Microsoft Dynamics CRM vs SugarCRM: Independent Review

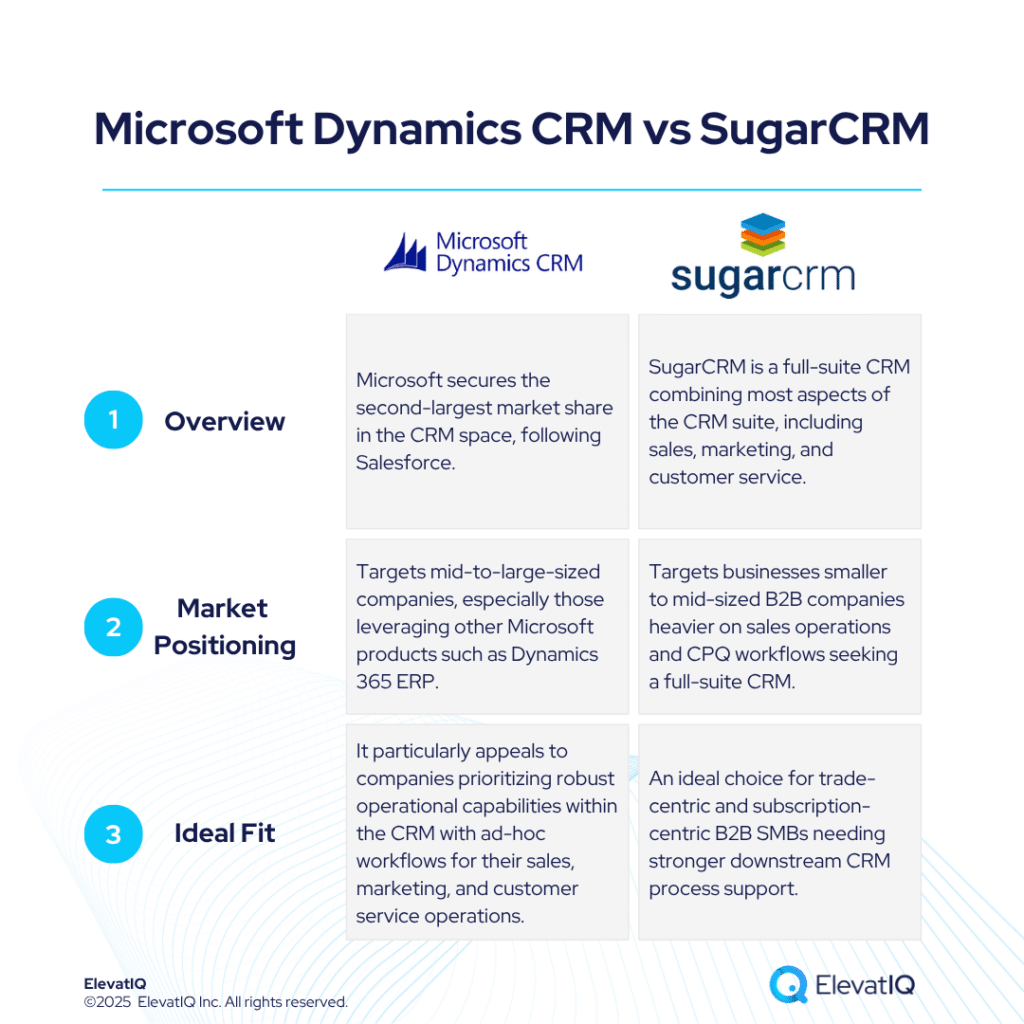

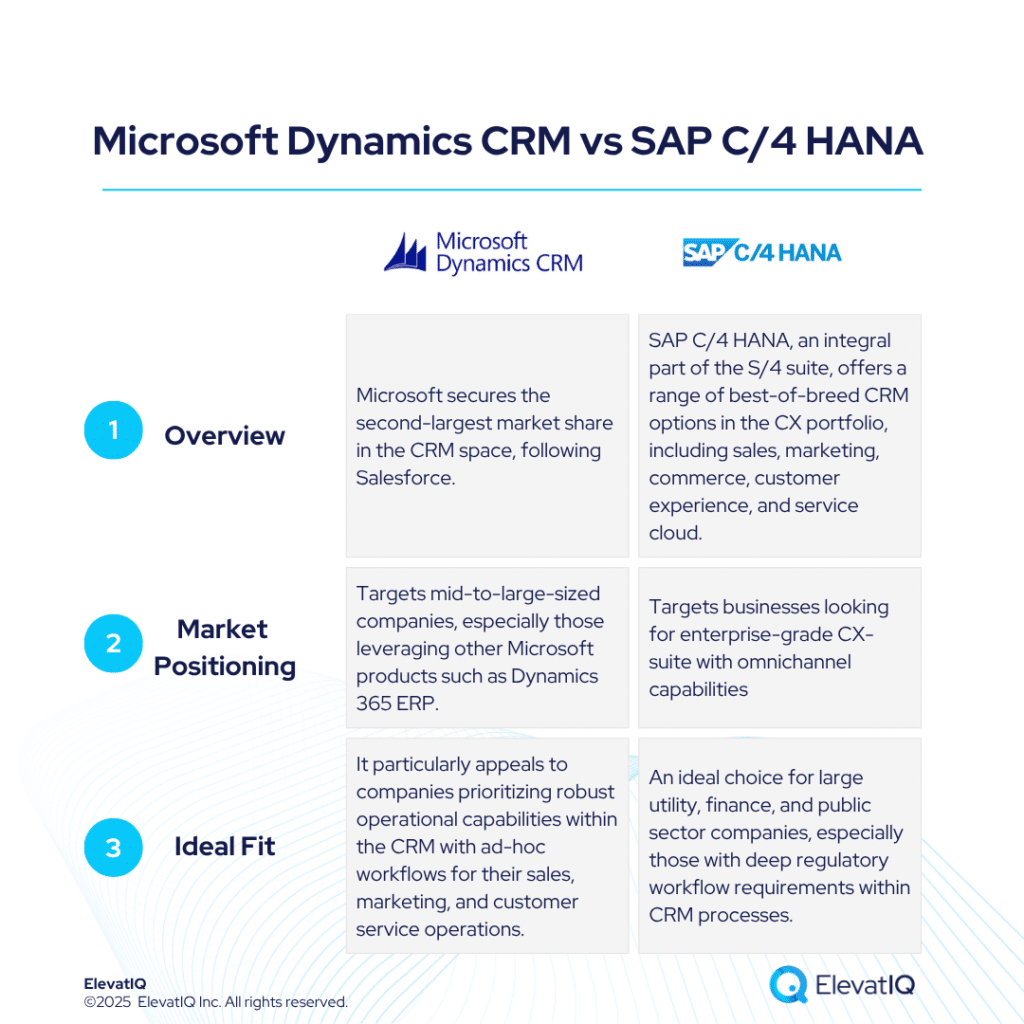

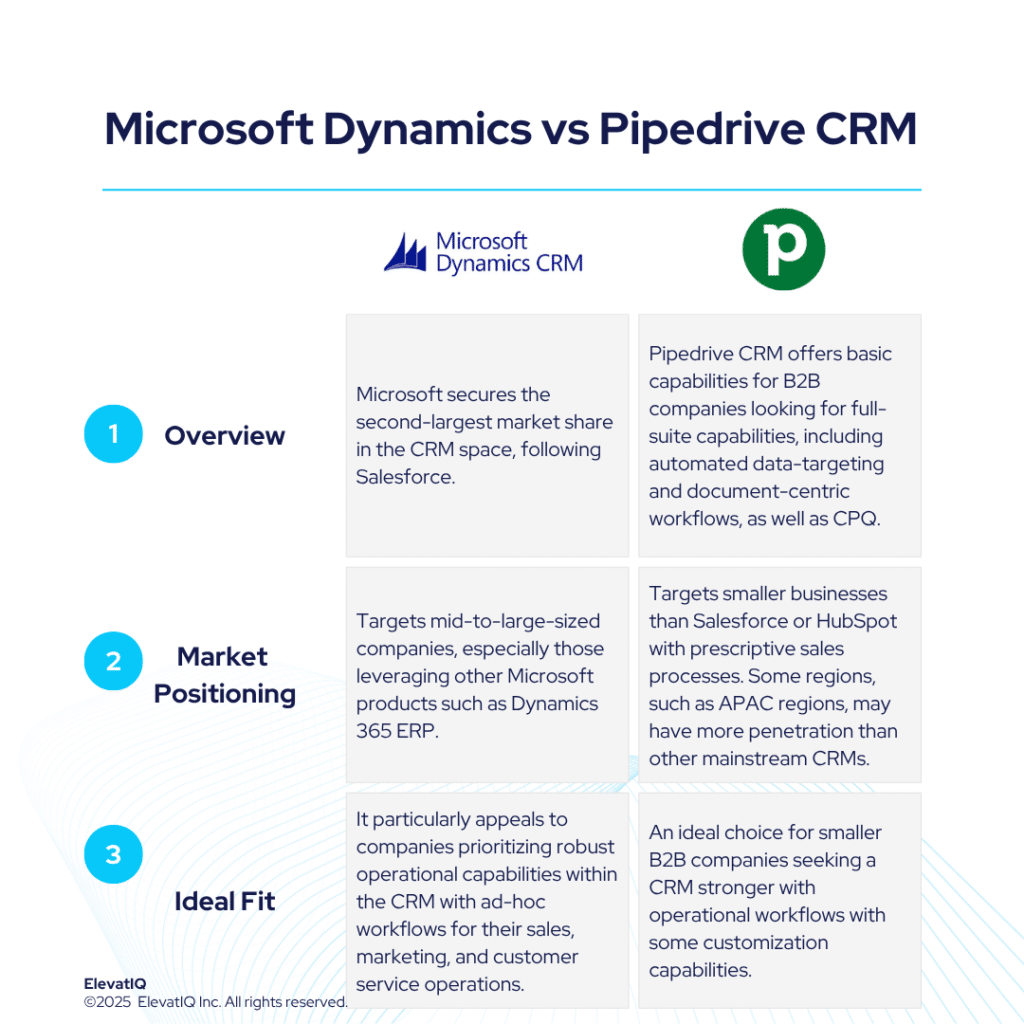

Microsoft Dynamics CRM is a robust and highly customizable platform designed for organizations that require flexibility to manage complex, non-standard workflows. Its broad feature set includes modules for sales, customer insights, field service, call centers, and event management, making it a comprehensive solution for enterprises operating across multiple departments. However, its reliance on third-party add-ons for capabilities like omnichannel support and content management introduces added implementation time and cost, which can be a barrier for small and mid-sized businesses with tighter resources or lean IT teams.

SugarCRM, by contrast, is purpose-built for industrial SMEs that operate with more traditional lead generation methods—such as trade shows—and need deeper integration with tools like CPQ. It caters to organizations that prioritize streamlined sales processes and tight coupling with back-end systems like ERP. SugarCRM also offers out-of-the-box features that are less common in many mainstream CRMs, such as project management and subscription handling. These built-in tools reduce the need for third-party add-ons, making it a more self-contained solution for manufacturers and distributors.

Both platforms support customization. But Microsoft Dynamics CRM offers a more mature ecosystem and greater extensibility for enterprise needs. Its large third-party marketplace and tight integration with Microsoft tools give it an edge for complex operations. SugarCRM, by contrast, suits companies that want moderate flexibility with built-in tools and simpler setup. It may not scale as far, but it works well out of the box—especially for industrial sales. The real question is: do you need a highly extensible platform or a focused CRM built for your industry?

What Is Microsoft Dynamics CRM?

Microsoft Dynamics 365 CRM delivers a powerful, all-in-one solution. It’s built for businesses that need tight CRM and ERP integration. Mid-market and enterprise teams can streamline sales, service, and marketing through a unified platform. It supports territory planning, global compliance, and deep customer insights. Unlike modular systems, Dynamics connects tightly with Microsoft’s full suite, keeping data and user experience consistent. But this depth adds complexity. Teams often need expert help to implement it. Sales teams may also find its product-pricing setup less flexible than they’d like.

In contrast, SugarCRM appeals to sales-centric organizations, particularly in industrial sectors, by offering built-in features like subscription and project management, and better out-of-the-box CPQ capabilities than Microsoft. But how well does SugarCRM handle evolving customer insights or large-scale event management? Does it provide the same extensibility and data governance required by global teams with high compliance needs? If you’re choosing between a deep enterprise stack and a focused, flexible CRM for industrial workflows, download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now.

What Is SugarCRM?

SugarCRM has changed a lot since its open-source beginnings. Once known for flexibility and low cost, it now targets specific industries—especially manufacturing, distribution, and mid-market industrial firms. Its interface competes with user-friendly platforms like HubSpot. At the same time, it integrates well with ERPs like Epicor and SYSPRO. SugarCRM handles complex products and layered data with minimal third-party tools. In contrast, Microsoft Dynamics CRM offers deep customization but often needs heavy consulting for niche setups. SugarCRM handles these use cases more naturally for its audience.

Every platform brings trade‑offs. SugarCRM’s BPM and project‑management modules streamline industrial workflows and align sales with service. But its built‑in ITSM and subscription tools can’t match the flexibility or scale of Microsoft Dynamics 365. Microsoft Dynamics powers complex business models with deeper infrastructure links, global governance, and a vast partner ecosystem. So decide: do you want a focused industrial solution or a full enterprise‑grade suite? Will SugarCRM’s out‑of‑the‑box ERP links serve you better than Microsoft’s broad set of modular apps? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now.

Microsoft Dynamics CRM vs SugarCRM Comparison

Microsoft Dynamics CRM is built to serve enterprises with complex, evolving needs. Its data model is broad and flexible, accommodating diverse industries and intricate sales, service, and operational workflows. The platform stands out for its deep integration across the Microsoft ecosystem, robust CPQ capabilities, and advanced operational tools like territory planning and compliance management. On the other hand, SugarCRM is highly optimized for industrial verticals. It includes native support for CPQ, ERP-friendly business object layers, and subscription workflows—features that are baked into the platform rather than bolted on. However, SugarCRM’s integration ecosystem, marketing automation, and customization capabilities don’t match the breadth and depth of Dynamics 365.

Choosing between these two platforms isn’t just about features—it’s about fit. Are you part of an industrial vertical looking for a CRM that integrates cleanly with your ERP? Or does your organization need a deeply customizable, globally scalable CRM that supports a variety of business models and customer engagement strategies? How important is seamless integration with productivity tools, enterprise reporting, or upstream marketing platforms? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now.

Microsoft Dynamics CRM vs SugarCRM Module Comparison

Both platforms bring a wide range of features aimed at improving operational efficiency and driving smarter business outcomes. In this comparison, we explore the unique strengths of Microsoft Dynamics CRM and SugarCRM across several key areas. By highlighting their differences, this analysis helps businesses identify which solution best fits their strategic goals and technical requirements.

The comparison focuses on capabilities within core CRM modules—including marketing, sales, customer service, and e-commerce—offering a clearer view into how each platform performs in supporting end-to-end customer engagement and operational workflows.

Marketing

Microsoft Dynamics CRM and SugarCRM both offer essential marketing functionalities, but they cater to different use cases and user profiles. Microsoft Dynamics CRM provides a strong foundation for content creation with reusable content blocks and integrated SEO metadata management tools, which can be a major advantage for organizations aiming to centralize their digital marketing assets. Additionally, its native tools for managing multiple social media accounts and handling email campaigns make it a suitable option for enterprises looking for a unified, omnichannel marketing approach.

SugarCRM, meanwhile, focuses more on ease of use and streamlined campaign execution. It allows marketers to create and manage email campaigns and landing pages with ease, and integrates with leading social platforms to facilitate social media engagement. However, its lack of dedicated SEO tools could be a gap for companies that rely heavily on organic search traffic. How important are SEO and content reuse in your marketing strategy? Do your teams prioritize ease of use or deep integration across digital channels? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now to explore which platform aligns better with your marketing goals.

Sales

Microsoft Dynamics CRM and SugarCRM both provide comprehensive tools to manage the sales process, but they approach these capabilities with different strengths. Microsoft Dynamics CRM excels in lead management by enabling businesses to capture, score, nurture, and convert leads into opportunities with a high level of detail and automation. Its visual sales pipeline management offers a clear view of the sales stages, helping teams track progress and forecast revenue accurately. Additionally, Dynamics CRM’s integrated email tracking and meeting scheduling tools improve sales efficiency by providing insights into customer interactions and streamlining appointment management. Collaboration features further enhance teamwork, making it easier for sales and marketing teams to stay aligned.

SugarCRM also supports these sales functionalities with an emphasis on user-friendly tools for capturing and nurturing leads throughout the sales cycle. Its sales pipeline visualization allows users to track deal progress and set key milestones, while email tracking provides essential analytics like open rates and click-through rates. Meeting scheduling and collaboration tools are designed to keep teams connected and organized. How critical are advanced lead scoring and detailed sales forecasting for your business? Do you need a CRM that integrates deeply with communication tools, or one focused on simplicity and ease of use? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now to find out which platform best fits your sales and collaboration needs.

Customer Service

Microsoft Dynamics CRM and SugarCRM both offer essential customer service features designed to enhance support efficiency and customer satisfaction. Microsoft Dynamics CRM includes a robust ticketing system that helps manage and resolve customer issues quickly, complemented by live chat capabilities through Dynamics 365 Customer Service. Its customer support automation offers automated workflows, escalation rules, and pre-defined response templates to streamline service processes. Additionally, Dynamics CRM supports omni-channel interactions, enabling businesses to engage with customers across multiple channels while providing self-service portals for added convenience.

SugarCRM provides similar customer service functionalities with tools to create, track, and resolve support tickets efficiently. Its live chat feature allows for instant customer engagement, and automation tools help reduce manual workload by handling repetitive tasks. SugarCRM also supports omni-channel communication, integrating voice, chat, email, and self-service portals to create seamless customer experiences. How important is having a tightly integrated ticketing and live chat system for your support team? Are automated workflows and omni-channel capabilities critical to your customer service strategy? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now to explore which platform aligns best with your customer support goals.

E-commerce

Microsoft Dynamics CRM provides comprehensive product catalog management tools that enable businesses to create, manage, and organize detailed product listings efficiently. Its deep integration with other Dynamics 365 applications, such as Dynamics 365 Supply Chain Management, helps streamline order fulfillment processes, ensuring seamless coordination from sales to delivery. Additionally, Microsoft Dynamics CRM supports advanced customer segmentation and personalized marketing efforts, offering targeted recommendations and actionable customer insights that enhance the overall shopping experience.

SugarCRM also offers solid capabilities in product catalog management, helping users define and categorize their products or services effectively. While it doesn’t provide native order fulfillment features, SugarCRM integrates with popular e-commerce platforms like Shopify to support these processes. Notably, SugarCRM leverages generative AI to deliver personalized shopping experiences, enabling businesses to engage customers with tailored content and offers. How important is integrated product catalog management for your sales strategy? Do you prioritize built-in order fulfillment capabilities or flexible e-commerce integrations? Are personalized shopping experiences a key factor in your CRM selection? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now.

Microsoft Dynamics CRM vs SugarCRM Pros

Microsoft Dynamics CRM excels at supporting complex business objects, making it well-suited for larger, regulated enterprises with intricate workflows. It features database-level replication and a shared common data model, which ensures data integrity and seamless integration across its suite of products. The platform is tightly integrated with other Microsoft solutions, providing a cohesive ecosystem for sales, marketing, and customer service operations. Additionally, Dynamics CRM offers robust territory management and global sales compensation planning capabilities, addressing the needs of businesses with extensive operational requirements.

On the other hand, SugarCRM offers a community edition that can be hosted on-premises, appealing to organizations with existing server infrastructure and in-house development teams looking for cost-effective CRM solutions. It also provides native support for ERP alignment and subscription-based business models, which is particularly beneficial for industrial and service-centric companies. SugarCRM’s ability to build ads directly from the platform adds another layer of marketing convenience. How important is on-premises hosting for your organization? Are advanced territory management and sales compensation key factors in your CRM choice? Does integrating CRM with ERP systems and subscription models influence your decision? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now to get detailed insights and make the best choice for your business.

Microsoft Dynamics CRM vs SugarCRM Cons

Microsoft Dynamics CRM is known for its tightly coupled data objects, which, while ensuring data consistency, can sometimes introduce complexity and reduce flexibility for users. This can lead to usability challenges, especially when compared to more intuitive and adaptable CRM platforms. Additionally, the platform’s support for CSV import and export is not particularly intuitive, which may frustrate sales teams needing to migrate or update data frequently. Reporting capabilities, although powerful, can feel limited or cumbersome to users accustomed to more modern, streamlined analytics tools.

SugarCRM, particularly its community edition, offers a cost-effective entry point with no licensing fees, but organizations must manage their own support, upgrades, hosting, and security. While it delivers essential CRM functionalities, the interface lacks modern design elements, potentially impacting user adoption and overall experience. Its ecosystem and integration options are also less mature compared to other market leaders, which may limit scalability. How critical is user-friendly data import/export for your sales team? Does your organization have the resources to manage self-hosted CRM infrastructure? How important is a modern, intuitive interface in driving adoption and productivity? Download the ultimate Microsoft Dynamics CRM vs SugarCRM comparison guide now to explore these factors in detail.

Download the Full Research Report