Last Updated on March 17, 2025 by Sam Gupta

Selecting an ERP for the automotive industry is uniquely challenging. The consumer-centric nature renders its processes exceptionally intricate and unpredictable. These behaviors have profound downstream effects on the entire value chain, necessitating constant innovation and modifications to existing products. This drives the need for tighter collaboration and joint planning, influencing compliance and global trade processes. This holds true even for smaller companies with limited global operations.

Additionally, the pressure of tighter margins necessitates heightened efficiency on shop floors, introducing distinctive scheduling challenges linked to specialized skills for each operation. Within the value chain, various players may share commonalities and differences, both equally influencing business processes. Shared aspects include adherence to quality standards and OEM reporting, as well as collaborative planning efforts. Conversely, divergent needs arise from unique manufacturing and distribution processes and planning methodologies. Consider, for instance, the contrast between a plastic supplier and a consumer-grade chemical distributor. Even the operations of a machine shop may significantly differ from those of an OEM specializing in school buses. All are generally bundled under automotive, yet their operations and processes are uniquely different.

These distinct considerations emphasize the necessity of understanding the critical success factors. As well as finding an appropriate ERP system designed to support similar transactional volume and operational processes. Choosing an ERP system not explicitly crafted for this sector might drive overengineering. And, in extreme cases, adoption and implementation challenges. Keen to discover the ERP systems fit for these market segments? Join us as we explore the top 10 automotive ERP systems on our list.

Criteria

- Definition of an automotive company. These are the companies in the automotive ecosystem, including OEMs, aftermarket service providers, manufacturers, and distributors. The list considers companies of all sizes in this ecosystem.

- Overall market share/# of customers. The higher the market share among automotive companies, the higher it ranks on our list.

- Ownership/funding. The more committed the management to the product roadmap for the automotive companies, the higher it ranks on our list.

- Quality of development. The more cloud-native capabilities, the higher it ranks on our list.

- Community/Ecosystem. The larger the community with a heavy presence from automotive companies, the higher it ranks on our list.

- Depth of native functionality for specific industries. The deeper the publisher-owned out-of-the-box functionality, the higher it ranks on our list.

- Quality of publicly available product documentation. The poorer the product documentation, the lower it ranks on our list.

- Automotive company market share. The higher the focus on automotive companies, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with automotive companies. The more aligned the acquisitions are with the automotive companies, the higher it rank on our list.

- User Reviews. The deeper the reviews from automotive companies, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product such as QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

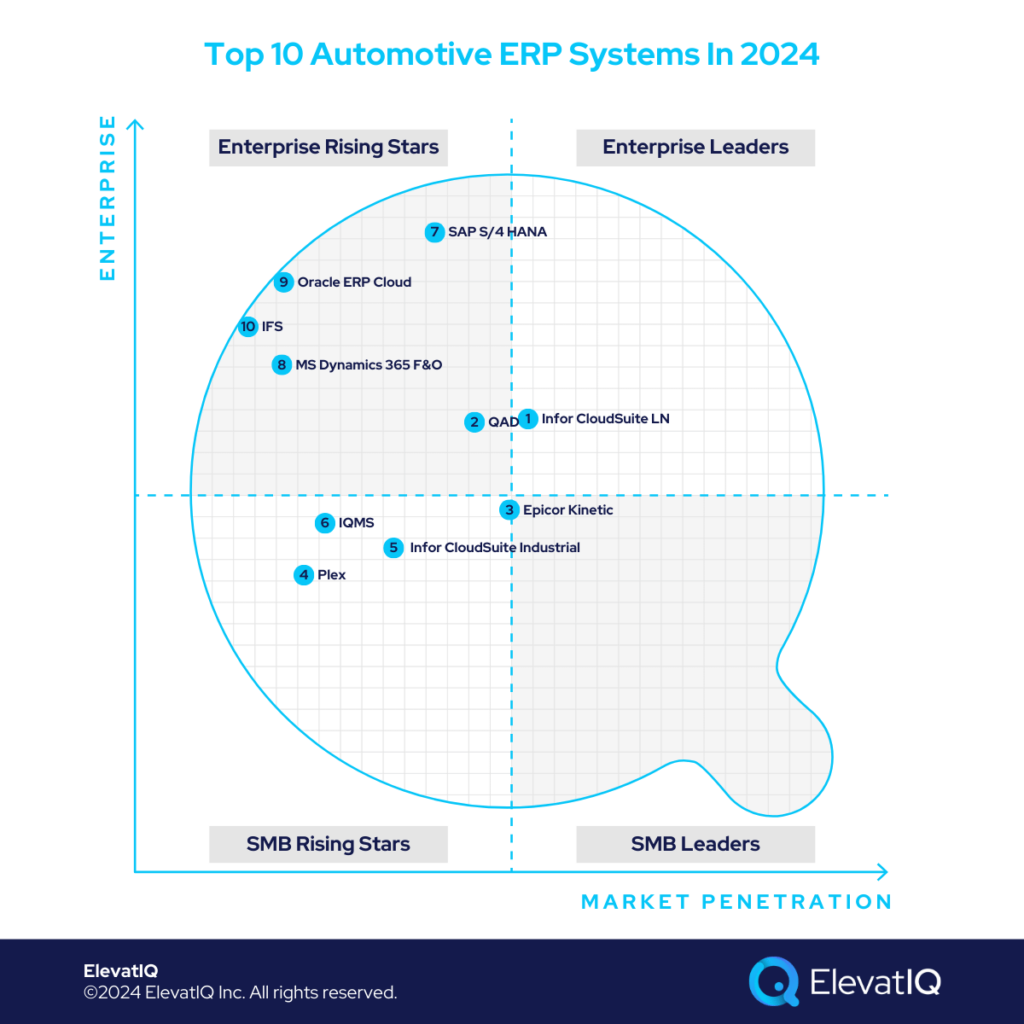

10. IFS

IFS specializes in serving mid-to-large automotive companies, with its strength in MRO and aftermarket operations. These businesses, handling complex equipment for various OEMs, engage in extensive collaboration with OEMs and suppliers. However, IFS might face challenges in supporting diversified business models within the automotive sector.

In terms of automotive-specific capabilities, IFS may lack efficiency in supplier collaboration, especially compared to solutions like QAD. While it supports various business models, its performance may not match the specialized features offered by competitors like Plex or QAD, particularly in automotive program management.

In comparison to other automotive-focused solutions, IFS may face challenges with out-of-the-box automotive capabilities like MMOG/LE, ITAF, and recall management. It suits automotive companies primarily engaged in field services. Also, a good fit for those seeking best-of-breed field service capabilities for a subsidiary or integrated with a corporate financial ledger. However, due to its limited focus and struggles with diverse business models, we have slightly downgraded its ranking this year. But it still secures its position at #10 among automotive ERP systems.

9. Oracle Cloud ERP

Oracle Cloud ERP targets large global automotive companies, boasting deep capabilities in integrating customer feedback with R&D data. While excelling in mixed-mode manufacturing and international supply chain aspects, it may encounter challenges with specific automotive capabilities.

Suitable for companies adopting a best-of-breed or decoupled architecture, Oracle Cloud ERP’s role limits to finance and HCM, with other systems catering to shop floor and manufacturing needs. Larger enterprises with robust IT departments are likely to be the only ones who will be successful in developing last-mile functionality on top of the vanilla platform.

Despite these considerations, Oracle would be the best fit as a corporate financial ledger for large automotive companies. A corporate ledger, while using another system deeper in capabilities at the subsidiary level, such as QAD, Plex, Infor LN, IQMS, or IFS. Or as the main ERP system with deep internal IT maturity and subject matter expertise in implementing complex automotive requirements. Such implementation often requires help from a change management company. This helps ensure broken processes don’t get assumed as requirements. A practice generally leads to wasting millions of dollars with failed implementation and poorly adopted systems.

It is also a great fit for private equity and holding companies if harmonizing the tool and skillset is more important for them than the additional costs of building last-mile capabilities on top of vanilla ERP platforms. Despite these considerations, Oracle secures the rank of #9 among the top automotive ERP systems.

8. Microsoft Dynamics 365 Finance & Operations

Microsoft Dynamics 365 F&O focuses on mid-market to large automotive companies, ideal for those with diverse operations encompassing various manufacturing processes, from discrete manufacturing for automotive parts to process manufacturing for activities like plastic extrusion or chemical divisions. Companies with complex field service operations, extensive collaboration with entities, and needs for trade compliance and embedded TMS find this tailored solution advantageous.

Smaller solutions, even those specialized in automotive business models, face challenges managing such diversity. This complexity is particularly notable for private equity-owned holding companies. The companies engaged in M&A cycles, where predicting future business models becomes a more intricate task.

Regarding automotive functionalities, Microsoft Dynamics 365 F&O provides a streamlined automotive add-on, albeit less comprehensive than alternative solutions. Limited last-mile functionality could mandate custom development or dedicated add-ons, requiring internal IT proficiency and expertise in implementing intricate automotive compliance frameworks. The involvement of a change management consulting firm may be necessary to prevent assuming broken processes as requirements. Despite no significant updates in automotive capabilities this year, it retains its position as the #8 choice among top automotive ERP systems.

7. SAP S/4 HANA

SAP S/4 HANA is tailored for large, global, publicly traded organizations requiring collaboration across entities and possessing robust internal IT capabilities. With the ability to scale for extensive MRP runs and process millions of journal entries per hour, it offers a unified system for streamlined operations. However, its last-mile functionality may lack depth in automotive-specific features like PPAP compliance, FMEA analysis, or recall management compared to specialized solutions.

Just like Oracle Cloud ERP or Microsoft Dynamics 365 F&O, SAP S/4 HANA would be the right fit for companies requiring support for complex business models but with their internal IT and subject matter expertise to implement complex automotive capabilities on top of vanilla solutions. The only exception when this would not be required is when companies might use it for corporate financial ledger in conjunction with another operational solution such as Infor LN, QAD, Plex, and IQMS for subsidiary-level operational needs. Despite these considerations, it still maintains its rank at #7 among top automotive ERP systems.

6. DELMIAWorks

IQMS/DELMIAWorks focuses on discrete manufacturing, with a strong emphasis on the automotive vertical and mid-market companies. Similar to QAD and Plex, it provides comprehensive out-of-the-box capabilities for automotive companies, covering MMOG/LE, APQP, gauge R&R, and PPAP compliance, making it particularly advantageous for those in the Honda ecosystem.

However, unlike some competitors, IQMS retains a patchy legacy interface and lacks a vibrant community, potentially affecting talent availability and consulting costs.IQMS is a fit for companies with fairly predictable and static business models primarily focused on plastic-centric business models in the automotive ecosystem. It might also be a great subsidiary solution for large enterprises if they are run fairly independently without much need for collaboration or synergies with other entities. With the least momentum with the solution, IQMS still maintains its position at #6 among the top automotive ERP systems.

5. Infor CloudSuite Industrial

Tailored for SMB OEMs with hybrid manufacturing models, Infor CloudSuite Industrial addresses the needs of automotive companies aiming for flexibility in engineering processes. While many companies typically adhere to formal SKUs and revisions driven by automotive OEMs, engineer-to-order-centric automotive companies may lack such formality. This flexibility accommodates companies without highly formalized BoMs.

Ideal for SMB OEMs and part manufacturers with field services, it may not be the best fit for larger automotive firms or those with process-intensive operations. For example, a discrete manufacturer with a lighter process footprint may find it suitable, whereas a process manufacturer like a plastic extrusion company with a packaging line might not.

Infor CSI’s process manufacturing capabilities were added to support complex discrete manufacturers with diversified business models and are not designed for intricate process manufacturing. Other challenges may arise for automotive companies with business models akin to metal companies that require support for parts without part numbers or those needing to support processes such as nesting or incorporating attributes in MRP planning. While providing out-of-the-box automotive capabilities, they are less detailed compared to solutions like QAD or Plex, impacting implementation budget and risk. Despite being more diverse than automotive-focused solutions like Plex or IQMS, Infor CSI maintains its position at #5 among top automotive ERP systems.

4. Epicor Kinetic

Epicor Kinetic caters to SMB automotive companies that are deeply involved in shop floor activities. An ideal choice for those managing schedules and quality processes within MES, similar to Plex, it may not be suitable for those relying on ERP for scheduling and centralized quality management. Unique BOM structures make it well-suited for companies with formal manufacturing processes and revision numbers. It’s particularly suitable for automobile manufacturers with complex inventories and unique material-to-operation correlations, as well as those handling large programs with WBS-centric processes.

Epicor Kinetic offers diversified support, combining distribution-centric planning with MRP within the same software. While it has acquired advanced field service capabilities, seamless integration might take time, making its field service capabilities less robust than those of some competitors, especially for aftermarket and MRO-centric companies. While an excellent solution for the mid-market and suitable as a subsidiary solution for large automotive companies, it might not be the optimal choice as the main ERP for very large companies due to limited financial hierarchies compared to larger ERP systems.

Most automotive companies with formal BOMs and revision numbers find Epicor Kinetic well-aligned with their planning processes. In comparison with solutions like Infor CloudSuite Industrial (Syteline), Despite these considerations, Epicor Kinetic ranks at #4 on our list of the top automotive ERP systems.

3. Plex

Plex focuses on automotive companies, particularly in the Toyota and Ford ecosystems. Tailored for last-mile S&OP and compliance in these ecosystems, Plex excels as a subsidiary-level solution with robust shop-floor-centric capabilities. It’s ideal for large companies to consolidate automotive portfolios on one solution as a subsidiary-level solution while using another large ERP system as a corporate ledger. It is also a very strong fit for pure-play automotive SMBs in the Toyota and Ford ecosystems.

Originating as an MES solution, Plex struggles with diverse business models, like those requiring project manufacturing capabilities in verticals such as contract manufacturing or engineer-to-order centric companies. In architectures where the shop floor is critical, Plex, like Epicor and IQMS, is a strong fit, but less so when ERP must house quality and scheduling processes, not MES. Cross-functional supply chain processes, while not as robust, are tailored for automotive use cases.

Despite not having widespread adoption like some competitors, Plex boasts super-rich capabilities for program management, pre-integrated with PLM and CAD. With native integration of skills and scheduling, Plex MES supports shop floor needs. Recent updates include functionality for the Ford ecosystem, but diverse business models might find Plex’s scope limiting. As a result, it ranks at #3 on our list of top automotive ERP systems.

2. QAD

QAD caters to mid to large global automotive companies, suitable as a subsidiary-level integrated with a corporate financial ledger or as a pure-play SMB option as their main ERP. Uniquely combining several aspects of supply chain and ERP suites, it’s uniquely tailored for automotive-centric companies. With other solutions, these capabilities generally reside in different siloes, creating isolated boundaries for complex cross-functional mature processes such as allocation or ATP. Recent acquisitions hint at combining HCM and MES capabilities, very similar to Plex’s capabilities, which are especially valuable for automotive companies because of their need for joint collaboration and planning needs. Unique scheduling processes prioritize skillsets and certifications, necessitating integrated learning processes.

Despite not providing as detailed capabilities for Toyota, Honda, or Ford ecosystems, it’s slightly more diverse than other focused solutions such as Plex but not as diverse as other solutions such as Infor LN. Unlike Infor LN, QAD, similar to Oracle ERP Cloud and Microsoft Dynamics F&O, embeds TMS capabilities within the solution. Its user-friendly UI, contrasting with Infor LN, suits business users without requiring extensive customization.

However, QAD’s weaknesses lie in its legacy technology stack and infrastructure, lacking the agility of mainstream cloud providers. Despite the recent announcement of technology updates, which might take a while to stabilize, we have downgraded QAD slightly due to its limited vertical focus and applicability in M&A or holding company structures. Despite these considerations, it holds the #2 rank on our list of top automotive ERP systems.

1. Infor LN

Infor LN, a robust solution for global automotive companies in diverse discrete manufacturing, targets upper mid-market to large players, particularly excelling in the Honda ecosystem. Ideal as a subsidiary-level solution for large enterprises consolidating automotive operations on one solution, it also suits mid-sized companies with varied automotive-centric discrete manufacturing models. However, Infor LN faces challenges with process-centric operations for companies that might also include business operations such as plastic or chemicals as part of their automotive operations.

Unlike smaller solutions like Plex or Infor CSI that might not have as detailed capabilities for each mode of manufacturing and might struggle with complex business models, Infor LN can cover a lot of grounds with most automotive-centric discrete and distribution business models, whether long-standing large programs or aftermarket business that also has very complex distribution operations. Infor LN also has very strong global trade compliance capabilities. While Infor LN is versatile for diverse manufacturing models, Plex holds stronger pure-play capabilities for Toyota and Ford ecosystems. Infor LN, a true SAP S/4 HANA replacement for upper mid-market or lower enterprise automotive companies, offers pre-integrated best-of-breed features like Infor Nexus, WFM, WMS, and specialized PLM solutions.

With reduced implementation time and risks due to pre-integrated functionality, Infor LN stands out as a reliable solution localized and globalized in 50 countries. Despite limitations in broader capabilities compared to other vanilla solutions, recent upgrades acknowledge its broader application in various automotive business models, securing the top rank at #1 on our list of the top automotive ERP systems.

Conclusion

Automotive companies possess distinctive needs, ranging from product forecasting to supply chain demand. Unique quality and reporting standards, especially for ecosystems like Toyota and Honda, require meticulous compliance to safeguard scorecards. Failing to adapt to OEMs’ evolving demands jeopardizes success. Hence, automotive-specific capabilities are crucial, as vanilla ERPs may entail risk and cost due to longer and more expensive implementation cycles.

When choosing an ERP for your automotive company, avoid getting lost in generalized features. This list, published by truly independent automotive ERP consultants, aims to streamline your options and guide you toward a successful implementation.