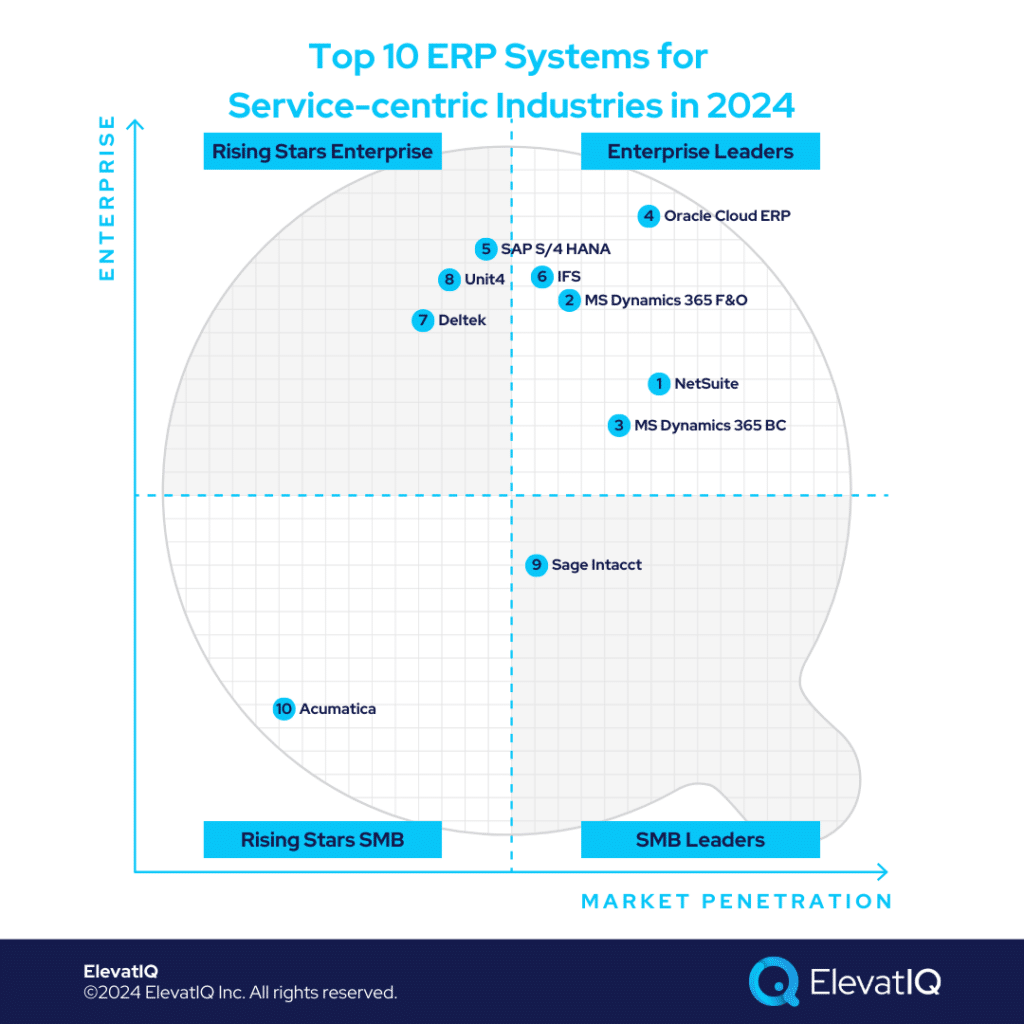

Service-Centric Businesses: Typically devoid of inventory-centric operations, ERP systems for service-centric industries demand distinctive features and architecture. Unlike their product-centric counterparts, which heavily rely on inventory-costing layers and MRP strategies, service-centric industries exhibit even more operational diversity. In some cases, ERP functions confine themselves to managing corporate financial ledgers, while custom software handles the bulk of operational tasks. This diverse industry segment ranges from non-profit organizations to the public sector, and the list goes on with particularly construction, real estate, mining, utilities, energy, consulting, and financial services.

Service-Centric Business Processes: Even within sectors like non-profit organizations, diverse needs demand extensive customizations, also raising questions about the role of ERP in such markets. Despite process variations, aspects like project management, indirect procurement, and scheduling specialized resources remain consistent. For industries like professional services and architectural firms, resource scheduling is paramount, while industries such as construction or real estate may find it less relevant. The nuances and complexities of service-centric industries necessitate an entirely unique ERP strategy for this market segment.

Service-Centric ERP Needs: PSA (Professional Services Automation) takes center stage in service-centric industries, particularly highlighting skill-based scheduling as a distinctive feature. Its integration with Human Capital Management (HCM) workflows also sets it apart. In contrast, product-centric industries prioritize embeddedness with CAD/PLM or TMS/WMS, crucial for their inventory-centric operations. Despite some inventory presence in service-centric industries, their layers are less complex, leading to occasional confusion with product-centric ERP systems. While project management and project manufacturing may resemble PSA, product-centric systems avoid skill-based resource identification to curb unnecessary overhead. Identifying ERP systems tailored for service-centric industries? This list is an excellent starting point.

10. Acumatica

Acumatica, primarily a product-centric ERP solution, has recently announced that they are launching an edition tailored for professional services companies. While Acumatica has capabilities relevant for other service-centric verticals, such as subscription billing, its coverage is fairly limited, primarily confined to the corporate financial ledger. Also, as of today, it has very limited global financial capabilities, making it less relevant for globally operated organizations requiring localizations in multiple countries aiming to explore synergies among those entities. Its limitations also substantially extend to non-profit-specific capabilities, but it would be a great fit for construction and mining-centric verticals due to its embedded field service and asset management capabilities. Thus, given its limited relevance to service-centric verticals, it ranks at #10 on our list.

Strengths

- Multiple business models in one database. Service companies such as architectural firms and mining companies might find Acumatica attractive if their operations have flavors of product-centric companies such as manufacturing or eCommerce.

- Cloud-native, with the experience being very similar to other SaaS products, such as Salesforce or Quickbooks.

- Great as the first ERP system. While it would require consulting effort for implementation, the data layers are not as complex as larger ERP systems, making it a great first ERP system for service-centric smaller companies.

Weaknesses

- PSA capabilities just released. The PSA module has just been released and may take some time to stabilize, even though it contains a project management module for construction-centric verticals.

- Limited global application. Acumatica is relevant only in certain countries where they might have localization supported.

- HCM module not embedded. One key requirement for service-centric verticals is particularly embedded HCM and indirect procurement processes, which are substantially limited with Acumatica.

9. Sage Intacct

Service-centric companies seeking their first ERP system find Sage Intacct an ideal fit. While exclusively focusing on service-centric verticals such as non-profit, SaaS, construction, and many more, it highly limits the core ERP capabilities. They would require several add-ons in most of these sectors. Although limited to operational capabilities, it can act as the global financial ledger for global operations with enterprise-grade finance capabilities, such as partner accounting and revenue recognition. Thus, with the limited scope as an ERP requiring add-ons for operational capabilities, it ranks at #9 on our list.

Strengths

- Deep service-centric last-mile capabilities. It has one of the strongest service-centric finance and accounting capabilities, also including fund and grants accounting, pre-populated KPIs, and reports.

- Globalized and Localized in over 120 countries. It can natively support multi-entity collaboration features of over 120 countries.

- Salesforce, HR, and Marketplace Integrations for service-centric industries. Sage owns and maintains Salesforce and payroll integrations, particularly ensuring the quality of development.

Weaknesses

- May Require Subscriptions for Best-of-breed CRMs. Primarily an accounting solution. So the solution doesn’t have any CRM capabilities at all, as well as limited supply chain capabilities, even for indirect procurement.

- Will Require Consulting Expertise Compared to Other Smaller Systems. While Sage Intacct maximizes audibility and compliance through its design, successfully utilizing the product would require consulting expertise and internal IT maturity to navigate the added layers.

- Not a complete ERP. Would require several bolt-ons, even in verticals where they might have a tailored version. The tailored version would provide best-of-breed finance and accounting capabilities while using add-ons for everything else.

8. Unit4

Unit4 is a purpose-built enterprise-grade ERP for non-profit, public sector, and consulting companies. While ideal for some, tailored workflows would be limiting for other diverse service-centric business models such as healthcare, construction, or mining. Given its limited scope in certain industry verticals, it does not provide the best fit for service companies aiming to streamline several subsidiaries in one solution or for private equity firms streamlining their entire portfolio. Thus, with its limited relevance to certain service-centric industries, it ranks at #8 on our list.

Strengths

- Strong HCM and Indirect Procurement Capabilities Pre-integrated and Pre-baked. Tailored to educational institutes and non-profits.

- Non-profit Accounting and PSA Capabilities Offered Out of the Box. The non-profit package includes native capabilities for the fund and grant capabilities with a strong PSA module to manage resources and projects.

- Designed to Handle Global Enterprise Workloads. While two versions exist for large enterprises and another for the mid-market, the large one has proven successful with large non-profit institutes seeking alternatives to SAP S/4 HANA or Oracle Cloud ERP.

Weaknesses

- Legacy Solution. While rearchitected for the cloud, it’s a legacy solution. So, the user and mobile experience might not be as great as other options born in the cloud.

- Limited Install Base in North America. Primarily a European solution with a very limited presence and ecosystem in North America. So, you might struggle to find consulting companies and marketplace add-ons focused on the North American market.

- Fit for a limited number of service-centric industries. Because of its tighter alignment with non-profit and public-sector verticals, other industries might find non-profit-specific capabilities overwhelming. It might also not be a fit for diverse organizations seeking capabilities outside of their comfort zone.

7. Deltek

Deltek targets upper-mid and lower-enterprise service-centric industries in construction, government contracting, architecture, and engineering verticals. Companies seeking proprietary integration and embeddedness with government contracting workflows find it an ideal fit. However, these proprietary capabilities might be overwhelming for other diverse industries. Just like Unit4, Deltek serves as a great solution for certain service-centric verticals but might not suit other verticals or companies with diverse business models as effectively. Thus, given its limited relevance for service-centric verticals, it ranks at #7 on our list.

Strengths

- Last-mile capabilities for GovCon and construction-centric verticals. Deltek has last-mile capabilities in the construction and GovCon space, requiring substantial development atop vanilla solutions.

- Access to the databases and networks relevant to these industries. Deltek has several products in its portfolio with industry databases and networks, providing it a unique advantage over other vendors.

- Multi-entity capabilities. Their multi-entity capabilities are rich, making them suitable for upper mid-market companies seeking one solution to host all of their entities in one database.

Weaknesses

- Limited focus. The limited focus of the solution might be a challenge for service-centric verticals active with M&A cycles, especially for business models outside of Deltek’s expertise.

- Limited ecosystem and consulting base. As of today, their ecosystem and consulting base significantly limit their capabilities.

- Limited best-of-breed capabilities. Service-centric industries opting to build best-of-breed architecture might not find as many pre-baked integration options, requiring substantial consulting efforts.

6. IFS

IFS enjoys a unique position for most service-centric verticals with its depth in project-centric organizations. It also particularly excels in workflows tailored for asset-heavy industries, along with possessing depth in field service capabilities. While IFS would suit many service-centric verticals such as construction, energy, and utilities, it might lack operational depth for verticals such as non-profit or the public sector. Since the solution targets larger mid-market and lower enterprise companies, it might be overwhelming for smaller companies. Thus, given its broader application than other focused solutions, it ranks at #6 on our list.

Strengths

- Enterprise-grade field service and asset management capabilities. While limited in its suite and focus, their last-mile capabilities are the strongest, particularly relevant for service-centric industries.

- The data model is aligned with companies with large programs. Industries such as MRO, Oil, and Gas follow very different project structures and BOMs. And IFS’s data model allows them to manage complex programs without any ad-hoc arrangements.

- Technology. While a legacy solution, IFS technology has rearchitected and modernized itself using cloud-native SaaS technologies.

Weaknesses

- Limited focus. The limited focus might be a challenge for other service-centric verticals active with M&A cycles.

- Limited ecosystem. Its presence and install base still lag behind other solutions on this list in North America.

- It is not the right fit for holding and private equity companies as a corporate ledger. While IFS can provide best-of-breed capabilities in a tier-two architecture or act as the main ERP hosting most enterprise processes, using IFS solely as the corporate financial ledger might not be the best fit.

5. SAP S/4 HANA

SAP S/4 HANA fits well for large globally operated companies with the scale of Fortune 1000 companies. Its data model allows hosting most business models in one solution, but that infinite scalability might also be overwhelming for smaller companies, requiring higher IT maturity and implementation budgets. While capable of hosting most business processes, operations teams at service-centric organizations might not prefer to host their workflows inside ERP systems. Thus, the preference for decentralized architecture at service-centric companies gets it the rank of #5 on this list.

Strengths

- Non-profit accounting and PSA capabilities are provided out of the box. Expect a non-profit accounting package including grant and fund reporting with a PSA and skill-based scheduling.

- Best-of-breed capabilities pre-integrated. The best-of-breed software, such as Concur, SuccessFactors, and CRM, are pre-integrated with SAP S/4 HANA, a pre-baked integration with the potential to save millions of dollars.

- HANA and financial traceability for large, global organizations. Because of the power of HANA, SAP S/4 HANA can process very complex transactions with visual traceability across entities, along with end-to-end traceability, auditability, and approvals of SOX compliance workflows.

Weaknesses

- CRM and membership capabilities. CRM workflows might not be fluid enough to meet the unique needs of service-centric companies.

- Adoption issues for service-centric verticals. Unlike product-centric organizations, service-centric verticals don’t have as financially embedded transactions, causing efficiency issues with teams if their workflows were to be managed inside complex ERP systems such as SAP S/4 HANA.

- Overwhelming for smaller organizations. The data model is designed for large, complex organizations, overwhelming for smaller, service-centric organizations.

4. Oracle Cloud ERP

Oracle Cloud ERP, similar to SAP S/4 HANA, is a great fit for very large globally operated organizations, especially publicly traded companies. It can accommodate most service-centric business models as part of its solution and has tailored capabilities for non-profits along with a PSA solution that is tightly embedded with the standalone HCM solution. Compared to SAP S/4 HANA, Oracle Cloud ERP fluid architecture allows flexibility that service-centric companies need for a decentralized architecture along with an ability to create custom forms and workflows easily. Thus, with the solution aligned with the needs of service-centric companies, Oracle Cloud ERP ranks at #4 on our list.

Strengths

- Designed for large service-centric organizations. The embedded HCM and CRM processes are suitable for large service-centric organizations. The P2P workflows are friendlier for the indirect procurement needs of such organizations.

- Native capabilities for grant and fund accounting. Expect native capabilities for grant and fund accounting provided as part of the package with very robust budget planning tools pre-integrated and pre-populated, easily merged with external datasets.

- Embedded HCM and PSA processes. Expect HCM and PSA to be fully immersed with the ERP, as well as grant and fund compliance processes.

Weaknesses

- Custom CRM workflows. While Oracle Cloud ERP might support the needs of membership from the perspective of finance and ASC606, the operational capabilities would require translation of data and process model, requiring expensive consulting and internal IT expertise.

- Best-of-breed pre-built integrated options may be limited. Expect substantial efforts in integrating sector-specific CRMs and tools, as options may be limited for specific service-centric organizations.

- Overwhelming for smaller organizations. The data model and translations required to be successful with the product may be too overwhelming for companies outgrowing QuickBooks or other smaller ERP systems.

3. Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is a great fit for service-centric SMB companies with diversified business models operating globally. Its project management module is uniquely tailored to the needs of professional services organizations with each resource identified. It also has non-profit-centric accounting packages provided out of the box and a best-of-breed CRM that is highly customizable. The MS ecosystem also has very highly talented developers capable of customizing the CRM data model to the most unique service-centric workflows. Thus, given its broader focus on service-centric industries, it ranks at #3 on this list.

Strengths

- Designed for global companies. Natively supports global regions and localizations. Ideal fit for countries where the other suite-centric solutions, Deltek or Unit4, might not be present.

- Non-profit accounting and PSA capabilities are provided out of the box. Expect a non-profit accounting package including grant and fund reporting with a PSA tailored for service-centric organizations and skill-based scheduling.

- Marketplace and ecosystem. Augments core capabilities with a very vibrant marketplace, supporting diverse business models such as oil and gas, energy, and non-profit.

Weaknesses

- Financial traceability and SOX compliance. It might not be the most Intuitive for finance leaders. The financial traceability may not be as intuitive as SAP for global, publicly traded service-centric companies.

- Technical focus and limited business consulting expertise in the Microsoft ecosystem. The ecosystem has technical companies but with limited business consulting experience, which might drive over-customization and overengineering of Microsoft products, ultimately leading to implementation failure.

- Limited Microsoft support for smaller partners. Unlike other ERP companies, Microsoft doesn’t offer any support or control to its smaller partners, leading to implementation issues because of the limited control over its channel.

2. Microsoft Dynamics 365 Finance & Operations

Microsoft Dynamics 365 Finance & Operations is a great fit for upper-mid-market and lower-enterprise companies operating globally. It can host a variety of business models in one solution, along with the flexibility of customized workflows for service-centric organizations. MS Dynamics 365 F&O includes an out-of-the-box non-profit accounting package along with best-of-breed capabilities supported through its marketplace. It also has a CRM and field service solution that can be used in conjunction with the ERP solution, making it especially relevant for certain service-centric verticals. Thus, due to its wider applicability for many different business models, it ranks at #2 on our list.

Strengths

- Designed for large organizations. Ideal for large, global companies with complex service-centric business models operating in multiple countries.

- Non-profit accounting package capabilities are offered out of the box. Embedded non-profit accounting capabilities are offered out of the box.

- Data center options and data locations of choice might be available in most countries. With the backing of Azure, complying with regulations such as the Patriots Act may be easier, an issue especially crucial with service-centric companies.

Weaknesses

- It may not be the best fit for publicly traded companies. The traceability requirements for publicly traded companies might not be as intuitive.

- The CRM data model might not be as fluid for certain service-centric verticals. The CRM data model is not as fluid as other solutions in the market, making it less friendly for business users with a need for customized workflows.

- Overwhelming for smaller organizations. The data model and infinite scalability might be overwhelming for smaller organizations seeking simpler solutions easier to configure.

1. NetSuite

NetSuite is a great fit for several service-centric verticals, including non-profit, media, energy, utilities, construction, and oil and gas. It can support not only the lighter commerce processes of service-centric businesses but also complex workflows such as subscription-based business models. NetSuite HCM and PSA provide the unique embeddedness service-based organizations need to support their skill-based operations. The FP&A and indirect procurement processes are uniquely tailored for these industries. Thus, with the introduction of field service and its CPQ being tailored, it is one of the most adopted solutions in service-centric verticals, securing its rank at #1 on this list.

Strengths

- An in-built package with fund and grant accounting capabilities is offered out of the box. Expect native capabilities for grant and fund accounting provided as part of the package with very robust budget planning tools for SMB non-profit companies pre-integrated and pre-populated, easily merged with external datasets.

- Marketplace and ecosystem. Vibrant marketplaces and ecosystems, with tons of pre-baked integrations and add-ons available for diverse business models.

- Ideal for global companies growing through M&A. Supports several diverse and global business models out of the box, making it ideal for companies part of the private equity portfolio and growing through M&A.

Weaknesses

- Limited operational depth for some verticals. The operational depth with solutions such as Unit4 or Deltek for certain verticals might require add-ons or custom development.

- Embeddedness with best-of-breed solutions. Service-centric verticals that enjoy using their favorite tools, such as Salesforce or JIRA, might not like to use NetSuite for their operational workflows.

- Not a fit for very large service-centric organizations. While NetSuite can support very large multi-entity operations, companies that might be acquiring hundreds of companies each year might find NetSuite to be limiting.

Conclusion

In contrast to product-centric counterparts, service-centric organizations demand ERP systems with flexibility, given their ad-hoc workflows with limited financial control needs. The limited benefits of ERP processes in service-centric settings can result in adoption challenges, especially in verticals where employee experience matters more than operational efficiency. If you’re choosing an ERP system for service-centric industries, scrutinizing nuances is crucial. When ERP systems seem indistinguishable, the guidance of an independent ERP consultant can be invaluable.