Last Updated on March 17, 2025 by Sam Gupta

Aerospace and defense industries face unique challenges due to stringent quality and regulatory requirements. Unlike consumer-driven automotive sectors, A&D operates with long sales cycles and uncertainties, making supply chain planning intricate. The custom nature of A&D products, coupled with formal revision tracking, adds complexity, necessitating ERP systems with unique BOM structures. While collaboration with local suppliers has its own challenges, international supplier collaboration dictates trade compliance requirements at another level because of national security and geopolitical issues.

Equally challenging are manufacturing processes that vary per business model, requiring solutions tailored to each. While some ERP systems suit plastic manufacturers serving A&D OEMs, others offer versatility for diverse global business models. Despite looser margin requirements in A&D compared to automotive, stringent quality standards can impact margins. Highly engineered aerospace parts demand precise vendor collaboration and time sensitivity to avoid supply chain disruptions.

A&D companies engage in extensive pre-sales processes, involving multiple stakeholders and proofs-of-concept during R&D. This uniqueness underscores the need for ERP systems with built-in engineering and pre-sales workflows to support contract requirements. Some business models might require access to proprietary databases, integration with industry systems, and compliance requirements related to the upkeep of processes. Choosing an ERP system for the A&D industry requires a deeper study of business models and transactions, as generic solutions may necessitate significant investments in longer implementation cycles, which might be out of the range of most SMB companies. Find out which ERP systems are designed to meet the distinctive needs of the A&D sector.

Criteria

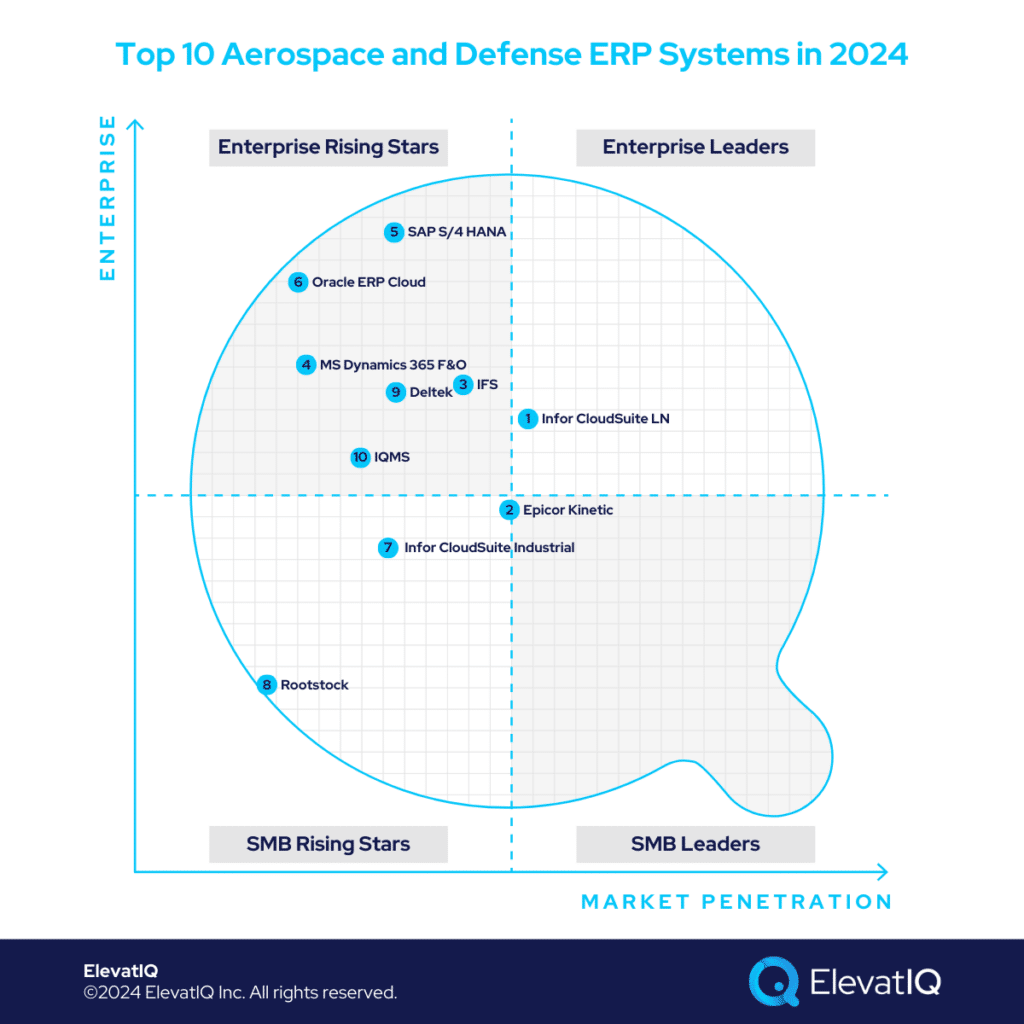

- Definition of an aerospace and defense company. These are the companies in the A&D ecosystem, including OEMs, manufacturers, and distributors. The list considers companies of all sizes in this ecosystem.

- Overall market share/# of customers. Higher market share among aerospace and defense companies ranks higher on our list.

- Ownership/funding. The more committed the management to the product roadmap for the A&D companies, the higher it ranks on our list.

- Quality of development: More cloud-native capabilities rank higher on our list.

- Community/Ecosystem. The larger the community with a heavy presence from aerospace and defense companies, the higher it ranks on our list.

- Depth of native functionality for specific industries. Deeper publisher-owned out-of-the-box functionality ranks higher on our list.

- Quality of publicly available product documentation. Poorer product documentation ranks lower on our list.

- A&D company market share. The higher the focus on aerospace and defense companies, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- The acquisition strategy is aligned with aerospace and defense companies. The more aligned the acquisitions are with the aerospace and defense companies, the higher it ranks on our list.

- User Reviews. The deeper the reviews from aerospace and defense companies, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product such as QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. IQMS/DELMIAWorks

IQMS, tailored for plastics-centric operations in the aerospace and defense ecosystem, stands out with last-mile capabilities and depth in aerospace compliance. Well-suited for A&D firms supplying plastic components to tier 1 and tier 2, it may not address the intricacies of operations in OEMs or tier 1 companies. The native support for ITAR certifications adds to its appeal. However, its weaknesses become apparent when considering larger A&D companies engaged in complex aerospace projects, contributing to its placement at #10 on our list of top aerospace and defense ERP systems.

Strengths

- Great for plastic manufacturers supplying to aerospace. While limited in its suite, capabilities for plastic-centric industries outshine when it comes to unique scheduling requirements.

- Best for aerospace and defense companies on SolidWorks. With the same company as SolidWorks owning it, tighter and seamless integration of both products, which are built and maintained by the same vendor, is a huge plus.

- Technology – This is probably the most legacy solution of all on this list, with no announcement if they plan to modernize the technology.

Weaknesses

- Limited focus. The limited focus might be a challenge for aerospace and defense companies diversifying their operations and being active with M&A cycles.

- Limited ecosystem. The consulting base is extremely limited with most resellers being CAD resellers, with limited experience in ERP implementation and cross-functional processes.

- It is not the right fit for holding and private equity companies as a corporate ledger. While a great subsidiary solution and a solution for pure-play plastic-centric manufacturers for SMB aerospace and defense companies, it’s not the best fit for diverse A&D companies as their main ERP solution.

9. Deltek

Deltek, tailored for government contractors in the A&D sector, excels in project-centric organizations. It suits A&D companies that are heavily reliant on government revenue. However, its narrow focus poses challenges for firms equally involved in commercial and government sectors or those with diverse business models like field service and manufacturing.

Despite strengths, Deltek exhibits weaknesses in CRM capabilities, limiting suitability for organizations with extended sales cycles and collaboration needs. Manufacturers or distributors targeting government sectors may find their manufacturing and distribution capabilities lacking. Nonetheless, Deltek maintains its prominence for project-driven government A&D contractors, securing the #9 rank on our list of top aerospace and defense ERP systems.

Strengths

- Last-mile capabilities for GovCon for A&D contractors. The GovCon functionality is intricate, requiring subject matter expertise and driving longer implementation time without Deltek’s pre-baked functionality.

- Access to the databases and networks relevant to these industries. Deltek has access to quoting databases and industry data, making it a very strong ERP system for companies in the A&D sector.

- Multi-entity capabilities. Their multi-entity capabilities are rich, making them suitable for upper mid-market and lower enterprise companies to host all of their entities in one database.

Weaknesses

- Limited focus. The limited focus of the solution might be a challenge for enterprise companies active with M&A cycles, especially for business models outside of Deltek’s expertise.

- Limited ecosystem and consulting base. As of today, their ecosystem and consulting base is significantly limited.

- Not as complete ERP capabilities as part of the suite. Most of the ERP products in Deltek portfolio are not as complete as other solutions on this list, requiring integration and external systems for missing capabilities.

8. Rootstock

Rootstock caters to engineer-to-order centric SMBs in the A&D sector, offering robust mobile-native capabilities atop the Salesforce platform. Particularly fit for smaller A&D companies with heavy usage of the Salesforce platform for their CRM and field service solutions, it might also fit as a subsidiary solution for some entities that might be heavier users of Salesforce and might prefer a unified user experience across the enterprise. Given these considerations, Rootstock ranks at #8 on our list of top aerospace and defense ERP systems.

Strengths

- Native integration with other salesforce products. Its strength Includes native integration with other Salesforce products such as Salesforce CRM and Field Service. This is especially beneficial for A&D companies with longer sales cycles with multiple stakeholders and parties collaborating during the pre-sales phase.

- Cloud-native mobile capabilities. Inheriting native mobile capabilities from the Salesforce platform, it is strong with native cloud mobile capabilities.

- WBS-centric manufacturing capabilities. While Rootstock might not be as strong with all modes of manufacturing as some of the other solutions on this list, it is especially strong in project-centric manufacturing with detailed WBS and milestones spanning over months.

Weaknesses

- Finance and Accounting. Rootstock started as the MRP solution and relied on other accounting solutions. Their accounting capabilities are not as layered and scalable, requiring ad-hoc arrangements.

- Reliance on Third-part Quality Module. With quality processes embedded at each step, using a third-party quality module might not provide as immersive an experience as products that have quality baked into their processes.

- Smaller Ecosystem. The ecosystem is relatively small for rootstock, with less than 500 installations. This could pose a risk in finding talent for future support and customizations.

7. Infor CloudSuite Industrial

Infor CloudSuite Industrial caters to SMB A&D manufacturers with short-run jobs and deep layers of sub-assemblies, with or without formal product management or engineering processes.

Its embedded quality processes are especially friendly for A&D companies since centralized quality management across processes, including procurement, production, and customer services, is required for traceability and reporting. Limited operational WBS support and BOMs without dates may pose challenges for A&D companies with extended lead times. Despite these considerations, Infor CloudSuite Industrial maintains its #7 rank on our list of top aerospace and defense ERP systems.

Strengths

- Support for both informal and formal BOMs and engineering processes. Infor CSI BOMs don’t mandate revision numbers, making it easier for A&D companies without formal products to implement their BOMs.

- Deep Costing Layers. Compared to other products with patchy experience, the costing layers follow superior rational structure and scale well, where tracking costs for large programs such as A&D might be critical.

- Field service integration with core manufacturing processes. Especially critical for A&D suppliers that collaborate with their OEMs in the post-sales phase, with multiple parties involved for servicing, internal or external, containing complex commission structures.

Weaknesses

- Not fit for diverse A&D manufacturers. A&D manufacturers that might also be heavy in process-centric operations might struggle with it.

- Not for A&D manufacturers but also heavy in distribution. Infor CSI suits pure-play manufacturing organizations with limited support for distribution planning and operations.

- Not strong for WBS-centric manufacturing. Long-standing programs spanning multiple months require detailed WBS-centric capabilities to support both operational and financial activities as part of the project, critically important A&D OEMs.

6. Oracle Cloud ERP

Targeting large global A&D companies, Oracle Cloud ERP offers diverse solutions for complex business models. Ideal fit for large A&D companies as a corporate financial ledger while using focused solutions such as Infor LN, IFS, or Deltek at the subsidiary level. Using it as the main ERP and building last-mile A&D companies might require substantially longer implementation cycles, rendering them cost-prohibitive for SMB companies. Given these considerations, Oracle ERP Cloud maintains its #6 rank on our list of top aerospace and defense ERP systems.

Strengths

- Ideal solution for publicly traded large global A&D companies. Oracle Cloud ERP is an ideal solution as the corporate financial ledger for A&D companies with multiple layers of financial hierarchies operating in multiple countries.

- Proven solution with large workloads. Large A&D companies may process millions of GL entries per hour. The workload Oracle Cloud ERP is designed to handle.

- Ecosystem. It has an ecosystem of experienced consultants who have the capabilities to handle the design and architecture of such complex enterprises.

Weaknesses

- Limited last-mile capabilities. The last mile capabilities for specific A&D verticals, such as integration with GovCon processes and database may require solutions from third party or custom integration, making the implementation overly expensive.

- Limited pre-integrated capabilities with A&D-specific ancillary systems. Integration with A&D-specific PLMs, configurators, and CPQ systems is not out-of-the-box, increasing the implementation time and costs.

- Overwhelming for SMB A&D companies. It is not a fit for SMB A&D companies because the over-bloated financial layers are only relevant for large A&D companies.

5. SAP S/4 HANA

SAP S/4 HANA supports complex business models and global entities in the same database, providing end-to-end traceability for large global A&D companies. Ideal fit for large A&D companies as a corporate financial ledger while using focused solutions such as Infor LN, IFS, or Deltek at the subsidiary level. Using it as the main ERP and building last-mile A&D companies might require substantially longer implementation cycles, rendering them cost-prohibitive for SMB companies. Given these considerations, SAP S/4 HANA maintains its #6 rank on our list of top aerospace and defense ERP systems.

Strengths

- Ideal solution for publicly traded large global A&D companies. SAP S/4 HANA is an ideal solution as the corporate financial ledger for A&D companies with multiple layers of financial hierarchies operating in multiple countries.

- Proven solution with large workloads. Large A&D companies may process millions of GL entries per hour. The workload and MRP workloads SAP S/4 HANA is designed to handle.

- Financial and transactional traceability embedded for globally complex A&D companies. SAP S/4 HANA has transactional maps embedded as part of the product, providing the traceability that globally complex A&D OEMs with large programs need.

Weaknesses

- Limited last-mile capabilities. The last-mile capabilities for specific A&D verticals, such as integration with GovCon processes and databases, may require solutions from third parties or custom integration, making the implementation overly expensive.

- Limited pre-integrated capabilities with A&D-specific ancillary systems. Integration with A&D-specific PLMs, configurators, and CPQ systems is not out-of-the-box, increasing the implementation time and costs.

- Overwhelming for SMB A&D companies. It is not a fit for SMB A&D companies because the over-bloated financial layers are only relevant for large A&D companies.

4. Microsoft Dynamics 365 Finance & Operations

MS Dynamics 365 F&O caters to global A&D companies in the upper mid-market and lower enterprise space, supporting complex business models, including support for discrete, process, and distribution-based planning. It is especially strong with WBS-centric processes covering operational and financial schedules equally well. The challenge with MS Dynamics 365 F&O would be the best-of-breed ancillary systems critical for A&D systems, which are not owned and maintained by Microsoft, requiring third-party add-ons. Given these considerations, MS Dynamics 365 F&O maintains its position at #4 on our list of top aerospace and defense ERP systems.

Strengths

- Ideal solution as a corporate financial ledger for publicly traded large global A&D companies. In conjunction with A&D-focused ERP systems at the subsidiary level.

- Ideal solution for upper mid-market or lower enterprise A&D companies looking for one solution to host their diverse business models, including discrete and process manufacturing, distribution, MRO, and A&D-specific consulting services.

- Ecosystem. The largest marketplace with solutions to augment most A&D business models not supported by the core product.

Weaknesses

- Not proven solution with large workloads. While MS Dynamics may have been used as a financial ledger for the workload of Fortune 1000, it is not as proven for the global MRP workload in one solution.

- Limited last-mile capabilities. The last-mile capabilities for specific A&D verticals, such as integration with GovCon processes and databases, may require solutions from third parties or custom integration, making the implementation overly expensive.

- Limited pre-integrated capabilities with A&D-specific ancillary systems. Integration with A&D-specific PLMs, configurators, and CPQ systems is not out-of-the-box, increasing the implementation time and costs.

3. IFS

Targeting larger field service and MRO organizations, IFS is a great solution for larger A&D companies looking for best-of-breed field service and EAM capabilities atop corporate financial ledgers such as SAP or Oracle. It might also be a great fit for upper mid-market and lower enterprise companies primarily focusing on managing large A&D programs. Despite these considerations, IFS maintains its rank at #3 on our list of top aerospace and defense ERP systems.

Strengths

- Unique program architecture tailored to track the costs of large A&D programs. Unlike smaller ERP systems with a 1:1 relationship between a sales order and a project, IFS is designed to handle large programs where consolidated visibility would be critical without ad-hoc arrangements.

- Enterprise-grade field service and asset management capabilities. Especially suitable for A&D companies because of their need to maintain expensive assets with complex workflows and scheduling requirements for field services.

- Unique financial workflows to support complex A&D programs. Expensive MRO operations require unique workflows, such as closing transactions financially at the line level, which might not be possible with ERP systems not designed to handle such transactions.

Weaknesses

- Limited focus. The limited focus might be a challenge for A&D companies active with M&A cycles.

- Limited ecosystem. Its presence and install base are still limited in North America compared to other solutions on this list.

- It is not the right fit for holding and private equity companies as a corporate ledger. While IFS can provide the best-of-breed capabilities in a tier-two architecture or can act as one solution, IFS might not be the best fit to be used just as the corporate ledger for large A&D enterprises.

2. Epicor Kinetic

Highly effective for SMB A&D companies, Epicor Kinetic’s BOMs align seamlessly with A&D firms employing formal engineering processes, emphasizing critical traceability in change control. Specifically tailored for metal-centric industries supplying aerospace, its inventory model accommodates vital processes like nesting and includes attributes in MRP runs. Planning processes cater to complex A&D manufacturing companies with extensive distribution business models. Its WBS-centric processes adeptly handle large programs and short-run jobs. With these considerations, Epicor Kinetic secures the #2 position on our list of top Aerospace and Defense ERP systems.

Strengths

- Great for formal manufacturing organizations. The manufacturing organizations with formal engineering processes with revision numbers would relate to the product more.

- MRP runs are designed to support complex inventory. MRP runs support product attributes for planning, which is critical for business models such as metal parts manufacturers supplying to aerospace OEMs.

- WBS-centric process to handle large programs. Detailed WBS structure containing operational and financial schedules along with large programs requiring a 1:N relationship between a sales quote/order and a project.

Weaknesses

- Not a great fit for A&D companies with more than three layers of financial hierarchies. Requires ad-hoc arrangements for larger mid-market companies with more than three financial hierarchies.

- Limited focus. Private equity and holding companies looking for support outside of Epicor’s core expertise might struggle with it.

- Limited support for field service, process manufacturing, and scalable customer masters. The acquired field service solution is not as seamlessly integrated as today, as well as struggling with process-heavy A&D companies, such as a plastic manufacturer supplying to A&D OEMs. The customer master layers are not as detailed as with other solutions, requiring ad-hoc arrangements for consolidated insights.

1. Infor CloudSuite LN

Infor LN caters to the upper mid-market and lower enterprise A&D manufacturing companies, serving as their primary ERP, provided their business model aligns with Infor LN’s capabilities. It also excels as a subsidiary solution for large enterprises with independently operating subsidiaries. Unlike smaller manufacturing ERPs with limitations in detailed WBS processes or supporting consolidated views of large programs, Infor LN equally supports diverse A&D international business models, with companies heavily focused on process operations being the only exception. With these strengths, Infor LN retains its top position on our list of aerospace and defense ERP systems.

Strengths

- Last-mile capabilities for most A&D business models. Capabilities such as contract flow-down clauses and government audit support require intertwined business objects. They might not work as seamlessly with systems not naturally designed to support these processes.

- WBS-centric large programs with mixed-mode manufacturing support. Native support for large programs with superior 1:N relationships among projects, quotes, sales orders, and contracts.

- A&D-centric PLM with embedded processes and configurator. PLM-ERP integration requires bi-directional data exchange. Using an external system that is not OEM-owned and maintained is technically and financially risky.

Weaknesses

- Not the best fit as a corporate ledger. Private equity and holding companies requiring global solutions with a tier-2 solution at the subsidiary level might not be the best use of Infor LN’s strengths.

- Limited focus. The limited focus on certain business models poses the risk of requiring other ERP systems to support complex and diverse business operations such as process manufacturing or metal-centric A&D companies.

- Limited ecosystem and consulting base. The consulting base is highly limited, primarily relying on very few Infor resellers for consulting and support.

Conclusion

Navigating complex operations and rigorous regulations, aerospace and defense companies demand meticulous process control. Meeting regulatory obligations often brings substantial administrative overhead, affecting profit margins.

Opt for an ERP system tailored to A&D processes, steering clear of generic solutions that may require risky customizations and add-ons, elevating the risk of ERP implementation failure. Ensure your choice aligns with aerospace and defense requirements, utilizing this list as a guide to narrow down options. Seeking assistance from independent ERP consultants is a prudent step toward ensuring success.