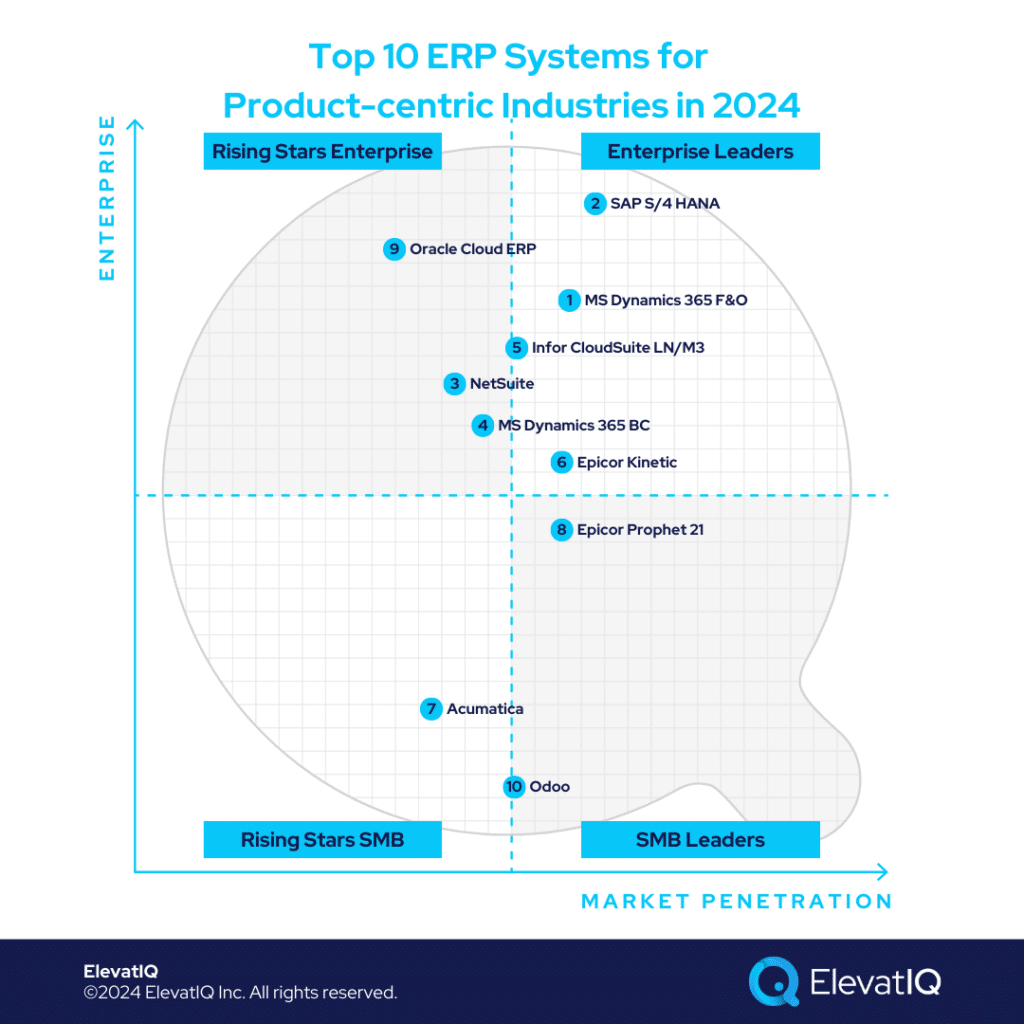

Defining Product-centric Industries. Unlike service-centric counterparts, product-centric industries heavily invest in inventory-centric operations rather than human resources and employee experience. This distinction necessitates uniquely tailored ERP systems. For manufacturers, distributors, and the entire manufacturing value chain focused on building and commercializing products, the major differentiator lies in the products they sell. Service-centric providers offering consulting services to these companies form the exception.

Business Models and Processes of Product-centric Industries. Within the product-centric industries segment, diverse business models abound, spanning discrete products to process-centric industries. Differences extend to manufacturing approaches, encompassing make-to-stock, make-to-order, configure-to-order, or project manufacturing. Additional variations arise in industrial or FMCG distribution, introducing nuances between B2B and B2C transactions. While a predominant focus on product-centric processes is common, some industries may intertwine service-centric processes, particularly if offering consulting services alongside products, adding complexity to the overall business model.

The ERP needs of product-centric industries. Tailoring ERP systems to product-centric industries hinges on their product development and commercialization processes. Varied stakeholders, including customers and suppliers, play crucial roles during the engineering phase, particularly for high-cost products. Retail and distribution models necessitate warehouse-level planning and allocation, while manufacturing-centric models involve joint forecasting and planning with suppliers and retailers. These diverse needs collectively shape the ERP requirements for product-centric industries. If you’re on the lookout for ERP systems tailored to these industries, kickstart your search with this curated list.

Criteria

- Overall market share/# of customers. The higher marketshare with product-centric industries drives higher rankings on this list.

- Ownership/funding. The superior financial position of the ERP vendor leads to higher rankings on this list.

- Quality of development. How modern is the tech stack? How aggressively is the ERP vendor pushing cloud-native functionality for this product? Is the roadmap officially announced? Or uncertain?

- Community/Ecosystem. How vibrant is the community? Social media groups? In-person user groups? Forums?

- Depth of native functionality. Last-mile functionality for specific industries natively built into the product?

- Quality of publicly available product documentation. How well-documented is the product? Is the documentation available publicly? How updated is the demo content available on YouTube?

- Product share and documented commitment. Is the product share reported separately in financial statements if the ERP vendor is public?

- Ability to natively support diversified business models. How diverse is the product to support multiple business models in the same product?

- Acquisition strategy aligned with the product: Any recent acquisitions to fill a specific hole for product-centric industries? Any official announcements to integrate recently acquired capabilities?

- User Reviews: How specific are the reviews about this product’s capabilities? How recent and frequent are the reviews?

- Must be an ERP product: Edge products such as HCM, CRM, eCommerce, MES, or accounting solutions that are not fully integrated to support enterprise-wide capabilities are not qualified for this list.

10. Odoo

Odoo is a great choice for product-centric startups outgrowing QuickBooks or other smaller accounting or CRM packages seeking to integrate their processes, minimizing data siloes. While Odoo is a great ERP system for companies starting on their ERP journey, its data model is leaner and designed to provide basic transactional capabilities. Among product-centric industries, Odoo could be a great fit for retail and commerce-centric startups with diverse business models operating in multiple countries. Odoo is also a superior fit in geographies where other operationally rich solutions might not be available. While great for consumerized products, Odoo might not be the best fit for complex products requiring complicated engineering and product models with deep layers of costing and MRP workloads. Well-adopted among product-centric companies, Odoo ranks at #10 for product-centric industries.

Strengths

- Easier for companies outgrowing QuickBooks. The lean data model and workflows make it easier for product-centric startups transitioning from QuickBooks-like solutions.

- Ecosystem and Development Help. The availability of cheaper technical talent globally helps product-centric startups extend or augment core capabilities.

- Ideal for diverse product-centric startups. The data and process model supports diverse industries, especially suitable for product-centric companies selling consulting services requiring project management capabilities.

Weaknesses

- Mature capabilities are not as pre-baked as larger peers. Mature capabilities such as MRP, allocation, and batch are not as detailed as with other richer ERP systems.

- An open-source ecosystem might lead to inexperienced developers promoting untested and unsecured code, causing cybersecurity issues or operational disruptions.

- Requires business consulting help to avoid overengineering by developers. Without access to seasoned ERP consultants, Odoo implementation is likely to run into implementation or adoption challenges.

9. Oracle Cloud ERP

Oracle Cloud ERP is a great choice for global product-centric enterprises. While major penetration of Oracle Cloud ERP is among service-centric verticals, it might be a fit for some product-centric verticals where the operational processes might not be as complex or hosted inside ERP. An example of such verticals would be retail, where the scope of ERP might limited to a corporate financial ledger. Oracle Cloud ERP is also a great choice for product-centric enterprises with evolving business models due to active acquisition cycles. An example of such companies would be either the holding companies or companies part of the PE portfolio requiring streamlining processes on one ERP system across the enterprise globally. Given its relevance and adoption among some verticals for product-centric industries, it ranks at #9 on our list.

Strengths

- WMS and TMS Capabilities Bundled with the ERP. Oracle Cloud ERP has WMS and TMS processes tightly embedded as part of the ERP transactions, and it is especially friendly for retail and 3PL-centric operations.

- Proven Solution with Large Workloads. Large product-centric companies may process millions of GL entries per hour. The workload Oracle Cloud ERP is designed to handle.

- Ecosystem. It has an ecosystem of experienced consultants who have the capabilities to handle the design and architecture of such complex enterprises.

Weaknesses

- Limited Last-mile Capabilities. The last-mile capabilities for specific product-centric verticals, such as industrial distribution or complex manufacturing, might be expensive to configure and implement.

- Not necessarily a Product-centric Solution. While installed with some large enterprises, it’s major focus is on service-centric verticals.

- Overwhelming for SMB product-centric companies. Not a fit for SMB product-centric companies looking for a turn-key solution tailored to the processes of the specific micro-vertical.

8. Epicor Prophet 21

Epicor Prophet 21 is a great choice for industrial distributors seeking deeper operational capabilities with the flexibility of replacing most components offered as part of the Epicor Prophet 21 suite. The requirements for specialized tools or integration with third-party best-of-breed systems might lead to expensive and uncontrollable implementation costs. While Epicor Prophet 21 might be a great choice for smaller pure-play industrial distributors, it might not be the best choice for diverse product-centric companies operating globally. Given its relevance and adoption among industrial distribution companies but with limited application for other diversified product-centric industries, it ranks at #8 on our list.

Strengths

- Rich Industrial ERP Distribution Systems Capabilities Provided Out-of-the-box. The system natively supports complex relationships between vendors and suppliers (and buying groups), along with capabilities such as branch accounting, retail-centric material flow, and warehouse architecture.

- Best for Prescriptive Architecture. Epicor Prophet 21 is a good fit when you can replace/use the systems provided in the Epicor ecosystem, such as payment providers, POS systems, shipping add-ons, and marketplace integrations.

- Pre-integrated with Other Best-of-breed Industrial B2B Systems. Integration with other best-of-breed industrial eCommerce systems, such as Optimizely or Unilog, is pre-baked.

Weaknesses

- Limited Capabilities to Support Diverse Distributors. Only fit for businesses with traditional business models with a limited number of channels. Not fit for modern distributors and DTC-centric businesses.

- Legacy Technology. While the new Kinetic experience can offer mature cloud capabilities such as enterprise search, the underlying data model and other cloud capabilities, such as mobile, are still legacy and patchy.

- Ecosystem. Limited number of consultants and partners available to support the product. The marketplace is extremely limited to create the best-of-breed architecture.

7. Acumatica

Acumatica is a great choice for diverse product-centric companies from $10-$100M in revenue operating in a handful of developed countries. It is especially friendly for companies with diverse product-centric business models ranging from manufacturing, retail, and distribution, aiming to explore synergies among these operations. While great for diverse product-centric companies, it might not be the best for companies over $100M seeking mature ERP capabilities, such as complex MRP runs or allocation cycles. But it’s a great fit for smaller companies with limited implementation budgets. Given its relevance for smaller product-centric companies, it ranks at #7 on our list.

Strengths

- B2B and B2C Products. Its data model is friendly for B2B businesses, with support for complex customer hierarchies and pricing (and discounting layers). It also supports divisional/branch accounting with warehouse-level pricing and replenishment strategies.

- Diverse Capabilities to Support the Needs of Multiple Business Models. Support for hybrid business models in the same product/database, such as manufacturing and distribution (or manufacturing combined with construction, DTC, or field service).

- Cloud-native UI and Flexible Pricing Options. Consumption-based pricing options reduce costs substantially for certain business models, such as seasonal businesses with labor spikes.

Weaknesses

- Limited Global Capabilities. The current multi-entity functionality might be limiting for companies with operationally connected offshore locations.

- Limited Mobile Reporting Capabilities. The mobile capabilities are leaner for complex reporting scenarios such as parallel processing.

- Multiple Add-ons may be Required for Regulated Industries and Complex Manufacturing. Requires several add-ons, such as MES, PLM, and quality, posing integration and communication challenges.

6. Epicor Kinetic

Epicor Kinetic is a great choice for companies with complex manufacturing and distribution operations in the industrial verticals. Its product data model is especially friendlier for complex, regulated industries with formal engineering processes. It can also support project-centric manufacturing and distribution-centric operations with the same product. While great for manufacturing, it’s not as great for diverse operations, especially for FMCG or retail-centric product companies. Given its relevance among manufacturing companies but limited applicability for other business models globally, it ranks at #6 on our list.

Strengths

- Strong for Companies with Formal Manufacturing Processes. Mandatory revision numbers and the BOMs driven by revision numbers would be especially appealing for formal engineering organizations with their BOMs aligned to Epicor Kinetic’s data model.

- Strong with Complex Inventory Needs. Companies requiring multiple attributes that need to be part of the planning and MRP, such as metal, fastener, automotive, and aerospace, would find Epicor Kinetic appealing.

- Microsoft Look-and-feel. Epicor has a very similar look and feel to Microsoft ERP products, providing you with the same experience but with much deeper last-mile capabilities where other products might struggle.

Weaknesses

- Global Financial Operations. Unlike larger products that might support more than three layers of financial hierarchies, such as corp, subsidiary, entity, and business units, the limited number of layers would require operationally inefficient workarounds, such as using sub-accounts for such traceability.

- Embedded Experience with Field Service and Quality. Despite recent acquisitions, the field service capabilities are not as embedded, making it challenging for some product-centric verticals, such as aftermarket, where such capabilities are essential.

- Weak Ecosystem and Marketplace. Epicor takes a suite approach to its products while selling directly to its customers, limiting the overall consulting and marketplace penetration.

5. Infor CloudSuite LN/M3

Infor CloudSuite LN and M3 are two completely different products, targeting large manufacturing companies in the upper mid-market and lower enterprise segments. LN targets complex manufacturing products such as rocketships, satellites, or construction machinery. Meanwhile, Infor M3 suits apparel, F&B, and chemical manufacturing. They might be great for pure-play manufacturing capabilities, but they might not be the best fit for other product-centric verticals such as pure-play retail or distribution. Given their relevance for manufacturing companies with limited applicability for other verticals, it ranks at #5 on our list.

Strengths

- Global Operations. Only solutions in the market with sufficient financial hierarchies and global trade compliance functionality pre-baked with products to support manufacturers exploring global financial and operational synergies.

- Last-mile Capabilities Along With Breadth of Capabilities for Diversified Manufacturing Business Models. Verticals such as apparel manufacturing require the deeper integration of PLM, vendor portals, and merchandising solutions. Complex manufacturing requires handling units, several layers of allocation management, and international trade compliance.

- Best-of-breed Integrations Offered Out-of-the-box. Most tools that a manufacturer would require, such as HCM, PLM, data lake, ERP, WMS, TMS, and advanced supply chain planning, are all pre-integrated with LN and M3.

Weaknesses

- Might Not be the Best Fit as a Corporate Solution for Holding and Private Equity Companies. Holding companies as diverse as manufacturing, construction, and professional services may not be able to keep all of their entities on one solution.

- Legacy UI and Experience. Infor LN and M3 are both legacy solutions with technical limitations to provide the cloud-native experience with universal search, mobile experience, etc.

- Weak Ecosystem and Marketplace. The consulting base and marketplaces are virtually non-existent for both Infor LN and M3.

4. Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is a great fit for globally diverse SMB companies seeking to host multiple product-centric business models in one solution. Its data model is especially friendly for FMCG and pharma-centric companies, with an ecosystem containing add-ons to support most business models. With the limited operational depth, it might require several add-ons and might not be the best fit for companies seeking depth with industrial distribution or manufacturing. Given its wider application and broader relevance for several product-centric business models, it ranks at #4 on our list.

Strengths

- Rich Distribution ERP Systems Capabilities Natively Supported. Replenishment strategies such as warehouse-level transfers, license plate construction, and bin-level capabilities are supported out-of-the-box for complex distribution businesses.

- Cloud-native Architecture. The product has been completely rearchitected using the cloud-native architecture.

- Global Capabilities and Ecosystem. Unlike several products such as Acumatica, which is primarily a North American product, it has support for several European, Asian, and African countries where most products might struggle.

Weaknesses

- Limited Capabilities to Support Diverse Product-centric Companies. Only fit for FMCG-centric distributors. The industrial distribution would require add-ons to support capabilities such as buying groups, HVAC code integration, and vendor catalogs.

- Unproven Add-ons and Unqualified Consulting Networks. Microsoft partner processes are not as streamlined as other vendors. So it may require the help of an independent ERP consultant to vet the add-ons and architecture in the Microsoft ecosystem.

- Ecosystem. While the ecosystem may have options for distribution industries where BC specializes in, it might not have integrations with the best-of-breed eCommerce systems in the industrial distribution space.

3. NetSuite

Like Microsoft Dynamics 365 Business Central, NetSuite is a great fit for globally operating SMB companies requiring multiple business models hosted in one solution. With the capabilities built to support operations for both publicly and privately owned companies, its application is much broader compared to other solutions. While great for diverse business models, it might not be the best fit for complex industrial distribution or manufacturing requiring a much thicker add-on. Given its broader application for various business models among product-centric companies, it ranks at #3 on our list.

Strengths

- B2C Data Model and Processes. NetSuite’s data model is especially attractive for B2C companies with integration requirements with several B2C channels, such as marketplaces.

- Global Capabilities. NetSuite can natively support the localization requirements of more than 100 countries. As well as consolidating and supporting intercompany transactions.

- Ecosystem. NetSuite has one of the largest ecosystems with pre-baked integration available to support the integration with multiple digital and physical channels.

Weaknesses

- Limited B2B Capabilities. The data model and pricing are not friendly for B2B companies. The pricing layers are not as scalable as other systems, such as Acumatica. NetSuite may struggle with the complex product catalog for industrial distributors.

- Limited Capabilities for Diverse Distributors. Distributors with diverse business models with manufacturing, construction, or field service might require several add-ons.

- Not Designed for Large Companies. NetSuite may struggle with transactional workload requirements of companies over $1B, especially for transactional businesses aiming to process their end-to-end transactions inside NetSuite.

2. SAP S/4 HANA

SAP S/4 HANA is a great fit for large, global enterprises operating globally, publicly or privately owned. Its product model can support MRP runs of very complex product-centric organizations aiming to find synergies globally, whether in a shared services model or in two-tier settings. While great for larger organizations, it might not be the best fit for smaller companies with limited IT budgets. With one of the strongest capabilities for product-centric companies seeking mature ERP capabilities after outgrowing smaller ERP packages such as Acumatica or NetSuite, it ranks at #2 on our list.

Strengths

- Large Workloads. SAP S/4 HANA could process more than 100K serialized goods receipts within 22 secs while Oracle Cloud ERP took more than 18 mins for the same test. SAP S/4 HANA’s design allows companies to process the workload requirements of Fortune 500 when every other system might struggle.

- Best-of-breed Architecture for Distributors. SAP’s best-of-breed architecture can support the business model of large distributors, irrespective of whether they are a traditional distributor or a combination of 3PL, which typically has a different warehouse and TMS architecture than traditional distributors.

- Financial Traceability and Control. Fortune 500 organizations with shared service models spread in multiple countries would appreciate the financial traceability built at the document level.

Weaknesses

- Weak Operational Capabilities for the Cloud. The last-mile capabilities available with some of the mid-market products may require substantial development with SAP S/4 HANA.

- Limited Pre-baked Integration. The third-party integration options such as integration with eCommerce platforms, POS systems, channel connectivity, etc may require substantial development efforts.

- Overwhelming for Smaller Organizations. The complex workflows built to support the processes of large, complex organizations may overwhelm organizations seeking simpler solutions without unnecessary processes and approval flows.

1. Microsoft Dynamics 365 F&O

Microsoft Dynamics 365 F&O is a great fit for global companies in the upper mid-market or lower enterprise segment seeking mature cloud ERP capabilities. Unlike smaller ERP systems such as NetSuite or MS Dynamics 365 Business Central F&O would not require as many add-ons, simplifying the implementation and limiting implementation risks. While great for larger global companies, it might not be the best fit for smaller product-centric companies. With its equal depth for both discrete and process-centric verticals, it’s one of the most diverse solutions on this list. Given its wider adoption for several business models among product-centric companies, it ranks at #1 on our list.

Strengths

- Operationally Richest Cloud Product for Large Complex Businesses. Businesses that have multiple global entities with complex business models such as discrete and process manufacturing, distribution, and project-based business models would find Microsoft Dynamics F&O attractive.

- Cloud-native Architecture. The product has been completely rearchitected using the cloud-native architecture. Cloud capabilities are stronger than competing products for distributors such as SAP S/4 HANA and Oracle ERP Cloud.

- Common Data Model and Database-level Integration for Best-of-breed Architecture. Large, complex systems could be frightening to use for sales and field service crews. Microsoft provides pre-baked integration with the best-of-breed CRM and field service products.

Weaknesses

- Financial Traceability and Audit Support. Complex global organizations may struggle with financial traceability and SOX compliance capabilities.

- Large Workloads. Compared to SAP S/4 HANA, it might not be able to match the performance expectations of large complex organizations where companies may need to process millions of journal entries per hr.

- Overwhelming for Smaller Organizations. The complex workflows built to support the processes of large, complex organizations may overwhelm organizations seeking simpler solutions without unnecessary processes and approval flows.

Conclusion

Despite apparent similarities, ERP systems for product and service industries are distinctly different, creating potential confusion due to shared terminology. Crucially, the inventory requirements diverge significantly between service-centric and product-centric organizations. If you are selecting an ERP System for Product-Centric Industries, be sure to scrutinize the intricacies of inventory layer structures, focusing on alignment with the specific needs of product-centric industries. Opting for an independent ERP consultant is a wise choice, especially if navigating these nuances isn’t part of your daily routine.