Last Updated on December 21, 2025 by Shrestha Dash

Mid-market companies pursuing growth through geographic expansion, new subsidiary formation, or strategic acquisitions frequently discover that their ERP licenses cover only the original implementing entity. Mostly with vendors demanding substantial additional fees, to extend system access to new corporate entities. For example, a manufacturer acquiring a complementary business finds their ERP contract defines “affiliate” so narrowly that the acquired company requires entirely separate licensing at full list prices. Or a services company expanding into three new countries learns their vendor interprets licensing as limited to their domestic headquarters. Along with international subsidiaries each requiring separate subscriptions.

These multi-entity ERP licensing complications arise because standard vendor contracts intentionally limit scope to single legal entities or specific geographies. Thus, creating revenue opportunities as customers grow through expansion or acquisition. What seemed like a straightforward licensing agreement during initial implementation transforms into a complex maze. Mostly including entity definitions, affiliate provisions, geographic restrictions, and M&A clauses that can add millions to ERP costs as organizations scale.

Successfully negotiating multi-entity ERP licensing requires understanding how vendors define covered entities and restrict geographic deployment, establishing enterprise-wide licensing covering all current and future subsidiaries without additional fees, securing broad affiliate definitions encompassing acquired companies, addressing M&A provisions enabling seamless integration of purchased businesses, and protecting against the vendor lock-in that emerges when multi-entity restrictions make organizational growth prohibitively expensive from an ERP cost perspective.

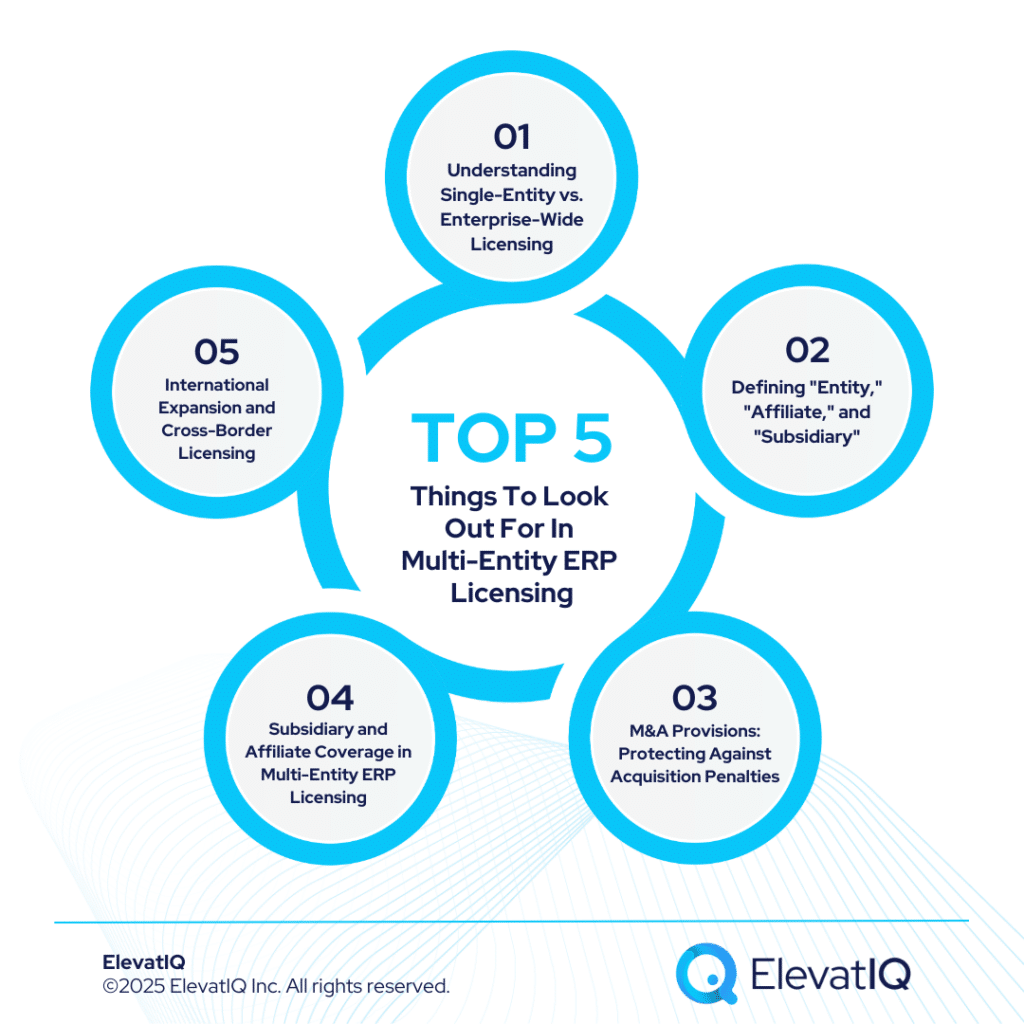

Understanding Single-Entity vs. Enterprise-Wide Licensing

The fundamental multi-entity ERP licensing decision during contract negotiations determines whether licenses cover only the implementing organization or extend enterprise-wide across all related corporate entities.

Single-Entity Licensing Limitations

How It Works: Standard vendor contracts limit licensing to the specific legal entity executing the agreement—typically your headquarters, parent company, or primary operating subsidiary. This entity-specific approach means:

Subsidiary Exclusions: Wholly-owned or majority-owned subsidiaries operating as separate legal entities, even if fully controlled by the parent—require separate licensing. A parent company with five operating subsidiaries would need six separate license sets under strict single-entity interpretations.

Geographic Restrictions: Licenses covering your US headquarters don’t automatically extend to your UK subsidiary, Mexican manufacturing operation, or Asian sales office. International entities require separate licensing regardless of ownership structure.

Affiliate Limitations: Sister companies, joint ventures (even majority-owned), or affiliated entities under common control but not in direct parent-subsidiary relationships fall outside license scope, requiring separate agreements.

Vendor Revenue Opportunities: This fragmented approach maximizes vendor revenue as growing organizations repeatedly license the same ERP platform across their corporate structure, paying multiple times for functionally identical software.

Enterprise-Wide Licensing Benefits

Comprehensive Coverage: Enterprise-wide multi-entity ERP licensing extends access across your entire corporate structure—parent, subsidiaries, affiliates, international operations, under a single unified agreement at consolidated pricing.

Growth Accommodation: As you form new subsidiaries, expand internationally, or acquire companies, these entities automatically fall within existing licensing rather than triggering new fees. Your ERP costs scale with user additions or consumption increases, not entity proliferation.

Simplified Administration: Single enterprise-wide agreements eliminate managing dozens of entity-specific contracts, each with different terms, renewal dates, and pricing structures. Centralized contract administration reduces overhead and ensures consistency.

Negotiating Leverage: Consolidating multi-entity ERP licensing into enterprise agreements provides negotiating leverage through larger committed spend, enabling volume discounts and favorable terms vendors won’t extend to fragmented single-entity deals.

Defining “Entity,” “Affiliate,” and “Subsidiary” in Multi-Entity ERP Licensing

The most critical provisions in multi-entity ERP licensing contracts revolve around how vendors define covered entities, with narrow definitions benefiting vendors through additional licensing opportunities and broad definitions protecting buyers as organizations evolve.

Entity Definition Strategies

Legal Entity vs. Business Unit: Clarify whether “entity” means legal corporate entities or includes business units, divisions, departments, and operational groups within legal entities:

“‘Entity’ means any legal corporate entity—corporation, limited liability company, partnership, or other organization—regardless of whether organized as separate business units, divisions, brands, or operational groups within such legal entities.”

Without this clarity, vendors might argue that divisions or business units within your legal entity require separate licensing.

Ownership Thresholds: Establish what ownership percentage qualifies entities for inclusion under multi-entity ERP licensing:

“‘Subsidiary’ means any entity in which Customer owns, directly or indirectly, more than fifty percent (50%) of outstanding voting securities or equity interests. ‘Affiliate’ means any entity controlling, controlled by, or under common control with Customer, where ‘control’ means ownership of fifty percent (50%) or more of voting securities.”

Direct vs. Indirect Ownership: Ensure multi-entity ERP licensing covers both direct subsidiaries and multi-level ownership structures:

“Covered entities include subsidiaries owned directly by Customer and subsidiaries owned indirectly through intermediate holding companies or subsidiary chains, provided Customer’s aggregate ownership exceeds fifty percent (50%) at each level.”

Future Entity Coverage: Address entities formed or acquired after contract execution:

“All subsidiaries, affiliates, and controlled entities formed, established, or acquired by Customer during the contract term shall automatically be included within this Agreement at no additional licensing cost beyond applicable user-based fees.”

Geographic Scope Provisions

Worldwide Licensing: Eliminate geographic restrictions limiting where entities can operate:

“Licenses granted hereunder are worldwide and permit Customer and covered entities to deploy and use the ERP system in any country or jurisdiction without geographic restriction or additional fees.”

Data Residency Flexibility: For cloud ERP, address data residency without licensing implications:

“Customer may select data residency locations for covered entities’ ERP data without affecting licensing terms, pricing, or covered entity definitions. Data residency requirements shall not create separate licensing obligations.”

International Expansion Rights: Protect against fees when expanding to new countries:

“Customer may deploy ERP system to entities operating in countries where Customer did not operate at contract execution without additional licensing fees, provided such entities meet covered entity definitions regardless of geographic location.”

M&A Provisions: Protecting Against Acquisition Penalties

Mid-market companies pursuing growth through acquisition require multi-entity ERP licensing provisions addressing how purchased businesses integrate into existing agreements without triggering substantial additional costs.

Acquisition Integration Rights

Acquired Company Coverage: Establish that acquired entities automatically fall within your enterprise licensing:

“Upon Customer’s acquisition of any company, business, or entity (an ‘Acquired Entity’), such Acquired Entity shall automatically be deemed a covered subsidiary under this Agreement, with licensing rights extending to Acquired Entity’s employees, operations, and locations without additional fees beyond user-based charges.”

Integration Transition Periods: Recognize that acquired companies may operate competitor ERP systems requiring migration time:

“Acquired Entities operating alternative ERP systems at acquisition date may continue such systems for up to [12-18] months while migrating to Customer’s ERP platform. During this transition, Acquired Entities are not required to license Customer’s ERP immediately upon acquisition.”

License Portability: Address transferring licenses from acquired companies to buyer’s agreements:

“If Acquired Entity holds licenses for the same ERP platform Customer licenses hereunder, such licenses shall transfer to Customer’s Agreement at Customer’s option, with combined licensing receiving volume discount pricing based on aggregate user counts.”

M&A Notification and Pricing

Acquisition Notification Timeframes: Establish reasonable notification windows:

“Customer shall notify Vendor of acquisitions within [30-60] days of transaction closing. Notification triggers good-faith discussions regarding incremental user licensing required for Acquired Entity’s employees but does not create separate entity licensing obligations.”

User-Based Fees Only: Ensure acquisitions trigger only user-based fees, not entity licensing charges:

“Acquired Entities pay only for additional named or concurrent users required to accommodate their employees. Vendor shall not charge entity licensing fees, deployment fees, implementation fees, or any charges beyond user-based subscription costs for integrating Acquired Entities into Customer’s existing ERP environment.”

Volume Discount Application: Secure that acquisitions increase your volume discount tier:

“Upon acquisition, combined user counts from Customer and all Acquired Entities determine volume pricing tiers. Vendor shall apply enhanced volume discounts retroactively to contract effective date if combined users would have qualified for better pricing tiers.”

No Retroactive Charges: Prevent vendors from charging retroactively for pre-acquisition periods:

“Vendor acknowledges it has no relationship with or claims against Acquired Entities for periods prior to acquisition closing. Customer owes no fees for Acquired Entity’s use of competing ERP systems before acquisition or for any period before Acquired Entity migrates to Customer’s ERP platform.”

Subsidiary and Affiliate Coverage in Multi-Entity ERP Licensing

Beyond acquisition scenarios, multi-entity ERP licensing must address ongoing formation of new subsidiaries, joint ventures, and affiliated entities as business operations evolve.

New Subsidiary Formation

Automatic Coverage: Eliminate vendor approval or notification requirements when forming subsidiaries:

“Customer may form, establish, organize, or create unlimited subsidiaries, affiliates, or controlled entities during the contract term. All such entities automatically receive ERP licensing rights under this Agreement without vendor approval, notification requirements, or additional entity fees.”

Operational Flexibility: Ensure subsidiary licensing doesn’t depend on business rationale or operational model:

“Covered entity definitions apply regardless of subsidiary’s purpose, operations, revenue, employee count, or business activities. Subsidiaries formed for special purposes, holding company structures, or operational segregation receive identical licensing rights as primary operating entities.”

Spin-Offs and Divestitures: Address what happens when entities leave your corporate structure:

“Upon Customer’s divestiture, spin-off, or sale of any covered entity, such entity’s licensing rights terminate upon transaction closing. Customer shall notify Vendor within [30] days of divestitures but owes no penalties, fees, or charges for divested entities ceasing ERP use.”

Joint Venture and Partial Ownership

Majority-Owned Ventures: Clarify whether joint ventures where you hold majority interest qualify:

“Entities in which Customer owns, directly or indirectly, more than fifty percent (50%) of voting securities qualify as covered subsidiaries regardless of joint venture structure, minority partner participation, or operational control sharing arrangements.”

Minority Investments: Address entities where you own substantial but non-controlling stakes:

“For entities where Customer owns twenty-five percent (25%) to fifty percent (50%) of voting securities (‘Minority Affiliates’), Customer may extend ERP access to such entities on a user-fee-only basis without entity licensing charges, provided Minority Affiliate employees included in Customer’s user counts.”

International Expansion and Cross-Border Licensing

Mid-market companies expanding globally encounter multi-entity ERP licensing complications from geographic restrictions, data sovereignty requirements, and local entity formation mandates.

Geographic Licensing Models

Country-Specific Restrictions: Standard contracts often limit deployment to specific countries or regions:

“Licenses are valid only for deployment within [United States and Canada]. Deployment to additional countries requires separate licensing agreements.”

These restrictions create substantial costs as international expansion requires negotiating new contracts for each geography.

Worldwide Licensing Alternatives: Negotiate unrestricted global deployment rights in multi-entity ERP licensing agreements:

“Licenses granted are valid worldwide without geographic limitation. Customer may deploy ERP system in any country, jurisdiction, or territory without additional fees, approvals, or separate licensing agreements, subject only to Customer’s compliance with applicable export control regulations.”

Local Entity Requirements

In-Country Presence: Some jurisdictions require local legal entities for business operations. Ensure multi-entity ERP licensing covers these mandatory formations:

“Licenses extend to local entities Customer is required to form by applicable law or regulation in any jurisdiction, including but not limited to mandatory local corporations, partnerships, representative offices, or branches required for conducting business in specific countries.”

Representative Offices and Branches: Address non-subsidiary operational structures:

“In addition to subsidiaries and affiliates, covered entities include Customer’s representative offices, foreign branches, regional headquarters, and any other operational presence established in any country, regardless of whether such presence constitutes a separate legal entity.”

Data Residency and Multi-Region Deployment

Cloud Infrastructure Locations: For cloud ERP, address data residency without licensing implications:

“Customer may select any of Vendor’s available data center regions for deploying covered entities’ ERP instances without affecting licensing terms, pricing, or entity coverage. Data residency selections are operational decisions not requiring licensing modifications or creating entity-specific fees.”

Multi-Region Instances: Clarify whether separate regional deployments require separate licensing:

“Customer may deploy multiple ERP instances in different geographic regions to satisfy data residency, performance, or regulatory requirements. Multi-region deployments do not create separate licensing obligations; all regions and instances are covered under this single Agreement with users allocated across regions at Customer’s discretion.”

Practical Multi-Entity ERP Licensing Strategies for Growing Organizations

Mid-market companies navigating expansion through subsidiaries, international growth, or acquisitions require proactive multi-entity ERP licensing strategies preventing vendor-imposed constraints on organizational development.

Pre-Negotiating Growth Scenarios

Three-Year Entity Projection: During initial ERP procurement, project entity growth over the contract term:

- Planned subsidiary formations

- Anticipated international expansion countries

- Potential acquisition targets or size ranges

- Joint venture or partnership structures under consideration

Use these projections to negotiate multi-entity ERP licensing provisions accommodating expected growth without future renegotiation or additional fees.

Scenario-Based Provisions: Address specific growth scenarios explicitly:

“If Customer acquires entities with combined annual revenues under $[X], such acquisitions integrate under existing licensing with only user-based fees. Or if Customer expands into [specific countries], international entities receive identical licensing rights as domestic operations. If Customer forms holding company structures or operational subsidiaries, such entities automatically fall within covered entity definitions.”

Volume Commitment Strategies

Enterprise Agreements: Negotiate enterprise-wide licensing based on projected consolidated user counts:

“Customer commits to [500-1,000] users across all entities over the contract term. Vendor provides enterprise-wide licensing covering unlimited entities, subsidiaries, and affiliates at consolidated per-user pricing with [40-50%] discount off list prices.”

Enterprise commitments provide vendors revenue certainty justifying favorable multi-entity ERP licensing terms while giving buyers flexibility to allocate users across their growing corporate structure.

Regular Entity Reconciliation

Annual Entity Reviews: Establish processes for vendors and customers to synchronize entity lists:

“Annually, Customer shall provide Vendor with current list of covered entities. This reconciliation is for administrative purposes only and does not create licensing obligations for listed entities beyond user-based fees already contracted.”

Regular reconciliation prevents surprises at renewal when vendors demand payment for entities they claim weren’t properly licensed.

Strategic Negotiation of Multi-Entity ERP Licensing

Growing mid-market organizations pursuing expansion through subsidiary formation, international deployment, or strategic acquisition require comprehensive multi-entity ERP licensing provisions preventing vendor restrictions and additional fees from constraining growth strategies. Successfully negotiating multi-entity ERP licensing requires establishing enterprise-wide coverage for all current and future entities, securing broad affiliate and subsidiary definitions, addressing M&A scenarios enabling seamless acquisition integration, eliminating geographic restrictions on international expansion, and ensuring entity proliferation doesn’t create ongoing licensing costs beyond user-based fees.

Organizations that negotiate robust multi-entity ERP licensing during initial contracts position themselves for cost-effective scaling as business development drives entity formation and geographic expansion. Conversely, buyers accepting single-entity limitations discover that vendor-imposed licensing restrictions make growth expensive, administratively complex, and strategically constrained as ERP costs escalate with every subsidiary added or company acquired.

For mid-market companies navigating ERP procurement while pursuing growth strategies, independent advisory expertise provides essential guidance through complex multi-entity ERP licensing negotiations, helping secure contract provisions that enable rather than constrain organizational development and international expansion.