Last Updated on March 9, 2024 by Sam Gupta

Traditionally, ERP systems lacked WMS capabilities due to technological and architectural differences. However, with the advent of cloud technology, modern systems now include basic WMS features for mid-market users, eliminating concerns about complex integration or the need for a separate WMS package. Nevertheless, companies, even with simpler operations, often outgrow these basic capabilities and find the need for best-of-breed WMS software.

Once you reach this stage, the next step is to identify the most suitable best-of-breed WMS software. A crucial consideration emerges for companies with a 3PL focus, even if it constitutes a minor component of their business model. As distributors seek diversification, many explore 3PL offerings, leading to a warehouse architecture distinct from the traditional approach closely tied to inventory accounting. Moreover, the requirements for accelerated transactions and round-the-clock operations highlight the essential need for a dedicated warehouse management system.

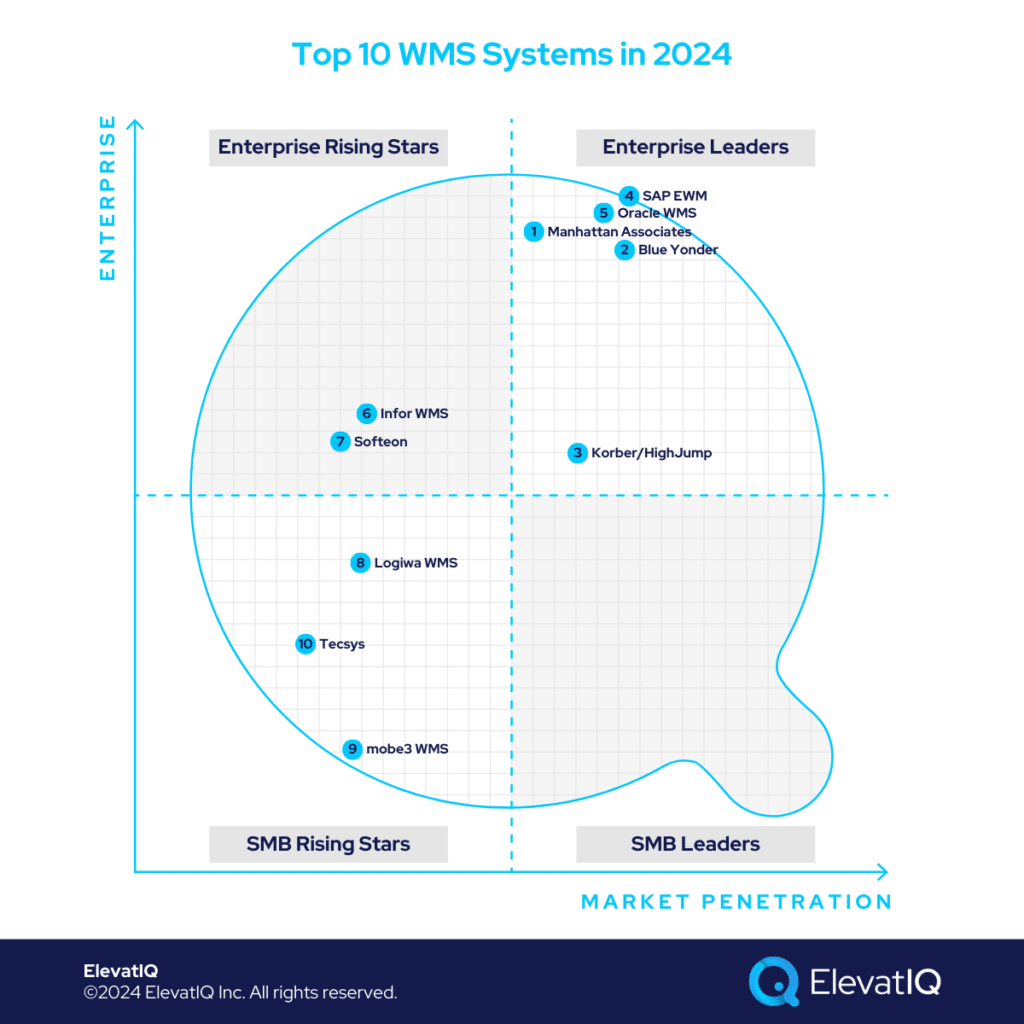

With technological advancements, warehouse architecture has undergone significant evolution, comprising three key components: the warehouse management system (WMS), warehouse execution system (WES), and warehouse control system (WCS). The control system’s role is to transmit commands, facilitate integration with hardware, and ensure smooth coordination. The warehouse management system primarily handles data and inventory management, while the execution component unifies these functions. WMS solutions may offer some or all of these capabilities, often bundled with additional systems in their suite. Now, let’s explore the top 10 WMS systems in 2024.

Criteria

- Overall market share/# of customers. How large is the market share of this WMS product? WMS vendors‘ overall market share is irrelevant for this list if they have multiple WMS products in their portfolio.

- Ownership/funding. Who owns the WMS vendor? Is it a private equity company, a family or a group of families, or a wealthy corporate investor?

- Quality of development (legacy vs. legacy dressed as modern vs. modern UX/cloud-native). How modern is the tech stack? Not clunky! How aggressively is the WMS vendor pushing cloud-native functionality for this product? No fake clouds! Is the roadmap officially announced? Or uncertain?

- Community/Ecosystem. How vibrant is the community? Social media groups? In-person user groups? Forums?

- Depth of native functionality (for specific industries). Last-mile functionality for specific industries natively built into the product?

- Quality of publicly available product documentation. How well-documented is the product? Is the documentation available publicly? How updated is the demo content available on YouTube?

- Product share and documented commitment (of the publisher through financial statements). Is the product share reported separately in financial statements if the WMS vendor is public?

- Acquisition strategy aligned with the product. Are there any recent acquisitions to fill a specific hole with this product? Are there any official announcements to integrate recently acquired capabilities?

- Maturity of the Supply Chain Suite. How mature are other capabilities that would augment WMS, such as TMS, WMS, S&OP, and the network?

- User Reviews. How specific are the reviews about this product’s capabilities? How recent and frequent are the reviews?

- Must be a WMS product. Must be a recognized WMS product by several analyst firms with a proven track record and market share.

10. Tecsys

Tecsys specializes in serving healthcare and retail sectors, offering unique capabilities tailored to specific verticals, particularly in point-of-use inventory management. While many WMS vendors may include hardware or have partnerships for devices and ASRS systems, Tecsys stands out with its focus on specialized hardware and interfaces crucial for point-of-use systems, which could be costly to develop on generic WMS platforms.

These sectors also benefit from Tecsys’ robust multi-location inventory features, facilitating seamless goods transfer across various locations. Opt for Tecsys if you’re a mid-market healthcare or retail organization, especially if you have distinct needs they uniquely address.

Pros

- Point-of-use inventory management, with specialized hardware and interfaces, is crucial for traceability.

- Multi-location Capabilities are suitable for facilities with diverse locations, such as hospitals or retail businesses.

- eCommerce and retail-friendly with an integrated Order Management System (OMS), catering to budget-conscious mid-market Direct-to-Consumer (DTC) and e-commerce-centric companies.

Cons

- Outdated technology compared to some modern cloud-native options.

- Not a comprehensive suite like larger players such as Blue Yonder and Manhattan, lacking a full supply chain suite.

- Limited ecosystem and consulting options compared to other alternatives on the list.

9. Mobe3 WMS

Mobe3 WMS is among the more compact solutions featured on this list, commonly integrated into smaller ERP ecosystems. Despite its size, it boasts rich features tailored to support the specific requirements of smaller warehouses, particularly in process and batch-centric industries.

These industries demand specialized capabilities, such as pallet and lot attributes, integrated into the solution. Opt for Mobe3 WMS if you are a small organization seeking a cost-effective and easily implementable WMS tool.

Pros

- iOS-friendly and cloud-native, uniquely designed for iOS interfaces, making it one of the few cloud-native WMS systems.

- Advanced capabilities for SMBs, including features like measuring picking metrics, surpassing expectations for its size.

- Advanced capabilities for process and batch manufacturing, offering support for lot attributes, bin attributes, and pallet attributes crucial for advanced slotting and cross-docking.

Cons

- Technology and compatibility issues with some devices require careful consideration of device compatibility.

- Reports of software bugs from some users, indicating potential stability concerns compared to larger vendors.

- Not suitable for enterprises, lacking the transaction processing capabilities required by larger organizations.

8. Logiwa WMS

Logiwa WMS is tailored for eCommerce and parcel-centric operations, excelling in various aspects of warehouse management, including WMS, WCS, and WES. While its capabilities are robust, they may not be as comprehensive as those offered by some other enterprise solutions featured on this list. Opt for Logiwa if you require a cloud-native, feature-rich WMS designed for mid-size warehouses with a focus on parcel-centric operations.

Pros

- Ideal for eCommerce and parcel-centric operations, making it particularly well-suited for businesses in these sectors.

- Feature-rich, offering advanced capabilities typically found in mid-size WMS systems, although not as advanced as some enterprise solutions.

- Cloud-native UI/UX, providing an intuitive interface and user experience. Encompasses capabilities across WMS, WCS, and WES, including integration with ASRS systems and AGVs.

Cons

- Learning curve, requiring users to adapt to the system, especially if they lack prior experience with WMS solutions.

- Not as user-friendly as simpler WMS systems like Mobe3, necessitating training and implementation efforts.

- Limited coverage for complex enterprise modes, primarily designed for parcel-centric operations, makes it less suitable for warehouses with diverse modes.

7. Softeon

Softeon caters to a customer base similar to Infor WMS, focusing on the upper mid-market segment. However, it lacks proven experience with enterprise customers compared to some other solutions on this list, and it might be too robust for smaller companies.

Consider Softeon if you are a mid-sized organization in search of an advanced WMS that not only offers additional capabilities like distributed order management but also supports crucial batch processing required for larger warehouse operations.

Pros

- Robust batch capabilities, addressing the needs of mid-sized companies that have outgrown basic barcoding solutions.

- Seamless integration with other solutions included in the suite, streamlining the connectivity between different components like distributed order management.

- Distributed order management capabilities are beneficial for high-volume retail and distribution organizations managing complex transactions, including micro-fulfillment operations.

Cons

- Not tailored for enterprise-scale operations. lacking a proven track record with larger companies.

- Requires third-party add-ons for enterprises needing additional supply chain capabilities, making the suite less comprehensive than larger solutions like Blue Yonder or Manhattan.

- May be too intricate for very small operations, with layers supporting batch processing potentially overwhelming for companies with minimal scale.

6. Infor WMS

Infor WMS is tailored for distributors in the upper mid-market segment, particularly prevalent in manufacturing industries, with a notable focus on verticals where solutions like Infor LN and M3 hold prominence. This is particularly applicable to sectors such as Automotive, Aerospace, Fashion, and Industrial distribution. If you are a mid-market manufacturer, especially considering or already utilizing Infor LN or M3 ERP systems, Infor WMS might be a suitable choice.

Pros

- Seamless integration with other Infor ERPs. Infor WMS offers pre-integrated solutions with Infor LN and M3, addressing the inherent challenges of ERP-WMS integration, especially for manufacturers already leveraging these ERP systems.

- Comprehensive supply chain capabilities. In addition to WMS, Infor WMS incorporates various supply chain offerings, including S&OP and visibility platforms, making it comparable to larger supply chain suites like Blue Yonder or Manhattan.

- 3D warehouse functionality. The unique 3D warehouse capability is particularly advantageous for larger warehouses, enhancing operational efficiencies through a virtual 3D layout.

Cons

- Limited suitability for large enterprises. While excelling in upper mid-market warehouses, Infor WMS might not be the optimal choice for high-volume warehouses with smaller dollar transactions.

- Weakness in TMS execution. The Transportation Management System (TMS) component is not as robust, necessitating the adoption of a best-of-breed TMS execution product to align with more robust suites like Blue Yonder.

- Suboptimal for 3PL. While possessing capabilities similar to SAP EWM, Infor WMS is not tailored for 3PL perspectives, lacking in-depth compliance, freight audit features, and dispatch and rate shopping functionalities typically essential for 3PL operations.

5. Oracle WMS

Oracle WMS is well-suited for expansive transactional warehouses seeking a dedicated supply chain layer to manage high transaction volumes, 24/7 operations, or the warehouse architecture of a 3PL business model. It is particularly advantageous for enterprises desiring comprehensive supply chain capabilities within a unified suite, especially if already integrated with Oracle Cloud ERP. If you are a large enterprise, particularly leveraging other Oracle products like ERP or RMS, Oracle WMS may be a suitable choice.

Pros

- Complete suite for a comprehensive tech stack. Oracle WMS integrates various supply chain capabilities, including RMS, S&OP, TMS, etc., offering a comparable feature set to other expansive suites like Blue Yonder and Manhattan.

- Pre-integration with other Oracle apps. Oracle WMS seamlessly integrates with other Oracle applications such as ERP and TMS, eliminating the need for expensive custom integration efforts, making it suitable for large enterprises.

- Proven for high transaction volumes. Oracle WMS has demonstrated its effectiveness in managing millions of transactions and large, busy warehouses and operations.

Cons

- Overwhelming for smaller companies. The data model and product design may pose challenges for smaller organizations, introducing additional steps and operational overhead.

- Dependency on add-ons for specific capabilities. Oracle lacks native capabilities for network, data, and maps, relying on partners to provide these features, limiting its execution capabilities.

- Expensive customization for compliance workflows. Implementing compliance workflows not pre-built into the core requires substantial development and consulting efforts, contributing to higher customization costs compared to other solutions.

4. SAP EWM

SAP EWM caters to enterprise-grade warehouses and distribution companies, especially those with a 3PL business model, particularly when integrated with other SAP solutions like SAP S/4 HANA. However, it may not be the best fit for smaller warehouses operating on a limited consulting budget. Opt for SAP EWM if you are a large distribution company with a global presence, particularly leveraging other SAP products such as SAP S/4 HANA or SAP Hybris.

Pros

- Support for both decoupled and embedded architecture. This flexibility enables companies to facilitate 24/7 warehouse operations and accommodate the unique warehouse architecture demands of a 3PL business model, distinct from the financial representation in the ERP system.

- Power of HANA. Leveraging the robust capabilities of HANA, SAP EWM can efficiently handle the demanding workloads of Fortune 500 organizations, providing a competitive edge compared to solutions that might struggle with such volumes.

- Advanced capabilities for 3PL. SAP EWM offers features tailored for 3PL operations, including support for value-added services integral to the 3PL business model, and enhancing capabilities for billing and service offerings.

Cons

- Too big for smaller companies. The complex data model of SAP EWM may pose challenges for smaller organizations seeking streamlined systems without the overhead crucial for larger enterprises.

- Learning curve and expensive implementation. Implementing SAP EWM involves a significant learning curve and substantial implementation costs due to the system’s complexity.

- Expensive. In comparison to other solutions on this list, SAP EWM’s pricing may not be as accommodating for smaller organizations.

3. Korber/HighJump

Korber/HighJump serves mid- to upper-mid-sized companies seeking an integrated suite, including last-mile capabilities. Although Korber/HighJump features various integrated components like TMS, DSD, and freight audit capabilities, it may not offer the same level of comprehensiveness as some other solutions on this list. Opt for Korber if you have graduated from standalone, smaller WMS systems and require a suite with advanced WMS capabilities tailored for mid-market companies.

Pros

- Fairly comprehensive suite for both WMS and TMS. Korber’s suite encompasses several pre-integrated components, providing advantages not found in smaller solutions like mobe3.

- Pre-integrated WMS and TMS. The pre-integrated WMS and TMS offered by Korber are particularly beneficial for mid-market companies, eliminating the need for extensive integration efforts required by standalone WMS and TMS systems.

- DSD capabilities. Korber addresses the needs of companies in the DSD space, offering specialized capabilities such as proof of delivery, in-house fleet management, and unique dispatch and scheduling features based on routing or priority.

Cons

- Issues with pre-baked integration. While Korber provides pre-baked integration, thorough vetting of integration flows based on specific requirements may be necessary. Custom integration might be required if existing flows prove insufficient for particular use cases.

- Not a complete Supply Chain suite. Compared to other suites on this list, Korber may lack some comprehensive capabilities, such as integrated S&OP and control tower features that are more expansive in other solutions.

- Not for enterprises. Unlike proven solutions such as Blue Yonder and Manhattan, Korber may not have as extensive experience with large accounts.

2. Blue Yonder

Blue Yonder boasts the strongest supply chain suite, coupled with advanced WMS capabilities, well-established in enterprises, particularly within high-volume retail companies. However, Blue Yonder may not be suitable for smaller businesses. Opt for Blue Yonder if you are a large enterprise, especially in the retail sector, seeking a comprehensive supply chain suite seamlessly integrated with a WMS.

Pros

- Enterprise-grade WMS with pre-built components. Blue Yonder stands out as a leading supply chain suite, validated through successful collaborations with Fortune 500 accounts.

- Ideal for retail-centric industries. Offering advanced capabilities tailored for retailers managing extensive SKU portfolios and multiple locations, Blue Yonder excels in location-level planning.

- Pre-integrated support for all supply chain modes. Blue Yonder provides comprehensive assistance across all supply chain modes, inclusive of a supply chain control tower with advanced AI and ML capabilities, enhancing the existing WMS features.

Cons

- Too large for SMBs. Blue Yonder’s extensive capabilities may be overwhelming for small and medium-sized businesses seeking simpler WMS solutions.

- Cost-prohibitive for SMBs. The expense associated with Blue Yonder may be deemed excessive by SMBs without enterprise-scale requirements.

- Lack of a network component in the supply chain suite. A notable drawback is Blue Yonder’s absence of an owned network. Solutions with an integrated network possess enhanced data control, enabling richer insights to augment WMS capabilities.

1. Manhattan Associates

Manhattan WMS stands as one of the most robust solutions in the market, particularly excelling in high-volume retail scenarios. While Manhattan may not offer the same comprehensiveness in its Supply Chain suite, it is exceptionally well-suited for large enterprises in the food, grocery, shoe, and apparel industries. However, it may not be the optimal choice for smaller businesses. Opt for Manhattan if you are a sizable company, particularly in the food, grocery, shoe, and apparel sectors, seeking a top-tier WMS solution.

Pros

- The suite includes a pre-integrated point of sale. Manhattan’s suite incorporates a pre-integrated point of sale, offering significant advantages for companies lacking internal IT capabilities for integration or unwilling to invest in costly integration processes.

- Capable of handling enterprise workloads. Proven with enterprise retailers dealing with extensive transaction volumes and SKU portfolios, Manhattan demonstrates proficiency in deep planning and merchandising capabilities.

- Effective management of complex verticals. Manhattan excels in handling unique requirements associated with inventory planning in verticals like grocery, shoes, and apparel, showcasing specialized WMS capabilities.

Cons

- Incomplete supply chain suite. Although Manhattan’s suite covers essential execution components such as WMS, TMS, OMS, and POS, it falls short in other supply chain pillars such as S&OP and network.

- Requires add-ons for comprehensive supply chain capabilities. Companies seeking a holistic suite experience may need multiple add-ons to match the capabilities of other Supply Chain suites like Blue Yonder.

- Not designed for SMBs. Tailored for enterprise companies, Manhattan’s design may not be as accommodating for smaller businesses seeking simpler solutions.

Conclusion

Selecting a WMS system can be challenging, given its intersection with various software categories and evolving packaging strategies. As technology progresses, the distinctions are becoming less clear, adding to the complexity.

For those seeking a new WMS system, a crucial step is understanding your business model and transactions and aligning them with suitable software with the help of independent WMS consultants. This list aims to offer a concise starting point for further evaluation.