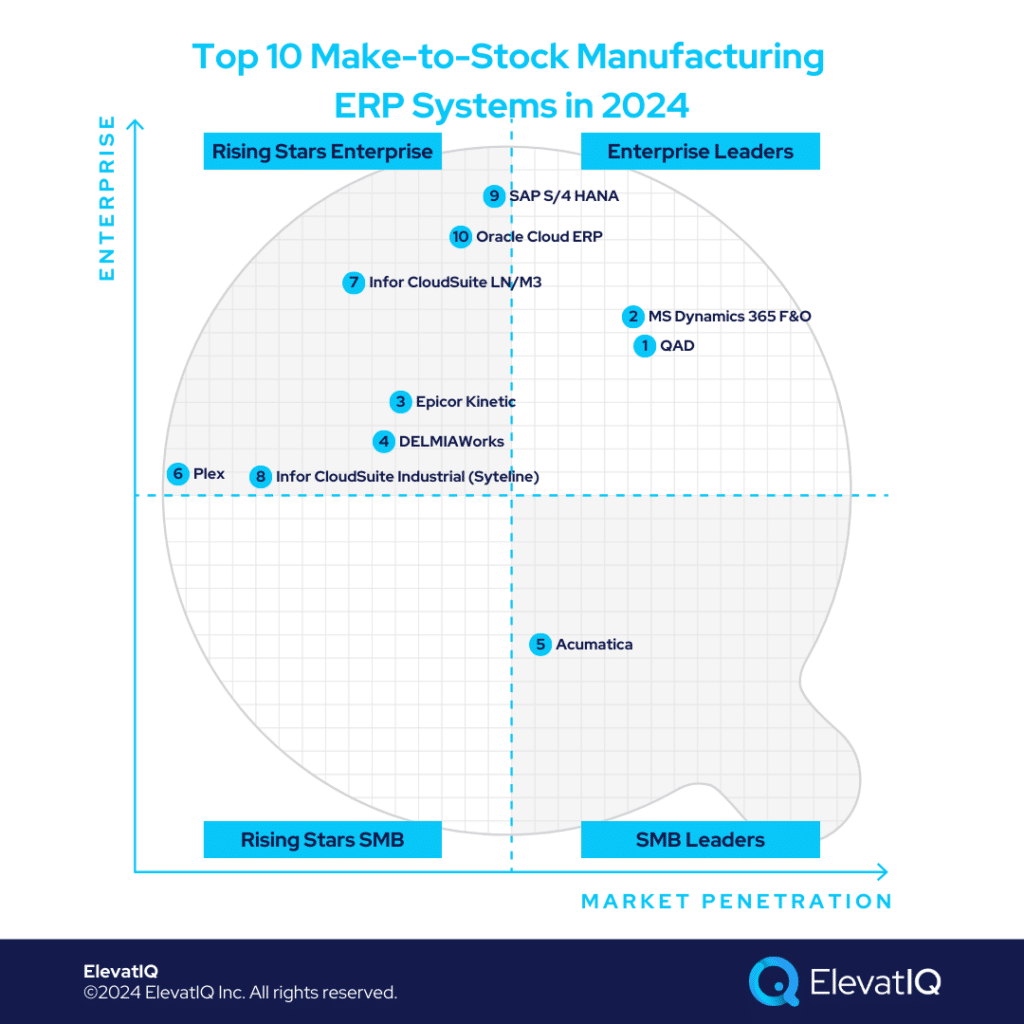

Top 10 Make-to-Stock Manufacturing ERP Systems In 2024

Make-to-stock Companies: Contrary to make-to-order enterprises, make-to-stock companies are often consumer-oriented, necessitating robust supply chain planning and potentially eCommerce capabilities. These companies span various sectors, encompassing both discrete and process manufacturing methodologies. Product portfolios may feature consumer staples like food items and household goods, as well as consumer electronics or automobiles. Material inputs can vary widely, particularly from plastics and chemicals to steel and organic ingredients. As long as products are stockpiled for future sale, they fall under the umbrella of make-to-stock operations.

Make-to-stock Manufacturing Business Processes: While many make-to-stock companies may incorporate elements of make-to-order processes, their product offerings typically lack the complexity found in engineer-to-order or project manufacturing setups. Given their retail or eCommerce-centric operations, robust supply chain planning is crucial, influencing the required system architecture and ERP functionalities. Despite simpler manufacturing processes, labor requirements may not be as extensive. Thus, resulting in less complex bills of materials primarily centered on ingredients.

Make-to-stock Manufacturing ERP Needs. The ERP requirements for make-to-stock operations can be influenced by various external systems like POS, S&OP, merchandising, planning, and eCommerce, depending on the system architecture. Given the consumer-centric nature of their products, make-to-stock businesses often rely heavily on logistics processes involving WMS and TMS, distinguishing them significantly from make-to-stock or engineer-to-order models. Unlike these models, make-to-stock processes typically entail less emphasis on configurator, CPQ, CAD, PLM, and PDM, as their products are comparatively simpler. Their bills of materials (BOMs) are less intricate, with fewer sub-assemblies and shorter lead times. Therefore, let’s explore the top 10 make-to-stock manufacturing ERP systems.

Criteria

- Definition of a make-to-stock manufacturing company. These companies in the make-to-stock ecosystem include manufacturers primarily following make-to-stock business mode in a variety of industries, including CPG, food and beverage, chemicals, automotive, aerospace, furniture, or building materials etc. The list considers companies of all sizes in this ecosystem.

- Overall market share/# of customers. The higher marketshare among make-to-stock companies drives higher rankings on this list.

- Ownership/funding. The superior financial position of the ERP vendor leads to higher rankings on this list.

- Quality of development. How modern is the tech stack? How aggressively is the ERP vendor pushing cloud-native functionality for this product? Is the roadmap officially announced? Or uncertain?

- Community/Ecosystem. How vibrant is the community? Social media groups? In-person user groups? Forums?

- Depth of native functionality. Last-mile functionality for specific industries natively built into the product?

- Quality of publicly available product documentation. How well-documented is the product? Is the documentation available publicly? How updated is the demo content available on YouTube?

- Product share and documented commitment. Is the product share reported separately in financial statements if the ERP vendor is public?

- Ability to natively support diversified business models. How diverse is the product in supporting multiple business models in the same product?

- Acquisition strategy aligned with the product: Any recent acquisitions to fill a specific hole for make-to-stock industries? Any official announcements to integrate recently acquired capabilities?

- User Reviews: How specific are the reviews about this product’s capabilities? How recent and frequent are the reviews?

- Must be an ERP product: Edge products such as HCM, CRM, eCommerce, MES, or accounting solutions that are not fully integrated to support enterprise-wide capabilities are not qualified for this list.

10. Oracle Cloud ERP

Geared toward large global make-to-stock firms, Oracle Cloud ERP excels with high transaction volumes, especially when Oracle Cloud ERP might be used only as a corporate financial ledger while using other specialized solutions such as QAD or DELMIAWorks at the subsidiary level. With the retail-friendly TMS and WMS system along with the RMS component, Oracle Cloud ERP is especially friendly for make-to-stock businesses. Thus, securing its rank at #10 among the top 10 make-to-stock manufacturing ERP systems in 2024.

Strengths

- Robust finance capabilities for large, global make-to-stock manufacturers. Capabilities include having five layers of GL restrictions, multiple layers of sub-ledgers, and book closing requirements across divisions, especially relevant for larger make-to-stock businesses with several hierarchies across their retail divisions.

- Proven solution with large workloads. Large companies may process millions of GL entries per hour. The transaction volume is especially higher for make-to-stock businesses, especially if these transactions are hosted inside the ERP.

- Ecosystem. Oracle Cloud ERP has an ecosystem of experienced consultants who have the capabilities to handle the design and architecture of such complex enterprises.

Weaknesses

- Expensive consulting is required for make-to-stock integrations. While systems such as WMS, TMS, RMS, and S&OP are likely to be part of the suite, they will still require substantial consulting expertise to enable similar capabilities as might be available out-of-the-box with focused solutions such as DELMIAWorks or QAD.

- Limited industry-specific capabilities. Oracle Cloud ERP is likely to have industry-specific compliance required in certain verticals, such as plastic-specific capabilities with DELMIAWorks or automotive ERP capabilities with QAD.

- Overwhelming for SMB make-to-stock manufacturers. The enterprise data model and financial layers might be overwhelming for SMB make-to-stock manufacturers.

9. SAP S/4 HANA

Targeting large make-to-stock manufacturing companies with global operations, SAP S/4 HANA excels in handling millions of transactions per hour. The EWM and LE products from SAP are especially friendly for make-to-stock-centric businesses, supporting both embedded or decoupled architecture where make-to-stock businesses might have 3PL components as part of their business processes. Such businesses also require faster processing or movement of goods within warehouses. Despite the pros and cons, it secures its rank at #9 among the make-to-stock manufacturing ERP systems in 2024.

Strengths

- An enterprise-grade product designed for diverse manufacturing companies, including make-to-stock. The item master, product model, and warehouse architecture can accommodate the needs of most manufacturing business models, including make-to-stock.

- The power of HANA to run global operations end-to-end in one system. Our simple test of HANA’s capabilities with 100K serialized goods receipt found it to be faster than most systems out there. SAP S/4 HANA could process it in under 22 seconds, while Oracle cloud ERP took more than 18 mins for the same test. This is especially friendly for verticals such as electronics with serialized product offerings.

- Financial governance and best-of-breed architecture. Financial traceability is built with each transaction, which makes the transactions and SOX governance flows highly traceable.

Weaknesses

- Behind in cloud capabilities. Despite advanced technical capabilities such as AI, the last mile industry capabilities and operational functionality are limited in the cloud version.

- Too big for smaller companies. Companies looking for a fully baked suite without internal IT capabilities will find it overwhelming.

- Limited last mile capabilities and third-party pre-integrated options. The last-mile capabilities available with other ERP systems, such as QAD or DelmiaWORKS, would not be as strong with SAP S/4 HANA.

8. Infor CloudSuite Industrial (Syteline)

With its primary target market being make-to-order, Infor CloudSuite Industrial would be a great fit for companies with mixed-mode manufacturing processes, especially for products and business models where they would require equal depth in both processes. While Infor Cloud Industrial can cover both, it might not be the best fit for companies that are retail or eCommerce heavy because of its complex product model. It is also not the best fit for companies with complex inventory needs such as metal or plastics. Thus, with the primary target being SMB make-to-stock companies heavier in manufacturing, it ranks at #8 among the top make-to-stock manufacturing ERP systems in 2024.

Strengths

- Support for both informal engineering processes. This is especially friendly for make-to-stock companies without formal engineering processes or complex products.

- Deep costing layers. While costing might not be the most critical for make-to-stock companies, it might be beneficial for companies with fluctuating costs, such as electrical components or steel manufacturers.

- Field service integration with the core manufacturing processes. Verticals heavier in residential or field services would require tightly embedded field services with the manufacturing processes, making it friendlier for make-to-stock companies with field services operations.

Weaknesses

- Disconnected financial reporting experience. Unlike other products, financial reports are not embedded with the product and would require an Excel interface, creating a patchy experience for users.

- Poor user experience and steep learning curve. While marketed as a cloud product, the cloud capabilities, such as enterprise search and opening multiple tabs, are limited, making the experience non-intuitive.

- Weak ecosystem and third-party options. Similar to Epicor, Infor CSI takes the suite approach. So it might be harder to find integration with best-of-breed third-party apps.

7. Infor CloudSuite LN/M3

Infor CloudSuite LN and M3 are two completely different products and target upper mid-market make-to-stock companies compared to Infor Cloud Suite Industrial. With the primary target market for LN being complex and engineer-to-order-centric manufacturing business models, it might be a good fit for make-to-stock companies with diverse business models. M3 targets retail, apparel, and chemical manufacturing companies – the majority of them are made-to-stock with heavy retail components. Thus, given their fit for many make-to-stock verticals, it ranks at #7 on our list of top make-to-stock manufacturing ERP systems.

Strengths

- Global operations. For LN and M3, there are very few comprehensive manufacturing solutions with a heavy global presence, containing capabilities such as global trade compliance and international supplier collaboration that are uniquely relevant for make-to-stock verticals.

- Last-mile capabilities, along with the breadth of capabilities for diversified manufacturing business models. Make-to-stock with heavier distribution operations would require capabilities such as handling units that are natively built with both products.

- Best-of-breed integrations offered out-of-the-box. Most tools that a manufacturer would require, such as HCM, PLM, data lake, ERP, WMS, TMS, and advanced supply chain planning, are all pre-integrated with LN and M3.

Weaknesses

- It might not be the best fit as a corporate solution for holding and private equity companies. Make-to-stock companies as diverse as manufacturing, construction, and professional services may not be able to keep all of their entities on one solution and database.

- Legacy UI and Experience. Infor LN and M3 are both legacy solutions with technical limitations to provide the cloud-native experience with universal search, mobile experience, etc.

- Weak Ecosystem and Marketplace. The consulting base and marketplaces are virtually non-existent for both Infor LN and M3 if you need third-party best-of-breed pre-integrated solutions.

6. Plex

Adopting an MES-first strategy, Plex targets companies in the Toyota and Ford automotive ecosystems. Despite superior technology compared to other solutions on this list, Plex has fewer installs, primarily focusing on the automotive industry. The automotive industry, especially the large OEMs, where Plex is especially known, are generally made-to-stock, requiring joint collaboration with their suppliers, which might be overkill for simpler made-to-order businesses. Plex would be an ideal fit for MES-heavy make-to-stock manufacturers, especially in the automotive ecosystem, emphasizing more operational capabilities than the core ERP needs. Thus, securing its rank at #6 among the top make-to-stock manufacturing ERP systems.

Strengths

- Last-mile functionality for Toyota and Ford ecosystems. Tailored for manufacturers in the Toyota ecosystem (i.e., Toyota suppliers), Plex offers distinctive features, especially the compliance requirements that would require substantial consulting efforts on vanilla ERP systems.

- MES-first approach. Originating as an integrated MES solution, Plex boasts extensive MES capabilities. This appeals to make-to-stock companies handling processes traditionally within ERP, like quality, scheduling, and asset maintenance, providing a valuable shop floor perspective.

- Cloud-native UI and architecture. Similar to cloud-native alternatives like NetSuite or Acumatica, Plex features a cloud-native and mobile-friendly user interface.

Weaknesses

- Limited core ERP capabilities. While Plex lacks extensive finance and accounting capabilities for global organizations, it could be a great two-tier solution used at the plant level on top of Oracle and SAP as a corporate system.

- Limited make-to-stock manufacturing capabilities. While it might have some make-to-stock capabilities, it might not be the best fit for make-to-stock manufacturing companies requiring mixed-mode manufacturing capabilities.

- Limited ecosystem and consulting base. Plex has fewer installations and a minimal marketplace and consulting base compared to other manufacturing ERP systems on this list.

5. Acumatica

Tailored for manufacturing companies in the $10-100 million range, Acumatica suits make-to-stock manufacturers with relatively simpler global operations present in fewer countries. Acumatica has several advantages for make-to-stock manufacturers, including native integration with eCommerce systems and the availability of add-ons on its marketplace to augment its core capabilities. While the product and BOM model is relatively scalable to work even for make-to-order manufacturing, it would be more suitable for make-to-stock because of the missing advanced features such as Kanban or allocation layers, a crucial need for make-to-order operations. Thus, given its pros and cons, it ranks at #5 on our list of top make-to-stock manufacturing ERP systems.

Strengths

- Native integration with leading eCommerce platforms. Along with BOMs and manufacturing capabilities that are friendlier for make-to-stock verticals, it integrates natively with leading eCommerce platforms, a requirement for most make-to-stock verticals.

- Diverse business models but friendlier for discrete make-to-stock manufacturers. The product can accommodate multiple business models in the same database, making it easier to explore synergies across different business models, and is especially friendlier for discrete make-to-stock verticals because of its BOMs being aligned to discrete manufacturing.

- Cloud-native UI. Superior experience for teams using ERP primarily on mobile devices.

Weaknesses

- Pricing. With make-to-stock verticals being consumer-focused, the consumption-based pricing might be more expensive due to the higher number of transactions.

- Process manufacturing capabilities. It might not be the best fit for make-to-stock verticals requiring process manufacturing capabilities, which would require thick add-ons, risking implementation.

- Limited global capabilities. The current multi-entity functionality might be limiting for make-to-stock companies with operationally connected offshore locations.

4. IQMS/DELMIAWorks

IQMS, tailored for plastics-centric operations, would be uniquely suitable for plastic extrusion make-to-stock manufacturing companies working for large OEMs in the automotive and aerospace verticals. IQMS natively supports the supply chain planning and S&OP operations for plastic-centric verticals. But it might not be the best fit for other discrete-centric make-to-stock verticals. IQMS would be an ideal fit for smaller make-to-stock companies or for larger companies as a subsidiary-level system. Thus, contributing to its placement at #4 among make-to-stock manufacturing ERP systems.

Strengths

- Great for plastic-extrusion make-to-stock manufacturers. While limited in its mixed-mode capabilities, it’s especially suitable for plastic-centric make-to-stock industries when it comes to unique scheduling requirements.

- S&OP planning capabilities are friendlier for make-to-stock verticals. Make-to-stock, especially process manufacturing such as plastic manufacturing requires unique CAD and PLM capabilities, along with the S&OP planning capabilities included with the suite.

- Technology – This is probably the most legacy solution of all on this list, with no announcement if they plan to modernize the technology.

Weaknesses

- Limited focus. The limited focus might be a challenge for make-to-stock companies diversifying their operations and being active with M&A cycles.

- Limited ecosystem. The consulting base is extremely limited with most resellers being CAD resellers, with limited experience in ERP implementation and cross-functional processes.

- It is not the right fit for holding and private equity companies as a corporate ledger. It might not be the right fit for make-to-stock companies primarily using it as a corporate financial ledger.

3. Epicor Kinetic

Epicor Kinetic targets small-to-mid-size make-to-stock manufacturers specializing in industries with complex inventory needs, such as automotive, aerospace, metal, fabrication, and medical devices. While the product model is friendlier for formal engineering organizations, the complex inventory layers and distribution planning are included as part of the same solution, making it a fit for certain make-to-stock verticals such as metal, automotive, or medical devices. However, the requirement of formal engineering processes might discourage companies with SKUs without the need for revision numbers. Thus, securing their rank at #3 among the top make-to-stock manufacturing ERP systems.

Strengths

- Strong with complex inventory needs. Companies that require multiple attributes that need to be part of the planning and MRP, such as metal, fastener, automotive, and aerospace, would find Epicor Kinetic to be appealing.

- Strong support for distribution processes along with manufacturing. Distribution planning requires complex structures for bin numbers, a unique requirement for make-to-stock manufacturing companies that are heavier on distribution.

- Microsoft look-and-feel. Epicor has a very similar look and feel to Microsoft ERP products, providing you with the same experience but with much deeper last-mile capabilities where other products might struggle.

Weaknesses

- Global financial operations. Unlike larger products that might support more than three layers of financial hierarchies, such as corp, subsidiary, entity, and business units, the limited number of layers would operationally inefficient workarounds, such as using sub-accounts for such traceability.

- Support for process manufacturing. While Epicor Kinetic has a module to support process manufacturing, the capabilities are lean to support the operations of pure-play make-to-stock process manufacturers.

- Embedded experience with field service and quality. Despite recent acquisitions, the field service capabilities are not as embedded and proven as some of the other products on this list.

2. Microsoft Dynamics 365 F&O

Microsoft Dynamics 365 F&O excels in localizations where other focused solutions might not be available, providing only a few options for make-to-stock companies. It is uniquely suitable for make-to-stock companies with several TMS and WMS options along with S&OP that closely integrate with MS Dynamics 365 F&O. It can not only support both discrete and process verticals, but it also has very strong support for distribution-heavy operations, making it uniquely suitable for diversified make-to-stock operations. Therefore, given its pros and cons, it ranks at #2 on our list of make-to-stock manufacturing ERP systems.

Strengths

- Richer core ERP capabilities for make-to-stock companies in the cloud. Compared to other solutions that might have superior layers for other service-centric verticals, such as Oracle Cloud ERP, Microsoft Dynamics 365 F&O has a mature cloud version for make-to-stock companies.

- Support for both discrete and process verticals as well as complex distribution operations. Unlike other products on this list that can support only a few manufacturing business models, Microsoft Dynamics F&O supports both discrete and process as well as distribution operations.

- Powerful ecosystem and marketplace add-ons. Microsoft has a talent and consulting base in countries where finding talent may be a challenge.

Weaknesses

- Limited pre-baked integrations for make-to-stock companies. The integration relevant for make-to-stock companies such as eCommerce and POS are not OEM owned, requiring third-party add-ons.

- Too big for smaller companies. The smaller companies would find it overwhelming with the configuration and approval flows built for large enterprises.

- Limited last mile capabilities. The last-mile functionality relevant to specific industries, such as plastic or medical, would be substantially limited, requiring third-party add-ons or custom development.

1. QAD

With QAD’s focus being primarily on mid-to-large automotive, electronics manufacturing, and life sciences companies, it is uniquely suitable for make-to-stock companies that are heavy on the supply chain. It might also not be the best fit for companies requiring mixed-mode manufacturing capabilities along with make-to-stock. While they have announced plans to advance their technology stack, the new version might take a while to be fully rolled out and available. Thus, securing its rank at #1 on our list among the top make-to-stock manufacturing ERP systems.

Strengths

- Global capabilities. While not as globalized and localized as other larger solutions, such as SAP S/4 HANA or Oracle, QAD is widely localized, supporting several countries that require global synergies and international supplier collaboration and supply chain planning.

- Supply chain suite + ERP. Combining capabilities that traditionally resided in a Supply Chain Suite, QAD includes trade compliance, TMS capabilities, and S&OP planning in its core solution. These capabilities are highly applicable for make-to-stock business models.

- Integrated best-of-breed capabilities. QAD offers best-of-breed integration that can support not only make-to-stock operations but also other mixed-mode manufacturing operations requiring integrations such as CAD or PLM.

Weaknesses

- Diverse business models. QAD’s limited focus poses challenges for holding and private equity companies with aggressive M&A cycles trying to keep all of their entities on one solution.

- Global corporate solution. While operationally strong, QAD may not be the best fit for companies seeking a global corporate financial solution.

- Weak ecosystem. QAD lacks a robust ecosystem, including limited partners and coverage for third-party add-ons and marketplaces.

Conclusion

Make-to-stock manufacturing demands specialized inventory and supply chain planning solutions tailored for this sector. Not all manufacturing products are suitable for make-to-stock processes, especially those designed for discrete manufacturing. While a few products offer support for both discrete and process manufacturing along with distribution planning, the majority are geared toward specific business models, complicating the selection of software tailored for make-to-stock operations. Picking the ideal make-to-order manufacturing ERP system requires a meticulous review of transactions and workflows. Also, selecting an ill-suited system could lead to implementation challenges. While this compilation provides helpful guidance, consulting with an independent ERP consultant can significantly improve your implementation outcomes.

FAQs

Top 10 Make-to-Stock Manufacturing ERP Systems In 2024 Read More »