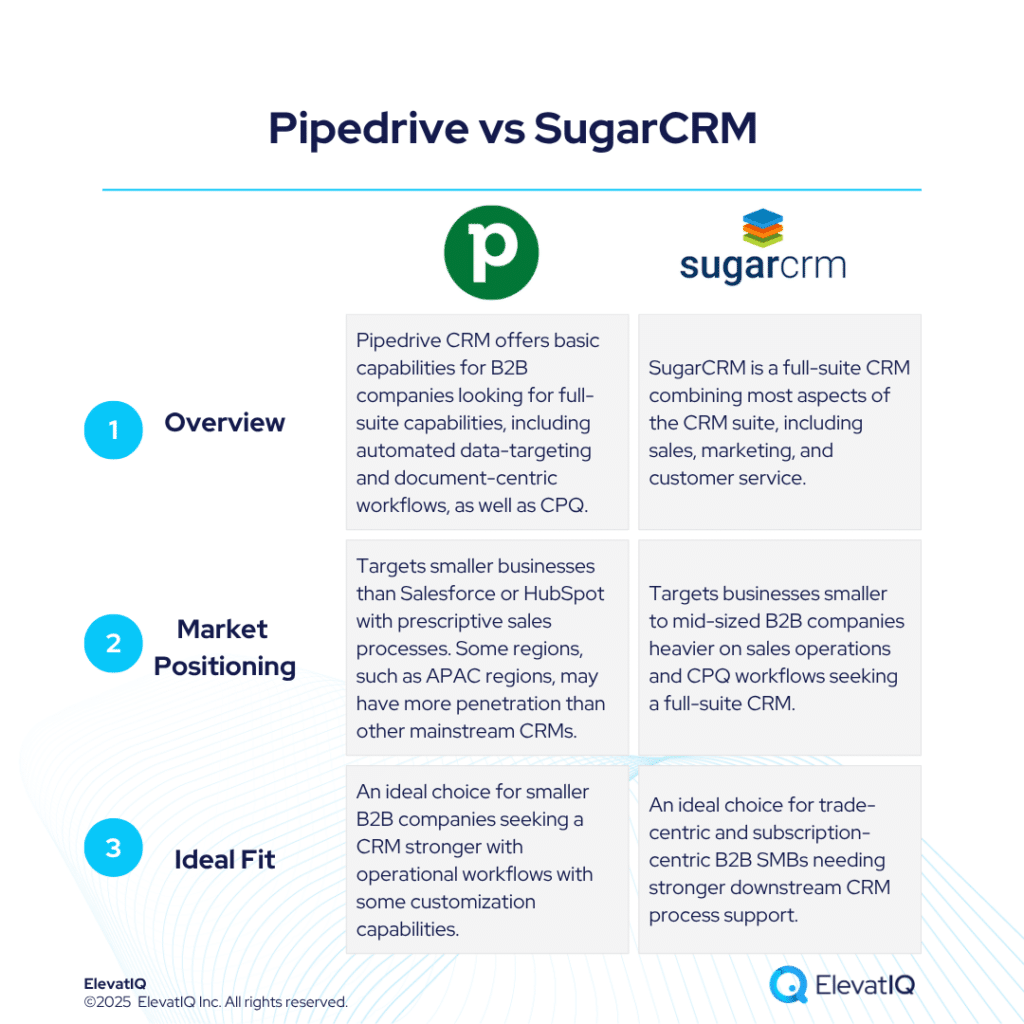

Pipedrive vs SugarCRM: Independent Review

SugarCRM, on the other hand, is better suited for SMBs in industrial sectors with complex, product-driven sales processes. Its built-in CPQ tools and data-centric workflow capabilities cater well to subscription-based business models where sales teams must interact with detailed product catalogs and estimations. Although its ecosystem remains more limited than leading CRM vendors, SugarCRM excels in environments where ERP integration is essential but extensive custom development is impractical due to resource constraints. This makes it a strong choice for mid-sized companies seeking a cost-effective solution with deeper backend connectivity.

While both Pipedrive and SugarCRM cover essential CRM areas like sales, marketing, and quoting, they fall short in supporting advanced use cases such as field service operations or enterprise-grade custom app development. Pipedrive’s rigid object model restricts workflow flexibility, making it difficult to adapt to evolving sales strategies. In contrast, SugarCRM’s built-in business process management (BPM) engine enables low- and no-code customizations, providing more flexibility for process adaptation. Although SugarCRM originated as a legacy platform, its updated UX now rivals more modern competitors—including Pipedrive—offering a balance between usability and depth for industrial businesses navigating complex sales cycles.

What Is Pipedrive CRM?

Pipedrive targets small to midsize businesses that want a simple, ready-to-use CRM. It favors ease of use over deep configurability. Its built-in CPQ and product catalog tools cut the need for third-party add-ons, giving quick value to product-focused SMBs. A lightweight design and basic workflow engine speed up implementation, making it ideal for lean IT teams with modest budgets. However, these strengths can limit firms needing advanced customization, tight CMS integration, or event-driven marketing. In those cases, SugarCRM or HubSpot may offer a stronger fit.

SugarCRM, in contrast, is built for SMBs with more complex sales cycles, particularly those that depend on CPQ and data-rich workflows. While Pipedrive supports data-driven marketing through recent acquisitions, it still falls short in areas like workflow flexibility, integration breadth, and long-term scalability. So how much control do you need over your CRM processes? Does your organization prioritize rapid setup and simplicity, or are you looking for deeper process automation and customization as your business grows? Download the ultimate Pipedrive vs SugarCRM comparison guide now to see which platform aligns best with your growth strategy.

What Is SugarCRM?

SugarCRM has evolved from its open-source roots into a focused, industry-ready CRM. It serves manufacturing, distribution, and subscription-based businesses. The platform integrates tightly with industrial ERPs like Epicor, SYSPRO, and Plex. This integration helps manage complex product structures and long sales cycles better than many general-purpose CRMs. Built-in subscription workflows and a basic project management module add value for companies with ongoing customer relationships and small sales-related projects. SugarCRM lacks the app development flexibility of Microsoft Dynamics and the broad ecosystem of Salesforce. However, its industrial focus makes it a reliable and specialized choice.

Pipedrive, in contrast, delivers a broader suite of business applications with a streamlined, easy-to-use interface—ideal for small teams and fast-growing SMBs looking for rapid deployment and minimal complexity. However, it lacks the depth of pre-built ERP integrations and subscription workflow capabilities that SugarCRM brings to the table. So which CRM is the better fit for your organization? Do you need deep industry alignment and built-in support for manufacturing or subscription models, or do you prioritize simplicity and speed to value? Download the ultimate Pipedrive vs SugarCRM comparison guide now to discover which platform best matches your operational needs.

Pipedrive vs SugarCRM: Overall Comparison

Pipedrive CRM offers an intuitive interface and lightweight structure. It suits small businesses and startups that value ease of use. The data model resembles HubSpot’s, providing a clean, user-friendly experience. However, it lacks complexity for advanced workflows like territory management or layered approvals. Pipedrive’s ecosystem includes over 400 integrations and continues to grow. Its strengths lean toward simple sales enablement, not full-scale CRM orchestration. Marketing automation comes through add-ons like Campaigns by Pipedrive. These features may not meet the needs of companies with advanced segmentation or upstream marketing strategies.

SugarCRM delivers structured workflows and business object layers for ERP-focused and industrial use cases. It offers native CPQ and subscription workflows. It supports territory planning and sales compensation for large, process-driven organizations. Its ecosystem is smaller than Salesforce or Microsoft Dynamics. Reporting customization options are also limited. The choice depends on your business needs. Do you want an easy, out-of-the-box CRM with lighter capabilities? Or do you need built-in support for complex industrial processes? Decide between flexibility for rapid startup or depth for long-term scalability. Download the ultimate Pipedrive vs SugarCRM comparison guide to find your best fit.

Pipedrive vs SugarCRM: Their Module Comparison

Both Pipedrive and SugarCRM deliver a wide range of features aimed at improving business operations and driving efficiency. This comparison highlights the unique strengths of each platform across several key areas, helping organizations evaluate which solution best fits their specific needs. In the sections that follow, we examine core capabilities across marketing, sales, customer service, and e-commerce to support a more informed CRM selection process.

Marketing

When it comes to marketing capabilities, Pipedrive and SugarCRM take very different approaches. Pipedrive focuses on simplicity and integration, offering basic content and email campaign functionality through third-party tools like Google Docs and Campaigns by Pipedrive. While it supports some aspects of social media and analytics, its feature set is relatively lightweight, making it more suitable for small businesses with modest marketing needs. SEO and social scheduling require additional tools, which may introduce added cost or complexity for teams looking for an all-in-one solution.

SugarCRM, in contrast, provides more robust native marketing features, including content creation tools for email campaigns and landing pages, integrated email marketing with tracking capabilities, and real-time dashboards covering sales, marketing, and support metrics. Though it doesn’t include dedicated SEO functionality, its deeper marketing stack and social media integrations make it better suited for organizations that require more comprehensive, in-platform marketing support. So, how important is built-in marketing functionality to your CRM strategy? Would your team benefit more from an integrated toolset, or a lightweight solution with plug-and-play flexibility? Download the ultimate Pipedrive vs SugarCRM comparison guide now to explore which platform aligns best with your marketing goals.

Sales

Pipedrive and SugarCRM both offer a solid foundation for managing sales processes, but they cater to different types of organizations with varying complexity needs. Pipedrive stands out for its intuitive lead management tools like the Leads Inbox, Live Chat, and Web Visitors, which help smaller teams streamline inbound engagement and qualification. Its customizable pipeline management and built-in meeting scheduler make it a favorite for SMBs looking for simplicity and agility. Email tracking and collaboration tools like Sales Assistant further enhance sales team efficiency by providing real-time updates and engagement insights—all within a user-friendly interface.

SugarCRM, on the other hand, delivers more structured and data-driven tools for organizations with longer or more complex sales cycles. From capturing and nurturing leads to visualizing deal progress and syncing meetings across teams, its features are tailored for companies that require deeper tracking, forecasting, and internal coordination. However, the learning curve and configuration effort can be steeper. So which CRM best supports your sales process—an agile, plug-and-play platform like Pipedrive, or a more sophisticated system like SugarCRM with layered tracking and collaboration capabilities? Download the ultimate Pipedrive vs SugarCRM comparison guide now to discover which solution aligns best with your sales goals.

Customer Service

When it comes to customer support features, both Pipedrive and SugarCRM offer solid foundational capabilities, but they differ in terms of integration depth and operational maturity. Pipedrive integrates help desk and CRM ticketing tools, allowing support teams to create and manage tickets within the sales platform. Its Live Chat functionality—available through the LeadBooster add-on—supports real-time engagement, while automated workflows help manage follow-ups, emails, and call scheduling. With built-in omni-channel capabilities, Pipedrive allows businesses to handle customer interactions across various channels like phone, email, social media, and chat—though some of these may require add-ons or third-party integrations.

SugarCRM, meanwhile, offers a more comprehensive and tightly integrated approach to customer support. From native ticket creation and resolution tracking to real-time chat and automation tools for streamlining repetitive tasks, SugarCRM supports a more robust customer service operation. Its omni-channel support features, including voice, chat, email, and self-service portals, provide a seamless experience for customers while giving teams greater control over the support lifecycle. So, does your business need a lightweight solution with flexible integrations, or a more unified, enterprise-ready support framework? Download the ultimate Pipedrive vs SugarCRM comparison guide now to evaluate which CRM can best elevate your customer service strategy.

E-commerce

Pipedrive and SugarCRM both offer features that support e-commerce and product-focused operations, but they differ in how these capabilities are structured. Pipedrive provides a built-in Product Information Management (PIM) system, allowing users to efficiently manage product data within the CRM. It also includes Sales Order Management tools that help streamline fulfillment processes, making it a good fit for SMBs that want to manage product workflows without relying heavily on third-party tools. Additionally, Pipedrive centralizes customer data to offer behavioral insights, supporting personalized engagement throughout the sales cycle.

SugarCRM, on the other hand, emphasizes deeper personalization through the use of generative AI and more advanced customer behavior modeling. While its product and order fulfillment features are typically delivered via integrations with platforms like Shopify, its ability to deliver tailored shopping experiences sets it apart for companies focused on personalization at scale. Which matters more to your business: simplicity and built-in product workflows, or advanced personalization powered by AI and e-commerce integrations? Download the ultimate Pipedrive vs SugarCRM comparison guide now to find out which platform aligns best with your product and customer engagement strategies.

Pipedrive vs SugarCRM: Their Pros

Pipedrive CRM is tailored for sales teams that prioritize ease of use, automation, and fast time-to-value. Its intuitive interface—reminiscent of HubSpot—makes it especially attractive for businesses with limited technical resources. Pipedrive simplifies lead capture, nurturing, and reporting through workflow automation tools that reduce manual data entry and increase team efficiency. For organizations looking to streamline sales processes without heavy customization or IT dependency, Pipedrive offers a practical solution that balances functionality and user-friendliness. It also appeals to teams that want a plug-and-play CRM with minimal setup and straightforward reporting tools.

SugarCRM, on the other hand, caters to cost-sensitive organizations with more technical expertise in-house. Its community edition allows for on-premises hosting, making it ideal for companies with existing IT infrastructure and regulatory needs. Additionally, SugarCRM supports direct ad-building within the platform and aligns well with ERP systems, offering subscription-based CRM functionality that appeals to industrial or product-centric businesses. So, what matters most for your organization—an easy-to-use platform that works right out of the box, or one that offers deeper control, ERP integration, and self-hosting flexibility? Download the ultimate Pipedrive vs SugarCRM comparison guide now to determine which platform fits your team’s capabilities and strategic direction.

Pipedrive vs SugarCRM: Their Cons

Pipedrive CRM is best suited for smaller teams with straightforward CRM needs, but it may present limitations for B2B organizations with complex hierarchies or enterprise-level requirements. The platform’s data model makes it difficult to share and manage leads and contacts across large teams, and its restricted data import/export capabilities can further hinder scalability. While Pipedrive excels in simplicity and ease of use, these constraints make it less suitable for larger companies seeking advanced reporting, flexible data sharing, or multi-layered customer management structures.

Download the Full Research Report

Pipedrive vs SugarCRM: Independent Review Read More »