Sage’s announcement of enhanced AI capabilities within Sage Intacct marks a significant advancement in enterprise financial software automation. The latest developments introduce Sage AI finance automation tools designed to address persistent challenges in financial operations, from month-end close processes to accounts payable management.

According to industry analysis, the enhancements specifically target operational inefficiencies that have historically consumed finance team resources. The Sage AI finance automation framework encompasses intelligent reconciliation, embedded payment solutions, and sustainability reporting capabilities that reflect broader market demands for streamlined financial operations.

Research conducted by Sage indicates that 84% of finance leaders seek to accelerate book closing processes, while 87% actively pursue more sophisticated accounts payable automation solutions. These statistics underscore the market demand driving AI-powered financial software development across the enterprise technology landscape.

Financial Operations Automation Landscape

The evolution of Sage AI finance automation occurs within a broader context of digital transformation initiatives affecting finance departments globally. Organizations increasingly recognize that manual financial processes create bottlenecks that limit strategic capabilities and operational agility.

Market Drivers for AI Finance Tools

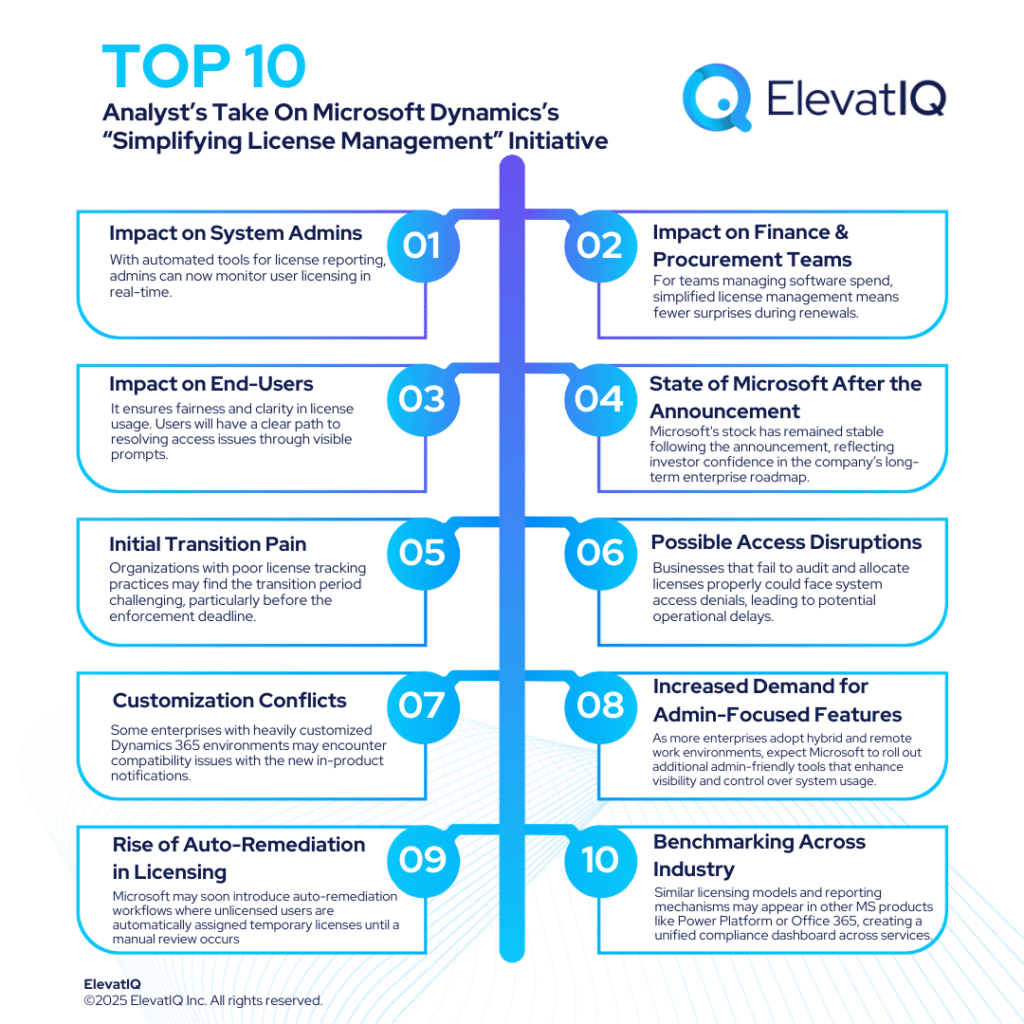

Enterprise finance teams face mounting pressure to deliver faster, more accurate financial reporting while managing increasing transaction volumes and regulatory requirements. Traditional approaches to financial operations management often prove insufficient for organizations experiencing growth or operating in complex business environments. Industry observers note that financial software vendors have responded to these challenges by developing AI-powered solutions that automate routine tasks while maintaining accuracy and compliance standards. The Sage AI finance automation initiative represents this broader trend toward intelligent financial operations management.

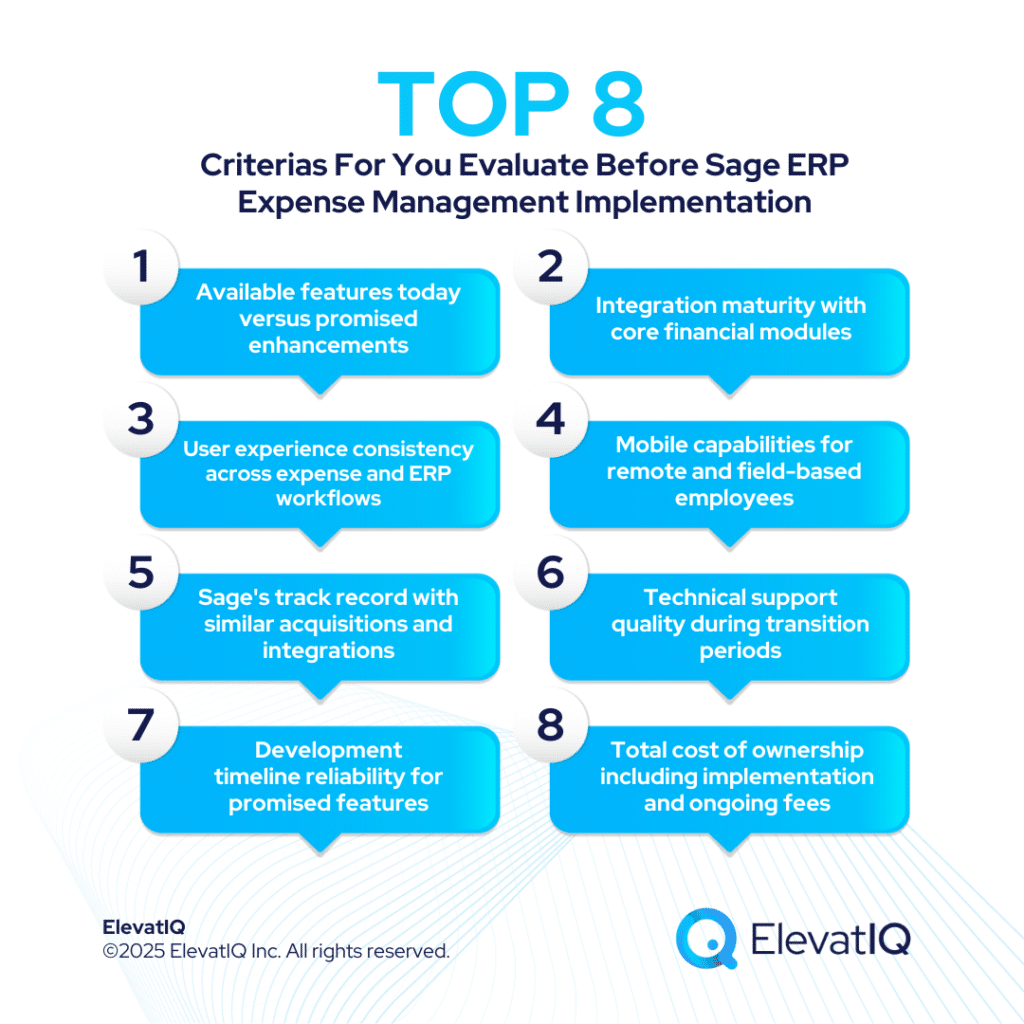

Competitive analysis suggests that finance automation capabilities are becoming standard expectations rather than differentiating features. Organizations evaluating financial software increasingly prioritize AI capabilities alongside traditional functionality and integration requirements. Understanding these market dynamics provides essential context for examining how Sage has structured its AI-powered solutions to address specific operational challenges while supporting broader digital transformation objectives.

Technology Integration Considerations

The Sage AI finance automation architecture integrates artificial intelligence capabilities directly within existing Sage Intacct workflows, minimizing disruption while maximizing functionality enhancement. This approach differs from solutions that require separate AI platforms or extensive system modifications. Technical specifications indicate that the AI-powered features operate within the established Sage Intacct environment, enabling organizations to leverage existing user training and system integrations. This integrated approach addresses common implementation challenges associated with introducing new technology capabilities into established financial operations.

AI-Powered Financial Process Enhancement

While market drivers explain the demand for automation, the practical value of Sage AI finance automation depends on specific capabilities that address operational pain points in financial management processes.

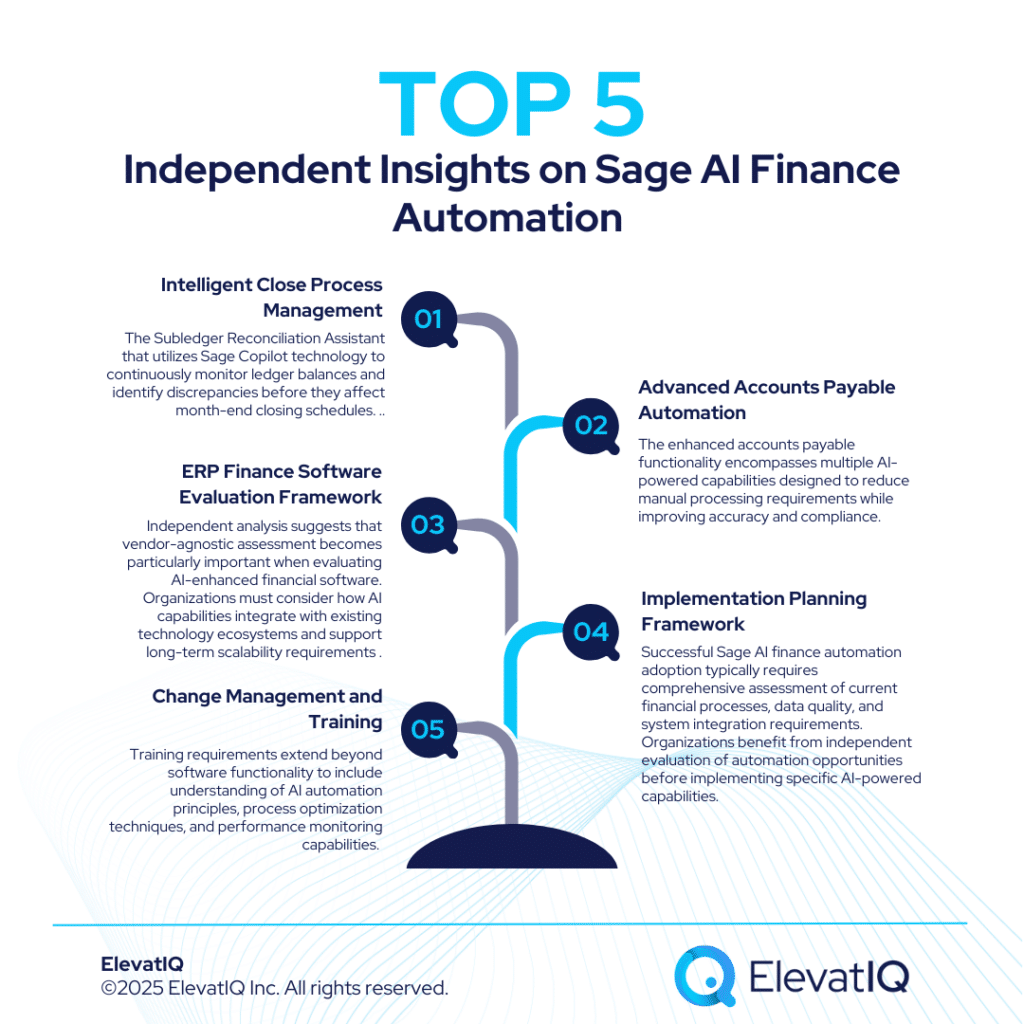

Intelligent Close Process Management

The AI-Powered Close functionality introduces a Subledger Reconciliation Assistant that utilizes Sage Copilot technology to continuously monitor ledger balances and identify discrepancies before they affect month-end closing schedules. This proactive approach represents a significant advancement over traditional reconciliation processes that rely on manual review and correction. Industry analysis suggests that month-end close acceleration has remained a persistent challenge for finance teams across various industries. The Sage AI finance automation framework addresses this challenge through standardized close tasks, customizable templates, and real-time notification systems that coordinate team activities and track progress.

The Close Workspace functionality provides centralized management of closing activities, enabling finance teams to maintain visibility across multiple process streams while ensuring completion of required tasks. This systematic approach to close management could significantly reduce the time and effort required for monthly financial reporting cycles. These AI-powered close capabilities demonstrate how artificial intelligence can enhance existing financial processes without requiring fundamental changes to established accounting practices or organizational structures. Moving beyond close process management, the Sage AI finance automation platform addresses operational challenges in accounts payable and procurement workflows that affect daily financial operations.

Advanced Accounts Payable Automation

The enhanced accounts payable functionality encompasses multiple AI-powered capabilities designed to reduce manual processing requirements while improving accuracy and compliance. Sage Vendor Payments, powered by MineralTree technology, embeds payment processing directly within the Intacct environment. Payment processing capabilities include ACH transfers, check generation, and virtual card payments with integrated fraud protection and enhanced visibility into payment status. This embedded approach eliminates the need for separate payment systems while providing comprehensive payment management functionality.

AI-powered Line-Level Matching automatically correlates invoice details with purchase order information, reducing the manual effort required for accounts payable processing. This capability addresses a common source of inefficiency in financial operations where invoice processing creates bottlenecks that affect cash flow management and vendor relationships. The Sage Intacct eProcurement expansion provides embedded vendor punchout capabilities that enable direct vendor interaction with automated order data capture. This integration streamlines procurement processes while maintaining visibility and control over purchasing activities.

Strategic Implications for Financial Technology Architecture

The availability of Sage AI finance automation capabilities creates new considerations for organizations planning their financial technology infrastructure and vendor relationships.

ERP Finance Software Evaluation Framework

The introduction of AI-powered financial capabilities influences how organizations evaluate enterprise resource planning software and financial management systems. Traditional evaluation criteria focused primarily on functional capabilities and integration requirements must now incorporate AI functionality and automation potential. Independent analysis suggests that vendor-agnostic assessment becomes particularly important when evaluating AI-enhanced financial software. Organizations must consider how AI capabilities integrate with existing technology ecosystems and support long-term scalability requirements across multiple business functions.

Industry experts emphasize the importance of building comprehensive enterprise architecture that considers data flows between financial systems, operational applications, and reporting platforms. This approach enables organizations to maximize AI automation benefits while maintaining flexibility for future technology evolution. The complexity of evaluating enterprise software across categories such as ERP, financial management, business intelligence, and compliance tools requires structured assessment processes that consider both current capabilities and future development trajectories. Moving from evaluation considerations to practical implementation, organizations must develop frameworks for deploying Sage AI finance automation tools while ensuring integration with existing financial processes and systems.

Implementation Strategy Development

Successful Sage AI finance automation adoption typically requires comprehensive assessment of current financial processes, data quality, and system integration requirements. Organizations benefit from independent evaluation of automation opportunities before implementing specific AI-powered capabilities. Business process documentation becomes critical when introducing AI automation into financial workflows. Organizations must clearly define current-state processes, identify automation opportunities, and establish metrics for measuring improvement outcomes. An AI-augmented approach to business process optimization can help identify the most beneficial automation targets while ensuring compliance with financial reporting requirements.

The complexity of financial software implementation often necessitates specialized expertise spanning accounting practices, technology architecture, and change management. Organizations typically require support covering ERP selection and optimization, process re-engineering, and user training across their financial transformation initiatives.

Competitive Dynamics and Market Response

The Sage AI finance automation announcement occurs within a competitive landscape where multiple vendors are developing AI-powered financial capabilities to address similar market demands.

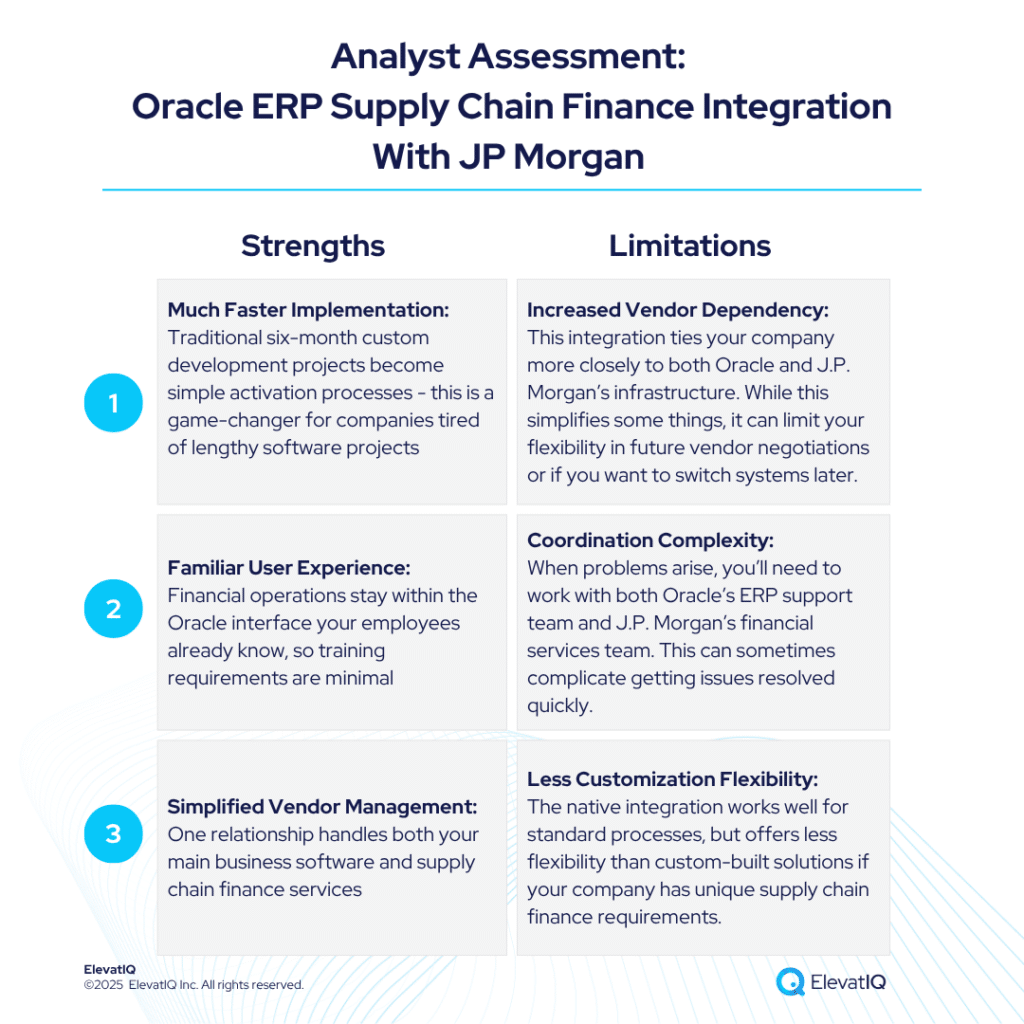

Industry Vendor Response Analysis

Technology industry analysts have characterized Sage’s AI finance automation development as part of broader market trends toward intelligent financial operations management. Similar capabilities are emerging across major ERP platforms, including SAP S/4HANA Finance, Oracle NetSuite, and Workday Financial Management. Competitive analysis indicates that AI-powered financial capabilities are becoming baseline expectations rather than differentiating features across major ERP platforms. Organizations evaluating financial software must consider not only current AI functionality but also vendor roadmaps for continued capability development.

Market research suggests that Sage AI finance automation adoption may accelerate broader digital transformation initiatives that have been constrained by manual financial processes. Organizations previously limited by traditional financial software capabilities now have access to automation tools that support more strategic financial management approaches. The competitive landscape demonstrates how financial software vendors are responding to market demands through AI integration rather than separate AI solutions, reflecting customer preferences for embedded capabilities over standalone automation platforms. Understanding competitive dynamics provides context for examining how different market segments and regional requirements influence Sage AI finance automation adoption patterns.

Market Segment Adoption Patterns

Different industry sectors face varying requirements for financial automation based on transaction volumes, regulatory environments, and operational complexity. Manufacturing organizations may prioritize procurement automation and cost accounting integration, while service companies might focus on revenue recognition and project profitability analysis. Small and medium-sized businesses represent a key target market for Sage AI finance automation tools, as these organizations often lack the resources to develop custom automation solutions but require the efficiency benefits of AI-powered financial processes.

Large enterprises with complex financial operations may find value in AI automation for specific process areas while maintaining existing systems for other functions. This selective adoption approach requires careful integration planning to ensure data consistency and process coordination across different automation levels.

Professional Services and Implementation Support

The complexity of Sage AI finance automation implementation creates demand for specialized expertise in financial process optimization, AI integration, and change management strategies.

Expertise and Advisory Requirements

Sage AI finance automation implementation requires specialized knowledge spanning financial accounting practices, AI technology capabilities, and system integration requirements. Organizations typically benefit from independent advisory services during evaluation and planning phases, particularly when assessing automation opportunities across multiple financial process areas. The complexity of financial software architecture often necessitates support for enterprise technology selection, requirement definition, and vendor negotiation processes. These services help organizations navigate technical specifications while addressing specific operational requirements and compliance considerations.

- A structured, vendor-agnostic approach to digital transformation planning ensures that AI automation investments align with broader organizational objectives and existing technology infrastructure. This comprehensive evaluation process considers integration requirements across enterprise software categories including ERP, business intelligence, and compliance management systems.

- Business process optimization becomes particularly important when implementing Sage AI finance automation solutions. Organizations must align existing workflows with AI automation capabilities while maximizing efficiency gains and maintaining financial control standards.

- Beyond technical implementation, successful AI automation adoption requires comprehensive organizational change management strategies that address user training, process modification, and performance measurement requirements.

Change Management and User Adoption

AI finance automation often requires updated procedures, role definitions, and skill development for finance team members. Organizations benefit from comprehensive change management support to ensure successful transition from manual processes to AI-powered workflows. Training requirements extend beyond software functionality to include understanding of AI automation principles, process optimization techniques, and performance monitoring capabilities. These skills are essential for maximizing Sage AI finance automation investment value and maintaining operational effectiveness.

Future Outlook for AI Finance Automation

Technology advancement in AI finance automation occurs within a dynamic market environment where customer demands, regulatory requirements, and competitive pressures continue to shape capability development and adoption patterns.

Technology Evolution Trends

Industry forecasts suggest that AI finance automation capabilities will expand beyond current Sage offerings as market demand increases and technology maturity improves. Additional vendors are likely to develop similar AI-powered solutions addressing comparable operational challenges in financial management.

AI capability evolution within financial software may accelerate as organizations gain experience with automation implementation and identify additional optimization opportunities. The Sage AI finance automation development could influence broader market adoption of AI technologies in financial operations across various industry sectors. Technology development occurs within regulatory environments that continue to evolve regarding financial reporting, data privacy, and AI governance requirements. Sage AI finance automation solutions must adapt to changing compliance landscapes while maintaining operational efficiency and accuracy standards.

Market Maturity and Adoption Acceleration

The success of Sage AI finance automation implementation across different organizations may influence similar initiatives from other financial software vendors, potentially creating more comprehensive AI automation ecosystems for financial operations management. Organizations that successfully implement AI finance automation may achieve competitive advantages through improved operational efficiency, faster financial reporting cycles, and enhanced analytical capabilities. These benefits could drive broader market adoption as organizations seek to maintain competitive positioning.

Conclusion

Sage’s AI finance automation initiative represents a significant development in enterprise financial software evolution. By addressing persistent challenges in financial operations while enabling enhanced analytical capabilities, the initiative demonstrates how AI technology can transform traditional financial management approaches. Organizations evaluating AI finance automation options benefit from independent assessment of operational requirements, technology integration implications, and long-term strategic alignment. The complexity of these implementations typically requires specialized expertise spanning financial process optimization, technology selection, and organizational change management.

The Sage AI finance automation framework illustrates how software vendors are embedding AI capabilities directly within established business applications rather than developing separate AI platforms. This trend suggests continued evolution toward intelligent business systems that enhance operational efficiency while maintaining familiar user experiences. Success in AI finance automation adoption depends on careful planning, appropriate expertise engagement, and alignment with broader digital transformation objectives. Organizations that approach these initiatives strategically position themselves to achieve significant operational improvements while maintaining financial accuracy and compliance standards.

Industry Expertise Note: Independent technology consultants specializing in vendor-agnostic digital transformation planning provide valuable perspective during AI finance automation evaluation processes. Organizations benefit from objective assessment of automation opportunities, integration requirements, and strategic implications when considering major financial software investments such as Sage AI finance automation implementations. Expert guidance in enterprise software selection across 200+ categories—from ERP and AI platforms to financial management and business intelligence tools—ensures that AI automation decisions support comprehensive operational optimization strategies rather than creating isolated technology investments.