Last Updated on March 17, 2025 by Sam Gupta

Specialized ERP systems for the pharmaceutical industry provide tailored features, outperforming generic alternatives that lead to longer implementation times. Crucially, pre-baked capabilities within the system’s data model prevent add-ons from struggling with version upgrades. Opting for pre-built pharma capabilities, such as managing multiple serial and lot numbers, boosts implementation success—features often lacking in smaller ERP systems designed for single serial or lot numbers. While sufficient for other industries, attempting to implement such embedded layers might derail implementations, with unintended consequences because of the intertwined nature of data dependencies.

While pharma-specific ERP systems provide deeper last-mile capabilities, their focus is likely to be limited to a few business models, posing scalability challenges for large companies in growth or acquisition phases. Predicting future needs is complex, especially for companies engaged in M&A cycles, owned by private equity, or part of a holding company structure. While larger solutions support various models, implementing compliance-specific features can be costly. Smaller systems may also encounter limitations in global applications due to flatter architecture.

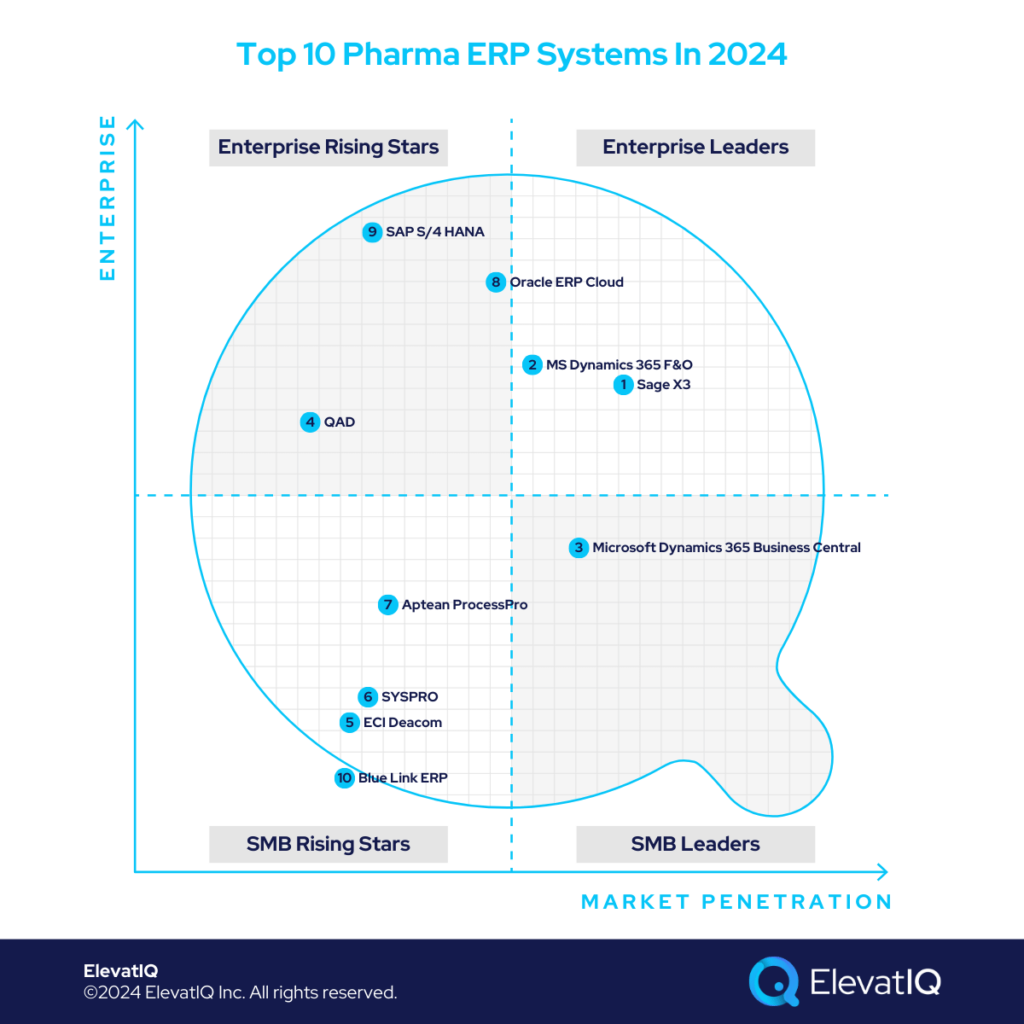

Technical expertise alone is insufficient for pharma-specific compliance; deeper subject matter expertise is essential. This includes capturing NDC codes, managing both serial and lot numbers for the same product, and handling inventory based on expiring lots. Addressing data structure nuances is one challenge, but meeting aggressive traceability demands and DSCSA compliance adds another layer. Evaluating ERP systems for pharmaceutical needs is facilitated by exploring the top 10 pharma ERP systems, providing valuable insights.

Criteria

- Definition of a pharma company. These companies in the pharma ecosystem include pharmaceuticals, biotechnologies, cannabis, and nutraceuticals. They might also have distributors, repackagers, dispensers, and manufacturers — companies of all sizes in this ecosystem.

- Overall market share/# of customers. The higher the market share among pharma companies, the higher it ranks on our list.

- Ownership/funding. The more committed the management to the product roadmap for the pharma companies, the higher it ranks on our list.

- Quality of development. The more cloud-native capabilities, the higher it ranks on our list.

- Community/Ecosystem. The larger the community with a heavy presence from pharma companies, the higher it ranks on our list.

- Depth of native functionality for specific industries. The deeper the publisher-owned out-of-the-box functionality, the higher it ranks on our list.

- Quality of publicly available product documentation. The poorer the product documentation, the lower it ranks on our list.

- The pharma industry market share. The higher the focus on pharma companies, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with pharma companies. The more aligned the acquisitions are with the pharma companies, the higher it ranks on our list.

- User Reviews. The deeper the reviews from pharma companies, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product like QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. Blue Link ERP

Blue Link ERP focuses on serving pharma distribution firms, ideal for those in the startup segment outgrowing QuickBooks with under $10 million in revenue. However, it lacks suitability for large pharma companies or those requiring extensive manufacturing capabilities. Without significant updates recently in its portfolio, it still maintains its rank at #10 on our top pharma ERP systems list.

Strengths:

- Deep Last-Mile Capabilities for Pharma Companies. The biggest strength of Blue Link ERP would be its last-mile functionality. These capabilities include suspicious drug monitoring, CSOS and ARCOS reporting, and TI/TS/TH transmission via EDI.

- DSCSA Compliance Subject Matter Expertise. The other strength of Blue Link ERP includes its subject matter expertise and its involvement with the DSCSA community. It also includes continuous updates of their product as regulatory compliance changes regarding the data elements.

- Decent Technical Architecture. The final strength of Blue Link ERP would be its technical architecture, especially when you compare it with the other products in this category. For example, comparable products use a file-based database. However, Blue Link ERP contains a Microsoft SQL Server database.

Weaknesses:

- Not Suitable for Pharma Manufacturers. Pharma companies that need heavy manufacturing capabilities and distribution might find it limiting.

- Smaller Ecosystem and Publisher’s Financial Position. The other weakness of Blue Link ERP includes a smaller talent ecosystem. It also includes its financial standing as it is not backed by a private equity firm or a corporate investor.

- Only Suitable for Smaller Pharma Companies. Blue Link ERP is not meant for companies that will be in revenue of over $10 million.

9. SAP S/4 HANA

SAP S/4 HANA caters to larger pharma enterprises, excelling in the large enterprise segment or adopting a best-of-breed approach for diversified capabilities. Its key strength is accommodating various global pharma business models within one database, but it may lack deep last-mile capabilities, relying on ISV solutions or elongating implementation times. While this reliance can be cost-prohibitive for SMB pharma companies, it aligns with the best-of-breed architecture needs required by large pharma companies, essential for transactional decoupling and accommodating diverse departmental needs. Despite these considerations, it maintains its position at #9 on our list of the top pharma ERP systems.

Strengths

- Superior Financial Control and Governance for Large Pharma Companies. Superior financial traceability and the SOX compliance support required for large, publicly traded companies.

- Ability to Support Diversified Business Models. Supports diversified business models whether you are a re-packager, assembler, dispenser, medical device, drug manufacturer, or any of their combinations.

- Solid Best-of-Breed Options. The availability of best-in-class, best-of-breed products such as CallidusCloud for CPQ, SAP EWM for warehouse and TMS capabilities, and SAP Hybris for e-commerce for larger pharma companies.

Weaknesses

- Limited Last-mile Functionality for DSCSA compliance. Limited last-mile functionality for DSCSA compliance, which might be pre-packaged with the smaller specialized pharma ERP systems on this list.

- Overbloated Financial Control Processes. Overbloated financial control processes, such as compliance, allocation, and approval flows, are only necessary for large organizations.

- Not Fit for Smaller and Mid-size Pharma Companies. The SMB pharma companies would find SAP S/4 HANA overwhelming and run the risk of implementation failure because of the efforts required to test and simplify the processes needed for smaller companies.

8. Oracle Cloud ERP

Oracle Cloud ERP, much like SAP S/4 HANA, targets larger pharma enterprises, excelling in the large enterprise segment or adopting a best-of-breed approach for diversified capabilities. Its strength lies in accommodating global pharma business models within one database, though it may lack deep last-mile capabilities, often relying on ISV solutions or extending implementation times. Unlike SAP S/4 HANA, Oracle Cloud ERP boasts higher penetration in the pharmaceutical verticals due to its existing install base with JD Edwards. The friendly data model and higher win rate make it a preferred choice. Aligned with the best-of-breed architecture, crucial for transactional decoupling, it secures its position at #8 on our list of the top pharma ERP systems.

Strengths:

- Deep ERP Capabilities for Large Pharma Companies. Robust core ERP features such as international trade management and supply chain planning.

- Talent Ecosystem and Well-adopted Product. It is one of the most adopted products and has very large communities of consultants to build custom pharma-specific functionality.

- Ability to Support Diversified Business Models. Rich product model, and can natively support many distribution and manufacturing processes such as process or discrete.

Weaknesses:

- Limited Last-mile Functionality for DSCSA compliance. Limited last-mile functionality for DSCSA compliance, which will require an add-on or custom development.

- Overbloated Financial Control Processes. Overbloated financial control processes are needed for larger companies but might be overwhelming for smaller companies.

- Not Fit for Smaller and Mid-size Pharma Companies. Finally, the SMB companies would struggle to relate to the product due to the over-bloated approval flows, allocation, commitment, and financial control processes.

7. Aptean ProcessPro

Aptean ProcessPro focuses on SMB process manufacturers, including the pharmaceutical sector, tailored for those with significant manufacturing needs. Ideal for companies with heavier manufacturing, it may not suit those with diversified business models, especially in private equity or holding company structures. However, it can serve as an effective subsidiary-level solution for large pharma companies, particularly if the subsidiary operates independently. Unsuitable for businesses with diverse manufacturing needs, it secures its position at #7 on our list of the top pharma ERP systems.

Strengths

- Deep Process Manufacturing Capabilities. Including formulation management and batch manufacturing.

- Financial Stability of a Private Equity Company. The financial backing of the publisher as it is backed by one of the largest private equity companies.

- Deeper ERP Capabilities than Smaller Pharma ERP Systems. Much bigger product than some of these specialized ERP systems, such as Blue Link ERP or Deacom, with more profound manufacturing and supply chain capabilities similar to Netsuite, Acumatica, or Sage X3.

Weaknesses

- Legacy Interface. Because it has not received the same attention in the Aptean portfolio as some other products, such as Aptean Ross.

- Smaller Ecosystem. The adoption and the smaller ecosystems to get support for the product if you are not happy with the support provided by Aptean.

- Last-mile Functionality for DSCSA Compliance Not as Strong. Finally, its DSCSA compliance capabilities may not be as strong as the specialized pharma ERP systems such as Blue Link ERP or Deacom.

6. SYSPRO

SYSPRO targets small food and beverage companies, Including smaller pharma distributors. Especially suitable for smaller pharma companies with diversified business models due to its native support for discrete and process manufacturing capabilities. Not as suitable for large pharma companies with multiple entities and a presence in multiple countries. It might be a great fit as a subsidiary-level solution for smaller entities if they are relatively independent in the holding company structure. Despite these considerations, it still maintains the rank at #6 on our list of the top pharma ERP systems.

Strengths

- Support for Formulation Management Capabilities. Built as part of the product.

- Ability to Support Diversified Business Models. Accommodates several different business models for smaller drug manufacturers, distributors, repackagers, or laboratories that might produce drugs and devices both.

- Supply Chain and Finance Capabilities. Deeper supply chain and finance capabilities than its peers, including a robust unit of measure support, bin number capabilities, inventory valuation methods, and costing layers.

Weaknesses:

- Only Suitable for Smaller Pharma Companies. Not a fit for larger companies with multiple entities and presences in multiple countries. Its design can’t allow data sharing between entities.

- Limited DSCSA Compliance Functionality. Not as robust with its support for pharma-specific functionality, especially DSCSA compliance. As a result, it may require add-ons or custom development that might be prepackaged with pharma-centric ERP such as Blue Link ERP or Deacom.

- Technical Issues with the Product. While the product has come a long way in moving away from a file-based data structure to a more reliable SQL-based data store, the users report errors with the product. And the product is not as mature as some of the other leading vendors on this list.

5. ECI Deacom

ECI Deacom targets small process manufacturing companies that might be eCommerce and DTC heavy with pharma being a key vertical for them due to its product alignment. Not the best fit for companies with revenue of more than $10 to $20 million due to its limited finance and ERP capabilities.Recent updates? No relevant announcement that will directly benefit companies in the pharma industry. But it still maintains the rank at #5 on our list of the top pharma ERP systems.

Strengths

- Deep eCommerce and DTC Capabilities. E-commerce and DTC-related features built as part of the product, such as route accounting and proof of delivery.

- Deep Last-Mile Capabilities for Pharma Companies. The pharma-specific capabilities that can support both distributors and manufacturers, such as master lot numbers, formulation and pre-formulation management, and weight measurement during the quality processes.

- Financial Backing of Private Equity and Technical Architecture. Deacom has an SQL-based data store and a more modern interface.

Weaknesses

- Only Suitable for Smaller Pharma Companies. Only suitable for smaller pharma companies with less than $20 million in revenue due to its limited financial and inventory control functionality.

- Ability to Support Diversified Business Models. It’s primarily a process manufacturing product and would struggle with companies that may require both discrete and process manufacturing support.

- Weaker Supply Chain and Finance Capabilities. While the operational and e-commerce capabilities are strong with Deacom, the Supply Chain and finance capabilities are weaker with limited pricing and discounting options, inadequate UoM support, and leaner costing layers for larger pharma companies.

4. QAD

QAD targets upper mid-large pharma manufacturing companies. Especially suitable for companies with the need for deeper operational functionality than the larger products such as SAP S/4 HANA or Oracle Cloud ERP. Not so suitable for the smaller pharma companies as they will find it overwhelming. Recent updates? No relevant announcement that will directly benefit companies in the pharma industry. But it still maintains the rank at #4 on our list of the top pharma ERP systems.

Strengths

- Ability to Support Diversified Business Models. QAD’s data and product model allow it to serve various pharma industries with the combination of discrete and process manufacturing business models such as drug, device, and diagnostic tests.

- Process Manufacturing Capabilities. Includes process and discrete manufacturing capabilities, which is an advantage compared to other similar products.

- Rich ERP Capabilities to Support Mid- to Large- Pharma Companies. Has deep international trade management and Supply Chain capabilities, which gives QAD an edge over its larger peers as QAD will have deeper operational functionality for pharma along with these capabilities geared for larger manufacturing companies.

Weaknesses

- Technical Architecture. It still uses a legacy programming language and is not hosted on mainstream cloud providers’ infrastructure, so finding support for QAD could be a concern.

- Primarily Targeted for Discrete Manufacturing Verticals. QAD is a discrete manufacturing product, even though it targets process manufacturing. So, the pharma manufacturers and distributors may not receive as much attention from QAD as discrete manufacturers.

- Talent Ecosystem. The talent ecosystem is not as prolific as SAP S/4 HANA or Oracle ERP Cloud. And because of that, you might struggle to find support if you are not happy with the support from QAD.

3. Microsoft Dynamics 365 Business Central

MS Dynamics 365 BC targets SMB pharma distributors. And it’s especially suitable for pharma companies that require depth in supply chain and distribution processes, along with the platform’s flexibility to build last-mile functionality. However, it’s not suitable for larger companies or pharma manufacturers as it does not have the formulation management capabilities to support process manufacturing. Recent updates? No relevant announcement that will directly benefit companies in the pharma industry. But we have upgraded the rankings of MS BC substantially this year due to the quality of add-ons available to support the pharma industry. And now it ranks at #3 on our list of the top pharma ERP systems.

Strengths

- Availability of several add-ons with deep pharma capabilities. The biggest plus for MS BC is its ecosystem and add-ons from highly credible companies that could provide similar capabilities as Blue Link ERP or Deacom.

- Native support of packaging serial numbers with lot numbers. MS BC offers a rich data model with capabilities such as support for multiple lots and serial numbers to support the scenarios of NDC and packaging serial numbers.

- Deep supply chain and bin allocation capabilities. MS BC has native capabilities to support pharma distributors with multiple warehouses, centralized and decentralized supply network needs, multiple hierarchies of bins, and rich UoM support.

Weaknesses

- It would require an add-on for DSCSA compliance. It would require an add-on or custom development for DSCSA compliance, such as suspicious drugs or TS/TI/TH reporting.

- Does not have native support for formulation management. MS BC doesn’t natively support formulation management, a severe limitation for pharma distributors heavy in R&D and production.

- Not suitable for pharma manufacturers. Limited manufacturing capabilities with lighter assembly-centric manufacturing.

2. Microsoft Dynamics 365 Finance & Operations

Like Oracle ERP Cloud, Microsoft Dynamics 365 Finance and Operations targets larger pharma companies with revenue over a billion dollars and 1,000 employees. It is not suitable for smaller to medium-sized manufacturers and distributors. Recent updates? No relevant announcement that will directly benefit companies in the pharma industry. But we have upgraded the rankings of MS Dynamics 365 F&O substantially this year due to the quality of add-ons available to support the pharma industry. And now it ranks at #2 on our list of the top pharma ERP systems.

Strengths

- Deep ERP Capabilities for Large Pharma Companies. First, it is among the largest ERP products and has deep core ERP capabilities like SAP S/4 HANA and Oracle Cloud ERP, with a large majority of functionalities available in its cloud version.

- Ability to Support Diversified Business Models. Second, F&O has a rich product model to support diversified manufacturing and distribution businesses, including process and discrete manufacturing capabilities needed for larger pharma companies with several divisions with different focuses.

- Pre-integrated Best-of-breed Options. Finally, the F&O product also comes pre-packaged and pre-integrated with the MS Dynamics 365 CRM, known for its tight data model and transactional data integrity to support the territory planning for controlled substances.

Weaknesses

- Limited Last-mile Functionality for DSCSA Compliance. Might require an add-on or custom development to support pharma-specific compliance and regulatory processes.

- Overbloated Financial Control Processes. Overbloated financial control processes, such as compliance, allocation, and approval flows, which are only necessary for large organizations.

- Not Fit for Smaller and Mid-size Pharma Companies. Finally, SMB pharma companies would find the product overwhelming and run the risk of implementation failure because of the efforts required to test and simplify the processes needed for smaller companies.

1. Sage X3

Sage X3 targets upper-mid to large pharma companies with less than $1B in revenue that seek a replacement for other larger products due to their weaker operational support and overwhelming workflows. Not as suitable for the smaller pharma companies that will have revenue under $50 million or the larger companies with a presence in more than 10-15 countries. Recent updates? No relevant announcement that will directly benefit companies in the pharma industry. But it still maintains the rank at #1 on our list of the top pharma ERP systems.

Strengths

- Great Alternative for Large Pharma Companies. Designed for process and food and beverage manufacturing and distribution. As a result, it provides far deeper functionality for large pharma companies out of the box.

- Designed for Process and Food Manufacturing Companies. Its product and operational processes are designed for process manufacturing companies with deep support for features such as product families.

- Great Ecosystem of Consultants for Pharma Validation. The ecosystem includes consulting companies with deep expertise in the Sage X3 product and validation procedures.

Weaknesses

- DSCSA Compliance May Require Additional Efforts. The pharma-specific capabilities might not be as robust as pharma-specific ERP systems.

- Not Suitable for Smaller Pharma Companies. Its design could be overwhelming for very small pharma companies. It might not get as much value due to the configuration and integration requirements.

- Limited Pre-integrated Best-of-breed Options. Limited best-in-class best-of-breed options as SAP S/4 HANA or Microsoft Dynamics 365 F&O for additional capabilities that larger companies would require.

Conclusion

Pharma companies have involved operations and reporting needs, requiring ERP systems that have native support for the data model to meet the changing regulatory requirements. The ERP systems and vendors that don’t have pharma as their primary vertical would not be able to catch up with these demands and might require you to develop them yourselves.

Due to the financial and implementation risks associated with the development efforts, you need an ERP system designed to support most pharma processes natively. So, make sure that the ERP system you choose is designed for the pharma industry. Hopefully, this list, along with the expertise of independent ERP consultants, can help you narrow down some options.