Last Updated on January 6, 2026 by Shrestha Dash

The ERP pricing models landscape has undergone a dramatic transformation over the past decade. What once began as straightforward per-user licensing has evolved into a complex ecosystem of subscription models, consumption-based pricing, and hybrid approaches that promise flexibility but often deliver budget uncertainty.

Over 70% of new ERP implementations chose cloud-based subscription models in 2024, marking a decisive shift away from traditional perpetual licensing. But this evolution isn’t just about moving to the cloud—it’s fundamentally changing how organizations budget for, deploy, and scale their ERP investments. Understanding these ERP pricing models isn’t just a procurement exercise. It’s strategic. The wrong pricing structure can lock you into escalating costs, limit organizational agility, or create budget unpredictability that undermines your digital transformation goals.

The Traditional User-Based Pricing Model

User-based pricing charges organizations based on the number of people accessing the ERP system. For years, this was the standard approach—simple to understand, straightforward to budget, but increasingly problematic as organizations demand broader system access and real-time collaboration.

How User-Based Pricing Works

This model comes in two primary flavors, each with distinct characteristics and cost implications:

| Pricing Type | How It Works | Cost Profile | Best For |

| Named Users | Each employee gets unique login credentials | Higher per-user cost | Small teams with dedicated ERP users |

| Concurrent Users | Based on simultaneous logins at any given time | Lower license count needed, but higher per-license cost | Global organizations spanning time zones |

Named user licensing is straightforward—you purchase a license for each person who needs access, and that person has unlimited system availability. Concurrent licensing is more nuanced. If you have 100 employees but only 30 ever use the system simultaneously, you might only need 30-40 concurrent licenses. The system simply blocks access when the limit is reached, which can create operational friction during peak periods.

The Core Limitation

The fundamental problem with user-based ERP pricing models is simple: it punishes organizational growth and collaboration. When you add employees, your ERP costs automatically increase—regardless of whether those users create proportional value. A warehouse worker who logs in twice daily to confirm shipments costs the same as a financial analyst using the system continuously throughout the workday.

This creates perverse incentives that undermine the very collaboration and visibility that ERP systems are designed to enable:

- Organizations limit ERP access to “essential” users only

- Departments share login credentials (violating licensing terms)

- Real-time collaboration becomes cost-prohibitive

- Data visibility gets artificially restricted across the organization

The system that should unify your business operations instead creates information silos driven by licensing costs.

When User-Based Pricing Still Makes Sense

Despite its limitations, user-based models work well in specific scenarios:

- Stable, predictable headcount: Organizations with minimal employee fluctuation can accurately forecast licensing needs

- Limited ERP scope: Companies using ERP primarily for back-office functions with a defined user base

- Smaller teams with deep usage: When everyone accessing the system uses it extensively throughout their workday

- Budget predictability requirements: Finance teams that need fixed, knowable costs without consumption variability

The bottom line? User-based ERP pricing models are straightforward to understand and budget, but fundamentally constrain how organizations can leverage their ERP investment.

The Cloud Subscription Pricing Model

The shift to cloud ERP brought subscription pricing as the default model, fundamentally changing both how organizations pay for ERP and how they think about technology ownership. This transition was driven by vendors seeking predictable recurring revenue and buyers seeking lower barriers to entry, reduced IT overhead, and faster implementation timelines.

Why Subscription Models Dominate

Subscription pricing eliminated the massive upfront capital expenditure that characterized perpetual licensing, replacing it with manageable monthly or annual recurring fees. The vendor handles infrastructure, updates, and maintenance, freeing internal IT teams from server management and patch deployment. ERP implementation timelines compress because there’s no hardware procurement or data center preparation.

For CFOs, subscription models transform ERP from a capital expenditure to an operational expense, improving cash flow management and balance sheet optics.

The True Cost Structure

Subscription-based ERP pricing models aren’t just “software rental.” Understanding the full cost requires examining multiple components:

- Base Platform Fee: This covers core ERP functionality access. For systems like NetSuite, this base platform fee is separate from per-user charges and typically non-negotiable.

- User Licenses: Full users typically range from $40-$200+ per month depending on the vendor and feature tier. Limited users cost $8-$50 per month. Adding just 10 full users at $100 each increases your monthly costs by $1,000—or $12,000 annually.

- Module Add-Ons: Industry-specific functionality, advanced features like production scheduling, and integration capabilities often come as additional modules with separate subscription fees.

- Support Tiers: Basic support is often included, but premium support packages that provide dedicated support engineers add 15-25% to your total cost.

The Eight-Year Break-Even Reality

Here’s the math that vendors don’t advertise prominently: eight years of ERP subscription equals the cost of one traditional perpetual licensing model.

- Years 1-3: Subscription appears significantly cheaper due to lower upfront costs

- Years 4-7: Cumulative subscription costs approach perpetual license equivalent

- Year 8+: Subscription becomes measurably more expensive on a pure cost basis

- Year 10+: Cumulative subscription costs significantly exceed perpetual licensing alternatives

For organizations with long planning horizons and stable requirements, this TCO reality makes perpetual licensing (where still available) financially compelling despite higher upfront costs.

Hidden Subscription Escalations

What makes subscription ERP pricing models particularly challenging isn’t the base cost—it’s the built-in escalation mechanisms:

- Annual price increases are standard in most subscription contracts, typically running 3-5% yearly for “product improvements.” Over a decade, this compounds significantly. A $60,000 annual subscription with 4% yearly increases becomes $88,815 by year 10.

- Feature tier upgrades force costly transitions when you outgrow your current tier. What starts as a mid-tier subscription often requires enterprise tier upgrades as your business scales.

- User creep is inevitable. Business growth automatically increases recurring costs as you add employees. Mergers and acquisitions can instantly multiply your user count and associated fees.

- Module expansion happens gradually as departments discover functionality they need, but each addition compounds your monthly fees permanently.

Strategic Subscription Considerations

The decision to embrace subscription pricing should be based on organizational circumstances and strategic priorities:

| Subscription Makes Sense When: | Subscription Becomes Problematic When: |

| Minimizing upfront capital expenditure is critical | Long-term TCO analysis shows perpetual licensing would be more cost-effective |

| Implementation speed trumps long-term cost optimization | Annual price increases compound unpredictably |

| Organization lacks in-house IT infrastructure | Vendor lock-in limits negotiating leverage at renewal |

| Regular feature updates provide competitive advantage | Cumulative costs over 10+ years become unsustainable |

| Planning horizon is 5 years or less | Organization has stable requirements and long lifecycles |

The reality is that subscription ERP pricing models democratized ERP access for mid-market companies that couldn’t afford massive perpetual license investments. But it shifted the cost burden from upfront to ongoing and that ongoing burden never stops.

The Consumption-Based Pricing Model

Consumption-based ERP pricing models represent a fundamental departure from user-centric approaches. Rather than charging based on who has access to the system, vendors charge based on what you actually do with it—transaction volumes processed, data storage consumed, API calls made, or compute capacity utilized.

The Consumption Model Explained

Different vendors measure consumption differently, but the core principle remains consistent: costs scale with business activity rather than user count. This means your ERP investment grows proportionally with your business operations rather than your organizational headcount.

How Consumption Metrics Work

Understanding consumption metrics is essential because these determine your actual monthly or annual costs:

Transaction-Based Pricing: Vendors charge per business transaction. Sales orders, purchase orders, invoices, payments, shipments. Acumatica pioneered this approach with their Commercial Transaction Volume (CTV) model, which tracks the highest count among transaction types monthly. If you process 1,000 sales orders, 700 customer payments, and 675 AR invoices, your CTV is 1,000.

Resource Consumption Tiers: Some vendors count “Key Documents”. Major transactions that load the database, when they’re saved or posted, combined with storage capacity, API calls, and compute processing.

Usage-Based Elements: This includes volume of data processed, number of transactions handled, advanced feature utilization, data storage requirements, and bandwidth consumption.

The Challenge: Budget Unpredictability

The fundamental problem with consumption-based ERP pricing models lies in forecasting difficulty:

- Business Growth Uncertainty: A 30% sales increase means 30% more transactions and 30% higher ERP costs. What started as a $50,000 annual subscription can balloon to $65,000 or $75,000 through consumption-based charges.

- Operational Changes: Process automation initiatives can multiply API calls exponentially. New integrations with e-commerce platforms, CRM systems, or supply chain tools dramatically alter consumption patterns.

- Seasonal Volatility: Retail organizations see 3-5x transaction spikes during peak seasons. Manufacturing cycles create consumption fluctuations. Without contracted limits, consumption pricing exposes organizations to escalating costs.

Consumption Model Variants

Acumatica’s tiered approach represents a good example of consumption-based ERP pricing model in the market:

| Tier | Target Organization Size | Transaction Capacity | Upgrade/Downgrade Rules |

| Essentials | Fewer than 20 employees | Lower transaction volumes | Upgrade if volumes exceed limits 3+ times in 12 months |

| Select | Fewer than 50 employees | Medium transaction volumes | Same upgrade rules apply |

| Prime | Fewer than 200 employees | Higher transaction volumes | Downgrade allowed if consistently under-utilizing |

| Enterprise | Over 200 employees | Highest transaction volumes | Custom arrangements possible |

Protecting Against Consumption Overruns

When negotiating consumption-based ERP pricing models, organizations must establish protective mechanisms:

- Generous included allocations: Baseline transaction volumes plus 20-30% growth buffer

- Absolute spending caps: Maximum annual costs regardless of consumption

- Transparent usage tracking: Real-time visibility with proactive alerts at 75% and 90% thresholds

- Pre-agreed overage rates: Known pricing for exceeding tier limits

- Multi-year price locks: Protection against arbitrary annual increases

The reality is that consumption-based ERP pricing models align costs with business activity in theory, but require sophisticated contract protections to avoid budget catastrophe in practice.

Strategic Imperatives for ERP Pricing Models

Understanding traditional and modern ERP pricing models is fundamental to making informed decisions that align with your business objectives and financial constraints.

User-Based Models: Simple but Constraining

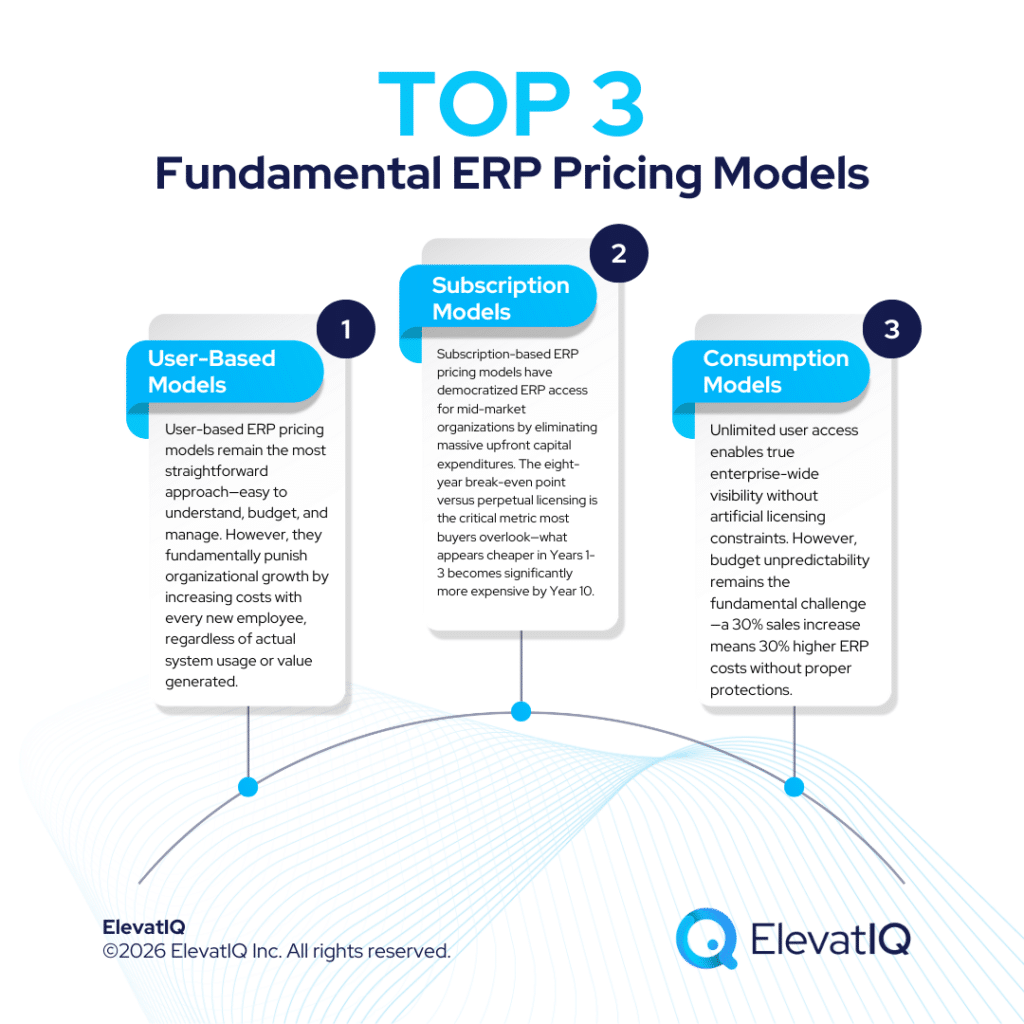

User-based ERP pricing models remain the most straightforward approach—easy to understand, budget, and manage. However, they fundamentally punish organizational growth by increasing costs with every new employee, regardless of actual system usage or value generated. These models work best for stable, small teams with predictable headcount (under 50 users) where budget predictability outweighs flexibility needs. As organizations demand broader system access for real-time collaboration and enterprise-wide visibility, user-based models increasingly become a constraint rather than an enabler.

Subscription Models: Lower Entry, Higher Long-Term Cost

Subscription-based ERP pricing models have democratized ERP access for mid-market organizations by eliminating massive upfront capital expenditures. The eight-year break-even point versus perpetual licensing is the critical metric most buyers overlook—what appears cheaper in Years 1-3 becomes significantly more expensive by Year 10. Built-in escalation mechanisms compound at 3-5% annually, turning a $60,000 subscription into $88,815 over a decade. Multi-year rate locks and escalation caps below 3% are non-negotiable protections for any subscription contract.

Consumption Models: Alignment with Activity

Consumption-based ERP pricing models represent the most innovative approach, aligning costs with business operations rather than headcount. Unlimited user access enables true enterprise-wide visibility without artificial licensing constraints. However, budget unpredictability remains the fundamental challenge—a 30% sales increase means 30% higher ERP costs without proper protections. Absolute spending caps, transparent real-time usage tracking, and pre-agreed overage rates transform consumption models from budget risk into strategic advantage.

The Path Forward

Each of these ERP pricing models offers distinct advantages and introduces specific risks that require sophisticated analysis and contract negotiation. Organizations that understand these dynamics negotiate 20-40% better total cost of ownership outcomes than those accepting standard vendor contracts.

The complexity of modern ERP pricing models demands expert guidance. Whether you’re evaluating your first ERP implementation or renegotiating an existing contract, working with independent ERP advisors who understand vendor economics, market benchmarks, and negotiation tactics levels the playing field. At ElevatIQ, we help organizations navigate pricing model selection, calculate true TCO across different approaches, and negotiate contract protections that preserve flexibility as your business evolves.

Don’t let pricing model complexity undermine your ERP investment. The difference between an optimal and suboptimal structure can represent 30-50% variation in costs over typical contract lifecycles—and more importantly, the difference between a system that scales with your growth and one that constrains it. Choose your ERP pricing models strategically, negotiate aggressively, and build protections that align vendor economics with your business success.