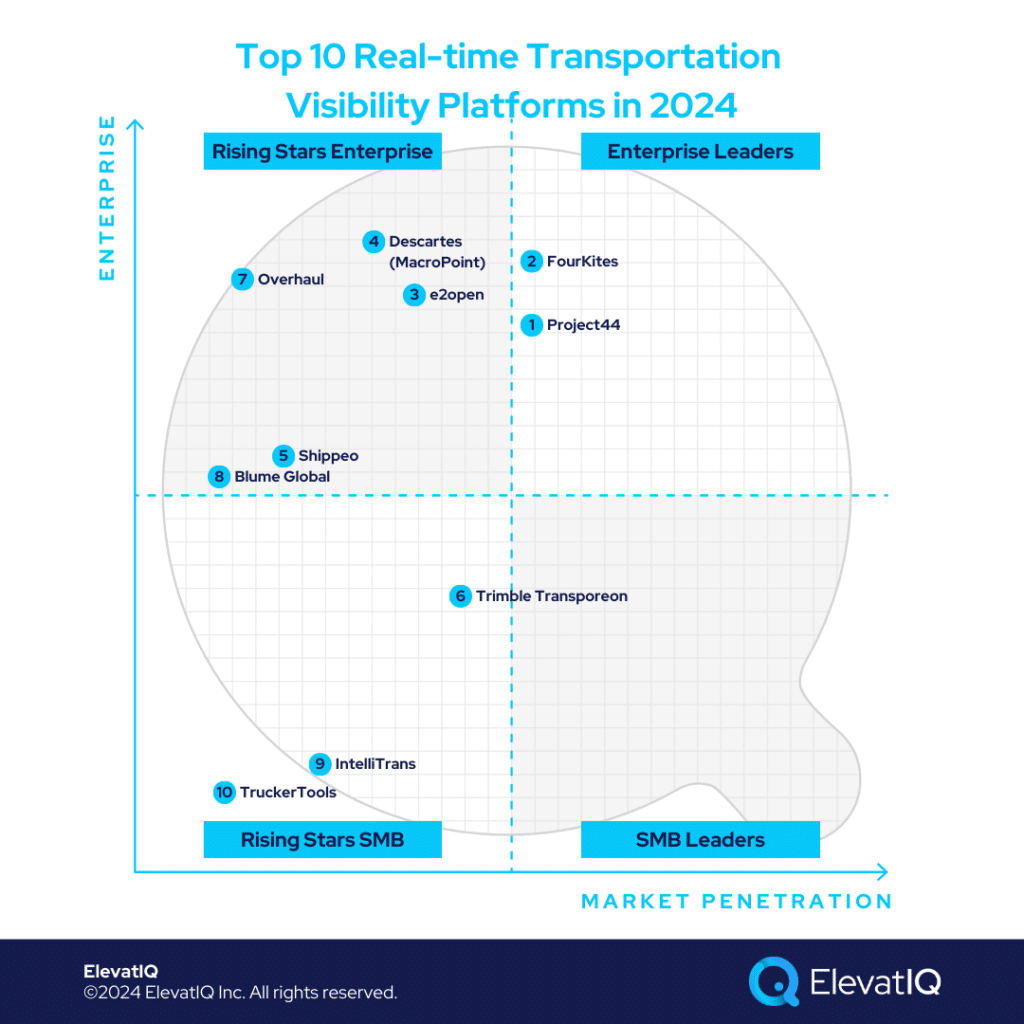

Top 10 Real-Time Transportation Visibility Platforms 2024

In the realm of real-time transportation visibility platforms, apparent similarities abound, with each touting comparable capabilities. Yet, distinctions emerge; some specialize in specific modes, while others offer multi-modal prowess. Geographic coverage further diverges, with prevalence in North America for some and exclusive focus on Europe for others. While some function as standalone applications, their primary role lies in empowering supply chain control tower applications—integral solutions seeking to finalize the supply chain equation through carrier-centric data.

Though widely embraced, real-time transportation visibility platforms represent a relatively recent phenomenon. Previously, such capabilities were unattainable due to the absence of industry-wide traceability. Although, the advent of carrier networks and ELD regulations has now unlocked these datasets. These newly accessible datasets wield substantial power independently and, when correlated, amplify the insights furnished by these platforms. Real-time visibility platforms extend beyond supply chain traceability, delving particularly into advanced scenarios like transportation risk management across geopolitical boundaries facilitated by technologies like blockchain.

The deployment of RFID chips on containers facilitates detailed traceability, particularly encompassing international multi-party BOM tracking. Platforms enhanced with AI and ML showcase impressive KPIs, achieving a 99.99% accuracy in delivery ETA. Notwithstanding pre-established networks and datasets, challenges arise in onboarding current carriers, potentially leading to misleading insights and incomplete traceability. Thus, platforms offering a superior user experience and streamlined onboarding processes are likely to provide enhanced insights. While the suitability of these platforms varies, some are tailored for SMB customers, and others are designed as enterprise-grade solutions. Now, let’s delve into the top 10 real-time transportation visibility platforms in 2024.

10. TruckerTools

TruckerTools is perhaps the smallest solution on this list, targeting freight brokers to see load visibility. The number of modes is substantially limited, without the coverage for modes such as air or ocean. With the limitation of its network, it might not be the best fit for companies seeking a platform with international multi-modal traceability.

Pros

- ELD integration. While the platform is relatively smaller, ELD integration allows data to be acquired in an autonomous fashion without relying on manual acquisition.

- SMB friendly. The simplicity of the solution and the costs would be friendlier for SMB companies.

- Detailed visibility. While not as comprehensive with the coverage, the visibility use cases are detailed.

Cons

- Does not cover other modes of transportation, such as air or ocean. The visibility is primarily limited to trucking data, making it not a right fit for multi-modal traceability.

- Clunky UI. The clunky UI might lead to poor adoption among carriers, making data collection harder and insights misleading.

- Integrating with TMS requires consulting help. While cheaper with licensing, the consulting help required for integration TMS might be expensive for smaller companies.

9. IntelliTrans

IntelliTrans, compared to TruckerTools, is slightly richer with its capabilities, especially for multi-modal scenarios. While it covers several models, the network coverage is limited compared to other advanced tools such as Project44 or FourKites. It is a great option for SMBs looking for multi-modal capabilities with some level of TMS integration provided, but may not the best fit for large enterprises seeking comprehensive network coverage and end-to-end supply chain traceability.

Pros

- SMB-friendly. While not as comprehensive a network for exhaustive multi-modal traceability, the costs and leaner layers of the software make it SMB-friendly.

- Multimodal features. Compared to TruckerTools, it covers more modes such as road, rail, and ocean than being just limited to trucking data.

- Integrated TMS. Integrated TMS would reduce consulting costs, but further vetting may be required to ensure the use cases supported by pre-integrated workflows would work for the datasets and the use cases that need to be supported.

Cons

- Limited to road, rail, and ocean. Limited coverage might lead to misleading and incomplete insights but may be OK for companies on a budget.

- Not designed for large enterprises. Large enterprises requiring mature capabilities such as AI and ML, with comprehensive coverage for networks, might find it limiting.

- Ecosystem limited. The companies consulting on the tool might be limiting, making it harder to find talent relying on vendor-provided professional services.

8. Blume Global

Blume Global is another option for SMB companies needing global visibility with multimodal features. Post-acquisition with WiseTech, it can now offer broader capabilities, including pre-integrated TMS offerings, just like Trimble. Due to the limited AI and ML workflows and network coverage, it might not be the best fit for companies seeking mature capabilities.

Pros

- Multimodal features. This is especially helpful for companies seeking global traceability across most modes.

- Integrated TMS. The integrated TMS would reduce consulting costs, but further vetting is required to ensure the usability of pre-integrated workflows.

- Now part of WiseTech Global group. Due to the integration with WiseTech Global Group, its financial sustainability would not be an issue.

Cons

- Ecosystem limited. The limited ecosystem makes it challenging to find talent and a consulting base compared to larger peers.

- Not as well adopted or funded as other options. While it is part of the WiseTech group, it’s not as adopted as other options such as Project44 or FourKites.

- Not as comprehensive as other options on this list. The network is limiting, making the datasets potentially biased and misleading for companies seeking multi-modal traceability.

7. Overhaul

Overhaul is an enterprise-grade option for companies seeking global trade traceability and transparency. It has some unique capabilities, such as integrated RiskGPT, helping companies manage their risks. However, the platform might not be built as other solutions on this list, with limited options to mine relevant insights.

Pros

- Great transportation visibility tool. This is especially useful for companies seeking global traceability, especially in areas such as insurance, theft, etc.

- GSOC feed integrated along with visibility. The integration of GSOC data makes it unique for risks and security-centric workflows.

- AI and RiskGPT capabilities integrated. Compared to smaller options limited with AI capabilities, it features richer AI and RiskGPT capabilities for risk forecasting and prevention.

Cons

- Communication errors between the carrier and the platform. The communication between the carrier and the platform might not be as seamless, causing issues with communication and leaving datasets unreliable.

- The limited network may require carriers to participate. Because of the limited network, companies would be required to invite their carriers that might not already be on the platform, making the adoption harder and insights potentially biased and misleading.

- Not as well as designed and might be cluttered with GPS pings. While the system has tons of data, navigating through data might be a challenge because of the missing scalable layers to customize insights relevant to each user in the company.

6. Trimble Transporeon

Trimble Transporeon is a comprehensive solution, particularly strong with the carrier and trucking side of data, making it ideal for transportation companies or companies with internal fleets, such as agriculture or construction. It might not be the best fit for enterprises seeking mature capabilities with AI and ML workflows and multimodal traceability through the international supply chain.

Pros

- Over 150K carriers are part of the network. One of the largest sample sizes of carriers, making carrier adoption easier.

- Integrates with over 3000 ERP and TMS systems. The pre-integrated workflows help mine data and with integration without expensive consulting costs.

- Power of Trimble’s powerful maps and telematics technology, timeslot, and retail timeslot management. Trimble’s unique offering includes powerful maps and telematics technology, augmenting ELD and carrier-centric data and providing more accurate metrics.

Cons

- Mainly an European solution. While a comprehensive network, its geo exposure is limited, with Europe being the main focus, struggling in other geographies such as North America.

- Relies on some datasets on other players, such as Roambee. Due to the limited datasets, they rely on other providers for some datasets, such as Roambee.

- Not as comprehensive as other solutions on this list. While a great solution for several industries, it’s not as comprehensive as some of the other solutions on this list.

5. Shippeo

Shippeo is great for companies looking for road transportation visibility, mainly focused on Europe. It’s network is not as comprehensive as other solutions such as Project44 or FourKites, especially covering different geographies. While a great solution for Europe, it might not be the best fit for companies seeking global traceability across all modes.

Pros

- Carbon emission tracking. One of the unique advantages of Shippeo is that it provides carbon emission data, especially useful for geographies such as Europe where carbon emissions tracking may be used as an input for planning and reporting.

- Accurate truck positioning. Due to the rich datasets, it can provide far superior positioning of trucks, making ETAs far more reliable and helping with planning, generally difficult with other tools that might not be as accurate with truck positioning.

- Machine learning to calculate ETA. Shippeo is packaged with machine-learning capabilities to complete the missing datasets.

Cons

- Network not as strong as other platforms. The current network is not as strong as other solutions, such as Project44 or FourKites.

- Mainly a European solution as well. Since it is focused on Europe, companies in other geographies might find it challenging.

- Not integrated suite as other platforms. The other platforms on this list have more integrated capabilities, augmenting limited datasets and providing richer insights.

4. Descartes (MacroPoint)

Descartes MacroPoint is the best for global freight visibility and carrier capacity for logistics-intensive businesses such as freight brokers or logistics service providers. Unlike other solutions on this list with limited data and security models, Descartes MacroPoint offers enterprise layers that accommodate the needs of different personas, ensuring the right insights for the right user profiles. Descartes MacroPoint would not be a great fit for SMB companies seeking a simpler solution with a limited budget.

Pros

- The ability to fine-tune alerts and accurately track the driver’s location all the time. The systems with limited data and security layers make gleaning insights overwhelming, impacting product adoption.

- Global coverage. It’s not as limited as other SMB solutions on this list, with its coverage for various geographies.

- Focus on logistics-centric businesses. Logistics-centric businesses have a very unique need, with a primary focus on international BOM data, where Descartes is extremely strong.

Cons

- Expensive. While great from a coverage perspective, smaller companies might struggle to justify the price tag.

- Carrier performance might not be as strong. Compared to other options on this list, carrier performance data might not be as strong, leaving a critical dataset for end-to-end traceability.

- Designed from the perspective of logistics providers, limited carrier network. While great for logistics service providers as they have unique needs, it might be limiting for diverse business models.

3. e2open

e2open is the best for global companies looking for a complete suite, including network, planning, and execution. While it relies on other solutions, such as FourKites and Project44, for carrier-centric data, it could be a powerful for companies seeking real-time transportation visibility platforms because of other datasets, enriching the transportation data and completing the supply chain equation. It might not be the best fit for companies seeking simpler solutions.

Pros

- Complete suite. The biggest advantage of e2open is that it’s a complete suite, combining all modes and geographies, making it one of the strongest platforms for end-to-end supply chain traceability.

- Combined network channel and carrier. e2open has its own network, making the adoption far easier for companies onboarding their existing carriers.

- Richer data and analytics. The AI and ML capabilities and the power of the network, along with the security and data layer, offer decision-grade data that might not be available through any other platforms.

Cons

- Relies on Shippeo for transport visibility data. While e2open has some carriers and data, it relies on Shippeo for the datasets, posing sustainability issues if it loses its relationship with Shippeo or if Shippeo gets acquired by a competitor.

- Expensive. With the amount of capabilities packed as part of the solution, it might be cost-prohibitive for SMBs.

- It is not the best fit for companies looking for a standalone RTV platform. e2open is a suite and not necessarily an RTV platform if the cross-functional alignment might be a challenge, and this platform needs to be purchased at the departmental level.

2. FourKites

FourKites is perhaps the best platform for enterprises seeking standalone real-time transportation visibility platforms. It has global coverage across all modes. But might not be the best for companies seeking suite capabilities across the supply chain and not just transportation. Also, it might not be the best fit for SMBs seeking an affordable solution.

Pros

- 490K Carriers, ETAs 6x more accurate, 98% of global ocean traffic, and 17K airports. Compared to other solutions on this list, FourKites has one of the most comprehensive coverage and is more accurate because of its data coverage.

- 1.5M monthly parcel and last mile load. The inclusion of parcel and last mile load is an added advantage and a critical component for end-to-end transportation traceability.

- Visibility past transportation to include yards, warehouses, and stores. While the purpose is to include just the transportation visibility, including yards, warehouses, and stores, it helps with end-to-end visibility of the entire transportation value chain.

Cons

- Expensive. The comprehensive datasets and AI and ML capabilities to forecast decision-grade data make it expensive for SMBs.

- Not as strong with service parts. The intent of the platform is not to provide the supplier-side of traceability. So it would not be a great fit for the supply chain visibility needed for supplier collaboration in business units such as spare parts businesses.

- Limited integration with other TMS systems. Some of the TMS systems might not be as integrated, requiring companies to spend on consulting efforts.

1. Project44

Project44 is the best for SMBs seeking standalone real-time transportation visibility platforms. Compared to FourKites, Project44 is relatively friendlier for SMBs. It also provides a guarantee for carrier compliance, a huge risk for companies struggling to get their carriers on the platform, leading to misleading insights and unreliable data. Project44 is also GDPR-compliant, making it friendlier for geographies such as Europe.

Pros

- Carrier compliance guarantee. One of the biggest challenges in being successful with real-time transportation visibility platforms is carrier onboarding. Project44 not only has one of the largest carrier onboarding, minimizing the need to onboard as many carriers. But they also offer a guarantee because of how streamlined the process is.

- 230K+ carriers, 760 ELD providers over more than 48 countries, 4.33 million drivers, 3.55 M trucks, 800K fleets. These data points make them one of the largest global networks.

- GDPR compliant. Project44 is perhaps one of the few systems that are GDPR-compliant, highly relevant for companies with a presence in the European market.

Cons

- Steep learning curve. The enterprise and scalable layers might require change management and training budget, which also might be out of reach for some SMBs.

- Not an open platform. The open platform makes it easier and creates trust for carriers to join. While they are not open, they are one of the largest networks. Not being open might lead to mistrust among carriers and, as a result, their resistance to joining the network.

- Requires carriers to agree on connecting. Carriers might not agree to join the network, thus leading to misleading insights and incomplete data, which is where their guarantee might be helpful.

Conclusion

Choosing real-time transportation visibility platforms necessitates insight into the underlying network, particularly data sources. Without this awareness, platforms may seem indistinguishable, potentially resulting in misguided choices. While some aspects, like platform vetting, maybe within your control, poor user experience could hinder adoption within your carrier network, impacting desired outcomes. If you’re exploring the top 10 real-time visibility platforms, consider leveraging the expertise of independent supply chain consultants for a successful selection.