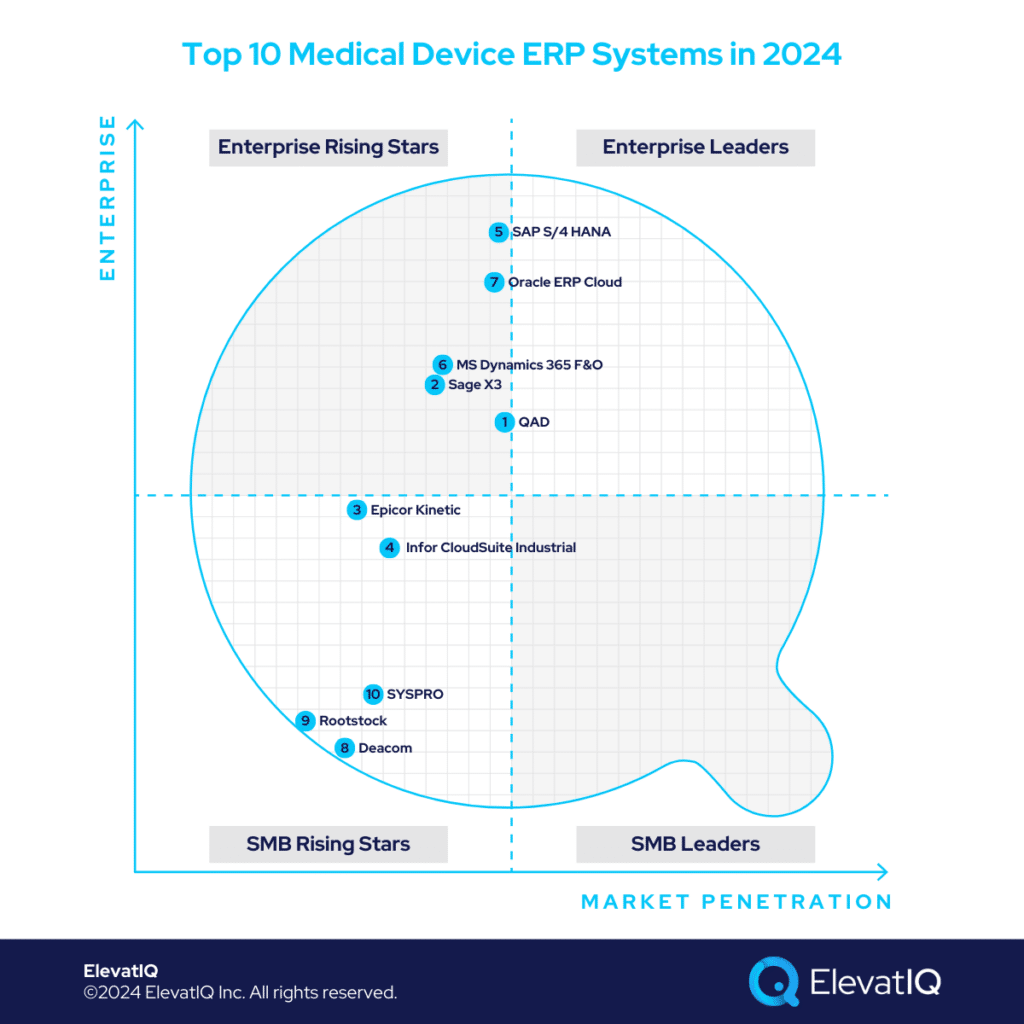

Top 10 Medical Device ERP Systems in 2024

The medical device industry has unique ERP needs, spanning consumable and large CapEx equipment segments. The laboratory segment, positioned in between, demands specialized integration like LIMS. Contract manufacturers handle diverse needs and support processes across multiple industries. Consulting companies within the medical device industry may share professional service processes but have distinct ERP requirements. Processes and regulations vary based on diagnostic or surgical use. Consumables align with make-to-stock, emphasizing robust distribution and eCommerce integration. Large machines reflect engineering-to-order processes, requiring support for extensive programs, field services, and both make-to-stock and make-to-order processes for consumables. Additional complexity arises from drug-centric processes, heightening ERP considerations for each device type.

Apart from pre-built compliance processes, ERP systems tailored to the medical device industry vary in terms of supported business processes, transaction volume, and operational scope—be it local or global. Those supporting global process integration may prioritize diversified business models, which is crucial for companies within PE portfolios or holding structures. The sector faces heightened scrutiny, with investors demanding comprehensive reporting, even for pre-revenue companies. Implementing systems to support reporting needs efficiently becomes imperative to minimize administrative overhead.

Key features encompass electronic signatures and device history records, sharing similarities with aerospace and automotive industries but with added constraints for medical device companies. Validation requirements, like software validation with each change, exhibit variability. CRM processes encounter complexities due to diverse market timelines affecting quoting. This overview merely scratches the surface of essential features for medical device companies. Excited to delve into ERP systems tailored for this industry? Let’s navigate the top 10 medical device ERP systems.

Criteria

- Definition of a medical device company. These are the medical device ecosystem companies, including large medical equipment manufacturers, consumable manufacturers, diagnostic companies, and CROs. The list considers companies of all sizes in this ecosystem.

- Overall market share/# of customers. The higher the market share among medical device companies, the higher it ranks on our list.

- Ownership/funding. The more committed the management to the product roadmap for the medical device companies, the higher it ranks on our list.

- Quality of development. The more cloud-native capabilities, the higher it ranks on our list.

- Community/Ecosystem. The larger the community with a heavy presence from medical device companies, the higher it ranks on our list.

- Depth of native functionality for specific industries. The deeper the publisher-owned out-of-the-box functionality, the higher it ranks on our list.

- Quality of publicly available product documentation. The poorer the product documentation, the lower it ranks on our list.

- Medical device company market share. The higher the focus on medical device companies, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with medical device companies. The more aligned the acquisitions are with the medical device companies, the higher it ranks on our list.

- User Reviews. The deeper the reviews from medical device companies, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product such as QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. SYSPRO

SYSPRO is designed for SMB medical device companies, particularly those in consumables or diagnostic segments, aligning well with distribution and commerce-centric industries. Ideal for complex consumable devices, SYSPRO supports both discrete and process industries, with a focus on food-centric sectors. However, it may not suit devices requiring engineer-to-order or field service-centric processes. SYSPRO can be a suitable solution for small subsidiaries operating fairly independently. Resembling SAP in feel and featuring solid finance and distribution capabilities, SYSPRO maintains its #10 position on our list of top medical device ERP systems.

Strengths

- Inventory and supply chain capabilities. Its strengths for medical device companies include its substantial inventory and supply chain capabilities.

- Medical device quality requirements. The other bonus points for SYSPRO include its ability to support electronic signature capture, CAD integration, and detailed audit trails of the transactions critical to support FDA 21 CFR 11 and GMP requirements.

- Native support for process manufacturing capabilities. Finally, the other plus point for SYSPRO would be its native support for process manufacturing capabilities. These features will be helpful for companies such as contract research organizations or laboratories that might develop drugs along with devices.

Weaknesses

- Fit for companies with one legal entity. Designed primarily for smaller manufacturing facilities with one legal entity.

- Limited manufacturing capabilities. Deeper manufacturing features, such as line-level backflushing for both material and operations and Kanban, would be a challenge.

- Not a fit for large capital equipment medical device manufacturers. Not designed for complex capital equipment devices such as radiology or cancer machines.

9. Rootstock

Tailored for smaller discrete medical device manufacturers, Rootstock is optimal for companies in the $10-$100 million range, especially those heavily reliant on Salesforce. Well-suited for large CapEx machinery with robust processes, including CPQ, project management, and field services, it is suitable for handling consumables associated with such machinery. However, it may not be the ideal choice for devices packaging drugs with their assembly. Not a potential subsidiary solution for pharma companies or research centers focused on CapEx equipment, Rootstock’s limited business process diversity makes it less suitable for large companies with varied models. Despite a limited install base, its popularity in the cloud-native segment earns it the #9 rank among medical device companies on this list.

Strengths

- Native Integration with Other Salesforce Products. Such as Salesforce CRM and Field Service. As well as Salesforce CPQ and commerce are especially strong for medical device companies that care for enterprise-grade territory management and customer experience.

- Cloud-native Mobile Capabilities. Inheriting native mobile capabilities from the Salesforce platform, it is strong with native cloud mobile capabilities. Its WMS mobile capabilities, such as cross-docking and license plate numbers, are especially attractive.

- Mixed-mode Manufacturing Capabilities. Finally, its strength includes mixed-mode manufacturing capabilities, with the exception of process manufacturing capabilities.

Weaknesses

- Finance and Accounting. Rootstock started as the MRP solution and relied on other accounting solutions. They have recently developed accounting capabilities, which are not as strong as other products on this list.

- Reliance on Third-part Quality Module. Relying on other solutions in the Salesforce ecosystem, such as ComplianceQuest, Rootstock does not own a quality module.

- Smaller Ecosystem. The ecosystem is relatively small for rootstock, with less than 500 installations. This could pose a risk in finding talent for future support and customizations.

8. Deacom

Deacom focuses on smaller process-centric pharma companies, emphasizing commerce over discrete-centric or large devices. It excels as a solution for diagnostic, drug, and smaller consumable devices with a strong commerce focus. While Deacom integrates various enterprise software categories like quality management and compliance, its core ERP layers have flat models, requiring ad-hoc arrangements and posing challenges with batch-centric capabilities. Ideal for companies prioritizing transactional capabilities, it may not suit those seeking mature ERP functionalities. Despite these considerations, it retains the #8 rank among top medical device ERP systems.

Strengths

- Technology. Deacom’s strengths for medical device manufacturers include its technology, which has a modern interface and an SQL database. The other products in this category typically rely on file-based databases.

- Process Manufacturing Capabilities. The other plus points for Deacom would be the capabilities for medical device companies that are more of a drug/chemical company than a device company.

- Track and Trace and Route Accounting. Finally, its strength would also be in its native capabilities for track and trace and route accounting capabilities for medical device companies distributing fast-moving goods such as sanitizers or surgical masks on their vehicles.

Weaknesses

- Not a Discrete Manufacturing Product. It will struggle with companies requiring complex discrete manufacturing features such as CAD integration or multi-layered BOMs with thousands of components with change orders.

- Fit for Fast-moving Consumable Products. its native design is deficient for large capital equipment manufacturers as its costing and BOM capabilities will be extremely limited for them.

- Limited Finance and Supply Chain Management Capabilities. Limited finance and supply chain capabilities, such as complex UoM, deep pricing and discounting support, and 1.N capabilities as they relate to the orders, shipments, and invoices.

7. Oracle Cloud ERP

Oracle Cloud ERP targets large, global medical device manufacturers with revenues generally exceeding $1 billion, offering consolidation in a unified database for diverse business models. Ideal for companies with varied entities, including commerce, consumables, large capital equipment, medical device consulting, contract manufacturing, and subsidiaries of hospitals or research centers. Though lacking last-mile capabilities for these models, it provide foundational ERP layers, minimizing the need for additional systems. While suitable as a corporate financial ledger, it may not be the optimal choice as a subsidiary solution. Despite these nuances, it holds the seventh position in our list of top medical device ERP systems.

Strengths

- Core ERP capabilities. One of the largest ERP solutions in the market, with deep capabilities in supply chain and logistics, is provided as part of the core solution.

- Diverse, global capabilities. The ability to support multiple business models in one solution globally located.

- Financial control and public company capabilities. Financial control capabilities are required for larger and public companies, such as SOX compliance, financial traceability, and month-end close collaboration across entities.

Weaknesses

- Medical Device Last-Mile Functionality. Limited last-mile functionality applicable for medical device manufacturers, such as device history records, reporting for FDA 21 CFR 11 and GMP, and electronic signature and skill certification processes embedded with each operational step.

- Longer Configuration and Customization Time. Longer time in customizing and configuring as the software design may consist of unnecessary allocation, commitment, and approval functionality for large companies.

- Not as Relatable for Plant Level Employees. Finally, the product may appear bloated for plant-level employees due to the missing operational perspective. Also, enabling this perspective may require unnecessary development and testing time.

6. Microsoft Dynamics 365 Finance & Operations

Microsoft Dynamics 365 Finance & Operations targets large, global medical device manufacturers in the upper mid or lower enterprise market. Ideal for companies with varied entities, including commerce, consumables, large capital equipment, medical device consulting, contract manufacturing, and subsidiaries of hospitals or research centers. Although lacking last-mile capabilities for these models, it provides foundational ERP layers, minimizing the need for additional systems. While suitable as a corporate financial ledger, it may not be the optimal choice as a subsidiary solution. Despite these nuances, it holds the 6th position in our list of top medical device ERP systems.

Strengths

- Core ERP Capabilities. Its strength includes the core ERP capabilities such as native support for mixed-mode manufacturing, including deep process manufacturing such as formulation management, catch weight management, approvals, and commitments.

- Best-of-breed Capabilities. Its strength also includes its best-of-breed capabilities with applications such as pre-integrated CRM and field service components.

- Technical Architecture. The technical architecture includes integration with other Microsoft products, such as Logic Apps and Azure Data Factory, allowing them to isolate their infrastructure for validation requirements.

Weaknesses

- Medical Device Last-Mile Functionality. Its weaknesses include limited last-mile functionality applicable for medical device manufacturers, such as device history records, reporting for FDA 21 CFR 11 and GMP, and electronic signature and skill certification processes embedded with each operational step.

- Customizability. Since MS products are highly technical and customizable in nature, it could pose control issues for companies if developers over-customize these products with limited visibility for financial executives.

- Implementation Control. Since Microsoft sells licenses in the OEM setting with a limited governance process in place, buying these products from unqualified resellers fires back and may lead to ERP implementation failure.

5. SAP S/4 HANA

SAP S/4 HANA targets large, global medical device manufacturers with revenues generally exceeding $1 billion, especially friendly for publicly traded companies with one of the best transactional traceability for globally complex and highly regulated medical device companies. Though lacking last-mile capabilities for these models, it provide foundational ERP layers, minimizing the need for additional systems. While suitable as a corporate financial ledger, it may not be the optimal choice as a subsidiary solution. Despite these nuances, it holds the 5th position in our list of top medical device ERP systems.

Strengths

- Superior Financial Control and Governance. Its strength includes the inbuilt visual workflow for each financial transaction, superior change control of the ERP configurations, and SOX compliance approval flow.

- Product Model Designed to Support Various Manufacturing. SAP’s product model is rich and supports various configurations, including mixed-mode manufacturing.

- Best of breed solutions. Several solutions, including SAP Hybris for e-commerce for medical device companies and Callidus Cloud for CPQ. SAP also has a robust WMS and TMS solution packaged as part of SAP EWM and SuccessFactors for HCM capabilities.

Weaknesses

- Integration Challenges with Best-of-breed Solutions. While SAP S/4 HANA has one of the best best-of-breed solutions, they might not be as pre-integrated as other solutions.

- Overbloated Customizations and Controls for Smaller Organizations. As with other larger products on this list, the controls provided as part of the product may feel unnecessary and overwhelming for smaller companies. In addition, they may add additional development and testing time to disable them.

- Last-mile Medical Device Manufacturing Capabilities. Last-mile medical device manufacturing functionality such as FDA reports, 21 CFR 11, and device history records functionality would require expensive customizations.

4. Infor CloudSuite Industrial

Infor CloudSuite Industrial targets small to mid-sized medical device manufacturers. While a great mixed-mode manufacturing solution, it suffers from several deficiencies, requiring ad-hoc arrangements, such as WBS processes not being as detailed, MRP being limited with attribute level planning, and distribution planning not being friendly for commerce-centric companies. It could be a great fit as a subsidiary solution for large medical device companies or as the main ERP for smaller medical device companies. Given these considerations, it ranks at #3 on our list of the top medical device ERP systems.

Strengths

- Designed from the Perspective of OEMs. Supports serializable units composed of other serialized components to provide a complete view of the device history.

- Quality Module Owned and Pre-Integrated. The quality module is deeply integrated and maintains a separate inventory for the quality-controlled components with deep coverage for in-process quality.

- Strong Field Service Capabilities. When several players may be involved in the sales and service transactions, including the scheduling of internal or external resources. As well as share compensation depending upon the level of effort from all parties involved.

Weaknesses

- Poor UX and Legacy Feeling. The interface is not as cloud-native as some of its legacy counterparts, with critical limitations such as advanced search capabilities.

- Not Suitable for Distribution-centric Medical Device Manufacturers. The product design is limited for manufacturers. However, the distributors that perform lighter manufacturing but may have deeper distribution needs, such as Supply Chain network planning or decentralized warehouse architecture, may struggle with the product.

- FDA- and Medical Device-Specific Regulatory Capabilities Not as Strong. Its weaknesses also include the efforts required in developing regulatory compliance reports and capabilities needed for medical device manufacturers.

3. Epicor Kinetic

Epicor Kinetic caters to small to mid-market discrete medical device manufacturers, particularly those specializing in CapEx manufacturing with WBS-centric processes. It is well-suited for companies with complex inventory management, where devices may serve multiple indications, requiring planning at the product attribute level. The product’s robust distribution-centric planning is also friendly for commerce-centric medical device companies. While an excellent choice for smaller companies or as a subsidiary solution for larger firms, its limited support for financial layers may hinder scalability for larger enterprises. Despite these considerations, it maintains its position at #3 on our list of top medical device ERP systems.

Strengths

- Mixed-mode manufacturing capabilities. The product model can accommodate several manufacturing processes for discrete manufacturers, such as Kanban, configure-to-order, make-to-order, and make-to-stock.

- UX Experience. While legacy, the UX experience is superior in the cloud today, with support for more complex cloud-native features such as the advanced search for data or forms.

- Last Mile Medical Device Capabilities. Its strength also includes the last-mile functionality for medical device manufacturers, such as electronic signature support through MES and track and trace capabilities starting from raw material through post-sale.

Weaknesses

- Limited financial layers. Epicor Kinetic is designed for small to medium companies to support only three layers of financial hierarchies. More than three layers of hierarchies may need ad-hoc arrangements.

- Third-party quality module. Its weakness also includes its reliance on the third-party quality module, limiting the tighter integration of the quality processes that medical device manufacturers need.

- Embedded field service experience. For CapEx device manufacturers require embedded and traceable field services processes with the core manufacturing processes because the field services capabilities were part of an add-on that Epicor just bought.

2. Sage X3

Sage X3 focuses on the upper mid-market and lower enterprise sectors, making it a strong choice for publicly traded companies or those requiring robust financial control. It excels as a financial ledger for larger enterprises or as the primary ERP for smaller companies, particularly in regulated industries. Despite its effectiveness, Sage X3 faces challenges in gaining momentum due to Sage’s primary focus on accounting firms serving SMBs. Consequently, it may not receive as much attention as other products in Sage’s portfolio. While slightly downgraded this year, it maintains its position at #2 on our list of top medical device ERP systems.

Strengths

- Process manufacturing capabilities. Its strength includes process manufacturing capabilities for companies such as laboratories and drug-like products instead of hardware devices.

- Deep finance and supply chain capabilities. Its strength also includes deep finance and supply chain capabilities, and the product is designed from the CFO’s perspective. This is helpful for large companies that need superior financial control and last-mile process manufacturing capabilities.

- Multi-entity Capabilities. Its strength also includes multi-entity capabilities that might not feel as natural with other focused products on this list.

Weaknesses

- Discrete manufacturing capabilities. Sage X3 has discrete manufacturing capabilities, but these capabilities may not be robust for complex equipment manufacturers.

- Third-party MES. Sage X3 does not have a pre-integrated OEM-owned MES component and would require integration and additional testing with third-party solutions with the legal and implementation risks due to multiple vendors involved.

- Last-mile medical device manufacturing capabilities. The last-mile medical device manufacturing capabilities would require additional development and testing, increasing the costs and risks for ERP implementation.

1. QAD

QAD caters to the upper, mid-market, and lower enterprise sectors, providing a robust solution for companies prioritizing integrated supply chain components, particularly in planning and collaboration, complemented by comprehensive ERP layers. The suite includes several integrated components like PLM, making it ideal for companies with intensive product management processes. QAD serves well as a subsidiary solution for larger enterprises using SAP or Oracle for their corporate financial ledger or as the primary ERP for smaller companies. With the recent announcement of a technology upgrade, it has been upgraded slightly, securing the top position on our list of top medical device ERP systems.

Strengths

- Supply chain perspective. Designed from the perspective of the Supply Chain and is probably the only mid-market product with deeper transportation management. As well as international trade management capabilities.

- Last mile medical device capabilities. The last mile medical device capabilities include automated quality management, serialization in support of unique device identification (UDI), the Drug Quality and Security Act (DQSA), and the Falsified Medicine Directive (FMD).

- Mixed-mode manufacturing capabilities. It has native discreet and process manufacturing capabilities and forward and backward recall traceability.

Weaknesses

- Ecosystem. QAD is not as well adapted as some other products on the list and does not have as prolific a VAR ecosystem as Microsoft, SAP, or Oracle.

- Technology and underlying technical architecture. While QAD has announced that they plan to modernize their technology, it might take a few years before the new platform becomes stable.

- Not a great fit for companies developing large complex capital equipment. While the product has mixed-mode manufacturing capabilities, it’s not meant to support large complex capital equipment manufacturers’ products with thousands of dependent components and sub-assemblies.

Conclusion

Given the stringent FDA compliance and quality requirements, medical device companies have intricate operations. Comprehensive CPQ capabilities are essential for controlling the global release process of equipment. When developing combinations of drugs, devices, or consumables with capital equipment, mixed-mode manufacturing capabilities become crucial.

Choose an ERP system designed to seamlessly support most medical device processes. Utilizing an ERP system not specifically tailored for the medical device industry may lead to substantial customizations and unnecessary testing for configurations packaged with other ERP systems. Ensure your chosen ERP system is purpose-built for the medical device sector, and let this list guide you in narrowing down your options. Consulting independent ERP experts can further enhance your decision-making process.