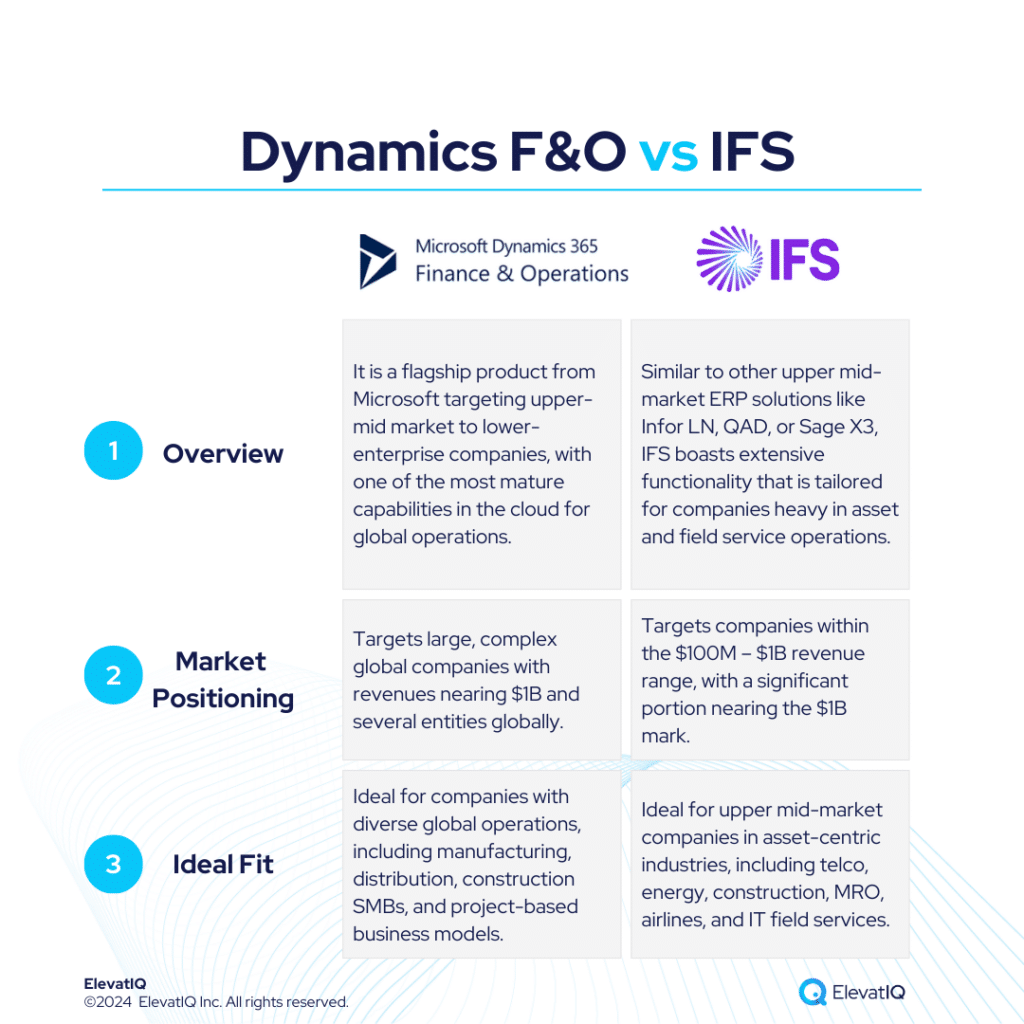

Microsoft Dynamics 365 F&O stands out for its enhanced cloud-native functionality, leading in capabilities particularly over competitors like SAP S/4 HANA and Oracle Cloud ERP. It caters to large, global companies with complex business models, offering mature technology and also a successful track record across industries. On the other hand, similar to other upper mid-market ERP solutions like Infor LN, QAD, or Sage X3, IFS boasts extensive functionality that is tailored for companies heavy in asset and field service operations. Dynamics F&O particularly targets large, complex global companies with revenues nearing $1B and several entities globally. Whereas, IFS is positioned for companies within the $100M – $1B revenue range, with a significant portion nearing the $1B mark.

Dynamics 365 F&O is ideal for companies particularly with diverse global entities, spanning industries like manufacturing, distribution, and construction. On the other hand, IFS boasts robust global, multi-entity capabilities and operates as a cloud-native solution. IFS not only delivers functional capabilities but also efficiently manages the transactional workload of upper-mid-market companies.

However, navigating the Dynamics 365 ecosystem may require assistance due to the presence of unqualified partners. Despite some technical issues, Dynamics 365 F&O remains a solid choice for companies of varying sizes and models. On the other hand, IFS appeals to enterprises seeking mature, industry-specific capabilities, reducing the need for extensive development with vanilla ERP systems like SAP or Oracle. Therefore, choosing between Dynamics F&O vs IFS requires a detailed examination, and this comparison offers valuable insights for ERP selection projects. Let’s delve deeper into the specifics.

| MS Dynamics 365 F&O | IFS | |

| Started in | One of the most established enterprise software companies in the world | 1986 |

| Ownership by | Microsoft | EQT |

| No. of customers | 50,000+ | 6,500+ |

What is Microsoft Dynamics 365 Finance & Operations (F&O)?

Microsoft Dynamics 365 F&O is often the third choice for larger global accounts, following SAP S/4 HANA and Oracle Cloud ERP. It offers a mature ecosystem with modern, cloud-native technologies, thus proving successful across various industries. It is perhaps the most diverse solution accommodating several global business models in one database, making it an ideal solution particularly for lower enterprise companies. While a great fit as a corporate ledger for large enterprises, it’s not as proven as other leading solutions in the enterprise market with workloads as high as millions of journal entries per hour that Fortune 1000 companies might demand.

Microsoft Dynamics 365 F&O also excels in localizations where other solutions may falter. A vibrant ecosystem makes it suitable for private equity and also holding companies aiming to streamline their portfolio companies on one solution. SMBs, however, might find its complex data model overwhelming. Large, complex global companies with revenues exceeding $1B will particularly find Microsoft Dynamics 365 F&O appealing.

Although Microsoft Dynamics 365 F&O lacks the operational depth of specialized solutions, larger companies favor its corporate-level financial control. In a two-tier setting, they often particularly utilize additional Dynamics 365 F&O add-ons like Adeaca for operational requirements. Furthermore, Dynamics F&O offers seamless integration for field service, HCM, and CRM at the database level, empowering large companies to construct a best-of-breed architecture. It is especially strong with WBS-centric processes covering operational and financial schedules equally well. Hence, the challenge with MS Dynamics F&O would be the best-of-breed ancillary systems critical for A&D systems, which are not owned and maintained by Microsoft, requiring third-party add-ons.

What Is IFS?

Similar to other upper mid-market ERP solutions like Infor LN, QAD, or Sage X3, IFS also boasts extensive functionality. This functionality is particularly tailored for companies heavy in asset and field service operations. Positioned uniquely in the market, IFS also appeals to enterprises seeking mature, industry-specific capabilities, reducing the need for extensive development with vanilla ERP systems like SAP or Oracle. IFS serves as an optimal alternative in the upper mid-market space, offering standalone best-of-breed asset management and field service capabilities or a comprehensive ERP solution meticulously crafted particularly for asset-centric industries, including telco, energy, construction, MRO, airlines, and IT field services.

The IFS data model also surpasses the complexity of smaller systems like Acumatica or NetSuite, demanding an experienced internal team and external advisory support to successfully align process and data codings with the intricate IFS data model. It is an ideal choice for upper mid-market companies outgrowing smaller systems, such as Acumatica or NetSuite, and requiring mature capabilities for enterprise-wide asset scheduling and maintenance. IFS not only delivers functional capabilities but also efficiently manages the transactional workload of upper-mid-market companies.

IFS boasts robust global, multi-entity capabilities and also operates as a cloud-native solution. The majority of IFS customers fall within the $100M – $1B revenue range, with a significant portion nearing the $1B mark. While IFS has its roots in Europe, they have been trying to grow its presence in North America. In 2023, IFS made strategic acquisitions to enhance its AI and also shop floor capabilities.

Dynamics F&O vs IFS Comparison

Navigating the choice between Dynamics F&O vs IFS is a significant decision for businesses particularly looking for operational efficiency and strategic alignment. Thus, this section delves into the comprehensive comparison of Dynamics F&O vs IFS across various critical dimensions.

| MS Dynamics 365 F&O | IFS | |

| Global Operational Capabilities | Can host multiple entities from different countries. | Has robust global multi-entity capabilities. |

| Diverse Capabilities | Can accommodate most business models, may require add-ons. | Companies with a diverse business model, such as manufacturing or expecting changes with the model, might struggle. |

| Best-of-breed Capabilities | Crucial capabilities such as PLM, etc, may not be pre-integrated. | Has one of the strongest field service and asset management capabilities. |

| Last-mile Capabilities | May require add-ons for specific micro-verticals. | Often require add-ons for specific micro-verticals. |

| Operational Functionalities | Rich operational functionality for large enterprises. | The operational capabilities would be deeper in some areas, making it a best-of-breed option for enterprise-grade asset and field service-centric use cases used alongside another ERP as a corporate ledger. |

| Integration Capabilities | Pre-integrated with CRM and field service. | Good fit for those seeking best-of-breed field service capabilities for a subsidiary or integrated with a corporate financial ledger. |

| Manufacturing Capabilities | Mature capabilities support diverse models. | Has comparatively limited manufacturing capabilities. |

| Pricing Model | Cost per user per month with flexible user management, without long-term commitment. | Recurring subscription-based model. |

| Key Modules | 1. Financial Management 2. Supply Chain Management 3. Manufacturing Management 4. Human Capital Management 5. Business Intelligence and Reporting 6. Security and Compliance 7. Develop and Customize 8. System Administration | 1. Manufacturing 2. Supply Chain Management 3. Projects 4. Finance 5. Human Capital Management 6. Procurement 7. Customer Relationship Management 8. Commerce |

Dynamics F&O vs IFS Feature Comparison

Both platforms offer a plethora of features and functionalities designed to streamline business operations and enhance efficiency. In this feature comparison, we delve into particularly the distinct capabilities of Dynamics F&O vs IFS across various critical dimensions, providing insights to aid businesses in making informed decisions regarding their ERP selection. Thus, this section discusses features under each of the following modules, particularly financial management, supply chain management, and manufacturing management.

Financial Management Comparison

In this section, we are discussing a detailed comparison of the financial management capabilities particularly offered by Dynamics F&O vs IFS. By examining their respective strengths and functionalities, particularly in managing financial processes. Businesses can therefore gain valuable insights to determine the best-suited ERP solution for their financial management needs.

| MS Dynamics 365 F&O | IFS | ||

| Financial Management | General Ledger | Creates and maintains accurate records for financial transactions and generates regular financial reports. | Centralizes financial data management, enabling accounting, reporting, and analysis. |

| Accounts Receivable and Accounts Payable | Automates workflows for managing vendor invoices, payments, and customer invoicing, streamlining the entire invoicing process and improving cash flow management. | Streamlines customer invoicing, payment processes, vendor invoices and payments. | |

| Cash Flow Management | Provides comprehensive cash flow forecasting capabilities, allowing to project future cash positions, identify potential shortfalls, and make informed decisions. | Enables accurate planning and forecasting of cash activities, and analyze liquidity and cash positions. | |

| Other Features | Chart of Accounts -Enables the creation of a hierarchical structure for categorizing financial information. | Currency Management – Handles transactions in multiple currencies, automatically calculating exchange rates and converting transactions into the base currency. | |

| Budgeting and Forecasting – Creates and manages budgets across different departments and business units. Also, leverages historical data and predictive analytics, to make accurate projections and align their financial strategies with business goals. | Tax Management – Automates and manages tax calculations, compliance, and reporting across multiple jurisdictions. |

Supply Chain Management Comparison

In this comparison, we explore and analyze the supply chain management capabilities of Dynamics F&O vs IFS, shedding light particularly on their respective strengths and weaknesses.

| MS Dynamics 365 F&O | IFS | ||

| Supply Chain Management | Warehouse Management | Provides advanced warehouse and transportation management features, including inventory tracking, order fulfillment, shipment planning, and real-time visibility into logistics operations. | Enables businesses to efficiently manage warehouse operations by automating the physical storage and retrieval of inventory items. |

| Service Management | Establishes service agreements and service subscriptions, handles service orders and customer inquiries, and manages and analyzes the delivery of services to customers. | Enables organizations to efficiently manage their field service operations, including planning, scheduling, dispatching, and mobile workforce management. | |

| Inventory Management | Offers real-time visibility into inventory levels, demand, and supply, enabling organizations to optimize their inventory planning, reduce stockouts, and improve customer satisfaction. | Provides real-time visibility into stock movements, allowing businesses to maintain optimal inventory levels by setting reorder points and reducing the risk of overstocking and stock-outs. | |

| Other Features | Procurement and Sourcing – Streamlines the procurement process by providing end-to-end visibility and control over purchasing activities. Also automates and optimizes the procurement workflows, reducing costs and improving supplier relationships. | Purchase Order Management – Streamlines the procurement process by automating the creation, tracking, and approval of purchase orders, ensuring efficient and accurate order fulfillment. | |

| Transportation Management – Offers real-time visibility into logistics operations. | Sales Order Management – Efficiently handles the entire sales order process from quotation to invoicing, ensuring accurate order fulfillment and real-time tracking across multiple sites. | ||

| Demand Planning and Forecasting – Generates accurate demand forecasts, helping organizations optimize production planning, inventory levels, and procurement decisions. | Requisition Management – Simplifies the procurement process by allowing users to create, track, and approve requisitions, ensuring that all purchase requests are efficiently managed and fulfilled. |

Manufacturing Management Comparison

In this comparison, we explore and analyze the manufacturing management capabilities of Dynamics F&O vs IFS, shedding light, particularly on their respective strengths and weaknesses.

| MS Dynamics 365 F&O | IFS | ||

| Manufacturing Management | Production Planning | Provides comprehensive production planning and control capabilities, allowing organizations to optimize their manufacturing processes. The system supports various production scenarios, including make-to-order, make-to-stock, and engineer-to-order, while providing real-time visibility into production schedules, resource allocation, and material requirements. | Optimizes manufacturing processes by providing tools for capacity planning, production scheduling, material requirements planning, and shop floor control, ensuring real-time visibility and efficiency. |

| Other Features | Shop Floor Management – Offers real-time monitoring of shop floor activities, capturing data on machine utilization, labor productivity, and production progress. | BOM and Routing – Streamlines manufacturing by detailing the components and materials needed for production and defining the sequence of operations required to produce a finished product. | |

| Product Lifecycle Management – Enables organizations to manage the entire product lifecycle, from design and engineering to manufacturing and after-sales service. The system integrates product data, engineering change orders, and quality management processes, ensuring seamless collaboration and visibility across different departments. | Advanced Scheduling and Planning – Enhances manufacturing efficiency by optimizing resource allocation, production schedules, and material requirements through advanced algorithms and real-time data analysis. |

Pros of Dynamics F&O vs IFS

When evaluating ERP solutions, understanding the distinct advantages of Dynamics F&O vs IFS is crucial. In this section, we are particularly exploring the strengths of Dynamics F&O vs IFS across various dimensions. Thus, shedding light on their respective capabilities and functionalities.

| MS Dynamics 365 F&O | IFS |

| Has a significant advantage in its extensive consulting base and a vibrant marketplace, a unique benefit unmatched by many ERP systems. | One of the most consistent user experiences that have been rearchitected and modernized. |

| Supports global operations and business models and pre-baked integration for the best-of-breed CRM and field service solutions. | One of the strongest asset-management capabilities for organizations with very thick asset and predictive maintenance needs. |

| Embedded WMS and TMS processes help companies that might require end-to-end traceability even after the good leaves the dock. | Designed to handle large programs where consolidated visibility would be critical without ad-hoc arrangements. |

| Legacy product rearchitected for the cloud. So, while better than other legacy products that might be behind in the cloud. | Unique financial workflows to support complex project manufacturing programs. |

Cons of Dynamics F&O vs IFS

Just like recognizing strengths is important, it’s also crucial to weigh the specific drawbacks of Dynamics F&O vs IFS. Therefore, in this section, we will delve into the limitations and challenges associated with Dynamics F&O vs IFS across various operational and financial dimensions.

| MS Dynamics 365 F&O | IFS |

| Overwhelming for smaller companies with the configuration and approval flows built for large enterprises. | Has a limited presence in North America and also a lean partner ecosystem. |

| Might not be able to match the performance expectations of larger organizations where processing millions of journal entries per hour is required. | Companies with a diverse business model, might outgrow or struggle with the solution. |

| Overbloated financial control processes, such as compliance, allocation, and approval flows, which are only necessary for large organizations. | Companies involved with the M&A or the ones part of the PE portfolio might not be the best fit for IFS. |

| May require consulting assistance to navigate the channel, given the presence of unqualified ISVs and VARs. | IFS might not be the best fit to be used just as the corporate ledger for large project manufacturing enterprises. |

Conclusion

In conclusion, both Dynamics F&O vs IFS offer robust ERP solutions tailored to different business needs, with each excelling in distinct areas. Dynamics F&O is ideal for large, complex global organizations, particularly those seeking comprehensive financial management and integration capabilities across multiple entities. Its cloud-native platform and extensive consulting base make it a versatile choice for companies looking to streamline operations, though smaller businesses may find its complexity overwhelming. On the other hand, IFS shines in asset-heavy industries, offering strong field service and asset management capabilities that are hard to match. Its focus particularly on project-based, asset-centric operations makes it an appealing choice for companies within the upper mid-market.

Dynamics F&O offers significant advantages for businesses requiring comprehensive global capabilities and also best-of-breed integrations with CRM and field service. However, its complexity may necessitate third-party add-ons and consulting assistance. IFS, meanwhile, provides a more streamlined approach for companies in industries like energy, construction, and IT field services, excelling in managing field operations and asset management.

Both systems have their strengths and limitations, so businesses should carefully evaluate their specific need. Also, seeking assistance from an independent ERP consultant can significantly aid the decision-making process. To get a 360-degree view of feature comparisons, it’s essential to explore not only Dynamics F&O vs. IFS but also insights from other analyses such as Dynamics F&O vs. Acumatica, SAP S/4 HANA, Oracle Cloud ERP, NetSuite, Dynamics 365 BC, Infor LN, Infor M3, and Kinetic.