Last Updated on March 17, 2025 by Sam Gupta

Isn’t distribution a breeze? Simply buying and selling others’ products. Choosing distribution ERP systems isn’t a walk in the park. The distribution business model can be as intricate as any other. Some layers of distribution ERP systems are similar to other ERP systems, such as geography, the need for diversified business models, and the size of a business. However, there are some unique layers with distribution ERP systems as well. For example, there is a clear divide between ERP systems designed for industrial verticals vs the ones that suit FMCG.

Industrial distributors present unique challenges with pricing catalogs, buying groups, and specific layers for UoMs. FMCG distributors may share some requirements but with distinct nuances, like the need for bin capabilities, license plates, and category planning tailored to FMCG specifics such as shelf-life and expiration date management. With lower margins compared to other industries, optimizing metrics like pick per hour is crucial. As manufacturers consider going DTC, meeting OEMs’ sales targets becomes non-negotiable for distributors to maintain relationships. Furthermore, the surge in marketplaces has exponentially increased architectural complexity for distributors.

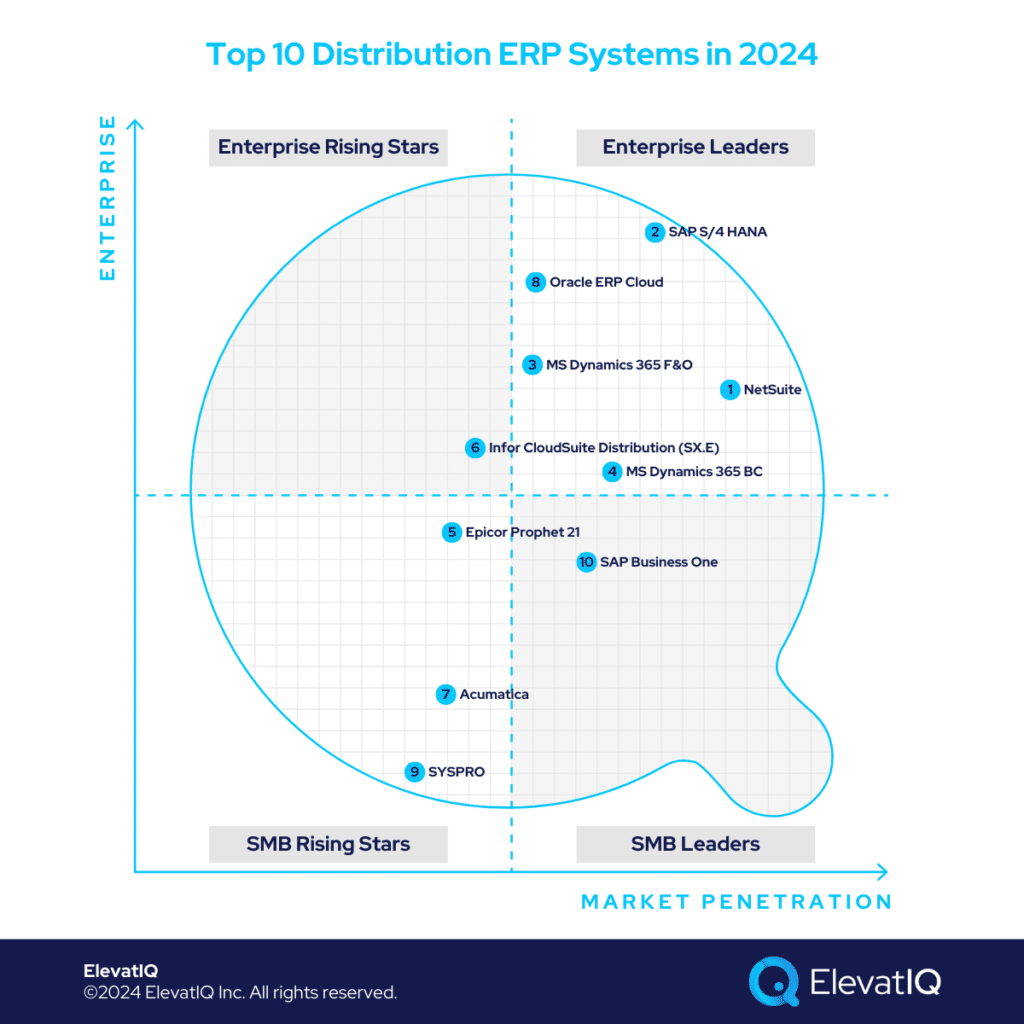

In the end, ERP process complexity and critical success factors determine if a system aligns with your business processes. While similarities exist among ERP systems, it’s the differences that impact your selection. So, how do you find the right fit? Our annual distribution ERP systems list not only outlines core capabilities but also tracks recent developments. This year, notable changes include Acumatica’s shift due to limited focus in certain countries, with other product positions adjusting marginally.

Criteria

- Overall market share/# of customers: The higher the market share of the product, the higher it ranks on our list.

- Ownership/funding: The more committed the management to the product roadmap, the higher it ranks on our list.

- Quality of development ( legacy vs. legacy dressed as modern vs. modern UX/cloud-native): The more cloud-native the distribution capabilities, the higher it ranks on our list.

- Community/Ecosystem: The larger the community for the specific product, the higher it ranks on our list.

- Depth of native functionality for specific industries: The deeper the distribution functionality provided out-of-the-box, the higher it ranks on our list.

- Quality of publicly available product documentation: The poorer the product documentation, the lower it ranks on our list.

- Distribution Product Share (and documented commitment of the publisher through financial statements): The higher the focus on distribution, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models: The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with distribution: The more aligned the acquisitions are with distribution, the higher it rank on our list.

- User Reviews: The deeper the reviews on public sites by distribution companies, the higher the score for a particular product.

- Must be an ERP product: It can’t be an edge product such as Salesforce, Workday, ServiceNow. Ariba, or Coupa. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. SAP Business One

Tailoring to smaller distribution companies with one legal entity and multiple warehouses, SAP Business One is ideal for those in regulated industries requiring audits. However, it falls short for companies seeking robust cloud-based operational capabilities. Despite its less exciting roadmap compared to others on our list and the recent exodus of several SAP Business One resellers to more cloud-native options such as NetSuite and Sage Intacct, it poses questions about SAP’s and SAP resellers’ commitment to this product. But due to its strength in regions lacking other operationally rich products on this list, like South America or Europe, it secures its #10 spot on our list.

Strengths

- Rich Financial Traceability. It provides the same transaction workflows and maps for global traceability as with SAP’s bigger solutions, such as SAP S/4 HANA and ByDesign.

- Support for HANA. Having HANA as the database allows SAP Business One to process the same workload as S/4.

- Ecosystem. SAP Business One has rich ecosystems, with industry partner solutions available, including scale, WMS, and shipping solution integration.

Weaknesses

- Leaner Cloud Solution. The cloud version has extremely limited distribution capabilities and would not be a fit for most distributors. The other solutions are likely to have native capabilities in the cloud and would not require a thick partner add-on.

- Limited Last-mile Capabilities. The last mile capabilities, such as buying group credit passthrough and integration with plumbing and electric codes, would be more expensive and technically risky.

- Limited Integrations. The other solutions, such as NetSuite and Acumatica, are likely to have more pre-baked integrations with best-of-breed systems such as Shopify, Channel Advisor, and OMS/POS systems.

9. SYSPRO

Much like SAP Business One, SYSPRO caters to smaller distribution companies with one legal entity and multiple warehouses. Ideal for food and beverage and FMCG distributors under $50 million in revenue, it’s less suitable for larger distributors with multiple entities or high workload demands. What sets SYSPRO apart is its diversity, offering capabilities for both discrete and process manufacturing alongside robust distribution and finance features. Despite receiving recent technological enhancements, its ranking slightly lowered this year due to momentum with other products on the list. Nevertheless, it secures the #9 spot.

Strengths

- Rich Distribution Functionality Available in Cloud. Its core finance and ERP functionality are very similar to SAP, with complex distribution features, such as activity-based costing, complex MRP strategies, and detailed inventory accounting layers.

- SQL-based Database. Unlike other smaller distribution packages, such as the ones in the ECi portfolio, the current versions of SYSPRO are SQL-based, allowing it to do far more heavy lifting.

- Native Capabilities to Support Food and Beverage Distributors. Support for formulas and recipes, a logistics process embedded as part of the ERP functionality, and features such as planning based on food family, etc.

Weaknesses

- Ecosystem. While SYSPRO has a great ecosystem and several partners, the ecosystem is not as robust as other distribution ERP systems on this list.

- Limited Last-mile capabilities. The industrial distributors might struggle with the limited last mile capabilities, such as buying group credit passthrough, and integration with plumbing and electric codes would be more expensive and technically risky.

- Limited Integrations. The other solutions, such as NetSuite and Acumatica, are likely to have more pre-baked integrations with best-of-breed systems such as Shopify, Channel Advisor, and OMS/POS systems.

8. Oracle Cloud ERP

Tailored for large distribution companies (over $1B in revenue) worldwide, Oracle Cloud ERP excels in managing substantial transaction volumes. Ideal for firms heavily relying on OMS and WMS/TMS in distribution, treating ERP as a financial ledger. Oracle’s best-of-breed products, including CPQ and TMS, offer a competitive edge with seamless integration. Its unique data model aligns with industries like telecom, media, healthcare, energy, and construction distribution, addressing unique processes where others may falter. Attractive to large, global, and publicly traded firms, Oracle Cloud ERP’s advancement in this year’s ranking stems from a lack of momentum among other solutions in the distribution space.

Strengths

- WMS and TMS Capabilities Bundled with the ERP. Oracle Cloud ERP has WMS and TMS processes tightly embedded as part of the ERP transactions.

- Proven Solution with Large Workloads. Large distributors may process millions of GL entries per hour. The workload Oracle Cloud ERP is designed to handle.

- Ecosystem. It has an ecosystem of experienced consultants who have the capabilities to handle the design and architecture of such complex enterprises.

Weaknesses

- Limited Last-mile Capabilities. The last mile capabilities for specific distribution verticals, such as integration with electrical and plumbing ecosystems, credit transfer between the buying groups, or support for B2C transitions, might be expensive.

- Not necessarily a Distribution Solution. It would be a natural fit for distribution verticals in telecom, media, and energy. The product-centric distribution industries might not be the best fit.

- Overwhelming for SMB Distributors. Not a fit for SMB distributors looking for a turn-key solution tailored to the processes of the specific micro-vertical.

7. Acumatica

Geared towards smaller distributors with revenue up to $100 million and a few entities in specific countries, Acumatica caters to B2B and B2C business models, including field service or DSD components. Not suited for larger companies with intricate global operations or significant workload demands. While add-ons cover most distribution verticals, the experience may lack nativity in complex industrial sectors. Acumatica’s substantial downgrade this year is attributed to unpredictable pricing, limited application in industrial verticals, and a narrow geographical focus. However, it still ranks at #7 on this list.

Strengths

- B2B Data Model and Processes. Acumatica’s data model is especially attractive for B2B companies with complex customer hierarchies, such as buying groups, vendor catalogs, B2B pricing, and branch accounting for inventory reconciliation across channels.

- Consumption-based Pricing. Acumatica’s consumption-based pricing may be especially attractive for companies with seasonal workers and low transaction volume.

- Diverse Businesses in the Same Product. Acumatica’s product architecture allows hosting all manufacturing, construction, field service, and distribution as part of the same product. That can support very complex business models.

Weaknesses

- Limited Global Capabilities. Acumatica is primarily a North American solution with very limited exposure globally. The product architecture has limitations when multiple countries with different currencies and sub-ledgers need to be hosted as part of the same solution.

- Not a Fit for Larger Distributors. Acumatica’s sweet spot is companies looking for ERPs under $100 million in revenue. Acumatica may struggle and may be slower with the workloads for companies with over $100 million in revenue.

- Limited Capabilities for B2C Business Models. Acumatica has limited support for B2C business models to support the processes of individual consumers. There is also limited support for B2C-centric platforms such as connectivity with marketplaces.

6. Infor® CloudSuite Distribution (SX.E)

Infor CloudSuite Distribution (SX.e) is Infor’s SMB distribution product, targeting industrial distributors with revenues of up to $250 million. Ideal for those with complex business models like brick-and-mortar locations, eCommerce storefronts, and light custom manufacturing. While used in large distribution accounts, its batch capabilities aren’t as intuitive as other products on this list. It is not the best fit for FMCG distributors or those with complex channels like DTC. It ranks slightly higher this year, benefiting from a lack of momentum with other products, and now sits at #6 on this list.

Strengths

- Rich Industrial ERP Distribution Systems Capabilities Provided Out-of-the-box. The system natively supports workflows such as image-based shopping lists, buying group credit passthrough, and warehouse-level reconciliation capabilities to support branch-level inventory and accounting.

- Pre-baked Integrations with Other Industrial Systems. Favorite among industrial buying groups and ecosystems, Infor CSD has pre-baked integrations with several industrial B2B systems, such as Optimizely and Unilog.

- Infor OS. Compared to other systems on this list that will require separate licensing for integration with Celigo or Dell Boomi, Infor OS can support integration with Infor and Non-Infor systems natively.

Weaknesses

- Limited Capabilities to Support Diverse Distributors. Need diverse capabilities not used by traditional distributors, such as CRM or customer service capabilities? Not a fit.

- Weak Data Structure to Gain Operational Efficiencies. The data structure is not as fluid as other ERP systems, such as Acumatica or NetSuite, to support 1:N scenarios required to achieve operational efficiency.

- Limited Pre-baked Integrations for Diverse Businesses. Companies with diverse architecture needs might struggle when they need support for systems such as pre-baked EDI connectivity, marketplace integration, or other eCommerce platforms not in the B2B industries.

5. Epicor Prophet 21

Epicor Prophet 21, Epicor’s SMB distribution offering, caters to industrial distributors with revenues of up to $250 million. Ideal for those with extensive catalogs of industrial products and control systems. It is not the optimal choice for FMCG distributors or businesses with intricate channels like DTC. Legacy industrial distributors with complex catalogs and light assembly needs will find Epicor Prophet 21 appealing. Its slightly higher ranking this year results from a lack of momentum with other products, securing its position at #5 on this list.

Strengths

- Rich Industrial ERP Distribution Systems Capabilities Provided Out-of-the-box. The system natively supports complex relationships between vendors and suppliers (and buying groups), along with capabilities such as branch accounting, retail-centric material flow, and warehouse architecture.

- Best for Prescriptive Architecture. Epicor Prophet 21 is a good fit when you can replace/use the systems provided in the Epicor ecosystem, such as payment providers, POS systems, shipping add-ons, and marketplace integrations.

- Pre-integrated with Other Best-of-breed Industrial B2B Systems. Integration with other best-of-breed industrial eCommerce systems, such as Optimizely or Unilog, is pre-baked.

Weaknesses

- Limited Capabilities to Support Diverse Distributors. Only fit for businesses with traditional business models with a limited number of channels. Not fit for modern distributors and DTC-centric businesses.

- Legacy Technology. While the new Kinetic experience can offer mature cloud capabilities such as enterprise search, the underlying data model and other cloud capabilities, such as mobile, are still legacy and patchy.

- Ecosystem. A limited number of consultants and partners are available to support the product. The marketplace is extremely limited to create the best-of-breed architecture.

4. Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is the SMB distribution product from Microsoft that targets FMCG distributors and construction-centric distributors. It’s especially suitable for distributors with complex supply chain networks and warehousing needs. While the add-ons may be available for other industrial verticals, the experience might not be as native and seamless as with other products on this list. Overall, FMCG distribution and construction-centric distributors will find Business Central attractive. It ranks slightly higher this year due to the lack of momentum for other products and now is at #4 on this list.

Strengths

- Rich Distribution ERP Systems Capabilities Natively Supported. Replenishment strategies such as warehouse-level transfers, license plate construction, and bin-level capabilities are supported out-of-the-box for complex distribution businesses.

- Cloud-native Architecture. The product has been completely rearchitected using the cloud-native architecture. Cloud ERP capabilities are stronger than those of competing products such as SAP Business One.

- Global Capabilities and Ecosystem. Unlike several products such as Acumatica, which is primarily a North American product, it has support for several European, Asian, and African countries where most products might struggle.

Weaknesses

- Limited Capabilities to Support Diverse Distributors. Only fit for FMCG-centric distributors. The industrial distribution would require add-ons to support capabilities such as buying groups, HVAC code integration, and vendor catalogs.

- Unproven Add-ons and Unqualified Consulting Networks. Microsoft partner processes are not as streamlined as other vendors. So it may require the help of an independent ERP consultant to vet the add-ons and architecture in the Microsoft ecosystem.

- Ecosystem. While the ecosystem may have options for distribution industries where BC specializes in, it might not have integrations with the best-of-breed eCommerce systems in the industrial distribution space.

3. Microsoft Dynamics 365 F&O

Microsoft Dynamics 365 F&O, Microsoft’s flagship product, is designed for larger distributors with revenues exceeding $1B and more than 10-20 entities. Ideal for larger companies boasting diverse business models and a global presence. Less suitable for smaller companies with limited internal IT capabilities. Large, complex global companies with revenues exceeding $1B will find Microsoft Dynamics F&O appealing. It ranks slightly higher this year due to the lack of momentum for other products and now is at #3 on this list.

Strengths

- Operationally Richest Cloud Product for Large Complex Businesses. Businesses that have multiple global entities with complex business models such as discrete and process manufacturing, distribution, and project-based business models would find Microsoft Dynamics F&O attractive.

- Cloud-native Architecture. The product has been completely rearchitected using the cloud-native architecture. Cloud capabilities are stronger than competing products for distributors such as SAP S/4 HANA and Oracle ERP Cloud.

- Common Data Model and Database-level Integration for Best-of-breed Architecture. Large, complex systems could be frightening to use for sales and field service crews. Microsoft provides pre-baked integration with the best-of-breed CRM and field service products.

Weaknesses

- Financial Traceability and Audit Support. Complex global organizations may struggle with financial traceability and SOX compliance capabilities.

- Large Workloads. Compared to SAP S/4 HANA, it might not be able to match the performance expectations of large complex organizations where companies may need to process millions of journal entries per hr.

- Overwhelming for Smaller Organizations. The complex workflows built to support the processes of large, complex organizations may overwhelm organizations seeking simpler solutions without unnecessary processes and approval flows.

2. SAP S/4 HANA

SAP S/4 HANA, SAP’s flagship product, caters to larger distributors with revenues exceeding $1B and more than 10-20 entities. Tailored for large companies with high-volume transactional demands, handling up to 1 million journal entries per hour—especially for business models with nuanced transactions requiring serial number traceability, which strains even the most robust systems. Its suite includes an embedded EWM solution, enterprise-grade CPQ, and a commerce platform, offering a best-of-breed architecture for complex distributors, including those with 3PL business models. Its slightly higher ranking this year results from a lack of momentum for other products, placing it at #2 on this list.

Strengths

- Large Workloads. SAP S/4 HANA could process more than 100K serialized goods receipts within 22 secs, while Oracle Cloud ERP took more than 18 mins for the same test. SAP S/4 HANA’s design allows companies to process the workload requirements of Fortune 500 when every other system might struggle.

- Best-of-breed Architecture for Distributors. SAP’s best-of-breed architecture can support the business model of large distributors, irrespective of whether they are a traditional distributor or a combination of 3PL, which typically has a different warehouse and TMS architecture than traditional distributors.

- Financial Traceability and Control. Fortune 500 organizations with shared service models spread in multiple countries would appreciate the financial traceability built at the document level.

Weaknesses

- Weak Operational Capabilities for the Cloud. The last-mile capabilities available with some of the mid-market products may require substantial development with SAP S/4 HANA.

- Limited Pre-baked Integration. The third-party integration options, such as integration with eCommerce platforms, POS systems, channel connectivity, etc, may require substantial development efforts.

- Overwhelming for Smaller Organizations. The complex workflows built to support the processes of large, complex organizations may overwhelm organizations seeking simpler solutions without unnecessary processes and approval flows.

1. NetSuite

NetSuite focuses on SMB distributors with up to $1B in revenue and several global entities. Ideal for eCommerce and retail-centric business models featuring consumerized products. Less suitable for B2B and industrial distributors with intricate distribution and manufacturing needs. Overall, SMB distributors with B2C business models will find NetSuite attractive. It maintains its #1 ranking from the previous year.

Strengths

- B2C Data Model and Processes. NetSuite’s data model is especially attractive for B2C companies with integration requirements with several B2C channels, such as marketplaces.

- Global Capabilities. NetSuite can natively support the localization requirements of more than 100 countries. As well as consolidating and supporting intercompany transactions.

- Ecosystem. NetSuite has one of the largest ecosystems with pre-baked integration available to support the integration with multiple digital and physical channels. As well as 3PL providers.

Weaknesses

- Limited B2B Capabilities. The data model and pricing are not friendly for B2B companies. The pricing layers are not as scalable as other systems, such as Acumatica. NetSuite may struggle with the complex product catalog for industrial distributors.

- Limited Capabilities for Diverse Distributors. Distributors with diverse business models with manufacturing, construction, or field service might require several add-ons.

- Not Designed for Large Companies. NetSuite may struggle with transactional workload requirements of companies over $1B and the ones that might be acquiring 10-20 entities every year.

Conclusion

Distribution enterprises possess unique demands in planning cycles and network structures. While manufacturing ERP systems might seem adequate, they lack the inherent alignment with distribution organizations. Failing to opt for a fitting distribution solution could result in employees relying on spreadsheets or isolated add-ons, impeding process scalability.

When assessing a distribution ERP system, pay attention to these intricacies to select the appropriately sized solution for your company. If you find the complexities overwhelming, consider enlisting the assistance of independent ERP consultants to streamline your selection process.