Rootstock ERP Release 2025: Latest Features & AI Capabilities Analysis

Rootstock Software has launched its latest Rootstock ERP release, introducing an AI-powered automation agent alongside enhanced financial capabilities and modernized interface elements. This comprehensive analysis examines the new Rootstock ERP release and the company’s entry into the growing market for intelligent manufacturing automation. The Rootstock ERP release targets manufacturing and distribution companies seeking streamlined operations through conversational interfaces and workflow automations.

AI Agent: Practical Automation or Genuine Intelligence?

The centerpiece of this Rootstock ERP release is the Manufacturing Automation Agent, currently in pilot phase. Users can interact with this agent through spoken or typed prompts to execute various ERP functions without navigating away from the main interface.

The agent’s documented capabilities include:

- Searching for existing work orders or generating new ones based on operational needs

- Summarizing recent sales orders

- Identifying customer buying patterns

- Viewing and adjusting inventory levels with cycle count corrections

- Processing scrap adjustments while creating supply orders

Modern manufacturing ERP enhancements often combine workflow automation with natural language interfaces to improve user interaction patterns. Organizations should evaluate such capabilities based on their specific process automation needs and user experience objectives, rather than broad technology categorizations.

The automation agent appears to execute predefined workflows through conversational interface rather than demonstrating genuine machine learning or autonomous decision-making capabilities. This technology is currently in pilot phase, allowing for valuable testing and refinement before full deployment.

For organizations evaluating comprehensive AI strategies beyond ERP automation, working with an independent AI enablement consultant becomes valuable for distinguishing between marketing claims and actual AI capabilities. ElevatiQ’s AI services help organizations develop realistic AI implementation roadmaps that align with genuine business intelligence requirements rather than automated task execution.

Other Feature Enhancements & Capabilities

Financial Enhancements Applicable to Most Industries

This Rootstock ERP release delivers four substantial financial module improvements.

- The 13-period fiscal calendar support enables configuration aligned with weekly business cycles, particularly valuable for retail, distribution, and manufacturing operations requiring consistent operational comparisons in high-transaction environments.

- Customer refund functionality introduces new workflows for AR/AP offsets and vendor-to-customer refund processing, responding directly to customer requests through Rootstock’s feedback mechanisms.

- POAP Match Attachments allow document attachment within Purchase Order/Accounts Payable matching screens, with files automatically carrying through to Payable Transactions for audit compliance.

- The General Ledger interface has been redesigned with contextual tabs, intelligent field groupings, and direct links to related records, facilitating transaction analysis and reconciliation processes. These enhancements address practical operational pain points rather than introducing revolutionary functionality.

Modern Grid Architecture and User Experience

The new grid interface debuts in this Rootstock ERP release, providing high-performance data interaction capabilities. The architecture supports editable grids with keyboard navigation, customizable filters and columns, linked data views, and advanced selection across multiple pages.

The grid represents modernization of traditional ERP data presentation, addressing user demands for more responsive interfaces. However, this functionality brings Rootstock ERP closer to industry standards rather than establishing new benchmarks.

Quick reminder: Organizations should evaluate whether these improvements justify the implementation costs and user retraining requirements.

Operational Process Improvements Targeting Manufacturing Workflows

Three key operational enhancements focus on manufacturing and supply chain processes in this Rootstock ERP update.

- Work Order Traveler enhancements now support printout generation for disassembly and labor-only work orders, incorporating logic for relevant components and operations only. These improvements address specific manufacturing documentation and execution requirements.

- Enhanced DRP Replenishment Control allows configuration to exclude existing supplies and demands when calculating planned quantities, providing greater flexibility in managing location-level inventory based on stocking thresholds.

- Multiple Subcontract Operations per Routing functionality, designed for Weighted Average Costing environments, enables assignment of multiple subcontract operations to single routings or work orders. This eliminates artificial BOM levels and simplifies routing structures.

Independent ERP Evaluation Framework for ERP Buyers

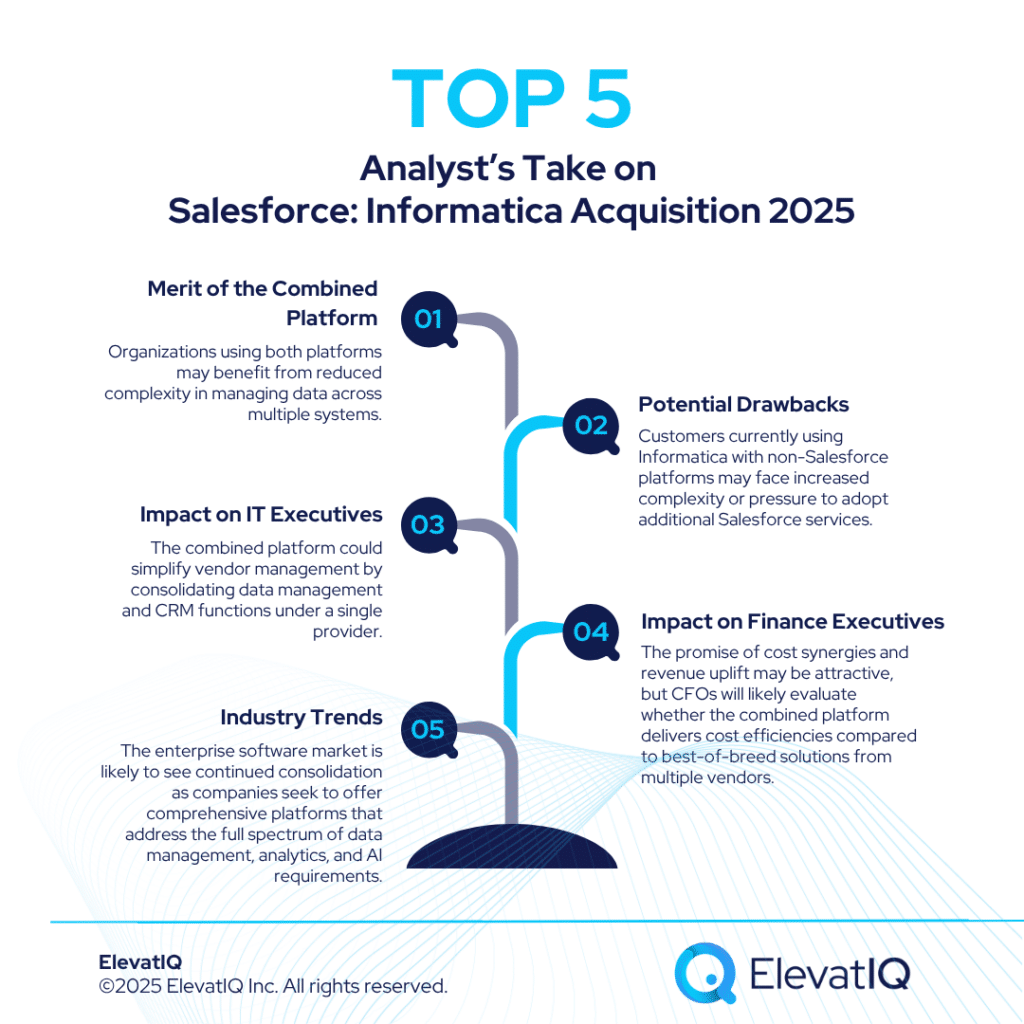

Understanding AI Agents and Market Competition

What is Rootstock’s New AI Feature?

This Rootstock ERP release adds AI agents designed specifically for manufacturing companies. These agents work within Salesforce and offer:

- Conversational interface: Talk to your ERP system in plain English

- Manufacturing focus: Built specifically for factory and production workflows

- Smart automation: Combines traditional automated processes with natural language interaction

- User-friendly design: Makes complex manufacturing processes easier to manage

How Do Competitors Compare?

Each major ERP vendor takes a different approach to AI integration:

| Vendor | AI APPROACHES |

| NetSuite | Focuses on analytics and reporting with embedded machine learning for forecasting and trend analysis. |

| SAP | Offers “Joule” AI assistant for cross-functional business processes and intelligent automation. |

| Microsoft Dynamics 365 | Integrates Copilot for natural language interactions across their business application suite. |

| Rootstock ERP | Specializes in manufacturing-specific conversational AI built on Salesforce’s cloud platform, focusing on production workflows and inventory management. |

Key Advantages and Considerations

Rootstock ERP Strengths

- Built on Salesforce’s reliable cloud infrastructure

- Likely to have access to Salesforce’s development resources and tools

- Particularly focused on manufacturing needs

- Established ecosystem with proven support

Important Considerations

- Rootstock’s AI development is tied to Salesforce’s overall platform direction

- Future AI capabilities depend on Salesforce’s broader strategy

How to Make the Right Choice?

When choosing an AI-enabled manufacturing ERP system, consider:

- Your specific operational needs: What manufacturing processes need the most help?

- Growth plans: How will your AI needs change as you expand?

- Current technology: What systems do you already use?

- Business value: Will the AI features actually improve your bottom line, not just user experience?

Recommendation: Consider hiring an independent AI enablement consultant to help evaluate which vendor’s AI enablement strategy best fits your company’s unique situation. They can help ensure you choose a solution that delivers real business results, not just impressive technology demos.

Business Impact and ROI Analysis

Reported Benefits and Efficiency Improvements

Organizations implementing conversational ERP interfaces typically report efficiency improvements in routine task execution through reduced system navigation, streamlined data entry processes, and enhanced workflow guidance. The actual impact varies significantly based on current process maturity, user adoption rates, and transaction volumes.

Implementation Cost Considerations

Organizations should consider training costs and potential productivity adjustments during adoption phases of this Rootstock ERP update. Timeline expectations should align with their operational complexity and change management capabilities.

Use Case Analysis

What Is Conversational ERP?

Instead of clicking through computer screens and menus, employees can talk to their business system like talking to a person. They can ask questions and give commands using normal language.

Companies that use conversational ERP usually see:

- Faster completion of daily tasks

- Less time spent navigating computer systems

- Easier data entry

- Better workflow guidance

Important: Results vary significantly. Success depends on how well your current processes work, how quickly employees adopt the new system, and how much work you do.

What to Expect During Implementation?

- Training costs – Employees need time to learn the new system

- Temporary slowdown – Work may be slower at first while people adjust

- Timeline– Benefits show up gradually as people get comfortable with talking to the system

Where Conversational ERP Works Best?

- High-Value Uses (Great Results): Everyday tasks people do repeatedly such as creating work orders, checking inventory levels, looking up customer orders. This works because instead of clicking through screens, employees just ask the system what they need.

- Limited-Value Uses (Poor Results): Tasks that still need human expertise such as complex financial analysis, strategic planning, or compliance reporting. This doesn’t work because it needs human thinking and expertise.

Is This The Best Fit for Manufacturing Companies?

Works Well For:

- Job shops – Companies that make custom products and change work orders frequently

- Make-to-order businesses – Companies that need to respond quickly to customer requests

- High inventory turnover – Companies that have lots of stock movement needing tracking

Doesn’t Work Well For:

- Process manufacturing – Chemical, pharmaceutical, and food & beverage companies with strict rules

- Highly regulated industries – Companies that need specific documentation that traditional systems handle better

- Complex multi-site operations – Companies with multiple locations needing structured data sharing

Assessment Summary

Conversational ERP implementation suitability likely depends on these factors:

- Volume of routine, repetitive tasks

- Customer response time requirements

- Manufacturing process complexity

- Organizational change management capabilities

Organizations should evaluate these factors against their specific operational requirements and existing technology infrastructure.

ERP Readiness and Risk Assessment

This Rootstock ERP update is expected to require specific organizational prerequisites for successful deployment. Critical success factors might include:

- Data accuracy across master data

- Real-time inventory synchronization

- Consistent naming conventions

- Established workflow maturity before introducing automation

Change management requires careful consideration. Adding automated workflows to your ERP system means your company must prepare for significant changes.

The bigger concern, however, is vendor dependency. Once you build your business processes around Salesforce, leaving becomes extremely difficult. Your company grows dependent on their platform, and with only a few viable alternatives available, you’re essentially locked in. This dependency creates a major problem: Salesforce can raise prices whenever they want, knowing you have limited options. As a result, you’ll likely lose all bargaining power in future contract negotiations.

What’s Driving this Release?

The manufacturing world is changing fast, and this latest Rootstock ERP update responds to what companies need most right now. Here’s what’s pushing this evolution:

Current Limitations

- Worker shortages are forcing companies to automate more tasks

- Supply chain disruptions require faster responses to problems

- Customers expect real-time updates on their orders

- Regulations demand better tracking of products and processes

ERP AI Agent Requirements

- Small automation steps instead of massive system changes

- Mobile-friendly tools that work on the factory floor

- Real-time data that helps make quick decisions

Rootstock’s new features tackle these needs, though they’re still limited by what the Salesforce platform can do.

Is Your Company Ready?

Your organization might be the right fit for this ERP AI Agent implementation if you have:

- High transaction volumes that would benefit from automation

- Clean, well-organized data in your systems

- Experienced Rootstock Software users who understand the platform

- Clear business processes that align with AI automation capabilities

You might want to wait and consider if you have:

- Poor data quality because the AI needs good data to work well

- Complex custom workflows that don’t fit standard automation

- Limited IT support for implementation and ongoing maintenance

- Heavy customization needs where flexibility matters more than automation

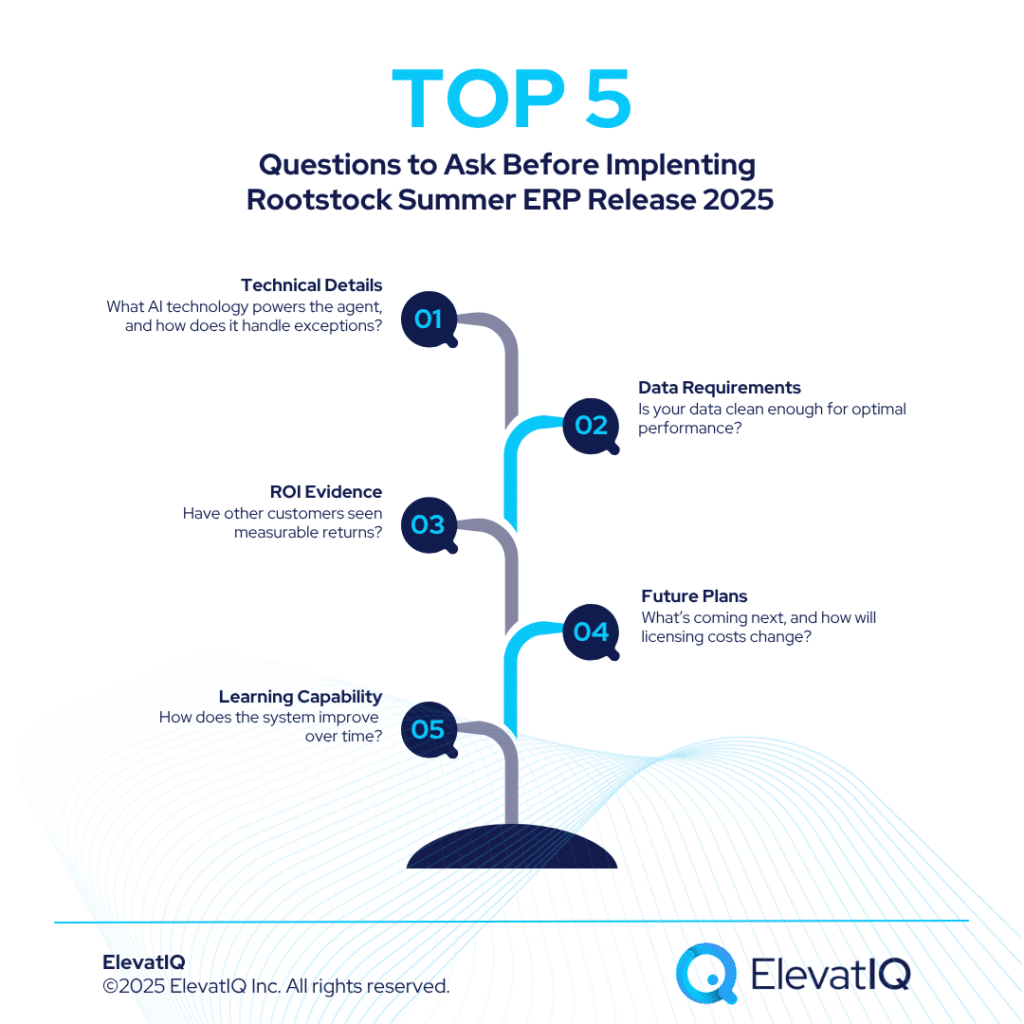

Key Questions to Ask

Before moving forward, evaluate:

- Technical Details: What AI technology powers the agent, and how does it handle exceptions?

- Data Requirements: Is your data clean enough for optimal performance?

- ROI Evidence: Have other customers seen measurable returns?

- Future Plans: What’s coming next, and how will licensing costs change?

- Learning Capability: How does the system improve over time?

FAQs

Rootstock ERP Release 2025: Latest Features & AI Capabilities Analysis Read More »