Last Updated on March 14, 2024 by Shrestha Dash

Operations managers are often responsible for all operational business processes from start to finish. From employees to suppliers, projects, jobs, and meetings, they strive to increase productivity, lower costs, and improve the quality of work. Their job is to empower their team of material planners, schedulers, estimators, warehouse workers, field service technicians, consultants, quality managers, maintenance staff, and laborers with relatable information.

The KPIs for operations managers would always differ based on their responsibilities, the size of the organization, and the industry. Operations management could be as diverse as managing tactical roles such as logistics to strategic roles such as procurement or marketing. Despite being so diverse, weak operations management can lead to weak sales and operations planning, which might, in turn, lead to operational disruptions and inferior customer experience. So, which KPIs for operations managers are the most relevant to ensure streamlined operations?

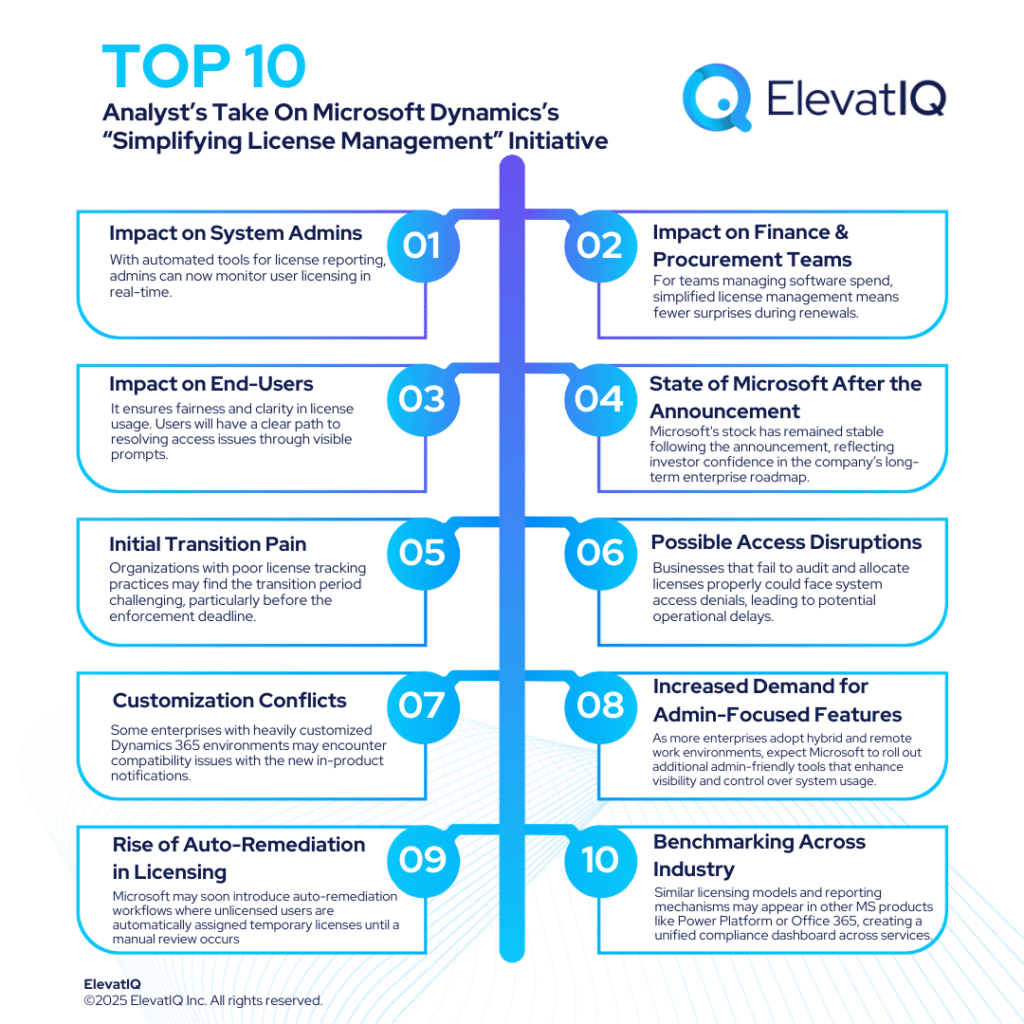

Operations managers are often tasked with harmonizing diverse functions spanning marketing, retail, human resources, sales, distribution, IT, finance, manufacturing, construction, and professional services. Here is the examination of the top 10 KPIs for operations managers based on each company department. This discusses ten departmental KPIs for operations managers: retail, marketing, human resources, sales, IT operations, distribution, finance, manufacturing, construction, and professional service operations KPIs, respectively. These KPIs serve as instruments, finely tuned to provide chaotic insights into the efficient, effective, and overall healthy operational facets.

Retail KPIs For Operations Managers

1. Gross Margins

Gross margins are critical components of retail KPIs for operations managers. It represents the percentage difference between the revenue generated from sales and the cost of goods sold (COGS). This means it measures the profitability of each product or service.

A high gross margin indicates that a significant portion of revenue is retained after covering the production or acquisition costs. Thus, signaling healthy financial performance. On the contrary, a low gross margin suggests that a substantial portion of revenue is consumed by the cost of goods sold, potentially impacting overall profitability.

Formula: Gross Margin Percentage=[(Total Revenue−Cost of Goods Sold)/Total Revenue]×100.

2. Average Order Value

Average order value provides insights into the average amount customers spend per transaction. AOV is calculated by dividing the total revenue generated by the number of orders. This metric is a valuable indicator of consumer purchasing behavior, reflecting the effectiveness of a company’s sales and marketing strategies.

A high AOV suggests that customers are making more valuable transactions, indicating a successful upselling or cross-selling approach. Conversely, a low AOV may signal the need for strategic adjustments to encourage customers to add more items to their carts. Operations managers keen on maximizing revenue and profitability should closely monitor AOV. They can utilize the insights gained to refine sales tactics, enhance customer experience, and optimize pricing strategies.

Formula: AOV= Total Revenue/Number of Orders

3. Customer Retention

Customer retention measures the ability of a business to retain its existing customers over a specific period. This metric is a testament to the loyalty and satisfaction of customers. It reflects the effectiveness of a company’s products, services, and overall customer experience.

A high customer retention rate indicates a strong and loyal customer base, highlighting successful customer relationship management strategies. Conversely, a low retention rate may signal dissatisfaction or a lack of engagement, prompting operations managers to investigate and implement strategies to improve customer satisfaction and loyalty. Armed with this metric, operations managers can proactively shape strategies to enhance customer engagement, foster brand loyalty, and drive sustained business growth.

Formula: Customer Retention Rate = (Number of Customers at End of Period - Number of New Customers Acquired During Period)/ Numbers of Customers at Start of Period

4. Conversion Rate

Conversion rate measures the percentage of website visitors or potential customers who take a desired action, such as making a purchase. It serves as a critical indicator of the effectiveness of a company’s sales and marketing strategies in turning potential customers into actual buyers.

A high conversion rate suggests that a significant portion of visitors is engaged and motivated to complete a transaction, reflecting the success of the company’s efforts in driving customer actions. Conversely, a low conversion rate may indicate inefficiencies or barriers in the customer journey, prompting operations managers to assess and refine the online shopping experience or marketing tactics.

Formula: Conversion Rate = (Number of Conversion/Number of Website Visitors or Potential Customers)×100

5. Foot Traffic and Digital Traffic

These two are essential retail KPIs for operations managers that provide insights into customer engagement across physical and online channels, respectively. Foot traffic refers to the number of visitors to a physical retail store, while digital traffic encompasses the online presence, measuring the number of visitors to a company’s digital platforms. These metrics indicate the level of interest and interaction customers have with the brand in different spaces.

High foot traffic signifies a bustling physical store, indicating popularity and potential sales opportunities. Similarly, high digital traffic suggests a robust online presence, which can translate into increased digital sales and brand visibility. On the flip side, low foot traffic or digital traffic may signal a need for improved marketing strategies, enhanced customer experiences, or adjustments to product offerings.

6. Inventory Turnover

Inventory turnover measures how efficiently a company manages its inventory by evaluating the number of times inventory is sold and replaced within a specific period. It is defined as the ratio of the cost of goods sold (COGS) to the average inventory during that period. This metric serves as a key indicator of inventory management effectiveness, providing insights into how quickly products are moving off the shelves.

A high inventory turnover ratio typically indicates efficient inventory management, swift sales, and minimized holding costs. Conversely, a low inventory turnover suggests slow-moving stock, potential overstocking issues, and increased holding costs. Operations managers can leverage this metric to fine-tune inventory strategies, optimize stock levels, and ensure a healthy balance between product availability and financial efficiency.

Formula: Inventory Turnover = Cost of Goods Sold (COGS)/Average Inventory

7. Returns and Exchanges

Returns and exchanges are integral components of retail KPIs for operations managers. It includes the volume of products customers bring back or exchange within a specified timeframe. This metric is a crucial measure of customer satisfaction, product quality, and overall operational efficiency.

A high rate of returns and exchanges may indicate potential issues such as dissatisfaction, product defects, or discrepancies between customer expectations and delivered goods. Operations managers must scrutinize the reasons behind high return rates to address underlying concerns, optimize product quality, and enhance customer experiences. Conversely, a low rate of returns and exchanges generally signifies customer contentment and operational effectiveness, indicating that products meet or exceed customer expectations.

Formula: Return and Exchange Rate = (Number of Returns and Exchanges/Total Number of Items Sold)×100

8. Stock Turnover Rate

Stock turnover rate is a metric that assesses how efficiently a company manages its inventory by measuring the number of times stock is sold and replaced within a specific period. This KPI is a key indicator of inventory management efficiency, providing insights into how quickly a company can sell and restock its products.

A high stock turnover rate generally indicates efficient inventory management, where products move briskly, reducing holding costs and potential obsolescence. Conversely, a low turnover rate may suggest overstocking or slow-moving inventory, leading to increased holding costs and the risk of product obsolescence. Operations managers can leverage this KPI to make informed decisions about inventory levels, ensuring a balance between meeting customer demand and optimizing operational costs.

Formula: Stock Turnover rate = Cost of Goods Sold (COGS)/Average Inventory Value

9. Sell-Through Rate

Sell-through rate quantifies the efficiency of a company in selling its inventory over a specific period. Essentially, it gauges how well a business is managing its stock levels and meeting consumer demand.

A high sell-through rate indicates that products are moving off the shelves swiftly, signifying strong consumer interest and effective inventory management. Conversely, a low sell-through rate may suggest that products are lingering in stock, potentially indicating overstocking, pricing issues, or a lack of demand. Operations managers, by closely monitoring sell-through rate, gain valuable insights into inventory performance, enabling them to make data-driven decisions on pricing strategies, product assortment, and overall inventory management for optimal business outcomes.

Formula: Sell-Through Rate = (Number of Units Sold/Beginning Inventory) ×100

10. Sales Year-Over-Year

Sales year-over-year (YoY) is one of the crucial retail KPIs for operation managers that assesses the percentage change in a company’s sales performance for a specific period compared to the same period in the previous year. It provides a longitudinal perspective on sales trends, allowing operations managers to gauge the overall growth or decline in revenue.

A positive YoY indicates sales growth, showcasing the effectiveness of business strategies and market demand. Conversely, a negative YoY suggests a decline in sales, prompting operations managers to investigate the root causes, adapt strategies, and make informed decisions to reverse the trend.

Formula: Sales Year-Over-Year = [(Current Year Sales - Previous Year Sales)/Previous Year Sales] ×100

Marketing KPIs For Operations Managers

11. Cost Per Click

Cost per click measures the average cost incurred by advertisers each time a user clicks on their online ad. CPC serves as a key metric for evaluating the efficiency and cost-effectiveness of online advertising campaigns.

A high CPC may indicate that the cost of acquiring each click is relatively expensive, possibly requiring a reassessment of the advertising strategy or targeting parameters. Conversely, a low CPC suggests that the advertising campaign is cost-efficient, allowing the company to reach a broader audience for a lower investment. Operations managers can leverage this metric to optimize advertising budgets, refine targeting strategies, and ensure that marketing initiatives generate valuable user engagement at an optimal cost.

Formula: CPC = Total Advertising Cost/Number of Clicks

12. Cost Per Acquisition

Cost per acquisition is one of the fundamental marketing KPIs for operations managers, serving as a metric to evaluate the average expense incurred in acquiring a new customer. CPA is a vital indicator of the efficiency and cost-effectiveness of a company’s marketing campaigns and strategies.

A high CPA suggests that acquiring new customers is relatively expensive, possibly indicating inefficiencies in the marketing approach or the need for optimization. Conversely, a low CPA reflects a more cost-effective strategy for attracting new customers. Monitoring CPA allows operations managers to assess marketing efforts’ return on investment (ROI), guiding strategic decisions and resource allocations to optimize customer acquisition processes effectively.

Formula: CPA = Total Cost of Acquisition/Number of New Customers Acquired

13. Return on Advertising Spend

Return on advertising spend is one of the critical marketing KPIs for operations managers, serving as a quantitative measure of the revenue generated for every dollar spent on advertising. It is a powerful indicator of the effectiveness and efficiency of a company’s advertising campaigns.

A high ROAS implies that the revenue generated significantly exceeds the advertising costs, suggesting a profitable and successful campaign. On the other hand, a low ROAS may indicate that the return on investment from advertising is not meeting expectations, prompting operations managers to reevaluate and refine their marketing strategies. Operations managers can utilize ROAS to optimize marketing budget allocation, identify successful channels, and make data-driven decisions to maximize the impact of advertising efforts on overall business profitability.

Formula: ROAS = Revenue Generated From Advertising/ Cost of Advertising

14. Time to Payback

Time to payback in marketing operations refers to the duration it takes for a company to recover the costs associated with acquiring a new customer. It is essentially a measure of the efficiency of marketing campaigns in terms of cost recovery.

A low time to payback is favorable, signifying a swift recovery of customer acquisition costs and a quicker return on investment. Conversely, a high time to payback suggests a longer period for cost recovery, which may raise concerns about the effectiveness and sustainability of marketing initiatives. Operations managers can use this metric to assess the efficiency of marketing efforts, optimize campaign strategies, and ensure a more rapid and cost-effective return on investment.

Formula: Time to Payback = Customer Acquisition Costs/ Average Monthly Gross Margin per Customer

15. Marketing-Originated Customer Percentage

Marketing-originated customer percentage is a key performance indicator in marketing operations, providing insights into the percentage of customers that can be attributed to marketing efforts within a specific period. It serves as a valuable measure of the effectiveness of marketing campaigns in driving customer acquisition.

A high marketing-originated customer percentage indicates that a significant proportion of new customers were influenced by marketing strategies, showcasing the success of marketing campaigns in attracting and converting leads. On the other hand, a low percentage suggests a need for adjustments in marketing strategies to enhance their impact on customer acquisition. Operations managers can leverage this KPI to gauge the return on marketing investments, refine campaign strategies, and optimize resource allocation to bolster customer acquisition through effective marketing initiatives.

Formula: Marketing-Originated Customer Percentage = (Number of Customers Acquired Through Marketing/Total Number of New Customers) ×100

Human Resource KPIs For Operations Managers

16. Absenteeism rate

The absenteeism rate is a metric that quantifies the frequency and extent of employee absences. It is defined as the percentage of scheduled work hours that employees are absent due to various reasons, such as illness, personal issues, or other unforeseen circumstances. The absenteeism rate provides valuable insights into workforce attendance patterns and employee engagement.

A high absenteeism rate may indicate potential issues within the workplace, such as low morale, dissatisfaction, or health concerns, which can negatively impact overall productivity. Conversely, a low absenteeism rate is generally associated with a motivated and engaged workforce. Operations managers can utilize this KPI to identify trends, address underlying concerns, and implement strategies to promote a healthier and more productive work environment.

Formula: Absenteeism Rate = (Total Scheduled Hours of Absence/Total Scheduled Work Hours) ×100

17. Overtime Hours

Overtime hours refer to the additional hours employees work beyond their regular scheduled work hours. This metric is crucial in understanding human resource utilization and indicates the workload demands on a workforce.

When overtime hours are high, it may signify increased workloads, tight deadlines, or understaffing, potentially leading to concerns about employee burnout, decreased morale, and increased labor costs. On the other hand, low overtime hours suggest efficient workforce management or a period of reduced demand. Operations managers utilize this metric to strike a balance between meeting operational demands and ensuring the well-being and productivity of the workforce.

Formula: Overtime Hours = Total Hours Worked - Scheduled Work Hours

18. Employee Turnover Rate

Employee turnover rate quantifies the percentage of employees who leave a company within a specific timeframe. This metric serves as a key indicator of workforce stability and organizational health.

A high turnover rate may suggest issues such as dissatisfaction, lack of engagement, or inadequate workplace conditions, potentially impacting overall productivity and morale. On the other hand, a low turnover rate typically signifies a stable and content workforce, reflecting positive workplace culture and effective talent management. Operations managers, armed with insights from this metric, can implement targeted strategies to reduce turnover, enhance employee satisfaction, and foster a more resilient and engaged workforce.

Formula: Employee Turnover Rate = (Number of Employees Departed/Average Number of Employees) ×100

19. Employee Efficiency Metrics

Employee efficiency serves as an invaluable KPI for operations managers, providing a comprehensive understanding of workforce productivity. These metrics include:

- Average time to complete a task

- Percent of tasks completed within goal time

- Error rate

- Revenue per employee

- Volume of simultaneous task

- Resolution rate

Sales KPIs For Operations Managers

20. Deals Closed YTD

Deals closed year-to-date provides a quantifiable measure of the total number of business deals successfully finalized within a given period, typically from the beginning of the year until the present moment. This metric clearly indicates a sales team’s effectiveness in converting leads into actual revenue-generating transactions.

A high number of deals closed YTD signals a robust and proactive sales effort, showcasing the team’s ability to navigate the sales pipeline and capitalize on opportunities. Conversely, a low number may suggest potential challenges or inefficiencies in the sales process, prompting operations managers to assess and refine sales strategies. Operations managers leverage this KPI to gauge the overall health of the sales function, set realistic targets, and implement targeted improvements to optimize deal conversion rates and, ultimately, drive revenue growth.

21. Customer Churn Rate

Customer churn rate is a critical sales operations KPI that quantifies the percentage of customers who discontinue their relationship with a business within a given period. This metric serves as a key indicator of customer attrition and the overall health of a customer base.

A high churn rate typically suggests issues with customer satisfaction, service quality, or competitive pressures, signaling potential revenue loss. Conversely, a low churn rate indicates a stable and satisfied customer base, reflecting successful customer retention strategies. Operations managers can utilize the churn rate to identify patterns, understand the reasons behind customer departures, and implement targeted measures to enhance customer satisfaction and loyalty.

Formula: Customer Churn Rate = Number of Customers Lost During a Period/Number of Customers at the Start of the Period) ×100

22. Lead-to-Opportunity Ratio

The lead-to-opportunity ratio is a key performance indicator in sales operations to assess the efficiency of converting leads into qualified opportunities. A high lead-to-opportunity ratio suggests a successful lead generation and qualification process, indicating that a substantial percentage of leads are translating into potential revenue-generating opportunities.

Conversely, a low ratio may imply inefficiencies in lead nurturing or qualification, signaling the need for improvements in the sales process to enhance conversion rates. Operations managers in sales can leverage this KPI to refine lead management strategies, optimize marketing efforts, and ensure a streamlined conversion pipeline, ultimately contributing to increased revenue and business success.

Formula: Lear-to-Opportunity Ratio = (Number of Opportunities Created/Number of Leads Generated) ×100

23. Lead Conversion Rate

Lead conversion rate is a metric that quantifies the percentage of leads that successfully transition into paying customers. This metric serves as a key performance indicator, shedding light on the effectiveness of a company’s sales funnel and the success of its lead generation and nurturing efforts.

A high lead conversion rate suggests a streamlined and effective sales process, indicating that a significant proportion of leads are progressing through the sales funnel to become valuable customers. On the contrary, a low lead conversion rate may signify inefficiencies or gaps in the sales strategy, prompting operations managers to reassess and optimize their lead management practices. Operations managers can leverage this metric to refine sales strategies, identify areas for improvement, and enhance overall sales performance, ultimately contributing to the company’s bottom line.

Formula: Lead Conversion Rate = (Number of Converted Leads/Total Number of Leads) ×100

IT KPIs For Operations Managers

24. Total Tickets vs Open Tickets

The number of total tickets vs open tickets provides insights into the efficiency of an IT support system. Total tickets represent the overall number of requests or issues raised by users, while open tickets are the subset that remains unresolved or in-progress. In essence, this KPI measures the ratio of resolved or closed tickets to the total number of tickets, offering a snapshot of the IT team’s responsiveness and effectiveness.

A high ratio indicates a swift resolution of issues, suggesting a proficient and agile IT support system. Conversely, a low ratio may signify a backlog of unresolved issues, potential inefficiencies, or challenges in meeting user demands promptly. Operations managers can utilize this KPI to gauge the health of their IT support services, make informed decisions on resource allocation, and ensure that user concerns are addressed in a timely manner, ultimately contributing to enhanced operational efficiency and user satisfaction.

25. Ticket Response Time

The duration it takes for a support team to respond to user-reported issues or service requests is called ticket response time. It serves as a key indicator of the efficiency and effectiveness of an IT support system.

A low response time is generally desirable, as it signifies a prompt acknowledgment of user concerns and a swift initiation of troubleshooting or problem resolution. Conversely, a high response time may indicate delays in addressing user issues, potentially leading to increased user frustration and a negative impact on overall service quality. Operations managers can leverage insights from this KPI to optimize IT support workflows, allocate resources efficiently, and enhance the overall user experience with IT services.

Formula: Ticket Response Time = [(Time of First Response - Time of Ticket Creation)/Number of Tickets]

26. Resolution Rate

Resolution rate is a critical IT operations KPI for operations managers that quantifies the effectiveness of resolving issues or incidents within a specified timeframe. This metric serves as a key performance indicator for IT support teams, measuring their efficiency in addressing and resolving technical challenges.

A high resolution rate signifies a swift and effective response to issues, indicating operational excellence and customer satisfaction. On the other hand, a low resolution rate may suggest inefficiencies in the IT support process. This can potentially lead to prolonged system downtimes and dissatisfied end-users. Operations managers can utilize this metric to gauge the performance of their IT support teams and identify areas for improvement. They can also ensure the smooth functioning of IT operations in alignment with organizational goals.

Formula: Resolution Rate = (Number of Incidents Resolved/Total Number of Incidents Reported) ×100

27. Mean Time to Recover

Mean time to recover quantifies the average time taken to restore a system/service to normal functioning after an incident or outage. It serves as a key performance indicator for operations managers in the IT industry. It also offers valuable insights into the efficiency of incident resolution processes.

A low MTTR indicates a swift and effective response to incidents, minimizing downtime and disruptions to IT services. Conversely, a high MTTR suggests a prolonged recovery process, potentially leading to increased downtime and adverse impacts on productivity. Operations managers use MTTR to assess the effectiveness of incident management, refine response strategies, and ensure timely service restoration. Ultimately, contributing to the resilience and reliability of IT systems within an organization.

Formula: MTTR = Total downtime/Number of Incidents

28. Technology Downtime

Technology downtime is when a system, network, or technology infrastructure is unavailable or not functioning as intended. It is the time when IT services or systems are offline, disrupting normal business operations. This metric is a key indicator of the reliability and resilience of an organization’s technological infrastructure.

A high technology downtime indicates a greater frequency or duration of disruptions. It can potentially lead to decreased productivity, customer dissatisfaction, and financial losses. Conversely, a low technology downtime suggests a more stable and robust IT environment, ensuring seamless business operations. Operations managers can utilize this KPI to pinpoint areas for improvement in IT systems and implement preventive measures. It can also ensure the uninterrupted flow of technology-dependent processes, safeguarding the overall efficiency and reliability of the organization.

Formula: Technology Downtime Percentage = (Total Downtime/Total Time) ×100

Distribution KPIs For Operations Managers

29. Supplier and Carrier Costs

Supplier and carrier costs quantify the expenses associated with sourcing materials from suppliers and transporting them through various carriers. It reflects the financial efficiency of the supply chain.

A high value may indicate increased costs, possibly due to inefficiencies in the supply chain, and calls for a reassessment of vendor relationships and transportation strategies. Conversely, a low value suggests cost-effectiveness in procurement and transportation, contributing to improved overall financial performance. Operations managers can utilize this KPI to negotiate better terms with suppliers and carriers, optimize logistics, and ultimately reduce overall distribution expenses.

Formula: Supplier and Carrier Costs = Total Procurement Costs + Total Transportation Costs

30. Supplier and Carrier Performance

Supplier and carrier performance gauges the effectiveness of both suppliers and carriers in meeting delivery and quality expectations. This KPI is a critical measure of reliability and consistency in the supply chain.

A high score indicates a dependable network, ensuring timely and quality deliveries. On the contrary, a low score may signal disruptions or inconsistencies, prompting operations managers to reassess and potentially diversify their supplier and carrier base. Operations managers can utilize this KPI to identify underperforming partners, negotiate improvements, and ensure a smooth and reliable flow of goods.

31. Inventory Turns and Carrying Costs

Inventory turns and carrying costs represent the number of times inventory is sold or used in a given period and the associated costs of holding that inventory. A high inventory turns value implies efficient inventory management, with goods swiftly transitioning from shelves to customers.

On the flip side, a low value may indicate overstocking, leading to increased carrying costs. Operations managers can utilize these KPIs to refine inventory strategies, minimize holding costs, and enhance overall supply chain efficiency.

Formula: Inventory Turns = Cost of Goods Sold/Average Inventory Value

32. Order Fill and Back Order Rates

Order fill rate measures the percentage of customer orders that are fulfilled completely on the first attempt, while the back order rate tracks the orders that cannot be filled immediately and are delayed.

High order fill rates signify efficiency and customer satisfaction, while high back order rates may indicate inventory shortages or inefficient order processing systems. Operations managers can utilize these KPIs to optimize inventory levels, improve order processing, and enhance customer service.

Formula: Order Fill Rate = Number of Order Filled/ Total Number of Orders

33. Picking and Packing Accuracy

Picking and packing accuracy assesses the precision in selecting and preparing items for shipment. A high accuracy rate suggests a well-organized warehouse and order fulfillment system, reducing the likelihood of errors and customer dissatisfaction.

Conversely, a low accuracy rate may lead to order discrepancies and additional costs for corrections. Operations managers can utilize this KPI to identify areas for improvement in warehouse processes, implement training programs, and enhance overall order accuracy.

34. Order Lead Time

Order lead time measures the time it takes from order placement to delivery, encompassing various stages. Short lead times indicate operational efficiency and customer responsiveness, while extended lead times may result in customer dissatisfaction and increased operational costs. Operations managers can utilize this KPIs to streamline processes, optimize workflows, and improve overall supply chain agility.

35. Receiving and Put-Away Cycle Times

Receiving and put-away cycle times evaluate the efficiency of receiving and storing goods upon arrival. Short cycle times indicate streamlined processes, reducing delays in inventory availability.

Prolonged cycle times, on the other hand, may result in operational bottlenecks and increased storage costs. Operations managers can utilize these KPIs to streamline receiving and storage processes, reducing bottlenecks and improving overall warehouse efficiency.

36. Transportation Costs

Transportation costs quantify the expenses associated with moving goods from suppliers to the distribution center and, eventually, to customers. High transportation costs may suggest inefficiencies or suboptimal route planning, impacting overall supply chain profitability. Operations managers can utilize this KPI to optimize transportation routes, negotiate favorable agreements with carriers, and reduce overall distribution expenses.

Formula: Transportation Costs = Cost per Mile x Total Miles Travelled

37. Transportation Delivery(SLA)

Transportation delivery (Service Level Agreement) measures the adherence to agreed-upon delivery timelines. High SLA compliance ensures reliability and customer satisfaction, while low compliance rates may lead to service disruptions and potential damage to customer relationships. Operations managers can utilize this KPI to monitor carrier performance, negotiate improved delivery terms, and ensure the timely arrival of goods.

38. Quote to Cash Cycle Time

Quote to cash cycle time calculates the duration from the initial customer quote to receiving payment. A shorter cycle time indicates a streamlined order-to-payment process, contributing to improved cash flow. Conversely, a prolonged cycle time may result in delayed revenue recognition and increased working capital requirements. Operations managers can utilize this KPI to streamline sales and billing processes, reducing cycle times and improving overall financial performance.

Finance KPIs For Operations Managers

39. Account Receivables Turnover

Accounts receivables turnover is a finance operations KPI that gauges the efficiency of a company in collecting payments from customers. A high turnover indicates a swift conversion of receivables into cash, reflecting strong cash flow and effective credit management.

Conversely, a low turnover may suggest potential issues in credit policies or difficulties in collecting payments. Operations managers can utilize this KPI to assess the effectiveness of credit and collection procedures, optimizing cash flow and maintaining financial stability.

Formula: Account Receivable Turnover = Net Credit Sales/ Average Accounts Receivable

40. Days Sales Outstanding

Days sales outstanding is a metric that quantifies the average number of days it takes for a company to collect payments after a sale has been made. It serves as a critical finance operations KPI, representing the efficiency of a company’s credit and collection processes.

A lower DSO indicates faster cash conversion and efficient credit management, while a higher DSO may signify potential challenges in the accounts receivable process. Operations managers can utilize DSO to optimize cash flow, identify potential collection issues, and streamline credit policies.

Formula: Days Sales Outstanding = (Accounts Receivable/ Net Credit Sales) × Number of Days in Period

41. Operating Cash Flow

Operating cash flow is a finance operations KPI that measures the cash generated or used by a company’s core operating activities. It provides insights into a company’s ability to generate cash from its regular business operations. A positive operating cash flow indicates financial health, liquidity, and the capacity to cover operating expenses.

Conversely, a negative operating cash flow may signify liquidity challenges. Operations managers can utilize this KPI to ensure there is sufficient cash to fund ongoing operations, invest in growth opportunities, and meet financial obligations.

Formula: Operating Cash Flow=Net Income+Non-Cash Expenses+Changes in Working Capital

42. Quick Ratio

The quick ratio also known as the acid-test Ratio, is a finance operations KPI that measures a company’s ability to meet its short-term obligations using its most liquid assets. It is a more stringent measure than the current ratio as it excludes inventory from current assets.

A high quick ratio suggests strong liquidity and an ability to cover short-term liabilities promptly. Conversely, a low quick ratio may indicate potential difficulties in meeting short-term obligations. Operations managers can utilize this KPI to assess short-term liquidity and make informed decisions about managing current liabilities.

Formula: Quick Ratio = (Cash + Marketable Securities + Receivables)/ Current Liabilities

43. Accounts Payable Turnover

Accounts payable turnover assesses how efficiently a company manages its accounts payable by measuring the number of times a company pays its average accounts payable during a specific period.

A high turnover suggests effective management of payables and efficient cash flow, while a low turnover may indicate potential liquidity challenges or delayed payments. Operations managers can utilize this KPI to optimize payment processes, negotiate favorable credit terms, and enhance overall financial efficiency.

Formula: Accounts Payable Turnover = Net Credit Purchases/ Average Accounts Payable

44. Cash Conversion Cycle

The cash conversion cycle measures the time it takes for a company to convert its investments in inventory and other resources into cash flow from sales. It reflects the efficiency of a company’s working capital management.

A shorter cash conversion cycle is generally favorable, indicating swift cash generation. Conversely, a longer cycle may suggest inefficiencies in working capital utilization. Operations managers can utilize this KPI to optimize inventory levels, improve credit and collection processes, and enhance overall cash flow efficiency.

Formula: Cash Conversion Cycle=Days Sales Outstanding (DSO)+Days Inventory Outstanding (DIO)−Days Payable Outstanding (DPO).

45. Operating Profit Margin

Operating profit margin is a finance operations KPI that measures the profitability of a company’s core operating activities. It is expressed as a percentage and indicates the proportion of revenue that remains as operating profit after deducting operating expenses.

A high operating profit margin suggests operational efficiency and effective cost management, while a low margin may indicate potential challenges in controlling expenses. Operations managers can utilize this KPI to assess the efficiency of core operations, identify cost-saving opportunities, and enhance overall financial performance.

Formula: Operating Profit Margin = (Operating Profit/Net Sales) ×100

46. Net Profit Margin

Net profit margin measures the overall profitability of a company by expressing net profit as a percentage of total revenue. It provides insights into a company’s ability to generate profit after all expenses, including taxes and interest.

A high net profit margin indicates strong financial performance, while a low margin may suggest challenges in controlling overall expenses. Operations managers can utilize this KPI to evaluate the overall financial health of the company, identify areas for cost optimization, and make strategic decisions to enhance profitability.

Formula: Net Profit Margin = (Net Profit/Net Sales) ×100

Manufacturing KPIs For Operations Managers

47. Product Development Costs and Time-to-Market

Product development costs and time-to-market in manufacturing operations KPIs refer to the expenditures incurred and the time taken to bring a new product from conceptualization to market availability. This KPI indicates the efficiency of the product development process, reflecting a company’s innovation speed and cost-effectiveness.

A high value may suggest prolonged development cycles and increased costs, potentially impacting competitiveness. Conversely, a low value signifies swift development and cost control, enhancing market responsiveness. Operations managers can utilize this KPI to streamline innovation processes, optimize resource allocation, and align product releases with market demands.

48. Job Cost and WIP Reporting

Job cost and work-in-progress (WIP) reporting represent the total cost incurred for completing a specific manufacturing job and the ongoing value of work in progress. This KPI indicates the financial efficiency and progress of manufacturing processes, with a high value signaling potential cost overruns or delays.

A low value implies effective cost control and timely job completion. Operations managers can leverage this KPI to manage production costs, improve resource utilization, and optimize workflow.

49. Scrap and Yield Quantities and Costs

Scrap and yield quantities and costs measure the volume of defective or wasted products in comparison to the total produced, along with associated costs. This KPI reflects the efficiency of production processes and product quality.

A high value indicates a high level of waste, which can result in increased costs and reduced profitability. Conversely, a low value signifies efficient production with minimal waste. Operations managers can utilize this KPI to identify areas for quality improvement, optimize production processes, and reduce costs.

50. Manufacturing Labor Efficiency

Manufacturing labor efficiency is a KPI that gauges the productivity of labor in the manufacturing process. This KPI indicates how effectively labor resources are utilized in manufacturing. A high value suggests efficient use of labor, minimizing costs per unit.

Conversely, a low value may indicate inefficiencies, leading to increased labor costs. Operations managers can leverage this KPI to optimize workforce management, identify training needs, and enhance overall production efficiency.

Formula: Manufacturing Labor Efficiency = (Actual Production Output/Standard Production Output) x 100

51. Machine and Resource Throughput

Machine and resource throughput in manufacturing operations KPIs measure the rate at which machines or resources complete tasks within a given time period. This KPI reflects the operational efficiency of machinery and resources.

A high value indicates optimal throughput and resource utilization, contributing to increased productivity. On the contrary, a low value may signal bottlenecks or underutilized resources. Operations managers can use this KPI to identify areas for improvement, allocate resources effectively, and enhance overall production capacity.

52. Production Schedule Attainment

Production schedule attainment is a KPI that assesses the extent to which actual production matches the planned production schedule. This KPI provides insights into operational reliability and adherence to timelines.

A high value suggests a consistent and reliable production schedule, contributing to customer satisfaction. Conversely, a low value may indicate challenges in meeting production targets, potentially affecting customer relationships and order fulfillment. Operations managers can utilize this KPI to optimize production planning, improve resource allocation, and enhance on-time delivery performance.

Formula: Production Schedule Attainment = (Actual Production Output/Planned Production Output) x 100

53. Resource Capacity Utilization

Resource capacity utilization measures the extent to which available resources are utilized in production. This KPI indicates the efficiency of resource allocation and utilization.

A high value suggests optimal utilization, contributing to cost-effectiveness. On the other hand, a low value may indicate underutilized resources, leading to increased per-unit costs. Operations managers can use this KPI to optimize resource allocation, identify areas for improvement, and enhance overall operational efficiency.

Formula: Resource Capacity Utilization = (Actual production Output/Maximum Possible Production Output) x 100

54. Changeover Time

Changeover time is a critical manufacturing operations KPI that measures the time taken to transition from producing one product to another. This KPI indicates the efficiency of changeover processes and the ability to adapt to different production requirements swiftly.

A high value suggests prolonged changeover times, potentially causing production delays and impacting overall efficiency. Conversely, a low value signifies quick and efficient changeovers, enhancing production flexibility. Operations managers can utilize this KPI to optimize production schedules, reduce downtime, and enhance overall operational agility.

55. Overall Equipment Efficiency (OEE)

Overall equipment efficiency is a comprehensive manufacturing operations KPI that assesses the performance, availability, and quality of equipment in the production process. OEE provides a holistic view of equipment effectiveness, with a high value indicating optimal equipment performance.

Conversely, a low value suggests potential areas for improvement, such as increased downtime or reduced production speed. Operations managers can use OEE to identify and address equipment-related inefficiencies, improve maintenance strategies, and enhance overall production effectiveness.

56. Sub-Contractor Performance

Sub-contractor performance is a KPI that evaluates the effectiveness and reliability of subcontractors engaged in the manufacturing process. This KPI indicates the impact of external contributors on overall operational success. A high value signifies dependable subcontractors contributing positively to production.

In contrast, a low value may indicate challenges such as delays or quality issues introduced by subcontractors. Operations managers can utilize this KPI to make informed decisions about subcontractor relationships, optimize supply chain partnerships, and ensure consistent production quality.

57. Capable-to-Promise (CTP)%

Capable-to-promise is a manufacturing operations KPI that evaluates a company’s ability to commit to fulfilling customer orders based on current production capabilities. This KPI indicates how effectively a company can meet customer expectations regarding order fulfillment.

A high CTP% value suggests a robust production system capable of accommodating customer demands. Conversely, a low value may indicate challenges in meeting order commitments, potentially affecting customer satisfaction. Operations managers can leverage this KPI to enhance production planning, optimize inventory levels, and improve customer order fulfillment.

Formula: CTP% = (Available-to-Promise/Total Demand) x 100

Construction KPIs For Operations Managers

58. Safety/Incident Rate

Safety/Incident rate is a crucial construction operations KPI that measures the frequency of safety incidents or accidents on a construction site. This metric is defined as the number of incidents (injuries, accidents, or near misses) per a specific unit of measurement. It is often expressed per 100,000 work hours.

A low safety/incident rate is indicative of a safe work environment, emphasizing the success of safety protocols and measures. Conversely, a high rate may signal potential hazards, prompting operations managers to reassess safety procedures. Operations managers can utilize this KPI to prioritize and enhance safety measures. Also, ensuring the well-being of the workforce and compliance with safety regulations.

59. Request for Information Win Rates

Request for information(RFI) win rates assesses the success of winning contracts or projects after responding to requests for information. A high win rate indicates effective bidding strategies and a competitive edge in the market. While a low rate may signify areas that require improvement. Operations managers can utilize this KPI to refine bidding approaches, better understand market dynamics, and optimize resource allocation.

Formula: Request for Information(RFI) Win Rates = (Number of Projects Won/Total Number of RFIs Submitted) x 100

60. Job Cost, Revenue, and Profitability

Job cost, revenue, and profitability are vital construction operations KPIs that gauge the financial performance of construction projects. The total expenses incurred during a project are job costs, the income generated is the revenue, and profitability is the net profit derived from subtracting costs from revenue.

High job costs relative to revenue can indicate financial inefficiency, while low profitability may signal unsuccessful project management. Operations managers can utilize these metrics to assess project financial health, and identify areas for cost optimization.

61. Quality Defects, Rework Costs and Time, Number of Inspections

Quality defects, rework costs and time, and number of inspections are interconnected construction operations KPIs. They measure the quality and efficiency of construction projects. On one hand quality defects represent deviations from project specifications. While rework costs and time quantify the resources spent on correcting defects. The number of inspections measures how frequently quality checks are conducted.

Low quality defects, rework costs, and inspection frequency indicate efficient project execution. While high values may suggest the need for improved quality control. Operations managers can utilize these KPIs to streamline project processes, enhance quality control, and minimize unnecessary expenditures.

62. Employee Retention

Employee retention measures the percentage of employees who remain with the construction company over a specific period. High employee retention signifies a positive work environment, skilled workforce, and effective management.

Conversely, low retention rates may signal issues with workplace satisfaction or leadership. Operations managers can utilize this KPI to implement strategies for talent retention. They can also foster a positive workplace culture, and address any underlying concerns.

Formula: Employee Retention Rate = (Number of Employee Retained/Total Number of Employees at Start of Period) x 100

63. Labor Efficiency/Utilization

Labor efficiency assesses how effectively labor resources are utilized on a construction project. High labor efficiency indicates optimal resource utilization, while low efficiency may suggest underutilization or inefficiencies in project planning. Operations managers can utilize this KPI to optimize workforce allocation, improve project scheduling, and enhance overall labor productivity.

Formula: Labor Efficiency = (Actual Labor Hours Worked/Available Labor Hours) x 100

64. Subcontractor Inventory

Subcontractor inventory is a construction operations KPI that evaluates the availability and efficiency of subcontractors for construction projects. It is defined as the number of qualified subcontractors available for hire at any given time.

High subcontractor inventory indicates a robust network of qualified subcontractors, facilitating flexibility in project staffing. On the other hand, a low inventory may lead to delays and increased costs. Operations managers can utilize this KPI to ensure a reliable pool of subcontractors, manage project timelines effectively, and mitigate risks associated with subcontractor availability.

Professional Service KPIs For Operations Managers

65. Average and Realized Bill Rates

Average bill rate represents the average price charged for professional services, while realized bill rate is the actual revenue generated per billable hour. These metrics provide insights into the pricing structure’s effectiveness and how well it aligns with the market. High rates indicate value perception, but if too high, it may lead to client dissatisfaction. Low rates may attract clients, but it could impact profitability.

66. Employee Utilization/Billable Rate

Employee utilization/billable rate gauges the percentage of an employee’s time spent on billable client work. High utilization rates signify efficient resource allocation, but excessive rates may lead to burnout. Low rates suggest underutilization, potentially impacting revenue. Operations managers can optimize team productivity by balancing utilization rates.

67. Billable Revenue Per Resource

Billable revenue per resource measures the average revenue generated per service professional. A high figure indicates efficient resource utilization, while low figures may signify inefficiencies. Operations managers can use this metric to assess team productivity and adjust staffing levels to meet demand.

68. Project Estimate Accuracy

Project estimate accuracy reflects how closely initial project estimates align with the actual effort and cost. High accuracy signifies effective project planning, leading to client satisfaction and profitability. Low accuracy may result in cost overruns and strained client relationships.

69. Project/Service Revenue, Profitability, Deal Size, and Bid-to-Win Ratios

These encompass a suite of metrics evaluating project or service success. Revenue and profitability showcase financial performance, deal size indicates project scale, and bid-to-win ratios highlight the effectiveness of securing new projects. High values across these metrics indicate successful project management and business development.

70. SaaS Contract Metrics (ARR, ACV, and Churn)

Annual recurring revenue (ARR), Annual contract value (ACV), and churn rate are very important metrics for SaaS contracts. ARR and ACV showcase subscription revenue, while Churn measures customer retention. High ARR and ACV are favorable, while low Churn indicates satisfied customers. Operations managers can use these metrics to refine subscription pricing, improve service, and ensure long-term customer relationships.

Formula:

ARR = Monthly Recurring Revenue (MRR) x 12

ACV = Average Monthly Contract Value (MCV) x 12

Churn Rate = (Number of Customers Lost/Total Customers at Start of Period) x 100

Conclusion

In conclusion, operations managers are pivotal in steering the ship of diverse business functions, ensuring smooth sailing across marketing, retail, human resources, sales, IT, manufacturing, distribution, construction, professional services, and beyond. As we delve into the lists of KPIs for operations managers, it becomes evident that these metrics are the compass guiding them through the intricate waters of day-to-day work.

From the intricate details of retail operations, such as gross margins and inventory turnover, to the intricacies of human resources, including absenteeism rate and employee turnover, and extending to the critical domains of sales, IT operations, manufacturing, finance, construction and distribution, each KPI paints a distinct picture of efficiency, effectiveness, and overall operational health. These KPIs for operations managers act as instruments, finely tuned to provide insights into the complex landscape of operational facets.