Last Updated on March 26, 2025 by Sam Gupta

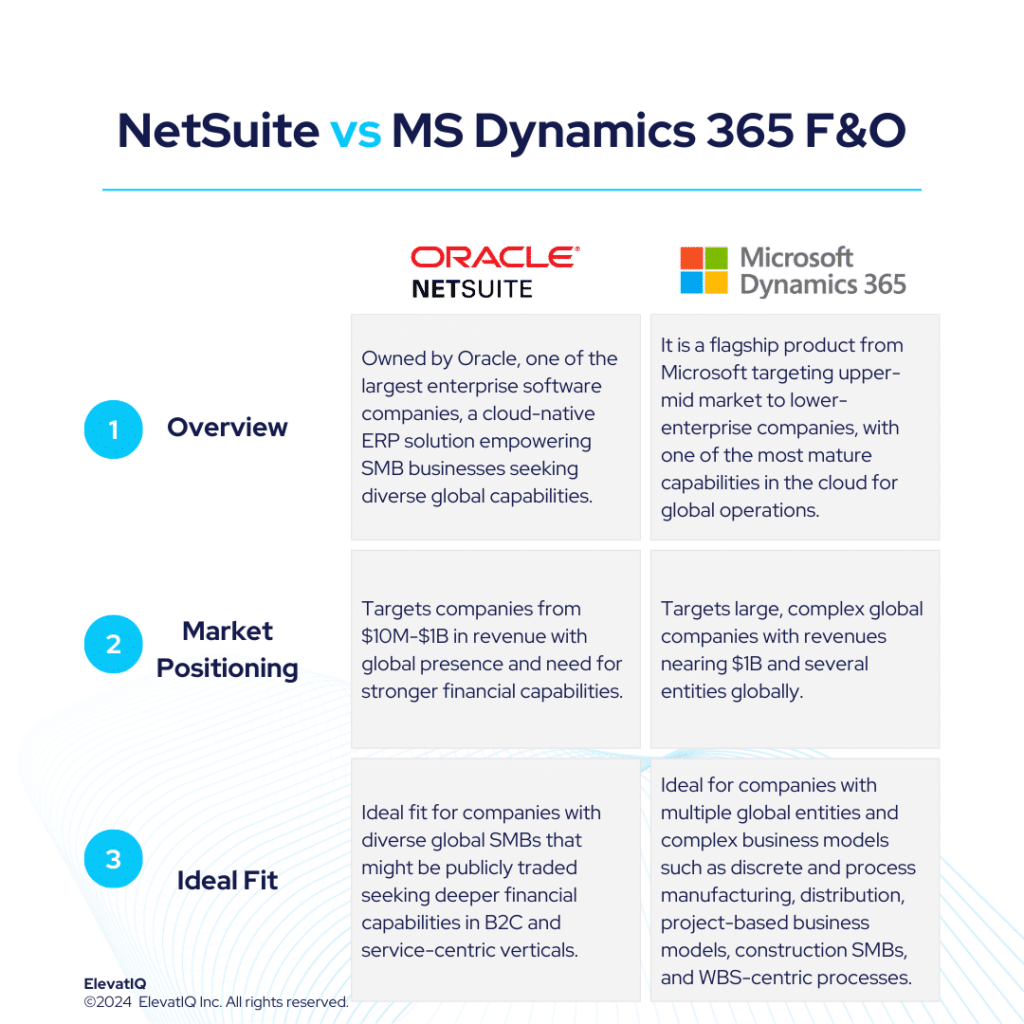

NetSuite caters well to globally dispersed small to mid-market firms, offering robust financial capabilities and extensive localization across multiple countries, albeit with less emphasis on operational functionalities tailored to specific business models. Conversely, Microsoft Dynamics 365 F&O represents superior cloud-native features, surpassing competitors like SAP S/4 HANA and Oracle Cloud ERP. NetSuite suits diverse companies including service-centric, distribution-centric, commerce-centric, and B2C organizations, whereas MS Dynamics 365 F&O is tailored for large, complex global enterprises generating revenue close to $1B with numerous global entities.

NetSuite excels across industries but may not be optimal for industrial distributors and manufacturers due to limitations in pricing and item master layers. In contrast, MS Dynamics 365 F&O is geared towards companies with multiple global entities and intricate business models like discrete and process manufacturing, distribution, project-based operations, construction SMBs with multiple entities, and WBS-centric processes. Despite challenges in Microsoft’s channel support, Dynamics 365 F&O offers a mature ecosystem with modern cloud-native technologies, proving effective across various sectors.

While Dynamics 365 F&O suits companies of diverse sizes and business models, NetSuite shines in supporting lighter manufacturing and consumerized products, particularly in health and beauty, fashion, apparel, and CPG industries. Therefore, if you’re weighing NetSuite against Microsoft Dynamics 365 F&O, this comparison delves into essential details to aid your ERP selection process. Let’s explore further!

| NetSuite | Microsoft Dynamics 365 F&O | |

| Started in | 1998 | One of the most established enterprise software companies in the world. |

| Ownership by | Oracle in 2016 | Microsoft |

| No. of customers | 37000+ | Over 50K |

What is NetSuite?

NetSuite stands out as the leading ERP solution, driven by its success for diverse industries particularly seeking stronger financial capabilities over the operational, robust ecosystem, credible marketplace add-ons, and comprehensive functionality. Although not as complex as some competitors like SAP S/4 HANA and Microsoft F&O, NetSuite excels in supporting diverse business models, including omnichannel architecture, matrix/dimensional inventory, and subscription-based models.

While NetSuite excels across industries, it may not be the ideal choice for industrial distributors and manufacturers due to limitations in pricing and item master capabilities. Its strength lies in supporting lighter manufacturing and consumerized products particularly health and beauty, fashion, apparel, and CPG. With robust financial capabilities and an integrated HCM solution, NetSuite is well-suited for service-centric industries, including smaller banks, credit unions, financial services, non-profit organizations, as well as the technology and media sectors. While NetSuite remains the top-ranked solution due to its product quality, there might be challenges with over-customization and integration issues, leading to implementation failures. Thus, working with NetSuite demands thorough vetting of their solution and architecture.

What Is Microsoft Dynamics 365 Finance & Operations (F&O)?

Microsoft Dynamics 365 F&O is often the third choice for larger global companies, following SAP S/4 HANA and Oracle Cloud ERP. It also offers a mature ecosystem with modern, cloud-native technologies, proving successful across various industries. It is perhaps the most diverse solution, accommodating several global business models in one database, making it an ideal solution particularly for smaller companies. While a great fit as a corporate ledger for large enterprises, it’s not as proven as other leading solutions in the enterprise market with workloads as high as millions of journal entries per hour that Fortune 1000 companies might demand.

Microsoft Dynamics 365 F&O excels particularly in localizations where other solutions may falter. A vibrant ecosystem thus makes it suitable for private equity and holding companies aiming to streamline their portfolio companies on one solution. SMBs, however, might find its complex data model overwhelming. Therefore, large, complex global companies with revenues exceeding $1B will find Microsoft Dynamics 365 F&O appealing.

Although Microsoft Dynamics 365 Finance and Operations lacks the operational depth of specialized solutions, larger companies favor its corporate-level financial control. Also,in a two-tier setting, they often utilize additional Dynamics 365 F&O add-ons like Adeaca for operational requirements. Furthermore, MS365 F&O offers seamless integration for field service, HCM, and CRM at the database level, empowering large companies to construct a best-of-breed architecture. It is especially strong with WBS-centric processes covering operational and financial schedules equally well. Thus, the challenge with MS Dynamics 365 F&O would be the best-of-breed ancillary systems critical for A&D systems, which are not owned and maintained by Microsoft, requiring third-party add-ons.

NetSuite vs Microsoft Dynamics 365 F&O Comparison

This section particularly delves into the comprehensive comparison of NetSuite vs Microsoft Dynamics 365 F&O across various critical dimensions.

| NetSuite | Microsoft Dynamics 365 F&O | |

| Global Operational Capabilities | Can handle multi-entity operations globally but not designed to handle enterprise workloads. | Can handle global entities in the upper-mid market and lower-enterprise segment. |

| Diverse Capabilities | Supports diverse business models but more favorable for B2C, hospitality, and service-centric. | Can accommodate most business models but may rely on add-ons for last-mile and industry-specific capabilities. |

| Best-of-breed Capabilities | Contains pre-integrated best-of-breed components such as HCM and FP&A, but their maturity varies. | Contains pre-integrated best-of-breed components such as CRM field service, but limited compared to other enterprise-grade solutions. |

| Last-mile Capabilities | Last-mile capabilities are extremely limited, especially for manufacturing or industrial distribution. | Core ERP layers are richer than NetSuite but may require add-ons for focused solutions like Infor or Epicor. |

| Operational Functionalities | Provides richer financial capabilities over operational. | Has richer financial and operational functionality, especially for large enterprises. |

| Integration Capabilities | Contains several pre-integrated solutions owned by NetSuite and more options with Celigo, but vetting by experts is recommended. | Database-level integration exists for best-of-breed applications like CRM or field service, including CDM and other MDM-centric interactions. |

| Manufacturing Capabilities | BOM layers are highly limited for assembly-centric operations, requiring several add-ons for mature manufacturing capabilities. | Offers mature manufacturing capabilities supporting various business models including process, discrete, or batch. |

| Pricing Model | Named-user based with long-term contracts without flexibility. | Cost per user per month with flexible user management, without long-term commitment. |

| Key Modules | 1. Financial Management 2. Accounting 3. Global Business Management 4. Inventory Management 5. Order Management 6. Supply Chain Management 7. Warehouse Management 8. Procurement 9. Customer Relationship Management | 1. Financial Management 2. Supply Chain Management 3. Discrete Manufacturing 4. Process Manufacturing 5. Project Management 6. Customer Relationship Management 7. Procurement |

NetSuite vs Microsoft Dynamics 365 F&O Feature Comparison

Both platforms offer a plethora of features and functionalities designed to streamline business operations and enhance efficiency. In this feature comparison, we delve into particularly the distinct capabilities of NetSuite and Microsoft Dynamics 365 F&O across various critical dimensions, providing insights to aid businesses in making informed decisions regarding their ERP selection. Thus, this section discusses features under each of the following modules, particularly financial management and supply chain management.

Financial Management Comparison

In this section, we are discussing a detailed comparison of the financial management capabilities particularly offered by NetSuite and Microsoft Dynamics 365 F&O. By examining their respective strengths and functionalities, particularly in managing financial processes. Businesses can therefore gain valuable insights to determine the best-suited ERP solution for their financial management needs.

| NetSuite | Microsoft Dynamics 365 F&O | ||

| Financial Management | General Ledger | Supports complex general ledgers including public reporting requirements of several countries. | Supports complex general ledgers including public reporting requirements of several countries with added layers needed for lower-enterprise organizations. |

| Accounts Receivable and Accounts Payable | Automates and streamlines invoice delivery, payment processing, and collections management as well as accounts payable processes. | Automates workflows for managing vendor invoices, payments, and customer invoicing, streamlining the entire invoicing process and improving cash flow management. | |

| Cash Flow Management | Provides visibility to optimize cash flows, monitor bank accounts, and manage liquidity. | Provides comprehensive cash flow forecasting capabilities, allowing to project future cash positions, identify potential shortfalls, and make informed decisions. | |

| Other Features | Tax Management – Manages domestic and global tax, generates detailed reports, and analyzes transactions real-time. | Chart of Accounts -Enables the creation of a hierarchical structure for categorizing financial information. | |

| Close Management –Automates inefficient manual tasks, such as journal entries, account reconciliations, variance analysis, and intercompany transactions. | Budgeting and Forecasting – Creates and manages budgets across different departments and business units. Also, leverages historical data and predictive analytics, to make accurate projections and align their financial strategies with business goals. |

Supply Chain Management Comparison

In this comparison, we explore and analyze the supply chain management capabilities of NetSuite and Microsoft Dynamics 365 F&O, shedding light particularly on their respective strengths and weaknesses.

| NetSuite | Microsoft Dynamics 365 F&O | ||

| Supply Chain Management | Warehouse Management | Provides the ability to optimize day-to-day warehouse operations, eliminate manual processes and minimize handling costs. | Provides advanced warehouse and transportation management features, including inventory tracking, order fulfillment, shipment planning, and real-time visibility into logistics operations. |

| Procurement | Streamlines procurement processes with source management, purchase management, vendor management and invoice processing. | Streamlines the procurement process by providing end-to-end visibility and control over purchasing activities. Also automates and optimizes the procurement workflows, reducing costs and improving supplier relationships. | |

| Inventory Management | Automates inventory management processes with multi-location fulfilment, cycle counting, replenishment, traceability and item visibility. | Offers real-time visibility into inventory levels, demand, and supply, enabling organizations to optimize their inventory planning, reduce stockouts, and improve customer satisfaction. | |

| Other Features | Supply Chain Planning – Provides the ability to analyze demand, determine replenishment requirements, add stock and create orders according to an up-to-date supply plan. | Transportation Management – Offers real-time visibility into logistics operations. | |

| Supply Chain Execution- Optimizes all supply chain assets, controls costs at each step. | Demand Planning and Forecasting – Generates accurate demand forecasts, helping organizations optimize production planning, inventory levels, and procurement decisions. |

Pros of NetSuite vs Microsoft Dynamics 365 F&O

When evaluating ERP solutions, understanding the distinct advantages of NetSuite vs Microsoft Dynamics 365 F&O is crucial. In this section, we are particularly exploring the strengths of NetSuite vs Microsoft Dynamics 365 F&O across various dimensions. Thus, shedding light on their respective capabilities and functionalities.

| NetSuite | Microsoft Dynamics 365 F&O |

| Provides richer financial capabilities over operational, with leaner operational layers built with the product compared to Microsoft Dynamics 365 F&O. | Has a significant advantage in its extensive consulting base and a vibrant marketplace, a unique benefit unmatched by many ERP systems. |

| Ideal for SMBs operating in different countries. | Supports global operations and business models and pre-baked integration for the best-of-breed CRM and field service solutions. |

| The data model is B2C friendly, supporting integration with B2C channels. | Embedded WMS and TMS processes help companies that might require end-to-end traceability even after the good leaves the dock. |

| Ideal for eCommerce-centric SMBs because of the ecosystem and the integration operations available for eCommerce-centric companies. | Legacy product rearchitected for the cloud. So, while better than other legacy products that might be behind in the cloud. May not have as superior user experience as Acumatica. |

Cons of NetSuite vs Microsoft Dynamics 365 F&O

Just like recognizing strengths is important, it’s also crucial to weigh the specific drawbacks of NetSuite vs. Microsoft Dynamics 365 F&O. Therefore, in this section, we will delve into the limitations and challenges associated with NetSuite vs. Microsoft Dynamics 365 F&O across various operational and financial dimensions.

| NetSuite | Microsoft Dynamics 365 F&O |

| Not a great value for companies operating only in a few countries. | The smaller companies would find it overwhelming with the configuration and approval flows built with ERP for large enterprises. |

| May struggle with transactional workload requirements of companies over $1B and the ones that might be acquiring 10-20 entities every year. | Might not be able to match the performance expectations of larger organizations where processing millions of journal entries per hour is required. |

| Not ideal for startups with simpler operating models. | Overbloated financial control processes, such as compliance, allocation, and approval flows, which are only necessary for large organizations. |

| Named-user-based pricing requires allocating fixed costs, even for seasonal workers or external users accessing the subset of data such as customer or vendor portals. | Harnessing the Microsoft Dynamics 365 ecosystem may require assistance from an independent ERP consulting firm to navigate the channel, given the presence of unqualified ISVs and VARs. |

| Not fit for companies seeking OEM-owned integration with core operational systems such as CAD or PLM. | Integration with A&D-specific PLMs, configurators, and CPQ systems is not out-of-the-box, increasing the implementation time and costs. |

| The last-mile capabilities required for manufacturing or industrial distribution are extremely limited. | The last-mile capabilities for specific A&D verticals, such as integration with GovCon processes and databases, may require solutions from third parties or custom integration. |

Conclusion

In the comparison between NetSuite vs Microsoft Dynamics 365 F&O, it’s evident that each solution offers unique advantages and considerations depending on the specific needs of your organization. NetSuite stands out for its robust financial capabilities and suitability for globally spread small to mid-market companies, particularly in service-centric industries. On the other hand, Microsoft Dynamics 365 F&O excels in accommodating complex global business models and offers a mature ecosystem with modern technologies.

Ultimately, the choice between NetSuite and Microsoft Dynamics 365 F&O hinges on factors such as company size, industry, operational requirements, and budget considerations. By carefully evaluating these factors and also engaging with an independent ERP consultant organizations can make an informed decision that aligns with their goals and objectives for ERP implementation.