Machinery Manufacturing Companies. Designing, producing, and assembling equipment used in various industries, such as agriculture, construction, and aerospace, are uniquely different when it comes to their needs. They differ as they create complex machines, requiring long standing processes for engineering departments and an army of engineers collaborating with customers. Their business model could be as diverse as containing the elements of product development, manufacturing, and after-sales services. Many may also offer maintenance, repair, and overhaul (MRO) services, providing ongoing support, requiring distinct ERP capabilities compared to other manufacturing industries.

Machinery Manufacturing Business Processes. Involving long-standing processes for machinery division, the processes begin with heavy engineering and creating detailed specifications. Critical components might need to start the sourcing process even before the contract gets signed, followed by the manufacturing phase, with changes happening even at the last minute. Quality control might require materials from customers and vendors, requiring inventory exchanges. The process may also include customization for specific client needs and after-sales services such as installation, maintenance, and repairs.

Machinery Manufacturing ERP needs. Effective ERP solutions for machinery manufacturing require advanced capabilities such as kanban, mixed-mode manufacturing such as engineer-to-order, make-to-order, and make-to-stock. They also need capabilities such as planning for long lead times and detailed layers of sub-assemblies including phantom. Swapping out make components with buy in bulk or allocating from inventory first before making one, their BOMs require one of the most complex capabilities. The scheduling could be equally complex with resources shared among the production and service divisions. Milestone and cost tracking could be other areas that are likely to be substantially complex, making ERP selection substantially challenging for machinery manufacturing.

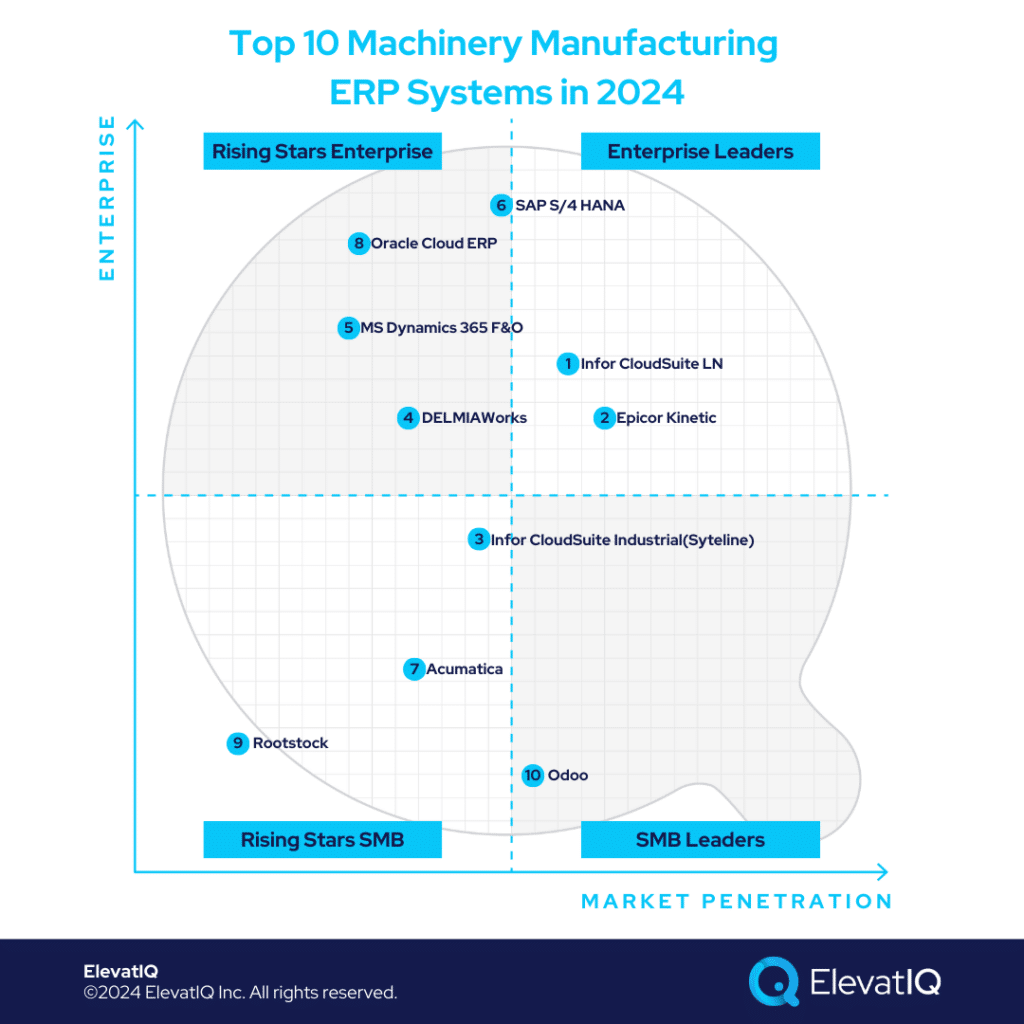

Criteria

- Definition of a machinery manufacturing company. Most machinery business models of all sizes including mechanical machines, industrial automation equipments across industries.

- Overall market share/# of customers. The higher market share among machinery manufacturing companies drives higher rankings on this list.

- Ownership/funding. The superior financial position of the ERP vendor leads to higher rankings on this list.

- Quality of development. How modern is the tech stack? How aggressively is the ERP vendor pushing cloud-native functionality for this product? Is the roadmap officially announced? Or uncertain?

- Community/Ecosystem. How vibrant is the community? Social media groups? In-person user groups? Forums?

- Depth of native functionality. Last-mile functionality for specific industries natively built into the product?

- Quality of publicly available product documentation. How well-documented is the product? Is the documentation available publicly? How updated is the demo content available on YouTube?

- Product share and documented commitment. Is the product share reported separately in financial statements if the ERP vendor is public?

- Ability to natively support diversified business models. How diverse is the product in supporting multiple business models in the same product?

- Acquisition strategy aligned with the product: Any recent acquisitions to fill a specific hole for machinery manufacturing industries? Any official announcements to integrate recently acquired capabilities?

- User Reviews: How specific are the reviews about this product’s capabilities? How recent and frequent are the reviews?

- Must be an ERP product: Edge products such as HCM, CRM, eCommerce, MES, or accounting solutions that are not fully integrated to support enterprise-wide capabilities are not qualified for this list.

10. Odoo

Odoo is well-suited for SMB machinery manufacturers outgrowing QuickBooks. Its data model isn’t as detailed as larger ERP systems like Acumatica or Infor CSI lacking advanced capabilities. Odoo’s less complex data embeddedness and fewer required layers make the implementation process more affordable compared to more intricate systems. Therefore, it acquires the #10 spot on our list of top machinery manufacturing ERP systems.

Strengths

- Well adopted among industry 4.0 companies. It is widely adopted, especially among Industry 4.0 companies and other machinery businesses. These companies may use it for procurement planning or more advanced scenarios that require sophisticated MRP planning. However, smaller machinery companies that typically purchase components per project may not need such advanced capabilities. For these smaller businesses, while it would be a good fit, the sophisticated features may not be necessary.

- Diverse solution to accommodate several business models. The ERP layers are highly adaptable and designed to support various business models such as machinery, parts, and service divisions for machinery manufacturers.

- Matrix functionality built as part of the inventory core. Most machinery manufacturers are likely to require complex inventory attributes that are not only used for reporting but also for planning. Odoo supports these complex inventory use cases.

Weaknesses

- Limited advanced capabilities. Advanced transactions that are bread-and-butter for machinery manufacturers such as blanket orders, batch transactions, phantom support, allocation, and kanban may have limited support natively.

- Not proven for complex BOMs. Most machinery manufacturers are likely to have very complex BOMs, requiring layers of subassemblies with complex logic such as swapping out a material or operation in the entire database in bulk might not as easy as with products designed for complex machinery manufacturing.

- Requires mature internal IT team. In tailoring, customizing, and configuring these ERP capabilities, the same capabilities that are already included as part of the suite, Odoo also requires a very mature internal IT team.

9. Rootstock

Rootstock caters to machinery manufacturing-centric SMBs, offering robust mobile-native capabilities atop the Salesforce platform. Most machinery manufacturing organizations are likely to be heavy users of Salesforce due to the longer sales cycle. They also might have their sales team involved during the operational phases due to the high-touch nature of these projects. The unified experience across sales and operations platforms provided by Rootstock would help machinery manufacturing organizations. Thus, ranking at #9 on our list of top machinery manufacturing ERP systems.

Strengths

- Unified Salesforce experience. It is well-aligned with Salesforce products, making it a strong choice for machinery manufacturers who handle large, complex projects. These companies often deal with high-value contracts and require extensive CRM integration for sales and marketing processes. Rootstock integrates seamlessly with Salesforce, supporting the content-driven and CRM-centric workflows typical in such high-value projects, unlike simpler manufacturing ERP modules like MTO.

- WBS friendly processes. Rootstock excels in WBS-centric functionality for project manufacturing. While other ERP systems may claim project manufacturing capabilities, they often lack integration with operational tasks and financial processes. Rootstock, however, effectively tracks operational tasks and integrates them with financial processes, making it a strong fit for projects requiring detailed management.

- Cloud native tech. It is highly cloud-native, offering a strong mobile experience, particularly valuable for service departments. If you need field service processes to handle orders, manage inventory, and capture signatures from mobile devices, Rootstock supports these needs effectively.

Weaknesses

- The Salesforce data model is not as relational. The underlying data model in Salesforce is not as relational as those in other ERP systems, which is typical for most CRM designs. As a result, you may encounter data integrity challenges with Rootstock.

- Not as diverse. The capabilities aren’t as diverse overall. So, if you’re trying to accommodate a variety of business models with your Rootstock installation, you may encounter some challenges.

- Not as well adopted. It’s not as widely adopted overall, and the number of logos they have is fairly limited, especially among machinery manufacturing logos, which are quite few.

8. Oracle Cloud ERP

Oracle Cloud ERP is a robust system designed for companies outgrowing smaller or mid-sized ERP systems like Odoo or Rootstock. It excels in consolidating global operations and providing comprehensive end-to-end traceability for financial and operational data, especially important for multinational and publicly traded companies. Oracle Cloud ERP is ideal for Fortune 500 and Fortune 1000 companies that require advanced data traceability and are subject to stringent audits. Therefore, it has secured the #8 position on our list of top machinery manufacturing ERP systems.

Strengths

- Diversity of the solution supported different business models. When considering Oracle Cloud ERP, its diversity is a key strength. For businesses with varied models, such as machinery combined with food manufacturing or restaurant operations, a more generalized ERP system is needed. Oracle Cloud ERP offers the flexibility and scale required for these complex, multi-faceted scenarios.

- Depth of ERP layers for large enterprises. Oracle Cloud ERP excels in scalability and flexibility, making it adaptable to various business processes and transactions. Its depth and versatility are key strengths of the system.

- Global financial consolidation and localization. Oracle Cloud ERP is often the best choice in regions where other solutions aren’t available. It offers native localization and a strong consulting base knowledgeable in local taxation, regulations, and processes.

Weaknesses

- Last mile capabilities through third-party vendors. It is ideal for regions lacking other solutions, providing native localization and expert consulting for local taxation, regulations, and processes.

- Expensive implementation. Implementations are generally more expensive and require significant internal expertise due to the complexity and numerous moving parts involved.

- Not as well adopted among machinery manufacturers due to limited operational capabilities. Oracle Cloud ERP is not as well adopted among machinery manufacturers, so the ecosystem and integration available for machinery manufacturers might not be as strong.

7. Acumatica

When comparing the previous three systems – Odoo, Rootstock, and Oracle Cloud ERP, Acumatica is the system companies will need when they outgrow either QuickBooks or Odoo, requiring consolidation of data siloes spread across departments. Machinery manufacturers will find Acumatica useful around the $20 to $30 million revenue mark, as they will face increasing challenges with inventory costing, asset selection, and internal supply chain consolidation. At this stage, external supply chain collaboration with international vendors may not yet be critical, and the collaboration footprint might be limited. Acumatica is particularly well-suited for companies operating in the US, Canada, the UK, or Australia. However, it may not be as well-supported in South America or Eastern Europe, and even if local partners offer some support, it might not be as widely adopted, potentially leading to challenges. Thus, Acumatica secures the spot #7 on our list of top machinery manufacturing ERP systems.

Strengths

- Core ERP layers. The core ERP layers can support various business models for machinery manufacturers. Other solutions might struggle with newer models like rentals or subscriptions because they weren’t designed for them, given that some were developed in the 1970s and 1980s. For machinery manufacturing, project manufacturing should be well supported.

- Diverse business models supported in the same database. If your business includes not just machinery manufacturing but also other models like food, you should be able to support all of these within the same database. This setup provides end-to-end traceability, but it’s typically limited to within the same country.

- Cloud-native. Acumatica may not be the best fit for companies with global operations looking for end-to-end traceability and consolidation between entities, especially if they require advanced manufacturing ERP capabilities.

Weaknesses

- Not as friendly for global consolidation. Acumatica may not be the best fit for companies with global operations looking for end-to-end traceability and consolidation between entities, especially if they require advanced manufacturing capabilities.

- Advanced manufacturing capabilities limited. While Acumatica’s capabilities are likely to be richer than smaller systems such as Odoo, advanced capabilities such as allocation layers, support for Kanban etc are likely to be limited.

- Suite capabilities through third-parties. The suite capabilities like PLM are available only through third-party providers, which increases vendor risk even with Acumatica.

6. SAP S/4 HANA

SAP S/4HANA is quite similar to Oracle Cloud ERP, so the factors relevant to Oracle Cloud ERP also apply to SAP S/4HANA. Generally, SAP S/4HANA’s data model is more widely adopted among machinery manufacturers, while Oracle Cloud ERP targets service-centric industries. SAP S/4HANA excels in product-centric industries, particularly with its HANA database, which efficiently consolidates MRP workloads, especially for centralized planning across multiple global entities. It handles complex product attributes and serial number tracking, making it ideal for managing production scheduling and integrating field service workflows. This end-to-end planning capability is a significant advantage for machinery manufacturing companies. Therefore, it secures the #6 spot on our list of top machinery manufacturing ERP systems.

Strengths

- ERP layers for complex organizations. Designed for global, highly regulated organizations with very complex business models ranging from discrete to process, combining all manufacturing modes including advanced business models such as configure-to-order.

- Diversity of the solution supporting most manufacturing processes. The ERP layers are highly adaptable and designed to support various business models, resulting in a very diverse product. In contrast, other products may not offer the same level of diversity.

- Global compliance and localization. Supports localization and compliance requirements of most countries across the world, for companies aiming to consolidate all of their global entities in one database and data model.

Weaknesses

- Machinery suite capabilities such as PLM through third-party vendors. A limitation with SAP S/4 HANA is that the suite capabilities, such as PLM and configurator, are more tailored toward machinery manufacturers. For these features, you may need to rely on third-party solutions.

- Expensive implementation. The ERP implementation may be slightly more expensive because you’re dealing with many different vendors and many different add-ons.

- Requires mature internal IT team. In tailoring, customizing, and configuring these capabilities, the same capabilities that are already included as part of the suite, SAP S/4 HANA also requires a very mature internal IT team.

5. Microsoft Dynamics 365 F&O

Microsoft Dynamics 365 F&O is similar to SAP S/4HANA and Oracle Cloud ERP. However, as of now, Dynamics 365 F&O offers a richer cloud version with more capabilities, especially in core operational areas. Unlike SAP S/4HANA and Oracle Cloud ERP, Dynamics 365 F&O may not provide the detailed approval processes and complex layers required by large enterprises, particularly those that are highly regulated or publicly traded. Therefore, Dynamics 365 F&O is well-suited for mid-market and upper mid-market companies but is less adopted among Fortune 500 companies, where workload expectations are generally higher. Thus, Microsoft Dynamics 365 F&O secures the #5 spot on our list of top machinery manufacturing ERP systems.

Strengths

- Core ERP layers to support diverse business models. When it comes to core operational capabilities, MS Dynamics 365 F&O may not provide the detailed layers and approval processes required by large enterprises, especially those that are highly regulated or publicly traded. However, it performs well in mid-market and upper mid-market companies.

- Comprehensive localization across the globe. It supports a wide range of business models and offers global localization in areas where other products may not be available, with strong consulting and localization support.

- Depth in WBS-centric processes. F&O offers greater depth in WBS capabilities, making it ideal for managing large projects and programs.

Weaknesses

- Machinery suite capabilities such as PLM through third-party vendors. Like SAP S/4HANA, you’ll need third-party solutions for PLM and other components, including supply chain management.

- Expensive implementation. The ERP implementation may be slightly more expensive because you’re dealing with many different vendors and many different add-ons.

- Requires mature internal IT team. In tailoring, customizing, and configuring these capabilities, the same capabilities that are already included as part of the suite, MS Dynamics F&O also requires a very mature internal IT team.

4. DELMIAWorks

DELMIAWorks, formerly known as IQMS, is a strong choice for machinery manufacturers using SolidWorks. These companies typically focus more on mechanical systems and may have fewer electrical components, though most modern machines do include some electrical elements. Generally, these businesses also use SolidWorks, AutoCAD, or similar CAD systems. DELMIAWorks aligns well with SolidWorks since both are owned by the same parent company, which ensures superior integration and a more synchronized upgrade cycle. Thus, DELMIAWorks acquires the #4 spot on our list of top machinery manufacturing ERP systems.

Strengths

- Complete suite pre-integrated. With this approach, you’ll get all the necessary components as part of the suite, eliminating the need to source them from other vendors. The advantage is that it can be more affordable and potentially implementable within a smaller budget.

- SolidWorks and integration owned by the same vendor. DELMIAWorks will have strong alignment with SolidWorks since they’re owned by the same parent company. This means superior ERP integration and a more synchronized upgrade cycle.

- Well adopted among machinery manufacturers. This is the old IQMS product, which works well for machinery manufacturers using SolidWorks. Typically, these companies are more focused on mechanical machines and may not have as many electrical components.

Weaknesses

- Legacy technology. The technology is very legacy compared to other ERP systems that we have on this list.

- Not as scalable for all discrete industries. It may not be as scalable for different business models but is particularly strong for plastic-centric business models. This can also be beneficial for machinery manufacturers who produce their own molds, as they sometimes have plastic components.

- Limited ecosystem and consulting base. Their ecosystem and consulting base are likely to be limited, as is common with other niche products.

3. Infor CloudSuite Industrial(Syteline)

Infor CSI is ideal for machinery manufacturers who do not have highly formalized engineering processes or standardized BOMs. These manufacturers often experience significant engineering changes throughout their processes, including frequent change orders, even close to shipment. This can cause friction, as their BOMs are not formalized and they may operate more like service-centric companies, lacking stringent regulation. This presents a challenge in the machinery manufacturing sector. However, Infor CSI is well-suited for these situations, especially if the BOMs require flexibility and features like revision numbers, due to its ability to accommodate fluid and adaptable BOM management. Thus, securing the #3 spot on our list of top machinery manufacturing ERP systems.

Strengths

- Engineering friendly for BOMs and costing. The UI experience is likely to be friendlier for engineering organizations performing complex BOM manipulations during the quoting process such as copying the entire BOM, replacing some parts to create the new quote, reflecting updated pricing without much manual efforts.

- Embedded field services process. From a machinery manufacturing perspective, they have embedded field service processes, for intertwined operations sharing resources among service and manufacturing divisions, operating with consolidated schedules, sharing capacity.

- Embedded quality processes. The solution also includes embedded quality processes, which is crucial in capital-intensive industries like medical devices. In these sectors, quality processes must be tightly integrated and traceable from procurement through production to returns. Having end-to-end traceability is a significant strength, as isolated quality processes may not be sufficient.

Weaknesses

- WBS-centric discrete processes. The WBS-centric discrete processes and project manufacturing capabilities are not as robust as those found in larger products.

- Not friendly for machinery manufacturers with complex inventory. If you have complex inventory with numerous attributes used for scheduling and planning, CSI might not be the best fit.

- Legacy technology. The technology is very legacy compared to other systems that we have on this list.

2. Epicor Kinetic

Epicor Kinetic is an excellent choice for businesses with highly formalized engineering processes, especially when strict change control and revision number tracking are required. This is common in industries like aerospace, where OEMs often mandate BOMs and revision numbers. In such cases, formal engineering processes are essential. Epicor Kinetic is also well-suited for industries like metalworking, where tracking metal components and their attributes is critical for scheduling and planning. The system’s capabilities in managing these aspects make it a great fit for companies in these sectors. Thus, it has acquired the #2 spot on our list of the top machinery manufacturing ERP systems.

Strengths

- Complex inventory. Epicor Kinetic is uniquely suitable for machinery manufacturers with complex inventory needs where they not only use product attributes for reporting but also as part of scheduling.

- Formal engineering governance. For industries like aerospace, where you rely heavily on OEMs and need formal engineering processes, or for metal-based manufacturing requiring detailed tracking of attributes, Epicor Kinetic is a great fit. It can handle complex scheduling and planning effectively.

- MES-architecture friendly. If you need a more MES-centric architecture, where quality and production processes are managed within the MES layer rather than the ERP layer, this can be crucial for industries where production is more critical than end-to-end traceability. In such cases, Epicor Kinetic would be a great fit.

Weaknesses

- Not friendly for companies without revision numbers. If you have very fluid BOMs, as is often the case with machinery manufacturers, editing revision numbers may not be user-friendly. Frequent changes and disorganization in BOMs can make the process more difficult.

- Field service and quality processes are not as embedded. The field service sub-assemblies and quality processes are less integrated into their data model. Although they have acquired a company for field service and are working on integration, the experience may not be as intuitive. Acquired add-ons often lack the proven reliability of consolidated components, resulting in a less seamless experience compared to products like Infor CSI.

- Weaker core accounting and finance layers. The finance layers are not as embedded with the core product, leaving with an impression as if using a patched product.

1. Infor CloudSuite LN

Infor CloudSuite LN addresses many limitations found in smaller products particularly like Infor CSI or Epicor Kinetic. It is particularly suitable for global manufacturing companies that require robust support for international supply chain and operational collaboration. CloudSuite LN is localized and globalized in many countries, at least 20 to 30, making it an excellent choice for companies operating in those regions and needing seamless international collaboration. It has been proven to handle very heavy workloads, accommodating companies with up to 20,000 employees, making it a strong option for larger enterprises. Hence, the #1 spot on our list of top machinery manufacturing ERP systems belongs to Infor CloudSuite LN.

Strengths

- Comprehensive machinery manufacturing capabilities. Fills the gap with smaller products with equally comprehensive capabilities for all modes of manufacturing and global operations.

- Pre-integrated suite. From the CloudSuite perspective, all components are pre-integrated, pre-built, and pre-tested within the suite, eliminating the need for third-party vendors. This generally reduces ERP implementation time and costs, as there are fewer contracts and less need to design the architecture.

- Global capabilities. Ideal for global manufacturing companies that need international supply chain and operational collaboration. It supports localization in 20 to 30 countries, allowing for effective global planning. Proven to handle heavy workloads for companies with up to 20,000 employees, Infor CloudSuite LN is a robust choice for such needs.

Weaknesses

- Expensive. The license is likely to be perceived as expensive by smaller companies as the enterprise layers included might not be as relevant for them.

- Not suitable for SMBs below $250M in revenue. Not sold to smaller companies. Infor might push companies to smaller products such as CSI. Going outside of Infor might be a better choice in such scenarios as they might be able to match some layers of LN for particularly smaller companies.

- Ecosystem. Their ecosystem and consulting base are likely to be limited, as is common with other niche products.

Conclusion

In conclusion, selecting the right ERP system is critical for machinery manufacturing companies, as it can significantly impact their operational efficiency and business growth. Each ERP solution discussed offers unique strengths and weaknesses, particularly catering to different aspects of the machinery manufacturing sector. From comprehensive global capabilities to specialized features for complex inventory management, the top ERP systems provide a range of functionalities to meet the diverse needs of the industry. Whether a company requires robust support for international operations or tailored solutions for specific manufacturing processes, understanding these ERP systems’ capabilities and limitations will help businesses make informed decisions and choose the best fit for their requirements. While this list offers valuable insights, seeking advice from an independent ERP consultant can greatly enhance your implementation success.