Negotiating Cloud ERP Consumption Models: Managing Variable Costs

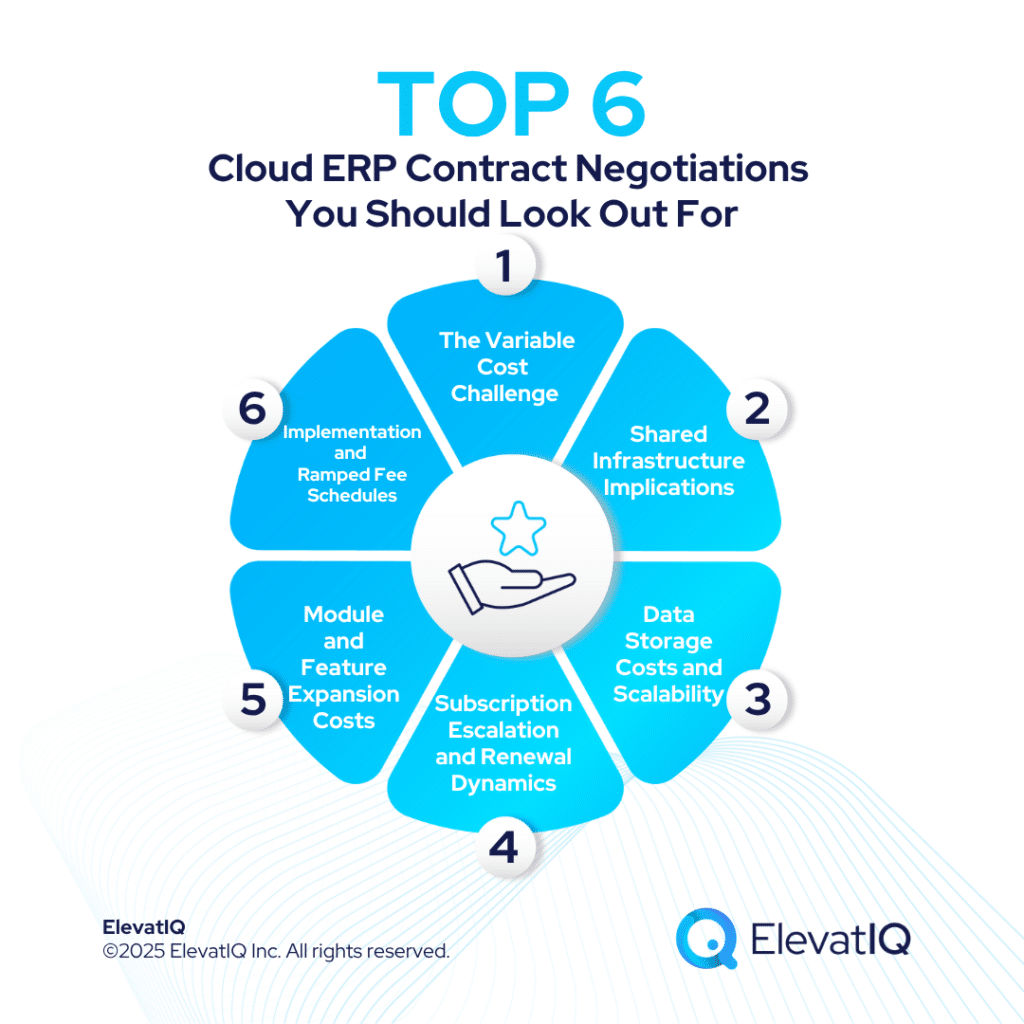

The shift to cloud ERP promised predictable subscription economics—no more massive hardware investments, no surprise infrastructure costs, just simple monthly or annual fees that scale with your business. Yet increasingly, organizations discover that cloud ERP bills bear little resemblance to initial projections. Transaction volumes spike unexpectedly, storage fees compound monthly, API calls proliferate as integrations deepen, and what started as a $50,000 annual subscription balloons to $150,000 or more through consumption-based charges that weren’t adequately anticipated or controlled.

This cost unpredictability stems from a fundamental shift in how cloud ERP vendors monetize their platforms. Rather than relying solely on user-based subscriptions, many vendors now supplement traditional per-user or per-application subscriptions with consumption-based elements (transactions, storage, API and compute usage, AI credits). The balance between fixed and variable charging differs by vendor and by which add-ons a customer uses. While these models align costs with usage theoretically, they create budget uncertainty and expose organizations to unlimited expense escalation if contracts lack appropriate protections.

Successfully negotiating cloud ERP consumption models requires understanding the various ways vendors structure variable costs, establishing comprehensive caps and limits that preserve budget predictability, securing transparent usage tracking and alert mechanisms, and protecting against the overage charges that transform “predictable” cloud costs into rapidly escalating financial obligations.

The Evolution of Cloud ERP Pricing: From Simple Subscriptions to Complex Consumption

Cloud ERP vendors initially emphasized pricing simplicity—$X per user per month, easy to understand, easy to budget. However, as platforms matured and vendors sought new revenue streams, pricing models evolved substantially, introducing consumption-based elements that create variable costs difficult to forecast accurately.

Understanding Consumption-Based Pricing in Cloud ERP

Consumption-based pricing charges organizations based on actual resource use rather than fixed subscription fees. This appears across cloud ERP platforms in several forms:

- Transaction-Based Pricing: Vendors charge per business transaction—sales orders, purchase orders, invoices, payments, shipments, etc. Acumatica, for example, uses a Resource Consumption License model tied to monthly transaction volumes. A growing business processing 10,000 transactions at go-live may find costs rising sharply as volumes increase to 25,000 or 50,000 unless contracts include protections.

- Data Storage Fees: Most subscriptions include baseline storage with additional capacity charged incrementally. As companies accumulate historical data, attachments, new entities, and higher transaction volumes, storage steadily grows. Fees that start small can compound into thousands monthly over time.

- Compute Capacity Charges: Processing-intensive operations—complex reporting, batch jobs, integrations, data transformations—consume compute resources vendors may charge for beyond included levels. Heavy month-end closes or large data volumes can trigger additional costs.

- API Call Pricing: Integrations with CRM, e-commerce, supply chain, and analytics systems generate API calls. Some vendors meter these and charge beyond included limits. Architectures making hundreds of thousands or millions of monthly calls can accumulate significant cost unless contracts set adequate allocations or caps.

- AI & Advanced Analytics Add-Ons: Many vendors now position AI, automation, and analytics capabilities as consumption-based add-ons. Pricing models are evolving—vendors like SAP and Microsoft use credit- or message-based systems—so buyers must treat AI pricing as time-sensitive during negotiation.

Consumption models create budget uncertainty because usage grows unpredictably. Business expansion increases transactions; new integrations multiply API calls; data accumulates annually; and operational changes alter consumption patterns. Without contracted limits, consumption pricing exposes organizations to escalating and unlimited costs.

Why Consumption Models Create Budget Challenges

The fundamental problem with consumption-based cloud ERP pricing lies in forecasting difficulty:

- Business Growth Uncertainty: Organizations implementing ERP don’t know precisely how business volumes will evolve. A 30% sales increase means 30% more transactions processed, potentially triggering higher pricing tiers or overage charges. Successful companies can find their ERP costs escalating faster than revenue growth if consumption pricing isn’t carefully structured.

- Operational Changes: Process improvements, automation initiatives, or business model evolution can dramatically alter consumption patterns. Implementing automated order processing that generates thousands more transactions monthly, while operationally beneficial, creates unexpected ERP cost increases under transaction-based models.

- Integration Proliferation: Organizations rarely deploy ERP in isolation. Over time, they add CRM integrations, e-commerce connections, supply chain platforms, analytics tools, and numerous other systems—each generating API calls and data synchronizations that increase consumption costs.

- Data Accumulation: Unlike transaction volumes that might stabilize, data storage grows continuously. Every transaction creates records that persist, every document uploaded consumes storage, every new subsidiary adds data. Storage fees compound month after month, creating a perpetually increasing cost component.

That said, many vendors also offer options (higher fixed tiers, annual commitments, reserved capacity) that can be used to reduce variability — so the right negotiation is often about choosing and contracting for the mix of fixed vs variable pricing that matches your risk tolerance.

Transaction-Based Pricing: Negotiating Usage Limits and Predictability

Transaction-based pricing models present the most direct consumption risk—costs scale linearly with business activity, creating unlimited expense potential as organizations grow or operational volumes increase.

Understanding Transaction Definitions

The first critical step when negotiating cloud ERP consumption models based on transactions requires establishing precise definitions of what constitutes a billable transaction:

- Granular vs. Aggregated Transactions: Does each line item on a purchase order count as a separate transaction, or does the entire order represent one transaction? When a sales order generates a shipment, invoice, and payment, does that create three transactions or one? Vendors benefit from granular transaction definitions that maximize billable events. Buyers need aggregated definitions that count related activities as single transactions.

- Internal vs. Customer Transactions: Should internal transfers between warehouses, intercompany transactions between subsidiaries, or data migrations count as billable transactions the same way external customer orders do?

- Test and Development Transactions: Do transactions in non-production environments—testing, training, development—consume the same transaction allocations as production operations?

Negotiating Transaction-Based Consumption Protections

Organizations negotiating cloud ERP consumption models with transaction-based pricing should secure these protections:

- Substantial Included Transaction Allocations: Rather than paying per transaction from volume one, negotiate generous included monthly allocations within base subscription pricing. Secure allocations substantially exceeding current volumes—if processing 10,000 monthly transactions today, negotiate 15,000-20,000 included monthly to accommodate growth without triggering overages.

- Tiered Pricing with Smooth Escalations: When consumption exceeds included allocations, ensure pricing increases gradually through defined tiers rather than jumping dramatically. Negotiate tier structures where moving from 20,000 to 25,000 monthly transactions creates modest incremental cost, not a pricing reset to higher per-transaction rates.

- Annual Rather Than Monthly Calculations: Monthly transaction limits create risk when business seasonality concentrates volumes in specific periods. Negotiate annual transaction allocations allowing flexibility to process more in busy months, fewer in slow periods, without triggering overages provided total annual volumes stay within limits.

- Transaction Rollover or Banking: Unused included transactions in low-volume months should roll over to subsequent months or bank toward peak periods, similar to mobile phone minute banking. This prevents paying for unused capacity while still facing overages during busy periods.

- Maximum Annual Increases: Lock in maximum annual increases to transaction pricing—perhaps 3-5% annually—preventing vendors from arbitrarily raising per-transaction costs year over year.

- Transparent Real-Time Tracking: Demand dashboard access showing current month transaction consumption, pace toward limits, and projected month-end totals. Without visibility, organizations discover overages only when invoices arrive, eliminating opportunity to adjust consumption patterns.

API Call Limits: Managing Integration Consumption Costs

Modern ERP systems never operate in isolation—they integrate with CRM platforms, e-commerce systems, supply chain tools, analytics applications, IoT devices, and numerous other systems. These integrations generate API calls that some vendors meter and charge for beyond included allocations.

Understanding API Consumption Patterns

API utilization varies dramatically based on integration architecture and business processes:

- Real-Time vs. Batch Synchronization: Real-time integrations keeping systems constantly synchronized generate far more API calls than nightly batch updates. An e-commerce integration syncing orders every 5 minutes might make hundreds of thousands of API calls monthly, while batch synchronization makes dozens.

- Read vs. Write Operations: Some vendors charge differently for API read operations (retrieving data) versus writes (creating or updating records). Complex integrations might generate far more reads than writes, amplifying costs if vendors charge per operation.

- Webhook vs. Polling Patterns: Modern webhook-based integrations where systems notify each other of changes generate fewer API calls than older polling patterns where systems repeatedly query for changes. Architecture decisions significantly impact consumption.

- IoT and Device Connections: Manufacturing organizations connecting IoT sensors, production equipment, or mobile devices to cloud ERP can generate millions of API calls monthly from automated data collection and equipment monitoring.

API Call Pricing Structures

Vendors structure API pricing various ways:

- Included Monthly Allocations: Base subscriptions might include 100,000, 500,000, or 1 million monthly API calls, with overage charges for additional usage.

- Tiered API Packages: Organizations purchase API capacity tiers—perhaps $500 monthly for 1 million calls, $1,500 for 5 million calls—scaling based on integration needs.

- Per-Call Overage Pricing: Beyond included allocations, vendors charge per API call—perhaps $0.50 per 1,000 calls—creating variable costs as integration usage grows.

- Unlimited API Models: Some vendors include unlimited API calls within subscriptions, simplifying budgeting but potentially incorporating these costs into base pricing.

Negotiating API Consumption Protections

Organizations building extensive cloud ERP integration ecosystems when negotiating cloud ERP consumption models should secure:

- Generous API Allocations: Negotiate included API call volumes substantially exceeding current usage, accommodating integration expansion and IoT device growth without triggering overages. Build 50-100% buffer beyond projected needs.

- Unlimited APIs for Specific Use Cases: For critical business processes—e-commerce order synchronization, customer data updates, inventory tracking—negotiate unlimited API calls rather than metered consumption. This prevents integration throttling or unexpected costs for core business operations.

- Webhook Support Without Surcharges: Ensure modern webhook-based integration patterns aren’t penalized versus older polling approaches. Contracts should encourage rather than discourage efficient integration architectures.

- Read Operation Discounts: If vendors charge per API operation, negotiate that read-only data retrievals cost significantly less than write operations that create or modify records, reflecting actual vendor infrastructure costs.

- Development and Testing Exemptions: API calls during integration development, testing, and troubleshooting shouldn’t consume production allocations. Negotiate separate non-production API limits or exemptions preventing development work from triggering production overages.

- Transparent API Monitoring: Demand real-time dashboards showing API consumption by integration, application, and operation type. Without granular visibility, diagnosing which integrations drive consumption becomes impossible when approaching limits.

- Overage Rate Caps: When API consumption exceeds allocations, negotiate maximum per-call overage rates preventing unlimited cost escalation. Lock in rates like “$0.50 per 1,000 calls, not to exceed $X monthly regardless of usage.”

Compute Capacity and Processing Consumption

Beyond transaction counts, storage volumes, and API calls, some cloud ERP vendors charge for compute capacity consumption—the processing power required for reporting, batch jobs, data transformations, and complex calculations.

Understanding Compute Consumption

Compute capacity consumption manifests through:

- Batch Processing Jobs: Month-end closes, financial consolidations, inventory valuations, cost allocations, and other batch processes consume compute resources proportional to data volumes and calculation complexity.

- Report Generation: Complex reports querying millions of records, performing calculations, and generating outputs require compute capacity. Organizations generating hundreds of daily reports for distributed users can accumulate substantial compute consumption.

- Data Warehouse and Analytics: Dimensional analysis, OLAP cubes, and analytical queries against historical data consume significant processing power, particularly when supporting numerous concurrent users.

- ETL and Data Integration: Extracting, transforming, and loading data between systems—particularly during migrations, consolidations, or regular synchronizations—requires compute capacity that vendors may meter.

Compute Pricing Models

- Reserved Capacity: Organizations purchase defined compute capacity—perhaps measured in virtual CPUs, processing hours, or proprietary capacity units—providing predictable costs for anticipated workloads.

- On-Demand Scaling: Systems automatically scale compute resources based on workload demands, with charges fluctuating based on actual consumption. This provides flexibility but creates cost variability.

- Burst Capacity Fees: Base subscriptions include standard capacity, with additional charges when workloads temporarily require more processing power—month-end closes or year-end processing, for example.

Negotiating Compute Consumption Protections

- Adequate Reserved Capacity: Negotiate included compute capacity sufficient for normal operations including peak periods like month-end, quarter-end, and year-end processing. Avoid models requiring burst capacity charges for routine business cycles.

- Burst Capacity Inclusion: If reserved capacity proves insufficient during exceptional circumstances, negotiate that reasonable burst capacity is included rather than charged additionally. Perhaps 20-30% above reserved capacity is available without overage fees.

- Processing Window Flexibility: If vendors employ time-based pricing where computing costs less during off-peak hours, ensure contracts don’t penalize organizations whose global operations require processing during “peak” windows in some geography.

- Optimization Assistance: Negotiate vendor obligations to identify inefficient queries, processes, or reports consuming excessive compute capacity. Vendors benefit from efficient resource usage and should assist optimizing rather than simply charging for consumption.

Establishing Comprehensive Consumption Caps and Guardrails

Individual protections for transactions, storage, APIs, and compute capacity prove insufficient without overarching consumption caps that limit total cost escalation regardless of usage patterns.

The Total Cost Cap Framework

- Maximum Monthly/Annual Cloud Spend: Negotiate absolute caps on total monthly or annual cloud ERP costs regardless of consumption levels: “Total Customer charges for all subscription, consumption, and usage-based fees shall not exceed $X annually, regardless of actual resource consumption.” This ultimate protection prevents unlimited cost escalation even when individual consumption elements remain within their specific limits but collectively create excessive total costs.

- Graduated Cap Structures: Caps might increase annually based on agreed escalation rates: “Year 1 maximum: $500,000; Year 2 maximum: $525,000 (5% increase); Year 3 maximum: $551,250 (5% increase).” This accommodates growth while preserving predictability.

- Consumption Categories: Within overall caps, establish sub-caps for different consumption categories preventing any single element from dominating costs:

- Transaction fees: Maximum $50,000 annually

- Storage costs: Maximum $25,000 annually

- API charges: Maximum $15,000 annually

- Compute overages: Maximum $10,000 annually

- Cap Breach Remedies: Define what happens when consumption would exceed caps. Options include:

- Soft Caps: Charges stop accumulating once caps are reached, with vendor and customer negotiating capacity additions

- Hard Caps: Systems throttle or limit functionality preventing cap breaches, forcing architectural conversations

- Renegotiation Triggers: Approaching caps triggers pricing renegotiations rather than automatic overages

Transparent Usage Tracking and Alert Mechanisms

Consumption protections prove worthless if organizations discover overages only when invoices arrive. Comprehensive consumption management when negotiating cloud ERP consumption models requires real-time visibility and proactive alerts.

Essential Tracking Capabilities

- Real-Time Dashboards: Demand vendor-provided dashboards accessible to administrators showing:

- Current month consumption across all metered categories

- Pace toward monthly/annual limits

- Trending compared to previous periods

- Projected month-end/year-end totals based on current utilization rates

- Granular Consumption Attribution: Track consumption by:

- User or user group

- Department or cost center

- Application or integration

- Transaction type or business process

- This granularity enables identifying consumption drivers and optimizing usage patterns when approaching limits.

- Historical Trending and Analytics: Maintain historical consumption data enabling trend analysis, seasonal pattern identification, and capacity planning. Understanding that December always shows 40% higher transaction volumes than August helps budget for predictable fluctuations.

- Programmatic Access to Metrics: Provide API access to consumption metrics enabling organizations to build custom monitoring, integrate with existing cost management platforms, or automate reporting to finance teams.

Proactive Alert Systems

- Threshold-Based Alerts: Configure alerts triggering when consumption reaches defined thresholds:

- 75% of monthly/annual limit: Warning notification

- 90% of limit: Urgent alert to management

- 95% of limit: Critical escalation requiring immediate action

- Velocity-Based Alerts: Notify when consumption rate increases dramatically over baseline—sudden 3x increase in daily API calls, for example—enabling early investigation of potential issues.

- Predictive Alerts: Use consumption trending to predict limit breaches before they occur: “Based on current utilization pace, you will exceed monthly transaction allocation in 12 days” enables proactive management.

- Multi-Channel Delivery: Ensure alerts reach appropriate stakeholders through email, dashboard notifications, and integration with IT management platforms rather than relying solely on periodic invoice reviews.

Overage Pricing: Negotiating Protections Against Cost Spikes

Despite included allocations, caps, and monitoring, consumption may occasionally exceed contracted limits. How contracts handle overages determines whether temporary spikes create manageable cost increases or budget-destroying surprises.

Overage Pricing Structures

- Pre-Agreed Overage Rates: Lock in specific per-unit pricing for consumption exceeding allocations: “$0.05 per transaction beyond included monthly allocation” provides predictability even when overages occur.

- Tiered Overage Pricing: Negotiate that initial overages cost less than extreme excess: “First 10% over allocation: $0.05/unit; 10-25% over: $0.08/unit; 25%+ over: $0.10/unit.” This creates graduated cost pressure while preventing linear escalation.

- Overage Forgiveness: For occasional, modest overages, negotiate that vendors forgive rather than charge: “Overages up to 10% of monthly allocation in any single month, occurring no more than twice annually, shall not result in additional charges.”

- Volume Discount Application: Ensure negotiated volume discounts apply to overage consumption, not just base allocations. Organizations shouldn’t pay higher per-unit prices for overages than for included capacity.

- Overage Caps: Establish maximum overage charges regardless of consumption: “Overage charges in any month shall not exceed 50% of Customer’s monthly subscription fee regardless of actual consumption levels.”

Grace Periods and Adjustment Opportunities

- Consumption Review Periods: When usage approaches or slightly exceeds limits, negotiate grace periods allowing evaluation and adjustment before overages trigger: “Customer shall have 30-day notice period when consumption reaches 95% of limits, during which no overage charges accrue while parties negotiate capacity adjustments.”

- Retroactive Limit Increases: If consumption legitimately and permanently increases—due to acquisition, new product launch, market expansion—negotiate ability to retroactively increase allocations preventing overage charges for new baseline consumption levels.

- Consumption Credit Banking: Negotiate that overage charges in some periods can be offset by under-consumption in others, similar to mobile phone rollover minutes. This smooths costs when consumption varies seasonally.

Strategic Negotiation of Cloud ERP Consumption Models

Cloud ERP consumption-based pricing models create budget unpredictability and expose organizations to unlimited cost escalation unless contracts include comprehensive protections. Successfully negotiating cloud ERP consumption models requires understanding how vendors structure variable costs (transaction-based pricing, storage fees, API call limits, compute capacity charges), establishing consumption caps and limits that preserve predictability, securing transparent real-time tracking and proactive alerts, and protecting against overage charges that transform “predictable” cloud costs into rapidly escalating expenses.

Organizations that negotiate consumption protections upfront—generous included allocations, comprehensive caps, transparent monitoring, favorable overage terms—position themselves for cost-effective cloud ERP adoption that delivers value without budget surprises. Conversely, buyers who accept standard consumption terms or fail to anticipate usage growth patterns discover that “predictable” cloud subscriptions create more cost volatility than the on-premises systems they replaced.

The investment in thorough consumption model negotiation delivers returns throughout the cloud ERP lifecycle, preventing the budget overruns and unexpected costs that plague organizations treating consumption terms as afterthoughts rather than critical contract elements that warrant serious attention. For organizations navigating cloud ERP procurement, independent advisory expertise provides essential guidance through the complex dynamics of consumption-based pricing, usage forecasting, and contract protections that transform variable costs into manageable, predictable expenses serving your organization throughout the cloud ERP lifecycle.

FAQs

Negotiating Cloud ERP Consumption Models: Managing Variable Costs Read More »