SAP: Six AI-Driven Methods to Improve Customer Support

SAP has outlined six AI-accelerated, proactive, and preventative methods that are improving customer support operations across industries. The company’s approach moves beyond traditional reactive support models to implement predictive analytics, real-time monitoring, and preventative measures. Thus, address issues before they impact customers. These SAP AI Support methods leverage artificial intelligence capabilities to create comprehensive customer support profiles, reduce support ticket volumes, and achieve significant operational improvements, including 100% uptime during critical business periods.

Structured Breakdown of SAP’s Six AI Methods

Real-Time Monitoring Through Advanced Observability

SAP AI Support begins with comprehensive real-time monitoring capabilities delivered through SAP Cloud ALM, which provides a feature-rich observability platform. This system collects telemetry data, including metrics, logs, and traces, from applications and their supporting infrastructure. The platform enables support teams to review system health through real-time analytics and centralized dashboards, allowing IT teams to respond quickly and fix issues while maintaining business operations with minimal interruptions.

The system utilizes OpenTelemetry standards to provide standardized observability within modern customer landscapes. This approach mirrors the predictive capabilities found in autonomous vehicles, where AI analyzes vast amounts of sensor data to prevent issues before they become critical problems. Omprakash H, Senior Director at Blueprint Technologies Pvt. Ltd., described the impact: “The SAP Cloud ALM solution has been instrumental for our IT operations. It offers real-time insights and seamless integration across all our enterprise applications, making everything run more smoothly. It’s like having a bird’s-eye view of our operations, ensuring efficiency and helping us stay proactive rather than reactive.”

Proactive Resolution Based on Customer Feedback Analysis

The second SAP AI Support method focuses on proactive resolution through systematic analysis of customer feedback loops. This approach identifies repeat requests in customer and user feedback, helping service providers prioritize critical needs and feature delivery. The effectiveness of this method is demonstrated in SAP Business Network and SAP Ariba solutions, where users now visit help centers 10.8 times less than in previous years due to product improvements based on customer feedback.

AI-enabled outbreak detection plays a crucial role in this method, allowing support teams to address unexpected increases in anomalies, customer complaints, or issues before they escalate. This proactive approach transforms traditional reactive support into a preventative system that addresses root causes. Alexey Ukrainsky, Solution Support Architect at SAP MCC, explained the process: “We continuously identify the reasons for frequent customer demands and challenges from inquiries raised to SAP support. This allows SAP to proactively deliver the most impactful product changes before they become a challenge for more customers. This way, we improve our products while also focusing on key product capabilities used by our customers today.”

Predictive Analytics for Issue Prevention

SAP AI Support incorporates sophisticated predictive analytics capabilities, demonstrated through SAP’s holiday season readiness program. This program provides comprehensive 360-degree customer support profiles designed to accelerate issue detection and anticipate potential problems before they occur. The system includes AI-driven features such as virtual support assistants, resource prediction, web traffic prediction, recommendation engines, case history analysis, issue correlation, and pattern recognition. The program’s effectiveness was proven during high-traffic periods, with measurable results in maintaining system uptime during critical business operations. The predictive analytics approach positions SAP as a leader in AI-driven, proactive support solutions across retail and other industries.

Tarun Luthra, Head of Support for I&CX Solutions, reported concrete results: “During Cyber Week 2024, SAP’s holiday reason readiness program equipped our support and ops teams to achieve 100% uptime for our customers with the predictive, proactive, and bi-directional support model implemented by the program.”

Customer Journey Mapping for Process Optimization

The fourth SAP AI Support method utilizes SAP Signavio solutions to help businesses visualize end-to-end customer journeys across different touchpoints. This comprehensive mapping enables companies to identify improvement areas in customer support processes, leading to more personalized and effective customer interactions. SAP Signavio Process Intelligence maps support processes to implement AI improvements for service optimization, resulting in a reported 100% increase in customer value. The SAP Signavio Journey-to-Process Analytics solution specifically addresses the challenge of connecting customer experience data with operational data, reducing time to insight while uncovering anomalies and trends.

Stefan Gammel, Business Process Consultant at Hilti Group, highlighted the integration benefits: “The challenge in increasing our customer experience lies in the direct link between process and journey activities. I see SAP Signavio solutions as the perfect tools for consolidating these two perspectives to develop operational excellence in step with customer experience.”

In-App Support Integration

SAP AI Support includes integration of support features directly within products, services, and systems. This Built-In Support approach provides users easy access to request assistance within the interface without requiring contact with support teams or leaving the platform. The system includes contextual, AI-assisted self-service options such as help documentation, troubleshooting tools, knowledge bases, and FAQs, along with real-time options like live chats with support engineers. WalkMe solutions and Built-In Support, when layered over multiple applications in business workflows, provide real-time, proactive, in-app guidance that significantly reduces the need for live assistance or support tickets. This approach minimizes disruption to user workflows while providing immediate access to relevant support resources.

Wilhelm Jütte, Chief Product Owner for Customer Support at SAP, described the concept: “Context significantly enhances the quality of support. Built-In Support works like a pit stop at a racetrack. The repair crew is right where the action is. The interruption is brief and far less disruptive than taking your car to the workshop, ensuring a smoother return to your activities. In the context of your company, this helps you win your business race.”

Proactive Mindset and Cultural Transformation

The final SAP AI Support method emphasizes the importance of an organizational mindset in sustaining proactive and preventative support strategies. High-performing support teams achieve optimal results through human-machine collaboration within a culture that promotes forward-thinking, outcome-driven, service-oriented, and data-driven approaches. This method recognizes that technological tools and processes require teams aligned with proactive thinking to achieve sustainability. The approach focuses on preventing issues rather than solely solving them, creating peace of mind for end-users, customers, partners, and support engineers, while ensuring every customer receives customized care before they need help.

Derek Matthews, Technical Support – Procurement Chief Innovation Officer at SAP, explained the philosophy: “Knowledge management within support is not just about enabling self-service through portals to deflect incoming tickets, but about eliminating the need to come to the support portal in the first place.”

Common Questions Buyers Are Asking

Q: How does SAP’s AI-driven support reduce actual support costs?

A: SAP AI Support demonstrates measurable cost reduction through decreased support ticket volumes. SAP Business Network and SAP Ariba users are now expected to visit help centers 10.8 times less than previously, indicating a significant reduction in support resource requirements and associated costs.

Q: What technical infrastructure is required to implement these AI support methods?

A: The implementation requires SAP Cloud ALM for observability, SAP Signavio solutions for process mapping, and integration capabilities for in-app support features. The system utilizes OpenTelemetry standards for modern observability frameworks.

Q: How does predictive analytics actually prevent issues before they occur?

A: SAP AI Support uses historical data analysis, pattern recognition, and machine learning algorithms to identify potential problems before they impact customers. The system likely analyzes case history, correlates issues, and predicts resource needs based on traffic patterns and usage trends.

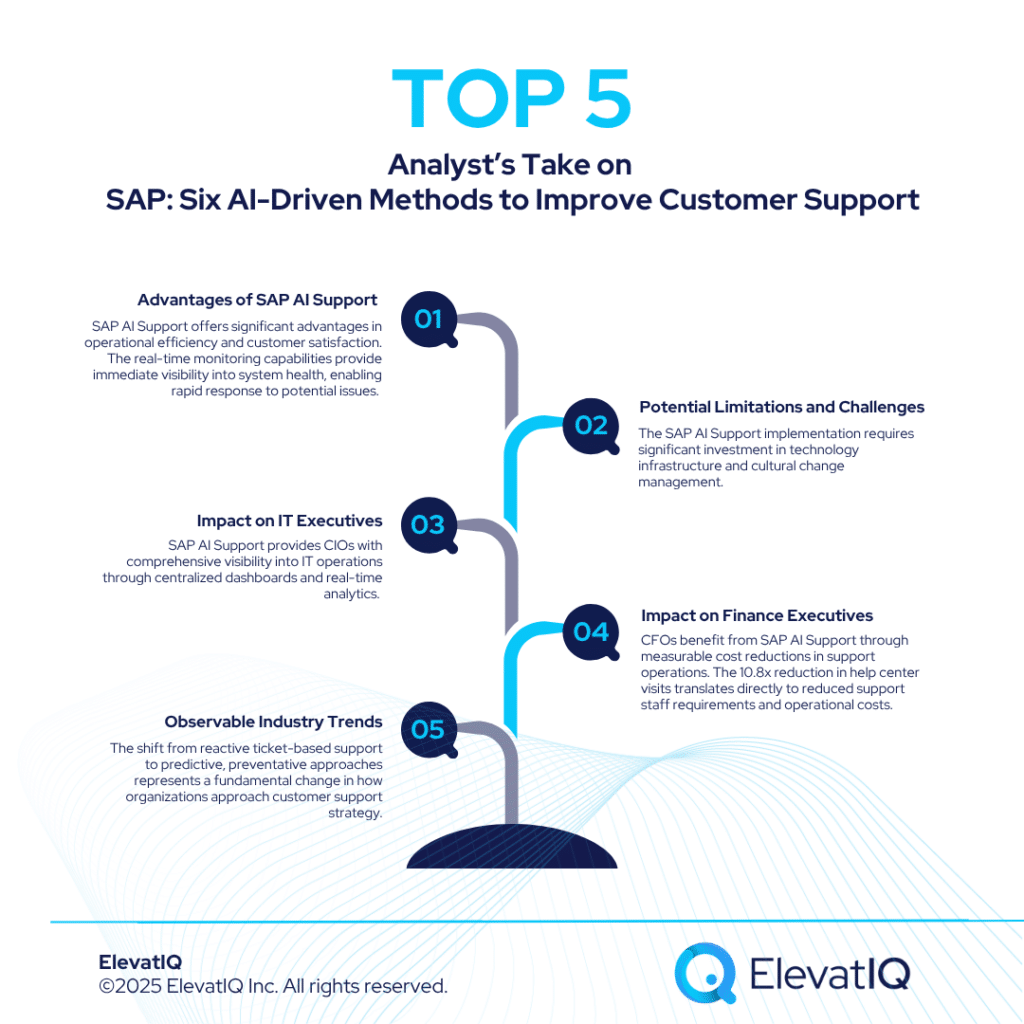

Analyst’s Take

Merit and Demerit Analysis of Key Features

Advantages of SAP AI Support Methods

SAP AI Support offers significant advantages in operational efficiency and customer satisfaction. The real-time monitoring capabilities provide immediate visibility into system health, enabling rapid response to potential issues. The 10.8x reduction in help center visits demonstrates tangible improvement in user experience and support cost reduction. The predictive analytics approach, proven through 100% uptime achievement during Cyber Week 2024, shows concrete business value in maintaining critical operations during peak periods. The integration of multiple AI-driven features creates a comprehensive support ecosystem that addresses issues at multiple touchpoints.

Potential Limitations and Challenges

The SAP AI Support implementation requires significant investment in technology infrastructure and cultural change management. Organizations must invest in SAP Cloud ALM, Signavio solutions, and integration capabilities, which may represent substantial upfront costs. The success of these methods depends heavily on data quality and organizational readiness to adopt proactive mindsets. Companies with limited historical data or resistance to cultural change may experience reduced effectiveness from these AI-driven approaches.

Impact on IT Executives

SAP AI Support provides CIOs with comprehensive visibility into IT operations through centralized dashboards and real-time analytics. The OpenTelemetry standardization offers CIOs better control over observability frameworks and reduces complexity in managing multiple monitoring systems. The predictive analytics capabilities enable CIOs to shift from reactive IT management to proactive system optimization. The ability to achieve 100% uptime during critical business periods demonstrates the value proposition for CIOs focused on operational excellence and business continuity.

However, CIOs must consider the integration complexity and ensure adequate training for IT teams to effectively utilize these AI-driven capabilities. The success of SAP AI Support implementation depends on proper data governance and security protocols to protect sensitive customer information processed by AI systems.

Impact on Finance Executives

CFOs benefit from SAP AI Support through measurable cost reductions in support operations. The 10.8x reduction in help center visits translates directly to reduced support staff requirements and operational costs. The prevention-focused approach reduces the financial impact of system downtime and customer dissatisfaction. The comprehensive customer support profiles and predictive analytics provide CFOs with better visibility into support costs and resource planning. The ability to maintain 100% uptime during critical business periods protects revenue and reduces potential financial losses from system failures.

CFOs must evaluate the return on investment for SAP AI Support implementation, considering upfront technology costs against long-term operational savings. The success metrics demonstrated by SAP suggest positive ROI potential, but individual organizations should conduct detailed cost-benefit analyses based on their specific support volume and operational requirements.

Future Predictions

SAP AI Support represents a significant shift toward AI-first customer support strategies that will likely become industry standard. Future developments will probably expand predictive capabilities beyond current anomaly detection to include more sophisticated pattern recognition and automated resolution systems. The integration of human-machine collaboration models suggests that future support systems will increasingly rely on AI augmentation rather than the replacement of human support staff. Organizations that adopt these proactive approaches early will likely gain competitive advantages in customer satisfaction and operational efficiency. The emphasis on in-app support and contextual assistance indicates that future customer support will become more seamlessly integrated into user workflows, reducing friction and improving user experience across all business applications.

Industry Trends

The SAP AI Support methods reflect broader industry trends toward proactive, data-driven customer service operations. The shift from reactive ticket-based support to predictive, preventative approaches represents a fundamental change in how organizations approach customer support strategy. The integration of multiple AI technologies, including machine learning, natural language processing, and predictive analytics, also demonstrates the maturation of AI applications in enterprise software. This trend toward comprehensive AI ecosystems rather than isolated AI features will likely accelerate across the enterprise software industry. The emphasis on cultural transformation alongside technological implementation reflects growing recognition that successful AI adoption requires organizational change management. This holistic approach to AI implementation will likely become standard practice for enterprise AI initiatives across all industries.

FAQs

SAP: Six AI-Driven Methods to Improve Customer Support Read More »