Last Updated on March 3, 2024 by Shrestha Dash

Before the advent of supply chain business networks, industries depended on research and survey-based approaches for supply chain planning. Companies in the data business often erred significantly, leading to inefficiencies throughout the supply chain. Establishing networks was challenging due to communication standard disparities and the difficulty of persuading the entire industry to converge on a single platform. While business-to-business communication relied on standards like XML or EDI, they offered limited connectivity and acknowledgment without centralized repositories to drive industry-wide supply chains.

As EDI networks expanded, they evolved to extract valuable data, especially for carriers. However, the supply chain equation still lacked traceability. Mode-specific networks emerged, effectively connecting stakeholders within each mode. Yet, achieving end-to-end supply chain traceability and control tower capabilities remained elusive due to industry-wide data silos. Recognizing this challenge, private equity firms saw the necessity of consolidating these silos into comprehensive networks that encompass various supply chain elements.

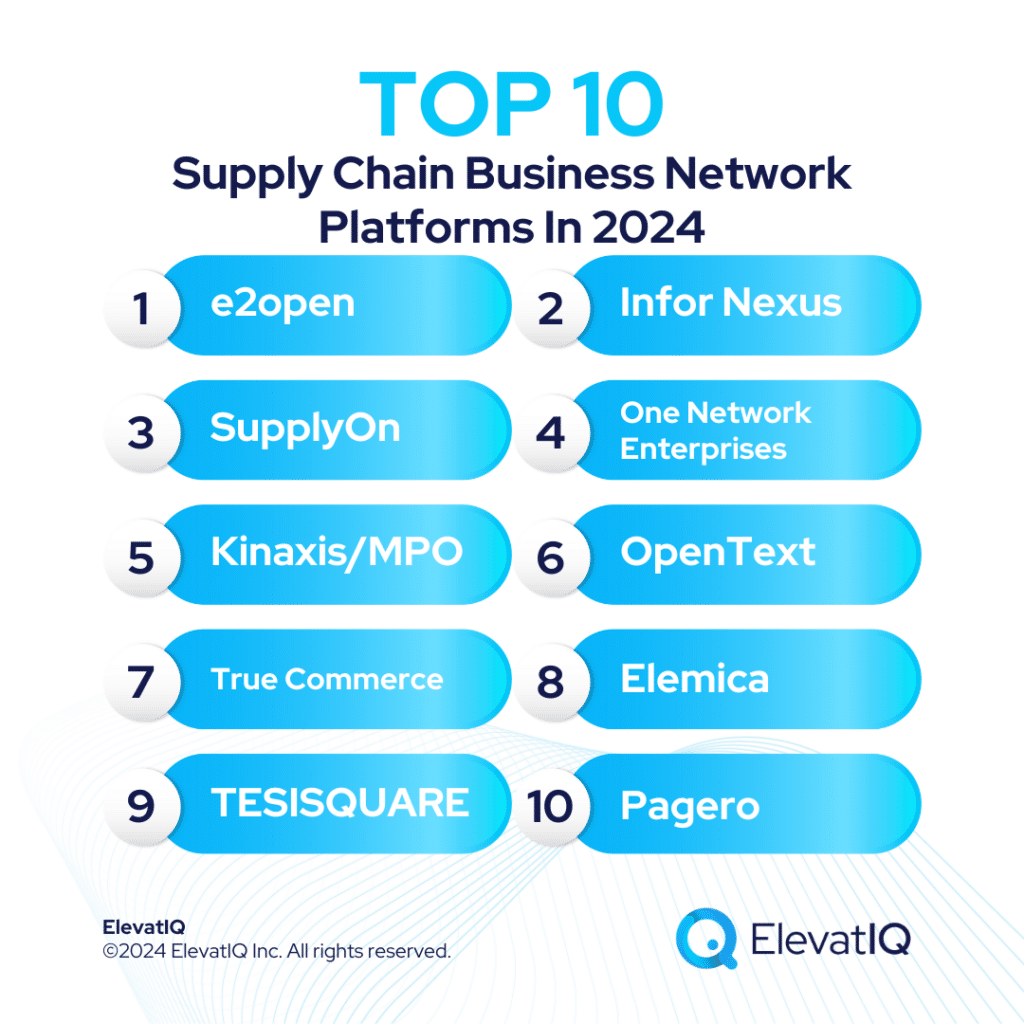

Unlocking the full potential of technology, achieving supply chain traceability requires strategic approaches. Managing domestic communication networks is feasible, yet crossing geopolitical boundaries introduces unique challenges. Global traceability remains elusive, given national security and data privacy concerns. Blockchain technology emerges as a solution, seamlessly connecting datasets while upholding security interests. The landscape expands with ESG and e-invoicing initiatives, broadening the equation. While the origin of each network varies, each serves a distinct purpose. These networks not only ensure end-to-end traceability globally but also supply essential data for AI algorithms, transforming demand forecasting. Intrigued about the top 10 supply chain business network platforms in 2024? Let’s delve into the exploration.

10. Pagero

Just like the role OpenText played for enterprise e-invoicing and document exchange for the stakeholders across the supply chain, Pagero’s cloud-native platform filled the same gap for SMBs, offering them a network very similar to OpenText. Pagero would be relevant if you are looking for a good document exchange solution, including e-invoicing support with trading partners for various markets. While Pagero’s network fills the gap with critical supply chains, they are not the best fit if you are looking for a vendor that could provide end-to-end supply chain visibility and traceability data, ranking at #10 on this list.

Pros

- Cloud-native interface. Pagero technologies are cloud-native, making vendor onboarding super easy, allowing you to not only use the vendors and carriers already on the network but invite your trading partners to the platforms as well, expanding the network even further.

- Easy connecting with trading partners. Connecting and onboarding new vendors could be done with a few clicks, reducing the friction and resistance of those who might not be willing to join the network because of friction in the process.

- E-invoicing compliance capabilities. Not many technologies in the market can allow true eInvoicing capabilities, which are critical to comply with processes in several countries, even for custom compliance requirements.

Cons

- Limited to document exchange. The scope of the network is limited to document exchange related to eInvoicing and communication with trading partners.

- Limited suite capabilities. Companies looking for an entire suite that could utilize the data generated by the network might not be the best fit.

- Not a real supply chain business network. It’s not necessarily a supply chain business network, but it does provide critical capabilities to communicate with supply chain stakeholders.

9. TESISQUARE

TESISQUARE presents a unique network origin, initially focusing on supplier collaboration within manufacturing and engineering value chains. Unlike carrier or eInvoicing networks, its strength lies predominantly in the European market, offering specific capabilities within the supply chain. While not comprehensive for the entire supply chain, it excels as a supplier collaboration network with strength within the SAP ecosystem. TESISQUARE secures a spot at #9 on our list, providing control tower features geared toward tracking supplier collaboration.

Pros

- Strong competence with SAP. They started with SAP partners to provide collaboration capabilities for SAP customers, leading to superior integration with SAP technologies.

- Sending drawings etc to suppliers. Not many companies can help with the engineering collaboration where drawings need to be collaborated with suppliers, providing them a unique value prop.

- Control tower capabilities. While limited capabilities, they have control tower capabilities, offering a centralized view of your supply chain.

Cons

- Limited to European network. Their network is primarily limited to European carriers, which might be limiting for companies seeking to track global supply chains.

- Fairly small network limited to European countries. The small network can lead to a biased view of the network, leading to partially completed data that is not as superior as other platforms on this list.

- Limited suite and data. The suite capabilities are very limited to a very specific use case, and not a complete suite similar to technologies such as e2open.

8. Elemica

Elemica originated as a carrier and document exchange network, similar to EDI vendors or shipping platforms, with a primary focus on process manufacturers. Since process manufacturers require unique capabilities with document exchange and shipping needs, their network is focused on specific geography, use cases, and industries, limiting their applicability as a true supply chain business network. But they could be a great platform if you are looking to communicate and collaborate with industry-focused trading partners. Given their pros and cons, they rank at #8 on our list.

Pros

- SMB friendly. Their platform is very SMB-centric for companies looking for basic communication capabilities within a TMS, especially ideal for companies for which supply chain footprint might be limited because of outsourced supply chains to 3PL and carrier companies.

- Connect with carriers, including rate shopping. Allows companies looking for basic carrier communication capabilities, including rate shopping.

- Chemical and process industry-specific capabilities. The chemical and process industry is very unique because of its complex inventory and quality requirements, requiring specific capabilities in a network platform.

Cons

- Not a real supply chain business network. While a great connectivity platform, it’s not really a real supply chain business network for companies seeking end-to-end traceability and true control tower capabilities.

- Really a document exchange and small shipping software. It’s really a very small package for document exchange and shipping needs.

- Smaller network footprint concentrated on certain industries. The size of the network is small, limiting its scope as a supply chain business network.

7. True Commerce

True Commerce is primarily an EDI network connecting trading partners in the automotive ecosystem, serving as a visibility platform for the automotive industry. While it could be a great value add for SMBs that might have access to a more robust supply chain platform, it’s not necessarily a true supply chain business network. But it could be a great network if your goal is to primarily connect with trading partners through EDI, ranking at #7 on our list.

Pros

- Easy connectivity with trading partners. The main benefit of True Commerce is trading partner communication, with a very lean network for visibility needs.

- SMB-friendly. It’s not as cost-prohibitive as other platforms on this list, making it friendlier for SMBs.

Cons

- Not a real supply chain business network. While great for connectivity, it’s not a real supply chain platform for companies seeking end-to-end traceability of their supply chain, along with control tower capabilities.

- Visibility is limited to Automotive. While great for the automotive value chain, it’s not the best fit for other industries.

- Limited insights and network size. The limited network size would provide biased insights and incomplete data that might not be as valuable for supply chain planning as with other platforms.

6. OpenText

OpenText provides enterprise-grade content exchange and trade document networks primarily for enterprise ERP ecosystems such as SAP or Oracle to provide connectivity with trading partners. With ESG and eInvoicing capabilities housed with these networks as well, their network has been expanded to these workflows, expanding their network further. While it’s a great platform for connectivity and collaboration, it’s not necessarily a true supply chain business network, ranking it as #6 on our rank for this year.

Pros

- Best-of-breed content management platform for enterprise workloads. It is one of the leading products for centralized management and distribution of physical document exchange.

- A business network for trading partner collaboration. One of the largest networks for trading partner collaboration.

- Global compliance. Global compliance capabilities require unique processes for each country and supply chain lanes, providing enterprise-grade compliance capabilities.

Cons

- Not a true supply chain visibility platform. While great for execution-centric capabilities with an external network, it’s not a true supply chain platform.

- Not friendly for SMBs. The enterprise compliance layers and business rules might be overwhelming for SMBs.

- Expensive. SMBs limited on budget and not caring for enterprise capabilities might find it overly expensive.

5. Kinaxis/MPO

Kinaxis, just like e2open, takes a very different approach to its suite and has a true supply chain business network that it owns, enabling the AI and ML workflows crucial for decision-grade data. Their network will provide end-to-end supply chain traceability for all global modes and control tower capabilities. While it might be a great planning suite for manufacturing-centric verticals, as in these industries, planning processes do not need to be tightly integrated with operational workflows, it might not be a great fit for retail-centric verticals as they require planning processes to be tightly integrated with order management, store and floor planning, warehouse, and procurement.

Pros

- Planning solutions integrated with the network. Integrated network with the planning solution provides unique capabilities for manufacturing-centric industries.

- Complementary capabilities for SAP and Oracle customers. Perhaps one of the best networks along with S&OP platforms for companies already on SAP and Oracle for their ERP.

- Decision-grade intelligence. The network provides proprietary data, and because of that, they are able to offer decision-grade data for their planning cycles.

Cons

- Not a strong execution component. Their biggest drawback is that they don’t have a strong execution component bundled as part of the suite, but for their industries, the suite might not be as relevant as it is for retail industries.

- The network is not as strong as its competitors. The strength of their network might not be as strong as other networks, such as e2open, limiting the quality of decision-grade data.

4. One Network Enterprises

One Network is one of the strongest networks for industry-wide collaboration and control tower capabilities. The network features a strong partner network, providing traceability across geopolitical boundaries using its unique technology capabilities, allowing it to have such traceability. The network is also uniquely positioned for complex scenarios such as counterfeit tracking or global pharma supply chain, making the network more relevant for the execution function than for planning, ranking it at #4 on our list.

Pros

- More than 75 companies in the partner network. Their strong partner network provides them with data to provide global supply chain capabilities combining all modes and regions.

- Telematics-Enabled Control Tower. The telematics data gathered from across the world help them provide end-to-end traceability that other networks might not have.

- Multi-party BOM tracking. This tracking is especially useful for tracking across all stakeholders, providing traceability for pharma or counterfeit.

Cons

- Not SMB-friendly. Global traceability might not be as relevant for SMB companies and might be expensive.

- Weak planning and execution capabilities. While great with network and global TMS-centric capabilities, other execution components might not be missing for non-transportation or 3PL companies, which might require traceability among trading partners and suppliers, along with an external supply chain.

- Limited network. While one of the strongest, the network is not as comprehensive as e2open, making it less reliable for decision-grade data.

3. SupplyOn

Much like OneNetwork and TESISQUARE, SupplyOn centers around procurement and supplier collaboration. While OneNetwork emphasizes global collaboration and industry-wide BOM tracking, SupplyOn, akin to TESISQUARE and Infor Nexus, specializes in procurement and supplier collaboration. It may not delve as deeply into the carrier aspect of the network. Although possessing data from a broader array of companies and countries than OneNetwork, its dataset might not match the completeness of networks like e2open. However, for those focused on procurement and supplier collaboration needs, SupplyOn stands out, earning the #3 spot on our list.

Pros

- 140 companies from 100 countries. The company and country set is much larger than OneNetwork but might not be as comprehensive as e2open.

- Primarily focused on the procurement network and e-invoicing. The focus on the procurement network and e-invoicing would provide much stronger capabilities for this area, although weaker on the carrier side of the network.

Cons

- Not SMB-friendly. The platform is not meant to be for SMBs so they will find it expensive.

- Weak planning and execution capabilities. While great for the network, it does not have embedded planning or execution capabilities for companies looking for embedded workflows utilizing this data and network, increasing the consulting and implementation budget in using it as part of the architecture, but at the same providing flexibility for the best-of-breed architecture or depart level purchase.

- Not as comprehensive as other platforms. The network coverage is not as comprehensive as other platforms on this list due to its primary focus on the supplier collaboration and procurement side of data.

2. Infor Nexus

Infor Nexus primarily serves as a visibility platform, focusing on the procurement and supplier collaboration aspects of the network. It relies on external datasets, such as those from partners like Project44 and FourKites, for carrier-side information. While it excels in meeting the supplier and procurement collaboration needs of verticals like automotive and aerospace, it falls short of providing a comprehensive supply chain business network. Nevertheless, its strength lies in fostering tight collaboration with other architectural layers, such as WMS and ERP, in industries where this collaboration is crucial. As a result, Infor Nexus secures the #2 spot on our list.

Pros

- Integrated with Infor solutions such as WMS and ERP. For industries where embedded experience with internal solutions such as WMS or ERP matters, it would provide a tighter experience because of pre-baked integration.

- Planning integrated with a network similar to Kinexis. Integrated planning would utilize a proprietary network, a similar strategy as Kinexis for decision-grade data, an architecture strategy relevant for these verticals.

- Collaboration and orchestration with global suppliers. Collaboration and orchestration with global suppliers would help with scenarios such as joint planning and forecasting, which are much more relevant for these industries.

Cons

- Leaner execution component compared to E2 Open. The execution, especially pertaining to external and global supply chains, would be weaker, requiring external components.

- Not SMB friendly. SMBs might find it overwhelming and expensive if they don’t care for global collaboration or joint planning with their suppliers.

- Limited ecosystem. The consulting base and ecosystem might be limited as compared to other options on this list.

1. e2open

e2open stands out as one of the most comprehensive platforms, encompassing a wide range of capabilities within a suite, including planning and execution, coupled with a robust network. In contrast to other solutions that may focus on specific datasets and networks in particular regions, e2open’s network spans suppliers, carriers, and ELD data, covering all modes and geographies. Its versatility shines when managing diverse operations, seamlessly supporting combined business models such as retail and manufacturing under the same portfolio. As a market leader, e2open secures the top spot at #1 on our list.

Pros

- The most comprehensive suite combines the power of planning. The most comprehensive suite can work for global and comprehensive business models as complex as retail and manufacturing, especially for business models such as Aftermarket, which are highly complex and combine elements of many industries.

- Execution and networks, are adopted by large enterprises. e2open has one of the largest logos on this list and is installed very commonly alongside SAP and Oracle.

- Cloud-native UI. Compared to other platforms on this list, e2open has relatively modern technology.

Cons

- Expensive. SMBs not caring for external supply chain traceability or decision-grade data might find it expensive.

- Not SMB friendly. The enterprise business rules and layers might be overwhelming for SMBs.

Conclusion

Revolutionizing supply chain planning, industry networks have reshaped the landscape. While you may not directly engage with these networks, comprehending their dynamics is key to evaluating supply chain visibility and platforms touting AI or control tower features. The robustness of their network shapes decision-grade data quality, influencing critical metrics like ETA and demand forecasting, pivotal for operational efficiency and supply chain planning. When evaluating a supply chain platform, delve into the underlying network to gauge the data quality it offers. If navigating this terrain seems daunting, seek guidance from independent supply chain consulting firms to make informed decisions.