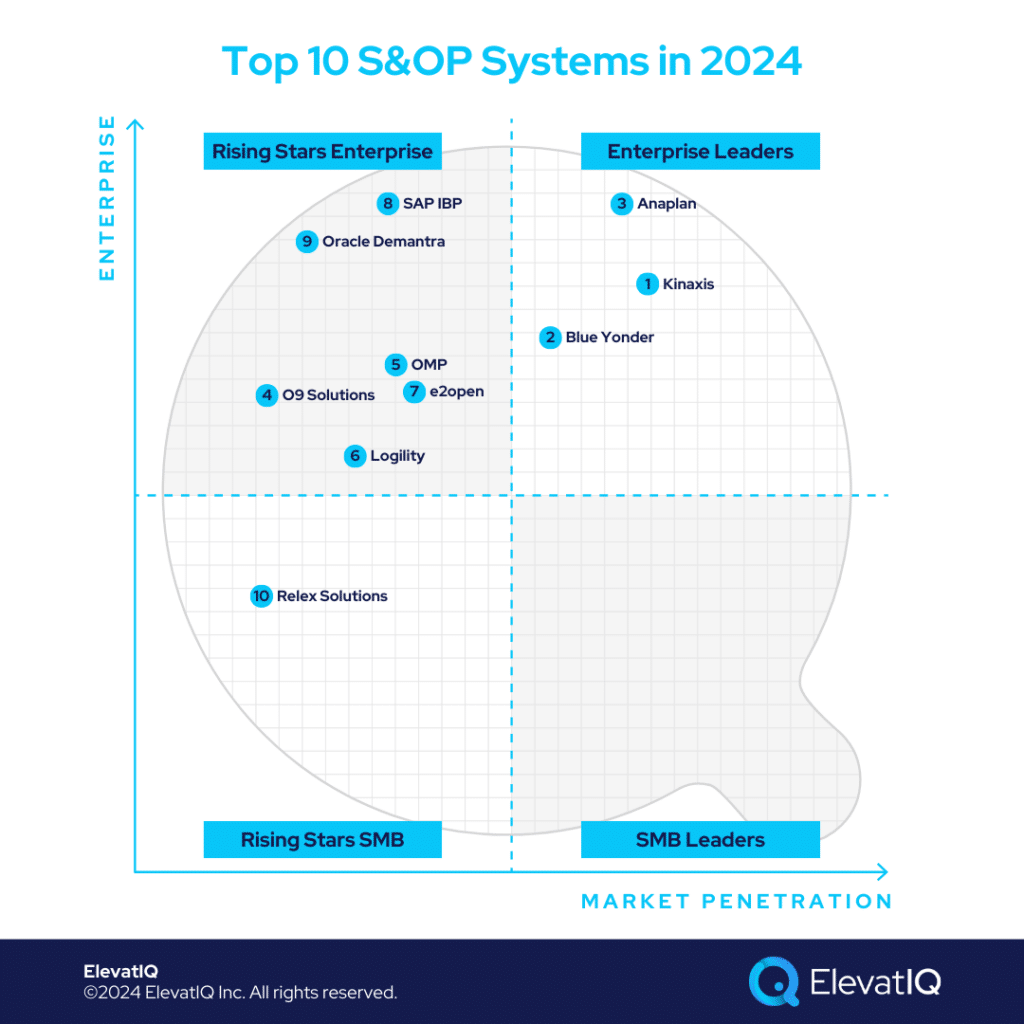

Running inventory-centric operations without an S&OP system is nearly impractical. Traditionally, businesses managed operations through complex spreadsheets, merging data from various sources. Despite ERP systems claiming S&OP capabilities, their rigid data structures for transactions hinder analytical workflows. An alternative system with a more flexible structure is needed, one that allows easy manipulation without disrupting core operations.

Tailoring data layers to analytical needs involves flattening and augmenting data based on organizational requirements and speed of insights. Analytical systems, unlike core operational data systems, have a lower impact from changes, such as SKU and BOM structure modifications. External changes may still necessitate adjustments to the data model for accurate correlation and association, ensuring the generation of necessary KPIs and insights for the organization.

The design of S&OP systems is influenced by various factors, with some systems integrating other suites like WMS, TMS, or OMS based on tight analytical workflows and operational requirements. Retail industries, for instance, may require collaboration between merchandising, planning, procurement, and R&D teams, prompting the inclusion of these processes within the S&OP system suite. Corporate strategy and transactional alignment play a crucial role in determining the suitable architecture, emphasizing the need for an S&OP system tailored to unique workflows. Ready to explore the top S&OP systems in 2024? Let’s delve in.

10. Relex Solutions

While various systems cater to different industries, S&OP systems necessitate industry-specific capabilities. In retail, planning varies even between softline and hardline operations. Relex excels in mid-market retail, providing pre-configured workflows for streamlined implementation. Unique features like retail floor planning and planogram optimization, common in larger supply chain suites, make Relex a robust choice for retail operations without displacing existing operational systems like WMS or TMS. Despite requiring closer integration with operational processes, Relex secures its position at #10 on our list.

Pros

- Integrated workforce planning. While smaller systems might require an external system for workforce planning, Relex can combine workforce planning as well, making a comprehensive planning engineer combining floor space planning or workforce.

- Great for teams needing standalone planning solutions. For teams that can’t afford to replace their existing transactional system, this could be a great best-of-breed system that can be installed without impacting the core operational infrastructure.

- Strong retail planning solutions such as pricing and promotions. The other solutions on this list might not have retail-specific capabilities such as pricing and promotions, requiring substantial efforts to implement them.

Cons

- Limited focus. The limited focus on retail might be irrelevant for companies centralizing their analytical processes and data siloes. Equally limited for diverse operations.

- Not an integrated suite. Unlike other supply chain suites that are likely to be pre-integrated, Relex might require substantial master data and consulting expertise if the analytical processes need to be tightly embedded with operational processes.

- Not meant to be for enterprise workloads. While a great mid-market solution, it’s not ideal for enterprise-level workloads with millions of SKU and location planning requirements.

9. Oracle Demantra

Much like SAP IBP, Oracle Demantra suits companies already using Oracle for various technologies like TMS, WMS, or ERP. Offering seamless integration for analytical processes closely tied to operational workflows, it proves beneficial for diverse businesses seeking robust S&OP capabilities. Particularly suitable for those with substantial implementation budgets to customize industry-specific processes, Oracle Demantra stands out as an excellent choice for large enterprises already integrated with Oracle retail solutions or ERP, securing its position at #9 on our list.

Pros

- Designed for enterprise planning workloads. Oracle Demanta is proven for large enterprise workloads where companies may have millions of SKU and location permutations and combinations.

- Comprehensive demand forecasting capabilities. While other products may not have as robust demand forecasting capabilities, especially containing enterprise-grade strategies and formulas built, Oracle Demantra has deep capabilities.

- Pre-integrated with other Oracle products. The pre-integrated workflows would reduce the consulting and integration time. But don’t forget to vet if the existing integration is good enough for your use case.

Cons

- User interface might be clunky. The user interface is not as modern as other modern options, leading to adoption issues among users.

- Steep learning curve. The enterprise-grade layers and data model would require substantial learning without prior experience with the product.

- Expensive. It might be too expensive for SMBs with simpler needs.

8. SAP IBP

Much like Oracle Demantra, SAP IBP caters well to businesses already utilizing SAP for various technologies like TMS, WMS, or ERP. Offering seamless integration for analytical processes closely tied to operational workflows, it proves beneficial for diverse enterprises seeking robust S&OP capabilities. Particularly suitable for those with substantial implementation budgets to customize industry-specific processes, SAP IBP stands out as an excellent choice for large enterprises already integrated with SAP S/4 HANA, earning it the #8 spot on our list.

Pros

- Pre-integrated with other SAP products. The pre-integrated nature of SAP IBP will help companies with embedded workflows if the planning workflows need to be tightly embedded with operational ones.

- Comprehensive supply chain planning capabilities. While other solutions might be limited in their capabilities, SAP IBP covers broad capabilities for a variety of industries.

- Designed for enterprise workloads. Proven for very large workloads with millions of SKU and location combinations and parallel workflows for enterprise-wide planning workloads.

Cons

- Dated user interface. The user interface might not be as modern as some of the other cloud-native platforms.

- May not be as visual as other platforms. The limited visual appeal might lead to adoption challenges and building consensus among different stakeholders.

- Expensive. SMBs not caring for enterprise capabilities might find it expensive.

7. e2open

e2open stands out as a holistic suite encompassing supply chain aspects like network, planning, and execution. Its strength lies in the robustness of its network, setting it apart from other platforms. Beyond technical capabilities, e2open excels in delivering vital industrial data, enhancing essential KPIs such as demand forecasting and arrival times. Ideal for businesses seeking a comprehensive suite with S&OP capabilities, e2open secures its position at #7 on our list.

Pros

- End-to-end Supply chain capabilities are part of the suite. e2open is perhaps the most comprehensive supply chain suite capable of building industry-wide supply chain planning workloads because of its network and access to industry data.

- Richest decision-grade data through its network. The quality of decision-grade data is completely dependent upon the amount and the quality of data available, making it one of the highest quality data crucial for S&OP planning.

- Collaboration planning is easy if customers and supplies are already part of the network. The biggest advantage of e2open is the network effect that you have, especially if both suppliers and customers are likely to be part of the same network.

Cons

- Expensive. SMBs not caring for enterprise-grade capabilities or networks might find its hefty price tag unnecessarily expensive.

- Learning curve. Due to the connected datasets with other execution capabilities, substantial consulting help with data modeling and implementation will be required.

- Not designed for SMBs. e2open’s target market is large enterprises, and SMBs are likely to find it overwhelming for their simpler needs.

6. Logility

Operating primarily in the prescriptive category, much like Relex, Logility caters to mid-market companies in specific industries. As a standalone S&OP system, Logility doesn’t necessitate the replacement of other transactional or operational components, allowing department-level implementation. The simplicity of data modeling and implementation is an advantage, given its independence from other suite components. However, incorporating Logility into the architecture may demand extensive enterprise architecture expertise for master data governance and integration workflows. Positioned at #6, Logility stands as a compelling prescriptive standalone solution for the mid-market.

Pros

- Standalone planning solutions. The standalone nature makes it easier to implement and use at the departmental level without requiring as much consensus with the other departments.

- Planning scenarios built up. The planning scenarios are built up, reducing consulting in building workflows from scratch but increasing training and adoption in learning the proprietary knowledge of the platform.

- Detailed inventory planning. Comprehensive inventory planning pre-built, requiring substantial consulting expertise to enable the same capabilities on the other platforms.

Cons

- Not designed for enterprises. Logility is not proven for enterprise-grade workloads, requiring planning for millions of SKUs and location combinations.

- Not a complete suite. Since it is not a complete suite, integrating it with other best-of-breed solutions would require substantial master data governance and enterprise architecture expertise.

- Limiting flexibility. Prescriptive workflows and proprietary knowledge may lack the flexibility analysts enjoy with spreadsheets or other technical platforms.

5. OMP

OMP follows a prescriptive approach similar to Relex or Logility, offering a distinctive solution tailored for industries with intricate inventories like chemicals, life sciences, and metal. Due to the unique planning cycles and data models necessary for these industries, OMP stands out, rendering other industry-agnostic solutions less relevant. However, its industry-specific focus may pose a challenge for businesses spanning diverse sectors. Positioned at #5, OMP emerges as a robust solution for mid-market companies with budget constraints seeking a prescriptive solution.

Pros

- Strong in life sciences and metal-oriented inventory planning. These industries have unique requirements to support complex attributes and lot and serial numbers, making them slightly difficult in vanilla platforms if they are not designed for those industries.

- Standalone planning solution. The standalone nature would not require building consensus with other departments or aligning data models, making it easier to implement at the department level.

- Friendlier for Mid-market because of pre-baked functionality. The pre-baked functionality and prescriptive workflows would reduce the consulting costs but increase training time to learn proprietary knowledge.

Cons

- Highly technical and would require significant consulting support. The prescriptive nature would require substantial consulting efforts in learning proprietary knowledge and translating current data models to platform data models.

- Not designed for enterprise workloads. It might not be the best fit for enterprises planning for millions of SKUs and location combinations, which might be even harder for these industries as the planning may need to be done at the lot or serial number level.

- Not the best fit for diverse operations. The focused nature may not be the best fit for companies seeking to manage diverse planning models on the same platform.

4. O9 Solutions

In the competitive landscape alongside enterprise-grade platforms like Blue Yonder and Anaplan, O9 emerges as a top choice for upper mid-market to enterprise companies. It caters to those seeking extensive technical capabilities for enterprise-wide planning, particularly within retail-centric industries. Many mid-market or outdated enterprise solutions may lag in technology investment, lacking advancements in AI and ML crucial for effective S&OP systems. Despite offering enterprise-level capabilities, o9 is not an exhaustive supply chain suite, enhancing ease of implementation at the department level. This position is o9 at #8 on our list.

Pros

- Advanced AI and ML capabilities. The enterprise-grade AI and ML are likely to be similar to Blue Yonder or e2open, with the only exception being the included network.

- Pre-built planning workflows tailored to specific industries, such as retail. The pre-built and prescriptive workflows would not require as much consulting effort as it would with other vanilla solutions such as Anaplan.

- The well-adopted solution in various in large enterprises. The O9 solution is well-proven with very large enterprise logos, which are very similar to Blue Yonder or e2open.

Cons

- Not the best fit for smaller businesses. The enterprise layers and consulting expertise required to implement and learn o9 might be overwhelming for SMB companies.

- Expensive. The SMB companies limited on budget might not appreciate its expensive price tag.

- Ecosystem. The ecosystem does not have as many consulting companies as it might be available for other leading platforms such as Anaplan.

3. Anaplan

Anaplan stands out as a highly sophisticated platform catering to enterprise-wide connected planning across FP&A, S&OP, and more. Unlike some prescriptive solutions, Anaplan minimizes the need for industry-specific proprietary knowledge. While its planning models may not match the scalability of Anaplan, it appeals to skilled planners accustomed to extensive spreadsheet use due to its flexible platform. However, leveraging Anaplan may entail a substantial consulting budget for workflows that could be pre-configured in other solutions. Positioned at #3 on our list, Anaplan is a prime choice for enterprises seeking scalable, connected planning without additional platforms.

Pros

- Highly customizable for sophisticated planning scenarios. The planning models can accommodate diverse planning models across industries rather than being limited to just one function or industry.

- Connected planning, including all planning datasets. Most other focused solutions, such as Relex, Logility, and o9, are likely to require another planning solution. Even the enterprise-grade supply chain suite would crate disconnected planning experience as FP&A and human resources planning are likely to be disconnected with them, making it one of the best candidate planning use cases despite missing the supply chain suite.

- Ecosystem. Anaplan has one of the most mature consulting bases compared to all other solutions on this list.

Cons

- Steep learning curve. Expect a very long implementation time for users to be proficient with planning models, leading to adoption issues.

- Requires consulting support. The technical platform would require building the business workflows and reports that might already be pre-built with several solutions on this list.

- Limited pre-baked industry-specific workflows. Limited pre-baked industry-specific workflows would require substantial help from consulting companies with expertise in building industry-specific planning models.

2. Blue Yonder

Similar to e2open, Blue Yonder offers a comprehensive suite encompassing various supply chain components such as WMS, TMS, and S&OP. Contrasting with e2open, Blue Yonder relies on partners for its network needs instead of having its proprietary network. Although it lacks a proprietary network, Blue Yonder excels in handling enterprise workloads, particularly in the retail sector. Comparing it with a few others, Blue Yonder and Anaplan take divergent approaches to their suites. Anaplan prioritizes connectivity and traceability in planning, whereas Blue Yonder excels when S&OP processes demand tighter embeddedness with operational processes. Positioned at #2 on our list, Blue Yonder proves to be an excellent S&OP system for enterprises seeking a comprehensive suite.

Pros

- Complete suite integrated for retail-centric industries. The complete suite would provide pre-baked integration, which is much harder to build where planning workflows are tightly embedded with operational processes such as merchandising and planning.

- Most tools are part of the suite for retail planners and merchandisers. Retail industries would find Blue Yonder most relatable as most tools related to retail planning are part of the suite, allowing everyone to operate seamlessly on the same data.

- Ecosystem. Blue Yonder is widely popular among large consulting firms, allowing customers to find talent easily.

Cons

- Expensive. SMB companies not caring for enterprise-grade capabilities might find Blue Yonder unnecessarily expensive.

- Not SMB friendly. The enterprise layers and tightness of the data model might be overwhelming for SMB companies looking for simpler platforms.

- Not the best fit for 3PL companies. Designed from the perspective of retail companies, it’s not as suitable for companies with 3PL as part of their business model as their planning cycles are uniquely different from retailers.

1. Kinaxis

Compared to other prescriptive options such as Logility or O9, Kinaxis is perhaps the ideal solution, covering many different market segments. Although it doesn’t have the same suite capabilities as Blue Yonder, it also makes it slightly friendlier for companies looking for a standalone S&OP system without requiring alignment with other departments. Like e2open, Kinaxis is perhaps the only other solution that owns a network, providing superior decision-grade data than other platforms. Contrasting with Anaplan, it would not require as much consulting help, especially for manufacturing companies, for which supply chain planning is far more detailed and different. Kinaxis is one of the most versatile options catering to many companies, making it the #1 option on this list.

Pros

- Richest pre-baked planning platform with enterprise-grade capabilities for manufacturers and retailers. Manufacturing planning requires traceability and planning at the BOM level, which are very similar capabilities to MRP, requiring far more firepower than for industries planning at the SKU and location level.

- Advanced capabilities such as returns and spare parts management. Pre-built return and spare parts management capabilities would not require as much consulting help as building these capabilities on a vanilla platform would.

- Proprietary Network. Kinaxis is perhaps one of the few platforms on this list that owns its own network, providing superior decision-grade data than other platforms.

Cons

- It may not be the most customizable platform. The prescriptive nature of the platform for analysts seeking a flexible platform to build capabilities atop the vanilla platform.

- Expensive. SMBs looking for simpler solutions without enterprise-grade capabilities and layers might find it expensive.

- Not SMB friendly. The enterprise layers might be overwhelming for companies, increasing the implementation budget and adoption risks.

Conclusion

Navigating the myriad S&OP systems can feel like solving a puzzle, with each platform adopting a unique approach tailored to traceability and connectivity goals. Industry considerations, including planning cycle nuances, further influence the suitability of each solution. As you contemplate an S&OP system, articulate its scope and collaboration with enterprise data. This clarity aids in selecting the optimal option from the provided list. If this task exceeds your expertise, seeking guidance from independent ERP consultants can be invaluable.