Last Updated on March 17, 2025 by Sam Gupta

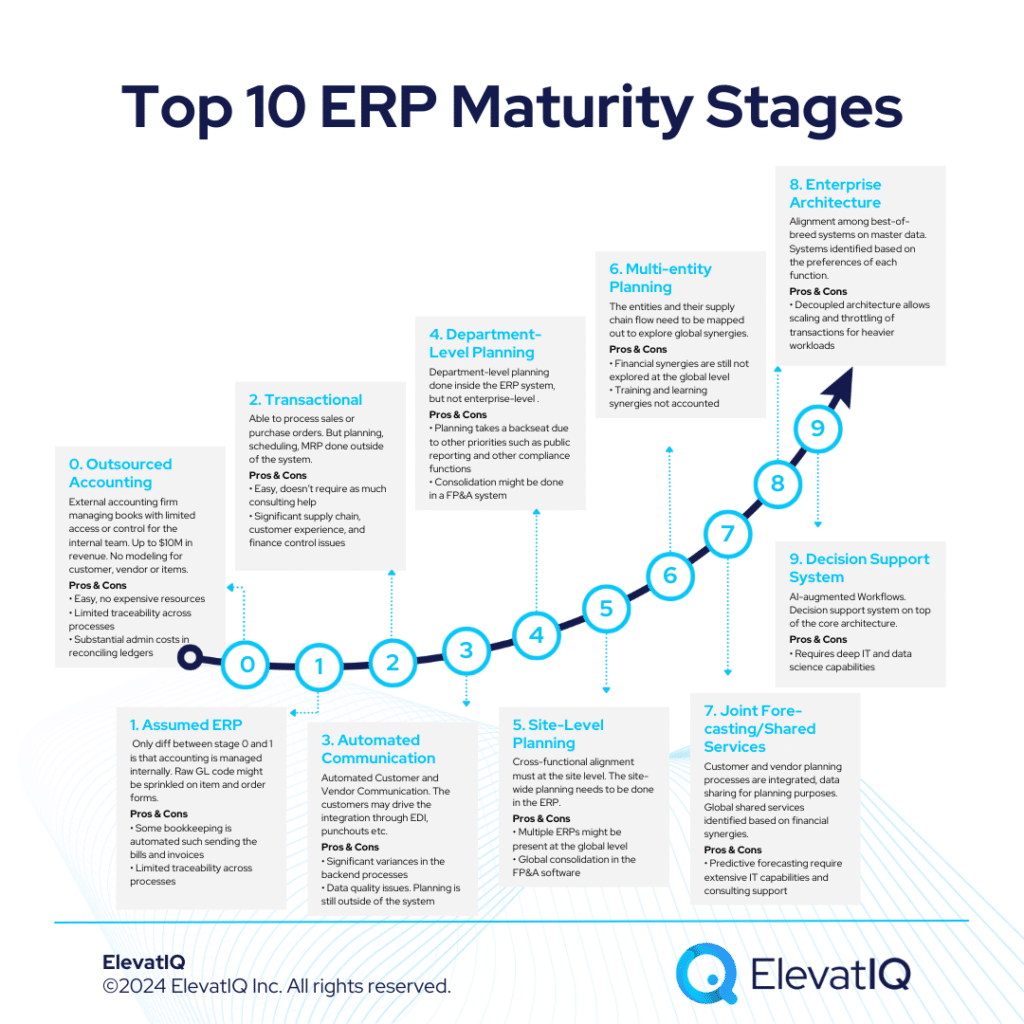

Getting the hang of the ERP implementation process takes time. Just the way it’s practically impossible to get a Ph.D. as soon as you enroll in a school, it’s also not pragmatic to get to one of the highest ERP maturity stages on your first attempt. In fact, you should not aim for that, as the success of your ERP implementation would depend upon finding the right tools designed for your ERP maturity stage.

In general, the first-time ERP implementation is likely to be the most immature, with very little process integration and, as a result, substantial manual overlaps (and admin efforts) across departments (and ledgers). Believe it or not, these implementations might even increase the overall workload without any tangible business outcome, discouraging first-time executives from any future digital transformation initiatives. When a company is past this ERP maturity stage, they hire slightly seasoned executives who are comfortable managing accounting and finance operations internally. As well as standardizing and modeling products (or services).

Sometimes, the ERP requirements of the company are driven by customers. In such cases, the front end typically takes priority over backend operations. But these implementation projects still have process and integration issues, creating planning siloes inside the company. As they advance with their backend processes, the 3rd and 4th ERP maturity stages are when they start experiencing material financial improvement from their operations. This is also where they would get true business agility. And the benefits of this agility? They can easily experiment with newer offerings and business models, allowing them to scale linearly. How about the overarching benefits? Gaining faster ERP maturity allows companies to grow rapidly.

Stage 0: Outsourced Accounting

This is perhaps the ERP maturity stage of most startups where they would be working with an outsourced accounting firm (to manage their books). They might use siloed systems (without embedded financial layers) to help with their operational processes, such as inventory, project management, and manufacturing. But at this stage, no integration with the accounting system exists.

The executive teams generally share their invoices, bills, and monthly statements with the accounting firm to manage their books. The accounting firm might provide reporting to the management teams to help with the decision-making. The internal team may have very limited visibility or control over how the accounting firm produces reports or insights. The operational teams might need to do data crunching at their end to handle their workflows and perform their jobs.

For industries heavier in transactions, these companies are generally under $10M in revenue. The other industries might be able to survive at this ERP maturity stage with much higher revenue. At this stage, they have no CFO or controller in place. The team may not have an accounting, finance, or supply chain background. And the founder might manage most strategic functions, sales, operations, IT, and finance. The team may not have the skillsets to undertake the data and process translation required to implement a tightly integrated ERP system. The product industries may have their SKU and BOMs modeled. However, no modeling might exist for customers and vendors. The services industries may not have any modeling at all.

Pros

- Easy for the team.

- Does not require expensive resources such as Ops and finance executives.

- Does not require as much consulting help to automate the processes.

Cons

- Limited traceability across processes.

- Substantial admin costs in reconciling ledgers.

- Data quality and financial control issues.

Stage 1: Assumed ERP

Once they outgrow the first ERP maturity stage, they can no longer rely on the outsourced accounting firm. But why? Because of the limited control and increased bookkeeping costs. At this stage, the companies in the product industries are in the range of $5M-$30 in revenue but higher for service-centric industries. They might still not have a CFO or controller in place. And neither is a CIO or Chief Supply Chain Officer. Most functions are still primarily controlled by the founder or President.

The system architecture? The team may be living on multiple disparate systems such as QuickBooks, Shopify, and CRM such as Salesforce or HubSpot, and financial planning and budgeting might be done at the department level, in siloed software, or in spreadsheets. And the state of their data? SKU and BOMs may be modeled for product-centric industries. Customers and vendors might be coupled with raw GL codes without the reusable customer classes or layers of GL codes to enforce business rules.

The only difference between stage 0 and stage 1 is that the accounting instance is managed internally as opposed to with the help of an accounting firm. As well as some light integration for sending bills, invoices, and GL codes in the raw form, with very little financial control across the processes. So the financial insights are generally limited – or would require substantial data crunching as the data model of various systems are isolated and not modeled. As a result, the end-to-end traceability of transactions is extremely challenging.

Pros

- Easy for the team.

- Does not require expensive resources such as Ops and finance executives.

- Does not require as much consulting help to automate and integrate the processes.

Cons

- Limited traceability across processes.

- Substantial admin costs in reconciling ledgers.

- Significant inventory, supply chain, customer experience, financial control, costing, and scheduling issues.

Stage 2: Transactional

With the growth of each department, the companies would struggle to grow (or might run into financial performance challenges) past $30M point. But why? Due to the increased marginal admin costs. And they would need to consolidate their processes and systems while keeping at least the main transactions (sales, purchase, and job orders) inside one core ERP system. In warehouse-centric industries, they might need to implement basic barcoding to reduce cycle time and transaction costs.

The companies in this ERP maturity stage are generally between $30M-$100M in revenue for product-centric industries and higher for service-centric ones. The team skills? CFO or Controller might be in place but not seasoned (with at most 2-3 ERP implementations under his/her belt). Ops might exist only as an execution function.No CIO or Chief Supply Chain Officer might be in place. Developers or IT managers might act as the CIO, with very limited ERP experience. The organizational structure might exist, but the CEO may not be as seasoned to build consensus and processes for cross-functional collaboration.

The system architecture? One or multiple ERP systems might exist, but the data, processes, and systems are only capable of transactional processing. The implementation may be finance-led, and the operational or supply chain perspective might be missing from the implementation, forcing them to use spreadsheets or siloed systems for their workflows. The implications? Significant variance and admin efforts are generally required to reconcile different books, ledgers, and master data.

Pros

- Easy for the team

- Does not require expensive resources such as Ops and finance executives to model various datasets

- Does not require as much consulting help to automate and integrate the processes

Cons

- Traceability limited across processes

- Substantial admin costs in reconciling ledgers

- Significant inventory, supply chain, customer experience, financial control, costing, and scheduling issues.

Stage 3: Automated Customer and Vendor Communication

Once they hit this stage, the transactional stage may not be enough with the growing transaction volume and, as a result, increased process overhead. Along with the growth, there are other factors, such as targeting larger customers — that might mandate seamless integration with their procurement systems – or having a specific certification or audit to win the large accounts. And this might drive another ERP implementation with the integration in mind.

Some companies may try to integrate their eCommerce systems or point-to-point integration offered through several SaaS tools. While the integration may be possible, the inclusion of additional channels and integration points will drive additional overhead. But the reconciliation is still done primarily through GL entries, with significant inventory inconsistencies and supply chain issues across channels.

Generally, multiple ERP systems are present at different warehouses and sites, with the role of ERP still very transactional in nature, with the majority of scheduling, planning, and costing happening outside of the ERP system or through ad-hoc adjustments. The consolidation is primarily done using the GL entries either inside the ERP system or using an FP&A tool. Significant manual reconciliation across the processes, but automated communication using punchouts, EDI, etc.

Pros

- Automated transactions with customer and vendor systems

- Does not require cross-functional alignment to operate on shared master data

- Functions can independently plan and use the tools of their choice

Cons

- Traceability limited across processes

- Substantial admin costs in reconciling ledgers

- Significant inventory, supply chain, customer experience, financial control, costing, and scheduling issues.

Stage 4: Department-Level Planning

While the customer and experience-driven requirements would take priority, the transactional nature of the processes and ad-hoc planning may lead to financial performance issues at this stage. And they will require teams to rethink their planning and scheduling processes. The increased workload and the pressure to hit the KPIs from the executive teams may lead departments to host their planning and scheduling processes inside the ERP system.

The planning would still be done at the department level due to the issues with the master data. And the site level or centralized planning may not be possible due to the differences between various departments. As well as the lack of experience of executive teams to build cross-functional consensus on the shared data. The executive team at this stage might still be relatively inexperienced in scaling global companies. Also, planning and scheduling might still take the backseat with the other easier priorities that might not require cross-functional alignments, such as public reporting or other compliance.

The system architecture? Multiple ERP systems may be present at different warehouses and sites, as well as operating in siloes, with no centralized planning or optimization. Consolidation of financial reports may be done manually or using FP&A software due to the disconnected data sources from various departments. So the implications? Significant manual reconciliation across the processes.

Pros

- Automated transactions with customer and vendor systems

- Does not require cross-functional alignment to operate on shared master data

- Functions can independently plan inside the ERP system without requiring cross-functional alignment on the master data

Cons

- Traceability limited across processes

- Significant issues with planning and scheduling.

- Oranization-wide synergies not explored, and significant admin effort to reconcile cross-functional processes.

Stage 5: Site-Level Planning

At this stage, the department-level planning will lead to significant outgrowth of the finance and IT department. But why? Due to the reconciliation efforts among various ledgers because of the disconnected systems and processes. The implications? Profitability or sales growth issues due to the limited marketing budget. Also, at this size, the disconnected planning across departments may lead to operational issues in meeting fulfillment targets( or scheduling resources). These issues will force executive teams to cross-functionally align the teams. Or hiring executive teams experienced in aligning teams and with several ERP implementations under their belt.

These executives might hire a business transformation consultant (a.k.a independent ERP consultants) to redesign their processes and master data optimized for site-level planning and scheduling. While executives may be convinced with the site-level centralized planning, they might not foresee the value in global planning and finding synergies across geographies. So there might still be multiple ERP systems across geographies with limited communication and collaboration among entities. And the multi-site consolidation and planning? They would use FP&A software in the reactive mode.

Pros

- The site is fully optimized with their internal processes

- Scheduling, costing, and planning are optimized at the site level

- traceability is possible

Cons

- Multi-entity and multi-geo synergies not explored

- Significant issues with planning and scheduling at the global level

- Heavier reconciliation cycle and longer close time due to the substantial variances among entities and translation required.

Stage 6: Consolidated Multi-entity Planning

While the site-level planning may be enough for domestic companies, they will outgrow that as their geographic footprint increase. As well as they get involved with substantial M&A cycles. This would require financial governance processes at the global level and finding synergies across geographies. At this stage, they would also require mapping out their material flow and supply chain processes across geographies to find synergies. But how? By consolidating the procurement of raw materials or reallocation of manufacturing capabilities.

Moving from site planning to consolidated multi-entity planning would require executive or private equity change that may be experienced in rewiring companies for global processes. A leading consulting firm may be involved in leading the international change process. As well as creating shared master data models that can be used across geographies. At this stage, while the business executives might be seasoned, the problems are not big to require large IT departments to do the workload planning and building an architecture that may require splitting the processes or systems because of the increased workload.

Pros

- Multi-entity and multi-geo operational synergies

- Shared master data across geos and shared planning and forecasting

- Multi-geo traceability possible

Cons

- Financial synergies not explored at the global level

- Training and learning synergies not accounted

- Might slow down the planning and forecasting cycles

Stage 7: Joint Planning and Forecasting/Shared Services

Once the operational synergies are fully exhausted, the next priority would be to align the vendor and customer processes for joint planning and forecasting. This would require mandating customer and vendor channels to share their data and be on the same/electronic systems, so the data can be gathered for joint forecasting and planning. Exploring the financial shared services model would require measuring transaction times and costs across geographies.

The shared services models and joint planning and forecasting would require a strong IT COE, which might only be possible after a company reaches a certain stage in ERP maturity. But the IT expertise is still limited to rewiring the business processes and designing the processes compatible to explore financial synergies. And the system architecture? There might be multiple ERP systems involved to segment the shared services model, but the operational processes would still be able to perform joint planning and forecasting.

Pros

- Predictive forecasting opportunities because of shared data from customers and vendors

- Ability to control disruptions in the end-to-end supply chain

- Ability to explore global financial synergies utilizing shared services

Cons

- Requires very expensive IT capabilities and consulting support

- Training and learning synergies not accounted

- Might slow down the planning and forecasting cycles

Stage 8: Enterprise Architecture/Best-of-breed

At this stage, the companies may be processing millions of journal entries, and so to handle the workload, the ledgers need to be designed to balance global planning and transactional performance. The processes need to be thought through from the technical perspective in terms of where the transaction volume and reconciliation effort are too high to keep the processes outside of the core ERP system. Also, due to the increased employee counts, the training and learning costs may drive the adoption of best-of-breed systems in specific functions.

This architecture would require a rethinking of enterprise architecture across system boundaries, in how the master data is produced and how it’s augmented, including reconciliation flows. Enterprise integration is so complex at this stage that companies need to implement a centralized integration architecture at the global level. They might as well require an MDM, mapping out all the producer and consumer workflows. This architecture may require testing throughput for each component to ensure that the global architecture is capable of handling the processing of these transactions. Most companies will have a very seasoned CIO as well as an IT department capable of designing the architecture at this scale.

Pros

- The decoupled architecture allows the scaling of transactions

- Business agility and faster M&A cycles because of clearly defined architecture

- Learning and training synergies explored

Cons

- Requires very expensive IT capabilities and consulting support

- Might be very expensive to build and maintain

- Lack of enterprise architecture expertise may lead to failed transformation initiatives

Stage 9: Decision Support System and AI-augmented Workflows

Clearly defined architectural boundaries and globally modeled master data allow mining quality data and building a decision support system layer on top of the core architecture. The decision support system would help complete the incomplete data by combining external datasets, build a data science layer that would help detect GL anomalies, superior revenue recognition workflows that will further optimize the profitability and revenue, and find opportunities by optimizing container space or better packaging strategies.

At this stage, all of your control centers are consolidated and have completely connected planning and forecasting data across the geographies, systems, processes, functions, customers, and vendors, as well as overlaying external industry datasets. Building and maintaining these capabilities requires not only the IT department but a very strong team of data scientists with deep capabilities of building models on top of the enterprise architecture to find revenue and profit opportunities, building real-time integrations with machines and sensors that can be reliably controlled using AI-augmented workflows.

Pros

- Connected planning allows for finding new revenue and profit optimization opportunities.

- Clearly separated boundaries for operational and data workflows allow scaling analytical workflows without impacting operational performance.

- Connected models allow operating on one planning data for the entire supply chain.

Cons

- Requires very expensive IT and data science capabilities

- Might be very expensive to build and maintain

- Lack of enterprise architecture expertise may lead to failed transformation initiatives.

Final Words

There are several variables that drive ERP maturity. And most companies go through many different cycles before they can realize true business value. So while you might feel that you are fairly successful with your ERP implementation, unless you are on stage 9, you have no idea what you have been missing out on.

And if you are curious whether you can get more juice from your existing digital transformation investments, try to grade yourself on this scale and gauge if you might have further room for improvement.