Configure-to-order Companies: Configure-to-order (CTO) manufacturing presents a unique category, as most businesses don’t initially operate in this model due to the overhead of product standardization, which can be challenging for startups. Additionally, the expectations of B2B and B2C industries for configure-to-order processes can differ significantly. B2C sectors such as furniture, mattresses, automotive, appliances, and tires often require configurability, primarily driven by consumer expectations. In contrast, B2B industries needing configurability encompass oil and gas parts, aftermarket services, industrial distributors, equipment manufacturers, and field service firms, for which the needs might be either customer-driven or inward-facing to streamline estimation and quoting processes. Smaller companies may initially categorize themselves as either service or engineer-to-order focused, managing their quoting processes manually before transitioning to configure-to-order workflows.

Configure-to-Order Manufacturing Business Processes: The processes for configurability vary based on drivers, demanding distinct architecture and systems. Configure-to-order workflows typically necessitate product templates and extraction of variables for configuration parameters. Different customer personas and journeys may dictate varying configuration needs; consumer-facing apps often feature fewer variables to prevent user overwhelm, while internal sales tools may offer more options based on customer requests. Field service apps, constrained by device limitations, particularly require simplified models for workers.

Configure-to-order Manufacturing ERP Needs. The configure-to-order manufacturing ERP requirements vary depending on process integrations across systems and also the complexity of the architecture. Businesses emphasizing engineering may utilize CAD and PDM systems with web plugins for customer collaboration, limiting configurable BOMs to these systems without affecting ERP processes. Alternatively, ERP systems may manage configurable BOMs, accommodating production and pricing variations per configuration. Consumer and field service processes often handle configurations within the commerce or field service layers, transmitting finalized BOMs. Curious about configure-to-order manufacturing ERP systems in 2024? Let’s explore.

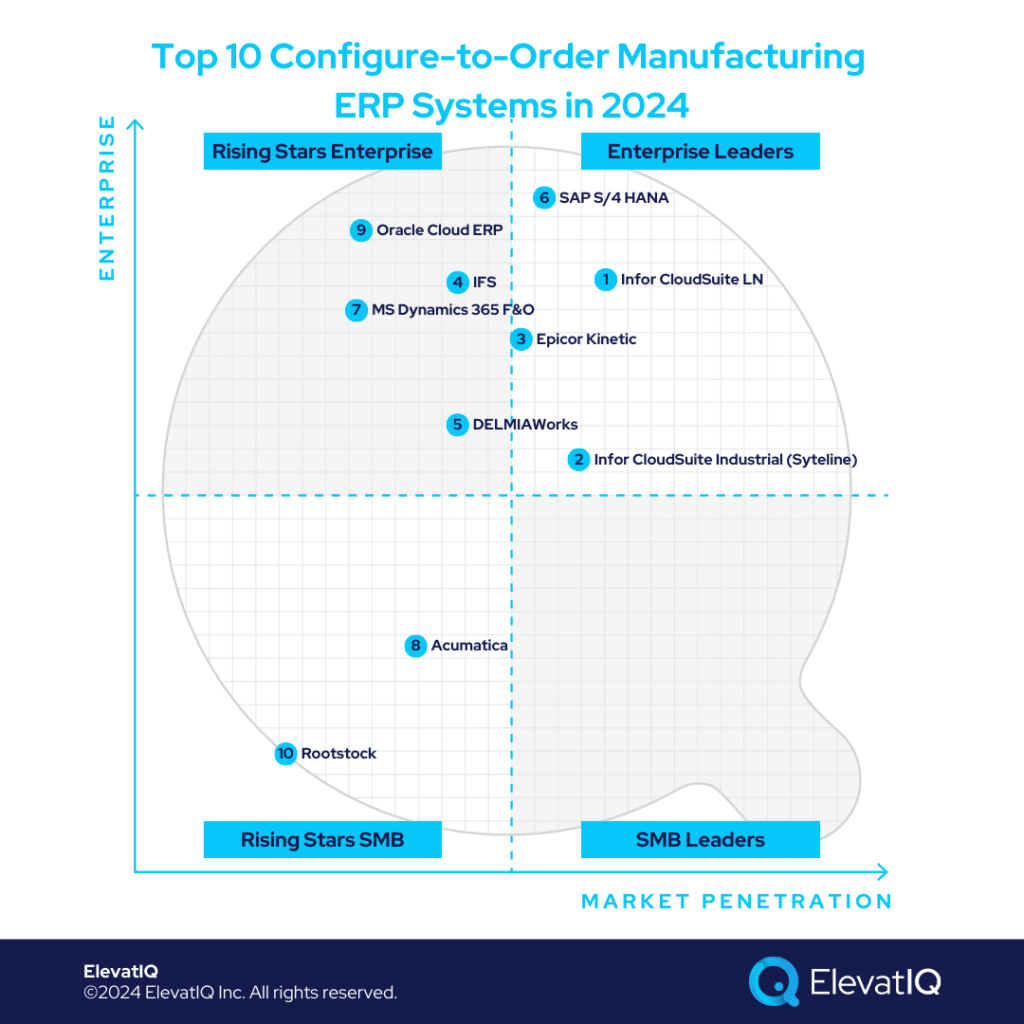

Criteria

- Definition of a configure-to-order manufacturing company. These companies in the configure-to-order ecosystem include manufacturers that are configuration-driven in a variety of industries, including building materials, mattresses, furniture, aftermarket, industrial distribution, medical devices and more. The list considers companies of all sizes in this ecosystem.

- Overall market share/# of customers. The higher marketshare among engineer-to-order companies drives higher rankings on this list.

- Ownership/funding. The superior financial position of the ERP vendor leads to higher rankings on this list.

- Quality of development. How modern is the tech stack? How aggressively is the ERP vendor pushing cloud-native functionality for this product? Is the roadmap officially announced? Or uncertain?

- Community/Ecosystem. How vibrant is the community? Social media groups? In-person user groups? Forums?

- Depth of native functionality. Last-mile functionality for specific industries natively built into the product?

- Quality of publicly available product documentation. How well-documented is the product? Is the documentation available publicly? How updated is the demo content available on YouTube?

- Product share and documented commitment. Is the product share reported separately in financial statements if the ERP vendor is public?

- Ability to natively support diversified business models. How diverse is the product in supporting multiple business models in the same product?

- Acquisition strategy aligned with the product: Any recent acquisitions to fill a specific hole for configure-to-order industries? Any official announcements to integrate recently acquired capabilities?

- User Reviews: How specific are the reviews about this product’s capabilities? How recent and frequent are the reviews?

- Must be an ERP product: Edge products such as HCM, CRM, eCommerce, MES, or accounting solutions that are not fully integrated to support enterprise-wide capabilities are not qualified for this list.

10. Rootstock

Rootstock specializes in serving SMBs with the support for configure-to-order models, leveraging Salesforce’s robust CPQ and field service features. It’s ideal for businesses requiring tight integration of configurator processes with CRM, field service, and eCommerce, particularly in medical device sectors with regulatory-dependent territory planning. Thus, Rootstock earns the #10 spot on our list of leading configure-to-order manufacturing ERP systems.

Strengths

- Native integration with other salesforce products. Its strength Includes native integration with other Salesforce CPQ and Field Services. This is especially beneficial for configure-to-order companies where the configurator processes need to be tightly embedded with CRM and field service processes.

- Native capabilities to support configure-to-order BOMs. Along with the manufacturing business models, Rootstock has support for configure-to-order BOMs, which might be a challenge with other products that might not be designed for configure-to-order processes.

- WBS-centric manufacturing capabilities. Most configure-to-order businesses are likely to be building complex products requiring configurations, making it critical to have WBS-centric processes.

Weaknesses

- Finance and accounting. Rootstock’s core ERP capabilities are not as robust as those of other manufacturing ERP systems. Their accounting capabilities are also not as layered and scalable, requiring ad-hoc arrangements.

- Reliance on third-party quality module. Rootstock would need several apps from Salesforce or non-salesforce ecosystems to be comparable in capabilities with other products on this list, posing communication challenges and implementation risks.

- Smaller Ecosystem. The ecosystem is relatively small for rootstock, with less than 500 installations. This could also pose a risk in finding talent for future support and customizations.

9. Oracle Cloud ERP

Oracle Cloud ERP is uniquely positioned for service-centric configure-to-order businesses, which tend to have different configure-to-order workflows than product-centric organizations, with their need for subscriptions, pricing, and bundles. While Oracle Cloud ERP’s CPQ and configurator workflows may also require additional add-ons to support the needs of diverse configure-to-order businesses. Although, the core ERP workflows would be sufficient for most business models. Thus, securing its rank at #9 on our list of top configure-to-order manufacturing ERP systems.

Strengths

- Robust finance capabilities for large, global configure-to-order manufacturers. Capabilities include having five layers of GL restrictions, multiple layers of sub-ledgers, and book closing requirements across divisions, especially relevant for larger Configure-to-order businesses primarily interested in using Oracle Cloud ERP as a corporate financial ledger.

- Proven solution with large workloads. Large companies may process millions of GL entries per hour. These workloads may be even higher for configure-to-order manufacturing companies, requiring them to decouple transactions as a single system might struggle to support, forcing them to best-of-breed architecture for such companies, an ideal fit for Oracle Cloud ERP.

- Ecosystem. Oracle Cloud ERP has an ecosystem of experienced consultants who have the capabilities to handle the design and architecture of such complex enterprises.

Weaknesses

- Limited last-mile capabilities and configure-to-order integrations. The last-mile capabilities and specialized integrations are relevant to configure-to-order businesses that might require third-party add-ons.

- It’s not necessarily a manufacturing solution. Oracle Cloud ERP’s concentration in configure-to-order businesses is limited, especially for product-centric organizations, making this vertical a lower priority for Oracle than service-centric organizations.

- Overwhelming for SMB configure-to-order manufacturers. The enterprise data model and financial layers might be overwhelming for SMB configure-to-order manufacturers.

8. Acumatica

Acumatica caters to configure-to-order businesses with intricate workflows, offering text-based configurator capabilities. Although not as immersive as Infor or Epicor in its 3D capabilities, Acumatica’s configurator, accessible via the customer portal, suits companies aiming to enhance internal quoting and estimation processes. Thus, positioning Acumatica at #8 among the leading configure-to-order manufacturing ERP systems.

Strengths

- Configurator add-on and configurable BOMs. Acumatica has a configurator add-on that sits on top of the core ERP modules, enabling the core configurator capabilities. It also supports configurable BOMs, which can support complex engineering processes or light products delivered through eCommerce.

- Support for sub-assemblies and phantom. Acumatica has strong support for sub-assemblies, which is crucial for configure-to-order BOMs, both for costing and scheduling. It also has strong support for phantoms, which is another huge plus, as most configure-to-order verticals will have a substantial number of phantoms as part of their BOMs.

- Support for complex rule-based configurations. Most field service-centric businesses are likely to have very complex rules with nesting and dependencies among the configurable logic. For example, if the material is leather, then the color could be either blue or black. Rules such as these are complex and can be enabled through configurator processes if the underlying logic doesn’t support nested rules.

Weaknesses

- Limited global capabilities. The current multi-entity functionality might be limiting for configure-to-order companies with operationally connected offshore locations.

- Limited mature manufacturing capabilities. Advanced features such as allocation layers or kanban are not built natively as part of the product, making it challenging for large configure-to-order companies aiming to streamline their inventory.

- Multiple add-ons may be required for configure-to-order manufacturing. Requires several third-party add-ons, such as MES, PLM, and quality, posing integration and communication challenges.

7. Microsoft Dynamics 365 F&O

While Microsoft Dynamics 365 F&O has a very rich product model to support complex configure-to-order operations, it will require configurator add-ons to support the needs of configure-to-order business models. Despite being limited to configurator capabilities, it will be more suitable for diverse configure-to-order operations or companies with uncertain business models because of M&A activity. Thus, securing the #7 spot among the top configure-to-order manufacturing ERP systems.

Strengths

- Richer core ERP capabilities for configure-to-order companies in the cloud. Compared to other solutions that might have superior layers for other service-centric verticals, such as Oracle Cloud ERP, Microsoft Dynamics 365 F&O has a mature cloud version for configure-to-order companies requiring base layers that can be easily augmented by third-party add-ons.

- Various best-of-breed options to support various configure-to-order business models. The best-of-breed ERP integration, such as CRM or field service, would allow supporting various configurator processes that might be tightly embedded with CRM or field service workflows. The other engineering or eCommerce-centric configurator processes would require third-party add-ons.

- Powerful ecosystem and marketplace add-ons. Microsoft has a talent and consulting base in countries where finding talent may be a challenge.

Weaknesses

- Limited pre-baked integrations for configure-to-order companies. The integration relevant for configure-to-order companies such as PLM, CAD, or eCommerce would require third-party ERP add-ons, increasing communication and integration risks.

- Too big for smaller companies. The smaller companies would find it overwhelming with the configuration and approval flows built for large enterprises.

- Integration and implementation risks for complex 3D configurator-driven processes. The implementation requiring substantial data exchange between the eCommerce and ERP layers might pose integration and communications challenges without the IT maturity and budget required for due diligence and process design.

6. SAP S/4 HANA

SAP S/4 HANA targets major global configure-to-order manufacturers, offering compatibility with SAP Hybris for a 3D configurator experience via the eCommerce layer. While other configure-to-order models like engineering or field service-centric may need third-party add-ons, SAP S/4 HANA boasts a robust product model supporting intricate configure-to-order processes. Its capability to manage millions of transactions per hour suits Fortune 500-scale enterprises, particularly those emphasizing financial compliance and governance. However, it may not be optimal for SMBs lacking internal IT maturity. Thus, securing the #6 spot on this list of top configure-to-order manufacturing ERP systems.

Strengths

- Enterprise product designed for configure-to-order centric companies. The item master, product model, and inventory are friendly for complex configure-to-order businesses because of scalable and modular BOM and costing layers.

- The power of HANA to run global operations end-to-end in one system. Our simple test of HANA’s capabilities with 100K serialized goods receipt found it to be faster than most systems out there. SAP S/4 HANA could process it in under 22 seconds, while Oracle cloud ERP took more than 18 mins for the same test. This is especially friendly for large configure-to-order businesses aiming to run their consolidated global MRP runs in one system.

- Financial governance and best-of-breed architecture. Financial traceability is built with each transaction, which makes the transactions and SOX governance flows highly traceable, especially friendly for publicly traded configure-to-order companies.

Weaknesses

- Behind in cloud capabilities. While SAP has made tremendous advancements, the cloud ERP version is still behind its on-prem variant.

- Too big for smaller configure-to-order companies. Companies looking for a fully baked suite without internal IT capabilities will find it overwhelming.

- Limited last mile Capabilities and third-party pre-integrated options. The last-mile capabilities relevant for configure-to-order businesses, such as CAD, PLM, configurator, etc, would require third-party add-ons.

5. IQMS/DELMIAWorks

DELMIAWorks caters to configure-to-order engineering and plastic-centric enterprises with intricate inventory requirements. It integrates seamlessly with SolidWorks, also facilitating streamlined workflows and enhanced customer collaboration. However, it may not be the optimal choice for eCommerce or field service-centric firms seeking consumer-grade 3D configurator experiences or configurable service functionalities on multiple mobile devices. IQMS is better suited for smaller configure-to-order companies or larger entities as a subsidiary-level system. Thus, earning it the #5 spot among configure-to-order manufacturing ERP systems.

Strengths

- BOM structure is friendly for configure-to-order companies. configure-to-order companies that are heavy on engineering collaboration, including collaboration with customers, would find DELMIAWorks to be compelling.

- Best for configure-to-order companies on SolidWorks. With the same company as SolidWorks owning it, tighter and seamless integration of both products, which are built and maintained by the same vendor, is a huge plus.

- Technology – This is probably the most legacy solution of all on this list, with no announcement if they plan to modernize the technology.

Weaknesses

- Limited focus. The limited focus might be a challenge for configure-to-order companies diversifying their operations and being active with M&A cycles.

- Limited ecosystem. The consulting base is extremely limited, with most resellers being CAD resellers and having limited experience in ERP implementation and cross-functional processes.

- It is not the right fit for holding and private equity companies as a corporate ledger. While a great subsidiary solution and a solution for pure-play configure-to-order manufacturers, it’s not the best fit for companies requiring diverse mixed-mode manufacturing companies or companies with complex business models.

4. IFS

Ideal for service-, project-, and asset-centric organizations, IFS is a great solution for highly engineered products particularly with WBS-centric workflows and long-standing programs. It would be ideal for companies requiring engineering collaboration and service-centric configurable quotes. Although, it might not be the best fit for eCommerce-centric consumer-grade 3D experience workflows. Despite these considerations, IFS maintains its rank at #4 on our list of top configure-to-order manufacturing ERP systems.

Strengths

- Unique program architecture tailored to track the costs of large configure-to-order programs. Unlike smaller ERP systems with a 1:1 relationship between a sales order and a project, IFS is designed to handle large programs where consolidated visibility would be critical without ad-hoc arrangements.

- Enterprise-grade field service and asset management capabilities. Especially suitable for configure-to-order companies because of their need to maintain expensive assets with complex workflows and scheduling requirements for field services.

- Unique financial workflows to support complex configure-to-order programs. Expensive products with configure-to-order operations require unique workflows, such as closing transactions financially at the line level, which might not be possible with ERP systems not designed to handle such transactions.

Weaknesses

- Limited focus. The limited focus might be a challenge for configure-to-order companies active with M&A cycles.

- Limited ecosystem. Its presence and install base are still limited in North America compared to other solutions on this list.

- It is not the right fit for holding and private equity companies as a corporate ledger. While IFS can provide the best-of-breed capabilities in a tier-two architecture or can act as one solution, IFS might not be the best fit to be used just as the corporate ledger for large configure-to-order enterprises.

3. Epicor Kinetic

Epicor Kinetic is tailored for small-to-mid-size configure-to-order manufacturers, particularly in industries with formal manufacturing processes. It offers a simpler 3D configurator experience, eliminating the need for consultants to configure products. However, its configurator may lack extensive options and scalability compared to more complex counterparts like Infor CSI or LN. While it excels in its niche, Epicor may not be the best choice for consumer-grade 3D configurator or configurable services experience. Thus, securing the #3 spot among top configure-to-order manufacturing ERP systems.

Strengths

- Strong for configure-to-order comapnies with formal manufacturing processes. The simplicity of the configurator is especially appealing to companies with limited consulting and implementation budgets, combined with their BOMs, especially appealing for businesses with formal manufacturing processes.

- Strong with complex inventory needs. For configure-to-order companies that use product attributes not only to drive the production BOMs but also if these variables are used as part of the production processes and planning, Epicor inventory processes would be especially friendly.

- Microsoft look-and-feel. Epicor has a very similar look and feel to Microsoft ERP products.

Weaknesses

- Global financial operations. Unlike larger products that might support more than three layers of financial hierarchies, such as corp, subsidiary, entity, and business units, the limited number of layers would operationally inefficient workarounds, such as using sub-accounts for such traceability.

- Embedded experience with field service and quality. Despite recent acquisitions, the field service capabilities are not as embedded and proven as some of the other products on this list, making it challenging for service companies looking for a configurable service experience.

- Weak ecosystem and marketplace. Epicor takes a suite approach to its products while selling directly to its customers. This limits the overall consulting and marketplace penetration.

2. Infor CloudSuite Industrial (Syteline)

Infor CloudSuite Industrial (Syteline) combines enterprise-grade configurator experience for complex products. It uses the same configurator module as its larger counterparts, such as Infor LN or M3, and can provide 3D product experiences that are very similar to SAP Hybriswell as visual 3D assemblies with complex animations and product orientations. While the configurator is complex, the underlying inventory layers might struggle for companies that use configurable attributes as part of their MRP or production runs. It might not be the best fit for companies with WBS-centric processes. Thus, placing it at #2 on our list among configure-to-order manufacturing ERP systems.

Strengths

- Complex configurator with consumer-grade 3D experience. Ideal for companies seeking consumer-grade 3D experiences, such as the furniture or mattress industry, as well as companies in the aftermarket and field-services spaces requiring OEM BOMs to be exploded on consumer-facing websites for field service and part purchase.

- Support for configurable BOMs with images. The configurator supports image-based guided configuration, quoting, and estimation processes.

- Field service integration of configurable BOMs. The field service processes support configurable BOMs for parts and service departments, which might require visual guidance on OEM BOMs.

Weaknesses

- Limited WBS-centric support for configurable products. The process model does not have as comprehensive support for WBS-centric processes, making it not as great fit for complex products with long lead times and complex programs requiring operational collaboration along with the financial activities and milestones as part of the project.

- Limited support for complex inventory with MRP and scheduling processes. The MRP and scheduling processes has limited support for product attributes, especially when it comes to using them for planning and purchase, making it inferior fit for industries with complex industries such as metal or chemical industries.

- Weak ecosystem and third-party options. Similar to Epicor, Infor CSI takes the suite approach. So it might be harder to find integration with best-of-breed third-party ERP add-ons.

1. Infor CloudSuite LN

Similar to Infor CSI, Infor CloudSuite LN bundles the same enterprise-grade product and overcomes other limitations, such as WBS-centric processes and support for larger programs.LN also has superior support for international supply chain processes, including vendor collaboration, especially where vendor and customer collaboration might be required to enable the configurator experience. Thus, winning the #1 spot among configure-to-order manufacturing ERP systems.

Strengths

- Global operations. Infor LN is the only solution in the market that has sufficient layers of financial hierarchies and global trade compliance functionality pre-baked with products to support configure-to-order manufacturers exploring global financial and operational synergies.

- Last-mile capabilities along with breadth of capabilities for diversified manufacturing business models. Configure-to-order verticals require deeper core ERP capabilities such as milestone and progress billing, operational tracking of programs, and consolidated view of costs of large programs not just as a report but also as part of the operational workflow without having users leave their transactional screens.

- Best-of-breed integrations offered out-of-the-box. Most tools that make-to manufacturer would require, such as HCM, PLM, data lake, ERP, WMS, TMS, and advanced supply chain planning, are all pre-integrated with LN.

Weaknesses

- Might not be the best fit as a corporate solution for holding and private equity companies. Holding companies as diverse as configure-to-order manufacturing, construction, and professional services may not be able to keep all of their entities on one solution and database.

- Legacy UI and Experience. Infor LN is a legacy solution with limited cloud-native capabilities such as universal search, mobile experience, etc.

- Weak Ecosystem and Marketplace. The consulting base and marketplaces are virtually non-existent for Infor LN.

Conclusion

Achieving success in configure-to-order manufacturing ERP particularly demands extensive process and product model sophistication. When processes align with industry or consumer expectations, leveraging established standards simplifies product formalization, facilitating the development of processes around predefined norms. Implementing configure-to-order manufacturing ERP processes for operational efficiency or streamlined quoting requires significant reengineering of product models and business processes. Thus, choosing the right ERP system necessitates a meticulous examination of transactions and workflows to avoid implementation challenges. While this list provides valuable guidance, consulting an independent ERP consultant can significantly improve implementation outcomes.