Growing startups transitioning from smaller accounting systems after they hit their first million in revenue may not immediately prioritize process integration. The simplicity of their existing systems may lead them to believe that larger counterparts overcomplicate processes and data. Some startups attribute their agility and superior customer experience to their “uniquely crafted processes.” Operational challenges typically emerge around $30-40 million in revenue, varying by industry, as headcount increases, leading to diverse processes and conflicting sources of truth.

This financial inflection point indicates the outgrowth of the startup stage. Progressing to the next inflection point involves embracing tighter processes and data integration while minimizing existing data silos. Companies weigh options between fully integrated ERP systems or partial integration, with operational integration being the priority. Depending upon the direct impact of data siloes on operational efficiency, the need for integration might vary. In certain industries, the need for integration may not be pressing due to lower transaction volumes or minimal impact on the bottom line.

During the startup phase, companies often lack the financial means to hire experienced executives or consultants. Consequently, they gravitate toward user-friendly ERP systems that require minimal expertise and are specifically designed to be “forgiving.” While their forgiving nature simplifies usage, it may lead to data integrity concerns. Nonetheless, these issues typically don’t have a substantial impact on the bottom line during this stage. The systems crafted for startups possess unique characteristics. Curious to discover which systems are tailored for this crucial phase?

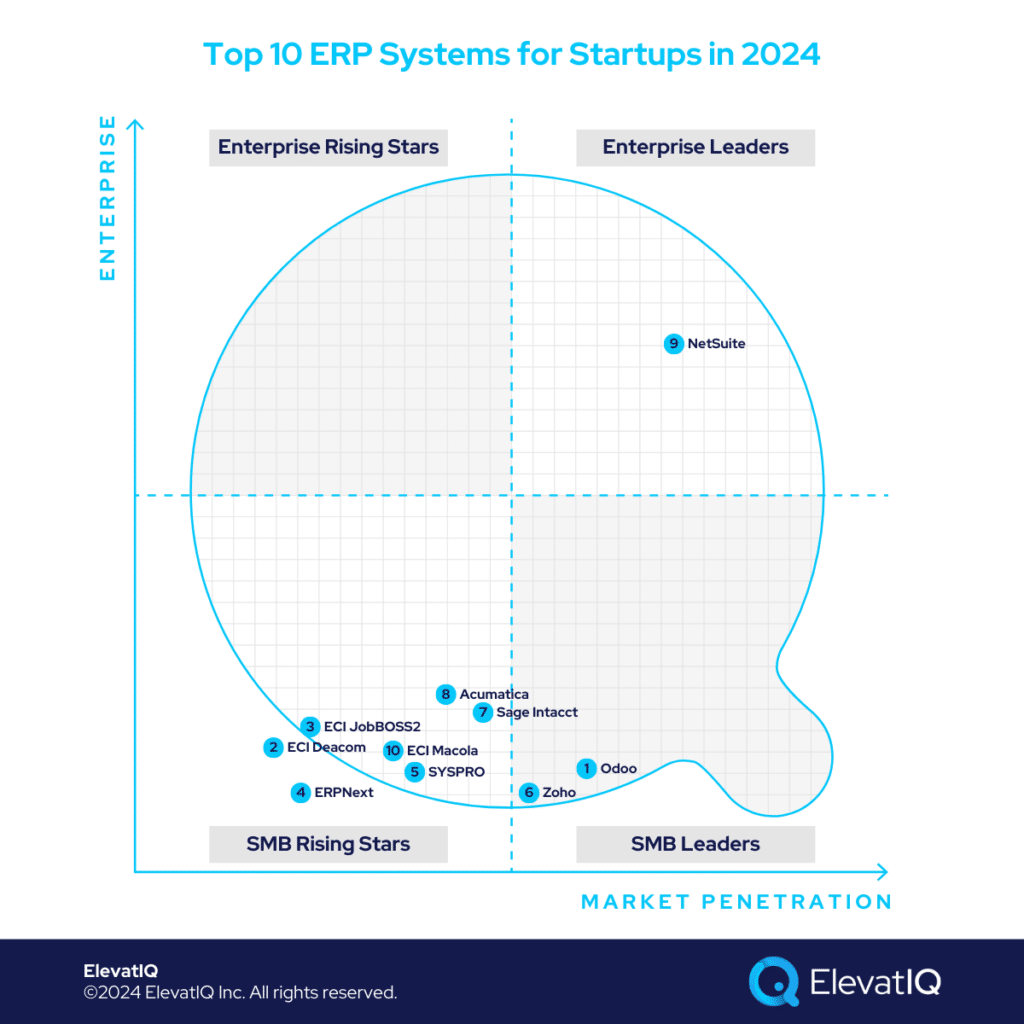

Criteria

- Definition of startups. Less than $10 mil in revenue or 20-25 employees. Founder leading most of the functions. 1-2 employees for each function, including accounting, purchasing, and operations. $0-30K implementation budget.

- Overall market share/# of customers. The higher the market share among the startup companies, the higher it ranks on our list.

- Ownership/funding. The more committed the management to the product roadmap, the higher it ranks on our list.

- Quality of development. The more cloud-native capabilities, the higher it ranks on our list.

- Community/Ecosystem. The larger the community with a heavy presence from the startups, the higher it ranks on our list.

- Depth of native functionality for specific industries. The deeper the publisher-owned out-of-the-box functionality, the higher it ranks on our list.

- Quality of publicly available product documentation. The poorer the product documentation, the lower it ranks on our list.

- Startup market share. The higher the focus on startups, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with startups. The more aligned the acquisitions are with the startup market, the higher it ranks on our list.

- User Reviews. The deeper the reviews from the startup companies, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product such as QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. ECI Macola

ECI Macola, acquired from Exact, resembles SYSPRO in functionality, serving 1K+ customers with deep capabilities for small manufacturers and distributors, surpassing Odoo or ERPNext. While not as robust as Acumatica or NetSuite, it excels with distribution industries and light manufacturing within ECI’s portfolio. Despite being less complex than Acumatica or NetSuite, consulting help is essential, setting it apart from DIY solutions like Odoo or ERPNext.

Without consulting help, companies are likely to run into implementation and adoption challenges. The uncertainty in ECI’s commitment to Macola’s future, especially innovation compared to other products in their portfolio, results in a substantial downgrade this year, maintaining rank #10.

Strengths

- A tightly integrated data model. The data model is scalable and very ERP-like but would require substantial consulting expertise to code and formalize SKUs, BOMs, and GLs.

- Processes are especially friendly for FMCG distributors. The data and process models are especially friendlier for FMCG distributors. It might not be as suitable for other industries or diverse business models.

- SQL-based. Compared to other solutions on this list, this is an SQL-based solution, providing tighter data integrity that might not be feasible with file-based variants.

Weaknesses

- Requires consulting help. The relational data structure requires substantial consulting help. Without seasoned executives or consutlants, the startups are likely to face implementation or adoption issues.

- Uncertain technology roadmap. With so many solutions in ECI’s portfolio, overlapping solutions like ECi Macola might not receive the same attention as their cloud-native variants.

- Not as cloud-native. While they have improved the tech stack substantially, it’s not as cloud-native as other options on this list.

9. NetSuite

NetSuite, a multi-tenant, multi-entity solution, targets distribution, B2C, and commerce-centric and service-centric organizations with an attractive starting implementation fee of $30K. The price point is appealing for startups, although it necessitates significant customer involvement. While suitable for upper-range startups, NetSuite is the most complex on this list, requiring consulting help.

Its object and process model rival Acumatica and Sage Intacct, and it offers globalized and operationally rich solutions for product-centric and service-centric companies. Despite being excellent for slightly larger organizations, NetSuite’s complexity makes it less desirable for startups seeking simpler DIY solutions. This year, NetSuite sees a slight downgrade but maintains rank #9 on the list for ERP systems for startups.

Strengths

- A scalable ERP. NetSuite’s diverse operational model and global capabilities can accommodate many business models in several geographies, making it a scalable ERP.

- Ecosystem and consulting base. The ecosystem has one of the best-of-breed SaaS solutions with pre-baked integration to augment its core capabilities, and the consulting base is available in most countries.

- Ability to support diverse business models. Ideal for startups that are private equity-owned or active with M&A cycles. Also, it is ideal for holding or private equity companies looking to streamline their entire portfolio on one platform.

Weaknesses

- Requires consulting help. The complex data model would require substantial consulting help, or the startups might face implementation or adoption challenges.

- Bloated Multi-entity Capabilities. The bloated multi-entity entities’ capabilities might be overkill for startups operating in just a couple of countries and might require unnecessary consulting and data modeling help.

- Expensive. NetSuite is perhaps one of the most expensive on this list, which might be cost-prohibitive for startups looking for affordable solutions.

8. Acumatica

Acumatica, a multi-tenant, multi-branch solution, primarily targets US and UK-based companies with limited global operational capabilities. It focuses on distribution, construction, manufacturing, and field service organizations, utilizing a reseller network for promotion. Although suitable for startups outgrowing their initial phase, Acumatica may lack simplicity for those avoiding costly consultants and intricate integrations.

Native integrations include Shopify, BigCommerce, POS, PLM, and marketplace integrations, catering to late-stage startups. However, the design complexity requires consulting help and budget allocation is necessary to maintain integrations. While Acumatica is comparable to NetSuite, its smaller size and simpler design make it more approachable for startups. This year, Acumatica experienced a slight downgrade but maintains rank #8 on the list of ERP systems.

Strengths

- A scalable ERP. Just like NetSuite, Acumatica’s data layers natively support complex business operations, whether you need simpler transactional processing capabilities or batch, to make your operations efficient.

- Ability to support diverse business models. Acumatica can support multiple business models as part of the same database, making it ideal for companies with diverse business models.

- Not as bloated with global capabilities. Limited multi-entity capabilities make the data model simpler for startups that don’t need unnecessary layers of global capabilities.

Weaknesses

- Requires consulting help. It would require seasoned ERP consultants to implement, making it less friendly for startups with limited implementation budgets.

- Pricing might be harder to predict with growth. Consumption-based pricing requires consulting expertise to estimate transactions as the pricing is not as intuitive and predictable as per-user pricing.

- Harder to learn. The ERP layers make it harder for startups to learn who might require a simpler data model without cross-functional dependencies and exceptions.

7. Sage Intacct

Sage Intacct focuses on non-inventory or service-centric industries, offering extensive financial capabilities suitable for mid-sized professional service firms. While surpassing QuickBooks enterprise, Microsoft GP, Zoho, and Odoo in financial capabilities, Sage Intacct may require add-ons, integrations, or custom development if you plan to use it in industries it doesn’t target, such as manufacturing or distribution.

Unlike QuickBooks or Odoo’s simplicity, Sage Intacct, tailored for slightly larger organizations, likely necessitates consulting help for implementation. For service startups, including non-profits, construction, marketing agencies, or financial services, Sage Intacct stands out, providing deeper operational capabilities unique to these verticals. Similar to NetSuite and Acumatica, Sage Intacct faces challenges with layers and complicated accounting and security structures that might be less beneficial for startups. As a result, it has been substantially downgraded and now ranks at #7 on our list of top 10 ERP systems for startups.

Strengths

- Ideal for holding and private equity companies looking for a corporate financial ledger. Ideal for holding companies to host global startups in one database.

- Friendlier for service-centric startups. Capabilities such as partner accounting and revenue recognition are natively built as part of the product.

- Ecosystem and consulting base. Their ecosystem consists of several SaaS vendors, and most accounting firms consult on the product.

Weaknesses

- Requires consulting help. A richer accounting and security layer would require help from consulting firms.

- Bloated Multi-entity Capabilities. Unnecessary for companies looking for simpler solutions.

- Integration challenges. Sage Intacct doesn’t have core capabilities built as part of the same solution, such as CRM or field service, requiring external software and integration maintenance in the long term.

6. Zoho

Zoho, like Odoo, dominates the CRM and HCM markets with a substantial market share. Employing a strategy akin to Salesforce and Workday but tailored for smaller startups in professional services, distribution, healthcare, and eCommerce. With growth, challenges may arise with intricate scenarios like consolidated invoicing or complex allocations. Despite these challenges, Zoho’s user-friendly design facilitates easy DIY implementation with minimal consulting help or expenses. However, we’ve downgraded Zoho due to less tightly integrated apps, causing potential data integrity issues for ERP-like operations. Despite the downgrade, it retains the #6 rank on our list of the top 10 ERP systems for startups in 2024.

Strengths

- Easier to learn for companies outgrowing QuickBooks. ERP data models are generally harder to learn because of cross-functional dependencies. That’s not the case with Zoho.

- Friendlier for service-centric startups. The data model is especially friendlier for service-centric operations, with CRM being very similar to Salesforce with an integrated project and HCM module.

- Does not require as much consulting help. The data model is flatter and doesn’t have as complex ERP layers, which makes the implementation easier and less expensive for startups.

Weaknesses

- Does not provide the same level of data and process integration as with a true ERP. Flatter data model would not be as scalable for startups looking for mature capabilities such as batch operations or layered pricing.

- Ecosystem limited to Zoho products. Zoho’s ecosystem might not have as many best-of-breed pre-integrated options for companies integrating with tools of their choice.

- Not a scalable ERP solution. The data model is not as tightly correlated, which will drive operational inefficiencies and financial control issues at the micro level with growth.

5. SYSPRO

SYSPRO, a single-tenant product, closely resembles ECI Macola, Microsoft GP, SAP Business One, or Infor Visual. Tailored for small discrete and process manufacturers and distributors, it offers extensive operational functionality comparable to Acumatica or NetSuite.

While not as globally localized as SAP Business One, SYSPRO matches in financial capabilities, supporting complex distribution businesses with rich UoMs, activity-based accounting, and layered object hierarchies. Despite these capabilities, implementation demands consulting help, posing challenges for startups in self-serve mode.

Comparable to Acumatica or NetSuite for businesses with one or a couple of US sites, SYSPRO lacks the cloud-native edge of newer players. Its operational and financial depth surpasses Odoo and Zoho, yet the complexity and implementation costs deter startups from seeking simpler, DIY-friendly solutions. Despite pros and cons, SYSPRO maintains the #5 rank on our list of top 10 ERP systems for startups.

Strengths

- A tightly integrated data model. An ERP-like data model with mature ERP capabilities, such as complex layers for inventory costing and MRP.

- Ability to support diverse business models. SYSPRO, while friendlier for F&B-centric distributors, can support many business models including discrete and process, as well as distribution.

- SQL-based. Compared to other solutions on this list, this is an SQL-based solution, providing tighter data integrity that might not be feasible with file-based variants.

Weaknesses

- Requires consulting help. The relational data structure requires substantial ERP consulting help. Without seasoned executives or consutlants, the startups are likely to face implementation or adoption issues.

- Harder to learn. The ERP layers would make it harder for companies that might be outgrowing point solutions such as accounting or CRM.

- Not as cloud-native. While they have improved the tech stack substantially, it’s not as cloud-native as other options on this list.

4. ERPNext

ERPNext stands out for startups with technical skills, following a distribution strategy akin to Odoo and fostering a vibrant open-source developer community. Though not as well-adapted as Odoo, it caters to the verticals with a heavier need for custom development, such as non-profits or universities.

While supporting basic transactions, it lacks depth in business objects and process models in richer ERP systems, which is crucial for scalability. Unlike other niche, focused solutions solutions, such as ECI Deacom, ProShop, GlobalShop, and JobBOSS2, ERPNext lacks industry-specific last-mile functionality. Despite the pros and cons, it maintains the rank of #4 on our list of the top 10 ERP systems for startups.

Strengths

- Easier for companies to outgrow QuickBooks. The data model is not as tightly correlated and integrated as other richer ERP solutions, making it easier for startups transitioning from point solutions such as CRM or QuickBooks.

- Ecosystem and Development Help. ERPNext has a vibrant technical community of developers, which makes it affordable for companies to access technical talent in several geographies.

- Does not require as much consulting help. The data layers are not as intertwined as the other richer ERP systems, making the implementation easier and less expensive.

Weaknesses

- Does not provide the same level of data and process integration as with a true ERP. Cross-functional data layers don’t have the same hierarchies and layers, making it less scalable compared to other richer ERP solutions.

- An open-source ecosystem might lead to inexperienced developers promoting untested and unsecured code. The code promoted by inexperienced developers may lead to cybersecurity issues and operational disruptions.

- Requires business consulting help to avoid overengineering by developers. And overengineering might lead to maintenance nightmares and operational inefficiencies.

3. ECI JobBOSS2

ECI JobBOSS2 emerges as a new cloud-native product, combining JobBOSS and E2 Shoptech’s strengths. JobBOSS was tailored for smaller custom manufacturing startups, while E2 Shoptech, a more robust counterpart akin to SYSPRO or Macola, targeted smaller jobs and machine shops, featuring deep capabilities seen in products like GlobalShop or ProShop.

As ECI JobBOSS2 unfolds, it’s poised to inherit JobBOSS’s development flavors, promising easy configuration in the DIY mode. With deeper functionality tailored for machines and job shops, unparalleled in vanilla solutions like Odoo or ERPNext, ECI JobBOSS2 holds its ground at #3 on our list of top 10 ERP systems for startups.

Strengths

- Easier to learn. The data model and user flows are similar to QuickBooks, making the software easier to learn for startups.

- Friendlier for machine shops. Ideal for smaller machine shops without complicated inventory needs or SKU codings but still with the most relevant operational capabilities, such as job management and basic scheduling.

- Does not require as much consulting help. The data model does not require codings or layers similar to richer ERP systems, making it much less expensive to implement.

Weaknesses

- Might not provide other crucial integrations such as MES or QMS out-of-the-box. Gaining compliance certifications may require expensive consulting and development help.

- Private Equity ownership might not be as friendly for startups with support and consulting. The support and consulting might not be as friendly as ECI, which is privately equity-owned, as startups might expect from other family-owned solutions.

- Compliance workflows such as AS9100 might require substantial consulting support. The compliance workflows might not be as pre-baked with other solutions that might not be ERP but might have richer operational and compliance capabilities.

2. ECI Deacom

ECI Deacom stands out as the purpose-built solution for process industries catering to food and beverage distributors, pharmaceutical and cannabis manufacturers, and DTC brands. Unlike file-based solutions, DeaCom excels in transactional integrity, boasting an SQL-based data store. Even more mature systems like Acumatica or NetSuite face challenges in these verticals, necessitating multiple add-ons.

Companies in these niches demand unique capabilities, including traceability, recall management, route accounting, and compliance with serial number requirements. While ECI Deacom, born in the cloud, may not have as detailed and scalable data model as NetSuite or Acumatica, its seamless implementation in the DIY mode, with minimal consulting assistance, contributes to its rank at #2 on our list of the top 10 ERP systems.

Strengths

- Easier to learn. A flatter data model makes it easier for startups transitioning from point solutions such as QuickBooks to learn.

- Cloud-native. The cloud-native interface would not have as much switchover effect as with the other legacy variants.

- Substantial last-mile capabilities for process and F&B verticals. Deeper operational capabilities required for process industries, such as route accounting or multiple serial and lot numbers supported on the item master, make it uniquely suitable for these industries.

Weaknesses

- The data model is not as scalable as a true ERP. The data model is especially flatter for complex operations such as multi-entity accounting, running into scalability and traceability issues.

- Private Equity ownership might not be as friendly for startups with support and consulting. The support might not be as friendly as with a family-owned company.

- It would require consulting help with data modeling. The deep layers of data required for pharma and F&B operations would require consulting support to implement successfully.

1. Odoo

Odoo emerges as a straightforward choice for startups, offering superior operational capabilities compared to cloud accounting solutions like QuickBooks, Xero, or FreshBooks. With an affordable per-app business model, Odoo has a tighter data model comparable to mature ERP solutions than lightly integrated software like Zoho. While lacking out-of-the-box last-mile functionality for niche industries, Odoo stands out for eCommerce companies and industry 4.0 integrators, leveraging in-house capabilities to extend and support internal processes.

Odoo’s object and process model may not match the richness of Acumatica or NetSuite, but this simplicity contributes to its startup-friendly design, eliminating the need for expensive consulting assistance. As a result, Odoo maintains its top position at #1 on our list of the top 10 ERP systems for startups.

Strengths

- Easier for companies to outgrow QuickBooks. The lean data model and workflows make it easier for startups transitioning from QuickBooks-like solutions to learn.

- Ecosystem and Development Help. The availability of cheaper technical talent globally helps startups extend or augment core capabilities.

- Ideal for diverse startups. The data and process model supports diverse industries, including product and service-centric startups, making it an ideal solution for private equity and holding companies to host all of their global startups in one database.

Weaknesses

- Mature capabilities are not as pre-baked as larger peers. Mature capabilities such as MRP, allocation, and batch are not as detailed as with other richer ERP systems.

- An open-source ecosystem might lead to inexperienced developers promoting untested and unsecured code. The inexperienced developers might promote untested code, causing cybersecurity issues or operational disruptions.

- Requires business consulting help to avoid overengineering by developers. Without access to seasoned ERP consultants, Odoo implementation is likely to run into implementation or adoption challenges.

Conclusion

Crafted for startups, these solutions provide vital features without requiring consulting, facilitating a smooth transition and adoption. With essential pre-built capabilities, they surpass other cloud accounting alternatives that barely provide after-the-fact financial reporting without access to critical financial control that you need with growth.

If you’re moving beyond QuickBooks, Xero, or FreshBooks, these solutions are perfect for advancing to the next stage of growth without straining your finances. Ensure a thorough analysis of your specific needs to pinpoint the solution aligning with your critical success factors. If you lack regular insights into these solutions, consider engaging independent ERP consultants for informed guidance.