ERP Maintenance Fee Negotiations: Capping Annual Increases Early

ERP maintenance fees represent one of the largest and least scrutinized components of total enterprise software ownership cost. For a mid-sized organization with $2 million in annual software licenses, maintenance typically starts in the 18–22% range for tier-1 ERP vendors of license value, approximately $360,000 to $440,000 per year. Without negotiated protection, these fees escalate annually, compounding over the contract lifecycle to add millions in unplanned costs.

The challenge with ERP maintenance fee negotiation is that most organizations treat it as an afterthought during initial contract discussions, focusing instead on license discounts and implementation terms. By the time the first annual renewal arrives, leverage has disappeared. The system is live, operations depend on vendor support, and the cost of switching platforms is prohibitively high. The vendor knows this. The annual increase notice that arrives without discussion is the structural result of failing to negotiate protection upfront.

This blog examines the specific mechanisms of maintenance fee escalation, the industry benchmarks that establish what constitutes reasonable vs. excessive increases, and the ERP contract negotiation strategies that cap long-term exposure before it compounds into financial impact that no discount on the front-end can offset.

Why Maintenance Fees Matter More Than License Costs Over Time

Most procurement teams celebrate achieving a 20–30% discount on software licenses and consider that a successful negotiation outcome. The reality is that license cost is a one-time event or at most, an event that recurs only when new users or modules are added. Maintenance fees, by contrast, are an annual recurring cost that escalates over the entire period the system remains in production.

The Compounding Mathematics of Uncapped Escalation

Consider a typical mid-market ERP deployment with $2 million in perpetual licenses. Standard vendor proposals include:

- Initial maintenance at 20% of license value: $400,000 annually

- Annual escalation of 3–5% (vendor standard terms, often characterized as aligned with CPI)

- No negotiated cap or multi-year lock

Over a 10-year period, that creates the following cost trajectory:

| Year | Annual Increase @ 3% | Annual Increase @ 5% | Cumulative 10-Year Cost @ 3% | Cumulative 10-Year Cost @ 5% |

| 1 | $400,000 | $400,000 | $400,000 | $400,000 |

| 5 | $450,980 | $486,200 | $2,124,349 | $2,210,126 |

| 10 | $523,130 | $622,110 | $4,587,859 | $5,031,560 |

The difference between a 3% annual escalation and a 5% annual escalation is approximately $443,000 over 10 years on a $2 million license base. That delta, nearly half a million dollars often exceeds the discount most organizations achieve on the original ERP license negotiation. And it occurs entirely in the background, year after year, because the escalation clause was not challenged at contract signing.

This is not a hypothetical scenario. Industry data indicates that without negotiated caps, typically range from 3–8% annually depending on vendor and contract language, with the higher end occurring when contracts include vague language like “increases consistent with vendor’s then-current pricing” rather than a defined percentage or index.

Why Vendors Prioritise Maintenance Revenue Over License Sales

ERP maintenance fees among the most profitable revenue streams in the vendor’s business model in the vendor’s business model. Unlike license sales – which require sales effort, discounting, and competitive positioning, maintenance revenue is recurring, predictable, and largely immune to competitive pressure once the system is live. This is why ERP maintenance fee negotiation during the initial contract phase is the only period when buyers have meaningful leverage to secure protection.

Once a system is in production:

- The cost of switching vendors is prohibitive — measured in millions of dollars for ERP implementation, data migration, and business disruption

- Operational dependency eliminates alternatives — the business cannot function without vendor support and updates

- Competitive pressure disappears — the organization is no longer evaluating multiple vendors, eliminating the leverage that existed during procurement

Vendors understand this dynamic structurally. The maintenance escalation clause in standard vendor terms is designed to maximise recurring revenue growth with minimal resistance, because resistance at the renewal stage carries operational consequences that few IT or finance leaders are willing to accept.

Industry Benchmarks: What Constitutes Reasonable vs. Excessive Maintenance Escalation

Effective ERP maintenance fee negotiation requires grounding discussions in market data rather than accepting vendor representations about what is standard or unavoidable. Industry research and contract benchmarking data provide objective reference points.

Standard Maintenance Fee Ranges by Deployment Model

Maintenance fee structures vary by deployment architecture and vendor, but industry benchmarks establish clear ranges:

On-premise perpetual licenses:

- Annual maintenance typically 15–25% of license value

- Industry standard: 18–22% for tier-1 vendors (SAP, Oracle, Microsoft)

- Lower-tier vendors and open-source platforms: 12–18%

Cloud subscription models:

- Maintenance and support bundled into subscription pricing

- Escalation occurs through annual subscription rate increases rather than separate maintenance fees

- Standard cloud subscription escalation: 3–7% annually without negotiated caps

Hybrid deployments:

- Separate maintenance fees for on-premise components

- Cloud subscription pricing for SaaS modules

- Requires separate escalation protection for each pricing component

What Market Data Says About Escalation Caps

Analysis of negotiated ERP contracts across industries reveals that organizations achieving favorable ERP maintenance fee negotiation outcomes typically secure the following protections:

- CPI-linked escalation: Annual increases capped at Consumer Price Index movement, typically averaging 2–3% over multi-year periods

- Fixed percentage caps: Maximum annual increase of 3% regardless of broader economic conditions

- Multi-year rate locks: Maintenance percentage frozen for 3–5 years, with any subsequent increases subject to renegotiation

- Hybrid structures: CPI or 3%, whichever is lower, providing protection against both inflation spikes and vendor pricing opportunism

Organizations that accept vendor standard terms without challenge often face escalation in the 4–8% range, approximately double the protection that ERP maintenance fee negotiation achieves. Over a 10-year contract lifecycle, that difference translates to 15–25% higher total maintenance spend.

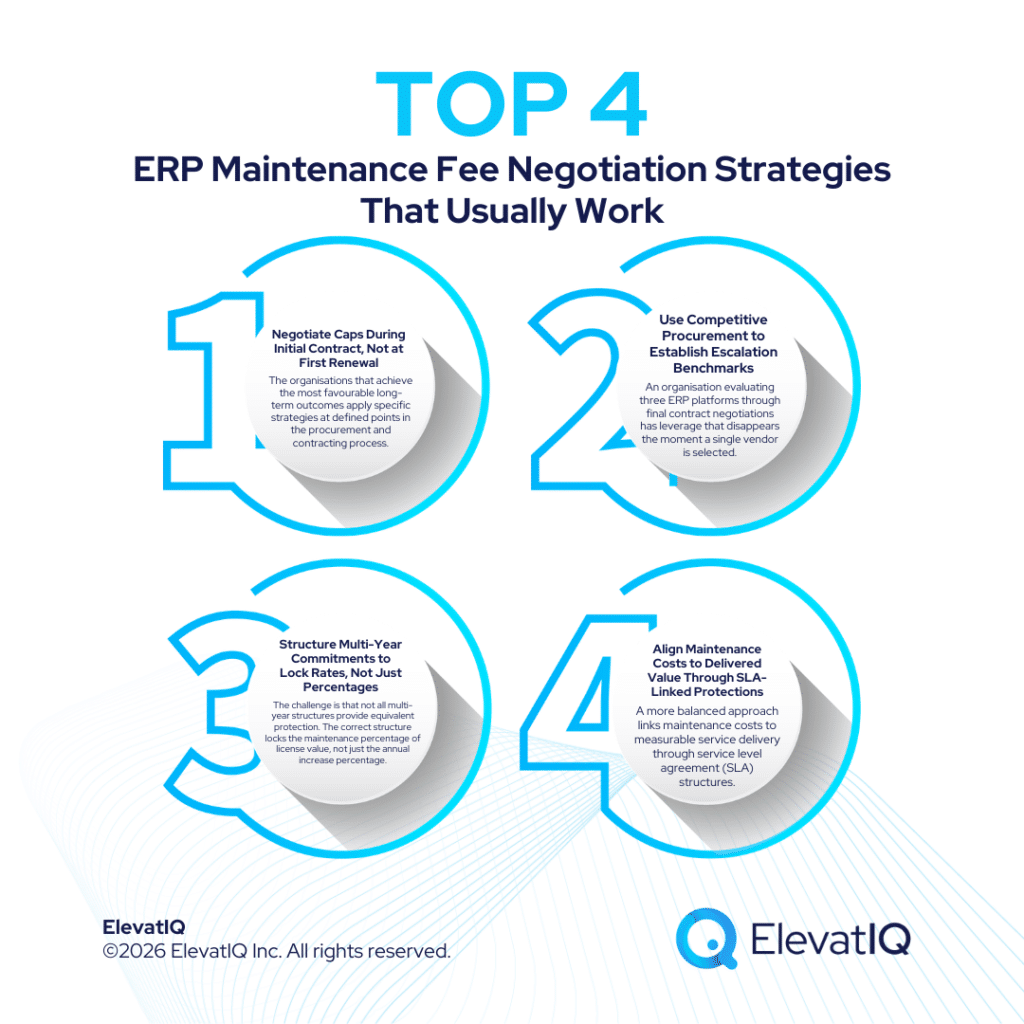

The Four ERP Maintenance Fee Negotiation Strategies That Actually Work

Maintenance fee escalation is not a technical requirement imposed by infrastructure costs or regulatory obligations. It is a commercial term subject to negotiation. The organizations that achieve the most favorable long-term outcomes apply specific strategies at defined points in the procurement and contracting process.

Negotiate Caps During Initial Contract, Not at First Renewal

The single most common ERP maintenance fee negotiation mistake is deferring the discussion until the first annual renewal. By that point, the system is live, the vendor has delivered value, and the organization’s operational dependence has eliminated the leverage that existed during competitive procurement.

The correct timing for maintenance escalation negotiation is during the initial contract phase, alongside license pricing, implementation terms, and service level agreements. Vendor sales teams are authorised to make concessions on maintenance terms when those concessions are necessary to close the deal. They are not authorised to make the same concessions 12 months later when the client has no credible alternative.

Specific contract language to negotiate:

- Explicit percentage cap: “Annual maintenance fee increases shall not exceed 3% per year, measured from the prior year’s fee.”

- CPI linkage: “Annual maintenance fee increases shall not exceed the percentage change in the Consumer Price Index for All Urban Consumers (CPI-U) as published by the US Bureau of Labor Statistics, measured over the prior 12-month period.”

- Hybrid protection: “Annual maintenance increases shall not exceed the lesser of (a) 3% or (b) CPI-U percentage change.”

- Multi-year lock: “Maintenance fees for Years 1–3 shall remain at 20% of license value. Any adjustment for Years 4–5 shall be subject to mutual agreement and shall not exceed CPI-U plus 1%.”

Use Competitive Procurement to Establish Escalation Benchmarks

Vendors make their most aggressive pricing concessions, on both license and maintenance terms, when facing genuine competitive risk. An organization evaluating three ERP platforms through final contract negotiations has leverage that disappears the moment a single vendor is selected.

How to apply this leverage to ERP maintenance fee negotiation:

- Include maintenance escalation terms in RFP requirements — explicitly request proposed escalation caps, multi-year locks, and index linkages as part of the formal vendor response

- Compare escalation terms across vendors — a vendor proposing 5% annual escalation when a competitor offers CPI-linked caps is providing evidence of negotiable flexibility

- Share competitive positions strategically — statements like “we have more favorable escalation protection from Vendor B” create pressure without breaching confidentiality

- Maintain competitive tension through final contract — continuing discussions with alternative vendors until all terms (including maintenance) are finalised prevents vendors from hardening positions after initial selection

Organizations that complete vendor selection before finalising maintenance terms routinely accept escalation clauses they could have negotiated more favourably. The vendor has no remaining commercial incentive to make concessions once the competitive process ends.

Structure Multi-Year Commitments to Lock Rates, Not Just Percentages

A common vendor counteroffer during ERP maintenance fee negotiation is to agree to an escalation cap in exchange for a multi-year commitment. This is frequently presented as a favorable trade: the organization gains rate certainty, and the vendor gains revenue predictability.

The challenge is that not all multi-year structures provide equivalent protection. The correct structure locks the maintenance percentage of license value, not just the annual increase percentage.

- Example of inadequate protection:

- “Maintenance fees shall increase at CPI annually, with a 3-year commitment.”

- This clause caps annual increases but does not prevent the vendor from adjusting the base maintenance percentage from 20% to 22% at renewal, then applying CPI escalation to the higher base. The result is an effective 10% increase in Year 4 (the 2-point percentage increase) followed by continued CPI escalation.

- Example of robust protection:

- “Maintenance fees shall remain at 20% of license value for Years 1–3. For Years 4–5, maintenance percentage may be adjusted to 21% maximum, with annual increases thereafter capped at CPI or 3%, whichever is lower.”

- This structure explicitly controls both the base maintenance percentage and the annual escalation mechanism, preventing vendors from achieving backdoor increases through percentage base adjustments.

Align Maintenance Costs to Delivered Value Through SLA-Linked Protections

Standard maintenance agreements obligate the customer to pay annual fees regardless of the quality or responsiveness of vendor support. A more balanced approach links maintenance costs to measurable service delivery through service level agreement (SLA) structures.

How SLA-linked maintenance protections work:

- Response time commitments: Vendor must acknowledge Priority 1 issues within 2 hours, Priority 2 within 8 hours

- Resolution commitments: Vendor must resolve or provide workaround for Priority 1 issues within 24 hours

- Availability commitments (cloud deployments): System uptime of 99.5% monthly

- Financial remedy for SLA failures: Credit of 5% of monthly maintenance fee for each SLA breach, cumulative up to 25% annually

This structure does not prevent maintenance escalation, but it ensures that escalating costs correspond to sustained service quality. Vendors that fail to meet support commitments bear financial consequence rather than the customer absorbing both poor service and annual fee increases. Including SLA-linked remedies in the maintenance agreement is a negotiation priority that belongs in the same initial contract discussion as escalation caps, not as a reactive measure after support quality degrades.

What Independent Advisors Bring to ERP Maintenance Fee Negotiation

The structural challenge in ERP maintenance fee negotiation is information asymmetry. Vendors negotiate enterprise software contracts daily across hundreds of clients. They know precisely what escalation terms other similarly situated buyers have accepted, what concessions are within sales team authority, and what positions will trigger management escalation. Buyers negotiate these contracts once every 7–10 years and lack visibility into market benchmarks beyond what the vendor chooses to disclose.

Independent ERP advisors reduce this asymmetry through:

- Market benchmark data across vendor pricing, maintenance percentages, and escalation caps drawn from recent comparable contracts

- Negotiation leverage — vendors recognise that experienced advisors cannot be misled by representations about what terms are standard or non-negotiable

- Vendor neutrality — advisors with no implementation practices or vendor partnerships can pursue aggressive negotiation positions without concern for preserving commercial relationships

The financial return on advisory engagement is typically measured in multiples. An advisor fee can save hundreds of thousands of dollars over 10 years in typical mid-market scenarios, before considering any license discount or implementation term improvements achieved through the same engagement.

The Conclusion

ERP maintenance fees are not a fixed cost imposed by technical requirements. They are a commercial term subject to the same negotiation leverage as license pricing, implementation scope, and payment terms. The difference is that maintenance escalation compounds annually over the system’s operational life , meaning that a 2-point difference in escalation rate has greater financial impact than a 20% discount on initial licenses.

The organizations that achieve the most favorable long-term ERP maintenance fee negotiation outcomes apply four disciplines:

- Negotiate escalation caps during initial contract phase, when competitive leverage exists

- Use competitive procurement to establish market benchmarks for escalation terms

- Structure multi-year commitments to lock maintenance percentage of license value, not just annual increase rates

- Align maintenance costs to delivered value through SLA-linked financial remedies

For organizations currently evaluating ERP platforms, mid-contract, or approaching first renewal, the team at ElevatIQ provides independent ERP advisory support across contract negotiation, benchmark analysis, and vendor engagement strategy, at exactly the stages where ERP maintenance fee negotiation makes the difference between controlled costs and compounding escalation.

(All commentary and analysis represents an independent advisory perspective based on industry benchmarks and cited primary sources.)

FAQs

ERP Maintenance Fee Negotiations: Capping Annual Increases Early Read More »