, significantly exceeding original estimates

- Operational impact: 2+ years of implementation-related disruptions

The Operational Challenges

According to financial disclosures and analyst reports, Metcash experienced several categories of operational difficulties:

- Financial Data Reliability Issues: The system struggled to provide accurate, timely financial reporting. Controllers and CFOs depend on real-time financial visibility for decision-making. When ERP systems fail to deliver reliable financial data, organizations lose confidence in the entire transformation.

- Cost Overruns: The total cost exceeded $200 million, with much of the overrun attributed to repeated attempts to reach go-live readiness, extended consulting engagements as implementation partners worked to stabilize systems, remediation costs fixing problems discovered during testing, and business disruption costs from prolonged implementation timelines.

- Extended Timeline: The multi-year delay between initial project start and stable operations created several problems including budget uncertainty as costs accumulated beyond projections, organizational fatigue as implementation teams and business users remained engaged far longer than planned, and opportunity costs as the business could not leverage planned ERP capabilities for strategic initiatives.

What Went Wrong: Multiple False Starts

Unlike Zimmer Biomet’s single catastrophic go-live, Metcash appears to have attempted multiple go-live readiness milestones, discovering each time that the system was not prepared. This pattern suggests inadequate readiness validation, overly optimistic implementation partner assessments, and organizational pressure to demonstrate progress, overriding objective quality gates.

The false start pattern creates specific problems:

- Implementation partner friction: Disputes emerge about whether delays result from vendor/partner performance or client readiness

- User confidence erosion: Business users who participate in “dress rehearsals” that fail lose trust in the project and implementation team

- Budget exhaustion: Multiple go-live attempts consume contingency budgets meant for other purposes

- Timeline compression: After multiple delays, pressure intensifies to proceed regardless of readiness

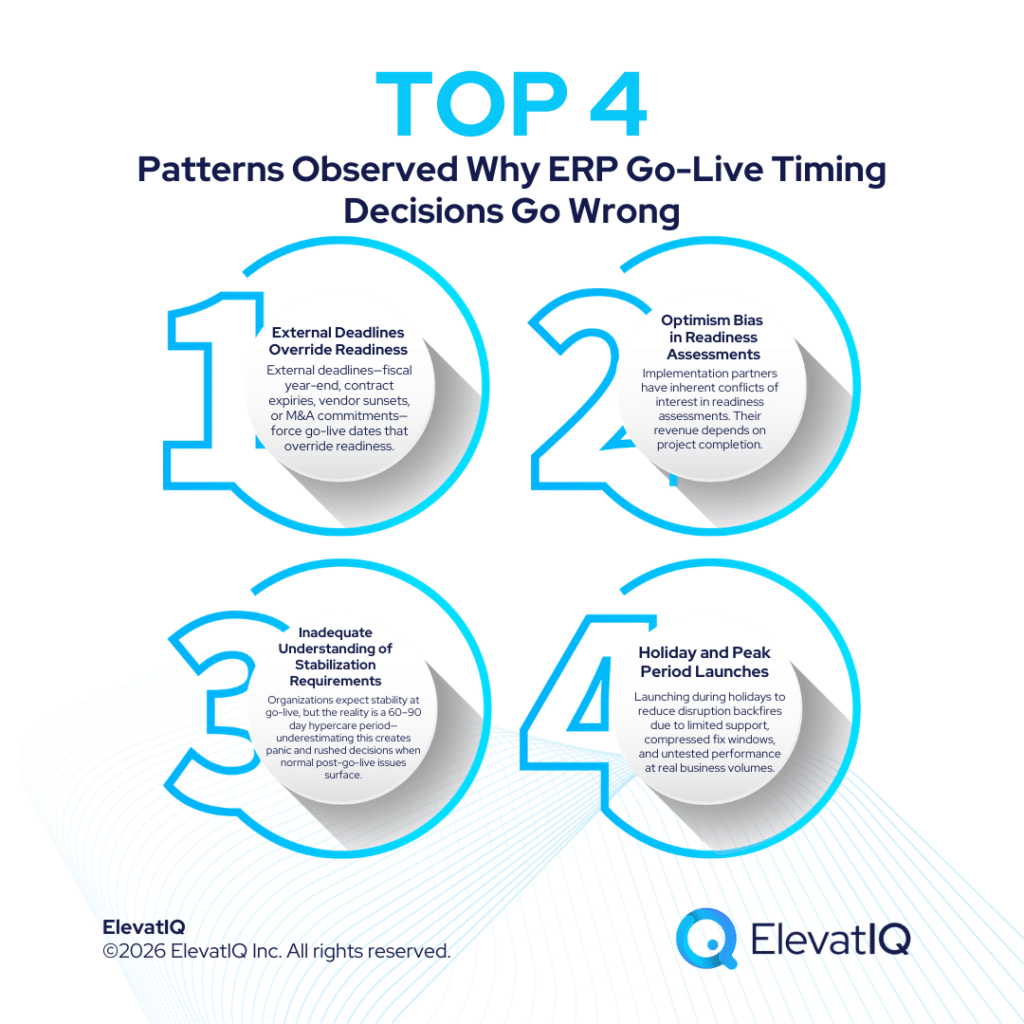

Why Go-Live Timing Decisions Go Wrong

Analysis of ERP go-live failures like Zimmer Biomet and Metcash reveals consistent patterns in how timing decisions become catastrophically flawed.

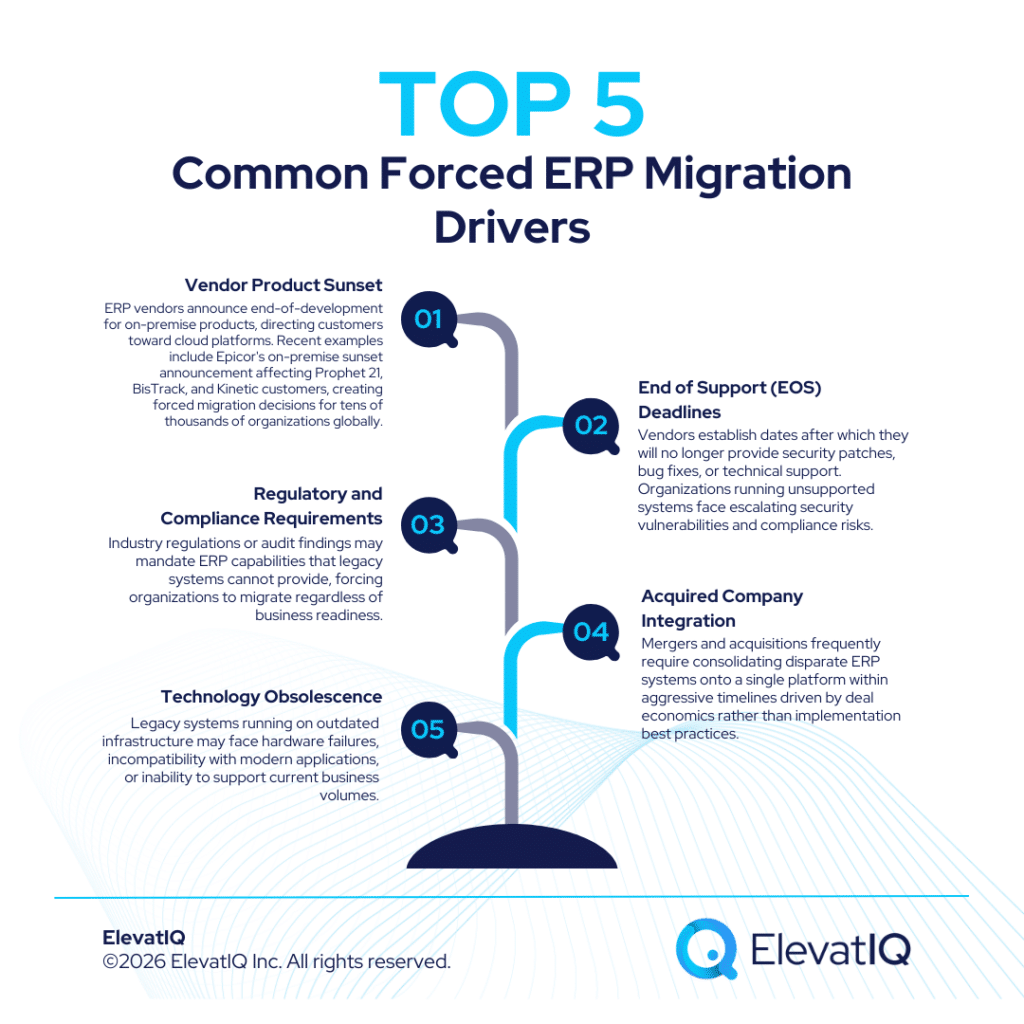

Pattern 1: External Deadlines Override Readiness

Organizations establish go-live dates based on fiscal year-end requirements, contract expiration deadlines, vendor support sunset dates, or M&A integration commitments. These external factors create immovable deadlines that override objective readiness assessments.

The psychological trap: After investing millions of dollars and months of effort, decision-makers face enormous pressure to demonstrate progress. Delaying go-live feels like failure, even when it represents the responsible choice. This creates a “doom loop” where deadline pressure intensifies precisely when objective indicators suggest more time.

Pattern 2: Optimism Bias in Readiness Assessments

Implementation partners have inherent conflicts of interest in ERP readiness assessments. Their revenue depends on project completion. Their utilization targets require moving teams to new engagements. Their reputations suffer when projects delay.

Similarly, internal project managers face career implications when implementations drag on. Vendor account teams want successful case studies to market. Everyone involved has incentives to present optimistic readiness assessments even when objective indicators suggest problems.

The result: Readiness assessments become exercises in optimism rather than objective evaluation. Teams dismiss minor issues as “manageable risks” that they can fix post–go-live. They often interpret warning signs generously as “expected challenges” instead of treating them as red flags that require delays.

Pattern 3: Inadequate Understanding of Stabilization Requirements

Organizations frequently underestimate how long systems require to reach stable operations. The expectation is often that go-live means “the system works.” The reality is that go-live begins a 60-90 day hypercare period where issues are discovered, processes are refined, users adapt, and organizations learn how to operate effectively in new environments.

When organizations plan go-lives assuming immediate stability rather than expected turbulence, they are unprepared for the reality. This creates panic when normal post-go-live issues emerge, leading to hasty decisions that compound problems.

Pattern 4: Holiday and Peak Period Launches

Some organizations deliberately choose holiday weekends or low-activity periods for go-live, reasoning that reduced business volumes will minimize disruption. This logic is flawed for several reasons:

- Limited support availability: Holiday weekends mean skeleton staffing when problems require all hands on deck. External support from vendors and implementation partners is similarly limited.

- Compressed troubleshooting windows: If go-live occurs on Friday of a holiday weekend and problems emerge, teams have only 1-2 days before normal business resumes Monday, insufficient time to resolve serious issues.

- Testing limitations: Low-volume periods do not stress-test systems adequately. Problems that remain hidden during low-activity launches emerge when normal volumes resume.

Zimmer Biomet’s July 4 go-live exemplifies this pattern, launching during Independence Day weekend when support resources were limited and business operations already disrupted.

The True Cost of Getting Go-Live Wrong

The financial impacts of ERP go-live failure extend far beyond direct implementation costs, creating cascading consequences that accumulate for years.

Direct Financial Costs

- Implementation Overruns: Both Zimmer Biomet and Metcash experienced significant cost escalation beyond original contracts. Zimmer’s $69 million contract grew by $23 million through change orders. Metcash exceeded $200 million total, far above initial estimates.

- Post-Go-Live Remediation: Fixing problems after production launch costs significantly more than delaying go-live to address issues properly. Zimmer Biomet’s estimated $72 million in post-launch stabilization costs illustrate this reality.

- Litigation and Dispute Costs: Zimmer Biomet’s $172 million lawsuit against Deloitte represents direct legal costs, discovery expenses, settlement negotiations, and management distraction from core business.

Operational Disruption Costs

- Revenue Losses: Zimmer Biomet attributed approximately $75 million annual revenue decline to ERP-related shipment delays. This represents direct opportunity cost when customers cannot receive products and may seek alternative suppliers.

- Supply Chain Disruption: Operational paralysis creates ripple effects. Suppliers receive delayed or incorrect orders. Customers experience fulfillment problems. Distribution partners cannot process transactions. Manufacturing facilities lack accurate inventory data.

- Productivity Losses: Organizations operating dysfunctional ERP systems experience dramatic productivity declines. Users spend hours working around system limitations, entering data multiple times when transactions fail, and manually reconciling information that systems should handle automatically.

Strategic and Reputational Costs

- Market Confidence Impact: Zimmer Biomet’s stock price declined significantly when ERP problems became public, erasing approximately $2 billion in market capitalization. Investors lose confidence when companies demonstrate inability to execute basic technology transformations.

- Customer Relationship Damage: Customers experiencing delivery delays, invoicing errors, or service disruptions may permanently shift purchasing to competitors. The long-term revenue impact can exceed immediate transactional losses.

- Employee Morale Erosion: Workforce reductions following ERP implementation problems—Zimmer Biomet cut 3% of its workforce—damage morale among remaining employees. Top performers may depart for organizations perceived as more stable.

- Vendor Relationship Deterioration: Lawsuits and public disputes destroy vendor and implementation partner relationships. Even if litigation settles, the working relationship required for ongoing support and future projects cannot be repaired.

Prevention Framework: Getting Go-Live Timing Right

Organizations can substantially reduce ERP go-live failure risk by implementing systematic approaches to timing decisions that prioritize readiness over deadlines.

Establish Objective Readiness Criteria

Go-live decisions must be based on measurable criteria that cannot be subjectively interpreted:

| Readiness Category | Measurable Criteria | Acceptance Threshold |

| Data Migration | Record accuracy, completeness, reconciliation | 99%+ accuracy on validated samples |

| System Performance | Response times, transaction throughput | Meets or exceeds legacy system performance |

| Integration Testing | End-to-end process execution, data flow | 100% critical processes functioning correctly |

| User Acceptance | Business user validation, sign-off | Formal approval from all department heads |

| Support Readiness | War room staffing, escalation processes | 24/7 coverage confirmed for 60-90 days post-launch |

These criteria must be validated independently, not just by implementation partners with conflicts of interest regarding timeline.

Implement Independent Readiness Assessments

Organizations should engage independent ERP advisors to validate readiness at critical gates. These assessments should have authority to recommend delays when criteria are not met, regardless of timeline pressure.

Independent assessments evaluate:

- Whether implementation partner claims about readiness are supported by evidence

- Whether testing coverage adequately validates critical business processes

- Whether stabilization planning accounts for realistic post-go-live challenges

- Whether organizational change readiness supports successful adoption

Build Stabilization Time Into Schedules

Organizations should plan go-lives with expectation of 60-90 day hypercare periods rather than assuming immediate stability. This means avoiding launches immediately before peak business periods, ensuring support resources are available for extended periods, and maintaining parallel systems or manual backup processes during stabilization.

Resist Pressure to Proceed When Not Ready

The most critical success factor is organizational courage to delay go-live when objective indicators suggest the system is not ready. This requires executive sponsors who prioritize long-term success over short-term deadline adherence, governance structures that empower teams to surface problems without career risk, and transparent communication about risks to stakeholders.

The financial reality: Delaying go-live by 30-60 days to address critical readiness gaps typically costs $500,000-$2 million in extended consulting and delayed benefits. Proceeding with unprepared systems costs tens or hundreds of millions in remediation, as Zimmer Biomet and Metcash demonstrate. The cost-benefit analysis overwhelmingly favors delays when readiness is questionable.

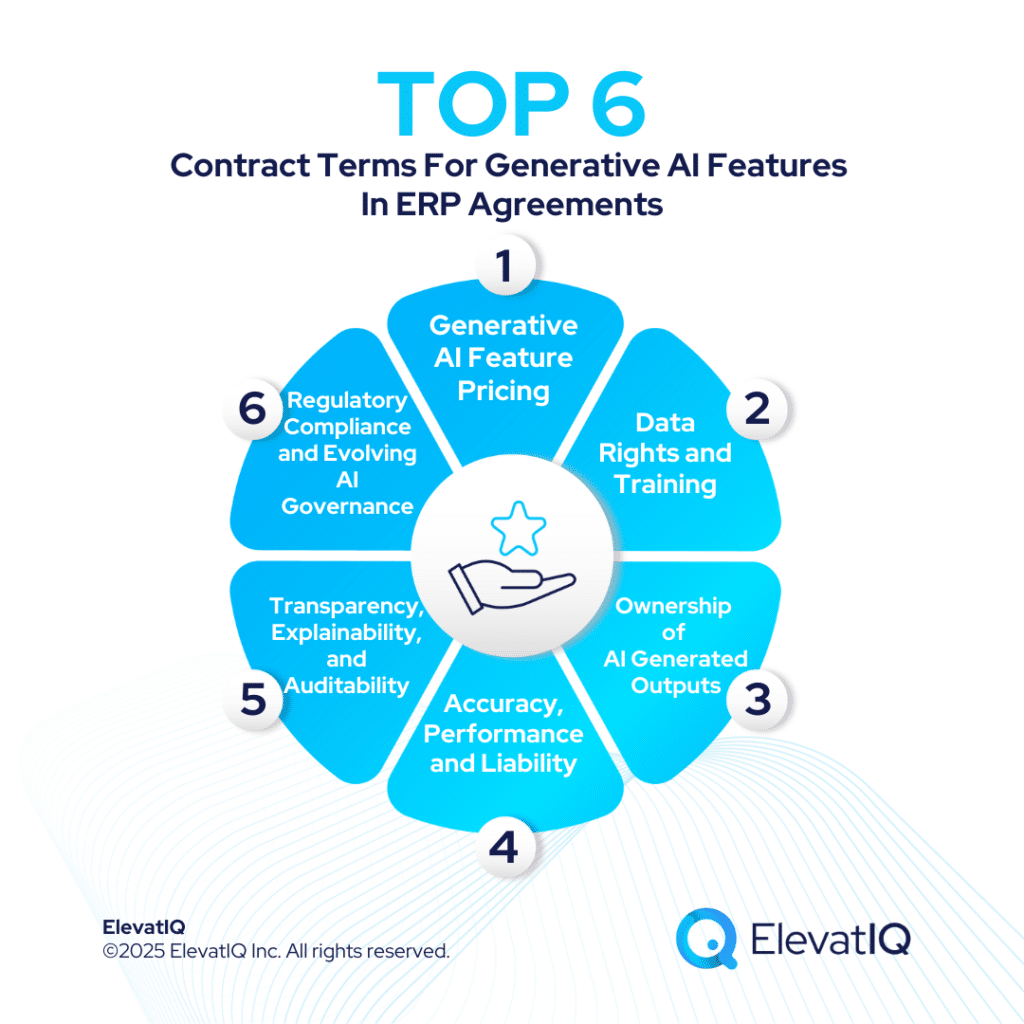

Working with Independent ERP Advisors

Organizations facing go-live decisions often lack internal expertise to objectively assess readiness and make informed timing choices. Implementation partners have conflicts of interest regarding timeline adherence. Internal teams face career implications when projects delay. Vendors want successful case studies to market.

This is where independent ERP advisors provide essential oversight that protects organizational interests.

At ElevatIQ, we help organizations avoid ERP go-live failure through:

- Independent Readiness Assessments: We conduct objective evaluations at critical gates, validating whether systems are genuinely prepared for go-live or require additional work before launch.

- Timing Strategy Development: We help organizations establish realistic go-live windows that account for their business cycles, resource availability, and adequate stabilization periods, rather than arbitrary deadline-driven schedules.

- Risk Assessment and Mitigation: We identify risks that implementation partners may minimize, evaluate the true readiness of data migration and integrations, and assess organizational change preparedness.

- Go/No-Go Recommendations: We provide independent recommendations on whether to proceed with scheduled go-lives or delay until readiness criteria are satisfied, backed by objective evidence rather than timeline pressure.

Our independent position means recommendations focus on sustainable success rather than meeting deadlines or protecting vendor/partner revenue.

Conclusion

The ERP go-live failures at Zimmer Biomet and Metcash illustrate the catastrophic consequences of poor timing decisions. Zimmer’s $172 million lawsuit, $75 million in lost revenue, and $2 billion market cap decline demonstrate that faulty go-live schedules cost far more than ERP implementation projects themselves. Metcash’s $200+ million in overruns and multi-year delays show how multiple false starts compound problems.

Organizations can avoid these outcomes by establishing objective ERP readiness criteria validated independently, resisting pressure to proceed when systems are not prepared, planning for realistic stabilization periods, and choosing go-live windows that ensure adequate support availability. The cost of delaying go-live to address readiness gaps is minimal compared to the exposure from proceeding with unprepared systems.

Working with independent ERP advisors who can provide objective readiness assessments, recommend appropriate timing strategies, and validate that systems are genuinely prepared substantially reduces risk. The investment in expert guidance represents a fraction of potential losses from failed go-lives.

(This content is based on publicly available vendor statements, industry research, analyst insights, and practitioner experience and is provided for informational purposes only.)