Last Updated on December 22, 2025 by Shrestha Dash

The modern enterprise technology landscape renders the concept of standalone ERP systems obsolete. Organizations implement ERP as the operational backbone connecting CRM platforms, e-commerce systems, supply chain tools, warehouse management, business intelligence applications, HR systems, and dozens of other specialized technologies creating integrated digital ecosystems. Yet while ERP integration costs represent one of the largest post-implementation expense categories, often 20-30% of total ERP ownership costs—most procurement teams neglect to negotiate comprehensive integration provisions during initial contract discussions, discovering too late that vendors charge premium rates for API access, integration platform usage, and third-party system connections.

This oversight proves expensive. For example, a mid-sized manufacturer implementing ERP discovers their contract allows only 10 API connections before triggering $5,000 monthly overage fees—inadequate when they need to integrate CRM, e-commerce, EDI, warehouse management, shipping systems, quality management, and business intelligence platforms. Or a distributor finds their vendor charges $15,000 annually for integration middleware access beyond basic included capabilities. A services company learns that unlimited API calls promised during sales discussions actually mean “reasonable use” subject to vendor interpretation and potential throttling.

Successfully negotiating ERP integration costs in contracts requires understanding how vendors structure integration pricing, establishing whether unlimited integrations or per-connection fees better serve your architecture, securing adequate API call allocations and rate limits, addressing integration platform and middleware costs, and protecting against the vendor lock-in that emerges when integration dependencies make switching ERP systems prohibitively expensive.

The Integration Imperative: Why No ERP Operates Standalone

The days when ERP systems functioned as self-contained applications handling all business processes have passed. Modern organizations employ best-of-breed strategies selecting specialized applications for specific functions—Salesforce for CRM, Shopify for e-commerce, Workday for HR, Tableau for analytics. With ERP serving as the transactional backbone connecting these technologies.

The Integrated Enterprise Architecture

This integration-centric architecture means ERP integration costs in contracts directly impact operational capabilities and total cost of ownership far beyond base ERP subscriptions.

- Supporting Functions: HR systems manage workforce planning, recruiting, and performance connecting to ERP for compensation, time tracking, and project assignment. Document management platforms store ERP-related files like contracts, invoices, and purchase orders with metadata linkage.

- Customer-Facing Systems: CRM platforms capture sales opportunities, customer interactions, and service requests that must synchronize with ERP for order processing, invoicing, and revenue recognition. E-commerce systems process online orders requiring real-time inventory visibility, pricing, and order fulfillment coordination with ERP.

- Supply Chain Ecosystem: Warehouse management systems direct fulfillment operations needing constant synchronization with ERP inventory, orders, and shipping. Transportation management platforms optimize logistics requiring ERP order and shipment data. Supplier portals enable vendor collaboration demanding ERP purchase order, receipt, and payment information exchange.

- Specialized Operations: Manufacturing execution systems coordinate shop floor operations with ERP production schedules and material requirements. Quality management platforms track inspections and non-conformances linking to ERP lot traceability. Asset management systems monitor equipment connecting to ERP maintenance and financial modules.

- Analytics and Intelligence: Business intelligence platforms aggregate ERP data with information from other systems creating comprehensive operational insights. Data warehouses consolidate ERP transactions with external data for advanced analytics. Financial planning tools require ERP actuals for budgeting and forecasting.

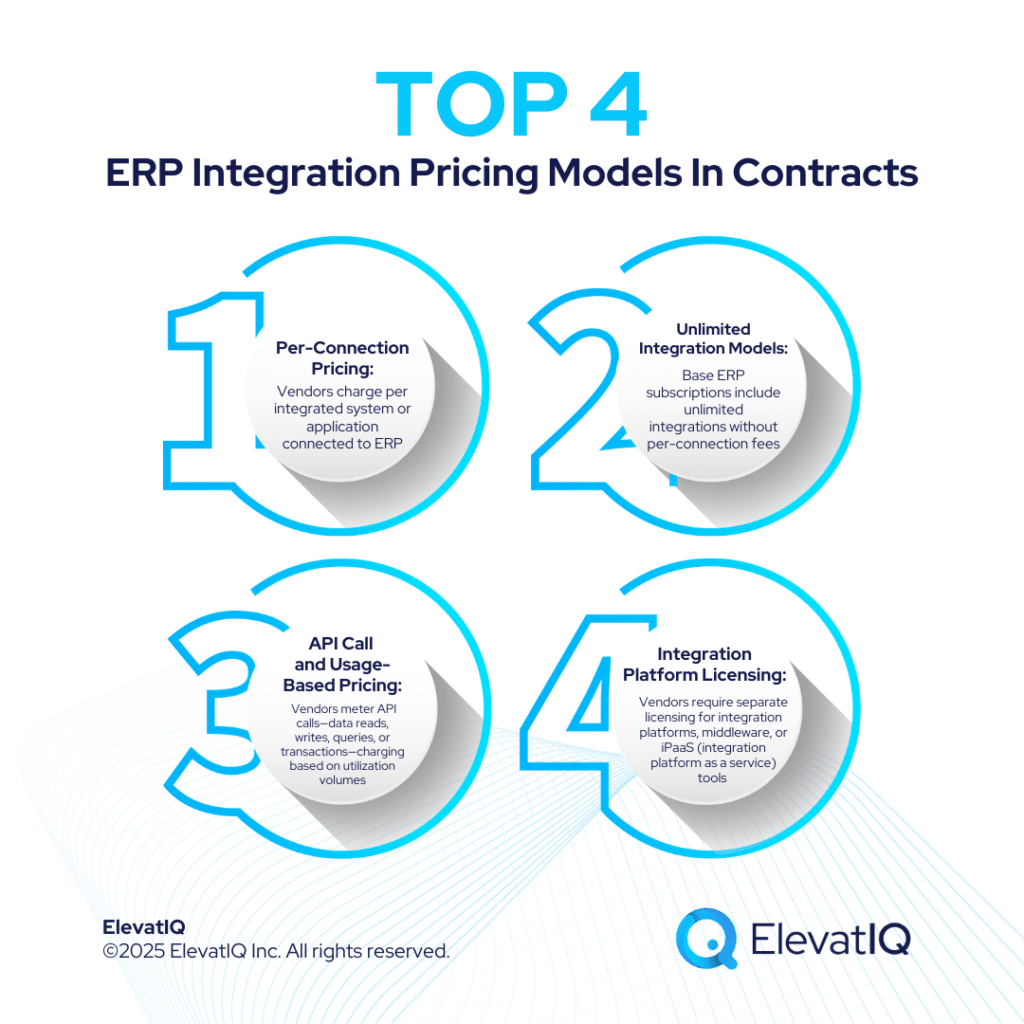

Understanding ERP Integration Pricing Models

Vendors structure ERP integration costs in contracts through various models creating dramatically different economic implications and negotiation considerations.

Per-Connection Pricing

How It Works: Vendors charge per integrated system or application connected to ERP—perhaps $500-$2,000 monthly per connection depending on complexity and vendor positioning.

Vendor Rationale: Each integration creates support obligations, infrastructure capacity requirements, and maintenance overhead as ERP updates potentially affect connected systems. Per-connection pricing theoretically aligns vendor compensation with integration complexity.

Buyer Implications: This model penalizes integration-rich architectures. Organizations needing 20-30 integrations face substantial recurring costs—$10,000-$60,000 monthly—beyond base ERP subscriptions. Costs escalate linearly as you add systems, creating disincentives for best-of-breed strategies.

Negotiation Focus: If accepting per-connection pricing, negotiate:

- Substantial included connections (10-20) within base pricing

- Volume discounts for additional connections

- Clear definitions of what constitutes a “connection” vs. a single integration with multiple data flows

- Rights to build custom integrations without per-connection fees

- No charges for internal system-to-system integrations within your ERP ecosystem

Unlimited Integration Models

How It Works: Base ERP subscriptions include unlimited integrations without per-connection fees. You can integrate as many systems as needed at no incremental cost.

Vendor Rationale: Modern cloud architectures with well-designed APIs create minimal marginal cost per integration. Vendors recognize integration-friendly positioning attracts customers and removes barriers to ERP adoption. Some vendors view integration capability as competitive differentiator rather than revenue opportunity.

Buyer Implications: Unlimited integration models provide budget predictability and remove constraints on architecture decisions. You can pursue best-of-breed strategies without ERP vendor penalties. However, “unlimited” often means unlimited connections, not unlimited API calls—important distinction when negotiating ERP integration costs in contracts.

Negotiation Focus: Secure explicit unlimited integration commitments:

- “Customer may integrate unlimited third-party systems and applications with ERP at no additional charge beyond base subscription”

- Clarify unlimited applies to both customer-built and vendor-supported integrations

- Ensure unlimited includes common integration patterns (real-time, batch, event-driven, streaming)

- Confirm unlimited covers integration to customer’s on-premises systems, not just cloud applications

API Call and Usage-Based Pricing

How It Works: Rather than charging per connection, vendors meter API calls—data reads, writes, queries, or transactions—charging based on utilization volumes. Base subscriptions might include 1 million monthly API calls with overages charged per thousand calls beyond included allocations.

Vendor Rationale: API calls consume infrastructure capacity, processing resources, and bandwidth. Usage-based pricing theoretically ensures customers pay proportional to actual consumption rather than subsidizing heavy users.

Buyer Implications: This model creates cost unpredictability. Integration architectures generating millions of API calls monthly—particularly real-time synchronizations or IoT device connections—face variable costs difficult to forecast. When negotiating ERP integration costs in contracts, understanding your API consumption becomes critical.

Negotiation Focus: Establish consumption protections:

- Generous included API allocations (5-10 million monthly minimum)

- Transparent real-time API usage tracking and alerts at 75%/90% thresholds

- Maximum monthly overage caps preventing unlimited cost escalation

- Webhook support reducing API call volumes versus polling patterns

- Separate allocations for reads vs. writes (reads should be cheaper/unlimited)

Integration Platform Licensing

How It Works: Vendors require separate licensing for integration platforms, middleware, or iPaaS (integration platform as a service) tools enabling connections between ERP and other systems. These platforms might cost $15,000-$100,000 annually depending on capability and scale.

Vendor Rationale: Integration platforms represent distinct products requiring separate development, support, and infrastructure investment. Vendors position these as premium offerings for organizations with complex integration needs.

Buyer Implications: Integration platform costs add substantially to total ERP ownership expenses. Organizations discovering platform requirements after implementation face unexpected costs and potential vendor lock-in if the platform becomes embedded in their architecture.

Negotiation Focus: Address platform costs during initial contracts:

- Maintain rights to use alternative integration tools without vendor restriction

- Negotiate inclusion of integration platform capabilities within base ERP pricing

- If separate licensing required, secure substantial discounts (50%+ off list pricing)

- Ensure platform licenses cover unlimited integrations, connectors, and data volumes

- Lock in multi-year platform pricing preventing annual escalation

API Governance: Rates, Limits, and Throttling

Beyond pricing models, ERP integration costs in contracts must address API rate limits, throttling policies, and service level commitments ensuring integrations perform reliably without unexpected restrictions or degradation.

Rate Limiting Policies

Understanding Rate Limits: Vendors implement rate limits restricting how many API calls systems can make within specific time windows—perhaps 1,000 calls per minute or 100,000 calls per hour. These limits prevent individual customers from overwhelming shared infrastructure.

Negotiation Requirements: Ensure rate limits accommodate your integration architecture:

- Document anticipated API call volumes by integration and time period

- Negotiate rate limits 2-3x above projected peaks to accommodate growth and spikes

- Secure written commitments that rate limits won’t decrease during contract term

- Establish escalation procedures when legitimate business needs require temporary limit increases

- Ensure rate limits apply per integration endpoint, not aggregate across all integrations

Throttling and Performance

Throttling Mechanics: When API usage approaches or exceeds limits, vendors may throttle requests—delaying responses, rejecting calls, or degrading service. This protects infrastructure but disrupts business operations if integrations fail.

Contract Protections: Address throttling explicitly when negotiating ERP integration costs in contracts:

- Prohibit throttling below contracted rate limits without customer consent

- Require advance notification (48-72 hours) before implementing throttling

- Establish that throttling may only occur during genuine system emergencies

- Secure SLA credits when vendor throttling prevents contracted integration performance

- Reserve rights to test API performance and challenge vendor throttling claims

Integration SLAs

Service Level Requirements: Integration reliability proves as critical as core ERP availability. Negotiating ERP integration costs in contracts should include integration-specific SLAs:

- Service credits when integration SLAs are breached

- API endpoint availability (99.9% uptime minimum)

- Maximum API response times (under 200ms for reads, under 500ms for writes)

- Integration failure notification within 15 minutes

- Maximum time to restore failed integrations (2-4 hours)

Middleware, iPaaS, and Integration Platform Costs

Many ERP integrations require middleware platforms or iPaaS solutions mediating between ERP and other systems. Whether you use vendor-provided platforms or third-party tools significantly impacts ERP integration costs in contracts.

Vendor Integration Platforms

Included Capabilities: Determine what integration tools vendors include in base subscriptions:

- Pre-built connectors to common applications (Salesforce, Shopify, NetSuite)

- Visual integration designers for building custom connections

- Data transformation and mapping capabilities

- Integration monitoring and error handling

- API management and security features

Separately Licensed Platforms: Vendors often position advanced integration platforms as premium add-ons. Negotiate inclusion or favorable pricing:

- “Integration platform capabilities described in Exhibit C are included in base subscription at no additional charge”

- If separate licensing required: “Integration platform pricing shall not exceed $X annually regardless of connections, data volumes, or integrations deployed”

- Lock in multi-year platform pricing with maximum annual increases (3-5%)

Third-Party Integration Tool Rights

Open Architecture: Ensure contracts permit using third-party integration platforms (MuleSoft, Dell Boomi, Workato, Zapier) without vendor restriction or penalty:

- “Customer may use any integration tools, platforms, or middleware to connect ERP with other systems. Vendor shall provide full API documentation and support for third-party integration architectures.”

No Exclusive Platform Requirements: Prohibit vendors from mandating their integration platforms:

- “Vendor shall not require Customer to use Vendor’s integration platform as condition of API access, support, or contracted functionality.”

API Documentation and Support: Secure commitments that API documentation, developer support, and integration assistance apply regardless of integration approach:

“Vendor shall provide comprehensive API documentation, developer resources, and integration support whether Customer uses Vendor’s integration platform or third-party tools.”

Integration in Implementation Contracts

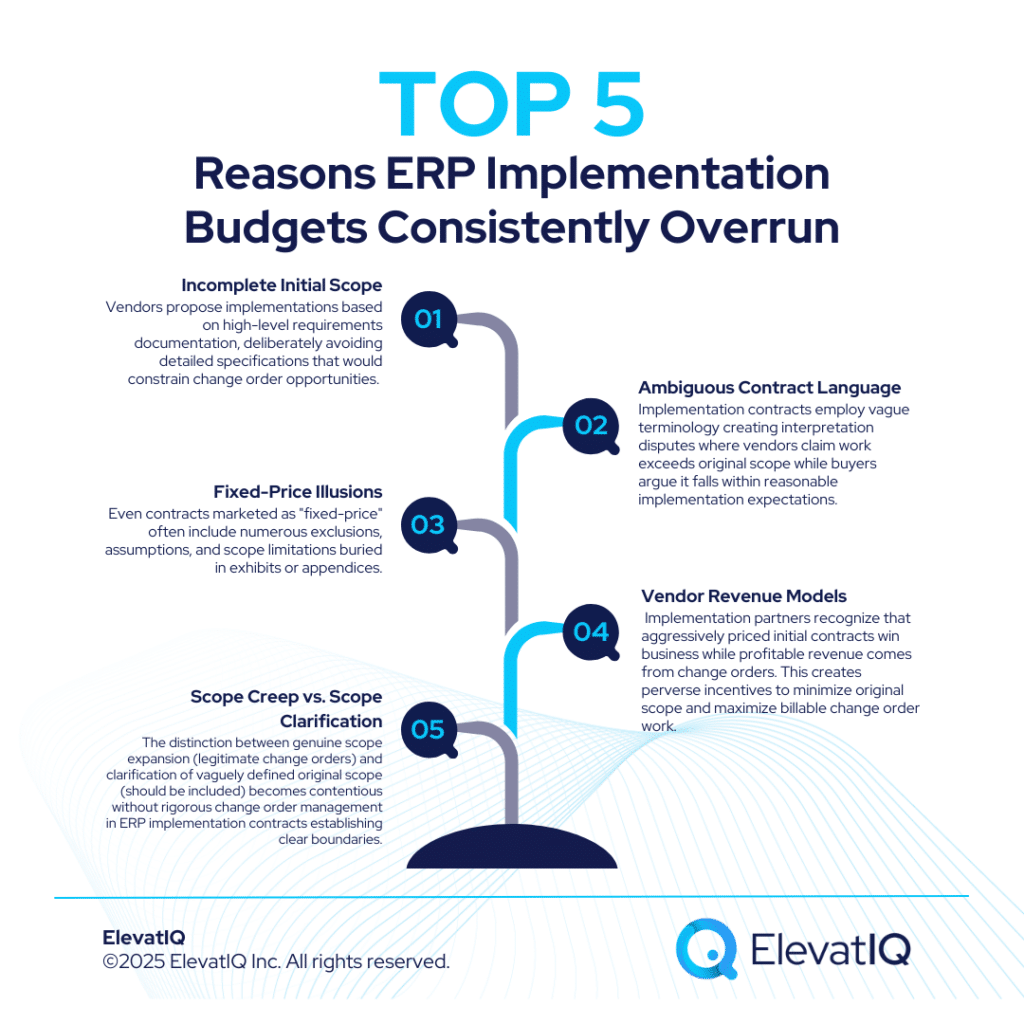

ERP integration costs in contracts extend beyond recurring subscription terms into implementation agreements governing initial integration development, testing, and deployment.

Scope and Deliverables

Integration Definitions: Implementation contracts must explicitly define integration scope:

- Number and type of systems requiring integration

- Data entities, objects, or records synchronized (orders, customers, inventory, etc.)

- Integration patterns (real-time, batch, event-driven)

- Error handling and reconciliation procedures

- Performance requirements and SLAs

Deliverable Specifications: Detail integration deliverables preventing scope disputes:

- Functional design documents for each integration

- Technical specifications and data mapping

- Integration code or configuration (with source code if applicable)

- Testing procedures and acceptance criteria

- Documentation for ongoing maintenance

- Training for IT teams managing integrations

Fixed Price vs. Time and Materials

- Hybrid Approach: Negotiate not-to-exceed caps on time-and-materials integration work: “Integration development on time-and-materials basis shall not exceed $X. If estimates suggest exceeding this cap, parties shall negotiate scope adjustments or fixed-price conversion before additional work proceeds.”

- Integration Pricing Models: Implementation contracts price integration development as fixed-price deliverables or time-and-materials services. Negotiating ERP integration costs in contracts requires choosing appropriate models:

- Fixed Price Benefits: Transfers integration cost risk to vendors, providing budget certainty. Appropriate when integration requirements are well-defined and scope is clear.

- Fixed Price Risks: Vendors pad estimates anticipating scope ambiguity. Any requirement changes trigger expensive change orders. Vendors may deliver minimum viable integrations meeting literal specifications without optimization.

- Time and Materials Benefits: Flexibility to adjust integration scope as requirements clarify during implementation. Often results in superior integration quality as vendors optimize rather than just meeting specifications.

- Time and Materials Risks: Unlimited cost exposure if integration proves complex. Requires robust governance and oversight preventing excessive billable hours.

Strategic Negotiation of Multi-Entity ERP Licensing

Modern ERP implementations require extensive integration with CRM, e-commerce, supply chain, analytics, and specialized operational systems. How vendors structure and charge for these critical connections significantly impacts total cost of ownership and operational flexibility. Successfully negotiating ERP integration costs in contracts requires understanding vendor pricing models, establishing whether unlimited integrations or per-connection fees better align with your architecture, securing adequate API call allocations with rate limits accommodating your needs, addressing integration platform and middleware costs, and ensuring implementation contracts comprehensively define integration scope and deliverables.

Organizations that negotiate robust integration provisions during initial contracts, before operational dependencies develop—position themselves for cost-effective best-of-breed architectures serving evolving business needs. Conversely, buyers who overlook integration costs discover that vendor restrictions, premium pricing, and limited API access constrain their ability to build integrated digital ecosystems essential for competitive operations.

For organizations navigating ERP procurement and negotiating ERP integration costs in contracts, independent advisory expertise provides essential guidance through complex integration architecture decisions, pricing model evaluation, and contract provisions protecting against the vendor lock-in and cost escalation that frequently emerge from inadequate integration planning.