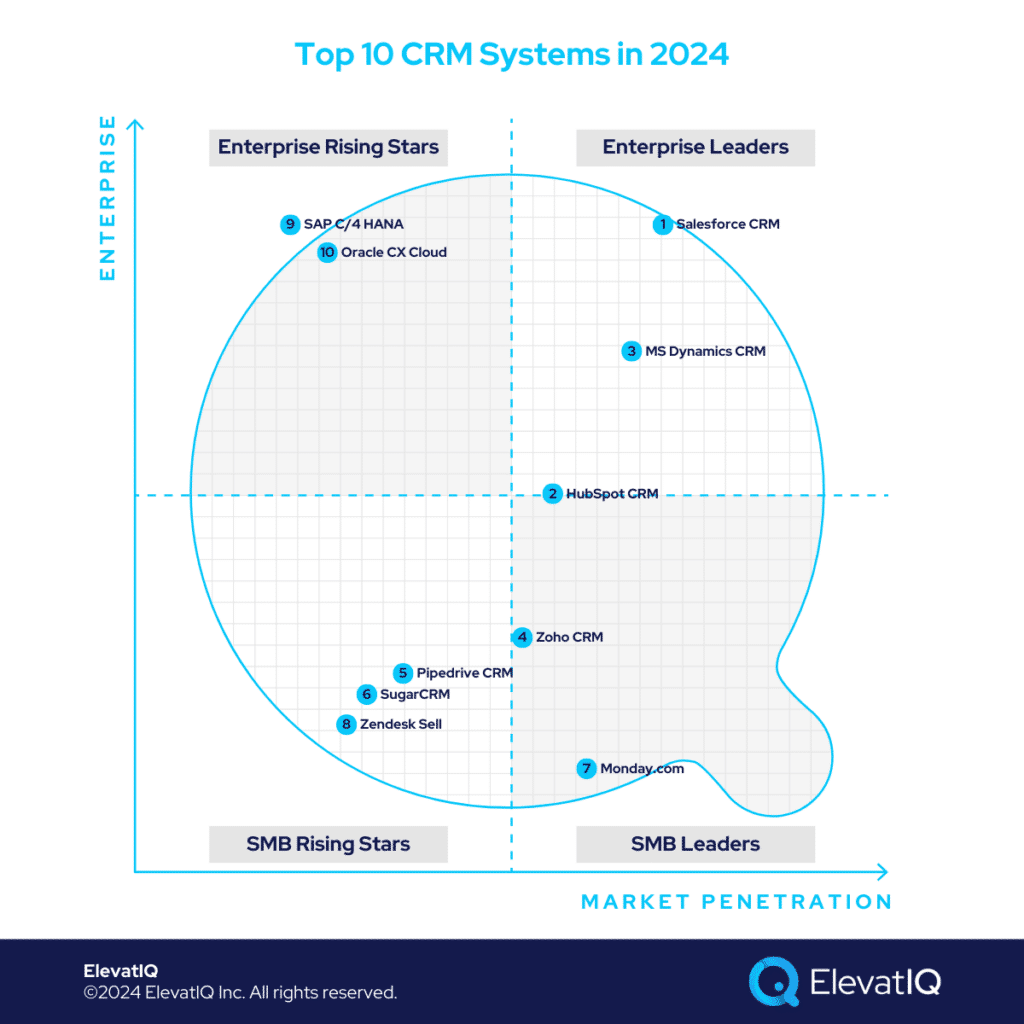

Top 10 CRM Systems in 2025

Sales and marketing teams have traditionally relied on ad-hoc tools like spreadsheets or standalone software to manage their workflows. However, the growing complexity of modern sales and marketing operations now requires more advanced, integrated systems. CRM workflows are not only more intricate but also vary widely across industries and business models. To deliver a seamless and intuitive user experience, your CRM must be tailored to the specific data structures relevant to your sector. The true value of a CRM lies in its ability to consolidate high-quality data from multiple sources and make it easily accessible to sales teams—something that becomes difficult when the CRM’s data model doesn’t align with your customer hierarchies or transactional frameworks.

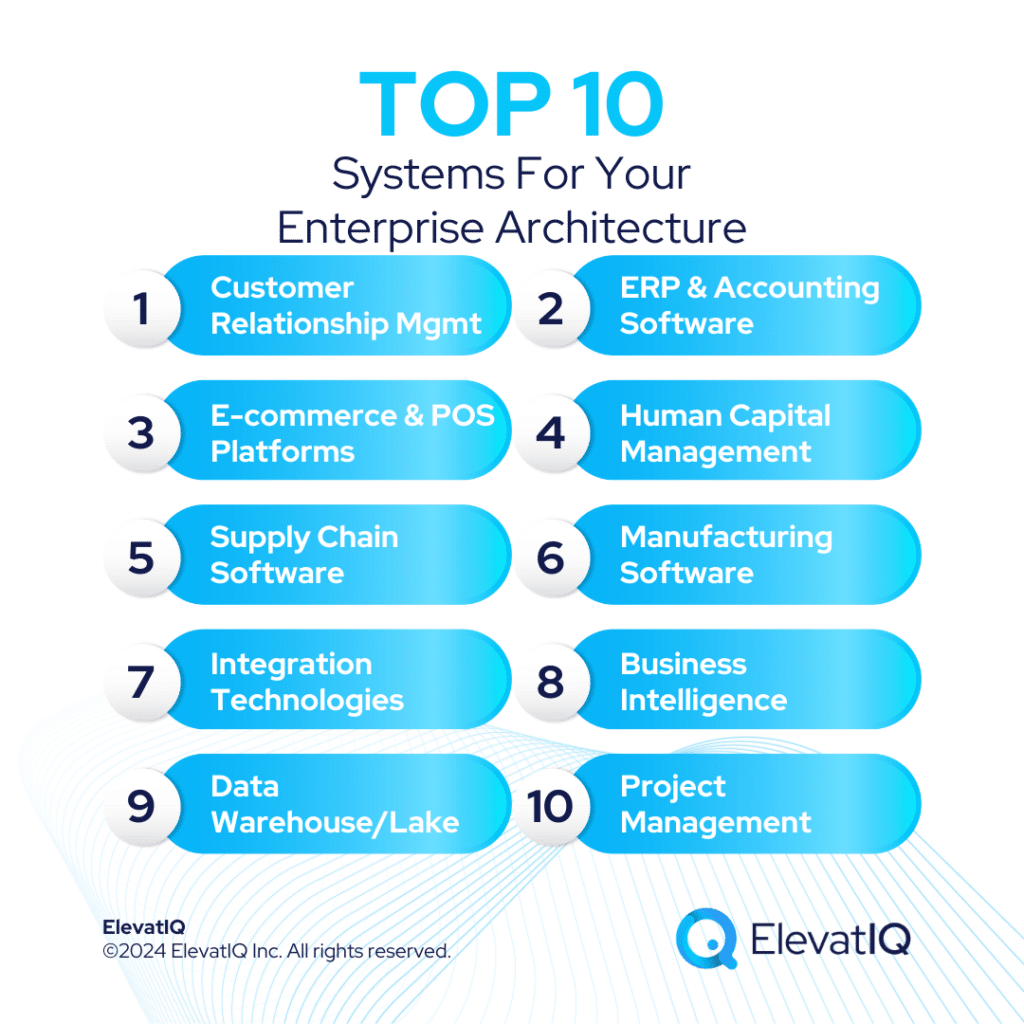

Additionally, the lines between CRM, CMS, call center platforms, e-commerce solutions, and ERP systems are increasingly blurred. Today’s CRMs often incorporate features once exclusive to ERP or e-commerce platforms, and overlap with CMS systems designed to handle industry-specific, customer-centric workflows, especially for organizations focused on tracking digital engagements. This convergence underscores the importance of clearly defining the roles and responsibilities of each system. Without a well-structured strategy, organizations risk poor user adoption and compromised data integrity.

CRMs built primarily for marketing automation may lack the robust data models required for downstream sales workflows, while those focused on sales processes might not support seamless integration with digital channels or content-driven engagement. Although some CRM platforms claim cross-industry flexibility, very few truly meet the unique demands of every business model. As a result, selecting the right CRM requires a deep understanding of your organization’s architecture and a careful evaluation of your options.

10. Oracle CX Cloud

Oracle Cloud CX stands out for its comprehensive suite of CRM tools, covering everything from sales and service to marketing, content, and advertising management. Built with large B2C enterprises in mind—particularly those in communications, media, and financial services—it offers powerful features like ad spend tracking, centralized asset management, and deep CPQ integrations tailored to complex subscription-based models. However, the discontinuation of Oracle Commerce signals a strategic shift that may limit the platform’s broader industry appeal. While it remains highly customizable, this flexibility often comes with a steep learning curve and the need for significant IT resources.

For enterprises with mature IT teams and a need for complex workflows, Oracle Cloud CX continues to deliver a solid CRM foundation. Yet, questions remain about its long-term direction and alignment with evolving market needs. Is Oracle committed to advancing CX Cloud amid its pivot toward healthcare and analytics? Can it keep up with competitors offering more agile, low-code platforms? And how sustainable is its customization-heavy model for fast-moving industries? Find out where Oracle Cloud CX stands among the top solutions this year—download the Top CRM Systems in 2025 report now.

9. SAP C/4 HANA

SAP C/4HANA, as part of the broader S/4HANA ecosystem, delivers a robust and deeply integrated CRM platform tailored for large enterprises with complex regulatory and operational needs. Its strengths lie in its seamless integration with other SAP products, making it especially valuable in highly regulated industries like utilities, finance, and the public sector. With advanced capabilities in identity management, consent tracking, and cross-channel personalization, SAP C/4HANA is particularly effective in supporting compliance-heavy environments. Its alignment with the Hybris product suite and SAP Configurator also makes it a strong fit for product-centric businesses requiring enterprise-grade quoting, territory, and compensation management tools.

Despite its deep functionality, SAP C/4HANA’s steep learning curve and complex customization requirements may deter mid-sized companies or those lacking strong IT resources. The platform’s limited flexibility and less intuitive marketing automation tools also raise questions about its adaptability to fast-changing sales and marketing landscapes. Is SAP doing enough to modernize its CRM experience for business users? Can it remain competitive in a market increasingly driven by low-code platforms and user-centric design? For a full comparison and insights into how SAP C/4HANA ranks among this year’s top CRM systems, download the Top CRM Systems in 2025 report now.

8. Zendesk Sell

Zendesk Sell is a lightweight CRM solution designed with simplicity in mind, making it an attractive option for small businesses already using Zendesk for customer support. Its origins in the Base CRM acquisition laid the foundation for a platform that supports essential sales functions like lead and opportunity tracking, calling, and emailing—features that startups with under 15 employees will find intuitive and accessible. The seamless transition for existing Zendesk users adds to its appeal, providing a familiar interface and easy integration for basic workflows.

However, Zendesk Sell’s streamlined approach comes with limitations. Larger organizations or those with more complex sales operations may quickly outgrow its capabilities. The lack of tight integration with Zendesk Support, weak marketing automation, and limited advanced features such as revenue planning and robust reporting raise important questions. Can Zendesk evolve to meet the growing demands of scaling businesses? How does it stack up against other entry-level CRMs that offer better integration and flexibility? To explore how Zendesk Sell compares to the leading CRM platforms this year, download the Top CRM Systems in 2025 report now.

7. Monday.Com

Monday.com has gained popularity among small businesses and teams already using it for project management, especially those looking to build custom CRM workflows tailored to unique operational needs. Its appeal lies in its flexibility—users can quickly set up automations, approval flows, and integrations without deep technical expertise. This makes it particularly useful for industries like real estate and non-profits, where standard CRM solutions may fall short. However, Monday.com still functions primarily as a project management platform, meaning teams must build out core CRM capabilities from scratch, which can increase complexity over time.

For organizations adopting Monday.com as a CRM, maintaining governance becomes crucial. Without proper oversight, teams may over-engineer workflows, resulting in inefficiencies, technical debt, and unpredictable costs. Additionally, the platform’s lack of built-in data integrity controls and advanced CRM features can be problematic as businesses scale. Is Monday.com truly sustainable as a long-term CRM solution for growing companies? Can it compete with out-of-the-box platforms that offer mature CRM functionality from day one? Download the Top CRM Systems in 2025 report now to see how Monday.com compares to other leading solutions.

6. SugarCRM

SugarCRM is a data-driven, sales-focused CRM platform designed to meet the needs of industrial businesses requiring strong ERP integration and complex quoting workflows. Its industry-specific CPQ capabilities make it especially effective for organizations dealing with product configurations, bills of materials, and subscription-based offerings. With built-in tools for ad creation and collaboration between sales and project management teams, SugarCRM streamlines operations for cost-sensitive companies—particularly those with in-house development resources and a preference for on-premises deployment through its community edition.

That said, SugarCRM may not be the best fit for organizations with fast-evolving or highly varied business models. The platform’s clunky interface, limited reporting, and hidden operational costs in the community edition could become barriers to growth. Additionally, while updates have been made, they haven’t significantly changed its position in this year’s rankings. Is SugarCRM evolving quickly enough to stay competitive in the modern CRM landscape? How much internal investment does it truly take to make the most of its features? Download the Top CRM Systems in 2025 report now to see how SugarCRM compares against today’s leading platforms.

5. Pipedrive CRM

Pipedrive CRM is a budget-friendly, user-friendly solution crafted for small businesses that need efficient sales tools without the complexity of enterprise-grade platforms. Its built-in CPQ functionality and document-centric workflows make it ideal for service-based or digital product companies, such as those selling online courses or subscriptions. Notably, Pipedrive offers strong support for the Asian market, setting it apart from many competitors by addressing international taxation and regulatory requirements—an often overlooked need in CPQ-enabled CRMs.

While recent enhancements, such as native workflow automation and improved data reporting via strategic acquisitions, improve usability for businesses with limited IT resources, Pipedrive still lacks the customization depth and scalability found in platforms like HubSpot. Is Pipedrive evolving quickly enough to stay competitive as small businesses scale and demand more complex features? Can it truly support B2B firms with layered organizational structures and larger sales teams? To see how Pipedrive stacks up against the competition, download the Top CRM Systems in 2025 report now.

4. HubSpot CRM

HubSpot CRM is a go-to platform for smaller, content-driven B2B companies that want a streamlined, user-friendly solution encompassing sales, service, CMS, and marketing automation. It offers a fast setup, intuitive interface, and robust tools for omnichannel tracking and marketing automation. Its strength lies in its ability to unify digital marketing and sales operations—particularly valuable for teams focused on lead generation and nurturing. The recent integration of Clearbit adds significant value by enriching CRM records with actionable data, allowing teams to personalize outreach and improve segmentation without leaving the platform.

However, HubSpot’s flexibility comes with trade-offs. As companies scale and face more complex sales structures or compliance-heavy operations, they may encounter limitations in HubSpot’s lean data model and lack of support for advanced workflows such as CPQ, territory management, or field service. Is your business ready to work around these limitations with custom development, or would a more configurable platform be a better fit? Are you prepared for how HubSpot’s evolving pricing tiers might impact your long-term budget? Download the Top CRM Software in 2025 report now to explore how HubSpot stacks up against the competition.

3. Zoho CRM

Zoho CRM has matured from a small business tool into a comprehensive platform capable of supporting large-scale service organizations. Its standout feature is the breadth of its application suite—offering everything from CRM to custom app development under a single flat-rate model. This approach makes it especially appealing to service-centric companies that don’t require deep financial integrations, as they can build and automate key business processes entirely within Zoho. The inclusion of Zoho Creator provides even more flexibility, enabling technical teams to rapidly deploy tailored applications and workflows without relying heavily on third-party tools.

That said, Zoho CRM does face limitations, particularly for multinational enterprises that require seamless global data handling or complex territory-based sales structures. Does your organization operate across multiple regions with strict data governance needs? Are you willing to invest in custom development to overcome Zoho’s narrower integration capabilities beyond its ecosystem? Download the Top CRM Software in 2025 report now to see whether Zoho CRM is the right fit—or if another platform offers a better balance of flexibility, scalability, and compliance readiness for your business.

2. Microsoft Dynamics CRM

Microsoft Dynamics 365 CRM continues to be a top choice for enterprises requiring a high degree of customization and scalability. Its strength lies in the ability to build robust, industry-specific workflows across sales, marketing, and service functions, supported by a deeply integrated Microsoft ecosystem. With advanced features like complex business object support and territory management, it’s well-suited for regulated industries and global organizations. However, deploying and maintaining multiple Microsoft apps within the platform demands architectural discipline, especially when these apps override core CRM objects and limit flexibility at the platform level.

Organizations with evolving CRM requirements must also weigh the trade-offs between customization freedom and long-term maintainability. Will your internal team be able to manage these complexities, or will you become overly dependent on third-party developers? Can your IT team handle the tighter object dependencies and integration constraints across apps and modules? Download the Top CRM Software in 2025 report now to see how Microsoft Dynamics 365 compares to other platforms.

1. Salesforce CRM

Salesforce remains the gold standard for enterprises seeking a deeply customizable and future-ready CRM platform. Its extensive data model supports a wide array of industries and business models, while its rich ecosystem offers pre-built solutions that simplify implementation and integration. Salesforce’s leadership in AI-driven automation and agentic capabilities sets it apart, empowering organizations to harness advanced analytics and predictive workflows. This robust product portfolio, combined with strong specialized capabilities—especially in telecom, media, and medical devices—helps Salesforce maintain its position as the top CRM platform in this year’s rankings.

However, the platform’s power comes with complexity and cost. Are you prepared to manage Salesforce’s sometimes challenging customization process and potentially steep learning curve? How will the investment in licensing and implementation balance against your organization’s CRM needs and budget? For sectors requiring close ERP collaboration, is Salesforce the best fit, or might another platform serve you better? Find answers to these questions and more by downloading the Top CRM Software in 2025 report now, and explore how Salesforce stacks up against the competition.

Final Words

As customer experience becomes increasingly critical to winning business, sales and marketing teams need more advanced CRM capabilities than ever before. A robust CRM system is vital for maintaining a unified view of customers throughout their entire journey, whether in pre-sales or post-sales stages. Without a centralized platform to manage workflows and interactions, staying competitive in today’s market can be a major challenge.

The CRM you choose has a direct impact on your overall enterprise architecture. That’s why it’s crucial to select a CRM that aligns well with your business model and supports your digital transformation goals. If you’re in the process of evaluating CRM solutions, be sure to weigh the factors mentioned here alongside insights from independent CRM experts. This guide is designed to help you narrow down the best options tailored to your organization’s needs.

Download the Full Report