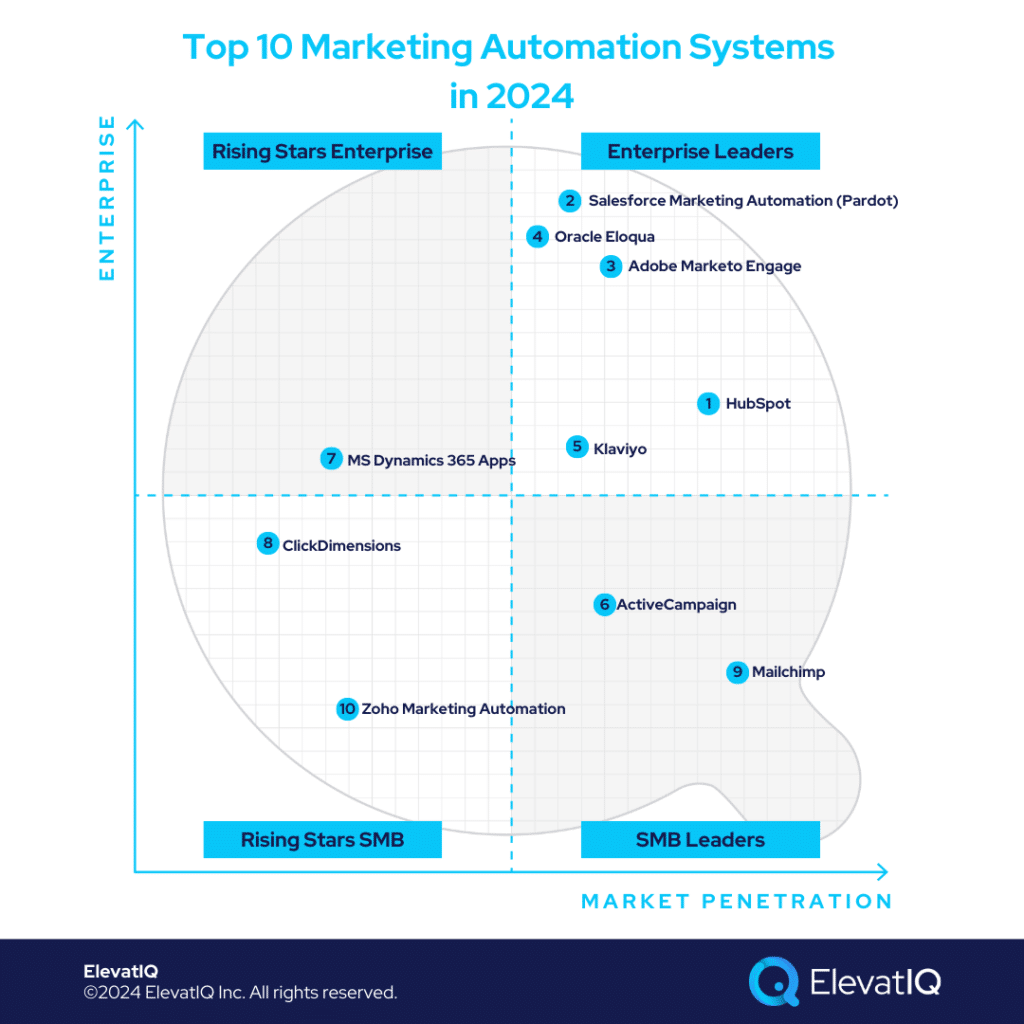

Top 10 Marketing Automation Systems In 2024

Marketing Automation. The noisiest category ever – due to lower barriers to entry. Generally, falling within the CRM systems category, specifically handling upstream marketing efforts. One key component is email marketing, but they also include SMS marketing and omnichannel capabilities, often integrating with CMS. Whether embedding widgets on websites through a CMS within the marketing automation framework – or using an external system, all these channels feed into the marketing automation system.

Historically, these systems were siloed, with CRMs focused primarily on data storage and operational workflows from a downstream marketing viewpoint. Marketing automation systems lived in their own world, as they didn’t need to be as tightly embedded as other transactional systems. But things changed as upstream marketing use cases matured and with their resulting traceability requirements. Some CRM systems acquired these point solutions, offering a complete suite. On the other hand, other vendors stronger in marketing automation capabilities built a CRM module from scratch within the same product suite. Built products are likely to provide a consistent experience. The acquired products, in comparison, may not have as consistent experience or tight integration, but they may offer the best-of-breed experience some companies prefer. This is how the marketing automation category has evolved.

In this context, we’re capturing systems that are both part of a suite and best-of-breed solutions. From an architectural perspective, marketing automation systems differ slightly, focusing more on workflows rather than processing transactions, which is more common in operationally focused CRMs. Integration and ecosystem are critical for marketing automation, and these integrations tend to be simpler because the systems aren’t as database-driven; they’re more workflow-oriented. This makes their design, mindset, and architecture distinct. You might already be confused, but don’t worry – we got you – with this article, which provides much-needed clarity on these systems.

Criteria

- Definition of a marketing automation system. The companies in this market segment would include companies of all sizes needing a marketing automation system as a pure-play category that can be deployed without requiring other dependencies.

- Overall market share/# of customers. The higher market share among marketing automation companies drives higher rankings on this list.

- Ownership/funding. The superior financial position of the marketing automation vendor leads to higher rankings on this list.

- Quality of development. How modern is the tech stack? How aggressively is the marketing automation vendor pushing cloud-native functionality for this product? Is the roadmap officially announced? Or uncertain?

- Community/Ecosystem. How vibrant is the community? Social media groups? In-person user groups? Forums?

- Depth of native functionality. Last-mile functionality for specific industries natively built into the product?

- Quality of publicly available product documentation. How well-documented is the product? Is the documentation available publicly? How updated is the demo content available on YouTube?

- Product share and documented commitment. Is the product share reported separately in financial statements if the marketing automation vendor is public?

- Ability to natively support diversified business models. How diverse is the product in supporting multiple business models in the same product?

- Acquisition strategy aligned with the product: Any recent acquisitions to fill a specific hole for marketing automation industries? Any official announcements to integrate recently acquired capabilities?

- User Reviews: How specific are the reviews about this product’s capabilities? How recent and frequent are the reviews?

- Must be a best-of-breed marketing automation product: Only products that can be deployed independently without requiring other dependencies such as transactional systems or CRM.

10. Zoho Marketing Automation

Zoho Marketing Automation is designed for companies beginning their marketing automation journey on a budget. Its licensing is more affordable than that of other marketing automation systems. Offering deep integration within its own ecosystem and a robust CRM, it’s suitable for slightly more operationally complex scenarios. If a company has ad hoc customer interaction needs that require capturing various custom objects (and workflows), Zoho is likely a good fit. Therefore, Zoho secures the #10 spot on our list of top marketing automation systems.

Strengths

- Workflow automation and forms. Key strength is its workflow automation and form capabilities. Zoho also includes the Zoho Creator platform, which is quite similar to Microsoft’s Power Platform.

- Salesforce-like data model. The data model is very similar to Salesforce, allowing operational and transactional scenarios – and not struggling as much with complex hierarchies of business objects required in certain industries.

- Journey builder for omni-channel experiences. While Zoho covers several modes to build omni-channel experiences, it might not be as comprehensive as systems such as Braze or Klaviyo, which might offer pre-baked B2C scenarios such as real-time interactive experiences.

Weaknesses

- Ecosystem not as robust as HubSpot. The ecosystem is not as robust as that of some other comparable platforms, requiring building most integrations with third-party platforms and increasing implementation costs.

- Not meant to be for enterprise use cases. With the substantial limitations baked with its business objects, such as the number of fields (or typed fields) allowed on a business object, it is not specifically designed for enterprise use cases.

- Not as natively integrated with data platforms. One key limitation would be its ecosystem of pre-integrated data platforms that might be required for either funneling MQLs automatically to the CRM (or for personalization and segmentation).

9. MailChimp

MailChimp is aimed at companies seeking a simpler CRM solution, primarily for B2C industries. It might also be relevant for B2B startups – as long as it’s used as a pure-play marketing automation platform. This would be for simpler B2B use cases, such as sending newsletters with relatively simpler tracking requirements (and customer hierarchies). Tailored for startups, it lacks the robust security features of other platforms. Customizability can also be limited, making it less suitable for mid-market, enterprise, or apartment market companies. Therefore, Mailchimp secures the #9 spot on our list of top marketing automation systems.

Strengths

- Audiences. It maintains several audiences with different subscription preferences (and communication needs). But note that the same contact included with multiple audiences is treated as a different contact, requiring paying twice for the same contact.

- Segments and Campaign Builder. The campaign builder is easy to use and can be picked up easily by most business users. But note the limitations on the number of journeys allowed with each plan.

- Support. As of today, MailChimp support is decent and responsive, making it easier for startups with limited implementation and support budgets.

Weaknesses

- Limited security layers compared to Pardot. The security layers it provides are not as robust compared to those available with HubSpot or Salesforce.

- Would require an additional CRM. You would need an additional CRM, as this platform may not function effectively for transactional use cases or for downstream workflows.

- Limited reporting. The pre-baked reporting is substantially limited. Getting meaningful data to design campaigns might not be as easy – and at times not even possible, without over-engineered (and risky) ad-hoc arrangements.

8. ClickDimensions

ClickDimensions is part of the Microsoft Dynamics 365 ecosystem. The core CRM features within the Microsoft platform are robust, allowing for the accommodation and customization of various business models. But it’s not as robust for upstream marketing automation features, hence the need for a ClickDimensions add-on. But even ClickDimension is limited. For upstream marketing and comprehensive omnichannel traceability, including CMS integrations with multiple platforms in the Microsoft ecosystem, ClickDimensions falls short. It lacks the richness and integration of capabilities found in platforms like HubSpot or Salesforce Pardot. Therefore, ClickDimensions secures the #8 spot on our list of top marketing automation systems.

Strengths

- Marketing automation workflows. You will have access to essential marketing automation workflows that are sufficiently robust to ensure a strong alignment with Microsoft Dynamics products.

- Tight alignment for MS 365. To maintain a strong alignment with Microsoft Dynamics products, ClickDimensions may be the only embedded and integrated option available unless you consider expensive, custom integration.

- Well-adopted platform in the MS ecosystem. Additionally, it is widely accepted within the Microsoft ecosystem, making it a significant advantage for companies using Microsoft solutions.

Weaknesses

- Very small player compared to other platforms. The limitations you may encounter include being a relatively small player in comparison to others in the market. Their R&D budget is limited, which means they won’t have the same capabilities as larger platforms like HubSpot or Salesforce.

- Limited omnichannel capabilities. The channel capabilities are going to be limited and not natively integrated with data platforms.

- Not as natively integrated with data platforms. There is no native integration with data platforms. For instance, when considering integrations with services like ZoomInfo or Apollo, the options may be either limited or entirely absent.

7. Microsoft Dynamics 365 Apps

Microsoft Dynamics 365 Apps has a Customer Insights product, which is primarily a CDP product that can integrate with several marketing automation execution systems. However, even Microsoft Dynamics 365 Customer Insights could be used for simpler marketing automation workflows, and it is used by companies on their ERP or CRM. The biggest challenge with the product would be to manage richer omnichannel and personalization scenarios possible with other marketing automation products such as Klaviyo or Braze. Therefore, Microsoft Dynamics 365 Apps secures the #7 spot on our list of top marketing automation systems.

Strengths

- Customer journeys. Straightforward customer journeys can be easily managed without requiring another specialized system for marketing automation.

- Tight embeddedness with MS stack. Marketing could be a suitable option since it is already integrated with the core product, eliminating the need to navigate third-party contracts or systems.

- Strong embedded CRM and field services workflows. This is especially true from a customer service and call center standpoint, where you’ll likely need extensive integrations.

Weaknesses

- Limited CMS, social, and ad workflows. The limitations you may encounter include restricted integrations with your CMS and data platforms. You won’t find as many integration options available, particularly when it comes to social media and advertising workflows, which may also be limited.

- Ecosystem not strong with upstream marketing and data providers. But for simpler marketing automation workflows, it’s not a bad option.

- Rigid user and security model. This can be both an advantage and a disadvantage. On the positive side, if your data is highly structured and relational, you may find this rigidity beneficial. However, it may also make it more challenging to leverage the flexibility offered by systems like HubSpot or Salesforce.

6. ActiveCampaign

Active Campaign is aimed at companies seeking a more affordable option. Generally, marketing automation systems determine their pricing based on the number of subscribed emails and the monthly email volume. This pricing structure can lead to high costs, especially with platforms like HubSpot or Pardot, which can be quite expensive for businesses that send numerous emails but sell lower-priced products. This pricing model can be a barrier for many companies, making Active Campaign a more cost-effective choice compared to other platforms. Therefore, ActiveCampaign secures the #6 spot on our list of top marketing automation systems.

Strengths

- Core marketing automation workflows. The core marketing automation workflows are integrated into the suite, providing a comprehensive solution. These workflows streamline various marketing tasks, making them an essential part of the overall platform.

- Cost. ActiveCampaign offers more competitive pricing compared to other platforms. Additionally, it provides a more robust suite of features than MailChimp.

- Well-adopted. ActiveCampaign is widely adopted, particularly when compared to platforms like ClickDimensions or Microsoft Dynamics 365 Customer Insights. It boasts a significantly higher number of installations, especially within the email marketing community, and is a well-established product in the space.

Weaknesses

- Not as comprehensive as other options. In terms of capabilities, it doesn’t offer the same level of comprehensiveness as some of the other available options.

- Limited ecosystem. Their ecosystem would not be as robust as HubSpot or Salesforce, with the number of options available for data platforms, ad and omnichannel integrations, and CMS providers.

- Does not have a CRM as part of the suite. It lacks a true CRM component for transactional and downstream CRM workflows within the suite, unlike other products such as Salesforce or Microsoft.

5. Klaviyo

Klaviyo has gained significant popularity recently, particularly among companies operating in a B2C ecosystem. Customer journeys in B2C environments tend to focus on managing touchpoints from a purchase cycle perspective rather than engaging with various touchpoints through content. As a result, Klaviyo is an excellent fit for companies looking to streamline and optimize these purchase-driven interactions. Therefore, Klaviyo secures the #5 spot on our list of top marketing automation systems.

Strengths

- B2C-specific journeys and integrations. Customer journeys with B2C companies are distinct, focusing on managing touchpoints from the purchase cycle perspective rather than driving touchpoints through content. This is where Klaviyo’s strength lies, as it is well-suited for handling B2C journey management effectively.

- Easy to use and implement. One of the biggest advantages of Klaviyo is that it’s easier for business users to use compared to other enterprise platforms, such as Braze. Platforms such as Braze might require technical expertise for channel integration and data workflows.

- Friendly for companies on Shopify. Klaviyo is deeply integrated into the Shopify ecosystem and is widely adopted among Shopify users. If you’re a product-centric or commerce-focused company using Shopify, Klaviyo could be a more suitable option for your needs.

Weaknesses

- Billing based on active profiles and usage could be trickier to understand. The billing process can be more complex, and estimating costs may also pose challenges. Their pricing model is based on active profiles or usage, and consumption-based pricing can often be difficult to predict.

- Not fit for B2B companies. The B2B companies have very different customer structures and marketing automation workflows compared to the event-centric and real-time workflows of B2C. So, B2B companies might struggle with it.

- Expensive. Klaviyo could be expensive for companies that are heavy on emails compared to other platforms on this list.

4. Oracle Eloqua

It is an excellent choice for companies with a slight enterprise focus, especially those using Oracle Cloud CX. Oracle acquired Eloqua, a powerful enterprise-grade product, and integrated it into its Oracle Marketing suite. This solution is particularly well-suited for B2C industries like media and telecommunications, where there are numerous customer touchpoints. Oracle Eloqua excels in ad-centric customer journeys, offering robust content management and other key capabilities as part of the same suite. Additionally, it provides enterprise-level workflows, supporting seamless alignment with field service and call center operations. Therefore, Oracle Eloqua secures the #4 spot on our list of top marketing automation systems.

Strengths

- Enterprise-grade capabilities include landing pages, webinars, events, and depth with custom objects. Enterprise-grade capabilities, including enterprise security, landing pages, webinars, and events, are all part of this solution.

- Pre-built integration with Oracle CX. One key advantage is that it is tightly embedded and integrated with Oracles’ other applications. So that’s a huge plus for companies already using other Oracle enterprise apps seeking connectivity and traceability with other downstream applications.

- Omnichannel workflows. The platform is relatively omnichannel, but it might not be as plug-and-play and fluid as other modern platforms such as Klaviyo.

Weaknesses

- Integration not as embedded with CRM. While Eloqua is integrated with the CRM, but the experience might be as embedded as with products created from scratch for seamless collaboration between these two systems, such as HubSpot.

- Steep learning curve. Its enterprise workflow and security layers might be overwhelming for SMB customers looking for simpler solutions with a limited implementation budget.

- Expensive. SMBs might not appreciate the price tag – and some of the capabilities offered might not even be relevant for the SMBs.

3. Adobe Marketo Engage

Adobe Marketer Engage is a robust enterprise-level product that is comparable to solutions like Eloqua and Salesforce’s Pardot. With capabilities baked in, such as events providing omnichannel experiences for design-heavy organizations such as B2C and media, it’s friendlier for B2C industries. It offers advanced capabilities for consolidating various channels, including web ads, into a unified portfolio. This tool enables businesses to track engagements and monitor customer journeys across multiple platforms, making it an ideal solution for enterprises looking to manage and optimize their marketing efforts on a large scale. Therefore, Adobe Marketo Engage secures the #3 spot on our list of top marketing automation systems.

Strengths

- Customizability for enterprise use cases. Workflow and security layers are highly customizable for enterprise use cases.

- Robust campaign program management features. Larger organizations generally have programs with multiple campaigns covering many different organization-wide goals, needing enterprise-grade capabilities for campaign program management that might not be relevant for SMBs.

- Event partner integration. The event capabilities are highly critical for media and event companies as they need to manage their communication as part of the same platform used for event logistics management.

Weaknesses

- Expensive. SMBs not looking for enterprise features generally find it expensive.

- Legacy feeling. The UI is fairly legacy compared to other products.

- Requires coding skills to build landing pages. Business users might need to work with developers for simpler workflows that are as simple as building landing pages.

2. Salesforce Marketing Automation (Pardot)

Salesforce marketing automation is an excellent choice for enterprise companies already using Salesforce CRM, although it works with other CRM products, too. Its strengths include the ability to create custom fields on core Salesforce objects for marketing automation and the availability of an exposed SQL layer, which allows for detailed analysis and segmentation—offering a level of granularity that is often not found in competing products. However, the integration with core CRM objects remains relatively shallow, limiting end-to-end traceability and making it feel as though users are navigating two separate silos, securing the #2 spot on our list of the top marketing automation systems.

Strengths

- Enterprise-grade custom fields on top of the core CRM objects. One major advantage of the Pardot product is the ability to create custom fields on top of the core Salesforce objects for marketing automation purposes.

- SQL-based querying and analytics capabilities. Another key feature is the exposed SQL layer, allowing for in-depth analysis of various scenarios from a segmentation perspective. This level of granularity is rare among other products on the market, making it more suitable for enterprise use.

- Enterprise-grade security. Workflow security is essential, particularly for large marketing teams, as it helps control email campaigns. Also, establishing approval workflows and implementing workflow security is crucial; it allows you to restrict access and manage marketing automation processes effectively.

Weaknesses

- Not as embedded experience with Salesforce CRM. It often feels like operating in two separate silos for companies seeking seamless integration between their CRM and marketing automation components.

- Expensive. Salesforce marketing cloud is more expensive than other smaller point solutions with simpler workflow and security layers.

- Steep learning curve. Enterprise-grade workflows and security layers require substantial training for users with limited technical skills.

1. HubSpot

HubSpot is ideal for content-driven B2B organizations heavy on upstream marketing workflows requiring tight embeddedness with their web workflows. It is widely adopted and integrated platforms, particularly in the marketing automation and CMS space, providing seamless integration with ad platforms, CMS systems, and data providers. Its pre-built integrations make it ideal for consolidating customer interactions and marketing strategies. However, HubSpot’s limitations arise in complex operational use cases, as its object structure and customizability may not meet the needs of companies heavy on transactional and operational workflows. Hence, HubSpot secures the #1 spot on our list of the top marketing automation systems.

Strengths

- Ecosystem. HubSpot has one of the most vibrant ecosystems, especially when it comes to connecting with various ad platforms or data platforms that are part of the marketing stack.

- Integration with upstream marketing providers such as CMS and data companies. The integration with upstream marketing providers, like CMS and data companies, is also included, especially if you’re using HubSpot CMS.

- Embedded CMS. It is likely to be one of the most widely adopted platforms in the CMS community as well. The other systems may rely on third-party CMS systems, limiting the interconnectedness and seamless interactions between these two systems.

Weaknesses

- Weak object structure for core CRM, such as parent-child relationships. The core object structure of HubSpot, particularly in operational scenarios, is weaker compared to other systems defined for transactional and downstream workflows such as HubSpot or Zoho.

- Limited customizability for enterprise use cases. When it comes to customizability for complex operational use cases, HubSpot is significantly limited.

- Not meant to be for commerce-driven B2C industries. Commerce workflows require different events and integration, along with the object structure. HubSpot is not necessarily designed for B2C-centric industries.

Conclusion

The evolution of marketing automation has created a diverse ecosystem, where each platform brings unique strengths and limitations to the table. Platforms like HubSpot and Salesforce Pardot dominate with their strong integration capabilities and enterprise-grade features, making them suitable for complex workflows and large organizations. Meanwhile, options like Zoho and MailChimp serve smaller businesses and startups by offering more accessible, cost-effective solutions, though they may lack robust integrations and advanced security features found in enterprise systems. While this list offers valuable insights, seeking advice from an independent ERP consultant can greatly enhance your implementation success.