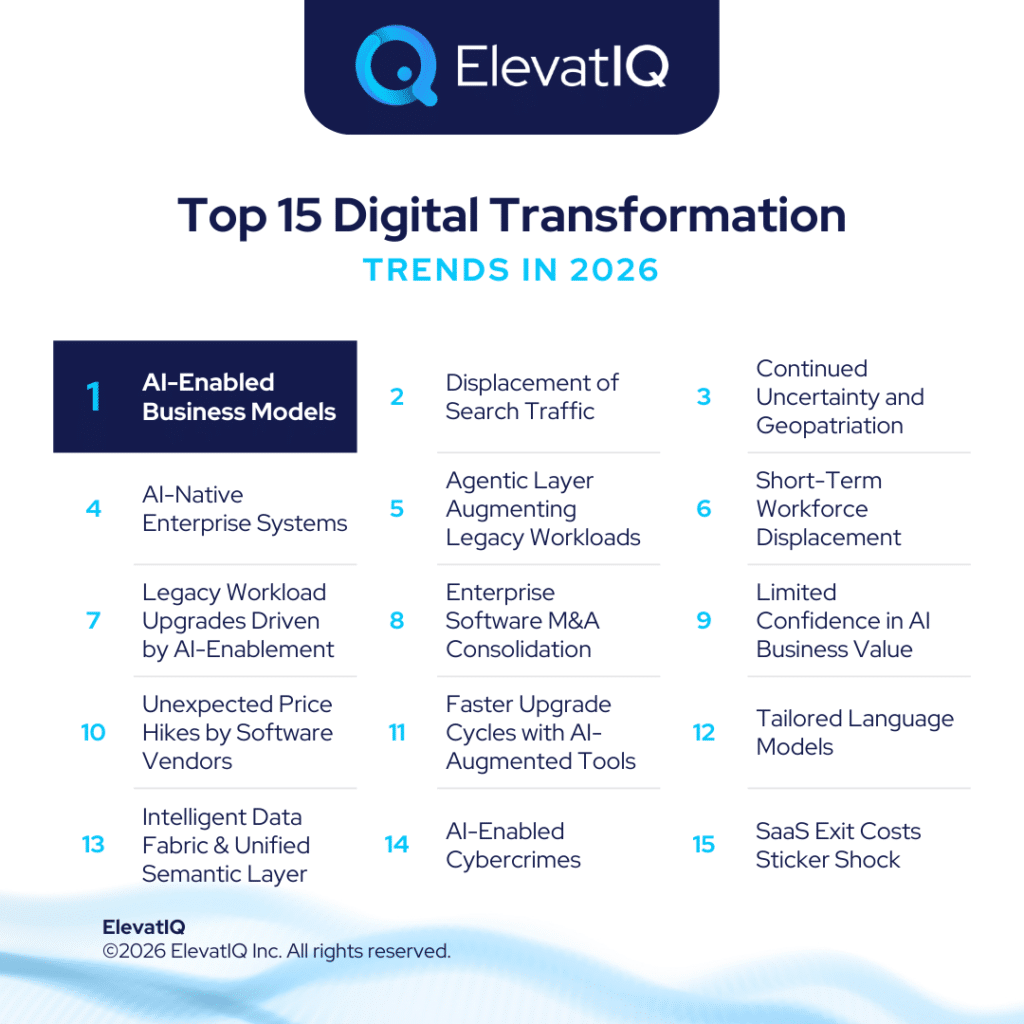

Top 15 Digital Transformation Trends in 2026

Digital transformation trends entering 2026 reflect continued economic caution and structural change. Organizations remain disciplined with capital allocation. As a result, expect an accelerating shift from CapEx-heavy investments to OpEx-based models. This transition is expected to drive stronger demand for SaaS platforms and lower upfront costs. At the same time, boards will prioritize near-term productivity gains and deprioritize long-horizon initiatives with uncertain ROI. While AI-driven efficiency will support long-term growth, the labor market is expected to stay soft through 2026, marking the peak of the displacement cycle. A meaningful rebound may emerge in 2027, assuming tariff uncertainty eases and macroeconomic confidence improves.

Despite slower GDP growth, enterprise software deal activity is likely to strengthen. The primary driver would be demand for AI-native capabilities. Incumbent vendors will accelerate acquisitions of emerging AI-native firms to secure early market positions. In parallel, private equity investors will increase capital deployment into AI-centric platforms. Over time, this consolidation could produce the next generation of large-scale enterprise software leaders, reshaping competition across these categories. As AI-native categories intensify, AI-enabled companies will be cheaper, moving faster, and making higher-quality decisions. Consequently, organizations of all sizes must reassess their operating models.

Meanwhile, geopolitical realignment and regulatory pressure are adding complexity to enterprise technology decisions. Many regions are favoring local vendors, sovereign cloud solutions, and compliant architectures. These shifts are influencing buying behavior and altering revenue profiles for global software providers. As volatility similar to 2025 continues, organizations must closely monitor vendor roadmaps, evaluate software supply chain and concentration risk, and prepare for potential forced upgrades. Therefore, a phased transformation strategy that capitalizes on these emerging trends remains the most effective path forward.

1. AI-enabled Business Models

AI-enabled business models will gain a sustainable competitive advantage over traditional models. They allow companies to deliver products and services faster, at lower cost, and with higher quality. As a result, incumbents that rely on legacy processes will face increasing disruption.

Moreover, as AI-centric processes become more pervasive, productivity gains will compound across the enterprise. Automation will reduce manual effort, shorten cycle times, and improve decision accuracy. In turn, organizations will see measurable improvements in both output quality and operational efficiency.

Over time, these advantages will extend across most product and service categories. AI will no longer act as a differentiator at the margins. Instead, it will become a foundational capability that reshapes how businesses operate, compete, and scale.

2. Displacement of Search Traffic Enabling Newer Business Models

Organic search traffic will continue to decline as AI models displace traditional search engines. Increasingly, AI assistants and LLMs will intercept user intent before it reaches websites. As a result, fewer customers will interact directly with classic search-driven web experiences.

At the same time, most web interfaces will evolve into fulfillment layers rather than discovery channels. AI systems will manage the majority of customer interactions, from research and recommendations to transactions and support. Consequently, organizations must rethink their digital marketing strategies and reduce dependence on search-driven traffic models.

This shift will also force changes beyond marketing. Companies will need to redesign process architectures and customer interaction models to align with AI-mediated engagement. Over time, these changes will materially reshape digital transformation strategies and redefine how value is created in an AI-driven economy.

3. Continued Uncertainty and Geopatriation

Macroeconomic headwinds and geopolitical uncertainty will persist into next year. Global superpowers continue to prioritize protective economic and security interests. As a result, policy-driven volatility will remain a defining constraint for enterprise investment decisions.

At the same time, these forces are accelerating the geopatriation of data and system workloads. Governments and regulators are pushing organizations toward domestic infrastructure, sovereign cloud platforms, and local technology vendors. Consequently, demand for regionally compliant solutions is rising across industries.

Over time, this shift may materially reshape market share across the technology landscape. Global providers could face slower growth in certain regions, while domestic and regional vendors gain ground. For enterprise leaders, this trend reinforces the need to reassess vendor strategy, data residency risk, and long-term technology alignment.

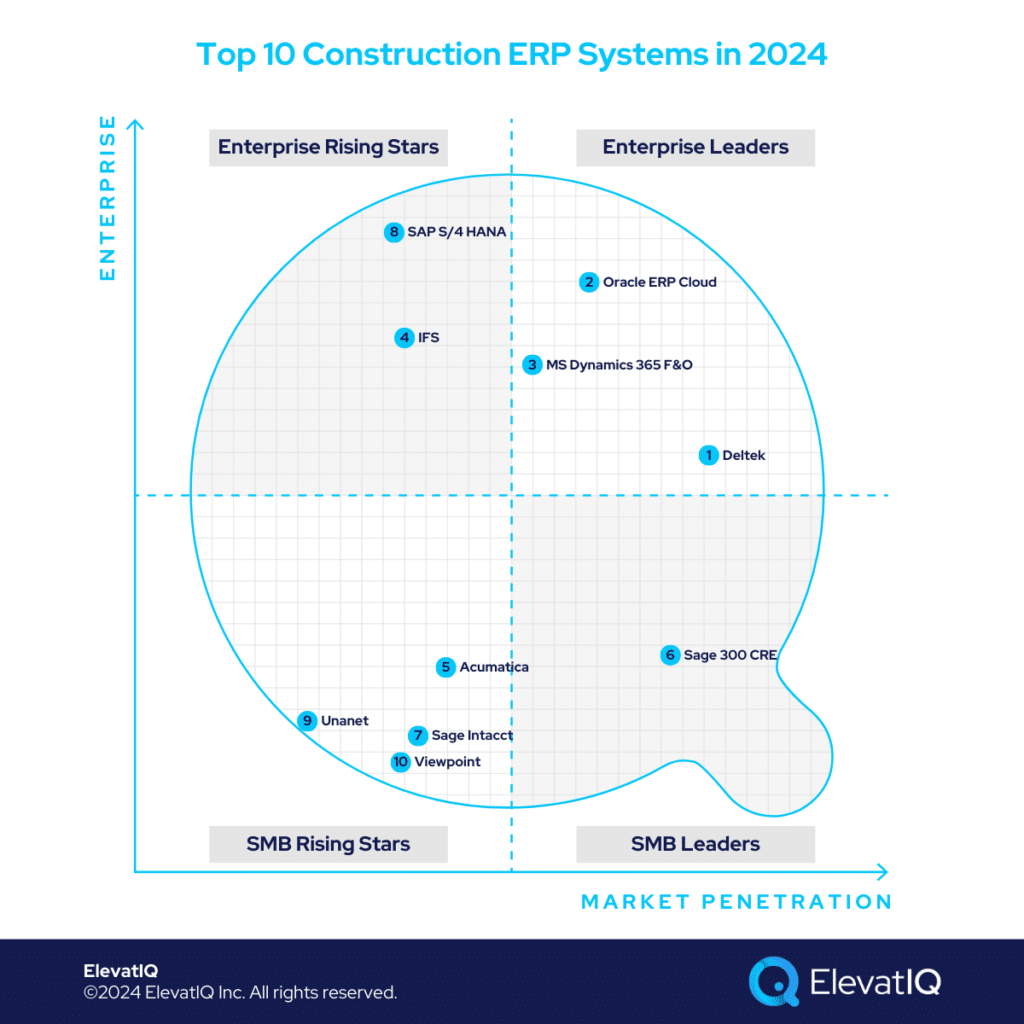

4. AI-Native Enterprise Systems

Accelerated development cycles and AI-driven interaction models are reshaping enterprise software. As a result, most software categories will see the rise of AI-native vendors with architectures that differ fundamentally from traditional systems. These platforms are built for automation, learning, and continuous adaptation from the start.

At the same time, long-standing constraints tied to legacy ERP platforms are beginning to fade. Limitations such as rigid workflows and restricted customization no longer apply in the same way. AI-native architectures allow systems to adapt dynamically to business requirements rather than forcing process conformity.

Over time, these shifts will reset architectural expectations across the enterprise. Users will interact with systems through intelligent agents, not static screens. In turn, AI-native technologies will redefine how work gets done and how value is created in modern enterprise environments.

5. Agentic Layer Augmenting Human Workers and Legacy Workloads

The agentic layer built on top of legacy workloads can unlock continuous improvement. It addresses long-standing process gaps and data inefficiencies that most organizations struggle to fix. As a result, companies can drive measurable gains without replacing core systems.

At the same time, this layer augments human workers rather than displacing them. It reduces manual effort and decision friction without requiring extensive reskilling. Consequently, organizations can scale AI-driven capabilities faster and with less operational disruption.

As agentic workloads mature, expectations for enterprise systems will rise. These capabilities will deliver outcomes similar to a full system overhaul. However, they avoid the cost, risk, and complexity of traditional ERP implementation cycles.

6. Workforce Displacement and Short-Term Labor Market Concerns Driven by AI Efficiencies

AI-driven efficiencies will enable more productive business models. At the same time, they will reduce or eliminate many elementary roles built on commoditized skills. As a result, workforce displacement will continue across multiple industries.

Consequently, unemployment rates may rise and place additional pressure on the labor market. This dynamic could contribute to a prolonged economic slowdown. In turn, organizations will face tighter cost controls and increased scrutiny over hiring and operating expenses.

These conditions will directly affect digital transformation budgets. Many organizations will limit long-term investments and prioritize near-term efficiency initiatives instead. As a result, transformation strategies will increasingly focus on incremental gains with faster and more predictable returns.

7. Legacy Workload Upgrades Driven by AI-enablement

Most enterprise software vendors are unlikely to invest heavily in AI for legacy or on-premise workloads. These environments limit scalability, learning, and continuous improvement. As a result, innovation will concentrate on cloud-based and AI-native platforms.

Meanwhile, AI-native experiences are becoming mainstream across enterprise software categories. Customers now expect automation, intelligent workflows, and real-time decision support as standard capabilities. Consequently, organizations will face growing pressure to modernize aging systems.

Over time, this pressure will accelerate legacy modernization programs. Companies will need to evolve traditional business models into AI-enabled ones to remain competitive. In doing so, they can align technology architecture with future operating and growth requirements.

8. M&A Consolidation and Shifting Enterprise Software Categories

M&A activity driven by the pursuit of AI capabilities will continue to reshape enterprise software markets. Vendors are using acquisitions to gain faster access to AI-native technology and talent. As a result, enterprise software categories and architectural models are evolving rapidly.

At the same time, legacy ERP vendors are accelerating investment in AI orchestration and agentic layers. These capabilities improve user experience through automation, recommendations, and intelligent workflows. Consequently, vendors can extend the life of existing platforms while signaling innovation to the market.

In parallel, vendors are investing in implementation tools and deployment accelerators. These technologies aim to shorten rollout cycles and improve user adoption. Over time, this focus on speed and usability will become a key differentiator in enterprise software selection decisions.

9. Limited Confidence in AI Business Value Because of Premature AI Trials

AI is often portrayed as a modern-day gold rush. As a result, many organizations rush into AI initiatives without sufficient analysis. This approach increases the risk of failed projects, lost confidence in AI, and reduced willingness to invest further.

In contrast, disciplined organizations take a more structured path. They assess business value drivers and perform detailed cost–benefit analyses before committing capital. At the same time, they invest in data quality, process clarity, and architectural readiness.

Consequently, these organizations are far better positioned to realize measurable AI value. They build trust in AI outcomes and sustain long-term investment momentum. Over time, this disciplined approach separates durable AI success from short-lived experimentation.

10. Unexpected Price Hikes by Software Vendors to Meet Revenue Targets

Macroeconomic pressure and aggressive vendor claims will continue to influence enterprise software pricing. Vendors are positioning agentic and AI capabilities as major revenue drivers. As a result, buyers will face price increases and unexpected changes in pricing variables.

At the same time, AI-driven and consumption-based pricing models are becoming more common. These models tie costs to usage, automation volume, and data intensity. Consequently, total cost of ownership will become harder to estimate and control.

Moreover, increasing architectural complexity will further complicate cost forecasting. Organizations will struggle to predict long-term spend across AI, data, and platform layers. Therefore, finance and IT leaders will strengthen cost governance to manage risk and avoid budget overruns.

11. Faster Upgrade Cycles with AI-augmented Tools and Technologies

AI-native technologies are introducing new implementation and adoption patterns. These shifts are giving rise to entirely new categories of enterprise tools. As a result, traditional implementation models are starting to break down.

Specifically, AI-native tools now include requirements management platforms, automated testing solutions, and autonomous configuration agents. These tools reduce manual effort and accelerate deployment timelines. Consequently, organizations can improve accuracy while lowering implementation risk.

Over time, this evolution will fundamentally reshape enterprise software delivery. Systems will be implemented faster, validated more continuously, and adopted more easily. In turn, AI-native tooling will redefine how organizations realize value from enterprise software investments.

12. Tailored Language Models

The next generation of language models will be tailored to specific industries and use cases. These models will deliver more accurate, context-aware intelligence. As a result, they will augment the capabilities of a wide range of products and services.

At the same time, personalized language models will enable new user experiences. Intelligent, conversational interfaces will replace many traditional workflows. Consequently, organizations will unlock new digital business models and monetization paths.

Over time, evolving interaction models will create significant revenue opportunities. They will also drive meaningful changes in enterprise architecture. To keep pace, organizations will redesign platforms to support orchestration, personalization, and AI-native engagement.

13. Intelligent Data Fabric & Unified Semantic Layer

Overhauling core operational and transactional systems remains difficult and risky. At the same time, modern data layers are becoming more action-oriented and transaction-aware. As a result, the boundary between data platforms and transactional systems will continue to blur.

Meanwhile, advanced data fabrics can now support real-time decisions, orchestration, and automated actions. They increasingly embed logic that once lived exclusively inside ERP and transactional applications. Consequently, organizations can drive change without disrupting core operations.

Therefore, organizations facing significant change-management constraints may avoid full system replacements. Instead, they will embed business logic directly within the data fabric. Over time, this approach will reshape enterprise architecture and reduce dependence on legacy transactional platforms.

14. AI-enabled Cybercrimes

Data silos are expanding as AI workloads grow across the enterprise. At the same time, security layers are becoming more fragmented. Meanwhile, cybercriminals are using AI-enabled attack tools to scale and automate threats.

As a result, cybercrime is expected to grow far faster than in the past. Attack frequency, sophistication, and impact will all increase. Consequently, organizations will face higher operational risk and greater exposure.

These threats will directly affect brand trust and market perception. Customers will hesitate to engage with companies they view as insecure or poorly protected. Therefore, cybersecurity resilience will become a critical differentiator in the AI-driven economy.

15. Significant Sticker Shock Associated with SaaS Exit Costs

Cloud adoption has accelerated rapidly across industries. For many organizations, cloud platforms are now the default choice for new initiatives. However, business teams often drive cloud procurement with limited IT oversight.

As a result, many cloud and SaaS implementations lack the rigor applied to traditional on-premise systems. Most SaaS platforms offer limited data portability and weak exit options. Unlike legacy systems, they rarely include mature migration pathways.

Consequently, organizations attempting to exit or switch platforms may face significant sticker shock. Data extraction costs can be high, and migration choices may be limited. Therefore, cloud exit strategy and data portability will become core considerations in modern digital transformation planning.

Final Words

Heading into 2026, digital transformation will be shaped by caution, AI acceleration, and structural change. Organizations that succeed will balance near-term efficiency with long-term readiness, while navigating geopolitical risk, pricing volatility, and workforce disruption.

A phased, value-driven approach—grounded in AI readiness, architectural flexibility, and disciplined investment—will separate resilient leaders from those reacting too late to permanent shifts in the enterprise landscape.

Download the Full Report

Top 15 Digital Transformation Trends in 2026 Read More »