Rootstock: AIRSYS Selects it for Global Expansion and Efficiency

In a significant move to modernize its operations and support its rapid global expansion, AIRSYS Cooling Technologies has selected Rootstock ERP to replace its legacy ERP solution. This decision is particularly driven by the need for a scalable and integrated ERP system that can enhance manufacturing processes, supply chain visibility, and reporting capabilities. This blog will delve into the details of this news, provide an analyst’s perspective on the implications of this decision, and also conclude with the potential impact on AIRSYS’s future growth.

Company Background

AIRSYS Cooling Technologies, founded in 1995 by Yunshui Chen in China, is a global leader particularly in mission-critical cooling solutions. The company provides sustainable, advanced, and also data-driven cooling solutions. It is particularly designed for industries such as telecommunications, data centers, semiconductor manufacturing, and medical imaging. With customers in over 100 countries, AIRSYS has grown into a global enterprise. It now has its headquarters in the United States.

ERP Selection

AIRSYS has chosen Rootstock ERP to replace its legacy ERP solution. The need for a modern, and also scalable ERP solution to support its global supply chain and rapid expansion drove the decision. Rootstock ERP is built on the Salesforce platform, thus allowing seamless integration with Salesforce Sales Cloud and Propel Software. This creates an interconnected technology stack, enabling real-time visibility, automated processes, and also enhanced decision-making capabilities.

Integration With Salesforce

One of the key reasons for selecting Rootstock ERP is its integration with the Salesforce platform. AIRSYS has been using Salesforce Sales Cloud for at least five years and wanted an ERP solution that would work seamlessly with this platform. Rootstock ERP, being built on the same platform, also ensures that customer data is already hosted on the same platform, eliminating the need for complex integrations.

Global Deployement

The deployment of Rootstock ERP will cover AIRSYS’s operations in the United States, China, and Europe. The implementation will begin with the manufacturing division, scheduled to go live in Q1 2025, followed by the U.S. operations. This phased approach ensures a smooth transition and minimizes disruptions to ongoing operations.

Consulting Partner

AIRSYS has partnered with Nagarro, a consulting firm, to implement Rootstock ERP. Nagarro will leverage its global and local teams to ensure a seamless implementation that supports AIRSYS’s innovation and global supply chain alignment. This collaboration showcases Nagarro’s expertise in delivering sophisticated ERP and digital transformation projects across geographies.

Strategic Goals

The selection of Rootstock ERP is part of AIRSYS’s strategic plan to modernize and consolidate its enterprise solutions, enabling the company to scale for exponential growth over the next three to five years. The company operates in rapidly evolving industries, including AI semiconductors and medical imaging, and needs a modern, scalable ERP solution to support its global supply chain.

New Facility

AIRSYS is expanding its business with a new manufacturing and distribution center in Greer, South Carolina, which will serve as the company’s global headquarters. This new facility will support the company’s growth and enhance its manufacturing and distribution capabilities.

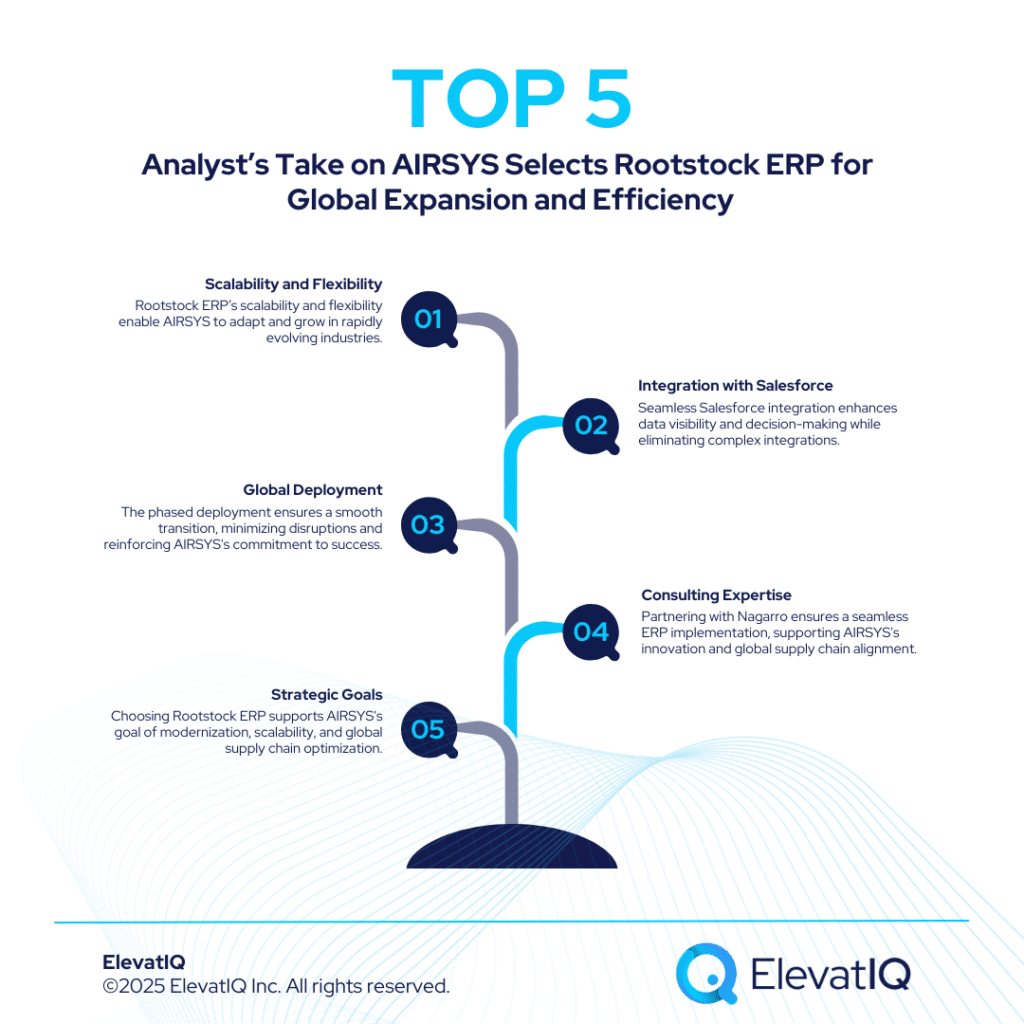

Analyst’s Take

From an analyst’s perspective, AIRSYS’s decision to select Rootstock ERP is a strategic move that aligns with the company’s growth objectives and industry trends. Here are some key points to consider:

- Scalability and Flexibility: Rootstock ERP’s scalability and flexibility make it an ideal choice for AIRSYS, which operates in rapidly evolving industries. The ERP solution can adapt to changing business needs and support the company’s growth over the next few years.

- Integration with Salesforce: The seamless integration with Salesforce is a significant advantage, as it ensures that customer data is already hosted on the same platform. This eliminates the need for complex integrations and enhances data visibility and decision-making capabilities.

- Global Deployment: The phased deployment approach ensures a smooth transition and minimizes disruptions to ongoing operations. This strategic approach demonstrates AIRSYS’s commitment to a successful ERP implementation.

- Consulting Expertise: Partnering with Nagarro, a consulting firm with expertise in delivering sophisticated ERP and digital transformation projects, ensures a seamless implementation that supports AIRSYS’s innovation and global supply chain alignment.

- Strategic Goals: The selection of Rootstock ERP aligns with AIRSYS’s strategic goals of modernizing and consolidating its enterprise solutions. This move will enable the company to scale for exponential growth and support its global supply chain.

- Industry Trends: AIRSYS operates in industries that are rapidly evolving, such as AI semiconductors and medical imaging. The adoption of a modern, scalable ERP solution positions the company to stay ahead of industry trends and meet the demands of its customers.

Key Industry Trends

The AIRSYS and Rootstock ERP collaboration highlights several key industry trends that are shaping the future of ERP solutions.

- Cloud Integration: The integration of ERP solutions with cloud platforms like Salesforce is becoming increasingly popular. This trend is driven by the need for real-time data visibility, seamless integration, and enhanced decision-making capabilities.

- Focus on Scalability: Companies are prioritizing scalable ERP solutions that can support their growth and adapt to changing business needs. This is particularly important for industries that are rapidly evolving, such as AI semiconductors and medical imaging.

- Global Deployment: The trend of deploying ERP solutions across global operations is evident. Companies are looking for ERP systems that can support their international supply chains and streamline operations across multiple regions.

- Partnerships with Consulting Firms: Partnering with consulting firms for ERP implementation is a growing trend, as these firms bring expertise and resources to ensure successful deployments.

- Focus on Innovation: Businesses are prioritizing ERP solutions that support innovation and digital transformation to stay competitive in their industries.

Is It Good For All?

The selection of Rootstock ERP addresses AIRSYS’s need for a modern, scalable ERP solution that supports their global supply chain and rapid expansion. The integration with Salesforce ensures a seamless transition and enhances their operational efficiency.

For Rootstock, the partnership with AIRSYS showcases their ERP solution’s capabilities and strengthens their reputation in the market. Nagarro benefits from demonstrating their expertise in delivering sophisticated ERP implementations, enhancing their credibility and attracting future clients.

What ERP Buyers like AIRSYS must know/might not know?

While the decision to adopt Rootstock ERP brings numerous benefits, there are several potential concerns that AIRSYS must address to ensure a smooth and successful implementation.

- Implementation Challenges: Deploying a new ERP system across global operations can be complex and may face challenges such as data migration, user training, and system integration. AIRSYS must have a robust implementation plan and support from experienced partners like Nagarro.

- Change Management: Adopting a new ERP system requires significant changes in business processes and workflows. AIRSYS must ensure that employees are adequately trained and supported during the transition to minimize disruptions and maximize the benefits of the new system.

- Data Security: With the integration of cloud-based ERP solutions, data security becomes a critical concern. AIRSYS must implement strong security measures to protect sensitive business data and also ensure compliance with data protection regulations.

FAQs

Rootstock: AIRSYS Selects it for Global Expansion and Efficiency Read More »