Last Updated on February 19, 2026 by Shrestha Dash

When SPAR Group launched its SAP S/4HANA implementation at its KwaZulu-Natal distribution center in February 2023, executives expected operational excellence and supply chain transformation. Instead, the widely reported ~$100 million implementation resulted in what court filings describe as ‘immediate and sustained operational collapse’ that persisted for 32 months, an example of how ERP master data failure can cascade into enterprise-wide operational paralysis. Thus, contributing to an estimated R1.6 billion in lost revenue. Also, now faces a R170 million(approx) lawsuit from franchisees whose businesses were severely impacted by the warehouse breakdown.

(All monetary amounts are in South African Rand (ZAR), unless otherwise stated. For reference, R1 billion ≈ USD $52–55 million at recent exchange rates.)

The SPAR case illustrates a devastating ERP master data failure combined with warehouse integration collapse, two of the most underestimated risks in ERP implementations. This was not a simple technical glitch or temporary adjustment period. It was a catastrophic breakdown in order picking, dispatch scheduling, inventory visibility, and pricing accuracy that left store shelves empty, customers fleeing to competitors, and franchisees unable to operate their businesses.

Understanding what went wrong at SPAR’s KZN distribution center, why master data and warehouse integration failures created such severe business impacts, and how organizations can prevent similar disasters is essential for anyone implementing warehouse management systems or distribution-focused ERP platforms.

ERP Implementation: The SPAR Group’s SAP S/4 HANA Implementation

SPAR Group is a multinational food retailer and wholesaler with approximately $8 billion in annual revenue, operating across multiple African markets. The company embarked on SAP S/4HANA implementation as part of its digital transformation strategy, intending to streamline operations, enhance supply chain efficiency, and improve business performance through modern ERP capabilities.

The KwaZulu-Natal distribution center served as the pilot site for the rollout, supporting 46 franchise stores operated by the Giannacopoulos family across SPAR, SuperSpar, and Tops brands. This regional DC represented a critical node in SPAR’s distribution network, making it both a logical pilot choice and a high-risk ERP implementation given the operational dependencies.

The Timeline

- February 2023: SAP S/4HANA goes live at KZN distribution center with immediate operational problems emerging. According to court documents, there was “immediate failures across order picking, dispatch scheduling, inventory visibility, and pricing accuracy”

- 2023 Financial Year: SPAR Group acknowledges R2 billion in lost sales attributed to SAP system issues, with the KZN region experiencing the most severe impacts.

- September 2023: Mark Huxtable, SPAR’s Chief Information Technology Executive, departs for “personal reasons.” Brett McDougall steps in to lead remediation efforts.

- 2024 Financial Year: Problems persist with continued operational challenges, though SPAR claims systems have returned to “full operation” and improvements are underway.

- January 2026: Giannacopoulos family files R168.7-170 million lawsuit claiming damages from February 2023 through September 2025, which franchisees claim resulted in operational disruption spanning approximately 32 months.

ERP Master Data Failure: How SPAR’s Data Foundation Broke Down

Master data represents the foundational information that ERP systems depend on, product catalogs, pricing structures, customer records, supplier information, and warehouse logistics data. When master data is corrupted, incomplete, or incorrectly mapped during migration, every process that touches that data fails.

What Broke in SPAR’s Master Data

According to SPAR’s 2024 integrated annual report and lawsuit filings, multiple master data failures created cascading operational problems:

Pricing Visibility Collapse: “The SAP dashboard lacked the clarity of the previous system, affecting pricing and margin visibility.” This master data problem meant that:

- Pricing information was not accurately reflected in the system

- Manual processes were required to verify and correct pricing

- Margins were negatively impacted by pricing errors

- Promotional pricing could not be executed reliably

Product Master Data Issues: The migration from legacy systems to SAP S/4HANA’s product master structure appears to have created data quality problems that affected:

- Product availability visibility

- Stock location accuracy

- Reorder point calculations

- Product classification and hierarchy

Customer and Location Master Data: Distribution operations depend on accurate customer and location data for routing, delivery scheduling, and order fulfillment. Issues in this master data domain likely contributed to:

- Dispatch scheduling failures

- Delivery route optimization problems

- Order assignment errors

Why Master Data Migration Is So Challenging

SPAR’s warehouse ERP implementation failure illustrates why ERP master data failure is one of the highest-risk outcomes of poor data migration strategies in ERP projects:

- Insufficient Validation: Organizations often validate data migration by counting records (did all products migrate?) without validating accuracy (is the data correct?). SPAR’s pricing visibility problems suggest validation gaps where data migrated but was fundamentally wrong.ufficient value compared to alternative paths.

- Legacy Data Quality: Distribution systems accumulate years of data quality issues, duplicate product records, inconsistent naming conventions, outdated customer information, orphaned location codes. Without comprehensive cleansing before migration, these problems transfer to the new system and multiply.

- Complex Data Relationships: Warehouse systems depend on intricate relationships between products, locations, customers, routes, and pricing. Breaking any of these relationships during migration creates operational breakdowns.

The Warehouse Integration Breakdown

While master data provided the foundation for failure, warehouse management system integration amplified the disaster by making it impossible to execute basic distribution operations.

Order Picking Collapse

Order picking, the process of retrieving products from warehouse locations to fulfill customer orders, broke down immediately after go-live. The lawsuit claims this failure persisted for over two years.

What went wrong:

- Warehouse staff could not locate products because system location data was inaccurate

- Pick lists generated by SAP did not match physical inventory reality

- Order priorities were incorrect, leading to wrong products being picked

- Picking efficiency plummeted as workers resorted to manual searches

The operational impact:

- Order fulfillment times extended from hours to days

- Pick accuracy rates dropped, requiring extensive quality checks

- Warehouse labor costs multiplied as workers spent hours locating products

- Customer orders could not be fulfilled on time

Dispatch Scheduling Failure

Dispatch scheduling coordinates when orders should ship, which trucks should carry them, and what routes to follow. This critical logistics function collapsed under the SAP implementation.

Operational consequences:

- Trucks departed with incomplete loads or wrong products

- Delivery schedules could not be met reliably

- Franchisee stores received partial shipments at unpredictable times

- Perishable inventory spoiled when delivery timing broke down

Inventory Visibility Loss

Perhaps the most damaging failure was loss of inventory visibility, SPAR could not accurately determine what products existed, where they were located, or when replenishment was needed.

The cascading effects:

- Financial reporting accuracy suffered from inventory discrepancies

- Stock levels shown in SAP did not match physical reality

- Reorder triggers fired incorrectly, creating overstocks or stockouts

- Franchisees could not trust inventory availability data when placing orders

The Business Impact of ERP Master Data Failure

The ERP master data failure and warehouse integration breakdown created financial and operational consequences that extended far beyond the KZN distribution center.

Financial Devastation

| Impact Category | Amount | Source |

| Total Revenue Loss | R1.6-2 billion | SPAR official acknowledgment / reports |

| Lost Profit (FY 2023-2025) | R720 million | Estimated lost profit (derived from reported revenue impact; not publicly disclosed by SPAR) |

| Franchisee Lawsuit | R170 million | Court filing (Giannacopoulos family) |

| Franchisee Lost Gross Profit | R142.9 million | Lawsuit claim breakdown |

| Lost Rebates/Overriders | R25.8 million | Lawsuit claim breakdown |

| Implementation Cost | ~R1.8 billion ($100M) | as reported by Bloomberg |

| Share Price Decline | 38% in one year | Market reaction |

The total economic impact approaches R3-4 billion when implementation costs, revenue losses, lawsuit exposure, and market capitalization destruction are combined.

Operational Paralysis

The Giannacopoulos family’s lawsuit describes operational conditions that make the human cost of system failure clear:

- “Shelves stood empty“: Customers visiting SPAR stores found empty shelves where products should have been, creating an immediate competitive disadvantage as shoppers switched to competitors whose shelves were stocked.

- “Promotions could not run“: Pricing data problems meant promotional campaigns could not be executed, eliminating a key competitive tool and reducing customer traffic.

- “Perishable stock went to waste“: Fresh produce, dairy, and other perishables spoiled when delivery timing broke down, creating direct financial losses and customer dissatisfaction.

- “Customers were lost to competitors“: Once customers establish new shopping patterns with competitors, winning them back becomes extremely difficult. SPAR faced not just temporary revenue loss but permanent customer defection.

Franchisee Devastation

The lawsuit claims “the system failure crippled their ability to trade” for 46 franchise stores across 32 months. This represents:

- Inability to maintain adequate stock levels

- Lost revenue from empty shelves and unavailable products

- Increased costs from sourcing through alternative wholesalers at premium prices

- Damaged store reputations as customers experienced poor service

- Staff frustration and turnover as employees struggled with broken systems

Root Causes: What Went Wrong in SPAR’s ERP Implementation

Analysis of the SPAR disaster reveals several fundamental failures in ERP implementation approach and risk management.

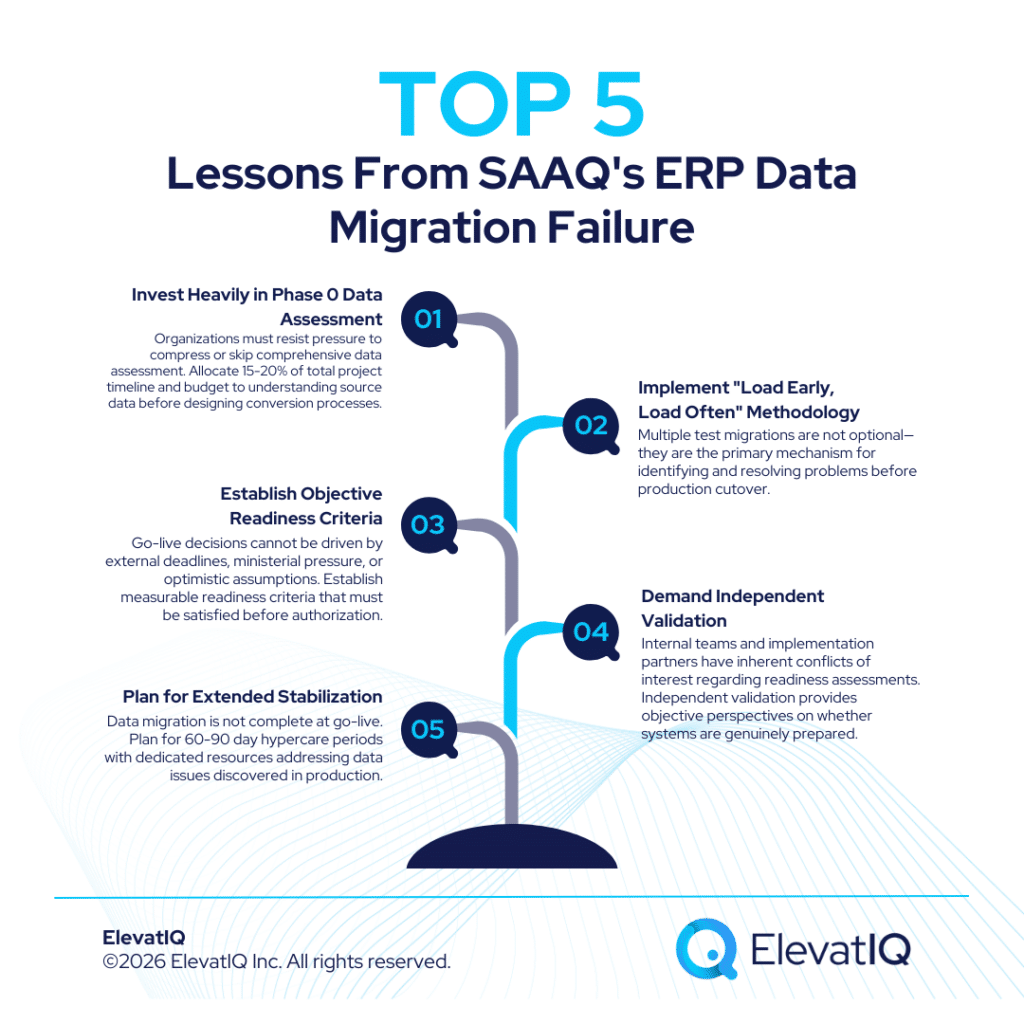

Inadequate Data Migration Strategy

The pricing visibility problems, inventory inaccuracies, and product master data issues all point to insufficient data migration planning and execution.

What should have happened:

- Comprehensive data profiling identifying quality issues before migration

- Extensive data cleansing to address duplicates, inconsistencies, and errors

- Multiple test migration cycles (“load early, load often”) validating data accuracy

- Business user validation confirming that migrated data was operationally usable

What likely happened:

- Compressed timeline leading to inadequate data cleansing

- Single migration attempt discovering problems too late

- Technical validation (record counts) without business validation (data accuracy)

- Assumption that data would “clean itself up” post-go-live

Warehouse Integration Underestimation

The order picking, dispatch scheduling, and inventory visibility failures suggest that warehouse management system integration was more complex than anticipated.

The integration challenge:

- Legacy warehouse systems had decades of operational optimization

- Staff knew how to work around legacy system limitations

- SAP S/4HANA’s warehouse management model differs significantly from many legacy warehouse systems

- Integration points between SAP and physical warehouse operations were not fully tested

Ignored Warning Signs

Court documents reference a whistleblower who “reportedly warned SPAR management of serious risks as early as 2021, but those warnings were allegedly ignored.”

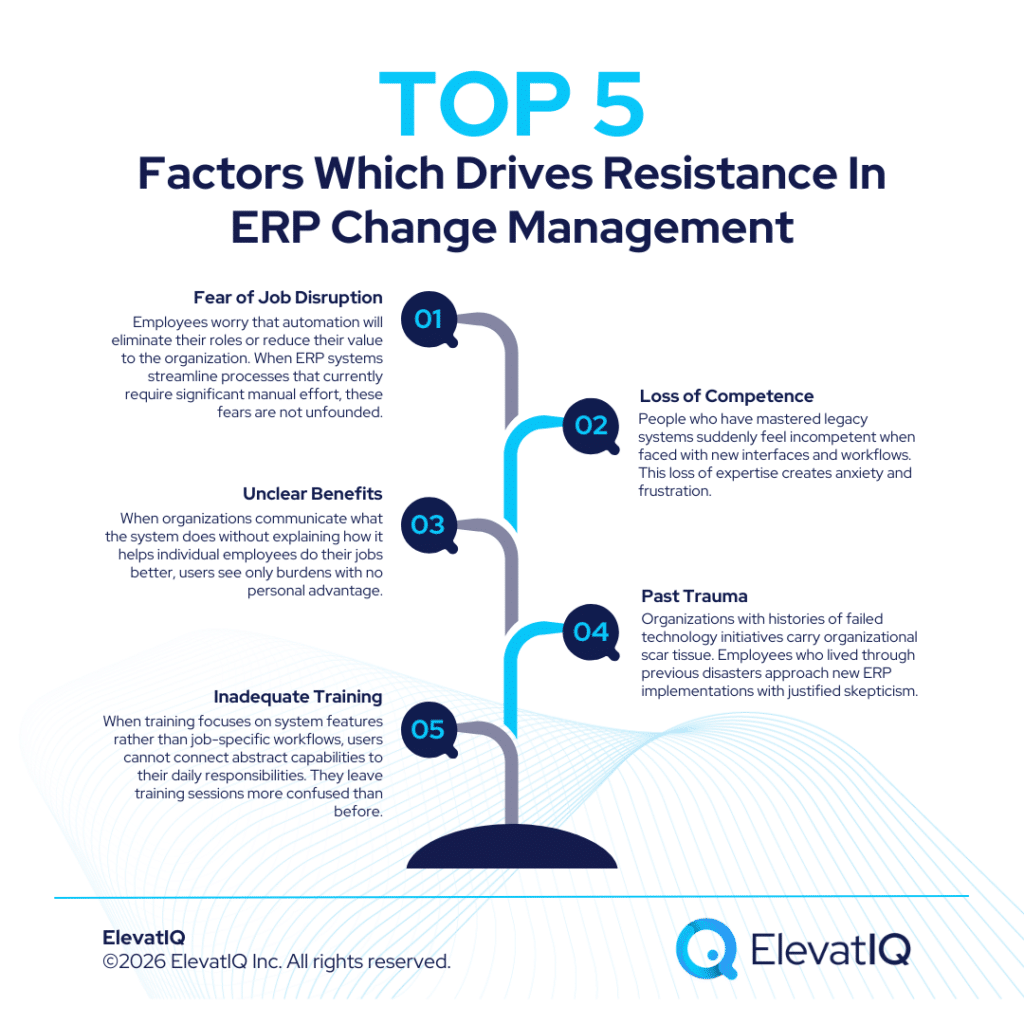

This pattern appears in many warehouse ERP implementation failures:

- Technical teams identify problems during implementation

- Business pressure to meet deadlines overrides concerns

- Warnings are dismissed as pessimism or resistance to change

- Organizations proceed with go-live despite clear red flags

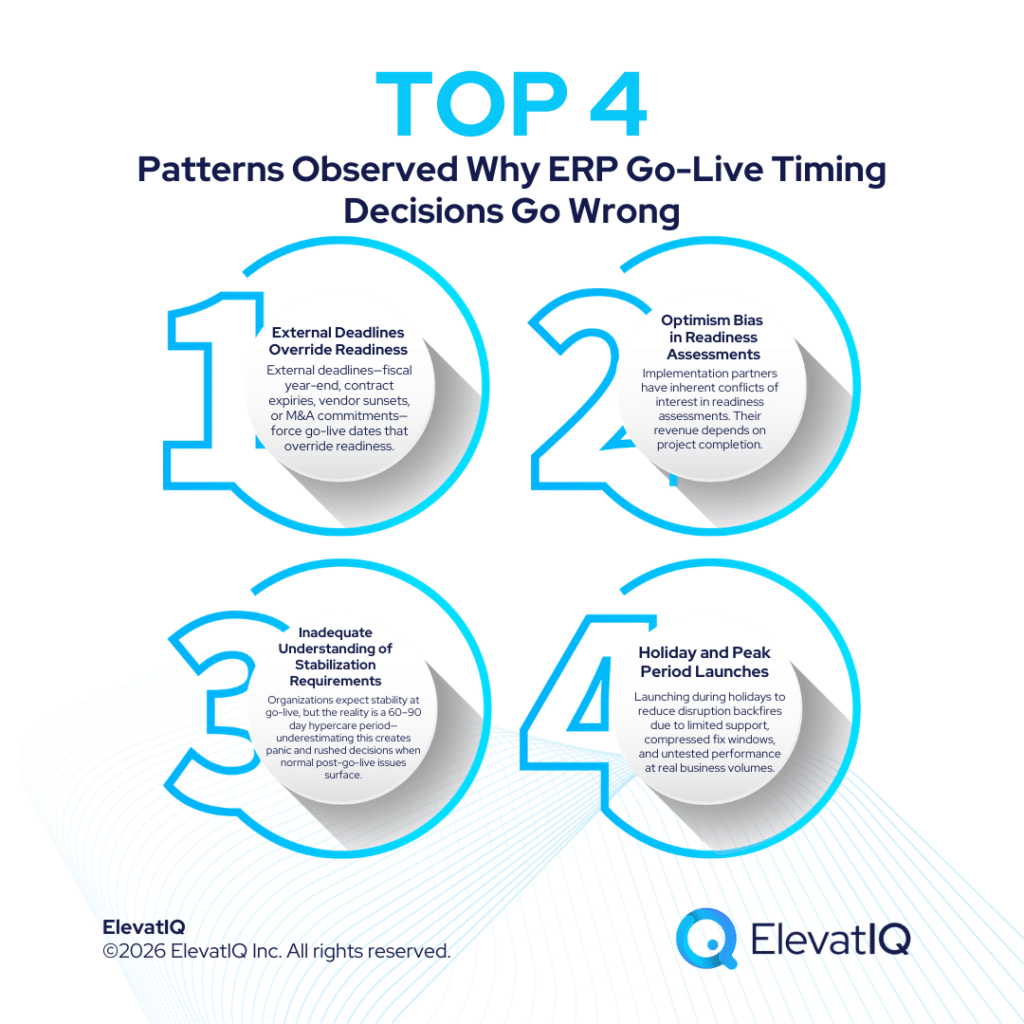

Poor Governance and Risk Management

SPAR’s 2024 annual report acknowledges that “poor governance and risk management” contributed to the failure. This manifests as:

- Inadequate oversight of implementation partner deliverables

- Insufficient independent validation of readiness

- Lack of objective go/no-go criteria

- Pressure to launch despite unresolved issues

Lessons Learned: Preventing Master Data and Warehouse Failures

Organizations implementing warehouse management systems or distribution-focused ERP platforms can learn critical lessons from SPAR’s disaster.

Lesson 1: Master Data Governance Is Not Optional

Master data must be governed as a strategic asset, not treated as a technical implementation detail.

Essential practices:

- Establish master data governance before migration begins

- Assign business ownership for each master data domain (products, customers, locations, pricing)

- Conduct comprehensive data profiling to identify quality issues

- Allocate 12-20 weeks for data cleansing before migration attempts

- Validate data accuracy through business user review, not just technical record counts

Lesson 2: Warehouse Systems Require Specialized Expertise

Warehouse management is operationally complex with minimal tolerance for disruption. Organizations cannot treat warehouse implementations as generic ERP deployments.

Critical requirements:

- Engage implementation partners with deep warehouse management expertise

- Conduct extensive process mapping of current warehouse operations

- Design integration between SAP and warehouse floor operations carefully

- Test with production volumes and real operational scenarios

- Plan for extended hypercare support post-go-live

Lesson 3: Pilot Implementations Must Be Genuine Tests

SPAR’s KZN distribution center was intended as a pilot, yet the same problems persisted for 32 months, suggesting the pilot did not effectively validate readiness before broader rollout.

Effective pilots:

- Run long enough to encounter edge cases and operational variations

- Include comprehensive business user validation

- Establish objective success criteria that must be met before expansion

- Treat pilot results honestly rather than optimistically

Lesson 4: Listen to Whistleblowers and Warning Signs

When implementation teams or business users raise concerns, organizations must investigate rather than dismiss them.

Warning sign protocols:

- Create anonymous channels for raising ERP implementation concerns

- Require investigation and documentation of all significant warnings

- Empower independent advisors to validate or refute concerns

- Delay go-live if warnings indicate fundamental readiness problems

Working with Independent ERP Advisors

Organizations implementing warehouse management systems face complex challenges that internal teams and ERP implementation partners may not have sufficient expertise to navigate successfully.

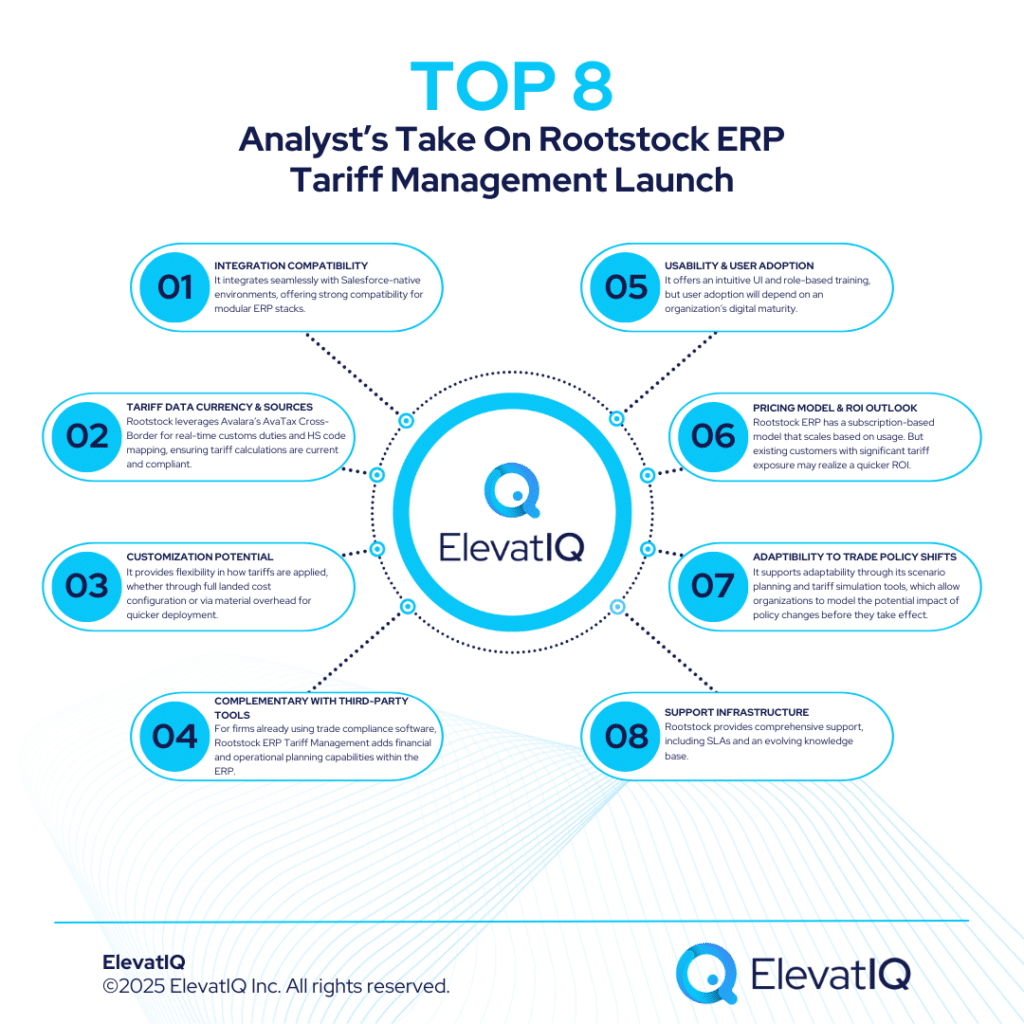

At ElevatIQ, we help organizations avoid ERP master data failure and warehouse integration disasters through:

- Master Data Strategy Development: We assess source data quality, design cleansing approaches, establish governance frameworks, and create validation processes that ensure data accuracy before migration.

- Warehouse Implementation Oversight: We provide independent validation of warehouse integration designs, review testing coverage with production scenarios, and assess operational readiness objectively.

- Independent Readiness Assessment: We evaluate whether organizations are genuinely prepared for go-live or require additional time, providing objective recommendations free from implementation partner timeline pressures.

- Risk Identification and Mitigation: We identify risks that internal teams may overlook and implementation partners may minimize, developing mitigation strategies before problems become disasters.

Conclusion

SPAR Group’s R170 million lawsuit represents more than litigation, it is evidence of how ERP master data failure, combined with warehouse integration breakdown, destroys business value. The R1.6 billion revenue loss, 32 months of operational paralysis, and 46 franchise stores severely impacted by system failure demonstrate that warehouse implementations carry catastrophic risk when master data and integration receive inadequate attention.

Organizations can avoid SPAR’s fate by treating master data governance as strategic priority, engaging specialized warehouse implementation expertise, conducting genuine pilots with objective success criteria, and listening to warning signs rather than dismissing them. The investment in proper planning, comprehensive data cleansing, and independent ERP validation costs far less than the exposure from failures like SPAR’s.

Master data is the foundation. When it fails, everything built on top fails with it.

(All figures and timelines are based on publicly reported information, company disclosures, and claims made in legal filings at the time of writing.)