Last Updated on December 28, 2024 by Sam Gupta

Are you a new CFO in a manufacturing company, and haven’t yet been exposed to manufacturing accounting or operations? It’s crucial to understand the intricacies of this industry to succeed in your role. Most manufacturing companies begin seeking a senior finance operations leader when they reach $20-50 million in revenue. Prior to that, they may outsource financial operations. They might use smaller accounting systems like QuickBooks, often with support from an external CPA firm. In these cases, the company’s owners or principals typically oversee the operations.

Once the company reaches the $20 million mark, it becomes difficult to maintain the same operational structure. At this point, they hire a financial operations leader like yourself to streamline processes and take control of the company’s financial position.

the difference between a controller and a manufacturing CFO role

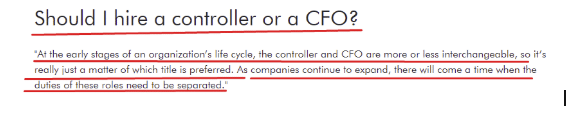

Before we start digging into the CFO role itself, it will be beneficial to understand the difference between a controller and a CFO role. How they differ, and how they both will be collaborating. Here is a snippet from the article published by one of the top recruiting agencies:

As you may have noted, the CFO and Controller roles are interchangeable in smaller companies. For simplicity, we are talking about manufacturing companies that may hire a controller or a manufacturing CFO for the first time. We will be using these terms interchangeably as well in this article.

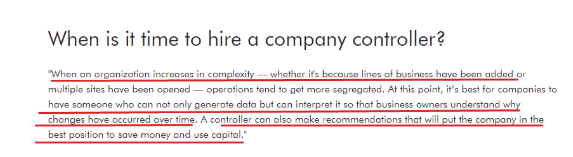

Before we start, let’s start with some triggers why companies hire a controller or manufacturing CFO. Unless they might be replacing a seasoned executive, in most cases, they hire them to streamline operations and improve financial control. Here is the same article again that talks about these events:

As the article suggests, expanding operations that could include adding additional plants is among the reasons why they might hire a controller or manufacturing CFO. The first time.

Have you been a manufacturing CFO before? If so, your job may be easier since you’re already familiar with how manufacturing companies operate and the key metrics to track for control. However, if you’re transitioning from a completely different industry, such as distribution or construction, you can expect a steep learning curve, as manufacturing financial operations are quite distinct.

Understanding the business model of a manufacturing company is critical

The first question you need to ask is whether the company operates in the process industry or discrete manufacturing. These two types of manufacturing differ significantly in terms of operations, compliance, and reporting. The best way to understand how discrete manufacturing differs from process manufacturing is to look at examples of manufacturing businesses and their products. Here are a few examples to help illustrate:

Examples of discrete manufacturers

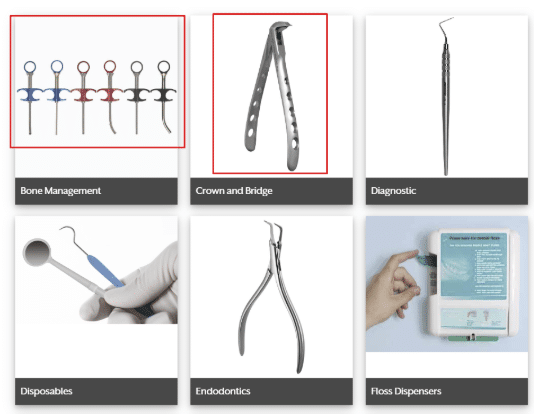

This is an example of a discrete manufacturer from the New York area that produces surgical instruments for the dental healthcare industry.

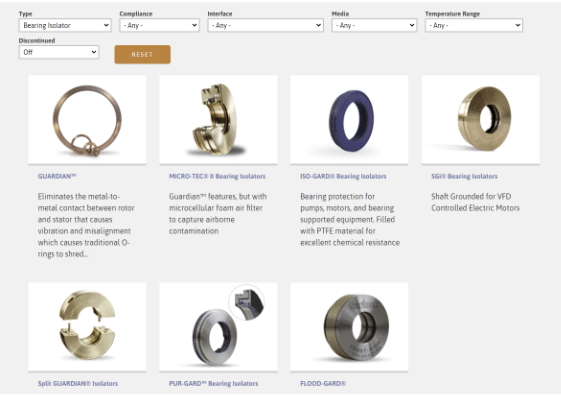

This is another example of a discrete manufacturer from the New York area. That produces fluid sealing and pipeline solutions for several industries. Including Chemical Processing, Primary Metals, Pulp and Paper, and Pharmaceutical

Examples of process manufacturers

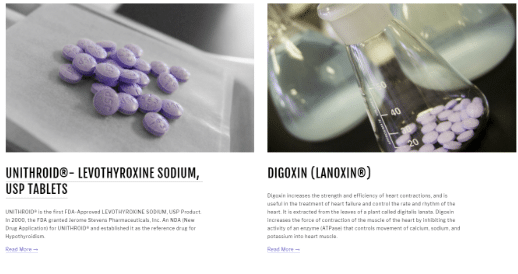

This is an example of a process manufacturer from the New York area that is a pharmaceutical manufacturer of prescription tablets and capsule formulations.

This is another example of a process manufacturer from the New York area that manufacturers packaged food for pets.

Were you able to spot the difference between discrete and process manufacturing through these examples? The key distinction lies in their manufacturing processes and how they produce their products. Process manufacturing uses formulations to create goods, whereas discrete manufacturing relies on a Bill of Materials (BOM). Formulations might resemble a mathematical formula (e.g., M3 = 2*M2 + M1) and involve interdependencies between the quantities or proportions of materials. In contrast, discrete manufacturing’s BOMs may include multiple layers for sub-components, but typically, the quantity of one material is not dependent on another.

For simplicity, most Food and Beverage, Chemicals, and Pharmaceutical companies are categorized under the process industry. On the other hand, companies that are more hardware-centric or assembly-oriented, such as Industrial Machinery, Electrical and Electronics Manufacturing, Automotive, Windows and Doors, and Medical Devices, are examples of discrete manufacturing. If you’re still unsure, here’s what Google suggests as the first search result:

Once you understand whether your company falls into the process or discrete category, the next step is to grasp how these products are ordered, planned, and how inventory is replenished. You also need to understand the production process and the sales approach.

This will help you determine how many of your processes are make-to-order (produced after receiving an order), make-to-stock (produced in advance to meet demand and stored in inventory), engineered-to-order (involving significant engineering and typically long-term), or project-centric manufacturing (where the entire manufacturing process is treated as a project rather than a continuous process).

After manufacturing processes, next comes the inventory

Once you have thoroughly analyzed each process, the next step is to assess how organized your inventory is, and whether there are formal processes in place for managing raw materials, work in progress (WIP), and finished goods. If your company has never had a controller or CFO, there’s a strong possibility that formal processes for inventory or the Bill of Materials (BOM) may not be established.

Identifying and categorizing your inventory, along with mapping the value chain, is crucial. This will enable you to perform product costing for each manufactured item, which is essential not only for understanding production costs but also for setting prices and determining discounts.

After mapping your inventory, the next step is to identify all your resources, including machines and tools, and map them to each operation. Since manufacturing involves many moving parts and costly machines, mapping these operations will help with costing, scheduling, and forecasting labor demand, ensuring your production runs at an optimal level.

Finance and accounting are a bit different too

Assuming you have a strong background in finance and accounting, I won’t go into those topics in detail here. The main difference between accounting for manufacturing and other organizations lies in the chart of accounts. Manufacturing organizations tend to have a more detailed chart of accounts, primarily to support product costing. As each BOM progresses through the production process, it may update multiple accounts as labor and materials are reported on the production order.

Other accounting topics to consider: If payment terms, payment methods, pricing and discounting procedures, and approval processes are not documented and centralized, you’ll likely need to sift through past paper-based invoices and orders to gather and organize this information.

Don’t forget customers, vendors, employees, and payroll processes

If you’ve already documented and gathered the major details of your business, the next step is to analyze your customer and vendor groups, as well as clean up any duplicate or outdated records. You may also need to map the end-to-end sales and purchasing processes. Finally, it’s important to understand how timesheets, expenses, and payroll are generated, as this will give you a comprehensive view of the organization.

This may seem overwhelming, but once you have a clear understanding of the business, that’s when your real work begins. As mentioned earlier, your role is to streamline operations and automate processes to help the company scale. The more manual and ad-hoc processes you have, the more bottlenecks and duplicated efforts you’ll encounter, making operations inefficient and costly. Your goal should be to automate and standardize as much as possible.

An integrated system could Help

Documenting these processes will help identify inefficiencies, but without a fully integrated system that connects all of your processes, implementing your recommendations and process improvements will be challenging, making it harder to streamline operations.

This is why incorporating the implementation of a fully integrated system should be a key part of your efforts. In fact, during your interview, they may ask if you have experience implementing an ERP system, or if ERP implementation could be a driving factor for the role. Typically, when a company recognizes the need to streamline its operations for the next phase of growth, it signals that they are ready for an ERP implementation. An ERP implementation involves several phases, including preparation and documentation. The steps mentioned above serve as a precursor to this process.